The plaintiffs in Molina-Aranda v. Black Magic Enterprises alleged RICO violations based on a scheme to bring them to the US under H2-B visas, but not pay accordingly. The Fifth Circuit affirmed the dismissal of their claims on causation grounds, observing: “Understating the type of work to be done may have supported obtaining the visas, but it was not the cause of underpayment; indeed, if one accepts the Plaintiffs’ allegations, truthfulness would likely have resulted in a lack of visas, keeping Plaintiffs from being able to come to the United States in the first place. But, critically, Plaintiffs’ reduced wages were several steps in the causal chain away from the transmission of fraudulent forms; nothing about the forms required underpayment. To even have the opportunity to underpay Plaintiffs, the Ramirezes had to submit fraudulent forms, obtain authorization, and bring the Plaintiffs to the United States for work. Only then could the Ramirezes actually underpay Plaintiffs.” No. 19-50638 (Dec. 21, 2020) (emphasis added).

The plaintiffs in Molina-Aranda v. Black Magic Enterprises alleged RICO violations based on a scheme to bring them to the US under H2-B visas, but not pay accordingly. The Fifth Circuit affirmed the dismissal of their claims on causation grounds, observing: “Understating the type of work to be done may have supported obtaining the visas, but it was not the cause of underpayment; indeed, if one accepts the Plaintiffs’ allegations, truthfulness would likely have resulted in a lack of visas, keeping Plaintiffs from being able to come to the United States in the first place. But, critically, Plaintiffs’ reduced wages were several steps in the causal chain away from the transmission of fraudulent forms; nothing about the forms required underpayment. To even have the opportunity to underpay Plaintiffs, the Ramirezes had to submit fraudulent forms, obtain authorization, and bring the Plaintiffs to the United States for work. Only then could the Ramirezes actually underpay Plaintiffs.” No. 19-50638 (Dec. 21, 2020) (emphasis added).

Monthly Archives: December 2020

The Fifth Circuit affirmed a summary judgment in favor of a business that had been accused of being a “control person” under Louisiana securities laws. “As the district court recognized, the contract between STC and SEI is strong evidence that SEI was unable to control STC’s primary violations. The contract made STC responsible for pricing the SIBL CDs and for providing accurate information to SEI. The contract does not assign any role to SEI in the sale or valuation of SIBL CDs. Further, as the district court noted, the investors’ ‘pleadings contain no evidence demonstrating that the relationship between the companies differed from that contemplated in the

The Fifth Circuit affirmed a summary judgment in favor of a business that had been accused of being a “control person” under Louisiana securities laws. “As the district court recognized, the contract between STC and SEI is strong evidence that SEI was unable to control STC’s primary violations. The contract made STC responsible for pricing the SIBL CDs and for providing accurate information to SEI. The contract does not assign any role to SEI in the sale or valuation of SIBL CDs. Further, as the district court noted, the investors’ ‘pleadings contain no evidence demonstrating that the relationship between the companies differed from that contemplated in the

contract.'” The Court then reviewed, and rejected, evidence about the types of work done by the defendant as a service provider. Ahders v. SEI Private Trust Co., No. 20-30186 (Dec. 3, 2020).

When you next want to pose a question in your writing, and really really emphasize it, please consider . . . the Interrobang! Wikipedia suggests the below examples of when the Interrobang may be just the punctuation mark you’re looking for. (H/T to Lucy Forbes of Houston for her knowledge of unconventional punctuation marks)

When you next want to pose a question in your writing, and really really emphasize it, please consider . . . the Interrobang! Wikipedia suggests the below examples of when the Interrobang may be just the punctuation mark you’re looking for. (H/T to Lucy Forbes of Houston for her knowledge of unconventional punctuation marks)

A Buddhist group sued for alleged infringement of the mark “Unified Buddhist Church of Vietnam” and two others. The Fifth Circuit concluded that of the seven relevant factors about secondary meaning, “only the first factor—the length and manner of use of the Unified Church’s asserted marks—has evidence weighing in favor of the marks having developed protectable secondary meaning.” On the record presented, that evidence alone was insufficient to justify a finding for the plaintiff, and the Court affirmed a defense summary judgment. The Unified Buddhist Church of Vietnam v. Unified Buddhist Church of Vietnam – Giao Hoi Phat Giao Viet Nam Thong Nhat, No. 19-20544 (Dec. 14, 2020, unpublished). (Relatedly, the Fifth Circuit recently affirmed the denial of a preliminary injunction in Future Proof Brands v. Molson Coors, based on a review of the “digits of confusion” as developed on that record, No. No. 20-50323 (Dec. 3, 2020, unpublished). Our firm represented the appellant in that matter.)

