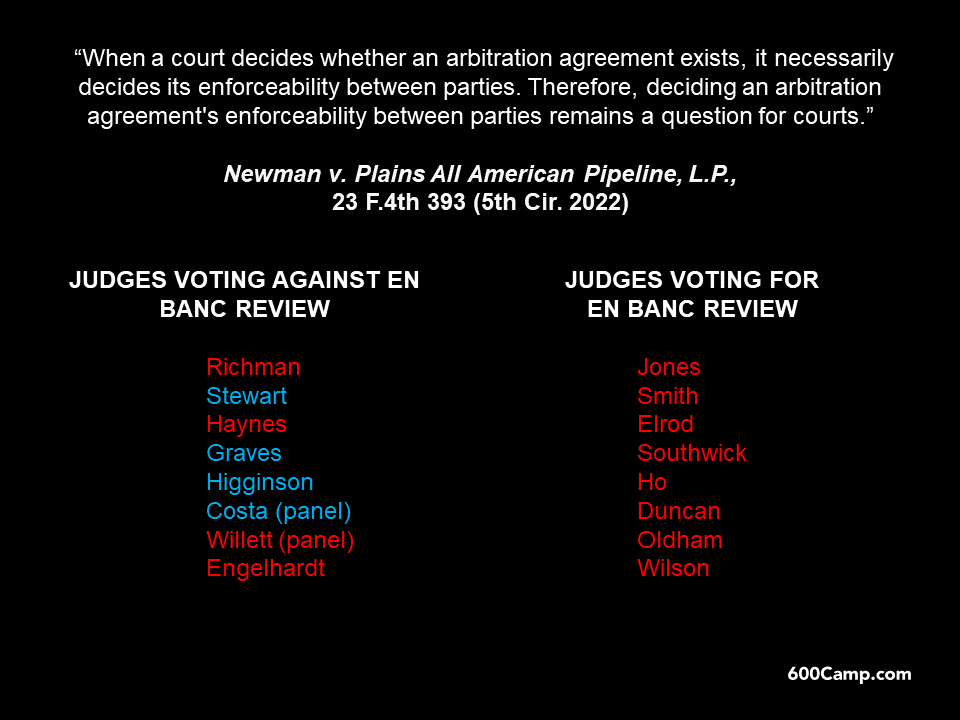

Applying the international convention about arbitration, the Fifth Circuit found an abuse of discretion in not compelling arbitration because of equitable estoppel, reasoning:

While Bufkin was certainly free to name and then dismiss the foreign insurers, the district court was not free to disregard them in considering the domestic insurers’ motion to compel arbitration. Yet in focusing on Bufkin’s dismissal of the foreign insurers, the district court neglected to consider the foreign insurers’ part in the seamless coverage agreement struck by the parties, and Bufkin’s interactions with the insurers. Honing in, that coverage arrangement included the arbitration clause that afforded the insurers–foreign and domestic—“predictability in resolving disputes dealing with the substantial risks presented by a surplus lines insurance policy.” … The upshot is that indulging Bufkin’s pleading-and-then-dismissing gamesmanship by denying arbitration turns on its head the axiom that “[t]he linchpin for equitable estoppel is equity—fairness.”

Bufkin Enterprises, LLC v. Indian Harbor Ins. Co., No. 23-30171 (March 4, 2024) (emphasis added).