The plaintiffs in Alaska Elec. Pension Fund v. Asar alleged securities fraud about the affairs of Hanger, Inc., the nation’s largest provider of orthotic and prosthetic patient care. The Fifth Circuit largely affirmed dismissal, but as to one defendant found adequate allegations of scienter based primarily on statements in an audit committee report, which “support the inference that McHenry shared the objectives of improperly enhancing Hanger’s financial results, or that he at least knew that others were doing so. A dissent would have also dismissed as to him, noting that “the complaint makes no effort to demonstrate which portions of the Report show that McHenry, or any other defendant, had the requisite scienter.” No. 17-50162 (Aug. 6, 2018).

The plaintiffs in Alaska Elec. Pension Fund v. Asar alleged securities fraud about the affairs of Hanger, Inc., the nation’s largest provider of orthotic and prosthetic patient care. The Fifth Circuit largely affirmed dismissal, but as to one defendant found adequate allegations of scienter based primarily on statements in an audit committee report, which “support the inference that McHenry shared the objectives of improperly enhancing Hanger’s financial results, or that he at least knew that others were doing so. A dissent would have also dismissed as to him, noting that “the complaint makes no effort to demonstrate which portions of the Report show that McHenry, or any other defendant, had the requisite scienter.” No. 17-50162 (Aug. 6, 2018).

Monthly Archives: August 2018

While cleaning ventilation equipment at the L’Auberge Casino in Lake Charles, Renwick fell from a defective ladder and later sued the property owner for his injuries. The Fifth Circuit reversed a summary judgment for the defense, noting “that it is th[e] combination of evidence–[Defendant’s] control of work-site access, its specific instructions about how to reach the vents, its rejection of an alternate access route, and the dispute over who provided the access ladder–that creates a jury issue on operational control.” (emphasis in original0 The Court reminded: “To be sure, a fact finder could ultimately reach a different conclusion. All we decide is that the evidence –viewed, as it must be, in the light most favorable to Renwick– would permit a reasonable trier of fact to resolve the operational control issue either way, and that the district court therefore erred in granting summary judgment.” Renwick v. PNK Lake Charles LLC, No. 17-30767 (Aug. 27, 2018).

While cleaning ventilation equipment at the L’Auberge Casino in Lake Charles, Renwick fell from a defective ladder and later sued the property owner for his injuries. The Fifth Circuit reversed a summary judgment for the defense, noting “that it is th[e] combination of evidence–[Defendant’s] control of work-site access, its specific instructions about how to reach the vents, its rejection of an alternate access route, and the dispute over who provided the access ladder–that creates a jury issue on operational control.” (emphasis in original0 The Court reminded: “To be sure, a fact finder could ultimately reach a different conclusion. All we decide is that the evidence –viewed, as it must be, in the light most favorable to Renwick– would permit a reasonable trier of fact to resolve the operational control issue either way, and that the district court therefore erred in granting summary judgment.” Renwick v. PNK Lake Charles LLC, No. 17-30767 (Aug. 27, 2018).

OGA Charters entered bankruptcy after a tragic accident involving one of its buses. Applying Louisiana World Exposition Inc. v. Fed. Ins. Co., 832 F.2d 1391 (5th Cir. 1987), and Houston v. Edgeworth, 993 F.2d 51 (5th Cir. 1993), the Fifth Circuit held: “We now make official what our cases have long contemplated: In the ‘limited circumstances,’ as here, where a siege of tort claimants threaten the debtor’s estate over and above the policy limits, we classify the proceeds as property of the estate. Here, over $400 million in related claims threaten the debtor’s estate over and above the $5 million policy limit, giving rise to an equitable interest of the debtor in having the proceeds applied to satisfy as much of those claims as possible.” Martinez v. OGA Charters LLC, No. 17-40920 (Aug. 24, 2018).