A Buddhist group sued for alleged infringement of the mark “Unified Buddhist Church of Vietnam” and two others. The Fifth Circuit concluded that of the seven relevant factors about secondary meaning, “only the first factor—the length and manner of use of the Unified Church’s asserted marks—has evidence weighing in favor of the marks having developed protectable secondary meaning.” On the record presented, that evidence alone was insufficient to justify a finding for the plaintiff, and the Court affirmed a defense summary judgment. The Unified Buddhist Church of Vietnam v. Unified Buddhist Church of Vietnam – Giao Hoi Phat Giao Viet Nam Thong Nhat, No. 19-20544 (Dec. 14, 2020, unpublished). (Relatedly, the Fifth Circuit recently affirmed the denial of a preliminary injunction in Future Proof Brands v. Molson Coors, based on a review of the “digits of confusion” as developed on that record, No. No. 20-50323 (Dec. 3, 2020, unpublished). Our firm represented the appellant in that matter.)

An IRS limitations statute runs from the filing of the “return” in question. The issue in Quezada v. IRS was whether the filing of a return–but the wrong type of return–starts the clock running. The Fifth Circuit found that it did, so long as it contained information from which the taxpayer’s claimed error could be identified: “Accordingly, consistent with a plurality of our sister circuits, we think the better reading of [Supreme Court precedent] is that the taxpayer is not required to file the precise return prescribed by treasury regulations in order to start the limitations clock. Instead, ‘the return’ is filed, and the limitations clock begins to tick, when the taxpayer files a return that contains data sufficient (1) to show that the taxpayer is liable for the tax at issue and (2) to calculate the extent of that liability.” No. 19-5100-CV (Dec. 11, 2020).

An IRS limitations statute runs from the filing of the “return” in question. The issue in Quezada v. IRS was whether the filing of a return–but the wrong type of return–starts the clock running. The Fifth Circuit found that it did, so long as it contained information from which the taxpayer’s claimed error could be identified: “Accordingly, consistent with a plurality of our sister circuits, we think the better reading of [Supreme Court precedent] is that the taxpayer is not required to file the precise return prescribed by treasury regulations in order to start the limitations clock. Instead, ‘the return’ is filed, and the limitations clock begins to tick, when the taxpayer files a return that contains data sufficient (1) to show that the taxpayer is liable for the tax at issue and (2) to calculate the extent of that liability.” No. 19-5100-CV (Dec. 11, 2020).

The Supreme Court’s rejection of Texas v. Pennsylvania (despite support from an amicus brief by two nonexistent states) has sparked an unusual national dialogue about the concept of standing (including the President’s accurate observation: “All they were interested in is ‘standing’, which makes it very difficult for the President to present a case on the merits.” (emphasis added)). The capable Rory Ryan at Baylor Law School has analyzed and critiqued the dissenters’ position; for reference, the entire order appears below:

The Supreme Court’s rejection of Texas v. Pennsylvania (despite support from an amicus brief by two nonexistent states) has sparked an unusual national dialogue about the concept of standing (including the President’s accurate observation: “All they were interested in is ‘standing’, which makes it very difficult for the President to present a case on the merits.” (emphasis added)). The capable Rory Ryan at Baylor Law School has analyzed and critiqued the dissenters’ position; for reference, the entire order appears below:

The State of Texas’s motion for leave to file a bill of complaint is denied for lack of standing under Article III of the Constitution. Texas has not demonstrated a judicially cognizable interest in the manner in which another State conducts its elections. All other pending motions are dismissed as moot. Statement of Justice Alito, with whom Justice Thomas joins: In my view, we do not have discretion to deny the filing of a bill of complaint in a case that falls within our original jurisdiction. See Arizona v. California, 589 U. S. ___ (Feb. 24, 2020) (Thomas, J., dissenting). I would therefore grant the motion to file the bill of complaint but would not grant other relief, and I express no view on any other issue.

