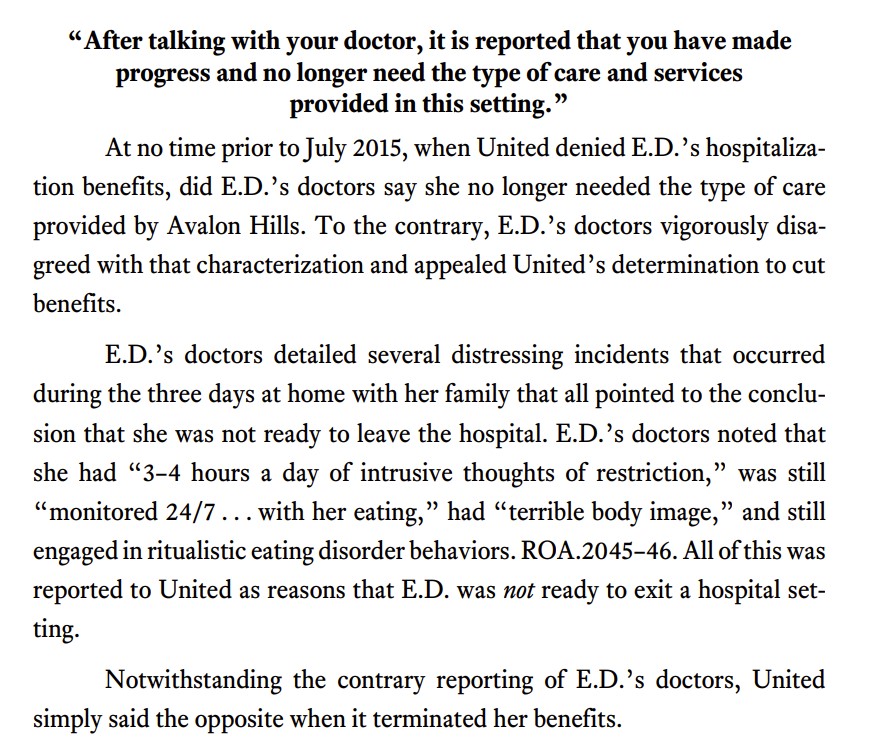

Dwyer v. United Healthcare Ins. Co., No. 23-50439 (Sept. 19, 2024), vitalizes the technical and often defense-favoring framework of ERISA benefits litigation, challenging virtually all material points–factual and legal–put forward by a plan adminstrator in its handling of claims relating to a serious anorexia case. On the facts, the opinion proceeded as follows, pointing out numerous inconsistencies between what the administrator contended and what the record, in fact, showed:

Unsurprisingly, given all three judges’ discomfort with the Fifth Circuit precedent that dictated the panel holding in Abraham Watkins v. Festeryga, that case will be considered by the en banc court. The issue, as summarized by the panel majority, is this:

Edward Festeryga, an attorney embroiled in a dispute with his former law firm, wants this case heard in federal court and contends we have appellate jurisdiction over the district court’s remand order because waiver is neither an issue of subject-matter jurisdiction nor a defect in removal procedure under 28 U.S.C. § 1447(c). We agree, but our 40-plus-year-old precedent provides otherwise, holding that a waiver-based remand order is jurisdictional under § 1447(c) and thus unappealable under § 1447(d).

While no longer in the academy, the capable Rory Ryan offered this insightful analysis of this case on X.

In TIG Ins. Co. v. Woodsboro Farmers Coop., the Fifth Circuit identified fact issues that precluded summary judgment in an insurance-coverage case.

In TIG Ins. Co. v. Woodsboro Farmers Coop., the Fifth Circuit identified fact issues that precluded summary judgment in an insurance-coverage case.

A key is whether damage to certain grain silos was “property damage” under a CGL policy. The diistrict court concluded that damage was due to defective construction. The Fifth Circuit credited the insured’s evidence that wind and weather caused the silos’ metal parts to degrade, bend, and fatigue. This evidence, including testimony from an inspector who saw the damage, supported the insured’s argument that the damage was not merely cosmetic but a “harmful change in appearance, shape, composition, or some other physical dimension to the claimants’ property.”

The Court also noted a fact issue about whether the damage occurred during the policy period, emphasizing that under Texas law, “occurred means when damage occurred, not when discovery occurred,” making it irrelevant that the damage was first observed after the policy period expired. No. 23-40435, Sept. 20, 2024.

In Favre v. Sharpe, a Hall of Fame NFL player contended that another Hall of Fame player defamed him during a TV broadcast. The Fifth Circuit affirmed the dismissal of the defamation claim, reasoning:

Sharpe’s statements–in response to facts widely reported in Mississippi news and specifically in the just-released Mississippi Today article–could not have been reasonably understood as declaring or implying a provable assertion of facts. His statements are better viewed as strongly stated opinions about the widely reported welfare scandal.

No. 23-6010 (Sept. 16, 2024).

An old adage cautions that “house guests, like fish, begin to smell after too long.” So too with exotic arugments about jury-trial rights, fueled by the Supreme Court’s vindication of such rights in an SEC enforcement action in SEC v. Jarkesy.

An old adage cautions that “house guests, like fish, begin to smell after too long.” So too with exotic arugments about jury-trial rights, fueled by the Supreme Court’s vindication of such rights in an SEC enforcement action in SEC v. Jarkesy.

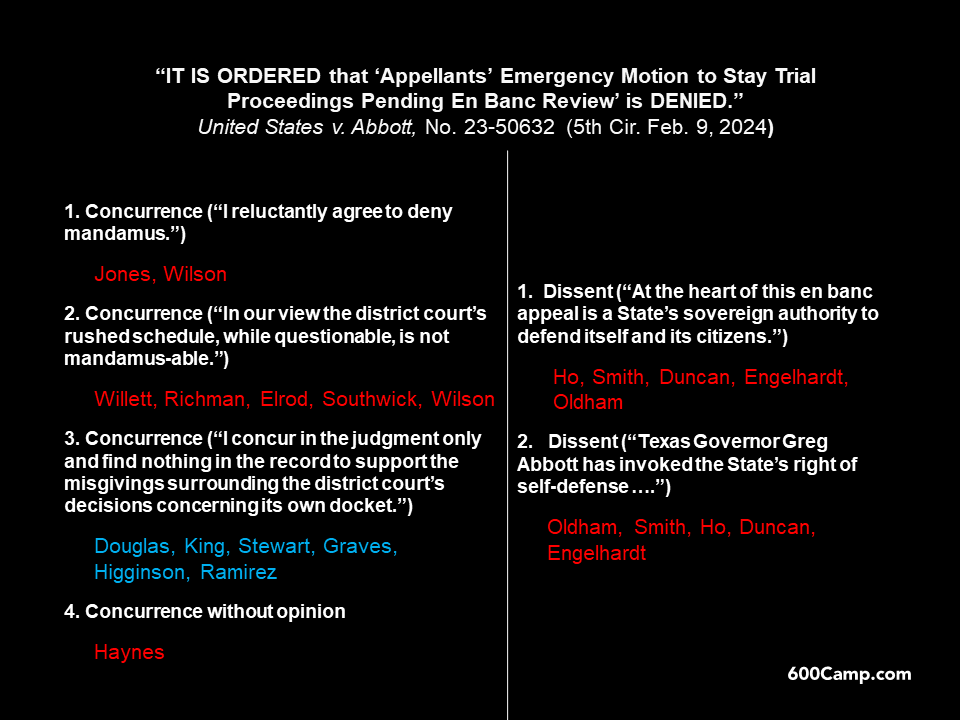

Specifically, in In re Abbott, Texas sought mandamus relief to compel a jury trial in its dispute with the United States about floating obstacles in the Rio Grande, arguing that the U.S.’s claim was analogous to a common-law claim for ejectment. The Fifth Circuit rejected that argument … because it isn’t:

Even if we did agree that this suit concerns competing claims over the rights to “possess” and “exclude” from the Rio Grande, it is no mere garden-variety dispute about “sticks in the bundle of rights that are commonly characterized as property.” … The only appropriate analogy for a [Rivers and Harbors Act] claim that has been presented by the parties is abatement of a public nuisance or purpesture. As the United States points out, there is a long tradition of equitable suits to clear obstructions upon public highways.

No. 24-50620 (Sept. 20, 2024).

In Keck v. Mix Creative Learning Center, LLC, the Fifth Circuit affirmed summary judgment for art studio that used the plaintiff’s copyrighted artworks (image of dogs) in online art kits for children. The Fifth Circuit found fair use, because the studio’s use of the artwork was transformative and did not harm the market for the plaintiff’s works; as the district court had observed, the studio “drew on Plaintiff’s art not for its inherent expressive value but for what it, accompanied by materials and instruction in art theory and history, could teach students.” No. 23-20188 (Sept. 18, 2024).

Nat’l Infusion Center Ass’n v. Becerra returns to the issue of standing in administrative law cases–a topic where the Fifth Circuit has had an unfortunate track record before the Supreme Court. The majority holds that the that the National Infusion Center Association has standing to challenge the “Drug Price Negotiation Program” established by the Inflation Reduction Act, noting procedural and economic injury.

Nat’l Infusion Center Ass’n v. Becerra returns to the issue of standing in administrative law cases–a topic where the Fifth Circuit has had an unfortunate track record before the Supreme Court. The majority holds that the that the National Infusion Center Association has standing to challenge the “Drug Price Negotiation Program” established by the Inflation Reduction Act, noting procedural and economic injury.

As to economic injury, the Court held: “NICA has shown that at least one of its members’ drugs will be subject to the Program, that the Program will lower the price for that drug, and that the lower price will lead to lower revenue for the member that administers the drug.” Critical to this holding–and the distinction of recent precedent about probabilistic future injury–was the majority’s conclusion that:

“predicting a profit seeking business’s response to changing economic incentives simply requires determining the direction in which the incentives are changing. Because the third-party decisions in NICA’s theory are guided by basic economic rationality, NICA has ‘thread[ed] the causation needle’ …”

(emphasis added). A dissent emphasized that NICA’s members do not have a concrete interest in profiting from Medicare reimbursements, as the statute does not entitle them to a profit, and that the complaint was filed before HHS announced the drugs selected for negotiation–creating tension iwth the rule that standing must exist at the time suit is filed. No. 24-50180 (Sept. 20, 2024).

Fittingly for a Friday, 600Camp celebrates its thirteenth anniversary of reasonably faithful reporting, comment, analysis, and meme-making about business-related cases in the U.S. Court of Appeals for the Fifth Circuit. You can celebrate by making some bread pudding with this classic recipe from Galatoiires, the grande dame of New Orleans Creole restaurants.

Fittingly for a Friday, 600Camp celebrates its thirteenth anniversary of reasonably faithful reporting, comment, analysis, and meme-making about business-related cases in the U.S. Court of Appeals for the Fifth Circuit. You can celebrate by making some bread pudding with this classic recipe from Galatoiires, the grande dame of New Orleans Creole restaurants.

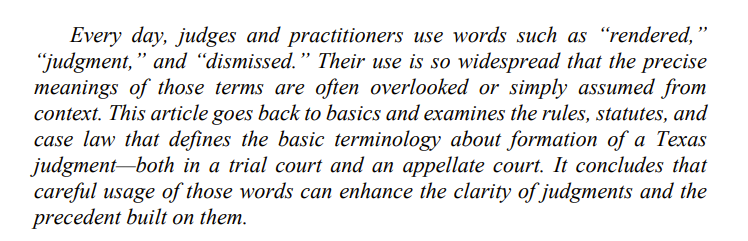

Occidental Petroleum Corp. v. Wells Fargo Bank, N.A. presents an Erie case, governed by Texas substantive law, as to whether the parties formed a contract. No. 23-20318 (Sept. 18, 2024).

Occidental Petroleum Corp. v. Wells Fargo Bank, N.A. presents an Erie case, governed by Texas substantive law, as to whether the parties formed a contract. No. 23-20318 (Sept. 18, 2024).

The Fifth Circuit held that Wells Fargo was judicially estopped from arguing that a contract was not formed. Under its precedent: “Judicial estoppel ‘prevents a party from asserting a position in a legal proceeding that is contrary to a position previously taken in the same or some earlier proceeding.’” (emphasis added).

But as a matter of Texas substantive law: “[J]udicial estoppel applies only if the successful representation arose in a different case or, at most, ‘in another phase’ of the same case. … By contrast, “[c]ontradictory positions taken in the same proceeding may raise issues of judicial admission but do not invoke the doctrine of judicial estoppel.” Fleming v. Wilson, No. 22-0166 (Tex. May 17, 2024). (emphasis added).

