Last year the Fifth Circuit held that the Consumer Financial Protection Bureau was funded through an unconstitutional mechanism that circumvented the Congressional appropriations process. That matter is now before the Supreme Court. The Second Circuit has now joined the fray in CFPB v. Law Offices of Crystal Moroney, P.C., No. 20-3471 (March 23, 2023), joining the D.C. Circuit in finding that the CFPB’s funding mechanism does not violated the Appropriations Clause.

Majestic Oil v. Certain Underwriters at Lloyd’s is an insurance coverage case in which the key issue is what caused a roof to leak. The plaintiff’s expert prepared a second report that added analysis of certain weather data; he characterized it as a permissible supplement to his original report, while the defense moved to strike it as containing an impermissible new opinion after the expert-report deadline.

Majestic Oil v. Certain Underwriters at Lloyd’s is an insurance coverage case in which the key issue is what caused a roof to leak. The plaintiff’s expert prepared a second report that added analysis of certain weather data; he characterized it as a permissible supplement to his original report, while the defense moved to strike it as containing an impermissible new opinion after the expert-report deadline.

The Fifth Circuit reversed the trial court’s ruling that struck the new report, remanding for more fulsome consideration of all four factors identified by Fed. R. Civ. P. 37(c)(1): “(1) the explanation for the failure to identify the [information]; (2) the importance of the [information]; (3) potential prejudice in allowings the timeliness of an expert report and the [information]; and (4) the availability of a continuance to cure such

prejudice.” No. 21-20542 (March 17, 2023, unpublished).

In a case about a school district’s liabilty for a student’s assault of another student, the Fifth Circuit declined to recognize a “state-created danger” exception to district officials’ immunity. The Court summarized:

The Due Process Clause of the Fourteenth Amendment provides that “[n]o State shall . . . deprive any person of life, liberty, or property, without due process of law.” “The Due Process Clause . . . does not, as a general matter, require the government to protect its citizens from the acts of private actors.” We have recognized just one exception to this general rule: “when [a] ‘special relationship’ between the individual and the state imposes upon the state a constitutional duty to protect that individual from known threats of harm by private actors.” However, “a number of our sister circuits have adopted a ‘state-created danger’ exception to the general rule, under which a state actor who knowingly places a citizen in danger may be accountable for the foreseeable injuries that result.” …

The problem for [Plaintiff] is that “the Fifth Circuit has never recognized th[e] ‘state-created-danger’ exception.” In our published, and thus binding, caselaw, “[w]e have repeatedly declined to recognize the statecreated danger doctrine.” For this reason, [Plaintiff] “ha[s] not demonstrated a clearly established substantive due process right on the facts [she] allege[s].” The district court thus erred in denying qualified immunity to Appellants.

Fisher v. Moore, No. 21-20553-CV (March 16, 2023) (footnotes omitted).

My home city of Dallas was founded with the hope of becomging an inland port, using the Trinity River to connect North Texas with the Gulf of Mexico. Unfortunately, the Trinity turned out to be essentially unnavigable.

My home city of Dallas was founded with the hope of becomging an inland port, using the Trinity River to connect North Texas with the Gulf of Mexico. Unfortunately, the Trinity turned out to be essentially unnavigable.

Lacking any navigable waters of my own, I am fascinated by opinions that define the “navigable waters” of the United States such as Newbold v. Kinder Morgan SNG Operator LLC. A fishing boat in the D’Arbonne National Wildlife Refuge ran into an underwater object; the case-dispositive issue was choice of law. If the accident did not occur in “navigable waters,” then Louisiana law controlled and the plaintiff would have no claim.

While the boat was, in fact, navigating at the time of the allision, the test excludes “recreational fishing” activity. The Fifth Circuit reviewed the relevant factors and found that the area the boat was in was not “navigable water” governed by federal law:

“[T]he location of the allision is on land that is dry 67 percent of the time, where vegetation is not destroyed and the land is not bare, as evidenced by the need to mow it with some regularity. More significantly, the Bayou D’Arbonne does have an ‘unvegetated channel’ which is some 597 feet wide at the location where the boat split off to fish near the sign. The sign was located 58 feet away from the unvegetated channel. The unvegetated channel is a neat, natural line by which the ordinary high-water mark may be established. Within the channel, there is no vegetation; outside of it, there is.”

No. 22-30416 (March 14, 2023).

An unfortunate incident involving out-of-hand heckling of Judge Duncan at Stanford Law School, compounded by an administrator fanning the flames, led to an apology from Stanford’s president. Aside of general problems with good manners and common sense, this sort of thing isn’t even good protesting; cf. Tinker v. Des Moines ISD, 393 U.S. 503 (1969) (protecting “a silent, passive expression of opinion, unaccompanied by any disorder or disturbance on the part of petitioners”).

New England Construction complained that large lumber companies monopolized the wood-products marked during the COVID-19 pandemic. Unfortunately for its claim, however, it only purchased the defendants’ lumber through intermediates (Lowes, Home Depot, etc.). It thus had no standing under the Illinois Brick line of authority, and the Fifth Circuit affirmed the dismissal of its claims. New England Construction, LLC v. Weyerhaeuser Co., No. 22-60329 (March 8, 2023) (unpublished).

New England Construction complained that large lumber companies monopolized the wood-products marked during the COVID-19 pandemic. Unfortunately for its claim, however, it only purchased the defendants’ lumber through intermediates (Lowes, Home Depot, etc.). It thus had no standing under the Illinois Brick line of authority, and the Fifth Circuit affirmed the dismissal of its claims. New England Construction, LLC v. Weyerhaeuser Co., No. 22-60329 (March 8, 2023) (unpublished).

Dream Medical Group v. Old South Trading Co. reminds how hard it is to challenge the merits of an arbitration award.

Dream Medical Group v. Old South Trading Co. reminds how hard it is to challenge the merits of an arbitration award.

Dream Medical bought medical face masks from Old South. They had a contract dispute that went to arbitration with the AAA. Dream Medical won and Old South opposed confirmation.

Among other arguments, Old South complained that its fraudulent-inducement claim was mishandled, in that the panel violated a AAA rule by not fully considering Old South’s fraudulent-inducement claim, and thus came within the FAA’s provision about arbitrators who “exceeded their powers.”

The Fifth Circuit rejected that argument as an invitation for us to reasses the merits of the Panel’s decision.” It also noted that “manifest disregard of the law” is not a viable, nonstatutory basis for opposing confirmation under Fifth Circuit precedent. No. 22-20286 (March 6, 2023) (unpublished).

The Fifth Circuit updated its panel opinion in United States v. Rahimi. The holding remains the same (that the federal law, criminalizing the possession of a firearm by someone subject to a domestic violence protective order, violates the Second Amendment), but the majority opinion adds explanation about what its holding does, and does not, affect. No. 21-11001 (March 2, 2023) (withdrawing and substituting prior opinion).

While I wrote an op-ed in the Dallas Morning News about the original opinion, noting that the Fifth Circuit had found the same statute constitutional under the pre-Bruen Second Amendment framework, I had not fully grasped the contrast until reading the revised opinion. The Fifth Circuit’s previous opinion turned on “means-end scrutiny” — in other words, a comparison of benefit and burden. The present opinion thus finds this law unconstitutional (as it must under its analysis of Bruen) even though Circuit precedent says that the law did not unduly burden gun rights when compared to the law’s policy objectives. It thus provides a particularly stark example of the impact of Bruen‘s history-only framework on the law in this area.

The poem Antigonish begins:

The poem Antigonish begins:

Yesterday, upon the stair,

I met a man who wasn’t there

He wasn’t there again today

I wish, I wish he’d go away.

In that spirit, the majority and concurrence in Mexican Gulf Fishing Co v. U.S. Dep’t of Commerce, No. 22-30105 (Feb. 23, 2023), disagreed about the continuing viability of Chevron.

The case presented a dispute about the authority of the Commerce Department, under a Congressional mandate to conserve the nation’s offshore fisheries, to require charter boats to carry a GPS-location device and submit specified records about fishing activity.

3-0, the Fifth Circuit concluded that the government had exceeded its boundaries. The majority used a Chevron approach to the relevant statute; a concurrence joined but argued that recent Supreme Court cases have tacitly overruled Chevron, and the third judge joined specific parts of the majority opinion.

Colorfully, the majority and concurrence disputed whether Chevron is fairly called the “Lord Voldemort of administrative law,” due to the Supreme Court’s unwillingness to refer to it recent administrative-law opinions. While that’s witty and good fun, the lack of clear guidance from the Supreme Court about this fundamental doctrine is clearly a problem–as this very opinion shows, since three judges approached the same issue in three different ways under the current state of the law. If the Supreme Court wants to overrule Chevron, it should overrule Chevron.

Colorfully, the majority and concurrence disputed whether Chevron is fairly called the “Lord Voldemort of administrative law,” due to the Supreme Court’s unwillingness to refer to it recent administrative-law opinions. While that’s witty and good fun, the lack of clear guidance from the Supreme Court about this fundamental doctrine is clearly a problem–as this very opinion shows, since three judges approached the same issue in three different ways under the current state of the law. If the Supreme Court wants to overrule Chevron, it should overrule Chevron.

Celebrate Mardi Gras with Emeril’s chicken and andouille gumbo recipe!

Celebrate Mardi Gras with Emeril’s chicken and andouille gumbo recipe!

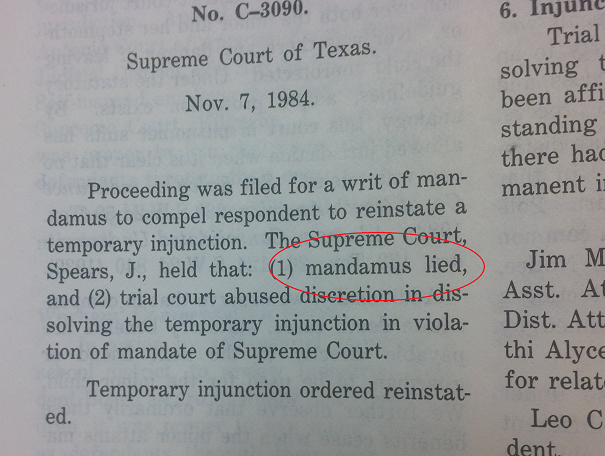

The Fifth Circuit didn’t bite on a last-minute attempt to stop a trial in the Allen Stanford litigation, denying a mandamus petition (with memorable language obviously written by Judge Higginbotham despite the “per curiam” designation):

The Fifth Circuit didn’t bite on a last-minute attempt to stop a trial in the Allen Stanford litigation, denying a mandamus petition (with memorable language obviously written by Judge Higginbotham despite the “per curiam” designation):

This case is, at minimum, complex, featuring myriad fact-specific issues litigated over the course of nearly a decade and a half through multiple courts. Halting the litigation’s momentum mere days before trial is set to begin would require indisputable clarity as to its necessity. Here, no such need is evident; assisted by able briefing and a review of the record, we are unpersuaded that either petition reaches the high demands of mandamus, or that the movant has satisfied the similar burden of staying the trial….