Monty Python’s famous “Dead Parrot” sketch involved John Cleese and Michael Palin debating whether a dead bird sold by a pet store was, in fact, deceased. In that same spirit, the case of Alliance for Good Government v. Coalition for Better Government addressed whether the Coalition’s bird-based logo infringed the Alliance’s logo:

Monty Python’s famous “Dead Parrot” sketch involved John Cleese and Michael Palin debating whether a dead bird sold by a pet store was, in fact, deceased. In that same spirit, the case of Alliance for Good Government v. Coalition for Better Government addressed whether the Coalition’s bird-based logo infringed the Alliance’s logo:

Alliance won in the trial court, as the birds appear identical, “with the same down-point ed beak, gazing over the same wing (the right), sporting the same number of feathers (forty-three).” Unphased, Coalition argued that its bird was a hawk, while Alliance’s was an eagle, leading to a puzzled exchange with the district judge:

ed beak, gazing over the same wing (the right), sporting the same number of feathers (forty-three).” Unphased, Coalition argued that its bird was a hawk, while Alliance’s was an eagle, leading to a puzzled exchange with the district judge:

DISTRICT COURT: They look exactly alike to me, the two birds.

COUNSEL: […] [N]o, they really aren’t, your Honor, if you look at the wing span. The wing span of the eagle is different from the hawk. It’s much larger and it fans out, and that’s just the way the hawk looks.

Equally puzzled, the Fifth Circuit affirmed: “To cut to the chase: Alliance and Coalition have the same logo.” No. 17-30859 (Aug. 22, 2018) (emphasis in original).

IAS, an insurance claim-adjusting firm, acquired Buckley, another such firm. Litigation ensued after Buckley was unable to bring the business from a large client, QBE. The Fifth Circuit found that IAS stated a viable fraudulent-inducement claim under Fed. R. Civ. P. 9(b) as to “three alleged misrepresentations that it contends led it to enter into the asset purchase agreement: (1) Buckley’s statement that Buckley & Associates was QBE’s ‘number one’ vendor; (2) Buckley’s statement that Buckley & Associates’ revenue from QBE would continue to grow; and (3) the statement in § 2.3 of the purchase agreement that its execution would not ‘violate, conflict, [or] result in a breach of . . . any Contract . . . to which [Buckley & Associates] is a party.'” The Court’s analysis of the third factor is particularly informative, touching on recent Texas Supreme Court authority about waiver-of-reliance provisions (Italian Cowboy Partners v. Prudential Ins. Co., 341 S.W.3d 323 (Tex. 2011)) and “red flags” that can negate justifiable reliance. (JPMorgan Chase Bank v. Orca Assets GP, LLC, 546 S.W.3d 648 (Tex. 2018)). A dissent would not have found any of the representations fraudulent as pleaded. IAS Service Group v. Buckley & Assocs., No. 17-50105 (Aug. 17, 2018).

IAS, an insurance claim-adjusting firm, acquired Buckley, another such firm. Litigation ensued after Buckley was unable to bring the business from a large client, QBE. The Fifth Circuit found that IAS stated a viable fraudulent-inducement claim under Fed. R. Civ. P. 9(b) as to “three alleged misrepresentations that it contends led it to enter into the asset purchase agreement: (1) Buckley’s statement that Buckley & Associates was QBE’s ‘number one’ vendor; (2) Buckley’s statement that Buckley & Associates’ revenue from QBE would continue to grow; and (3) the statement in § 2.3 of the purchase agreement that its execution would not ‘violate, conflict, [or] result in a breach of . . . any Contract . . . to which [Buckley & Associates] is a party.'” The Court’s analysis of the third factor is particularly informative, touching on recent Texas Supreme Court authority about waiver-of-reliance provisions (Italian Cowboy Partners v. Prudential Ins. Co., 341 S.W.3d 323 (Tex. 2011)) and “red flags” that can negate justifiable reliance. (JPMorgan Chase Bank v. Orca Assets GP, LLC, 546 S.W.3d 648 (Tex. 2018)). A dissent would not have found any of the representations fraudulent as pleaded. IAS Service Group v. Buckley & Assocs., No. 17-50105 (Aug. 17, 2018).