Yes, it’s kind of a pain, but it’s your vote, your voice, and your chance to be heard as to a widely-circulated attorney directory. The link to the Super Lawyers nomination site is here, and the deadline to make your nominations is December 21, 2020.

Yes, it’s kind of a pain, but it’s your vote, your voice, and your chance to be heard as to a widely-circulated attorney directory. The link to the Super Lawyers nomination site is here, and the deadline to make your nominations is December 21, 2020.

Automation Support, Inc. v. Philippi, No. 20-10386 (Dec. 8, 2020).

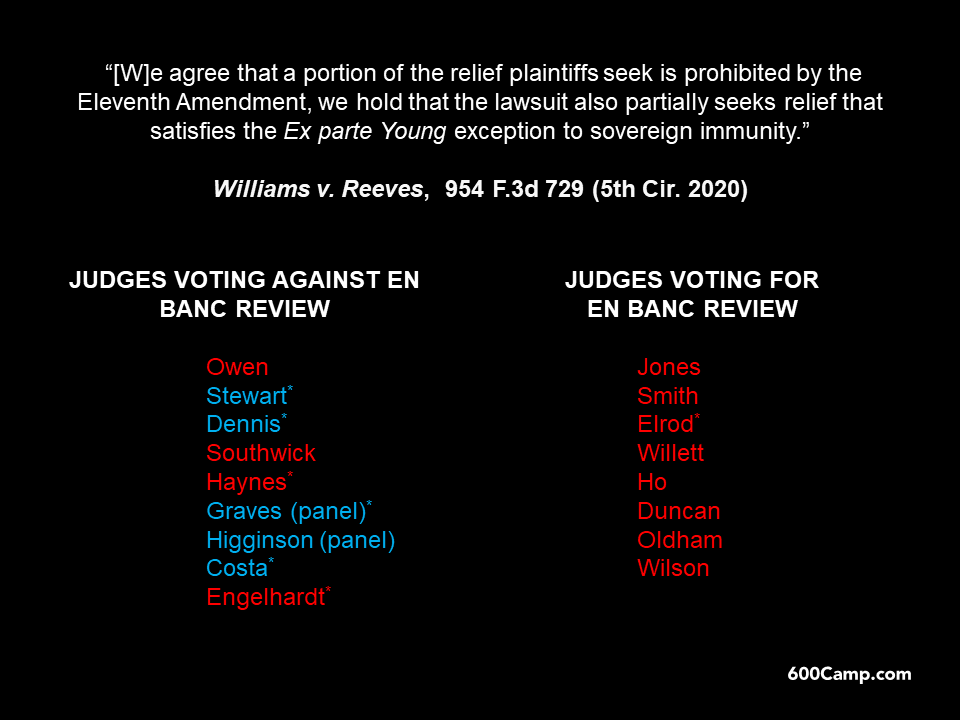

In Williams v. Reeves, 953 F.3d 729 (5th Cir. 2020), “[t]he plaintiffs in this lawsuit are low-income African-American women whose children attend public schools in Mississippi. They filed suit against multiple state officials in 2017, alleging that the current version of the Mississippi Constitution violates the ‘school rights and privileges’ condition of the [1870] Mississippi Readmission Act.” A Fifth Circuit panel found that ” a portion of the relief plaintiffs seek is prohibited by the Eleventh Amendment,” but that “the lawsuit also partially seeks relief that satisfies the Ex parte Young exception to sovereign immunity.” The full court recently denied en banc review by an 8-9 vote; the votes are described below, and they are identical to the split in another recent vote. (Red and blue show the political party of the nominating President, and an * indicates former service as a trial judge.)

