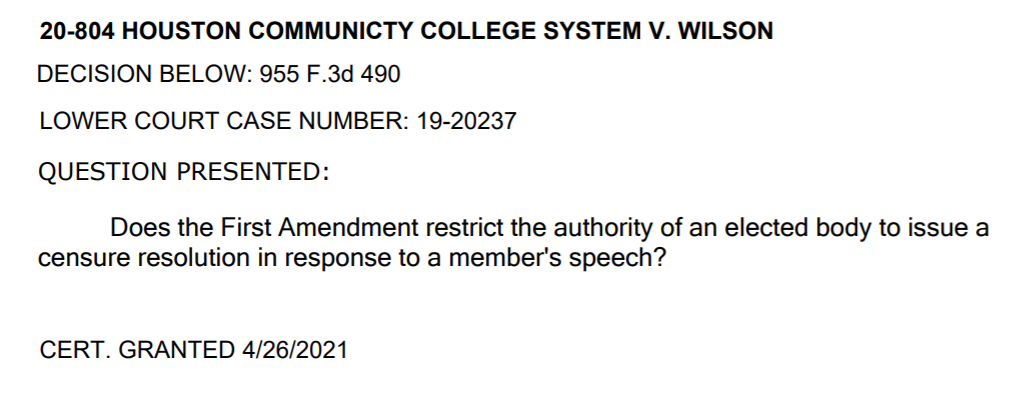

The difficult First Amendment case of Wilson v. Harris County Community College System, 955 F.3d 490 (5th Cir. 2020), produced a panel opinion that allowed an elected member of a community-college board to bring a claim about alleged retaliation for his exercise of First Amendment rights, followed by an 8-8 tie on the question of en banc review. The Supreme Court has now granted review of this fundamental issue about the relationship between elected officials’ rights and the interests of the institutions they serve:  (The first episode of the “Coale Mind” podcast considers this case along with the “Cancel Culture” phenomenon.)

(The first episode of the “Coale Mind” podcast considers this case along with the “Cancel Culture” phenomenon.)

Monthly Archives: April 2021

CNN recently reported on a Capitol rioter who was turned in by an unimpressed Bumble match (right). This story illustrates precisely the kind of “red-blue” interaction (admittedly, with less romanticism) that jury service forces when it brings together people of different backgrounds and interactions. These interactions are increasingly important in our divided times, and have taken on new dimensions after the difficult year of 2020. I discuss this topic (jury selection, not date-getting) with top jury consultant Jason Bloom in the most recent episode of the Coale Mind podcast.

CNN recently reported on a Capitol rioter who was turned in by an unimpressed Bumble match (right). This story illustrates precisely the kind of “red-blue” interaction (admittedly, with less romanticism) that jury service forces when it brings together people of different backgrounds and interactions. These interactions are increasingly important in our divided times, and have taken on new dimensions after the difficult year of 2020. I discuss this topic (jury selection, not date-getting) with top jury consultant Jason Bloom in the most recent episode of the Coale Mind podcast.

During the course of a long-running contract dispute, the Fifth Circuit remanded the case for further development of the record about diversity jurisdiction. Problems with appellate deadlines for a later appeal ensued; in reviewing the parties’ arguments the Court noted:

During the course of a long-running contract dispute, the Fifth Circuit remanded the case for further development of the record about diversity jurisdiction. Problems with appellate deadlines for a later appeal ensued; in reviewing the parties’ arguments the Court noted:

- “Full” v. “partial” remand. “It is true that in some cases where this court has remanded with a specific directive to the district court, we have retained jurisdiction over the appeal, obviating the need for the appellant to file a new notice of appeal after the district court’s remand proceedings. However, in those cases, this court specified that we retained jurisdiction over the appeal.”