The hard-fought litigation over Harris County’s bail policies returned to the Fifth Circuit after a limited remand on the scope and structure of proper injunctive relief. The Court granted a stay pending resolution of the merits; in particular, noting the effect of the appellate “mandate rule” on 3 parts of the revised injunction:

The hard-fought litigation over Harris County’s bail policies returned to the Fifth Circuit after a limited remand on the scope and structure of proper injunctive relief. The Court granted a stay pending resolution of the merits; in particular, noting the effect of the appellate “mandate rule” on 3 parts of the revised injunction:

- “The original injunction contained the requirement that a hearing be held within 24 hours. Thus, the same issue of what to do with arrestees during the gap between arrest and hearing—be it 24 or 48 hours—was always at issue and could have been addressed during the initial proceedings. Remand is not the time to bring new issues that could have been raised initially. Thus, Section 7 plainly violates the mandate rule, and the Fourteen Judges are likely to succeed on the merits as to that section.” (emphasis added)

- “[The first appeal determined that 48 hours was sufficient under the Constitution.. . . [I]n the model injunction, the proposed remedy for failure to comply with that requirement was for the County to make weekly reports to the district court identifying any delays and to inform the detainees’ counsel or next of kin about the delays. . . . The district co

urt was to monitor the situation for a pattern of violations and only then take possible corrective action. Anything broader than that remedy violates any reasonable reading of the mandate.” (emphasis added).

urt was to monitor the situation for a pattern of violations and only then take possible corrective action. Anything broader than that remedy violates any reasonable reading of the mandate.” (emphasis added).

O’Donnell v. Goodhart, No. 18-20466 (Aug. 14, 2018).

At the intersection of civil and criminal law, United States v. Gas Pipe reminds of the reach of the federal civil forfeiture: “Although ‘merely pooling tainted and untainted funds in an account does not, without more, render that account subject to forfeiture,’ untainted funds are forfeitable if a defendant commingled them with tainted funds ‘to disguise the nature and source of his scheme.’ Here, the Government alleged in its verified complaint that the defendant Claimants commingled tainted and untainted funds in the UBS accounts to conceal or disguise the tainted funds. Some commingled funds allegedly also secured a loan that financed the alleged spice scheme and which was repaid with criminal proceeds.” No. 17-10626 (Aug. 16, 2018) (citations omitted).

At the intersection of civil and criminal law, United States v. Gas Pipe reminds of the reach of the federal civil forfeiture: “Although ‘merely pooling tainted and untainted funds in an account does not, without more, render that account subject to forfeiture,’ untainted funds are forfeitable if a defendant commingled them with tainted funds ‘to disguise the nature and source of his scheme.’ Here, the Government alleged in its verified complaint that the defendant Claimants commingled tainted and untainted funds in the UBS accounts to conceal or disguise the tainted funds. Some commingled funds allegedly also secured a loan that financed the alleged spice scheme and which was repaid with criminal proceeds.” No. 17-10626 (Aug. 16, 2018) (citations omitted).

Veritext, a national court reporting service, challenged restrictions on its pricing practices (volume discounts, etc.) imposed by the Louisiana Board of Examiners of Certified Shorthand Reporters. The Fifth Circuit rejected Veritext’s constitutional claims but found that it had stated a viable restraint-of-trade claim under the Sherman Act. The Board claimed Parker antitrust immunity as a state actor, which required it to show “two requirements: first that ‘the challenged restraint . . . be one clearly articulated and affirmatively expressed as state policy,’ and second that ‘the policy . . . be actively supervised by the State.’” The Board satisfied the first, as its regulations were clear (thus creating the alleged restraint of trade in the first