The question whether judicial estoppel is substantive or procedural, and thus whether Erie applies to a federal court’s choice of law about that matter, is not addressed.

In Century Surety Co. v. Colgate Operating, LLC:

In Century Surety Co. v. Colgate Operating, LLC:

- The parties’ contract required Colgate (an oil well operator) and Triangle (a consultant) “to purchase indemnity insurance with limits the lesser of (1) ‘not less than $5 million’, or (2) ‘the maximum amount which may be required by law, if any, without rendering this mutual indemnification obligation void, unenforceable or otherwise inoperative.'”

- Clause 2 referred to a potential legislative restriction on indemnity agreement that didn’t come to pass.

- The district court say Clause 1 as setting a ceiling but not a floor on the indemnity obligation, but the Fifth Circuit saw the clause as setting both: “At heart, Century’s position assumes that Colgate set out a $76 million dollar indemnity obligation without clearly saying so in the contract by virtue of policies that Colgate acquired years after it had entered into the [contract].”

No. 23-50530 (Sept. 10, 2024).

28 U.S.C. § 1782 allows foreign parties to petition U.S. federal courts for assistance with discovery. When a district court rules on such an application, the Fifth Circuit expects an explanatoin:

… the district court’s order denying Paramo’s motion to quash is plainly deficient because it does not meaningfully engage with any of part of the § 1782 inquiry. Indeed, it does not engage at all beyond a barebones reference to “the Motion, the Response, the record and the applicable law.” And the Banorte Parties’ contention that the ruling is salvageable because “the district court referenced and analyzed the relevant factors” in its initial order granting § 1782 assistance is unavailing because, even there, the court did no more than recite the applicable factors. Had the court analyzed the factors, even summarily, either in the instant order denying Paramo’s motion or by reaffirming substantive analysis articulated in granting the initial § 1782 petition, this would be a different case.

Banco Mercantil de Norte, S.A. v. Paramo, No. 24-20007 (Aug. 28, 2024).

In Tesla, Inc. v. Louisiana Automobile Dealers Assoc., the Fifth Circuit addressed Tesla’s challenges to Louisiana’s automobile dealership regulations, which prohibit manufacturers from selling directly to consumers and performing warranty services for cars they do not own.

In Tesla, Inc. v. Louisiana Automobile Dealers Assoc., the Fifth Circuit addressed Tesla’s challenges to Louisiana’s automobile dealership regulations, which prohibit manufacturers from selling directly to consumers and performing warranty services for cars they do not own.

- Due Process. The Court found that Tesla had plausibly alleged a due process violation. The Commission’s composition, with members who are direct competitors of Tesla, created a “possible personal interest” that could bias their decisions, which was sufficient for the Rule 12 stage.

- Antitrust. From there, the Court vacated and remanded the dismissal of Tesla’s antitrust claim, noting that the due process ruling fundamentally altered the grounds on which Tesla’s alleged antitrust injury was based. Tesla’s allegations of exclusion from the market due to the Commission’s actions could constitute a plausible antitrust injury.

- Equal Protection. The Court affirmed dismissal of Tesla’s equal protection claim, concluding that preventing vertical integration and potential abuses of market power were legitimate state interests justifying the regulations.

A dissent saw matters differently, focusing primarily on the due-process claim and its reliance on board structure. No. 23-30480, August 26, 2024.

In Reule v. Jackson, the Fifth Circuit affirmed that a plaintiff lacks standing to challenge procedural rules, when those rules apply to meaningless substantive activity. A group of plaintiffs, declared as “vexatious litigants” under Texas law claimed that the procedural requirements thus placed on them by Chapter 11 of the Texas Civil Practice & Remedies Code were unconstitutional. The Court held that they lacked standing because their real grievance was with the original court orders declaring them vexatious, not with the officials who enforced those orders. Even if the procedural requirements were lifted, the plaintiffs would still face dismissal as a substantive matter. No. 23-40478, August 19, 2024

In Reule v. Jackson, the Fifth Circuit affirmed that a plaintiff lacks standing to challenge procedural rules, when those rules apply to meaningless substantive activity. A group of plaintiffs, declared as “vexatious litigants” under Texas law claimed that the procedural requirements thus placed on them by Chapter 11 of the Texas Civil Practice & Remedies Code were unconstitutional. The Court held that they lacked standing because their real grievance was with the original court orders declaring them vexatious, not with the officials who enforced those orders. Even if the procedural requirements were lifted, the plaintiffs would still face dismissal as a substantive matter. No. 23-40478, August 19, 2024

Shinsho Am. Corp. v. TransPecos Banks, SSB concluded that TransPecos Banks authorized HyQuality to sell its inventory, including the steel at issue, free of TransPecos’s security interest as allowed by section 9.315 of the UCC. This decision was based on the understanding between TransPecos and HyQuality that selling inventory was essential for HyQuality’s business operations, and that the proceeds from these sales would not be used to repay TransPecos’s loans directly. The proceeds were intended to be reinvested into the business, a practice TransPecos encouraged to avoid violating SBA rules and to support HyQuality’s ongoing operations. No. 23-20520 (Aug. 19, 2024).

Shinsho Am. Corp. v. TransPecos Banks, SSB concluded that TransPecos Banks authorized HyQuality to sell its inventory, including the steel at issue, free of TransPecos’s security interest as allowed by section 9.315 of the UCC. This decision was based on the understanding between TransPecos and HyQuality that selling inventory was essential for HyQuality’s business operations, and that the proceeds from these sales would not be used to repay TransPecos’s loans directly. The proceeds were intended to be reinvested into the business, a practice TransPecos encouraged to avoid violating SBA rules and to support HyQuality’s ongoing operations. No. 23-20520 (Aug. 19, 2024).

In Arms of Hope v. City of Mansfield, the Fifth Circuit examined when a case becomes moot during an interlocutory appeal. The Court distinguished between the mootness of the entire case, on the one hand, and the mootness of the specific issues presented in an interlocutory appeal, on the other.

Here, because the City of Mansfield amended its ordinances about “Unattended Donation Boxes,” the issues on interlocutory appeal from a preliminary injunction no longer had practical significance.

Citing U.S. Navy SEALs 1-26 v. Biden, the Court explained that when an interlocutory appeal becomes moot, it doesn’t stop the lower court from dealing with the remaining issues. Although the new ordinances didn’t completely address all concerns, the Court determined that these issues should be resolved by the district court rather than through a moot appeal. No. 23-10656, August 21, 2024.

In Kansas City So. Rwy. Co. v. Sasol Chemicals (USA), LLC, the Fifth Circuit addressed whether “track” in a lease agreement included the track that forms part of the switches.

In Kansas City So. Rwy. Co. v. Sasol Chemicals (USA), LLC, the Fifth Circuit addressed whether “track” in a lease agreement included the track that forms part of the switches.

The district court found the contract ambiguous because “track” was not explicitly defined to include or exclude switches.

The Fifth Circuit disagreed, noting that dictionaries define “track” as the continuous line of rails on which railway vehicles travel. “Switches,” as movable rails, are part of the track infrastructure. From there, the Court noted that throughout the lease, treating “track” and “switches” as mutually exclusive would lead to absurd results, such as gaps in maintenance obligations, liability allocations, and safety requirements.

The Court acknowledged the parts of the lease relied upon by the district court, which referred to “track infrastructure, switches, and tracks,” but reasoned that while these terms are sometimes listed separately, that doesn’t mean they were mutually exclusive. The separate references likely reflected the need to address different components of the railyard in detail. No. 23-10048, August 20, 2024.

The great Sherlock Holmes story The Hound of the Baskerviles took place on the English moor. The Fifth Circuit case of Diamond Services Corp. v. RLB Contracting, Inc., No. 23-40137 (Aug. 16, 2024), also involved a promlem of mooring:

Restaurant Law Center v. U.S. Dep’t of Labor presents a case study in review of an agency regulation after Loper-Bright:

Restaurant Law Center v. U.S. Dep’t of Labor presents a case study in review of an agency regulation after Loper-Bright:

- 29 U.S.C. § 203(t) says, in relevant part, that a “tipped employee” means “any employee engaged in an occupation in which he customarily and regularly receives more than $30 a month in tips.” (emphasis added).

- The Labor Department regulation implementing that statute focused on the amount of time, during the work period, that the employee engaged in tip-eligible activity; in summary: “An employer may take the tip credit for tip-producing work. But if more than 20 percent of an employee’s workweek is spent on directly supporting work, the employer cannot claim the tip credit for that excess. Nor can directly supporting work be performed for more than 30 minutes at any given time. An employer may not take the tip credit for any time spent on work not part of the tipped occupation.” (footnote omitted).

- Without the Chevron backstop, that regulation was invalid because it didn’t fit the statute’s unambiguous terms: “'[E]ngaged in an occupation in which [the employee] customarily and regularly receives more than $30 a month in tips’ cannot be twisted to mean being ‘engaged in duties that directly produce tips, or in duties that directly support such tip-producing duties (but only if those supporting duties have not already made up 20 percent of the work week and have not been occurring for 30 consecutive minutes) and not engaged in duties that do not produce tips.'”

“In short, as to supporting work, the Final Rule replaces the Congressionally chosen touchstone of the tip-credit analysis—the occupation—with one of DOL’s making—the timesheet.” No. 23-505762 (Aug. 23, 2024).

In Mission Pharmacal Co. v. Molecular Biologicals, Inc., the Fifth Circuit reversed the district court’s conclusion that a contract was “unambiguously silent” about certain reimbursements.

In Mission Pharmacal Co. v. Molecular Biologicals, Inc., the Fifth Circuit reversed the district court’s conclusion that a contract was “unambiguously silent” about certain reimbursements.

The case turned on the term “chargeback management.” The Court emphasized that the contract contemplated credits being issued to wholesalers, which undermined Molecular’s argument that Mission unilaterally assumed that obligation without contractual support:

“[F]aced with the question of whether the meaning of chargeback services includes reimbursement from Molecular, the fact that one answer leads to a harmonious contract, while the other leads to a dissonant one, is informative in determining the meaning of the term.”

No. 23-50321 (consolidated with No. 23-50446), August 16, 2024.

Mieco LLC v. Pioneer Natural Resources USA, Inc. involved a dispute over a natural gas supply contract affected by Winter Storm Uri.

Pioneer Natural Resources invoked the contract’s force majeure clause to excuse its failure to deliver gas during the storm. The clause defined force majeure as an “event or circumstance which prevents one party from performing its obligations,” and specified that the event must be beyond the party’s reasonable control and not due to its negligence. The clause further required the party to be “unable to overcome or avoid” the event “by the exercise of due diligence.”

The Fifth Circuit upheld the district court’s conclusion that “prevent” does not mean performance must be impossible, but can also include a significant hindrance or impediment. That said, the Court reversed summary judgment on whether Pioneer exercised the necessary “due diligence” to mitigate the storm’s effects. The clause required Pioneer to make reasonable efforts, and the Court identified factual disputes about whether Pioneer could have purchased spot market gas to fulfill its obligations, leading to a remand for further proceedings. No. 23-10575 (July 16, 2024).

In the high-profile Dallas case challenging the FTC’s new rule about noncompete enforcement, Judge Ada Brown ruled for the plaintiffs in all respects. Ryan LLC v. FTC (N.D. Tex. Aug. 20, 2024). The opinion sidesteps nagging questions about the propriety of a nationwide injunction by focusing on the plain terms of the Administrative Procedure Act:

In Canadian Standards Assoc. v. P.S. Knight Co. the Fifth Circuit resolved a copyright case about the reproduction and sale of Canadian model codes involving the Candaian electrical, propane, and oil-pipeline industries. Each of the relevant codes was fully incorporated into Canadian law in those areas.

In Canadian Standards Assoc. v. P.S. Knight Co. the Fifth Circuit resolved a copyright case about the reproduction and sale of Canadian model codes involving the Candaian electrical, propane, and oil-pipeline industries. Each of the relevant codes was fully incorporated into Canadian law in those areas.

The Court held that once these model codes were enacted into law, they lost their copyright protection under U.S. law, referencing its earlier decision in Veeck v. Southern Bldg. Code Congress, Int’l. The Court also rejected CSA’s efforts to distinguish Veeck, noting that the legal principle–incorporation into law means a loss of copyright protection–applied equally to the Canadian context. 23-50081; Aug. 15, 2024.

The Fifth Circuit addressed a range of trademark-related claims about a group of restaurants in Molzan v. Bellagreen Holdings, LLC, and reversed the grant of a Rule 12(b)(6) motion to dismiss about them.