“In November 2015, over a year after Richter claims that an implied contract had been formed, the parties exchanged a letter of intent. The letter stated that it was to be construed as securing a “preliminary understanding” between the parties and to serve as “a preliminary basis for negotiating a written agreement that will contain additional material terms, conditions and provisions not yet agreed upon by the parties.” The letter explicitly stated that it did not constitute a binding contract. We agree with the district court that this renders implausible any inference that the prior 2014 e-mail was intended by the parties to represent assent to be bound by contract …” Richter v. Carnival Corp., No. 20-10480 (Dec. 1, 2020).

“In November 2015, over a year after Richter claims that an implied contract had been formed, the parties exchanged a letter of intent. The letter stated that it was to be construed as securing a “preliminary understanding” between the parties and to serve as “a preliminary basis for negotiating a written agreement that will contain additional material terms, conditions and provisions not yet agreed upon by the parties.” The letter explicitly stated that it did not constitute a binding contract. We agree with the district court that this renders implausible any inference that the prior 2014 e-mail was intended by the parties to represent assent to be bound by contract …” Richter v. Carnival Corp., No. 20-10480 (Dec. 1, 2020).

In striking down a regulation of casket-making by a Louisiana monastery, the Fifth Circuit assured: “Nor is the ghost of Lochner lurking about.” St. Joseph Abbey v. Castille, 712 F. 3d 215, 226-27 (5th Cir. 2013). Nevertheless, that fearsome shade surfaced in Hines v. Quillivan, an equal-protection challenge to Texas’s regulation of telemedicine by veterinarians, only to be banished by the panel majority: “It is not irrational for a state to change in stages its licensing laws to adapt to our new, technology-based economy. If the Texas legislature finds the recently enacted changes on telemedicine successful, it may decide to expand those changes to include veterinarians. It is reasonable to have a trial period rather than to make a hasty policy change. Though we could conceive no rational basis for the law challenged in St. Joseph Abbey, we can conceive many rational bases here.”

In striking down a regulation of casket-making by a Louisiana monastery, the Fifth Circuit assured: “Nor is the ghost of Lochner lurking about.” St. Joseph Abbey v. Castille, 712 F. 3d 215, 226-27 (5th Cir. 2013). Nevertheless, that fearsome shade surfaced in Hines v. Quillivan, an equal-protection challenge to Texas’s regulation of telemedicine by veterinarians, only to be banished by the panel majority: “It is not irrational for a state to change in stages its licensing laws to adapt to our new, technology-based economy. If the Texas legislature finds the recently enacted changes on telemedicine successful, it may decide to expand those changes to include veterinarians. It is reasonable to have a trial period rather than to make a hasty policy change. Though we could conceive no rational basis for the law challenged in St. Joseph Abbey, we can conceive many rational bases here.”

A dissent saw matters differently, crediting the plaintiff’s argument that “[i]t simply is not rational to allow telemedicine without a physical examination for babies but deny the same form of  telemedicine for puppies on the ground that puppies cannot speak.” No. 19-40605 (revised Dec. 2, 2020).

telemedicine for puppies on the ground that puppies cannot speak.” No. 19-40605 (revised Dec. 2, 2020).

An error in pleading jurisdiction led to an inconclusive end in Accordant Communications v. Sayer Construction, No. 20-50169 (Dec. 4, 2020):

- Accordant won a $1.4 million arbitration award against Sayer.

- Accordant sued to confirm the award in federal court.

“As to the citizenship of the parties, Accordant alleged that it ‘is a limited liability company organized under the laws of Georgia with its principal place of business in Seminole County, Florida” and that Sayers ‘is a limited liability company organized under the laws of Texas with its principal place of business in Travis County, Texas.'”

“As to the citizenship of the parties, Accordant alleged that it ‘is a limited liability company organized under the laws of Georgia with its principal place of business in Seminole County, Florida” and that Sayers ‘is a limited liability company organized under the laws of Texas with its principal place of business in Travis County, Texas.'” - Sayer declined to answer postjudgment discovery, and on appeal argued that the district court lacked subject-matter jurisdiction (as the above allegations are based on the standards for a corporation rather than an LLC).