- Effect of an attorneys-fee appeal. “[W]hen the merits judgment has already become final and unappealable, a mere delay of that judgment is no longer possible, and the court lacks any authority under FRAP 4(a)(4)(A)(iii) and FRCP 58[(e)] to modify the finality or the effect of the merits judgment.” (citation omitted).

- Good cause is not GOOD CAUSE. “Rule 4(a)(5), unlike Rule 4(a)(4)(A)(iii) and Rule 58(e), does allow a district court to revive an untimely notice of appeal after the original time to appeal has expired. … Pathway’s motion cannot be construed as a Rule 4(a)(5) motion, however. The extension motion cites Rule 58(e) rather than Rule 4(a)(5), and its arguments are relevant only to the former ….”

Midcap Media Finance LLC v. Pathway Data, Inc., No. 20-50259 (April 20, 2021).

In one corner, there is “Metchup”: “Mr. Dennis Perry makes Metchup, which depending on the batch is a blend of either Walmart-brand mayonnaise and ketchup or Walmart-brand mustard and ketchup. Mr. Perry sells Metchup exclusively from the lobby of a nine-room motel adjacent to his used-car dealership in Lacombe, Louisiana. He has registered Metchup as an incontestable trademark. Though he had big plans for Metchup, sales have been slow. Since 2010, Mr. Perry has produced only 50 to 60 bottles of Metchup, which resulted in sales of around $170 and profits of around $50. He owns www.metchup.com but has never sold Metchup online. For better or worse, the market is not covered in Metchup.”

In one corner, there is “Metchup”: “Mr. Dennis Perry makes Metchup, which depending on the batch is a blend of either Walmart-brand mayonnaise and ketchup or Walmart-brand mustard and ketchup. Mr. Perry sells Metchup exclusively from the lobby of a nine-room motel adjacent to his used-car dealership in Lacombe, Louisiana. He has registered Metchup as an incontestable trademark. Though he had big plans for Metchup, sales have been slow. Since 2010, Mr. Perry has produced only 50 to 60 bottles of Metchup, which resulted in sales of around $170 and profits of around $50. He owns www.metchup.com but has never sold Metchup online. For better or worse, the market is not covered in Metchup.”

In the other corner, there is Heinz: “Along comes Heinz. It makes Mayochup, which is solely a blend of mayonnaise and ketchup. To promote Mayochup’s United States launch, Heinz held an online naming contest where fans proposed names. A fan submitted Metchup, and Heinz posted a mock-up bottle bearing the name Metchup on its website alongside mock-up bottles for the other proposed names. Heinz never sold a product labeled Metchup.”

In the other corner, there is Heinz: “Along comes Heinz. It makes Mayochup, which is solely a blend of mayonnaise and ketchup. To promote Mayochup’s United States launch, Heinz held an online naming contest where fans proposed names. A fan submitted Metchup, and Heinz posted a mock-up bottle bearing the name Metchup on its website alongside mock-up bottles for the other proposed names. Heinz never sold a product labeled Metchup.”

Sadly for Perry’s trademark-infringement claim, the Fifth Circuit concluded: “It would be a coincidence to ever encounter both Mayochup and Metchup in the market, much less get confused about the affiliation, sponsorship, or origin of the two products. Accordingly, no reasonable jury could conclude that Heinz’s use of Metchup in advertising or the sale of its own product, Mayochup, created a likelihood of confusion.” Perry v. H.J. Heinz, No. 20-30418 (April 12, 2021).

This week on the “Coale Mind” podcast, I had top-flight jury consultant Jason Bloom as a special guest; in the episode we touch on the many pervasive effects that 2020 will have on jurors and jury selection, including:

This week on the “Coale Mind” podcast, I had top-flight jury consultant Jason Bloom as a special guest; in the episode we touch on the many pervasive effects that 2020 will have on jurors and jury selection, including:

– A surprising eagerness of people to show up and serve on juries, in part driven by widespread feelings of frustration after months of shutdown;

– Concern about what Jason calls the “massive exercise in confirmation bias” that potential jurors bring to the courthouse with them, depending on how restricted a juror’s information sources may be;

– The once-obscure psychological terms “ultracrepidarian” and “pareidolia” (you have to listen to the podcast to explore those terms’ meaning 🙂;

– Remembering that 2020 changed potential jurors not only because of COVID, but because of Black Lives Matter, the Biden-Trump election and its aftermath, etc.

