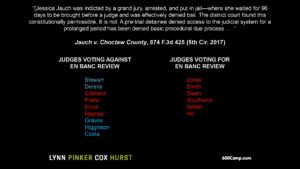

The Fifth Circuit recently denied en banc rehearing in the high-profile qualified immunity case of Jauch v. Choctaw County, where the panel denied immunity to a sheriff who had been sued over a lengthy period of pretrial detention. From one perspective, a chart of the 9-6 vote (below) shows a vote along “party lines,” with all of the votes for rehearing coming from judges appointed by Republican presidents (including both of President Trump’s recent appointments), and with all active judges appointed by Democratic presidents voting against rehearing. From another perspective, the vote shows that the group of active judges appointed by Republican presidents is hardly a monolithic bloc, as it divided roughly in half on the vote.

Monthly Archives: March 2018

Midwest Feeders, a cattle feedlot business, sued The Bank of Franklin under Mississippi law, alleging that the Bank tolerated a customer’s fraudulent activities that resulted in considerable financial harm. The Fifth Circuit affirmed summary judgment for the bank. Among other rulings, the Court addressed whether Mississippi law imposed a duty to avoid negligence on a bank, as against a non-customer. Finding no guidance from that state’s supreme court, and inconclusive opinions from other Mississipi courts, the Court surveyed authority nationally and noted “the merits of [the] line of cases” that potentially allowed such liability if the bank knoows of a fiduciary relationship between the customer and the non-customer. Unfortunately for the plaintiff, however, the Court held that “we cannot use our Erie guess to impose upon Mississippi a new regime of liability for its banks.” Midwest Feeders, Inc. v. Bank of Franklin, No. 17-60092 (March 27, 2018).

Midwest Feeders, a cattle feedlot business, sued The Bank of Franklin under Mississippi law, alleging that the Bank tolerated a customer’s fraudulent activities that resulted in considerable financial harm. The Fifth Circuit affirmed summary judgment for the bank. Among other rulings, the Court addressed whether Mississippi law imposed a duty to avoid negligence on a bank, as against a non-customer. Finding no guidance from that state’s supreme court, and inconclusive opinions from other Mississipi courts, the Court surveyed authority nationally and noted “the merits of [the] line of cases” that potentially allowed such liability if the bank knoows of a fiduciary relationship between the customer and the non-customer. Unfortunately for the plaintiff, however, the Court held that “we cannot use our Erie guess to impose upon Mississippi a new regime of liability for its banks.” Midwest Feeders, Inc. v. Bank of Franklin, No. 17-60092 (March 27, 2018).

In Legendre v. Huntington Ingalls, the Fifth Circuit found no “causal nexus” to support removal jurisdiction under the “federal officer” statute. The plaintiff alleged exposure to asbestos fibers brought home on her father’s clothing; he worked in a shipyard in the 1940s building tugs for the U.S. government. Under pre-2011 Fifth Circuit authority, that claim had a problem because the shipyard’s safety practices were not restricted by the government. The statute, however, was amended in 2011 “to allow the removal of a state suit ‘for OR RELATING TO any act under color of such [federa] office.'” Acknowledging that “significant argument,” and noting that other circuits have read the 2011 amendments to eliminate the “causal nexus” requirement, the Court affirmed remand – while plainly inviting a petition for en banc consideration of the issue.No. 17-30371 (March 16, 2018).

In Legendre v. Huntington Ingalls, the Fifth Circuit found no “causal nexus” to support removal jurisdiction under the “federal officer” statute. The plaintiff alleged exposure to asbestos fibers brought home on her father’s clothing; he worked in a shipyard in the 1940s building tugs for the U.S. government. Under pre-2011 Fifth Circuit authority, that claim had a problem because the shipyard’s safety practices were not restricted by the government. The statute, however, was amended in 2011 “to allow the removal of a state suit ‘for OR RELATING TO any act under color of such [federa] office.'” Acknowledging that “significant argument,” and noting that other circuits have read the 2011 amendments to eliminate the “causal nexus” requirement, the Court affirmed remand – while plainly inviting a petition for en banc consideration of the issue.No. 17-30371 (March 16, 2018).

