The Public Utilities Regulatory Policies Act (“PURPA”) directs the FERC to encourage alternative energy providers, called “Qualifying Facilities” under that statute. In a novel arrangement that encourages flexibility but also can raise “troublesome” Tenth Amendment concerns, PURPA directs state agencies — such as the Texas PUC — to adopt rules that comply with FERC’s regulations and help implement PURPA. Exelon Wind 1, LLC v. Nelson, No. 12-51228 (Sept. 8, 2014) (quoting Power Resource Group v. Public Utility Comm’n of Texas, 422 F.3d 231 (5th Cir. 2005), and FERC v. Mississippi, 456 U.S. 742 (1982)).

The Public Utilities Regulatory Policies Act (“PURPA”) directs the FERC to encourage alternative energy providers, called “Qualifying Facilities” under that statute. In a novel arrangement that encourages flexibility but also can raise “troublesome” Tenth Amendment concerns, PURPA directs state agencies — such as the Texas PUC — to adopt rules that comply with FERC’s regulations and help implement PURPA. Exelon Wind 1, LLC v. Nelson, No. 12-51228 (Sept. 8, 2014) (quoting Power Resource Group v. Public Utility Comm’n of Texas, 422 F.3d 231 (5th Cir. 2005), and FERC v. Mississippi, 456 U.S. 742 (1982)).

The Texas PUC, acknowledging this mandate as well as the vagaries of wind power generation in the Texas Panhandle, enacted a rule limiting the pricing benefits of PURPA to “Qualifying Facilities able to forecast when they will deliver energy to the utility.” Exelon, a wind power producer, challenged the validity of this rule under PURPA.

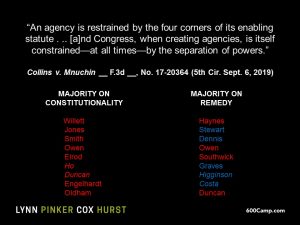

The Fifth Circuit first rejected a jurisdictional challenge, finding that Exelon’s attack on the rule was an “as-applied” challenge — over which federal courts have jurisdiction – as opposed to a “facial” challenge reserved to state courts. In so reasoning, the Court declined to give Chevron deference to a “Declaratory Order” by FERC. On the merits, — again declining to give the FERC letter deference — the Court upheld the PUC regulation: “The PUC had the discretion to determine the specific parameters for ehwn a wind farm can form a Legally Enforceable Obligation, and . . . left open the possibility that other wind farms might be able to provide firm power . . . .”

A dissent, agreeing with the jurisdictional analysis, differed on the merits, finding that the PUC rule conflicts on its face with the applicable FERC regulation, and that deference was due to the “FERC’s reasonable interpretation of that regulation according to well-established principles of adminstrative deference.”