– And a reminder that jury service—unlike the similar civic-engagement exercise of voting—forces jurors to form a consensus among their different beliefs; and

– Why 1-page written questionnaires for potential jurors may be particularly useful now in light of the above issues.

Confronted with the impossibly tangled Gordian Knot, Alexander the Great famously sliced it in half with his sword (right). Confronted with a “counterintuitive flow of money” in the complex intersection between pharmaceutical patents and the antitrust laws, in the Fifth Circuit affirmed the outcome of an FTC proceeding on the narrowest available ground in Impax Labs v. FTC, No. 19-60394 (April 13, 2021). The case arose from the settlement of a patent case between a brand-drug manufacturer and a generic drug maker, which presented these considerations about competition:

Confronted with the impossibly tangled Gordian Knot, Alexander the Great famously sliced it in half with his sword (right). Confronted with a “counterintuitive flow of money” in the complex intersection between pharmaceutical patents and the antitrust laws, in the Fifth Circuit affirmed the outcome of an FTC proceeding on the narrowest available ground in Impax Labs v. FTC, No. 19-60394 (April 13, 2021). The case arose from the settlement of a patent case between a brand-drug manufacturer and a generic drug maker, which presented these considerations about competition:

- The legal monopoly created by the brand-drug maker’s patent, and the challenge to it posed by the patent dispute;

- The framework established by the Hatch-Waxman Act for FDA approval of a generic drug, which has the practical effect of shifting all of the generic maker’s products into the first six months of manufacture;

- The settlement of the patent dispute by lengthening the brand-drug maker’s

monopoly in exchange for consideration given to the the generic manufacturer (which in turn, potentially worsens the approval “bottleneck” created by the Hatch-Waxman Act);

monopoly in exchange for consideration given to the the generic manufacturer (which in turn, potentially worsens the approval “bottleneck” created by the Hatch-Waxman Act); - The pro-competitive effect of ending a patent monopoly earlier than it might otherwise have ended;

- Whether certain pro-competitive features of the parties’ settlement had a “nexus” to the above payments.

The FTC concluded that these factors made the settlement anticompetitive, and also concluded that the parties had a “less restrictive alternative” available that would have avoided these issues. The Fifth Circuit affirmed on the less-restrictive-alternative ground, finding it supported by “[t]hree evidentiary legs–industry practice, credibility determinations about settlement negotiations, and economic analysis ….”

In an arbitrability dispute, the Fifth Circuit reviewed the basis for federal jurisdiction, noting: “[Vaden v. Discover Bank, 556 U.S. 49 (2009)] then went on to point out a wrinkle. ‘As for jurisdiction over controversies touching arbitration, however, the [Federal Arbitration] Act is something of an anomaly in the realm of federal legislation: It bestows no federal jurisdiction but rather requires for access to a federal forum an independent jurisdictional basis over the parties’ dispute.'” Applied to the case at hand: “Under that “look through” analysis, we hold that this underlying dispute presents a federal question. Polyflow’s arbitration demand included at least three federal statutory claims under the Lanham Act …. What matters is that a federal question—the Lanham Act claims—animated the underlying dispute, not whether Polyflow listed them in its original complaint.” Polyflow LLC v. Specialty RTP LLC, No. 20-20416 (March 30, 2021).