The Fifth Circuit addressed a range of trademark-related claims about a group of restaurants in Molzan v. Bellagreen Holdings, LLC, and reversed the grant of a Rule 12(b)(6) motion to dismiss about them.

- Trademark infringement. The plaintiff adequately alleged that the defendants kept using his “Ruggles” trademarks after the termination of their license, creating a likelihood of confusion. Specifically, the Court noted that the use of the “Ruggles Green” trademark in subdomains and redirections to the Bellagreen website. These actions made it “facially plausible that the Bellagreen Defendants were using the Ruggles and Ruggles Green trademarks and that use was creating confusion on the internet.”

- False advertising. Statements on the Bellagreen website, suggesting that Bellagreen was formerly Ruggles Green, and that the quality of food had not changed since 2008, could mislead consumers into believing that Bellagreen was still affiliated with the original Ruggles Green restaurants. The plaintiff’s allegations about these matters thus stated plausible claims.

- Trademark dilution. The Court affirmed the dismissal of the federal dilution claim but reversed the dismissal of the state-law claim. The Court recognized that while the “Ruggles” mark may not be famous nationwide, the plaintiff sufficiently alleged that the mark was famous within the Houston area.

No. 23-20492. Aug. 12, 2024

In Schmidt v. Rechnitz, the Fifth Circuit affirmed the bankruptcy court’s decision allowing a trustee to recover $10.3 million transferred to Shlomo and Tamar Rechnitz as part of a fraudulent scheme orchestrated by Mark Nordlicht, who had defrauded Black Elk Energy’s creditors.

In Schmidt v. Rechnitz, the Fifth Circuit affirmed the bankruptcy court’s decision allowing a trustee to recover $10.3 million transferred to Shlomo and Tamar Rechnitz as part of a fraudulent scheme orchestrated by Mark Nordlicht, who had defrauded Black Elk Energy’s creditors. Dickson v. Janvey clarifies the limits of a district court’s power to issue a global bar order. The Fifth Circuit held that the district court overstepped by attempting to enjoin foreign liquidators—who were not subject to its personal jurisdiction—from pursuing claims related to the Stanford Ponzi scheme in Switzerland. As the Court noted, “no in personam jurisdiction, no injunction,” rejecting the idea that a court’s in rem jurisdiction over a receivership estate could justify expansive orders against parties beyond its reach. No. 23-10726 (Aug. 15, 2024).

Dickson v. Janvey clarifies the limits of a district court’s power to issue a global bar order. The Fifth Circuit held that the district court overstepped by attempting to enjoin foreign liquidators—who were not subject to its personal jurisdiction—from pursuing claims related to the Stanford Ponzi scheme in Switzerland. As the Court noted, “no in personam jurisdiction, no injunction,” rejecting the idea that a court’s in rem jurisdiction over a receivership estate could justify expansive orders against parties beyond its reach. No. 23-10726 (Aug. 15, 2024).

The Kobayashi Maru was an impossible test used by Star Trek’s Starfleet Academy to challenge cadets. The plaintiff in Zaragoza v. Union Pacific R.R. Co. faced a similarly difficult challenge with the Ishihara test for color-blindness, leading to a dispute whether he should have been allowed to continue working as a train conductor. The Fifth Circuit held that limitations on his claim had been tolled:

The Kobayashi Maru was an impossible test used by Star Trek’s Starfleet Academy to challenge cadets. The plaintiff in Zaragoza v. Union Pacific R.R. Co. faced a similarly difficult challenge with the Ishihara test for color-blindness, leading to a dispute whether he should have been allowed to continue working as a train conductor. The Fifth Circuit held that limitations on his claim had been tolled:

“Zaragoza was included in the Harris class, as pled in February 2016 and as initially certified in February 2019. Therefore, his disability discrimination claims were tolled from the time they accrued until he asserted them, as an individual claimant, with the EEOC in March 2020.”

No. 23-50194 (Aug. 12, 2024).

Dickson v. Janvey, a dispute about the scope of an anti-litigation injunction, offers two basic reminders about the process of separating holding from dicta:

Dickson v. Janvey, a dispute about the scope of an anti-litigation injunction, offers two basic reminders about the process of separating holding from dicta:

- Not discussed, likely not holding. “[W]e have previously held that a district court’s power over a receivership enables it to enjoin third parties or non-parties from pursuing certain claims involving the res of the receivership estate. But our statements in those cases implicated the equitable remedies available to the district court and not its jurisdiction. No one objected to personal jurisdiction in those cases, likely because any such objection would have been frivolous. But even if there were a latent in personam defect in those cases, our silence could never be construed as an implicit holding.” (citations and footnotes omitted).

- Not necessary, likely not holding. “Hall suggested in dicta that federal courts may enter in rem injunctions in aid of a previous in rem judgment. It is unclear to us what the Hall court meant by this dicta. But … the Hall court’s reference to an ‘inrem injunction’ was unnecessary to its decision. Federal jurisdiction in that

case was not in rem. So the court’s in rem discussion was nonbinding dicta.” (citations omitted).

No. 23-10726 (Aug. 9, 2024) (Enthusiasts of dicta-holding distinctions will recall that courts have discretion whether to give effect to obiter dicta–an unnecessary but thoughtful statement–under the circumstances of a particular case.)

Gibson, Inc. v. Armadillo Distribution Enterprises, Inc. presented a trademark dispute about the iconic “Flyng V” electric guitar; the appellate issue was the admissibility of evidence about third-party use before 1992–five years before the relevant party acquired the rights to the relevant marks. The Fifth Circuit held that the district court’s time limit wasn’t justified by Fed. R. Evid. 403 or the applicable trademark law, concluding that it was potentially probative as to whether the mark was “generic” and thus deserving of any protection under trademark law. No. 22-40587 (revised August 8, 2024) (applying Converse v. Int’l Trade Comm’n, 909 F.3d 1110 (Fed Cir. 2018)).

Gibson, Inc. v. Armadillo Distribution Enterprises, Inc. presented a trademark dispute about the iconic “Flyng V” electric guitar; the appellate issue was the admissibility of evidence about third-party use before 1992–five years before the relevant party acquired the rights to the relevant marks. The Fifth Circuit held that the district court’s time limit wasn’t justified by Fed. R. Evid. 403 or the applicable trademark law, concluding that it was potentially probative as to whether the mark was “generic” and thus deserving of any protection under trademark law. No. 22-40587 (revised August 8, 2024) (applying Converse v. Int’l Trade Comm’n, 909 F.3d 1110 (Fed Cir. 2018)).

The issue in Gibson, Inc. v. Armadillo Distribution Enterprises, Inc. was the admissibilty of evidence about third-party use of an alleged trademark. After concluding that the trial court erred in excluding that evidence, the Fifth Circuit considered whether the error was harmful. To illustrate that concept, the Court discussed a helpful general case on that issue, Bocanegra v. Vicmar Services, 320 F.3d 581 (5th Cir. 2003), which it summarized as follows (citations omitted):

The issue in Gibson, Inc. v. Armadillo Distribution Enterprises, Inc. was the admissibilty of evidence about third-party use of an alleged trademark. After concluding that the trial court erred in excluding that evidence, the Fifth Circuit considered whether the error was harmful. To illustrate that concept, the Court discussed a helpful general case on that issue, Bocanegra v. Vicmar Services, 320 F.3d 581 (5th Cir. 2003), which it summarized as follows (citations omitted):

In Bocanegra v. Vicmar Services, Inc., a pedestrian was fatally injured when he was struck by a streetsweeper on the median of a highway. On the eve of trial, the pedestrian’s estate sought to introduce evidence demonstrating that the driver of the streetsweeper was impaired by the use of marijuana a few hours prior to the fatal collision. Citing Rule 403 and the Daubert standard, the district court granted the driver’s motion in limine and excluded the driver’s expert testimony and an admission from the driver that he had smoked marijuana a few hours before the incident. … On appeal, this court determined that the district court’s “reliance on Rule 403 as another basis to exclude [the relevant expert] testimony concerning cognitive impairment resulting from [the driver’s] ingestion of marijuana” constituted an abuse of discretion. This court further held that the error affected the pedestrian’s substantial rights because “the jury was not presented with a complete picture of what happened on the night in question.” This court concluded that the pedestrian’s estate was left with no means of countering the driver’s argument that he “reacted reasonably and did the best he could under the circumstances.”

No. 22-40587 (Aug. 8, 2024). From there, the Court concluded that the exclusion of the third-party use evidence in the case at hand prevented the jury from getting a complete picture of the alleged trademark’s use. PREVIEW: I have an article coming out in the Texas Law Review Online this fall that uses the metaphor of a “complete picture” to analyze the past SCOTUS term’s cases about the use of history.

I take the reins in this Bloomberg article today about the U.S. Chamber of Commerce choosing to file lawsuits about administrative-agency rules in Texas / the Fifth Circuit.

A summary-judgment affidavit can clarify, but not contradict, prior testimony. In Keiland Construction LLC v. Weeks Marine Inc., the Fifth Circuit described an example of permissible clarification;

For instance, Weeks stated in its certified discovery responses that it found Keiland’s rates for its project manager and superintendent to be “excessive.” Moreover, Hafner testified that “the project manager, superintendent, and estimator are overhead people and shouldn’t be included in the [actual] cost at all.” And Hafner—at trial and in his affidavit—testified that he could not calculate the costs because of “discrepancies” in the claimed costs. So he simply hypothesized an “hourly rate . . . that [he] believed could be justified.”

Keiland fails to show how, in any of these particulars, Hafner’s affidavit “impeaches,” rather than “supplements” or “explains,” the previous testimony.

No. 23-30357 (July 25, 2024) (footnotes omitted).

Escobedo v. Ace Gathering, Inc. invovlved “Crude Haulers,” who are “drivers of large, 18-wheeled tanker trucks who drive to producers’ oil fields, load crude oil onto their trucks, and then transport that oil on public roads and highways to an ‘injection point’ on a pipeline.”

Escobedo v. Ace Gathering, Inc. invovlved “Crude Haulers,” who are “drivers of large, 18-wheeled tanker trucks who drive to producers’ oil fields, load crude oil onto their trucks, and then transport that oil on public roads and highways to an ‘injection point’ on a pipeline.”

While that activity is conducted within Texas, the pipelines carry most of the oil to customers and markets in other states. The question was whether the drivers were engaged in “interstate commerce” within the meaning of the Motor Carrier Act of 1980.

While the pathway to the present legal standard was not free from detours, the standard itself is clear–“purely intrastate transportation rises to the level of interstate commerce when the product is ultimately bound for out-of-state destinations, just as the crude oil was here,” and no evidence suggested that the oil “came to rest” at a storage facility to potentially end its interstate journey. No. 23-20494 (July 31, 2024).

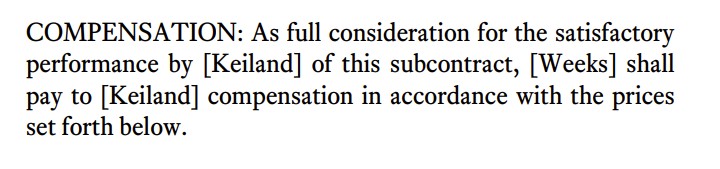

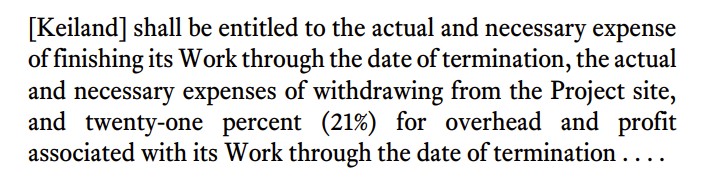

Examples of contract ambiguity don’t come along every day, so they deserve careful study when they do. Keiland Construction v. Weeks Marine found ambiguity because of tension in a contract between Section 5, titled “COMPENSATION”:

This language was followed by a schedule of lump-sum prices for various services. The other clause was Section 9, titled “TERMINATION FOR CONVENIENCE, which said in relevant part:

This language was followed by a schedule of lump-sum prices for various services. The other clause was Section 9, titled “TERMINATION FOR CONVENIENCE, which said in relevant part: The Fifth Circuit agreed with the district court that the combination of these two provisions produced ambiguity: “Keiland’s reading, that the sections required compensation for pre-termination work on a lump-sum basis and post-termination work on a cost-plus basis, is plausible. But so is Weeks’s, namely that Section 9 operated to convert all compensation due Keiland to cost-plus upon termination—particularly given that Section 9 specifies payment for 21% of costs “for overhead and profit associated with Work through the date of termination.” No. 23-30357 (July 25, 2024).