Despite this ‘clearly deficient’ and ‘basic’ pleading problem, the Fifth Circuit did not dismiss the case: “Considering the evidence in the record on appeal … we find that ‘jurisdiction is not clear from the record, but there is some reason to believe that jurisdiction exists.’ Therefore, we exercise our discretion under [28 USC] § 1653 and ‘remand the case to the district court for amendment of the allegations and for the record to be supplemented,’ if necessary.” (citation omitted).

Despite this ‘clearly deficient’ and ‘basic’ pleading problem, the Fifth Circuit did not dismiss the case: “Considering the evidence in the record on appeal … we find that ‘jurisdiction is not clear from the record, but there is some reason to believe that jurisdiction exists.’ Therefore, we exercise our discretion under [28 USC] § 1653 and ‘remand the case to the district court for amendment of the allegations and for the record to be supplemented,’ if necessary.” (citation omitted).

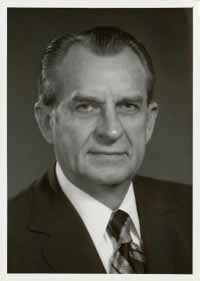

Hon. Thomas Reavley has passed away in Houston, at the age of 99. The Houston Chronicle summarizes his life of extraordinary service to the Texas courts and the U.S. Court of Appeals for the Fifth Circuit, as does the Texas Lawbook. His wisdom and statesmanlike presence will be missed by all.

Hon. Thomas Reavley has passed away in Houston, at the age of 99. The Houston Chronicle summarizes his life of extraordinary service to the Texas courts and the U.S. Court of Appeals for the Fifth Circuit, as does the Texas Lawbook. His wisdom and statesmanlike presence will be missed by all.

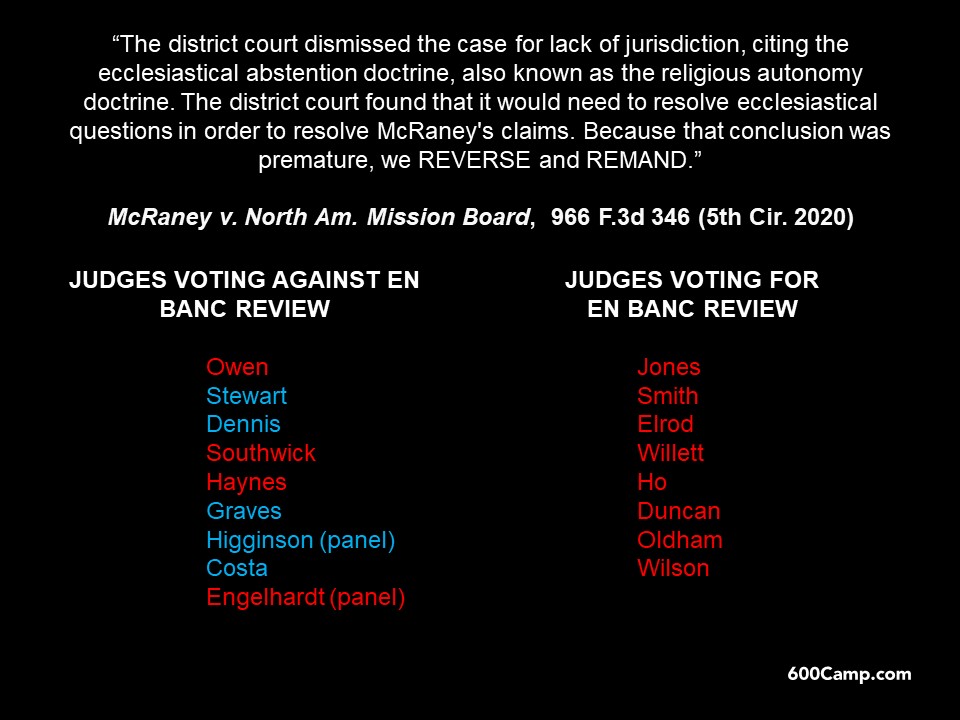

By an 8-9 vote, the Fifth Circuit abstained from en banc review of McRaney v. North American Mission Board, 966 F.3d 346 (5th Cir. 2020), in which the panel found that the application of the ecclesiastical abstention doctrine was premature given the stage of the parties’ case. A breakdown of the votes is below (the third panel member, Judge Clement, has taken senior status and did not participate in the vote):