The four most powerful words from the lips of a United States District Judge are simply “Call your first witness,” and the veteran presiding judge will so state in a few short days.

In re Toronto-Dominion Bank, No. 22-20648 (Feb. 14, 2023). (It could be debated whether those are in fact a trial judge’s most powerful words–a case could be made for “So ordered” or “Your objection is overruled,” for example.)

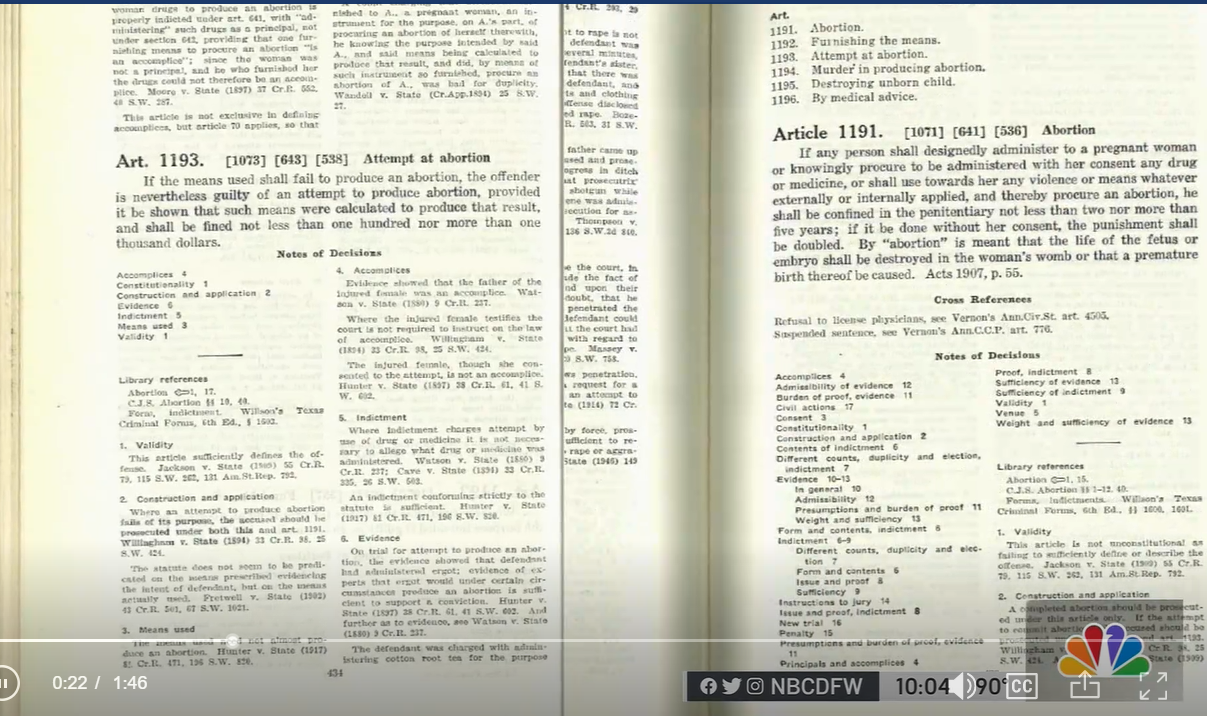

A case now pending in the Amarillo Division of the Northern District of Texas challenges the FDA’s approval of one of the drugs commonly used to carry out a “medication abortion,” including a question whether the 19th-Century Comstock Act prohibits the mailing of abortion-related medication. A decision is expected after preliminary-injunction briefing closes on February 24. This is the plaintiffs’ brief in support of a preliminary injunction, and this is the defendants’ response.

On Wednesday at noon, I am doing a virtual CLE for the Dallas Bar that reviews the key cases, since last spring, from the U.S. Court of Appeals for the Fifth Circuit and the Fifth Court of Appeals in Dallas. You can register here and you can download (subject to last-minute revisions) my PowerPoint here. I hope you can join me!

On Wednesday at noon, I am doing a virtual CLE for the Dallas Bar that reviews the key cases, since last spring, from the U.S. Court of Appeals for the Fifth Circuit and the Fifth Court of Appeals in Dallas. You can register here and you can download (subject to last-minute revisions) my PowerPoint here. I hope you can join me!

Last week’s opinion in United States v. Rahimi found that a federal law, criminalizing the possession of a firearm by someone under a domestic-violence restraining order, violated the Second Amendment’s protection of a right to bear arms.

The Attorney General plans to seek review. The perspective of a Dallas-based operator of a women’s shelter appears in this Fox 4 news story on the case. I recently wrote an op-ed about the opinion in the Dallas Morning News. A flavor of the national commentary about the case can be obtained from these representative articles in Slate and Reason.

Referring to a federal law that prohibits firearm ownership by someone subject to a domestic-violence restraining order, the Fifth Circuit holds in United States v. Rahimi:

“Doubtless, 18 U.S.C. § 922(g)(8) embodies salutary policy goals meant to protect vulnerable people in our society. Weighing those policy goals’ merits through the sort of means-end scrutiny our prior precedent indulged, we previously concluded that the societal benefits of § 922(g)(8) outweighed its burden on Rahimi’s Second Amendment rights. But Bruen forecloses any such analysis in favor of a historical analogical inquiry into the scope of the allowable burden on the Second Amendment right. Through that lens, we conclude that § 922(g)(8)’s ban on possession of firearms is an ‘outlier[] that our ancestors would never have accepted.’ Therefore, the statute is unconstitutional, and Rahimi’s conviction under that statute must be vacated.

No. 21-11001-CR (Feb. 2, 2023) (citation omitted).

The plaintiffs in Elson v. Black brought a putative class action against the manufacturers of the “FasciaBlaster, a two-foot stick with hard prongs that is registered with the Food and Drug Administration as a massager,” alleging that they “falsely advertised that the FasciaBlaster was able to ‘virtually eliminate cellulite,’ help with weight loss, and relieve pain.” The Fifth Circuit affirmed the dismissal of those class claims, noting that class-wide issues did not predominate:

- Law. “[V[ariations in state law here ‘swamp any common issues and defeat predominance'” as to reliance and other basic matters; and

- Fact. “Plaintiffs’ allegations introduce numerous factual differences that in no way comprise a coherent class. … [T]he named plaintiffs do not complain about the same alleged misrepresentations. Some are disgruntled because they expected the FasciaBlaster to reduce cellulite. Others are dissatisfied because they expected it to reduce their pain or address certain health concerns. And others are displeased because they expected it to help them lose weight. … Moreover, even within these groups, the possibility of class analysis disintegrates because the members did not rely on the same alleged misrepresentations.”

No. 21-20349 (Jan. 5, 2023).

Thanks to diversity jurisdiction, the Fifth Circuit reviews some fundamental state-law tort issues along with its loftier docket of constitutional disputes.

In Badeaux v. Louisiana-I Gaming, Badeaux sued for damages after he tripped over a sprinkler head at a casino. The Fifth Circuit affirmed summary judgment for the casino because the sprinkler head was “open and obvious,” noting, inter alia: “There are multiple photographs of the scene showing that: (1) there were working lights in the parking lot on the night of Badeaux’s fall; (2) the sprinkler head was located in a grassy, landscaped area that was separated from the parking lot by a raised curb; and (3) the raised curb surrounding the sprinkler head was painted bright yellow.”

No. 21-30129 (Jan. 20, 2023).

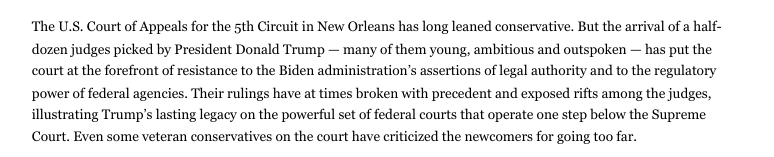

On January 29, the Washington Post published a lengthy article about issues of the day in the Fifth Circuit.

Significantly different and tone and focus, it is similar in scope to a Texas Monthly article of last summer about the Court.

An exasperated Fifth Circuit granted mandamus relief to require FERC to explain significant delay in a nuclear-power rate dispute, In re Louisiana Public Service Comm’n, No. 22-60458 (Jan. 18, 2023).

An exasperated Fifth Circuit granted mandamus relief to require FERC to explain significant delay in a nuclear-power rate dispute, In re Louisiana Public Service Comm’n, No. 22-60458 (Jan. 18, 2023).

As to jurisdiction, the Court observed: “This court has jurisdiction over the LPSC’s petition to safeguard our prospective jurisdiction to review final FERC orders under the Federal Power Act. When federal appellate courts have jurisdiction to review agency action, ‘the All Writs Act empowers those courts to issue a writ of mandamus compelling the agency to complete the action.'” (footnotes omitted).

As to the merits, the Court observed: “FERC is correct that ratemaking is challenging work, and we are fully aware of the difficulties attending the substitution of nuclear for other power sources, with its attendant difficulties of allocating huge installation costs among electrical suppliers now looking to a new power source. Yet Congress has duly charged FERC with this important duty, and FERC has yet to provide this court with a meaningful explanation for its inability to expeditiously conclude Section 206 proceedings. FERC must convince this court that it has acted ‘within a reasonable time . . . to conclude [the] matter presented to it.’ In failing to do so, FERC risks judicial intervention to protect the rights of the parties before it and the interests of consumers.” (footnotes omitted).