The Fifth Circuit agreed with the district court that the combination of these two provisions produced ambiguity: “Keiland’s reading, that the sections required compensation for pre-termination work on a lump-sum basis and post-termination work on a cost-plus basis, is plausible. But so is Weeks’s, namely that Section 9 operated to convert all compensation due Keiland to cost-plus upon termination—particularly given that Section 9 specifies payment for 21% of costs “for overhead and profit associated with Work through the date of termination.” No. 23-30357 (July 25, 2024).

American Warrior v. Foundation Energy Fund provides a useful reminder that “finality” can mean different things in different settings:

American Warrior v. Foundation Energy Fund provides a useful reminder that “finality” can mean different things in different settings:

AWI’s position elides the distinction between “finality” for the purposes of appealability and “finality” for the purposes of res judicata. These are related, but separate concepts. Thus, “finality for purposes of appeal is not the same as finality for purposes of preclusion.”

… Just as new facts or circumstances may warrant the modification of an injunction on behalf of a party that previously failed to obtain relief or modification, new facts or circumstances may also warrant an order modifying or lifting a bankruptcy automatic stay for a party previously denied relief. Res judicata does not tie a bankruptcy court’s hands to prevent the protection, disposition, or sale of estate property by lifting or modifying the automatic stay as changed conditions warrant.

… [P]arties may appeal the denial of a lift-stay motion, their failure to do so immediately does not prejudice their ability to obtain stay relief later, when the legal and factual landscape of the bankruptcy case changes.

No. 23-30529 (Aug. 1, 2024) (emphais removed).

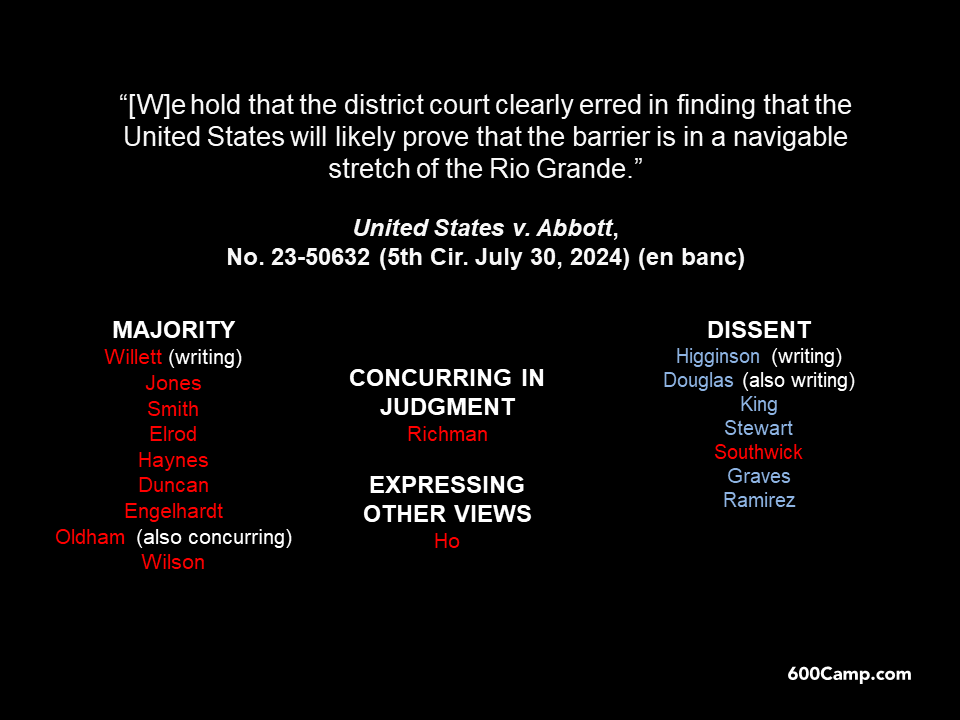

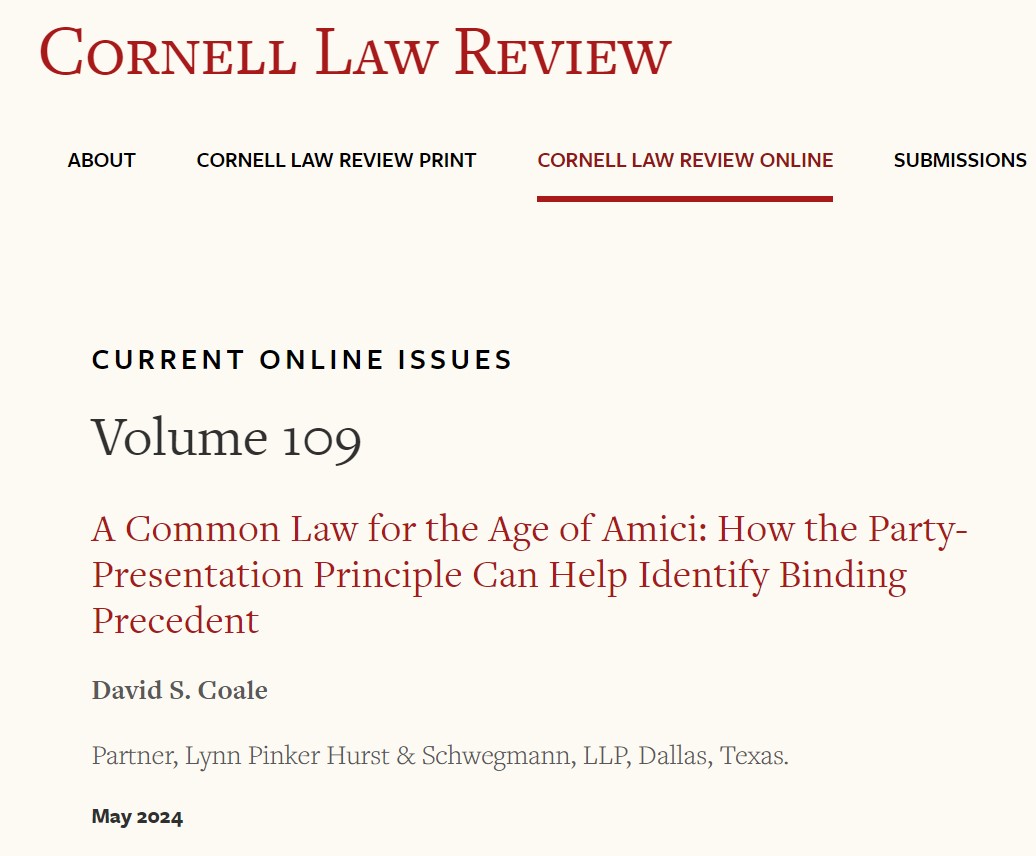

The party-presentation principle made an appearance yesterday in the “buoy case,” United States v. Abbott.

The specific issue is unique to this case, but the level of generality at which the Court identified the problem is of broader interest. Cf. United Natural Foods, Inc. v. NLRB, 66 F.4th 536, 556 (5th Cir. 2023) (Oldham, J., dissenting) (“Does anyone think that, when a party presents legal question X for decision in federal court, a federal judge is somehow disabled from reading any case, statute, regulation, or other authority not cited in the party’s brief? Of course not. We are duty-bound to understand the legal questions presented to us—even when a party presents a question less than perfectly.”).

(To learn more about this elusive but important principle, you can read my recent article in the Cornell Law Review Online).

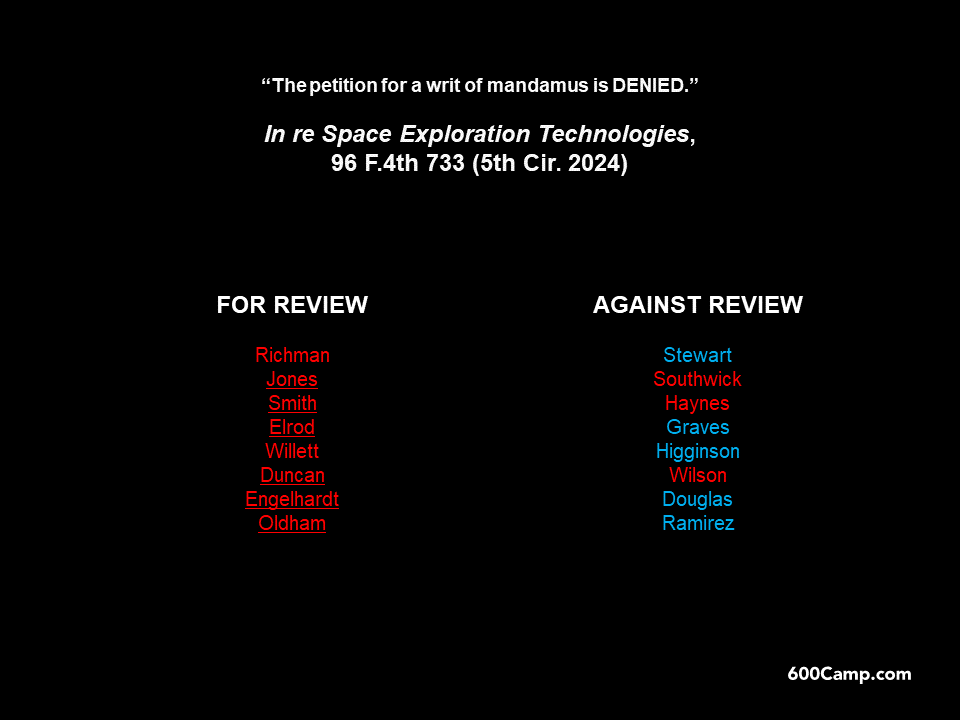

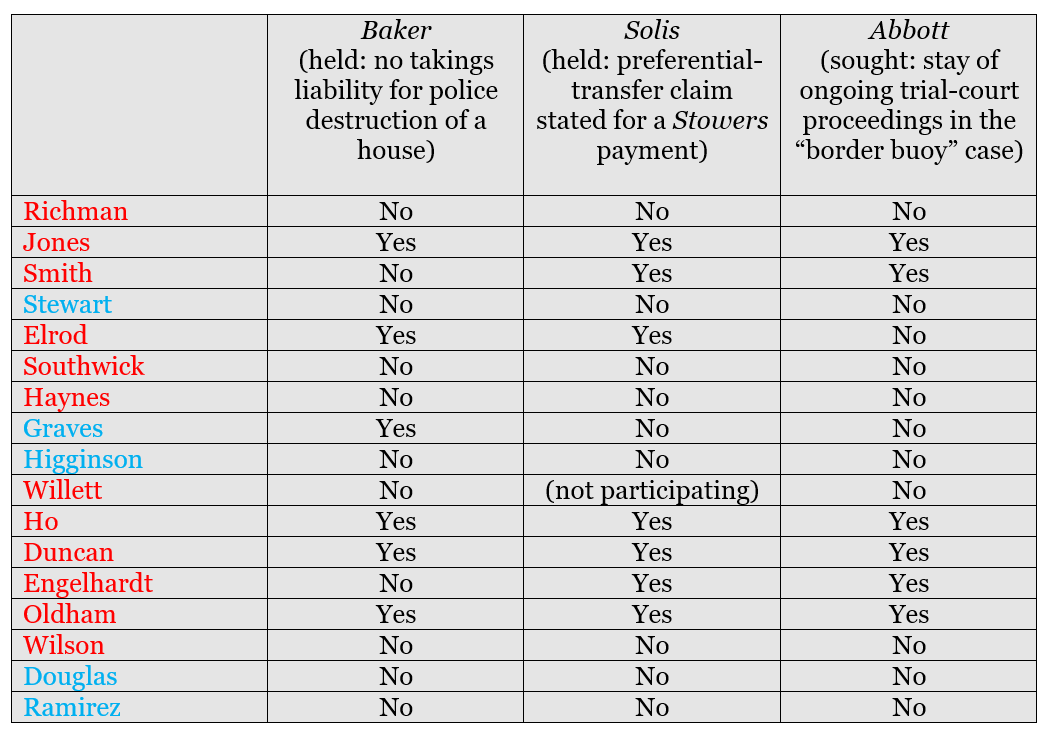

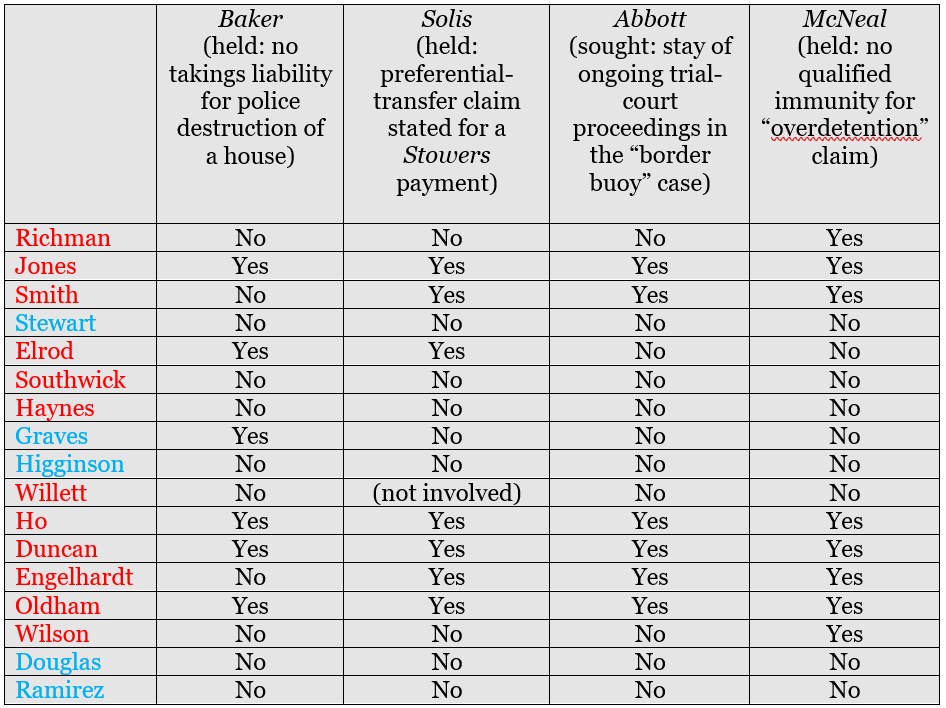

The en banc court has ruled for Texas in the ongoing “border buoy” dispute, with a breakdown of votes as follows:

Airlines for Am. v. Dep’t of Transp. illustrates how the issue of interim appellate relief stays (rimshot) in flux. The panel majority said:

Several airlines and airline associations seek a stay pending review of a recent Department of Transportation (“DOT”) Rule that regulates how airlines disclose fees to consumers during the booking process. Finding the Rule likely exceeds DOT’s authority and will irreparably harm airlines, we GRANT the requested stay and EXPEDITE the petition for review.

A third judge would have taken a more staid approach:

In 2022, the Fifth Circuit held that the CFPB’s funding was “double insulated” from Congressional review, and thus violated the Appropriations Clause of the Constitution.

In 2022, the Fifth Circuit held that the CFPB’s funding was “double insulated” from Congressional review, and thus violated the Appropriations Clause of the Constitution.

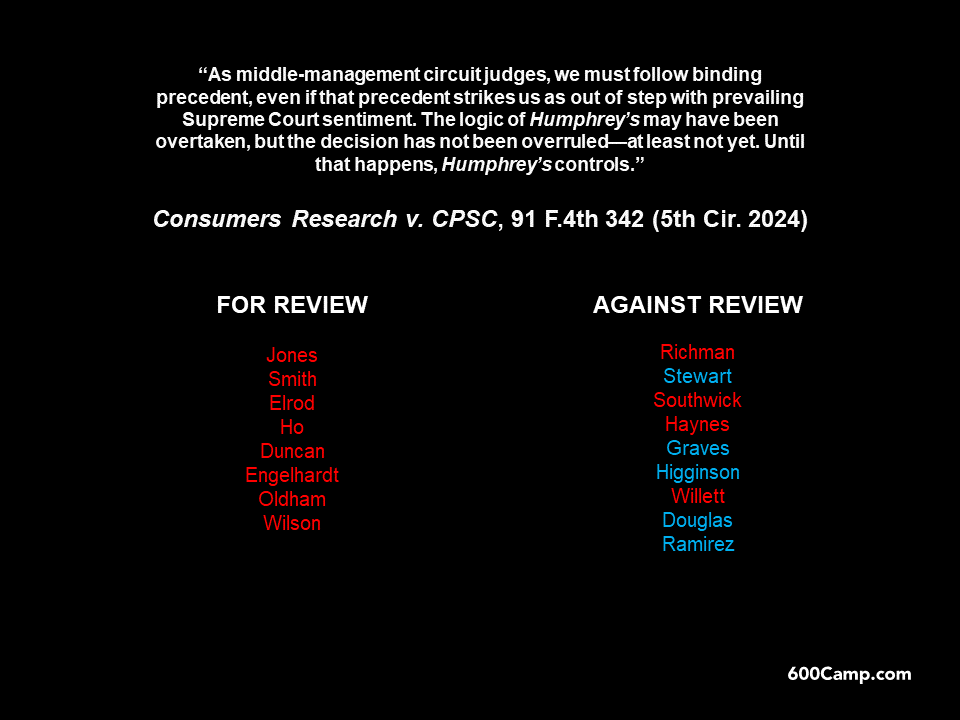

In a recent 7-1 opinion by Justice Thomas, the Supreme Court reversed and held otherwise. Notably, “double” or “doubly” appears nowhere in the Supreme Court’s majority or concurring opinions. The Court held that “an identified source and purpose are all that is required for a valid appropriation.”

Now, Consumers’ Research v. FCC, a 9-7 en banc opinion from the Fifth Circuit, doubles down on this line of argument, holding that the method used to calculate a “universal service fee” for the communication industry is unconstitutional as a “double-layered delegation” of power. The dissent observes that “Congress has provided the FCC with an intelligible principle that sufficiently delimits the FCC’s discretion based on the established universal service principles.” No. 22-60008 (July 24, 2024) (en banc).

28 U.S.C. § 1447(d) says: “An order remanding a case to the State court from which it was removed is not reviewable on appeal or otherwise.”

28 U.S.C. § 1447(d) says: “An order remanding a case to the State court from which it was removed is not reviewable on appeal or otherwise.”

But under the Supreme Court’s Thermtron precedent, that statute is read in concert with § 1447(c), such that § 1447(d) “’only prohibits appellate review of … remand orders … specified in neighboring subsection 1447(c).’ Thus, to the extent a district court remands a case for lack of subject-matter jurisdiction (e.g., non-diverse parties) or a defect in removal procedure (e.g., missing the 30-day removal deadline), we cannot review that order on appeal.” (citation omitted).

In Abraham Watkins v. Festeryga, the district judge remanded a case after finding that the removing party waived the right to remove by active participation in stae-court proceedings. Thus, the question for the Fifth Circuit was: “whether the district court’s remand order in this case … is a specified ground within § 1447(c) and thus barred from our review under § 1447(d) or a discretionary ground outside § 1447(c) and thus an appealable collateral order ….”

The panel held that it was bound by Circuit precedent from 1980, which held–albeit obliquely and vaguely–that state-activity waiver was a 1447(c) ground about jurisdiction and thus unreviewable. A concurrence recommends en banc review of that precedent.

The plaintiffs in a challenge to the FAA’s “watch list” were unable to bring claims about the effect of that list outside of the airport-security context. The Fifth Circuit reasoned that they lacked standing for such claims:

Although it is possible the Plaintiffs could be injured if their alleged placement on the Watchlist adversely affects them during a traffic stop, firearm purchase, or license application, they have not demonstrated that such injuries have occurred or are “certainly impending.”

(citation omitted). The court rejected Plaintiffs’ capacious argument that “once an agency’s power is called into question by a plaintiff who has suffered [an] Article III injury, courts consider the full range of the agency’s asserted power, even if the plaintiff has not been harmed by every aspect of the agency’s congressionally unauthorized actions.” Kovac v. Wray, No. 23-10284 (July 22, 2024).

Matthews v. Tidewater, Inc. rejects a challenge to a forum-selection provision that required dismissal of a Louisiana toxic-tort case in favor of England. The plaintiff, a Jones Act seaman, argued that the dismissal contravened the public policy enunciated in a Louisiana statute about litigation fora, but the Fifth Circuit disagreed.

Matthews v. Tidewater, Inc. rejects a challenge to a forum-selection provision that required dismissal of a Louisiana toxic-tort case in favor of England. The plaintiff, a Jones Act seaman, argued that the dismissal contravened the public policy enunciated in a Louisiana statute about litigation fora, but the Fifth Circuit disagreed.

The present case, as did [a prior case], involves a plaintiff who is not a Louisiana resident and an international employment contract requiring litigation in a foreign forum. We also stress Matthews’s lack of connections to Louisiana. Matthews worked for Tidewater, Inc., a Delaware corporation, and Tidewater Crewing, Ltd., a Cayman Islands corporation. He filed suit for injuries sustained outside the United States while servicing Egyptian oil wells in the Red Sea. Further, just as the [earlier] court observed Section 23:921A(2) protects Louisiana citizens from being forced to litigate their case in a foreign forum. Matthews is not a Louisiana citizen and has scant, if any, connections to Louisiana. He, therefore, is not the object of the statute.

No. 23-30305 (July 17, 2024) (citation omitted).

Applying City of Austin v. Reagan Nat’l Advertising, 596 U.S. 61 (2022), the Fifth Circuit held in National Federation of the Blind of Texas v. City of Arlington that Arlington’s regulation of donation-collecting “drop boxes” was not contend-based (example, right, from Arlington’s web page about the rule). From there, the panel majority found that the regulation satisfied intermediate scrutiny; a dissent took issue with one aspect of that holding. No. 23-10034 (July 17, 2024).

Applying City of Austin v. Reagan Nat’l Advertising, 596 U.S. 61 (2022), the Fifth Circuit held in National Federation of the Blind of Texas v. City of Arlington that Arlington’s regulation of donation-collecting “drop boxes” was not contend-based (example, right, from Arlington’s web page about the rule). From there, the panel majority found that the regulation satisfied intermediate scrutiny; a dissent took issue with one aspect of that holding. No. 23-10034 (July 17, 2024).

A high-ranking sergeant in the Armed Forces has a lot of chevrons (right). So too, today’s federal courts, after the overruling of Chevron. In Utah v. Su, the Fifth Circuit remanded a pending case that presented a post-Chevron issue of regulatory authority, reasoning:

A high-ranking sergeant in the Armed Forces has a lot of chevrons (right). So too, today’s federal courts, after the overruling of Chevron. In Utah v. Su, the Fifth Circuit remanded a pending case that presented a post-Chevron issue of regulatory authority, reasoning:

Whatever efficiency or economy is gained by taking up the parties’ invitation to decide their dispute in light of the intervening changes, both we and the circuit at large would be better served by the slight delay occasioned by remanding to the district court for its reasoned judgment.

No. 23-11097 (July 18, 2024).

“Great cases like hard cases make bad law. For great cases are called great, not by reason of their importance … but because of some accident of immediate overwhelming interest which appeals to the feelings and distorts the judgment.” Northern Securities Co. v. United States, 193 U.S. 197 (1904) (Holmes, J., dissenting).

Thus, United States v. Jean, in which a Fifth Circuit panel split 2-1 about an issue as to which other circuits have split 4-5, with only the Second appearing to have avoided the question. The issue is “whether district courts could consider non-retroactive changes in the law as a factor when deciding whether extraordinary and compelling reasons existed for compassionate release.” The resolution of the issue involves the cryptic phrase “extraordinary and compelling” in the relevant statute, and in the Fifth Circuit, also presents an “orderliness” question about prior Circuit precedent.

En banc review of this fiercely-disputed case seems likely. The bigger question, though, is why this case is in court. The district court found: “The term ‘rare’ does not give Mr. Jean’s rehabilitation and renewed outlook on life justice–it is wholly extraordinary.” As the panel majority observes about this and comparable cases:

The DOJ is apparently fearful that there are so many people incarcerated based on now unconstitutional or otherwise illegal laws; who have been incarcerated for ten years or more; whose sentence would be drastically different today; and whose individualized circumstances support compassionate release, that [the compassionate-release statute] will become a quasi-parole system. That is either a convenient exaggeration or a disturbing reality.

No. 23-40463 (July 15, 2024).

First v. Rolling Plains Implement Co., a fraud claim about the sale of a combine, found insufficient evidence to support the verdict about the date of claim accrual (“April 13, 2017”), noting the following:

First v. Rolling Plains Implement Co., a fraud claim about the sale of a combine, found insufficient evidence to support the verdict about the date of claim accrual (“April 13, 2017”), noting the following:

- Evidence about time, but not dates. “[T]here is a disconnect between the trial evidence and the jury charge. Statutes of limitation are necessarily date-specific, but the trial evidence spoke in general terms. Witnesses referred to holiday weekends, seasons, and months when describing the malfunctions, but the jury was tasked with identifying a specific date that began the limitations period. The jury was asked to select a specific date without the evidentiary basis to do so.”