Veritext, a national court reporting service, challenged restrictions on its pricing practices (volume discounts, etc.) imposed by the Louisiana Board of Examiners of Certified Shorthand Reporters. The Fifth Circuit rejected Veritext’s constitutional claims but found that it had stated a viable restraint-of-trade claim under the Sherman Act. The Board claimed Parker antitrust immunity as a state actor, which required it to show “two requirements: first that ‘the challenged restraint . . . be one clearly articulated and affirmatively expressed as state policy,’ and second that ‘the policy . . . be actively supervised by the State.’” The Board satisfied the first, as its regulations were clear (thus creating the alleged restraint of trade in the first  place), but failed the second: “Nothing in the record indicates that elected or appointed officials oversaw or reviewed the Board’s decisions or modified the Board’s enforcement priorities. And the Board’s argument on this point—that the legislature can amend the law in this area or veto proposed rules under Louisiana’s Administrative Procedure Act—is unconvincing. State legislatures always possess the power to change the law.” Veritext Corp. v. Bonin, No. 17-30691 (Aug. 17, 2018) (applying State Board of Dental Examiners v. FTC, 135 S.Ct. 1101 (2015)).

place), but failed the second: “Nothing in the record indicates that elected or appointed officials oversaw or reviewed the Board’s decisions or modified the Board’s enforcement priorities. And the Board’s argument on this point—that the legislature can amend the law in this area or veto proposed rules under Louisiana’s Administrative Procedure Act—is unconvincing. State legislatures always possess the power to change the law.” Veritext Corp. v. Bonin, No. 17-30691 (Aug. 17, 2018) (applying State Board of Dental Examiners v. FTC, 135 S.Ct. 1101 (2015)).

Fou r of my LPCH partners and I were recently named to “Best Lawyers in America” for 2019!

r of my LPCH partners and I were recently named to “Best Lawyers in America” for 2019!

An expert’s analysis of an electrical fire on a boat involved a “‘hose test,’ in which he directed water from a garden hose onto the boat’s wet bar and tracked where the water ended up.” Unfortunately for him, because this work was “meant to be a simulation or re-creation of what actually happened, it must be performed under ‘substantially similar conditions'” to the fire, and it was not: “Plaisance’s videos did not contain important information about how he conducted the experiment, such as ‘how long the hose ha[d] been running’ or ‘the pressure of the water coming out of the hose.’ Moreover, the video showed ‘a continuous stream of water from a garden hose directly at the junction between the back of the wet bar and the boat’s wall,’ and there was no indication that Gonzalez ever used a hose in that fashion. In fact, as the district court noted, Plaisance did not provide any information about how Gonzalez typically washed the boat.” Similar problems also undermined another expert’s testimony about electrical issues on the boat. Atlantic Specialty Insurance Co. v. Porter, Inc., No. 16-31259 (Aug. 6, 2018).

An expert’s analysis of an electrical fire on a boat involved a “‘hose test,’ in which he directed water from a garden hose onto the boat’s wet bar and tracked where the water ended up.” Unfortunately for him, because this work was “meant to be a simulation or re-creation of what actually happened, it must be performed under ‘substantially similar conditions'” to the fire, and it was not: “Plaisance’s videos did not contain important information about how he conducted the experiment, such as ‘how long the hose ha[d] been running’ or ‘the pressure of the water coming out of the hose.’ Moreover, the video showed ‘a continuous stream of water from a garden hose directly at the junction between the back of the wet bar and the boat’s wall,’ and there was no indication that Gonzalez ever used a hose in that fashion. In fact, as the district court noted, Plaisance did not provide any information about how Gonzalez typically washed the boat.” Similar problems also undermined another expert’s testimony about electrical issues on the boat. Atlantic Specialty Insurance Co. v. Porter, Inc., No. 16-31259 (Aug. 6, 2018).

Federal crop insurance “protects an asset that does not yet exist,” since future crops are not yet grown. Congress refined the applicable statutes in 2014, allowing farmers to “elect to exclude” certain low-production