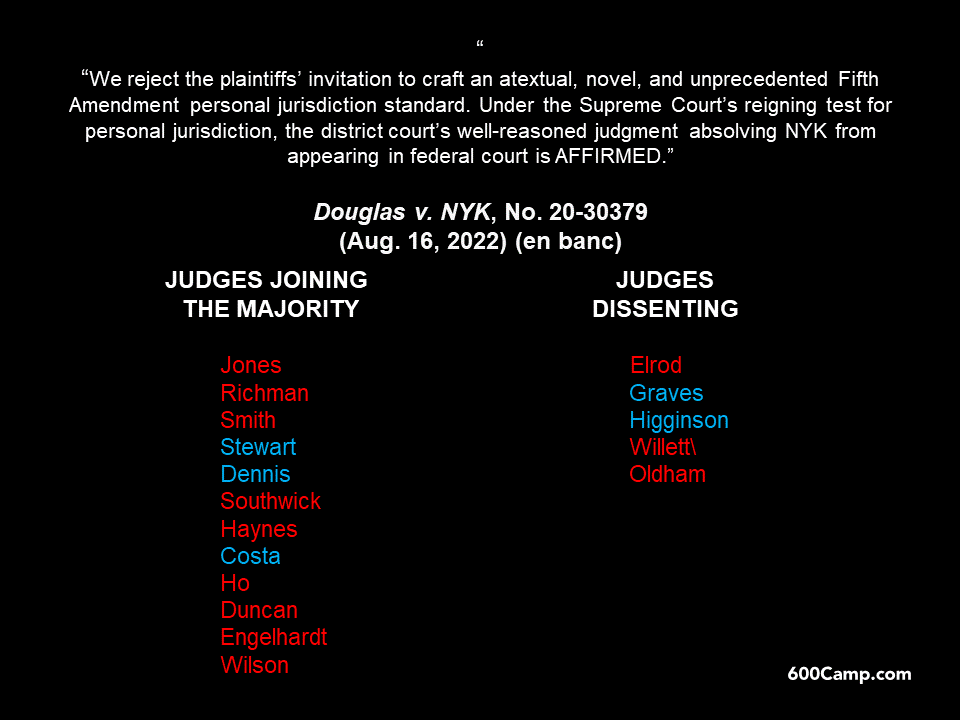

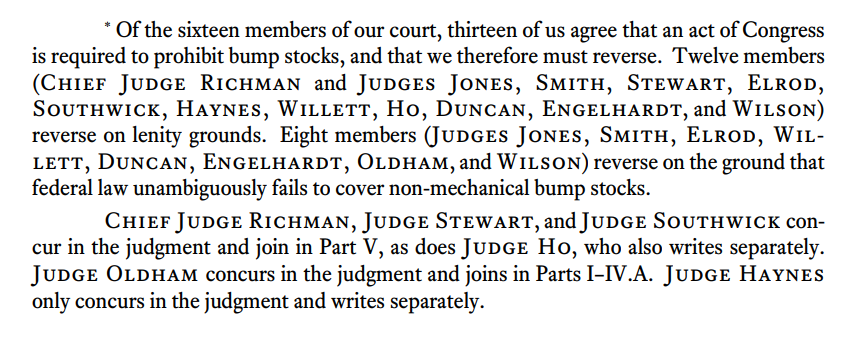

Cargill v. Garland, an en banc opinion released earlier this month, holds that the ATF’s “bump stock” rule was invalid. The diagram to the right, referenced by a link in the majority opinion, illustrates the firing mechanism for a semi-automatic firearm, which a bump stock facilitates by allowing rapid operation of the trigger.

Cargill v. Garland, an en banc opinion released earlier this month, holds that the ATF’s “bump stock” rule was invalid. The diagram to the right, referenced by a link in the majority opinion, illustrates the firing mechanism for a semi-automatic firearm, which a bump stock facilitates by allowing rapid operation of the trigger.

The majority opinions aligned as follows:

The three Democratic appointees on the court at the time (Higginson, Dennis, and Graves) dissented.

The three Democratic appointees on the court at the time (Higginson, Dennis, and Graves) dissented.

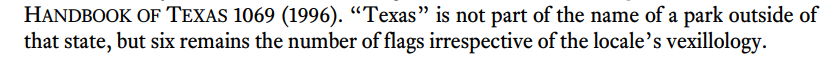

The Fifth Circuit reversed the dismissal of a securities claim against Six Flags involving its public statements about an expansion effort in China, concluding that as to some of the challenged statements, the plaintiff had satisfied the PSLRA’s demanding requirements. Oklahoma Firefighters Pension & Retirement System v. Six Flags Entertainment Corp., No. 21-10865 (Jan. 18, 2022). The opinion provides detailed discussion of just is required to adequately plead falsity and scienter, especially in the context of forward-looking statements. It also provides what appears to be the first reference in the Federal Reporter to vexillology (the study of flags):

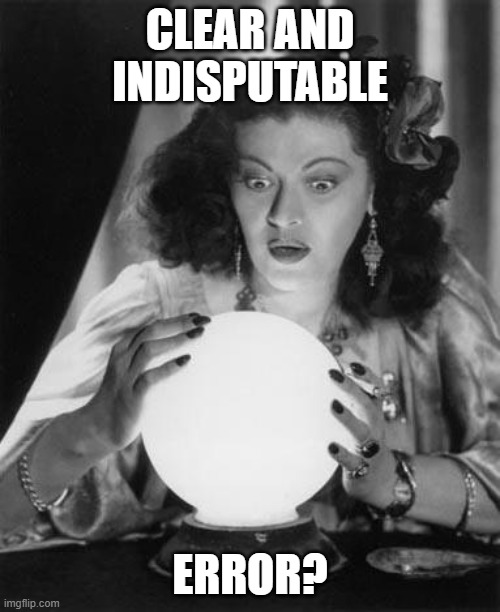

Last July, I fearlessly predicted that “[a] petition for en banc rehearing seems a near certainty” in Wages & White Lion Investments v. FDA, a challenge to a significant FDA regulation in the vaping industry. The full court has now voted to consider the matter en banc; time will tell if the panel majority’s analysis goes up in smoke, or whether the case simply offers smoke and no fire.

Last July, I fearlessly predicted that “[a] petition for en banc rehearing seems a near certainty” in Wages & White Lion Investments v. FDA, a challenge to a significant FDA regulation in the vaping industry. The full court has now voted to consider the matter en banc; time will tell if the panel majority’s analysis goes up in smoke, or whether the case simply offers smoke and no fire.

The main issue in Hanover Ins. Co. v. Binnacle Devel., LLC was the interpretation of a Texas Water Code provision about MUDs (“municipal utility districts”) — yes, “MUDdy waters.” Resolution of that issue led to a short discussion as to whether a key contract provision was a damage-limitation clause or a liquidated damages clause, and the Fifth Circuit said:

The damages clause is entitled “LIQUIDATED DAMAGES FOR DELAY/ECONOMIC DISINCENTIVE” and expressly provides for “liquidated damages in the amount of $2,500 for each [] calendar day” of delay. This provision does not, in substance, set a mere limitation of liability or delimit damages to “an agreed maximum.” 24 WILLISTON ON CONTRACTS § 65:6 (4th ed.). Rather, the clause provides that Hassell is liable for the liquidated damages of $2,500 for every day the Projects are late. Looks like a liquidated-damages provision to us.

No. 21-40662 (Jan. 12, 2023).

The Fifth Circuit and Texas Supreme Court both recently addressed limitations issues in commercial cases:

The Fifth Circuit and Texas Supreme Court both recently addressed limitations issues in commercial cases:

- Civelli v. JP Morgan Securities involved an investor’s claim that JP Morgan wrongly transferred certain shares of stock in an oil company. The Fifth Circuit declined to apply the discovery rule, stating: “Any injury incurred from the J.P. Morgan defendants’ alleged negligence in transferring the shares without plaintiffs’ consent arose at the time of the transfer. Because Civelli admits that he knew by February 2014 that they had transferred the funds, the rule of discovery does not apply.” No. 21-20618 (Jan. 11, 2023).

- Marcus & Millichap v. Triex Texas Holdings LLC was a suit against a real-estate broker about the sale of a gas station. The Texas Supreme Court held: “It is undisputed that Triex knew it was injured in December 2012. The question before us is whether the discovery rule defers accrual of Triex’s cause of action until it knew that Marcus & Millichap caused its injury. We hold that it does not.” No. 21-0913 (Jan. 13, 2023) (per curiam).

Yes, the defendant “intentionally” coded a key record in a certain way. But that “intentional” action did not establish an “intent” to harm the victim of an industrial accident:

Yes, the defendant “intentionally” coded a key record in a certain way. But that “intentional” action did not establish an “intent” to harm the victim of an industrial accident:

“Populars fails to show that Trimac knew it mislabeled the tanker. It is not enough that Trimac intentionally coded into its system that the tanker contained MDI. Doing so may have been reasonable, negligent, or reckless … [but Populars instead needed to demonstrate that Trimac (or a reasonable company in Trimac’s position) knew this designation was wrong, and, therefore, knew that Populars’s injury was inevitable. Despite claiming that ‘Trimac knew it possessed chemicals that would produce a violent exothermic reaction when mixed together,’ Populars points to no evidence to support that assertion.”

Populars v. Trimac Transportation, Inc., No. 22-30413 (Jan. 3, 2023, unpublished) (emphasis in original).

In a time of well-documented skepticism in the federal courts about the administrative state, the FTC has doubled down, seeking public comment on a rule that would ban enforcement of noncompetition agreements.

In a time of well-documented skepticism in the federal courts about the administrative state, the FTC has doubled down, seeking public comment on a rule that would ban enforcement of noncompetition agreements.

As part of the explanation for its authority, the FTC cited authority that “Section 5 reaches conduct that, while not prohibited by the Sherman or Clayton Acts, violates the spirit or policies underlying those statutes.” That broad language will sound familiar to readers of the vaccine-mandate cases and their discussions of the EEOC’s rulemaking authority.

Given the present climate in the courts about expansive claims of agency authority, it seems likely that any FTC rule in this area will lead to extensive litigation before such a rule actually takes effect.

In Louisiana v. Biden, No. 22-30019 (Dec. 19, 2022), a panel majority invalidated a Presidential vaccination mandate, holding: “This so-called ‘Major Questions Doctrine’ – that is, that ‘[w]e expect Congress to speak clearly when authorizing an agency to exercise powers of vast economic and political significance,’ – serves as a bound on Presidential authority.” (citation omitted, emphasis added, applying West Virginia v. EPA, 142 S. Ct. 2587 (2022)).

In Louisiana v. Biden, No. 22-30019 (Dec. 19, 2022), a panel majority invalidated a Presidential vaccination mandate, holding: “This so-called ‘Major Questions Doctrine’ – that is, that ‘[w]e expect Congress to speak clearly when authorizing an agency to exercise powers of vast economic and political significance,’ – serves as a bound on Presidential authority.” (citation omitted, emphasis added, applying West Virginia v. EPA, 142 S. Ct. 2587 (2022)).

A dissent saw matters otherwise. A commentator in Slate criticized the expansion of the major questions doctrine to actions by the executive branch. On this general topic, I’ve suggested in Law360 that the major questions doctrine may have the unintended consequence of justifying Congressional restrictions on Article III jurisdiction.

Now available! My (free) e-book, “Originalism Ascendant,” which builds upon recent media appearances to describe where the Constitution finds itself, for the rest of the 2020s, after the overruling of Roe v. Wade.

Now available! My (free) e-book, “Originalism Ascendant,” which builds upon recent media appearances to describe where the Constitution finds itself, for the rest of the 2020s, after the overruling of Roe v. Wade.

Topics include:

- How clear are the guidelines for state laws about abortion activity in another state?

- Will Lochner make a comeback?

- If so, what body of academic thought will provide guidance for the courts?

- What would Alexander Hamilton really think about modern economic regulation?

- Who exactly are “the people’s elected representatives” referred to by the Supreme Court in Dobbs?

I hope you enjoy my ideas and find them helpful in your own thinking about these important issues!

The Fifth Circuit recently summarized the sometimes-confusing law about when an adverse ruling about a grand-jury subpoena may be appealed:

The Fifth Circuit recently summarized the sometimes-confusing law about when an adverse ruling about a grand-jury subpoena may be appealed:

Our jurisdiction is generally limited to reviewing final decisions of a district court. This rule applies to appeals of orders issued in grand jury proceedings. There are two exceptions. First, if a witness chooses not to comply with a grand jury subpoena compelling production of documents and is held in contempt, that witness may immediately appeal the court’s interlocutory order. Second, under what is called the Perlman doctrine, a party need not be held in contempt prior to filing an interlocutory appeal if “the documents at issue are in the hands of a third party who has no independent interest in preserving their confidentiality.