- Only date, no evidence. The jury chose the only date presented as a day, month, and year: the Protection Plan’s expiration date. But the Protection Plan’s expiration date cannot support the verdict because it is temporally unrelated to any pertinent fact that would cause First to suspect fraud. … Trial witnesses testified that the main issue [around Memorial Day 2016]—computer problems that caused the engine to idle—was part-and-parcel of setting up the Combine.”

- Only date, no evidence, another reason. “[T]he jury’s selected date—April 13, 2017—occurred almost one year after the Memorial Day 2016 malfunctions. Rolling Plains did not identify additional events during this year that would cause First to suspect fraud.”

No. 23-10635 (July 11, 2024).

To the right is an alpaca. It should not be confused with PACA, a federal law against unfair dealings in the delivery of perishable produce on its way from field to the consumer. In A&A Concepts LLC v. Fernandez, the Fifth Circuit concluded that liabliity under PACA could run to individuals who are not managing members of an LLC in the produce-related chain of commerce, but then held that the defendant in that case could not be liable because he was not in a position to control “PACA trust assets.” No. 23-50757 (July 11, 2024)

To the right is an alpaca. It should not be confused with PACA, a federal law against unfair dealings in the delivery of perishable produce on its way from field to the consumer. In A&A Concepts LLC v. Fernandez, the Fifth Circuit concluded that liabliity under PACA could run to individuals who are not managing members of an LLC in the produce-related chain of commerce, but then held that the defendant in that case could not be liable because he was not in a position to control “PACA trust assets.” No. 23-50757 (July 11, 2024)

A recent need for maintenance on my F-150 pickup caused me to read through the manual, which led me to appreciate how well-organized and readable it was. So I wrote “Why You Should Write Briefs Like Car Manuals” for the Bar Association of the Fifth Federal Circuit (available along with many other practical short articles in the “for members” section of its website). I hope you enjoy it and find the article of some use in your practice!

The Horseracing Integrity and Safety Act of 2020, and its novel use of a private entity (the “Horseracing Integrity and Safety Authority”) to make and enforce rules for horse racing, did not fare well on a previous visit to the Fifth Circuit. A return trip received a more favorable reception:

The Horseracing Integrity and Safety Act of 2020, and its novel use of a private entity (the “Horseracing Integrity and Safety Authority”) to make and enforce rules for horse racing, did not fare well on a previous visit to the Fifth Circuit. A return trip received a more favorable reception:

In sum, we affirm the district court’s judgment that (1) Congress’s recent amendment to HISA cured the private nondelegation flaw in the Authority’s rulemaking power; (2) HISA does not violate due process; (3) the Authority’s directors are not subject to the Appointments Clause under Lebron; and (4) Gulf Coast lacks standing to challenge HISA on anticommandeering grounds. We reverse the district court’s judgment in one respect. Insofar as HISA is enforced by private entities that are not subordinate to the FTC, we DECLARE that HISA violates the private nondelegation doctrine.

National Horsemen’s Benevolent & Protective Association v. Black, No. 22-10387 (July 5, 2024). The private-nondelegation holding creates a split with the Sixth Circuit.

After another Supreme Court term featuring reversals of the Fifth Circuit on standing grounds in high-profile cases, I wrote this op-ed in today’s Dallas Morning News about that recurring issue.

Late last week, Judge Ada Brown from the Northern District of Texas held that the FTC exceeded its authority by its new rule about noncompetition agreements, granted a preliminary injunction, and set the matter for trial in late August. Notably, as of now, the relief granted does not include a nationwide injunction about the rule.

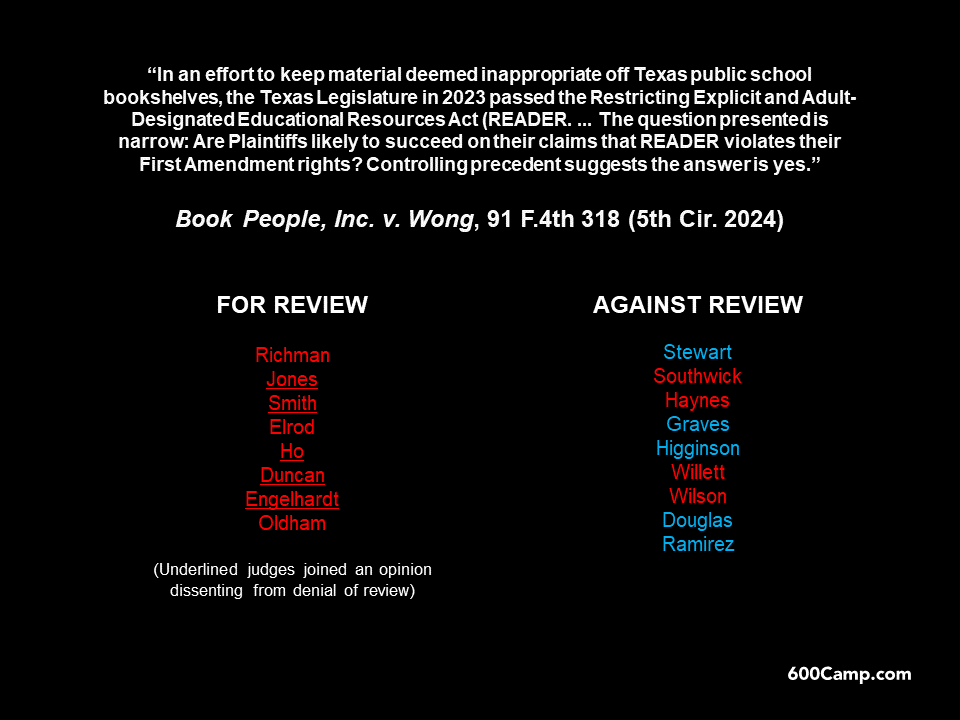

Maurice Sendak’s In the Night Kitchen, a Caldecott Honor book in 1971, is available from Amazon, the website of HarperCollins Publishers, and Barnes & Noble. The question whether it should also be available in the Llano County Library–recently answered “yes” by a Fifth Circuit panel–will now be examined by the en banc court.

Maurice Sendak’s In the Night Kitchen, a Caldecott Honor book in 1971, is available from Amazon, the website of HarperCollins Publishers, and Barnes & Noble. The question whether it should also be available in the Llano County Library–recently answered “yes” by a Fifth Circuit panel–will now be examined by the en banc court.

A recent mandamus opinion, In re Sealed Petitioner, made this provocative statement about the potential role of a mandamus writ:

But of course, “the federal courts established pursuant to Article III of the Constitution do not render advisory opinions ….” E.g., Pub. Workers v. Mitchell, 330 U.S. 75, 89 (1947). Fortunately, review of the cited case shows that it just states principles about mandamus review that are generally accepted as part of today’s standard practice (citations omitted):

But of course, “the federal courts established pursuant to Article III of the Constitution do not render advisory opinions ….” E.g., Pub. Workers v. Mitchell, 330 U.S. 75, 89 (1947). Fortunately, review of the cited case shows that it just states principles about mandamus review that are generally accepted as part of today’s standard practice (citations omitted):

Although the Company correctly observes that mandamus has historically been a drastic remedy generally reserved for really “extraordinary” cases, the federal courts of appeals (as well as the Supreme Court) have shown an increasing willingness in recent years to use the writ as a one-time-only device to “settle new and important problems” that might have otherwise evaded expeditious review. As the District of Columbia Circuit explained … “Schlagenhauf authorizes departure from the final judgment rule when the appellate court is convinced that resolution of an important, undecided issue will forestall future error in trial courts, eliminate uncertainty and add importantly to the efficient administration of justice.”

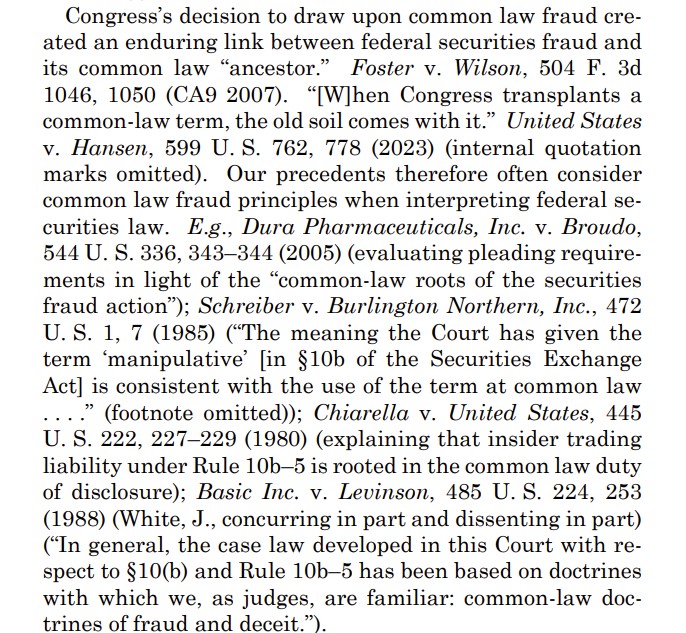

Much ink will be spilled over the Supreme Court’s use of history in resolving cases this term about the Appropriations Clause, possession of firearms by dangerous people, and the SEC’s internal courts. One key point in Jarkesy is the extent to which a word, used in the 1790s, has the same general meaning today. As the below quote illustrates, “fraud is fraud” oversimplifies the Supreme Court’s holding – but not by much. “Fraud” in today’s commercial law means pretty much what it did in the 1790s. Other words, such as “economy,” are not so easily transported through time, and that reality calls for caution in seeing Jarkesy as providing broad support for some other “originalist” ideas.

Fifth Circuit affirmed in SEC v. Jarkesy:

A defendant facing a fraud suit has the right to be tried by a jury of his peers before a neutral adjudicator. Rather than recognize that right, the dissent would permit Congress to concentrate the roles of prosecutor, judge, and jury in the hands of the Executive Branch. That is the very opposite of the separation of powers that the Constitution demands. Jarkesy and Patriot28 are entitled to a jury trial in an Article III court.

No. 22-859 (U.S. June 27, 2024).

The Supreme Court reversed the Fifth Circuit’s judgment in Murthy v. Missouri, a case about interaction between the federal government and social-media platforms during the COVID-19 pandemic. Again, the ground of reversal with standing, with the Supreme Court finding that the plaintiff’s claim of future injury was too attenuated, and that a “right-to-listen” theory of standing was not viable. No. 23-411 (U.S. June 26, 2024).

In  Paxton v. Dettelbach, individual plainitffs challenged a law about firearm silencers, making these statements about their standing:

Paxton v. Dettelbach, individual plainitffs challenged a law about firearm silencers, making these statements about their standing:

I intend to personally manufacture a firearm suppressor for my own non-commercial, personal use. The firearm suppressor will be manufactured in my home from basic materials without the inclusion of any part imported from another state other than a generic and insignificant part, such as a spring, screw, nut, or pin.

The Fifth Circuit found those statements inadequate for two reasons:

- “[T]he declarations do not state any intention to engage in conduct

proscribed by law,” because the federal law at issue was not a blanket prohibition (emphasis added). - “[T]he declarations lack the necessary detail to establish that the Individual Plaintiffs’ professed intent to make a silencer is sufficiently ‘serious’ to render their feared injury ‘imminent’ rather than merely speculative or hypothetical. As the Supreme Court explained in Lujan, at the summary-judgment stage, declarants’ profession of “‘some day’ intentions [to engage in certain conduct]—without any description of concrete plans, or indeed even any specification of when the some day will be—do not support a finding of the ‘actual or imminent’ injury” required for standing.”

And the Court rejected Texas’s claim to standing based on its “quasi-sovereign interests in its citizens’ health and well-being” and “its sovereign interest in the power to create and enforce a legal code.” No. 23-10802 (June 21, 2024).

In Lewis v. Crochet, the Fifth Circuit found that a ruling about the attorney-client privilege was properly appealed under the “collateral order” doctrine, applying Mohawk Indus. v. Carpenter, 558 U.S. 100, 103 (2009).

Judge James Ho’s dissent from the denial of en banc review in Gonzalez v. Trevino persuaded the ultimate audience yesterday, when the Supreme Court reversed the Fifth Circuit, and allowed the wrongful-arrest claim of Sylvia Gonzalez – an unfortunate victim of small-town politics – to proceed past the pleadings stage. No. 22-1025 (U.S. June 21, 2024). His opinion built on Judge Andrew Oldham’s dissent at the panel stage.