An unusual but intriguing coverage dispute arose after the insured’s death as a result of a bite from a mosquito infected with the dangerous West Nile virus. The Fifth Circuit reversed summary judgment for the carrier, observing in its analysis of the policy’s coverage for “accidental injury” –

An unusual but intriguing coverage dispute arose after the insured’s death as a result of a bite from a mosquito infected with the dangerous West Nile virus. The Fifth Circuit reversed summary judgment for the carrier, observing in its analysis of the policy’s coverage for “accidental injury” –

- The importance of defining the specific injury – “Instead of focusing on Melton’s bite from a WNV-infected Culex mosquito, Minnesota Life argues that a mosquito bite generally is not unexpected and unforeseen in Texas. But a bite by a generic mosquito is not the accidental injury Gloria pleaded in her complaint; instead, she says it is the bite by a WNV-infected Culex mosquito that triggers coverage. Without guidance from the policy as to how broadly or narrowly an ;’accidental bodily injury’ is to be defined, we take the facts of the alleged accidental injury as

Gloria contends.” - And as to whether an injury as “accidental” – the Court quoted then-Judge Cardozo’s analysis from a 1925 opinion about inhalation of an airborne pathogen: “Germs may indeed be inhaled through the nose or mouth, or absorbed into the system through normal channels of entry. In such cases their inroads will seldom, if ever, be assignable to a determinate or single act, identified in space or time. For this as well as for the reason that the absorption is incidental to a bodily process both natural and normal, their action presents itself to the mind as a disease and not an accident.”

- But the Court distinguished the situation addressed by Judge Cardozo: “Here, however, there was a determinate, single act—the bite—that is not incidental to a bodily process. The mosquito, an external “physical” force, affirmatively acted to cause Melton harm and produce an unforeseen result. We find that inhaling a community-spread pathogen and being bitten by a mosquito can be thinly sliced so as to be distinguishable.”

Wells v. Minnesota Life, No. 16-20831 (March 22, 2018).

The plaintiff won a multi-million dollar lawsuit about the sale of Akaushi cattle (example, to right), a specialty breed from Japan valued for its exceptional flavor, and made difficult to acquire as a result of export restrictions on what Japan regards “as a national treasure.” The Fifth Circuit affirmed in large part, reaching these holdings of broader interest:

The plaintiff won a multi-million dollar lawsuit about the sale of Akaushi cattle (example, to right), a specialty breed from Japan valued for its exceptional flavor, and made difficult to acquire as a result of export restrictions on what Japan regards “as a national treasure.” The Fifth Circuit affirmed in large part, reaching these holdings of broader interest:

- The jury found that the defendant “committed fraud by misrepresenting ‘that it intended to sell to [Plaintiff] 30% of its calves and that it would comply with the restrictions in the 2010’ Full-Blood Contracts” that set a number of specification s about registration, marketing, etc. Because “Texas courts have upheld fraud claims based on representations with less specificity,” the defendant’s sufficiency challenge was rejected.

- Despite testimony about millions of dollars in potential harm, the actual judgment awarded equitable relief. Because “the district court’s equitable remedy protected [Plaintiff] from actual harm[, its] harm is limited to presumed harm, and that is insufficient under Texas law to justify an award of punitive damages” in addition to the equitable relief.

- In affirming a calculation made in connection with the equitable remedies, the Court reminded of “the purpose of the law of disgorgement[,] under which ‘a disgorgement order might be for an amount more or less than that required to make the victims whole.'”

Bear Ranch LLC v. Heartland Beef, Inc., No. 16-41261 (March 20, 2018).