Federal crop insurance “protects an asset that does not yet exist,” since future crops are not yet grown. Congress refined the applicable statutes in 2014, allowing farmers to “elect to exclude” certain low-production  years from the historical calculations needed to write insurance for future crop production. The relevant amendment applied “for any of the 2001 and subsequent crop years,” and became effective immediately. A dispute arose between Texas winter wheat farmers, who announced their intention to exclude years under this statute, and the Federal Crop Insurance Corporation, who said it lacked time to prepare the necessary data. The Fifth Circuit rejected the FCIC’s argument that this statute’s “effective” date was distinct from its “implementation” date, finding that it failed step one of Chevron – “Such a problem arises not from an ambiguous

years from the historical calculations needed to write insurance for future crop production. The relevant amendment applied “for any of the 2001 and subsequent crop years,” and became effective immediately. A dispute arose between Texas winter wheat farmers, who announced their intention to exclude years under this statute, and the Federal Crop Insurance Corporation, who said it lacked time to prepare the necessary data. The Fifth Circuit rejected the FCIC’s argument that this statute’s “effective” date was distinct from its “implementation” date, finding that it failed step one of Chevron – “Such a problem arises not from an ambiguous  text but from Congress implementing razor sharp deadlines without, at least according to the FCIC, sufficient resources. That does not give the FCIC authority to disregard the plain text of the statute . . . .” Adkins v. Silverman, No. 17-10759 (Aug. 7, 2018).

text but from Congress implementing razor sharp deadlines without, at least according to the FCIC, sufficient resources. That does not give the FCIC authority to disregard the plain text of the statute . . . .” Adkins v. Silverman, No. 17-10759 (Aug. 7, 2018).

The parties settled and filed an unconditional stipulation of dismissal under Fed. R Civ. P. 41(a)(1)(A)(ii). Months later, one of them sought to reopen that action and rescind the settlement, alleging forgery of a key signature. The Fifth Circuit found that “ancillary jurisdiction” was not available, as that doctrine is limited to (1) “factually interdependent claims” (which “disappear[] . . . after the original federal dispute is dismissed,” or (2) “‘collateral issues’ . . . things like fees, costs, contempt, and sanctions,” which could apply to an appropriate order but not to this type of unconditional dismissal. The Court found jurisdiction under Fed. R. Civ. P. 60(b)(1), which addresses “mistake, inadvertence, surprise, or excusable neglect,” but was of little help here where the settlement documents expressly allocated risk about later-discovered evidence. Other parts of that rule did not apply. “By unconditionally dismissing this action under Rule 41(a)(1)(A)(ii), the parties divested the district court of subject-matter jurisdiction over their dispute. To reopen this case, Scott must lean on Rule 60(b). But that rule’s six doors remain closed.” National City Golf Finance v. Scott, No. 17-60283 (Aug. 9, 2018).

The parties settled and filed an unconditional stipulation of dismissal under Fed. R Civ. P. 41(a)(1)(A)(ii). Months later, one of them sought to reopen that action and rescind the settlement, alleging forgery of a key signature. The Fifth Circuit found that “ancillary jurisdiction” was not available, as that doctrine is limited to (1) “factually interdependent claims” (which “disappear[] . . . after the original federal dispute is dismissed,” or (2) “‘collateral issues’ . . . things like fees, costs, contempt, and sanctions,” which could apply to an appropriate order but not to this type of unconditional dismissal. The Court found jurisdiction under Fed. R. Civ. P. 60(b)(1), which addresses “mistake, inadvertence, surprise, or excusable neglect,” but was of little help here where the settlement documents expressly allocated risk about later-discovered evidence. Other parts of that rule did not apply. “By unconditionally dismissing this action under Rule 41(a)(1)(A)(ii), the parties divested the district court of subject-matter jurisdiction over their dispute. To reopen this case, Scott must lean on Rule 60(b). But that rule’s six doors remain closed.” National City Golf Finance v. Scott, No. 17-60283 (Aug. 9, 2018).

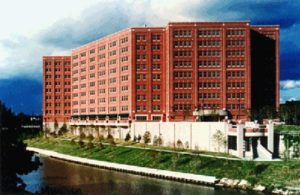

Problems in the construction of the Zapata County courthouse (right) led to litigation between S&P (the general contractor), and its subcontractors, as well as between S&P and its insurer. The insurer and S&P disputed S&P’s allocation of the proceeds from settlements with the subcontractors, and the Fifth Circuit affirmed judgment for the insurer: “S&P bears the burden to show that the subcontractor settlement proceeds were properly allocated to either covered or noncovered damages. If S&P cannot meet that burden, under the [two controlling cases], then we must assume that all of the settlement proceeds went first to satisfy the covered damages under U.S. Fire’s policy.” Satterfield & Pontikes Constr. v. U.S. Fire Ins. Co., No. 17-20513 (Aug. 2, 2018).