In re Grand Jury Subpoena, No. 21-30705 (Dec. 14, 2022). (At least in theory, a mandamus petition may also be available in this setting, see generally David Coale, Five Years After Mohawk, 34 Rev. Litig. 1 (2015)).

iiiTec v. Weatherford Technology Holdings presents a series of unfortunate events that led to dismissal of an appeal.

iiiTec v. Weatherford Technology Holdings presents a series of unfortunate events that led to dismissal of an appeal.

- “iiiTec filed two motions on July 23, 2021, the twenty-eighth day after judgment. The first was a request to exceed the page limit on its proposed Rule 59/60 motion; the second was a short 14-page motion to alter the judgment. A request for leave to file is not one that can toll the deadline to appeal, but a motion to alter is.” (footnote omitted). So far, so good. But then …

- “[W]hen the court struck iiiTec’s motion to alter on October 4, the deadline to appeal reset to thirty days later on November 3. But by that date, iiiTec still had not filed its notice of appeal; it had only filed another Rule 59/60 motion to reconsider. Under Rule 59, the motion was untimely for exceeding the strict 28-day period to file; and under Rule 60, the motion could not toll the deadline because it was filed more than 28-days after final judgment.” (footnote omitted).

No. 22-20076 (Dec. 27, 2022, unpublished).

The plaintiff in Newell-Davis v. Phillips challenged the constitutionality of Louisiana’s “Facility Need Review” for entrants into the respite-care business. The program requires Louisiana regulators to “determine if there is a need for an additional [respite care] provider in the geographic location” before a new business is authorized. The Fifth Circuit found that the program satisfied rational-basis review, noting:

The record supports the State’s assertions that FNR permits enhancement of consumer welfare by “allowing [LDH] to prioritize postlicensure compliance surveys that ensure client health, safety and welfare, over the resource intensive and costly initial licensing surveys.” For example, by limiting the number of providers in the respite care business, the State can focus its resources on a manageable number of providers, which aid it in ensuring that consumers receive the best possible care in their communities.

No. 22-30166 (Dec. 13, 2022).

Defense Distributed markets design files from which a rudimentary firearm can be made on a 3-D printer. This controversial product has drawn substantial attention from regulators, which in turn has led to litigation.

Defense Distributed markets design files from which a rudimentary firearm can be made on a 3-D printer. This controversial product has drawn substantial attention from regulators, which in turn has led to litigation.

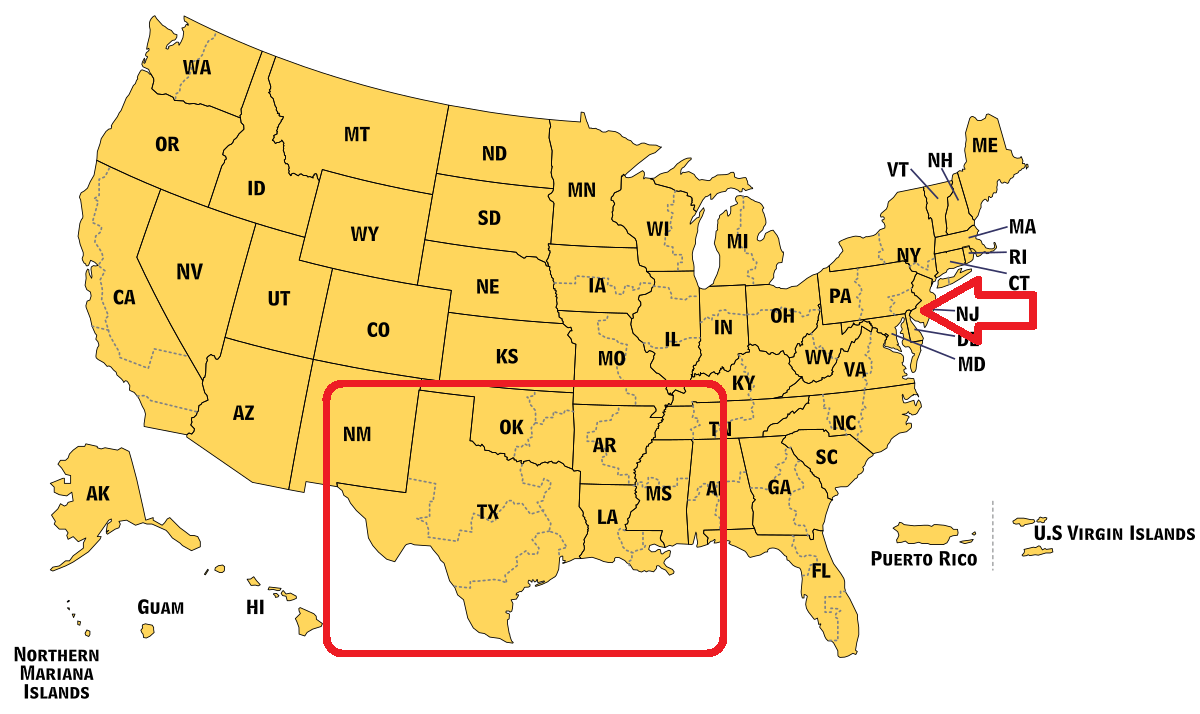

One part of that litigation, involving the New Jersey Attorney General, was transferred from Texas federal court to New Jersey federal court, after which a Fifth Circuit panel held that the transfer was erroneous. But New Jersey is not in the Fifth Circuit (right), and the New Jersey district court declined a request to voluntarily return the case.

Defense Distributed thus reloaded in Texas, “advanc[ing] two procedural theories to establish that the district court now has jurisdiction over their new request for a preliminary injunction against NJAG. One is that our court’s order to vacate the district court’s sever-and-transfer order automatically ‘revived’ plaintiffs’ claims against NJAG by operation of law. The second is that Federal Rule of Civil Procedure 15 allows plaintiffs to ‘refile’ their claims against NJAG, and they did so when they requested leave to amend to add NJAG to the existing case against the State Department in the Western District of Texas.” (emphasis added).

The Fifth Circuit found that neither theory was viable after a case had been transferred out of its jurisdiction. It observed that “[t]here was a solution to the jurisdictional morass in which plaintiffs found themselves: [t]hey could have moved for a stay of the district court’s transfer order before the case was transferred.” Defense Distributed v. Platkin, No. 22-50669 (Dec. 15, 2022) (Haynes, J., concurring in the judgment only).

A specific federal statute, 28 U.S.C. § 1782(a), deals with discovery requests in aid of foreign litigation. In Banca Pueyo SA v. Lone Star Fund IX (US), L.P., the Fifth Circuit held that its precedent “cannot be read either for the proposition that adversarial testing may be precluded on the merits of a § 1782(a) application following an ex parte ruling [about the requested discovery], or that [Fed. R. Civ. P.] 45 furnishes the only means to challenge the initiation of the subpoenas approved ex parte by the district court.” No. 21-10776 (Dec. 13, 2022).

A specific federal statute, 28 U.S.C. § 1782(a), deals with discovery requests in aid of foreign litigation. In Banca Pueyo SA v. Lone Star Fund IX (US), L.P., the Fifth Circuit held that its precedent “cannot be read either for the proposition that adversarial testing may be precluded on the merits of a § 1782(a) application following an ex parte ruling [about the requested discovery], or that [Fed. R. Civ. P.] 45 furnishes the only means to challenge the initiation of the subpoenas approved ex parte by the district court.” No. 21-10776 (Dec. 13, 2022).

The Senate today confirmed Hon. Dana Douglas of Louisiana as the newest judge on the Fifth Circuit, taking a seat vacated by long-serving Hon. James Dennis. Welcome to the court, Judge Douglas! Louisiana’s Advocate has a thorough story about her confirmation hearings and personal background.

The Senate today confirmed Hon. Dana Douglas of Louisiana as the newest judge on the Fifth Circuit, taking a seat vacated by long-serving Hon. James Dennis. Welcome to the court, Judge Douglas! Louisiana’s Advocate has a thorough story about her confirmation hearings and personal background.

Valiant efforts to argue that various things were not “assets” under a contract did not succeed in Sanare Energy Partners LLC v. PetroQuest Energy, LLC:

The Properties are “Assets” under the PSA, including section 11.1, even if the Bureau’s withheld consent prevented record title for the Properties from transferring to Sanare. This conclusion is plain from the PSA’s text, which excludes Customary Post-Closing Consents such as the Bureau’s from the category of consent failures that alter the parties’ bargain. Consent failures that do not produce a void-ab-initio transfer also do not alter the parties’ bargain, so the Agreements, too, are Assets under the PSA’s plain text.

No. 21-20677 (Nov. 29, 2022).

12-3 (one recusal), the full Fifth Circuit denied en banc review in Freedom From Religion Foundation v. Mack, in which the panel found no coercion (and thus no standing) in a challenge to a Texas JP’s pre-court practices.

The Fifth Circuit found that the rule of lenity applied in a disciplinary proceeding involving this Louisiana ethics rule:

A division of fee between lawyers who are not in the same firm may be made only if: (1) the client agrees in writing to the representation by all of the lawyers involved, and is advised in writing as to the share of the fee that each lawyer will receive; (2) the total fee is reasonable; and (3) each lawyer renders meaningful legal services for the

client in the matter.

It concluded that the rule was ambiguous when applied to successive rather than simultaneous counsel. In re Andry, No. 22-30231 (Nov. 29, 2022). The panel later granted rehearing and issued a revised opinion.