Judge James Ho’s dissent from the denial of en banc review in Gonzalez v. Trevino persuaded the ultimate audience yesterday, when the Supreme Court reversed the Fifth Circuit, and allowed the wrongful-arrest claim of Sylvia Gonzalez – an unfortunate victim of small-town politics – to proceed past the pleadings stage. No. 22-1025 (U.S. June 21, 2024). His opinion built on Judge Andrew Oldham’s dissent at the panel stage.

Palmquist v. Hain Celestial Group, Inc. provides helpful summaries of two important standards for evaluating motions to remand:

- Repleading. “[A] plaintiff should not be penalized for adhering to the pleading standards of the jurisdiction in which the case was originally brought. Otherwise, where there are potentially diverse parties, plaintiffs would essentially have to plead the federal pleading standard in state court for fear of having their claims against non-diverse parties thrown out upon reaching federal courts for failing to comply with the demands of Rule 12(b)(6).”

- New Matters in Repleading. “[A]dding new causes of actions and clarifying already alleged causes of actions are not mutually exclusive. We have already determined that the Palmquists may not expand the substance of their pleadings, for jurisdictional purposes, with the negligent-undertaking allegations. We, too, follow circuit precedent by permitting them to ‘clarify’ their already averred jurisdictional allegations after removal for purposes of an improper joinder analysis.”

No. 23-40197 (May 28, 2024).

In 2022’s Bruen opinion, the Supreme Court disapproved of “means-ends” analysis in Second Amendment cases:

In today’s Rahimi opinion, the Supreme Court walked that disapproval back, while nominally following the same history-based test:

The result was an 8-1 reversal of the Fifth Circuit opinion holding that the subject of a domestic protective order had a Second Amendment right to carry a firearm. (I argued that the Fifth Circuit’s opinion took “history” too far in this Dallas Morning News editorial last year.)

On remand from the Supreme Court after that court’s rejection of a challenge to the CFPB’s funding based on the Appropriations Clause, the Fifth Circuit issued a short judgment reflecting that ruling. Interestingly, the judgment expressly identifies the rehearing deadline while striking an earlier 28j filing by the plaintiff:

That filing is no longer available online, but the CFPB’s response suggests that the parties dispute the scope and effect of the Supreme Court’s mandate–and what that may mean for the other challenges to the CFPB presented in this case.

That filing is no longer available online, but the CFPB’s response suggests that the parties dispute the scope and effect of the Supreme Court’s mandate–and what that may mean for the other challenges to the CFPB presented in this case.

In Chamber of Commerce v. Consumer Financial Protection Bureau, the district court (for the second time) transferred a challenge to a new CFPB rule to the District of the District of Columbia. The district court reasoned, inter alia:

In Chamber of Commerce v. Consumer Financial Protection Bureau, the district court (for the second time) transferred a challenge to a new CFPB rule to the District of the District of Columbia. The district court reasoned, inter alia:

“Under Plaintiffs’ theory, there isn’t a city in the country where venue would not lie, as every city has customers who may potentially be impacted by the Rule. Plaintiffs could find any Chamber of Commerce in any city of America and add them to this lawsuit in order to establish venue where they desire. It appears that this is exactly what Plaintiffs attempted to do by recommending transfer to the Eastern District of Texas, Tyler Division. Here, once again, the only tie to the Eastern District of Texas, Tyler Division, was that one of the Plaintiffs happens to be there. None of the events occurred there and there is only a possibility that tangential harm could be felt by the Rule.”

(citation omitted, emphasis added). The Fifth Circuit found an abuse of discretion in that conclusion, granting mandamus relief (for a second time) to prevent the transfer. It reasoned, inter alia, that the request for a nationwide injunction materially affected the analysis:

“Final Rules are not meant to be ‘localized’—they are usually designed to affect the entire nation. That’s why plaintiffs seek nationwide injunctions when a final rule is poised to go into effect—they seek to block the effect across the nation. Therefore, this case is not one where Fort Worth citizens have a lesser stake in the litigation than D.C. citizens.”

In re Chamber of Commerce, No. 24-10463-CV (June 18, 2024). While that reasoning seems destined to drive administrative-law challenges to the MDL process rather than the district courts of the Fifth Circuit, it reflects the present state of the law on this issue.

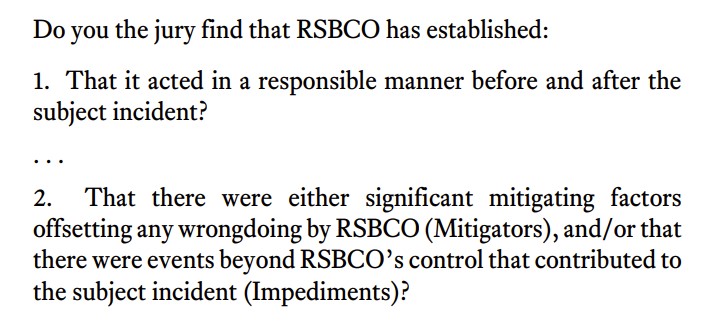

In RSBCO v. United States, the Fifth Circuit confronted a charge issue, called “a Casteel problem” in Texas state practice. The question was whether RSBCO established an excuse for late-filed tax returns, and the jury questions were as follows:

The jury answered “yes” to both questions. The problem emerged because the “mitigators” instruction for the second question was correct, but the “impediments” instrution was not. Therefore:

The jury answered “yes” to both questions. The problem emerged because the “mitigators” instruction for the second question was correct, but the “impediments” instrution was not. Therefore:

“Given the form’s single yes-or-no question as to mitigators ‘and/or’ impediments, there is no way logically to reconcile the verdict form to contain the improper instruction. Thus, the ‘challenged instruction could [well] have affected the outcome of the case,’ so we must vacate the verdict and remand for a new trial.”

No. 23-30062 (June 13, 2024) (citation omitted).

I didn’t really understand the issues in the bump-stock case until I saw the below graphic in Judge Elrod’s majority opinion for the en banc Fifth Circuit. Once I saw that, I realized why ATF had gone out over its skiis, and why the Supreme Court affirmed today.

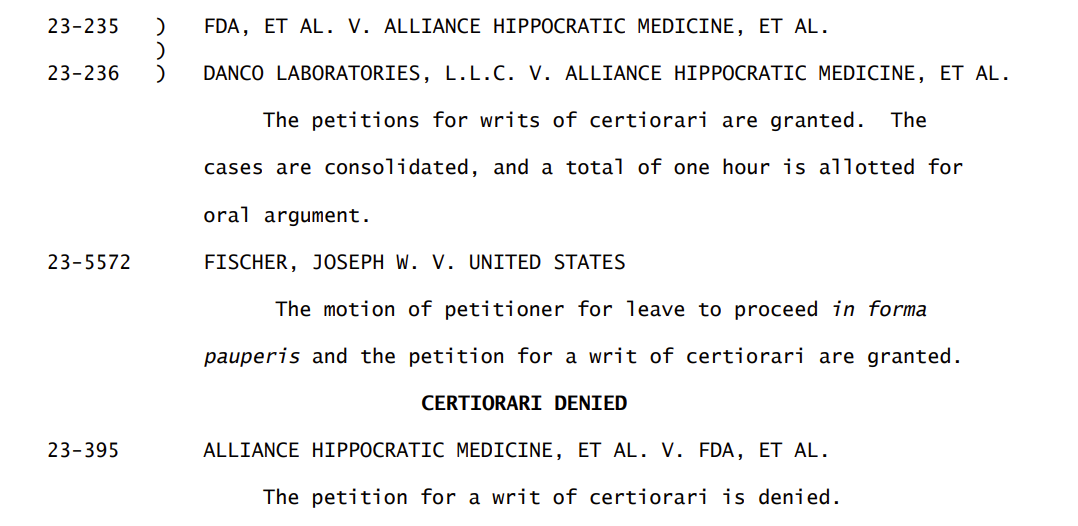

As I argued a year ago, more than once, the Supreme Court holds 9-0 this morning that the mifepristone plaintiffs lacked standing:

In 1949, a pipeline company received a grant from the Board of Mississipi Levee Commissioners to build and operate two crude oil pipelines in Issaquena County, Mississippi (the least populated county in the U.S. located to the east of the Mississippi River). A dispute arose over permitting fees, and the pipeline company sued the Levee Board for, inter alia, violating the Contract Clause of the U.S. Constitution.

In 1949, a pipeline company received a grant from the Board of Mississipi Levee Commissioners to build and operate two crude oil pipelines in Issaquena County, Mississippi (the least populated county in the U.S. located to the east of the Mississippi River). A dispute arose over permitting fees, and the pipeline company sued the Levee Board for, inter alia, violating the Contract Clause of the U.S. Constitution.

The Fifth Circuit affirmed dismissal: “Despite its significant investment in its pipelines, including their 2007 relocation, Mid Valley does not identify any affirmative or mutual obligations the Levee Board owed stemming from the 1949 Permit—because none are apparent in its express terms.” Accordingly, the Court distinguished this situation, where the permit clearly left complete discretion with the Board, from other permitting cases that did create some consideration / mutuality of obligation. Mid Valley Pipeline Co., LLC v. Rodgers, No. 23-60536 (June 5, 2024).

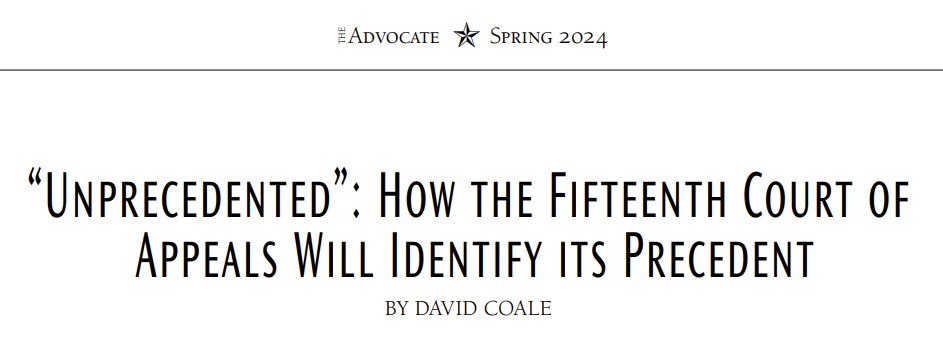

Governor Abbott has appointed the three inaugural members of the new Fifteenth Court of Appeals: Hon. Scott Brister, presently of Hunton Andrews Kurth, well-known statewide from his service on the Texas Supreme Court, and the author of City of Keller v. Wilson, 168 S.W.3d 802 (Tex. 2005); Hon. April Farris, of the First Court of Appeals; and Hon. Scott Field, of the 480th District Court in Williamson County, and formerly of the Third Court of Appeals.

Little v Llano County addressed the removal of books from a public library, producing three opinions and a judgment affirming a preliminary injunction against the removal. The two judges voting to affirm focused on Circuit precedent, Campbell v. St. Tammany Parish School Board, 64 F.3d 184 (5th Cir. 1995), and its statement:

Little v Llano County addressed the removal of books from a public library, producing three opinions and a judgment affirming a preliminary injunction against the removal. The two judges voting to affirm focused on Circuit precedent, Campbell v. St. Tammany Parish School Board, 64 F.3d 184 (5th Cir. 1995), and its statement:

“that officials may not ‘remove books from school library shelves “simply because they dislike the ideas contained in those books and seek by their removal to `prescribe what shall be orthodox in politics, nationalism, religion, or other matters of opinion.'”

(cleaned up). The case also appears to present the first use of the phrase “butt and fart” (a shorthand for one set of the books at issue) in a three-opinion panel case. No. 23-50224 (June 6, 2024).

SKAV, LLC, the operator of a Best Western hotel in Abbeville, Louisiana, sued a surplus-lines insurer about a hurricane-damage claim. The insurer sought to compel arbitration, based on a Louisiana statute that says:

SKAV, LLC, the operator of a Best Western hotel in Abbeville, Louisiana, sued a surplus-lines insurer about a hurricane-damage claim. The insurer sought to compel arbitration, based on a Louisiana statute that says:

A. No insurance contract delivered or issued for delivery in this state and covering subjects located, resident, or to be performed in this state, or any group health and accident policy insuring a resident of this state regardless of where made or delivered, shall contain any condition, stipulation, or agreement ..

(2) Depriving the courts of this state of the jurisdiction or venue of action against the insurer. …

D. The provisions of Subsection A of this Section shallnot prohibit a forum or venue selection clause in a policy form that is not subject to approval by the Department of Insurance.

Acknowledging differing approaches by district courts to examine this issue, the Fifth Circuit held in SKAV, LLC v. Indep. Specialty Ins. Co. that section (a)(2) of this statute applied to arbitration, and was not affected by section (D), which was fairly read as limited to forum and venue-selection clauses. No. 23-30293 (June 5, 2024).