In an arbitrability dispute, the Fifth Circuit reviewed the basis for federal jurisdiction, noting: “[Vaden v. Discover Bank, 556 U.S. 49 (2009)] then went on to point out a wrinkle. ‘As for jurisdiction over controversies touching arbitration, however, the [Federal Arbitration] Act is something of an anomaly in the realm of federal legislation: It bestows no federal jurisdiction but rather requires for access to a federal forum an independent jurisdictional basis over the parties’ dispute.'” Applied to the case at hand: “Under that “look through” analysis, we hold that this underlying dispute presents a federal question. Polyflow’s arbitration demand included at least three federal statutory claims under the Lanham Act …. What matters is that a federal question—the Lanham Act claims—animated the underlying dispute, not whether Polyflow listed them in its original complaint.” Polyflow LLC v. Specialty RTP LLC, No. 20-20416 (March 30, 2021).

The full Fifth Circuit declined to grant en banc review to State of Texas v. Rettig, 987 F.3d 518 (5th Cir. 2021), which involved constitutional challenges by certain states to two aspects of the Affordable Care Act. They contended that the “Certification Rule” violated the nondelegation doctrine, and that section 9010 of the ACA violated the Spending Clause and the Tenth Amendment’s doctrine of intergovernmental tax immunity. The panel found the laws constitutional, in an opinion by Judge Haynes that was joined by Judges Barksdale and Willett. “In the en banc poll, five judges voted in favor of rehearing (Judges Jones, Smith, Elrod, Ho, and Duncan), and eleven judges voted against rehearing (Chief Judge Owen, and Judges Stewart, Dennis, Southwick, Haynes, Graves, Higginson, Costa, Willett, Engelhardt, and Wilson),” with Judge Oldham not participating, and the five pro-rehearing judges joining a dissent.

The full Fifth Circuit declined to grant en banc review to State of Texas v. Rettig, 987 F.3d 518 (5th Cir. 2021), which involved constitutional challenges by certain states to two aspects of the Affordable Care Act. They contended that the “Certification Rule” violated the nondelegation doctrine, and that section 9010 of the ACA violated the Spending Clause and the Tenth Amendment’s doctrine of intergovernmental tax immunity. The panel found the laws constitutional, in an opinion by Judge Haynes that was joined by Judges Barksdale and Willett. “In the en banc poll, five judges voted in favor of rehearing (Judges Jones, Smith, Elrod, Ho, and Duncan), and eleven judges voted against rehearing (Chief Judge Owen, and Judges Stewart, Dennis, Southwick, Haynes, Graves, Higginson, Costa, Willett, Engelhardt, and Wilson),” with Judge Oldham not participating, and the five pro-rehearing judges joining a dissent.

In Tejero v. Portfolio Recovery Associates, a plaintiff who successfully settled a Fair Debt Collection Practices Act case sought recovery of attorneys’ fees, noting that the FDCPA allows a fee award for a “successful action to enforce …. liability.” The Fifth Circuit held that this language “means a lawsuit that generates a favorable end result compelling accountability and legal compliance with a formal command or decree under the FDCPA. Tejero won no such relief because he settled before his lawsuit reached any end result, let alone a favorable one. And by settling, Portfolio Recovery avoided a formal legal command or decree from Tejero’s lawsuit.” No. 20-50543 (April 7, 2021).

Several years ago, mathematicians rejoiced at the mapping of the world’s most complex structure, the 248-dimension “Lie Group E8” (right). Not to be outdone, the en banc Fifth Circuit has issued Brackeen v. Haaland, a 325-page set of opinions about the constitutionality of the Indian Child Welfare Act–a work so complicated that a six-page per curiam introduction is needed to explain the Court’s divisions on the issues. No. 18-11479 (April 6, 2021). The splits, opinions, and holdings will be reviewed in future posts.

Several years ago, mathematicians rejoiced at the mapping of the world’s most complex structure, the 248-dimension “Lie Group E8” (right). Not to be outdone, the en banc Fifth Circuit has issued Brackeen v. Haaland, a 325-page set of opinions about the constitutionality of the Indian Child Welfare Act–a work so complicated that a six-page per curiam introduction is needed to explain the Court’s divisions on the issues. No. 18-11479 (April 6, 2021). The splits, opinions, and holdings will be reviewed in future posts.