Problems in the construction of the Zapata County courthouse (right) led to litigation between S&P (the general contractor), and its subcontractors, as well as between S&P and its insurer. The insurer and S&P disputed S&P’s allocation of the proceeds from settlements with the subcontractors, and the Fifth Circuit affirmed judgment for the insurer: “S&P bears the burden to show that the subcontractor settlement proceeds were properly allocated to either covered or noncovered damages. If S&P cannot meet that burden, under the [two controlling cases], then we must assume that all of the settlement proceeds went first to satisfy the covered damages under U.S. Fire’s policy.” Satterfield & Pontikes Constr. v. U.S. Fire Ins. Co., No. 17-20513 (Aug. 2, 2018).

The district court dismissed fraud claims against an accounting firm for not complying with a Louisiana pre-suit review requirement. The Fifth Circuit affirmed but remanded for clarification as to whether the dismissal was with, or without, prejudice. Fed. R. Civ. P. 41 generally assumes that silence means “with

The district court dismissed fraud claims against an accounting firm for not complying with a Louisiana pre-suit review requirement. The Fifth Circuit affirmed but remanded for clarification as to whether the dismissal was with, or without, prejudice. Fed. R. Civ. P. 41 generally assumes that silence means “with  prejudice,” but the Supreme Court has recognized that that rule’s exception for “jurisdiction” goes so far as “encompassing those dismissals which are based on a plaintiff’s failure to comply with a precondition requisite to the Court’s going forward to determine the merits of his substantive claim.”

prejudice,” but the Supreme Court has recognized that that rule’s exception for “jurisdiction” goes so far as “encompassing those dismissals which are based on a plaintiff’s failure to comply with a precondition requisite to the Court’s going forward to determine the merits of his substantive claim.”

Firefighters’ Retirement System v. EisenerAmper LLP, No. 17-30273 (Aug. 2, 2018).

“Aetna’s reliance on any alleged misrepresentation by NCMC was not justifiable. Almost immediately after NCMC notified Aetna of its prompt pay discount, Aetna began investigating. Its investigation revealed NCMC’s billing practices. Yet Aetna continued to pay claims marked with the prompt pay discount moniker.” In support, the Fifth Circuit cited the recent and influential case of JPMorgan Chase v. Orca Assets, 546 S.W.3d 648 (Tex. 2018), and “promoted” the unpublished case of Highland Crusader Offshore Partners v. LifeCare Holdings, 377 F. App’x 422 (5th Cir. 2010), observing: “The panel recognizes that Highland Crusader is unpublished, and therefore not precedential, but we cite it here to show consistency throughout our case law.” North Cypress Medical Center v. Aetna, No. 16-20674 (July 31, 2018).

“Aetna’s reliance on any alleged misrepresentation by NCMC was not justifiable. Almost immediately after NCMC notified Aetna of its prompt pay discount, Aetna began investigating. Its investigation revealed NCMC’s billing practices. Yet Aetna continued to pay claims marked with the prompt pay discount moniker.” In support, the Fifth Circuit cited the recent and influential case of JPMorgan Chase v. Orca Assets, 546 S.W.3d 648 (Tex. 2018), and “promoted” the unpublished case of Highland Crusader Offshore Partners v. LifeCare Holdings, 377 F. App’x 422 (5th Cir. 2010), observing: “The panel recognizes that Highland Crusader is unpublished, and therefore not precedential, but we cite it here to show consistency throughout our case law.” North Cypress Medical Center v. Aetna, No. 16-20674 (July 31, 2018).