The parties’ licensing agreement referred to “Iced tea, Ready-to-Drink (RTD) Teas, RTD Beverages.” One side argued that the term “Ready-to-Drink Beverages” included “all beverages that are as-is ready for consumption including energy shots and vitamin water”; the other contended that, “as tea (i.e., the main product under the Agreement) is part of a category of beverages that generally require an additional step of preparation prior to consumption, the term may only cover only the beverages within this category.” Drinking deeply from principles of contract interpretation, the Fifth Circuit found the contract ambiguous because both positions were reasonable. Turning then to the testimony of the witnesses involved in drafting the contract, the Court found undisputed testimony in favor of the narrower view, and gave no weight to testimony from witnesses who had opinions but “did not participate in the negotiations.” The Court also avoided a dispute about who drafted the term, noting that “it is not necessary to determine who the drafter was because the term is only construed against the drafter ‘[I]n case of doubt that cannot be otherwise resolved.” Chinook USA v. Duck Commander, Inc., No. 17-30596 (March 15, 2018, unpublished).

The parties’ licensing agreement referred to “Iced tea, Ready-to-Drink (RTD) Teas, RTD Beverages.” One side argued that the term “Ready-to-Drink Beverages” included “all beverages that are as-is ready for consumption including energy shots and vitamin water”; the other contended that, “as tea (i.e., the main product under the Agreement) is part of a category of beverages that generally require an additional step of preparation prior to consumption, the term may only cover only the beverages within this category.” Drinking deeply from principles of contract interpretation, the Fifth Circuit found the contract ambiguous because both positions were reasonable. Turning then to the testimony of the witnesses involved in drafting the contract, the Court found undisputed testimony in favor of the narrower view, and gave no weight to testimony from witnesses who had opinions but “did not participate in the negotiations.” The Court also avoided a dispute about who drafted the term, noting that “it is not necessary to determine who the drafter was because the term is only construed against the drafter ‘[I]n case of doubt that cannot be otherwise resolved.” Chinook USA v. Duck Commander, Inc., No. 17-30596 (March 15, 2018, unpublished).

By a 2-1 opinion, in Chamber of Commerce v. U.S. Dep’t of Labor, the Fifth Circuit struck down the “Fiduclary Rule,” a regulation that significantly expanded regulation of investment advisors. The majority’s analysis focused primarily on the traditional definition of a “fiduciary” (a discussion of broad general interest to all business litigators), and the canon of interpretation that “provisions of a text should be interpreted in a way that renders them compatible, not contradictory.” The dissent focused on how, “[o]ver the last forty years, the retirement-investment market has experienced a dramatic shift toward individually controlled retirement plans and accounts.” Notably, footnote 14 of the majority opinion observes that “the Chevron doctrine has been questioned on substantial grounds, including that it represents an abdication of the judiciary’s’ duty under Article III ‘to say what the law is,'” quoting recent opinions my Justice Thomas and then-Judge Gorsuch. No. 17-10238 (March 15, 2018).

By a 2-1 opinion, in Chamber of Commerce v. U.S. Dep’t of Labor, the Fifth Circuit struck down the “Fiduclary Rule,” a regulation that significantly expanded regulation of investment advisors. The majority’s analysis focused primarily on the traditional definition of a “fiduciary” (a discussion of broad general interest to all business litigators), and the canon of interpretation that “provisions of a text should be interpreted in a way that renders them compatible, not contradictory.” The dissent focused on how, “[o]ver the last forty years, the retirement-investment market has experienced a dramatic shift toward individually controlled retirement plans and accounts.” Notably, footnote 14 of the majority opinion observes that “the Chevron doctrine has been questioned on substantial grounds, including that it represents an abdication of the judiciary’s’ duty under Article III ‘to say what the law is,'” quoting recent opinions my Justice Thomas and then-Judge Gorsuch. No. 17-10238 (March 15, 2018).