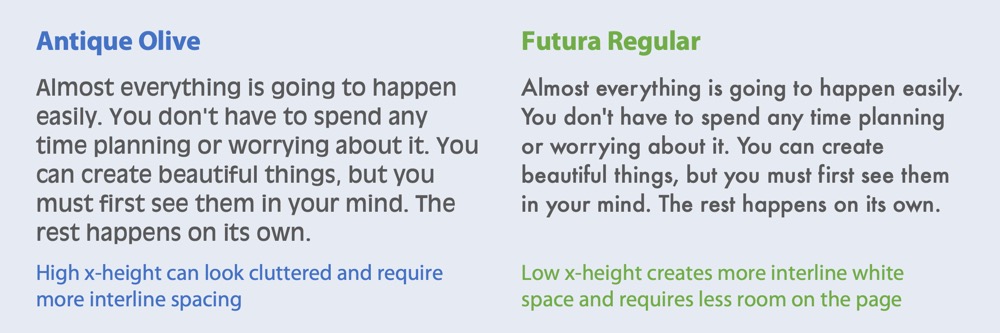

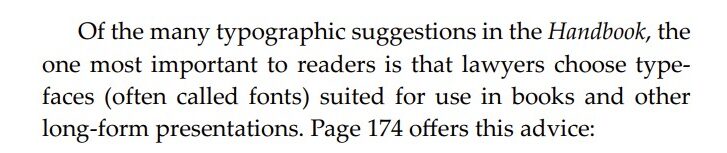

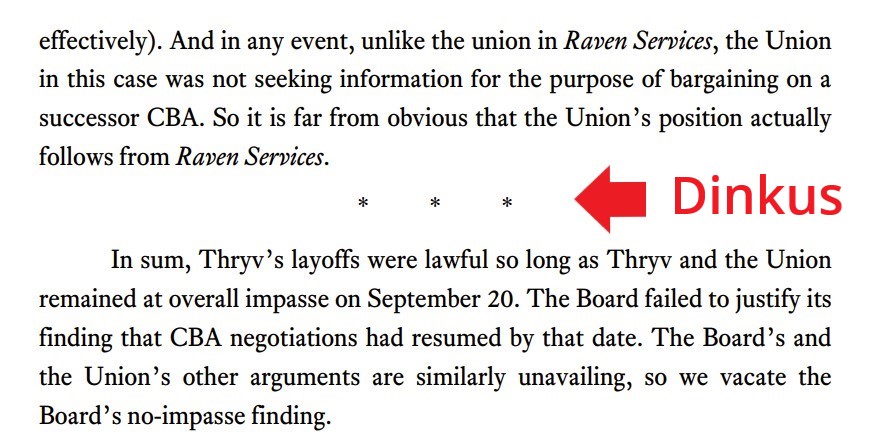

Judge Easterbrook’s recent opinion about good fonts for legal writing emphasized the importance of “x-height,” which is the relative size of a small “x” to a capital letter in a particular font. It’s important to note, though, that x-height is only one of the relevant size measures, and an excessively high x-height can cause problems with “descending” letters such as “p” and “y.” This excellent article, from which the below illustration is taken, further explains this point while defining the other relevant measurements.

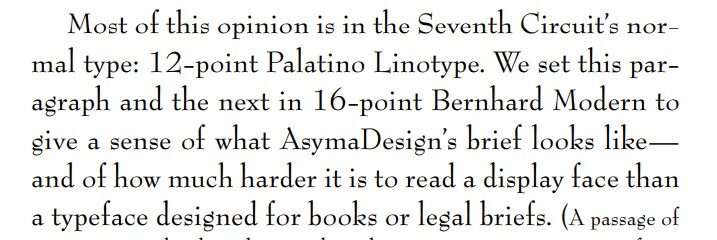

Legendary Seventh Circuit judge Frank Easterbrook has written authoritatively on many topics. Thanks to AsymaDesign, LLC v. CBL & Assocs. Mgmnt, Inc., the choice of a good font is now among them.

Judge Easterbrook noted that he was writing in Palatino Linotype, the standard font of the Seventh Circuit (and one of two that I regularly use, alternating with Book Antigua). He explained that it’s a desirable font for legal writing because it has a large “x-height” (the height of a lowercase “x” compared to a capital letter), along with similar fonts designed for book publication:

The Appellant made the unfortunate choice of Bernhard Modern, a “display face suited to movie posters and used in the title sequence of the Twilight Zone TV show.” Because of that font’s low x-height, it’s hard to read in book-like writing:

The Appellant made the unfortunate choice of Bernhard Modern, a “display face suited to movie posters and used in the title sequence of the Twilight Zone TV show.” Because of that font’s low x-height, it’s hard to read in book-like writing:

He concluded: “We hope that Bernhard Modern has made its last appearance in an appellate brief. “

He concluded: “We hope that Bernhard Modern has made its last appearance in an appellate brief. “

AAPS v. ABIM, No. 23-40423 (June 3, 2024), presented a question about pleading amendment, in which the Fifth Circuit said that the Galveston Division’s local rule about amendments was inconsistent with Fed. R. Civ. P.’s “liberal amendment scheme”:

Other local rules on this, and other, common features of ciivl litigation may draw challanges as a result of this opinion.

Other local rules on this, and other, common features of ciivl litigation may draw challanges as a result of this opinion.

Longtime fans of the Phantom comic strip know that, when the plot becomes particularly complex, the strip’s author will make a cameo and give an update, announced by the phrase “For Those Who Came in Late!” In that spirit, 600Camp provides an update about the ongoing litigation about a CFPB rule involving credit-card late fees:

Longtime fans of the Phantom comic strip know that, when the plot becomes particularly complex, the strip’s author will make a cameo and give an update, announced by the phrase “For Those Who Came in Late!” In that spirit, 600Camp provides an update about the ongoing litigation about a CFPB rule involving credit-card late fees:

- On May 7, President Biden touted the rule in his State of the Union address.

- May 10, Judge Pittman enjoined the rule, based on a Fifth Circuit case about the CFPB’s funding that the Supreme Court overruled a few days later;

- On May 28, Judge Pittman granted the CFPB’s renewed motion to transfer the case to the District of Columbia (after an earlier transfer order was reversed by the Fifth Circuit, based on the procedural interplay between the injunction application and transfer motion);

- A new mandamus petition followed, leading to an administrative stay of the transfer order until mid-June along with a request for a reponse to the petition.

The chaos caused by the Third Reich’s systematic theft of valuable art continues to the present day, as shown by Emden v. Museum of Fine Arts–a dispute about ownership of a painting called “The Marketplace of Pirna” (right). The claim of the heirs to the one-time owner failed because of the “act of state” doctrine, as the Fifth Circuit explained:

The chaos caused by the Third Reich’s systematic theft of valuable art continues to the present day, as shown by Emden v. Museum of Fine Arts–a dispute about ownership of a painting called “The Marketplace of Pirna” (right). The claim of the heirs to the one-time owner failed because of the “act of state” doctrine, as the Fifth Circuit explained:

The most straightforward and charitable reading of the Emdens’ complaint inevitably requires a ruling by a U.S. court that the Dutch government invalidly sent Moser the By Bellotto Pirna. The Emdens may be right: The Monuments Men may have improperly sent the By Bellotto Pirna to the [Dutch Art Property Foundation (“SNK”)]; the SNK may have unjustifiably sent Moser the By Bellotto Pirna even though he had a claim to only the After Bellotto Pirna; and the Museum may be violating the Washington Principles by refusing to return the painting to the Emdens.

But, per the act of state doctrine, it is not our job to call into question the decisions of foreign nations. As pleaded, the SNK’s shipping Moser the By Bellotto Pirna is an official act of the Dutch government. The validity and legal effect of that act is one that we may not dispute.

No. 23-20224 (May 29, 2024).

After much Sturm und Drang, the District of the District of Columbia returned Clarke v. CFTC to the Texas district court where that case started, reasoning:

[T]he Court will follow the weight of authority and transfer this case back to the requesting jurisdiction because the record establishes that it was transferred prematurely. The Court makes no decision on the Parties’ respective arguments on whether transfer would otherwise be appropriate. It certainly would be easy for the Court to keep this case—the Court currently has a case involving the same challenge against Defendant that is fully briefed and scheduled for argument soon. Nor does the Court quite understand how the District Court in Texas abused its discretion in making its determination. But the weight of authority instructs the Court on how such requests are routinely addressed, and the Court will follow that course of action here.

Clarke v. CFTC (citation omitted) (D.D.C. May 22, 2024).

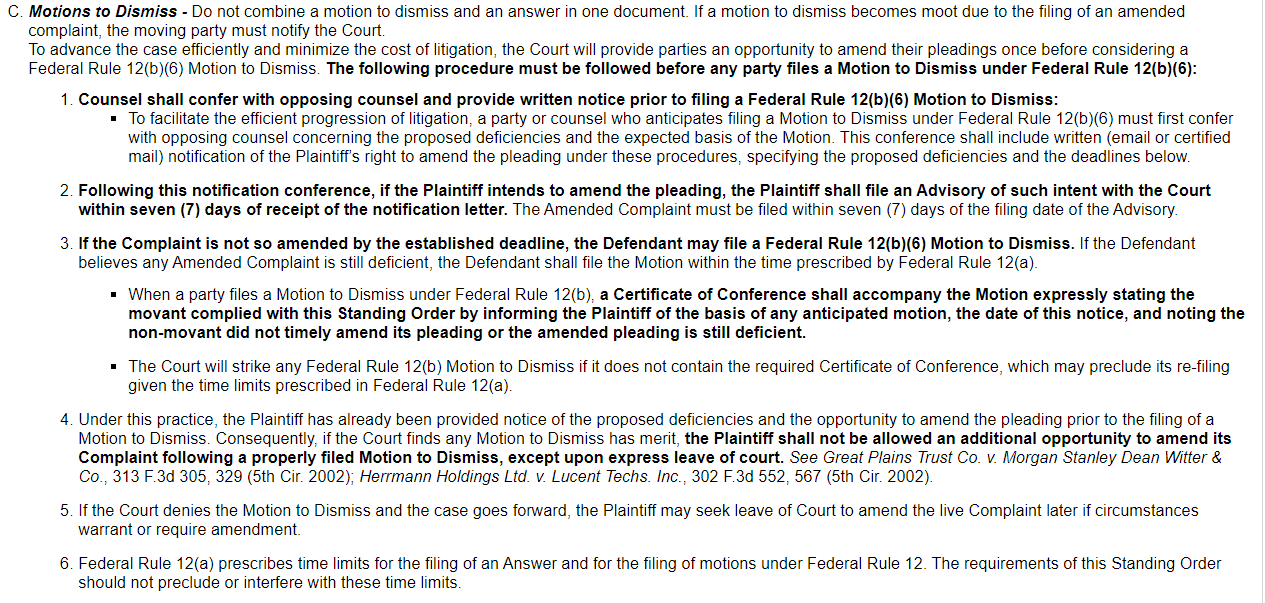

Thryv, Inc. v. NLRB, a review of the NLRB’s handling of an unfair labor practices case, presents deft usage of a typographical device called the “dinkus”:

Thanks to the observant Cedric Bond for pointing this out!

Hager v. Brinker Texas, Inc. reminds that the business-records exception to the hearsay rule has significant limitations. The Fifth Circuit summarized an earlier case, in a similar dispute about the admissibility of the employer’s records, as holding:

Hager v. Brinker Texas, Inc. reminds that the business-records exception to the hearsay rule has significant limitations. The Fifth Circuit summarized an earlier case, in a similar dispute about the admissibility of the employer’s records, as holding:

“[A]n employer’s human resource managers’ reports and letters tracing steps in investigating complaints of sexual harassment against an employee leading to discharge were admissible business records; but it also recognized that such reports would be ‘inadmissible where their “primary utility is for litigation.”‘”

Based on that rule, the Court held:

[T]he Venable declaration and Exhibit B were prepared immediately after the threat of Sharnez’s litigation loomed as Brinker knew that Sharnez complained of racial discrimination and mentioned contacting her lawyer. Venable’s conclusory assertion that the declaration and Exhibit B were made in the regular course of Brinker’s business, with no further explanation about whether it was company procedure to make similar records, does not frustrate this conclusion. Quite the opposite, Venable admitted that he had never before conducted an investigation into a guest complaint of racial discrimination, further undercutting any claim that the declaration was made in the “regular course” of business.

No. 21-20235 (May 22, 2024).