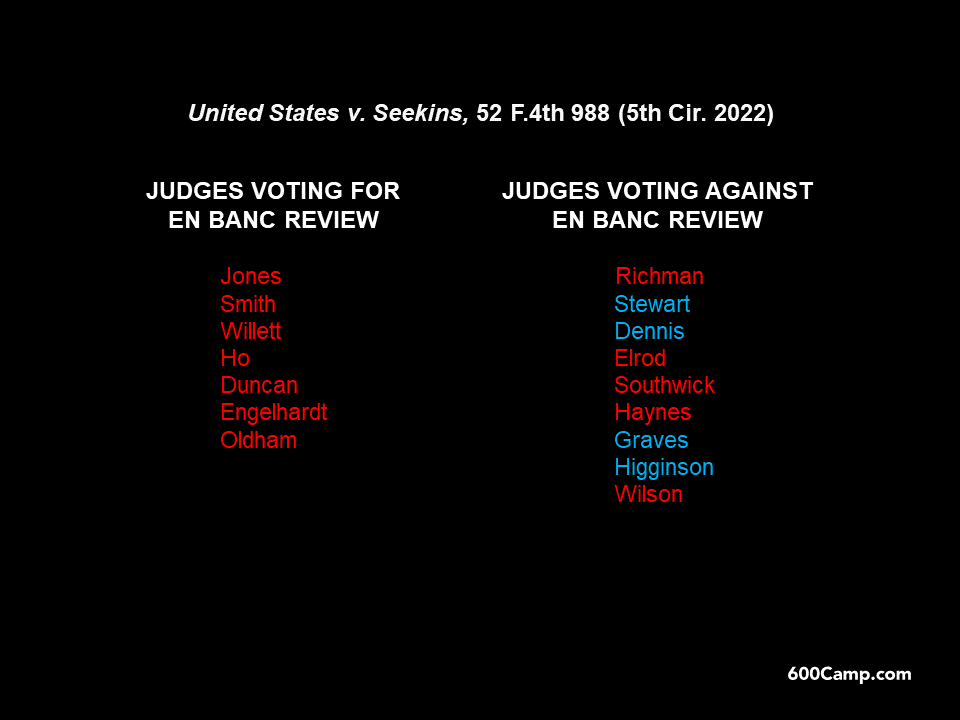

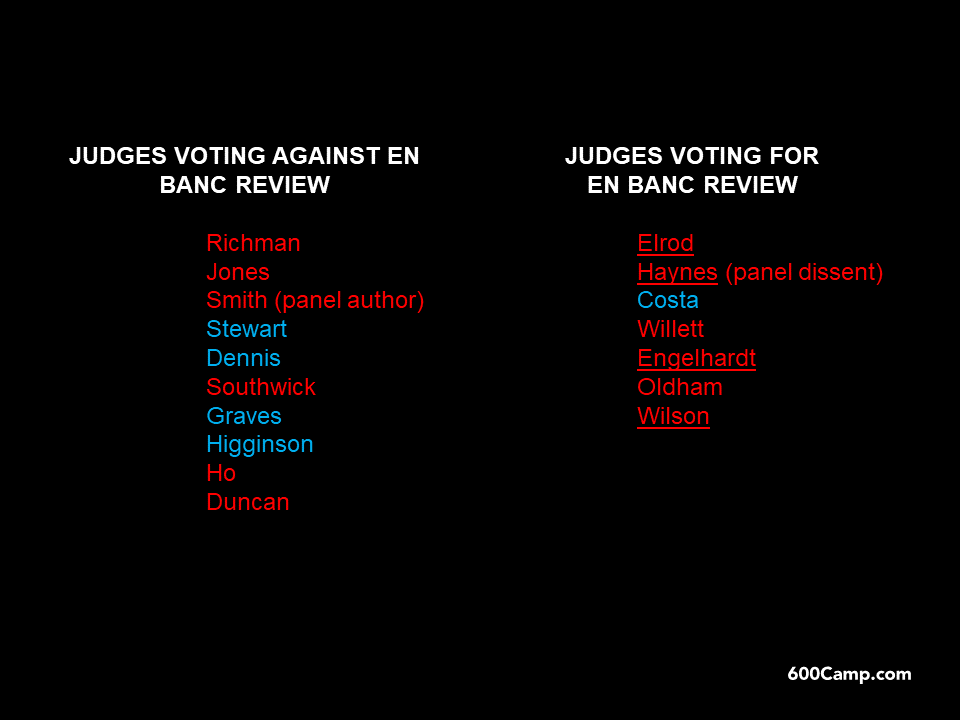

By a 9-7 vote, the Fifth Circuit declined to review en banc the panel opinion in Seekins v. United States. Under well-established Circuit precedent, Seekins presented a straightforward application of a criminal statute about possession of ammunition that had moved in interstate commerce. The petitioner directly challenged that precedent, arguing that it rested on an overly broad reading of Congress’ power to regulate interstate commerce. Plainly, the close vote signals the Court’s willingness to reconsider longstanding concepts about that constitutional provision. The breakdown of votes is below:

By a 9-7 vote, the Fifth Circuit declined to review en banc the panel opinion in Seekins v. United States. Under well-established Circuit precedent, Seekins presented a straightforward application of a criminal statute about possession of ammunition that had moved in interstate commerce. The petitioner directly challenged that precedent, arguing that it rested on an overly broad reading of Congress’ power to regulate interstate commerce. Plainly, the close vote signals the Court’s willingness to reconsider longstanding concepts about that constitutional provision. The breakdown of votes is below:

In a straightforward application of its class-certification and Daubert case law, the Fifth Circuit rejected the certification of a class of aggrieved buyers of tickets to fly on 737 Max planes operated by Southwest Airlines, finding that the buyers suffered no cognizable injury:

[T]he plaintiffs in this suit have not plausibly alleged that they’re any worse off financially because defendants’ fraud allowed Southwest and American Airlines to keep flying the MAX 8 during the class period. If anything, plaintiffs are likely better off financially. If the MCAS defect had been widely exposed earlier, the MAX 8 flights plaintiffs chose would have been unavailable and they’d have had to take different, more expensive (or otherwise less desirable) flights instead.

The Court reasoned that if information about the MAX’s problems had become publicly known earlier than it did, then some combination of Boeing, Southwest, and the FAA would have grounded the MAX (as in fact happened), thus reducing the available supply of tickets and raising prices. Earl v. The Boeing Co., No. 21-40720 (Nov. 21, 2022).

In federal court, “the Fifth Amendment Takings Clause as applied to the states through the Fourteenth Amendment does not provide a right of action for takings claims against a state,/” but in state court, “[t]he Supreme Court of Texas recognizes takings claims under the federal and state constitutions, with differing remedies and constraints turning on the character and nature of the taking ….” Devillier v. State of Texas, No. 21-40750 (Nov. 28, 2022) (footnotes omitted).

The Fifth Circuit concluded that an effort to collect a judgment in federal court failed for lack of a sufficient amount in controversy:

… As pre-judgment interest has completely accrued during the prior case, this sum can be precisely calculated and does not vary depending on the other awards and when the plaintiff files suit. Because pre-judgment interest is an accrued component of the judgment sued upon at the time the claim to enforce the judgment arose, and because pre-judgment interest’s value does not depend on the passage of time after entry of the state court judgment, pre-judgment interest can be fairly said to constitute an ‘essential ingredient in the . . . principal claim.

As to the post-judgment interest accruing after entry of the Texas Judgment, however, we conclude that it may not be included in determining the amount in controversy in an action to enforce that Judgment. Excluding post-judgment interest from the calculation furthers § 1332(a)’s statutory purpose of preventing plaintiffs from delaying in filing suit until sufficient interest has accrued such that they can reach the jurisdictional amount.

Cleartrac LLC v. Lantrac Contractors, LLC, No. 20-30076 (Nov. 17, 2022).

The plaintiffs in National Horsemen’s Benevolent & Protective Ass’n v. Black sought to rein in the Horseracing Integrity and Safety Authority, a private entity created by Congress in 2020 – nominally under FTC oversight – to nationalize the regulation of thoroughbred horseracing. The Fifth Circuit scratched HISA, finding it facially unconstitutional as an excessive private delegation of federal-government power:

The plaintiffs in National Horsemen’s Benevolent & Protective Ass’n v. Black sought to rein in the Horseracing Integrity and Safety Authority, a private entity created by Congress in 2020 – nominally under FTC oversight – to nationalize the regulation of thoroughbred horseracing. The Fifth Circuit scratched HISA, finding it facially unconstitutional as an excessive private delegation of federal-government power:

A cardinal constitutional principle is that federal power can be wielded only by the federal government. Private entities may do so only if they are subordinate to an agency. But the Authority is not subordinate to the FTC. The reverse is true. … HISA restricts FTC review of the Authority’s proposed rules. If those rules are “consistent” with HISA’s broad principles, the FTC must approve them. And even if it finds inconsistency, the FTC can only suggest changes. … An agency does not have meaningful oversight if it does not write the rules, cannot change them, and cannot second-guess their substance.

No. 22-10387 (Nov. 18, 2022) (citations omitted, emphasis added).

For those who had doubts about the matter, Foley Bey v. Prator confirms that the search of a fez is protected by qualified immunity if conducted as part of courthouse security, notwithstanding the plaintiffs’ appeal to the U.S.-Morocco Friendship Treaty of 1836. (The digital image to the right could be called a hi-res fez.) No. 21-30489 (Nov. 17, 2022).

For those who had doubts about the matter, Foley Bey v. Prator confirms that the search of a fez is protected by qualified immunity if conducted as part of courthouse security, notwithstanding the plaintiffs’ appeal to the U.S.-Morocco Friendship Treaty of 1836. (The digital image to the right could be called a hi-res fez.) No. 21-30489 (Nov. 17, 2022).

With #RIPTwitter trending as the top hashtag on that platform, it seemed like a good time to reflect on the phenomenon that is/was #appellatetwitter, and recall the remarkable talent of now-Judge @JusticeWillett for legal tweeting:

With #RIPTwitter trending as the top hashtag on that platform, it seemed like a good time to reflect on the phenomenon that is/was #appellatetwitter, and recall the remarkable talent of now-Judge @JusticeWillett for legal tweeting:

“Foreseeability is a fundamental prerequisite to the recovery of consequential damages for breach of contract.” T & C Devine, Ltd. v. Stericycle, Inc., No. 21-20310 (Nov. 15, 2022) (citation omitted); see also Hadley v. Baxendale, [1854] EWHC J70.

“Foreseeability is a fundamental prerequisite to the recovery of consequential damages for breach of contract.” T & C Devine, Ltd. v. Stericycle, Inc., No. 21-20310 (Nov. 15, 2022) (citation omitted); see also Hadley v. Baxendale, [1854] EWHC J70.

Consistent with that principle, the Fifth Circuit affirmed a summary judgment on a consequential-damage claim when the parties’ contract said that “[a]ll information obtained by [Plaintiff] in any Annual Report . . . shall be retained in the highest degree of confidentiality,” and went on to say: “Neither party may disclose the other party’s Confidential Information to any third party without the other party’s prior written approval.”

Thus: “Devine’s damages were not a probable consequence of the breach from Stericycle’s perspective at the time of contracting because it was not foreseeable that failing to provide confidential cost and expense data would deprive Devine of the opportunity to share that information with potential licensees.”

The Fifth Circuit granted mandamus relief as to an effort to subpoena Texas AG Ken Paxton for a deposition in a case about potentially overzealous enforcement of now-constitutional antiabortion laws.

The Fifth Circuit granted mandamus relief as to an effort to subpoena Texas AG Ken Paxton for a deposition in a case about potentially overzealous enforcement of now-constitutional antiabortion laws.

The panel majority concluded: (1) that the district court lacked subject matter jurisdiction and thus could not require his testimony, citing a recent Circuit case involving discovery and qualified immunity; (2) that the subpoena sought an inappropriate “apex” deposition; and (3) that plaintiffs overreached by opposing mandamus relief (because of a potential remedy by appeal), while also seeking to dismiss Paxton’s interlocutory appeal on immunity grounds (thus, extinguishing same).