Centerboard Securities sued Benefuel for not paying certain “success fees” on two transactions. Benefuel countered that the transactions were not “investments” within the meaning of their contract, as they included debt and equity aspects instead of solely equity. Tthe Fifth Circuit disagreed: “The term ‘investment’ is unambiguous and includes debt and equity. . . . Delaware courts have used the term ‘investment’ to refer to equity and debt.” Similarly, the phrase “current investor” in the contract could not be read to include a party’s subsidiaries or affiliates: “Delaware courts take the corporate form and corporate formalities very seriously. . . . and will disregard the corporate form only in the ‘exceptional case.'” Centerboard Securities LLC v. Benefuel Inc., No. 17-10344 (March 12, 2018) (citations omitted).

Centerboard Securities sued Benefuel for not paying certain “success fees” on two transactions. Benefuel countered that the transactions were not “investments” within the meaning of their contract, as they included debt and equity aspects instead of solely equity. Tthe Fifth Circuit disagreed: “The term ‘investment’ is unambiguous and includes debt and equity. . . . Delaware courts have used the term ‘investment’ to refer to equity and debt.” Similarly, the phrase “current investor” in the contract could not be read to include a party’s subsidiaries or affiliates: “Delaware courts take the corporate form and corporate formalities very seriously. . . . and will disregard the corporate form only in the ‘exceptional case.'” Centerboard Securities LLC v. Benefuel Inc., No. 17-10344 (March 12, 2018) (citations omitted).

The plaintiff in Al Copeland Investments LLC v. First Specialty Ins. Corp. sued on an insurance policy about a claim for property damage to its business. It argued that this forum selection clause in the policy:

The plaintiff in Al Copeland Investments LLC v. First Specialty Ins. Corp. sued on an insurance policy about a claim for property damage to its business. It argued that this forum selection clause in the policy:

“The parties irrevocably submit to the exclusive jurisdiction of the Courts of the State of New York and to the extent permitted by law the parties expressly waive all rights to challenge or otherwise limit such jurisdiction.”

was trumped by this Louisiana statute:

“No insurance contract delivered or issued . . . in [Louisiana] . . . shall contain any condition, stipulation, or agreement . . . [d]epriving the courts of [Louisiana] of the jurisdiction of action against the insurer.”

The Fifth Circuit disagreed and affirmed dismissal based on forum non conveniens: “[The statute] prohibits provisions in an insurance contract that would deprive Louisiana courts of jurisdiction. ‘A forum-selection clause is a provision . . . that mandates a particular state, county, parish, or court as the proper venue in which the parties to an action must litigate . . . .’ As the district court recognized, venue and jurisdiction are ‘separate and distinct.'” No. 17-30557 (March 9, 2018) (emphasis in original).

Because the Texas homestead exemption, like the Texas exemption for retirement accounts, applies at the time a Chapter 7 bankruptcy petition is filed, the Fifth Circuit rejected a trustee’s attempt to seize the proceeds from a sale of the debtor’s home. The Court concluded that a “snapshot” approach to the exemption, as it had previously used for retirement accounts, did not let the trustee reach the proceeds, concluding: “He is trying to transform the [proceeds rule] from one that extends the homestead exemption to some situations when the home is not owned on the filing date into one that limits the homestead exemption even when the debtor owns the home on the filing date.” Lowe v. DeBerry, No. 17-50315 (March 7, 2018).

Because the Texas homestead exemption, like the Texas exemption for retirement accounts, applies at the time a Chapter 7 bankruptcy petition is filed, the Fifth Circuit rejected a trustee’s attempt to seize the proceeds from a sale of the debtor’s home. The Court concluded that a “snapshot” approach to the exemption, as it had previously used for retirement accounts, did not let the trustee reach the proceeds, concluding: “He is trying to transform the [proceeds rule] from one that extends the homestead exemption to some situations when the home is not owned on the filing date into one that limits the homestead exemption even when the debtor owns the home on the filing date.” Lowe v. DeBerry, No. 17-50315 (March 7, 2018).