While applying a Louisiana statute, the Fifth Circuit reviewed federal securities law in Firefighters’ Retirement System v. Citco Group Ltd. and concluded that the defendants were not “control persons.” The substantive issue involved “material omissions from [an] offering memorandum”; thus, “to establish that the [defendants] were control persons, the pension plans must show that they had the ability to control the content of the offering memorandum.” The Court noted evidence that (a) the defendants “provided back-office administrative services” to the company at issue and could have stopped providing those services, (b) had made a loan that could have been called, and (c) “held … voting shares for administrative convenience” in a relevant entity, and found this evidence insufficient. No. 20-30654 (March 31, 2021).

While applying a Louisiana statute, the Fifth Circuit reviewed federal securities law in Firefighters’ Retirement System v. Citco Group Ltd. and concluded that the defendants were not “control persons.” The substantive issue involved “material omissions from [an] offering memorandum”; thus, “to establish that the [defendants] were control persons, the pension plans must show that they had the ability to control the content of the offering memorandum.” The Court noted evidence that (a) the defendants “provided back-office administrative services” to the company at issue and could have stopped providing those services, (b) had made a loan that could have been called, and (c) “held … voting shares for administrative convenience” in a relevant entity, and found this evidence insufficient. No. 20-30654 (March 31, 2021).

In an appeal from a reduction of an attorney-fee award in an unpaid-overtime case, the Fifth Circuit affirmed. Among other matters, it noted the interplay of the required “lodestar” calculation with other factors to be considered later in the analysis: “As to the fifteen-percent reduction of the lodestar under the Johnson actors, the magistrate judge was careful to avoid so-

In an appeal from a reduction of an attorney-fee award in an unpaid-overtime case, the Fifth Circuit affirmed. Among other matters, it noted the interplay of the required “lodestar” calculation with other factors to be considered later in the analysis: “As to the fifteen-percent reduction of the lodestar under the Johnson actors, the magistrate judge was careful to avoid so- called ‘double counting’ to the extent that a factor was already accounted for in the initial lodestar determination. Among the factors that were not already subsumed by the lodestar calculation, the magistrate judge emphasized that the success achieved is the most important factor and then also considered the novelty of the issues and preclusion of other employment.” Rodney v. Elliott Security Solutions, No. 20-30251 (April 1, 2021) (unpublished).

called ‘double counting’ to the extent that a factor was already accounted for in the initial lodestar determination. Among the factors that were not already subsumed by the lodestar calculation, the magistrate judge emphasized that the success achieved is the most important factor and then also considered the novelty of the issues and preclusion of other employment.” Rodney v. Elliott Security Solutions, No. 20-30251 (April 1, 2021) (unpublished).

Plaintiffs, businesses that supply information to credit bureaus, sued Lexington Law, a consumer-advocacy organization, for fraud in its preparation of demand letters by consumers. CBE Group v. Lexington Law Firm, No. 20-10166 (April 1, 2021). The Fifth Circuit affirmed JNOV for the law firm, observing problems with the plaintiff’s evidence of:

- A contract. “While Chavarria and Garza may have misunderstood the process through which Lexington Law would represent them (and that misunderstanding may have been prompted by the firm’s actions), they were still bound by the terms of an engagement agreement the validity of which is not in doubt.”

- Reasonable reliance. “Once Plaintiffs developed suspicions that the letters may not have been sent from consumers themselves, they incurred costs in investigating correspondence on their own accord rather than because of the FCRA or the FDCPA. Indeed, Plaintiffs’ internal policies require them to investigate and respond to dispute letters sent by consumers and third parties alike. Thus, Plaintiffs fraud claim falls short for the additional reason that they did not justifiably rely on any alleged misrepresentation.”