A concurrence would have focused on the apex issue and not the broader dispute about jurisdiction, at least at this stage of the proceedings. In re Paxton, No. 22-50882 (Nov. 14, 2022) — REVISED, (Feb. 14, 2023).

Stringer v. Remington Arms, No. 18-60590 (Nov, 7, 2022), presents an instructive analysis of failure-to-disclose allegations, in the context of alleged fraudulent nondisclosure of a design defect in a popular rifle design.

The panel majority found a failure to satisfy Rule 9(b):

“In [plaintiffs’] complaint, they explain that they have found public resources that contradict Remington’s public statements regarding the safety of the XMP trigger. They also allege that Remington had “actual and/or physical knowledge of manufacturing, and/or, design deficiencies in the XMP Fire Control years before the death of Justin Stringer” and that the company received customer complaints regarding trigger malfunctions as early as 2008. But Plaintiffs do not make the leap to fraudulent concealment. They say merely that Remington “ignored” notice of a safety related problem.“

(applying Tuchman v. DSC Commc’ns Corp., 14 F.3d 1061, 1068 (5th Cir. 1994) (“If the facts pleaded in a complaint are peculiarly within the opposing party’s knowledge, fraud pleadings may be based on information and belief. However, this luxury ‘must not be mistaken for license to base claims of fraud on speculation and conclusory allegations.'”).

The dissent would have found that rule satisfied, based in part of the detail provided about what Remington knew: “The complaint’s allegations indicate that Remington knew about problems with the X-Mark Pro trigger before the recall but did not disclose its knowledge of those problems during the limitations period. And, contrary to Defendants’ assertion that the complaint allegations relate only to the “Walker” trigger, the deposition testimony cited in the complaint expressly references the “XMP” trigger at issue here.”

In the 1985 classic, “Return of the Living Dead,” a rainstorm spreads a zombie-creating chemical throughout a city. In 2022, the Supreme Court’s relentless focus on originalism in cases like Dobbs has also awakened long-dead legal doctrines (even as it put to bed the prospects for a “Red Wave” in 2022’s Congressional elections).

In the 1985 classic, “Return of the Living Dead,” a rainstorm spreads a zombie-creating chemical throughout a city. In 2022, the Supreme Court’s relentless focus on originalism in cases like Dobbs has also awakened long-dead legal doctrines (even as it put to bed the prospects for a “Red Wave” in 2022’s Congressional elections).

Such a resurrection can be seen in the concurrence from Golden Glow Tanning Salon v. City of Columbus, No. 21-60898 (Nov. 8, 2022), which advocates an examination of a “right to earn a living” in light of how such economic matters were understood in the late 1700s.

Of course, that phrasing is precisely how the Supreme Court described the issue in Lochner v. New York, the long-discredited 1905 opinion that struck down a maximum-hour restriction in the baking industry:

“Statutes of the nature of that under review, limiting the

hours in which grown and intelligent men may labor to earn their living, are mere meddlesome interferences with the rights of the individual ….”

The Supreme Court abandoned Lochner in the 1930s when laissez-faire ideas proved useless in the face of a systemic failure of capitalism itself. There is, of course, ample room for argument about the proper role of government in the economy. But the invocation of “originalism” to simply ignore Lochner ‘s failure is not consistent with the recognized best practices for battling zombies.

The slippery statutory-interpretation question in United States v. Palomares, briefly summarized in Monday’s post, presented a concurrence by Judge Andy Oldham. In it, he reminded of the importance of “textualism” in statutory interpretation, while cautioning against “hyper-literalism”:

The slippery statutory-interpretation question in United States v. Palomares, briefly summarized in Monday’s post, presented a concurrence by Judge Andy Oldham. In it, he reminded of the importance of “textualism” in statutory interpretation, while cautioning against “hyper-literalism”:

“‘[W]ords are given meaning by their context, and context includes the purpose of the text.’ As Justice Scalia once quipped, without context, we could not tell whether the word draft meant a bank note or a breeze. Such nuance is lost on the hyper-literalist.”

(citations omitted). He further observed:

“[H]yper-literalism … opens textualism to the very criticism that necessitated textualism in the first place. In one of the most influential law review articles ever written, Karl Llewellyn denigrated the late nineteenth century ‘Formal Period,’ in which ‘statutes tended to be limited or even eviscerated by wooden and literal reading, in a sort of long-drawn battle between a balky, stiff-necked, wrongheaded court and a legislature which had only words with which to drive that court.'”

(emphasis added, quoting Karl M. Llewellyn, “Remarks on the Theory of Appellate Decision and the Rules or Canons about How Statutes Are to Be Construed,” 3 Vanderbilt L. Rev. 395 (1950)).

The prefix “hyper-” is well chosen; Jean Baudrillard’s Simulacra and Simulations developed the concept of “hyperreality,” by which “simulacra” of reality can supplant reality itself–precisely the scenario described by Llewellyn and Judge Oldham’s concurrence:

The prefix “hyper-” is well chosen; Jean Baudrillard’s Simulacra and Simulations developed the concept of “hyperreality,” by which “simulacra” of reality can supplant reality itself–precisely the scenario described by Llewellyn and Judge Oldham’s concurrence:

If we were able to take as the finest allegory of simulation the Borges tale where the cartographers of the Empire draw up a map so detailed that it ends up exactly covering the territory (but where, with the decline of the Empire this map becomes frayed and finally ruined, a few shreds still discernible in the deserts – the metaphysical beauty of this ruined abstraction, bearing witness to an imperial pride and rotting like a carcass, returning to the substance of the soil, rather as an aging double ends up being confused with the real thing), this fable would then have come full circle for us, and now has nothing but the discrete charm of second-order simulacra.

Bloomberg Law provides a good summary of yesterday’s arguments in SEC v. Cochran, addressed by the en banc Fifth Circuit in 2021, as to the appropriate places to advance constitutional challenges to SEC enforcement actions.

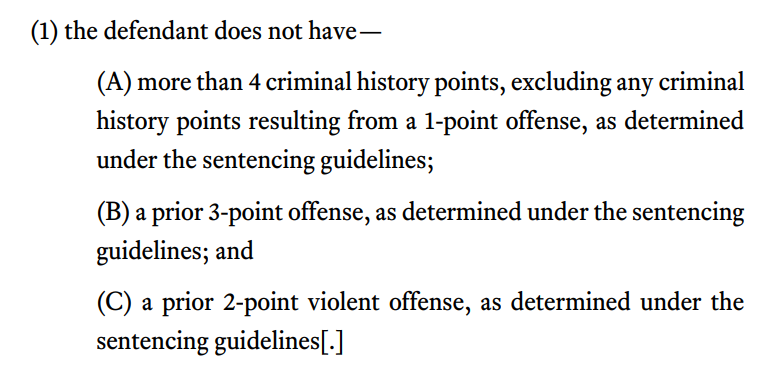

Nonami Palomares received a 120-month, mandatory-minimum sentence for smuggling heroin. She sought a lower sentence under 18 U.S.C. § 3553(f), which allows a drug offender with a sufficiently minor criminal history to receive relief from a mandatory minimums if certain criteria are satisfied.

Nonami Palomares received a 120-month, mandatory-minimum sentence for smuggling heroin. She sought a lower sentence under 18 U.S.C. § 3553(f), which allows a drug offender with a sufficiently minor criminal history to receive relief from a mandatory minimums if certain criteria are satisfied.

So far, simple enough. That statute, however, is extremely difficult to read. It has produced a circuit split, as well as three separate opinions from the panel members in United States v. Palomares, No. 21-40247 (Nov. 2, 2022).

Try your hand, if you dare, at reading the below law, and then compare your conclusion to the panel members’. To obtain sentencing relief, did Palomares have to negate all three matters in (A)-(C), or only one of them?

The recent en banc vote in Wearry v. Foster featured discussion of a “dubitante” opinion filed by a panel member. Unfamiliar with the term, I learned from Wikipedia that this phrase has a long and distinguished – if somewhat obscure – history in judicial opinions as a way for a judge to note his or her doubts about the rule of decision.

I then consulted my friend Brent McGuire, the pastor of Our Redeemer Lutheran Church in Dallas, who gave me further detail:

“Dubitante would literally mean ‘having doubts’ or “with a wavering [mind].’ It’s the singular participial form of the verb dubitō, dubitāre, which means to doubt or to waver. But that ‘e’ ending means it’s the ablative case, which is basically the adverbial case, that is to say, the case the noun or adjective takes when used to describe in some way a verb, adjective, or other adverb.”

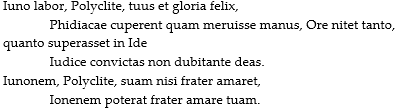

To illustrate its historical use, Pastor Maguire offered this epigram from Martial, found on the Tufts classical search engine:

which he translates roughly as:

Pastor Maguire explains: “Martial is telling the sculptor Polyclitus that his statute of Juno is so beautiful that Paris (at that most fateful beauty pageant on Ida) would have picked it over Venus (Aphrodite) and Minerva (Athena) without hesitation. Moreover, if Jupiter had not already fallen for his actual sister Juno, he would have fallen in love for Polyclitus’s statue of her.” Conversely, then, a “dubitante” judge may have joined Paris’s conclusion, but with nagging doubts about the eternal beauty of the goddesses.

The Fifth Circuit denied mandamus relief in In re Planned Parenthood, noting, in particular, that:

The Fifth Circuit denied mandamus relief in In re Planned Parenthood, noting, in particular, that:

The district court also stressed the lateness of Petitioners’ motion to transfer. It concluded that the motion was “inexcusably delayed,” observing that Petitioners “filed their motion seven months after this case was unsealed and months into the discovery period.” The district court was within its discretion to conclude that Petitioners’ failure to seek relief until late in the litigation weighed against transfer. This conclusion is only strengthened by the fact that Petitioners waited to seek transfer until after the district court denied their motion to dismiss and motion for reconsideration.

No. 22-11009 (Oct. 31, 2022) (citations omitted). In a part of the opinion joined by two judges, the Court also favorably reviewed the district court’s analysis of the underlying forum-transfer issue.

Central Crude, Inc. v. Liberty Mutual confirms that under Louisiana law, a pollution exclusion doesn’t require the insured to have the ultimate fault for the alleged pollution:

Central Crude, Inc. v. Liberty Mutual confirms that under Louisiana law, a pollution exclusion doesn’t require the insured to have the ultimate fault for the alleged pollution:

Neither the CGL policy nor [the Louisiana Supreme Court’s opinion in Doerr] requires identification of the party at fault for the oil spill in determining whether the total pollution exclusion applies here. The CGL policy’s total pollution exclusion broadly precludes coverage for bodily injury or property damage that “would not have occurred in whole or in part but for the actual, alleged or threatened discharge, dispersal, seepage, migration, release or escape of ‘pollutants’ at any time.” The provision requires a dispersal of pollutants but makes no requirement that the party responsible for the dispersal be determined.

No. 21-30707 (Oct. 26, 2022).