A recent opinion in a real estate foreclosure dispute summarizes the current state of the law on some key principles:

A recent opinion in a real estate foreclosure dispute summarizes the current state of the law on some key principles:

- When a national bank is sued as trustee in such a case, its citizenship contrrols the analysis of diversity, not that of the investors in the trust (applying and distinguishing Americold Realty Trust v. ConAgra Foods, 136 S. Ct. 1012 (2016));

- Because “Texas follows the common-law maxim that the mortage follows the note,” the trustee was “entitled to foreclosre on the property as holder of the note even if the assignment of the Deed of Trust was void.oserves as trustee of a real estate investment trust”; and

- A fraud claim failed when the aggrieved party “did not allege that he initially intended to bid on the property before learning of a potential buyer and changed his position after speaking with U.S. Bank’s representatives.”

SGK Properties LLC v. US Bank, N.A., No. 17-20130 (Feb. 9, 2018).

The Supreme Court has stayed further proceedings in Archer & Daniels Sales v. Henry Schein Inc., a dispute about the arbitrability of a substantial antitrust case about dental equipment. The application and response are an interesting window into this seldom-seen aspect of civil practice.

The Supreme Court has stayed further proceedings in Archer & Daniels Sales v. Henry Schein Inc., a dispute about the arbitrability of a substantial antitrust case about dental equipment. The application and response are an interesting window into this seldom-seen aspect of civil practice.

In a seemingly immortal case about the failure of Enron,  Plaintiffs sought to characterize several UBS business entities as one. The Fifth Circuit rejected this argument under the applicable Delaware test for a joint venture: “Plaintiffs fail to explain how the allegations identified in their brief on appeal support finding a joint venture under this test. None of the allegations allude to profit sharing, or loss sharing, right to control the purported joint venture.” (citations omitted). “Plaintiffs’ allegations—principally references to Defendants’ vague corporate platitudes about their integration as a firm—may logically support that Defendants shared a community of interest in their business activities, but this alone is insufficient to support joint venture liability.” Giancarlo v. UBS Fin. Servcs., No. 16-20663 (Feb. 26, 2018).

Plaintiffs sought to characterize several UBS business entities as one. The Fifth Circuit rejected this argument under the applicable Delaware test for a joint venture: “Plaintiffs fail to explain how the allegations identified in their brief on appeal support finding a joint venture under this test. None of the allegations allude to profit sharing, or loss sharing, right to control the purported joint venture.” (citations omitted). “Plaintiffs’ allegations—principally references to Defendants’ vague corporate platitudes about their integration as a firm—may logically support that Defendants shared a community of interest in their business activities, but this alone is insufficient to support joint venture liability.” Giancarlo v. UBS Fin. Servcs., No. 16-20663 (Feb. 26, 2018).

Castrellon sought to enforce a loan modification agreement; the defendants asserted a mutual mistake about Castrellon’s ability to sign the agreement without also obtaining the agreement of her ex-husband. Noting that she could be left empty-handed otherwise, the Fifth Circuit found a fact issue on that defense: “[T]he mere fact that the agreement may ultimately leave [her] empty-handed does not compel the conclusion that there was a mutual mistake . . . . [N]onetheless, it does support an inference that the parties mistakenly believed they could modify the loan agreement without [him] – an inference that we are required to draw at this juncture.” Castrellon v. Ocwen Loan Servicing, No. 17-40193 (Feb. 21, 2018, unpublished).

Castrellon sought to enforce a loan modification agreement; the defendants asserted a mutual mistake about Castrellon’s ability to sign the agreement without also obtaining the agreement of her ex-husband. Noting that she could be left empty-handed otherwise, the Fifth Circuit found a fact issue on that defense: “[T]he mere fact that the agreement may ultimately leave [her] empty-handed does not compel the conclusion that there was a mutual mistake . . . . [N]onetheless, it does support an inference that the parties mistakenly believed they could modify the loan agreement without [him] – an inference that we are required to draw at this juncture.” Castrellon v. Ocwen Loan Servicing, No. 17-40193 (Feb. 21, 2018, unpublished).