John Williams was seriously injured in a  crane accident; a jury found that the crane manufacturer “failed to warn Model 16000 Series crane operators that, if the crane tips over, large weights stacked on the rear of the crane can slide forward and strike the operator’s cab.” The Fifth Circuit affirmed that multi-million dollar verdict, finding that the jury acted within its authority as to (1) liability for failure to warn, (2) proximate cause and alleged misuse by Williams, (3) proximate cause and an alleged alternative warning (left),

crane accident; a jury found that the crane manufacturer “failed to warn Model 16000 Series crane operators that, if the crane tips over, large weights stacked on the rear of the crane can slide forward and strike the operator’s cab.” The Fifth Circuit affirmed that multi-million dollar verdict, finding that the jury acted within its authority as to (1) liability for failure to warn, (2) proximate cause and alleged misuse by Williams, (3) proximate cause and an alleged alternative warning (left), (4) a Daubert challenge to the plaintiff’s expert on warnings (applying Roman v. Western Manufacturing, 691 F.3d 686 (5th Cir. 2012), and Huss v. Gayden, 571 F.3d 443 (5th Cir. 2009) – two powerful statements by the Court about admissible expert analysis), and (5) admissibility rulings about other accidents and the plaintiff’s prior conduct. The opinion provides a powerful illustration of a well-conducted trial by jury. Williamv v. Manitowoc Cranes LLC, No. 17-60458 (Aug. 3, 2018).

(4) a Daubert challenge to the plaintiff’s expert on warnings (applying Roman v. Western Manufacturing, 691 F.3d 686 (5th Cir. 2012), and Huss v. Gayden, 571 F.3d 443 (5th Cir. 2009) – two powerful statements by the Court about admissible expert analysis), and (5) admissibility rulings about other accidents and the plaintiff’s prior conduct. The opinion provides a powerful illustration of a well-conducted trial by jury. Williamv v. Manitowoc Cranes LLC, No. 17-60458 (Aug. 3, 2018).

Villareal sought to redeem five certificates of deposit purchased in the early 1980s. His primary legal theory, apparently selected to avoid problems with suing on the instruments themselves, was the quasi-contractual / restitution theory recognized in Texas law for “money had and received.” That theory ordinarily does not apply when an express contract (here, the CDs) addresses the subject. To escape that limitation, Villareal relied on Texas authority under which “an overpayment beyond what a contract provides may sometimes be recovered as unjust enrichment. If an overpayment qualifies as unjust enrichment, reasoned the district court, so should an underpayment.” (citation omitted, emphasis in original). The Fifth Circuit disagreed: “Overpayment typically falls outside a contract’s terms and, in that event, the contract would not ‘cover[] the subject matter of the parties’ dispute.’ By contrast, here the dispute involved the claimed non-payment of a debt evidenced by express contracts (the CDs). Unjust enrichment has no role to play.” (citation omitted, emphasis in original). Villareal v. Presidio Nat’l Bank (revised), No. 17-50765 (July 27, 2018, unpublished). (Picture above of Professor Samuel Williston eyeing some of his extensive work on express contracts).

Villareal sought to redeem five certificates of deposit purchased in the early 1980s. His primary legal theory, apparently selected to avoid problems with suing on the instruments themselves, was the quasi-contractual / restitution theory recognized in Texas law for “money had and received.” That theory ordinarily does not apply when an express contract (here, the CDs) addresses the subject. To escape that limitation, Villareal relied on Texas authority under which “an overpayment beyond what a contract provides may sometimes be recovered as unjust enrichment. If an overpayment qualifies as unjust enrichment, reasoned the district court, so should an underpayment.” (citation omitted, emphasis in original). The Fifth Circuit disagreed: “Overpayment typically falls outside a contract’s terms and, in that event, the contract would not ‘cover[] the subject matter of the parties’ dispute.’ By contrast, here the dispute involved the claimed non-payment of a debt evidenced by express contracts (the CDs). Unjust enrichment has no role to play.” (citation omitted, emphasis in original). Villareal v. Presidio Nat’l Bank (revised), No. 17-50765 (July 27, 2018, unpublished). (Picture above of Professor Samuel Williston eyeing some of his extensive work on express contracts).