Among other issues from an insurance-coverage case arising from a building collapse, in Hudson Specialty Ins. Co. v. Talex Enterprises, LLC, the Fifth Circuit considered whether the expense of fire and police personnel was “maintenance” within the meaning of a policy exclusion. The Court found that term ambiguous as to those expenses, and thus construed it against the insurer:

The City paid for the around-the-clock presence of its fire and police personnel to protect the integrity of the site and keep people out.

On the one hand, it is reasonable to read this police and fire department presence as maintenance. By keeping watch over the site and keeping people out, these public safety officials were “upholding or keeping in being” the property in its current state. This aligns with one of the definitions of maintenance listed above.

On the other hand, the definitions of maintenance as “[t]he action of keeping something in working order” or “[t]he care and work put into property” both imply that actions are taken upon the property to keep it in working order. Keeping watch is an action, but it is not performed upon the property and does not involve putting work into the property. Thus, there are at least two reasonable meanings for the term maintenance—one where these expenses would fall under the exclusion and one where they would not.

No. 21-60794 (Oct. 28, 2022) (paragraph breaks added).

Levy (a citizen of Louisiana) sued Dumesnil (also a citizen of Louisiana), along with Zurich American Insurance Company (not a citizen of Louisiana), and another entity that “claims to be citizen of Louisiana, and nothing in the record indicates otherwise.”

Levy (a citizen of Louisiana) sued Dumesnil (also a citizen of Louisiana), along with Zurich American Insurance Company (not a citizen of Louisiana), and another entity that “claims to be citizen of Louisiana, and nothing in the record indicates otherwise.”

Complete diversity thus did not exist. A citizen of Louisiana was on both sides of the “v.”

Nevertheless, Zurich persisted. It removed to federal court. At the time it removed, it was the only defendant that had been served. Thus, argued Zurich, it had successfully completed a “snap” removal under Texas Brine Co. v. American Arbitration Association, Inc., 955 F.3d 482 (5th Cir. 2020).

The Fifth Circuit granted mandamus relief as to the trial court’s denial of the plaintiff’s motion to remand. Yes, Zurich had removed before the in-state defendant had been served, and thus satisfied that requirement for a successful snap removal. But Zurich had not satisfied the more basic requirement for a snap – or for that matter, any – removal based on diversity: complete diversity of citizenship.

Because “the existence of diversity is determined from the fact of citizenship of the parties named and not from the fact of service,” removal was improper. In re Levy, No. 22-30622 (5th Cir. 2022) (applying New York Life Ins. Co. v. Deshotel, 142 F.3d 873, 883 (5th Cir. 1998))

Summary judgment was affirmed in a contract case, despite the appellants’ claim that genuine issues of material fact existed about the overlap between two material parties: “Imperial and Harrison are—and always have been—separate entities with their own employees, customers, and warehouses. As the district court explained, A-Z and Ali do not allege, let alone present evidence, ‘that A-Z experienced any changes in ordering procedures, pricing, delivery schedules, type or brand of goods, inventory availability, or any other indicia that . . . [shows] it was no longer doing business with Harrison.'” Harrison Co., LLC v. A-Z Wholesalers, Inc., No. 21-11028 (Aug. 11, 2022).

Summary judgment was affirmed in a contract case, despite the appellants’ claim that genuine issues of material fact existed about the overlap between two material parties: “Imperial and Harrison are—and always have been—separate entities with their own employees, customers, and warehouses. As the district court explained, A-Z and Ali do not allege, let alone present evidence, ‘that A-Z experienced any changes in ordering procedures, pricing, delivery schedules, type or brand of goods, inventory availability, or any other indicia that . . . [shows] it was no longer doing business with Harrison.'” Harrison Co., LLC v. A-Z Wholesalers, Inc., No. 21-11028 (Aug. 11, 2022).

The Fifth Circuit set a boundary – literally – for part of the administrative state in BP v. FERC, which reviewed a FERC fine of BP for alleged gas-price manipulation associated with Hurricane Ike. The Court held:

Contrary to FERC’s position, we hold that the Commission has jurisdiction only over transactions in interstate natural gas directly regulated by the Natural Gas Act (NGA). Specifically, we reject FERC’s broader theory that its authority to address market manipulation extends to any natural gas transaction which affects the price of a transaction under the NGA. Otherwise, however, we uphold the Commission’s order. Nevertheless, because FERC predicated its penalty assessment on its erroneous position that it had jurisdiction over all (and not just some) of BP’s transactions, we must remand for reassessment of the penalty in the light of our jurisdictional holding.

No. 21-60083-CV (Oct. 20, 2022, unpublished) (emphasis added).

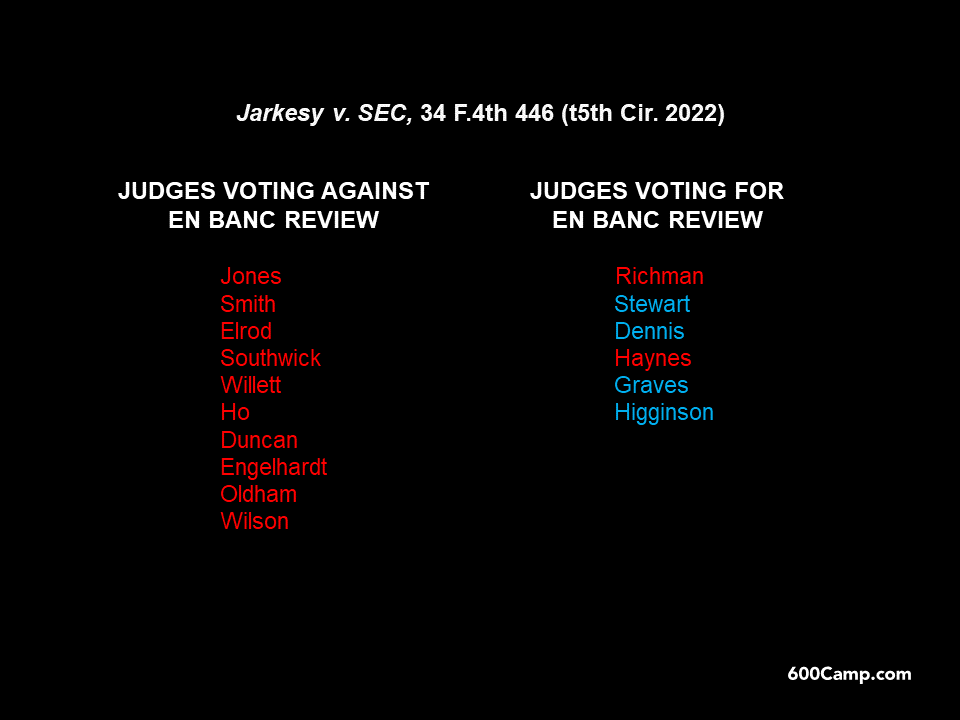

The Fifth Circuit recently declined to review Jarkesy v. SEC en banc; the division of votes was as follows (names in blue were appointed by a Democratic president; red, by a Republican one):

CFSA v. CFPB finds – again – that the Consumer Financial Protection Bureau is unconstitutionally structured, but this time because its “double insulated” funding mechanisms violated the Appropriations Clause by circumventing Congress’ “power of the purse.” The arguments about that fundamental Constitutional provision are intriguing and seem likely to draw the Supreme Court’s interest. No. 21-50826 (Oct. 19, 2022). The Fifth Circuit’s treatment creates a split with seven other federal courts, including PHH Corp. v. CFPB, 881 F.3d 75 (D.C. Cir. 2018). A recent Slate article offered criticism of the opinion.

The opinion also presents a rare appearance of the word “magisterial” to describe an earlier case on this topic:  Cf. Herman Hesse, “Magister Ludi” (1943).

Cf. Herman Hesse, “Magister Ludi” (1943).

If you are a Yale law student grown weary of debate about judicial clerkship policies, please come visit us here at Lynn Pinker Hurst & Schwegmann – Chambers says we’re in the top handful of courtroom advocacy firms in Texas, and the Dallas economy and legal market are both booming.

If you are a Yale law student grown weary of debate about judicial clerkship policies, please come visit us here at Lynn Pinker Hurst & Schwegmann – Chambers says we’re in the top handful of courtroom advocacy firms in Texas, and the Dallas economy and legal market are both booming.

Ramirez v. Paloma Energy, No. 21-30536 (Oct. 12, 2022, unpublished), provides a clean example of affirmance on a ground presented by the record, independent of the district court’s opinion:

Ultra Petroleum entered bankruptcy because of a sharp decline in natural gas prices. During the bankruptcy case, however, the price of gas recovered and soared and “propelled the debtors back into solvency.” That fortunate situation led to the question whether the “solvent debtor” concept survived recent Bankruptcy Code amendments.

Ultra Petroleum entered bankruptcy because of a sharp decline in natural gas prices. During the bankruptcy case, however, the price of gas recovered and soared and “propelled the debtors back into solvency.” That fortunate situation led to the question whether the “solvent debtor” concept survived recent Bankruptcy Code amendments.

The Fifth Circuit’s panel majority applied the relevant statutory-interpretation framework:

We must defer to prior bankruptcy practice unless expressly abrogated. The [Supreme] Court has endorsed a substantive canon of interpretation regarding the Bankruptcy Code vis-à-vis preexisting bankruptcy doctrine. Namely, abrogation of a prior bankruptcy practice generally requires an “unmistakably clear” statement on the part of Congress; any ambiguity will be construed in favor of prior practice.

(citations omitted), and concluded that the exception continued to apply:

The reason for this traditional, judicially-crafted exception is straightforward: Solvent debtors are, by definition, able to pay their debts in full on their contractual terms, and absent a legitimate bankruptcy reason to the contrary, they should. Unlike the typical insolvent bankrupt, a solvent debtor’s pie is large enough for every creditor to have his full slice. With an insolvent debtor, halting contractual interest from accruing serves the legitimate bankruptcy interest of equitably distributing a limited pie among competing creditors as of the time of the debtor’s filing. With a solvent debtor, that legitimate bankruptcy interest is not present.

Ultra Petroleum Corp. v. Ad Hoc Committee, No. 21-20008 (Oct. 14, 2022) (citations omitted). A dissent read the Code differently.

Echoing the Fifth Circuit’s recent opinion in King v. Baylor Univ., in Jones v. Administrators of the Tulane Education Fund, the Court again allowed a breach-of-contract claim about virtual education to proceed past the Rule 12 stage, concluding:

Echoing the Fifth Circuit’s recent opinion in King v. Baylor Univ., in Jones v. Administrators of the Tulane Education Fund, the Court again allowed a breach-of-contract claim about virtual education to proceed past the Rule 12 stage, concluding:

“First, we hold that the claim is not barred as a claim of educational malpractice because the Students do not challenge the quality of the education received but the product received. Second, we reject Tulane’s argument that the breach-of-contract claim is foreclosed by an express agreement between the parties, because the agreement at issue plausibly does not govern refunds in this circumstance. And third, we conclude that the Students have not plausibly alleged that Tulane breached an express contract promising in-person instruction and on-campus facilities because the Students fail to point to any explicit language evidencing that promise. But we hold that the Students have plausibly alleged implied-in fact promises for in-person instruction and on-campus facilities.“

No. 21-30681 (Oct. 11, 2022) (emphasis in original).

