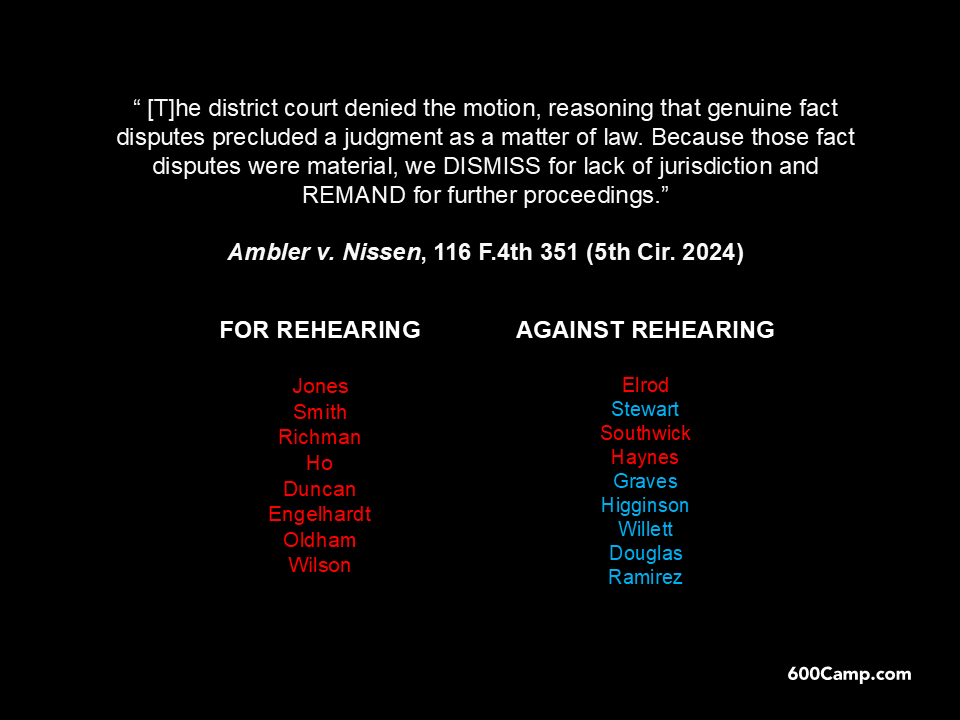

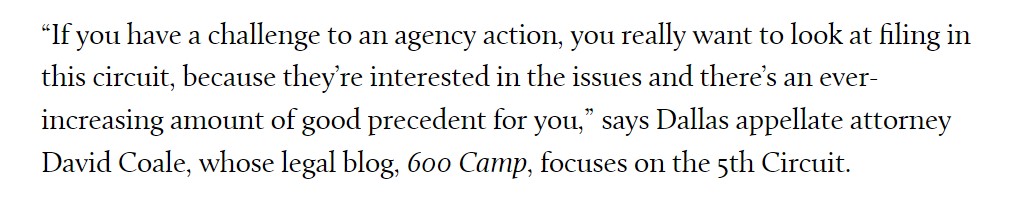

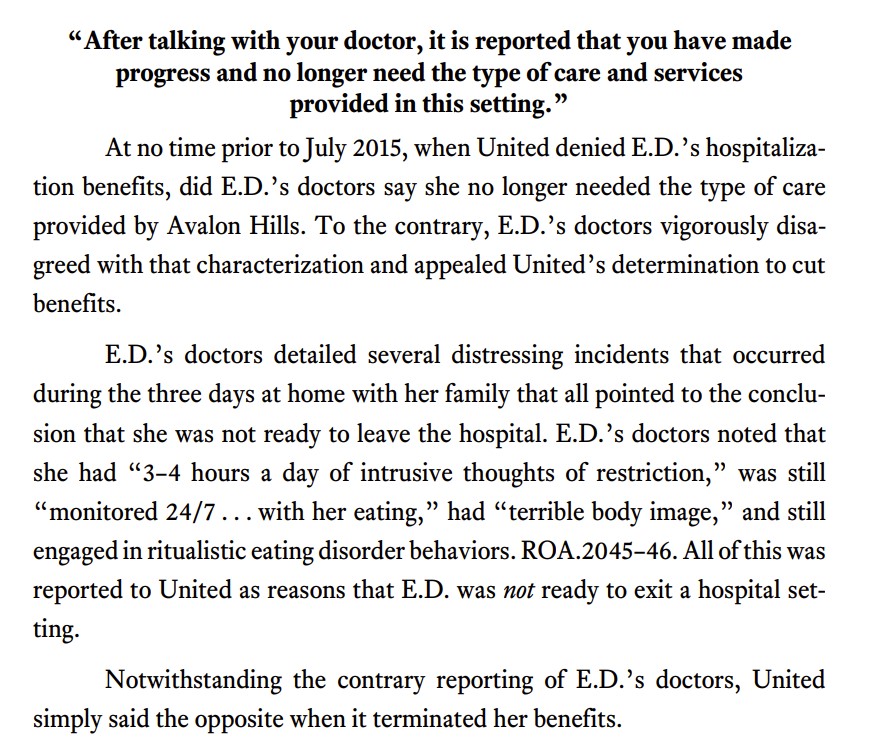

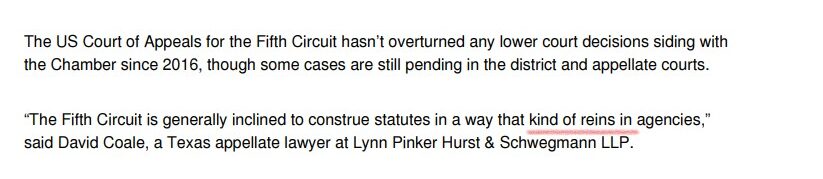

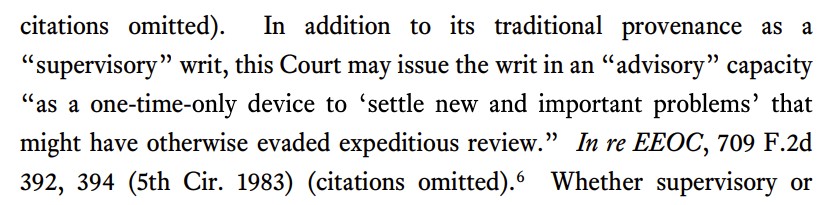

State of Mississippi v. JXN Water addressed whether an order compelling the disclosure of SNAP recipient data qualifies as an appealable collateral order.

State of Mississippi v. JXN Water addressed whether an order compelling the disclosure of SNAP recipient data qualifies as an appealable collateral order.

Remininding that the requirements for a collateral order are “stingent,” the Fifth Circuit found them satisfied here. The order (1) conclusively determined a disputed question, (2) resolved an important issue separate from the merits of the case, and (3) was functionally unreviewable on appeal from a final judgment. On the last point, the Court emphasized that once the confidential information of SNAP recipients is released, “no relief can make the information confidential again.” No. 24-60309, Apr. 10, 2025