The recent Crane v. City of Arlington opinion declined to dismiss a traffic-stop case on qualified immunity grounds, noting significant factual dispute about how the situation escalated into a tragic shooting. No. 21-10644 (revised Oct. 4, 2022). The Dallas Morning News covered the case, and I did a lengthy interview with Fox 4 in Dallas about it.

In a COVID-19 coverage case, the appellant in Coleman E. Adler & Sons v. Axis Surplus Ins. Co. tried to avoid earlier Fifth Circuit precedent by pointing to a recent opinion from an intermediate Louisiana appellate court. The Fifth Circuit did not accept the appellant’s argument, noting:

In a COVID-19 coverage case, the appellant in Coleman E. Adler & Sons v. Axis Surplus Ins. Co. tried to avoid earlier Fifth Circuit precedent by pointing to a recent opinion from an intermediate Louisiana appellate court. The Fifth Circuit did not accept the appellant’s argument, noting:

- Orderliness. “Our court’s rule of orderliness applies to Erie cases no less than cases interpreting federal law.”

- Erie. “[T]here has been ‘neither a clearly contrary subsequent holding of the highest court of [Louisiana] nor a subsequent statutory authority, squarely on point.’ Nor has there been contrary intervening precedent that ‘comprises unanimous or near-unanimous holdings from several—preferably a majority —of the intermediate appellate courts of [Louisiana].’ We have only one subsequent decision from an intermediate state court, and that cannot overcome our rule of orderliness.” (citations omitted).

No. 21-30478 (Sept. 20, 2022).

The panel majority in Freedom From Religion Foundation v. Mack found no coercion, and thus no standing for the plaintiff, in an Establishment Clause challenge to a Texas Justice of the Peace’s practices regarding a prayer at the beginning of court sessions. No. 21-20279 (Sept. 29, 2022).

The panel majority in Freedom From Religion Foundation v. Mack found no coercion, and thus no standing for the plaintiff, in an Establishment Clause challenge to a Texas Justice of the Peace’s practices regarding a prayer at the beginning of court sessions. No. 21-20279 (Sept. 29, 2022).

This case contrasts with Sambrano v. United States, in which the panel majority found standing in a Title VII case about a company’s vaccination requirement, concluding that the employer’s policies had a coercive effect as to certain employees’ religious beliefs. No. 21-11159 (Feb. 17, 2022, en banc review denied).

Chevrolet’s Caprice Classic was a popular sedan in the late 1970s. But the term “caprice,” applied to the business-judgment rule in the bankruptcy context, was less popular with the Fifth Circuit in In re J.C. Penney, No. 22-40371 (Oct. 6, 2022).

Chevrolet’s Caprice Classic was a popular sedan in the late 1970s. But the term “caprice,” applied to the business-judgment rule in the bankruptcy context, was less popular with the Fifth Circuit in In re J.C. Penney, No. 22-40371 (Oct. 6, 2022).

Specifically, a sublessee from J.C. Penney challenged that debtor’s decision to reject that sublease, noting irregularities in the relevant bidding process, and urging adoption a view of the business-judgment rule that would not defer to “the product of bad faith, or whim, or caprice.” The Court disagreed, observing:

The question is not whether the debtor’s decision reasonably protects the interests of other parties, but rather whether the decision “appears to enhance a debtor’s estate.” This distinction proves fatal to Klairmont’s claim, as bankruptcy, by definition, often adversely affects the interests of other parties. The long-standing purpose of allowing debtors to shed executory contracts is to afford trustees and assignees the opportunity to reject “property of an onerous or unprofitable character.” The correct inquiry under the business judgment standard is whether the debtor’s decision regarding executory contracts benefits the debtor, not whether the decision harms third parties.

No. 22-40371 (Oct. 6, 2022).

The Onion, America’s Finest News Source, recently weighed in at SCOTUS with a brilliant amicus brief about First Amendment protection for parody; this excerpt summarizes the overall flavor:

In Dune, Duke Leto Atreides cautions his son about the family’s move to Arrakis, telling him to watch for “a feint within a feint within a feint…seemingly without end.” In that spirit, Advanced Indicator & Mfg. v. Acadia Ins. Co. analyzed a complex removal issue, noting:

In Dune, Duke Leto Atreides cautions his son about the family’s move to Arrakis, telling him to watch for “a feint within a feint within a feint…seemingly without end.” In that spirit, Advanced Indicator & Mfg. v. Acadia Ins. Co. analyzed a complex removal issue, noting:

- “Ordinarily, diversity jurisdiction requires complete diversity—if any plaintiff is a citizen of the same State as any defendant, then diversity jurisdiction does not exist.”

- “‘However, if the plaintiff improperly joins a non-diverse defendant, then the court may disregard the citizenship of that defendant, dismiss the non-diverse defendant from the case, and exercise subject matter jurisdiction over the remaining diverse defendant.’ … A defendant may establish improper joinder in two ways: ‘(1) actual fraud in the pleading of jurisdictional facts, or (2) inability of the plaintiff to establish a cause of action against the non-diverse party in state court.’”

- But see: “[T]he voluntary-involuntary rule … dictates that ‘an action nonremovable when commenced may become removable thereafter only by the voluntary act of the plaintiff.’”

These principles applied to this situation: Advanced Indicator (a Texas business) sued Acadia Insurance (diverse) and its Texas-based insurance agent (not-diverse). But after suit was filed, Acadia invoked a Texas statute “which provides that should an insurer accept responsibility for its agent after suit is filed, ‘the court shall dismiss the action against the agent with prejudice.'”

The Fifth Circuit, noting different district-court opinions about this statute and carefully reviewing its own precedents, concluded that “because [the agent] was improperly joined at the time of removal, Acadia’s removal was proper.” No. 21-20092 (Oct. 3, 2022) (emphasis added, citations removed).

Scylla and Charybdis, the “double threat” foes of Ulysses in the Odyssey (right), would have been interested in Denning v. Bond Pharmacy, Inc., where the plaintiff successfully “show[ed] an injury in fact through her breach of contract claims.” So far so good. But the Court continued: “Athough Denning has established injury in fact, she cannot get past the redressability prong required to establish standing. This is because her injury, as she alleges it, is not redressable by the compensatory and punitive damages that she seeks. Put another way, rendering an award of damages in favor of Denning does not redress her insurer’s injury of being subjected to AIS’s unauthorized billing practices.” No. 21-30534 (Sept. 30, 2022).

Scylla and Charybdis, the “double threat” foes of Ulysses in the Odyssey (right), would have been interested in Denning v. Bond Pharmacy, Inc., where the plaintiff successfully “show[ed] an injury in fact through her breach of contract claims.” So far so good. But the Court continued: “Athough Denning has established injury in fact, she cannot get past the redressability prong required to establish standing. This is because her injury, as she alleges it, is not redressable by the compensatory and punitive damages that she seeks. Put another way, rendering an award of damages in favor of Denning does not redress her insurer’s injury of being subjected to AIS’s unauthorized billing practices.” No. 21-30534 (Sept. 30, 2022).

Addressing a basic but delicate issue about franchise law, the Fifth Circuit stated its test for enforcement of an arbitration agreement based on “close relationship” principles in Franlink Inc. v. BACE Servcs., Inc.:

Borrowing from the precedents, including the Third and Seventh Circuits, we extract a few fundamental factors applicable here that we will consider in determining whether these nonsignatories are closely related: (1) common ownership between the signatory and the non-signatory, (2) direct benefits obtained from the contract at issue, (3) knowledge of the agreement generally and (4) awareness of the forum selection clause particularly. Of course, the closely-related doctrine is context specific and is determined only after weighing the significance of the facts relevant to the particular case at hand.

No. 21-20316 (Sept. 28, 2022) (citations omitted, emphasis added).

In Rhone v. City of Texas City, the Fifth Circuit denied a request for emergency relief without prejudice, first describing the controlling rules:

In Rhone v. City of Texas City, the Fifth Circuit denied a request for emergency relief without prejudice, first describing the controlling rules:

[Fed. R. App. P. ] 8(a)(1) states that “[a] party must ordinarily move first in the district court for … (A) a stay of the judgment or order of a district court pending appeal.” Rule 8(a)(2) provides, however that “[a] motion for the relief mentioned in Rule 8(a)(1) may be made to the court of appeals or to one of its judges.” That provision is subject to a requirement that “[t]he motion must: (i) show that moving first in the district court would be impracticable; or (ii) state that, a motion having been made, the district court denied the motion or failed to afford the relief requested and state any reasons given by the district court for its action.” Rule 8(a)(2)(A).

Applying those rules, the Court concluded:

In this case, Rhone has moved for relief from judgment in the district court and no ruling has been made. As such, this motion is premature. Therefore, the motion before us is denied without prejudice. Should the district court deny Rhone’s pending motion, Rhone may revive the motion in this Court.

No. 22-40551 (Sept. 19, 2022, unpublished).

The district court in Williams v. Biomedical Research Foundation imposed a sanction for what it saw as an “impertinent” email to its law clerk. The Fifth Circuit reversed, noting: “The district judge signaled his intent to sanction Plante-Northington for the first time at an oral hearing on an unrelated matter. He then imposed the sanctions just minutes later at that hearing. Plante-Northington was allowed to utter only a few sentences in her defense before she was cut off. More importantly, she was given no advance notice sufficient for preparing a written or oral submission in response to the contemplated sanctions.” No. 22-30064 (Aug. 24, 2022) (unpublished).

Professor Steve Vladeck recently filed a provocative amicus brief about the State of Texas’s forum-selection practices in public law / constitutional cases.

The Fifth Circuit is soliciting comment on a potential change to local rule 47.5.4:

In BRFHH Shreveport, LLC v. Willis-Knighton Medical Center, the Fifth Circuit affirmed the dismissal of antitrust claims when:

In BRFHH Shreveport, LLC v. Willis-Knighton Medical Center, the Fifth Circuit affirmed the dismissal of antitrust claims when:

- As to the plaintiff’s theory of a “threat-and-accession” agreement in violation of section 1 of the Sherman Act, “[t]he problem is that LSU had a completely independent reason for refusing to cooperate with BRF, which predated any alleged coercion by Willis-Knighton. Specifically, LSU issued a notice of breach to BRF in 2015--the year before LSU’s cash crunch and Willis-Knighton’s alleged coercion.” (emphasis in original).

- And as to the related monopolization claim under section 2, the relevant allegations “are little more than high-level assertions about how wonderful things would be if Willis-Knighton hadn’t formed an exclusive-dealing relationship with LSU … [T]hey are miles away from plausibly alleging that Willis-Knighton came close to substantially foreclosing the Shreveport healthcare market.”