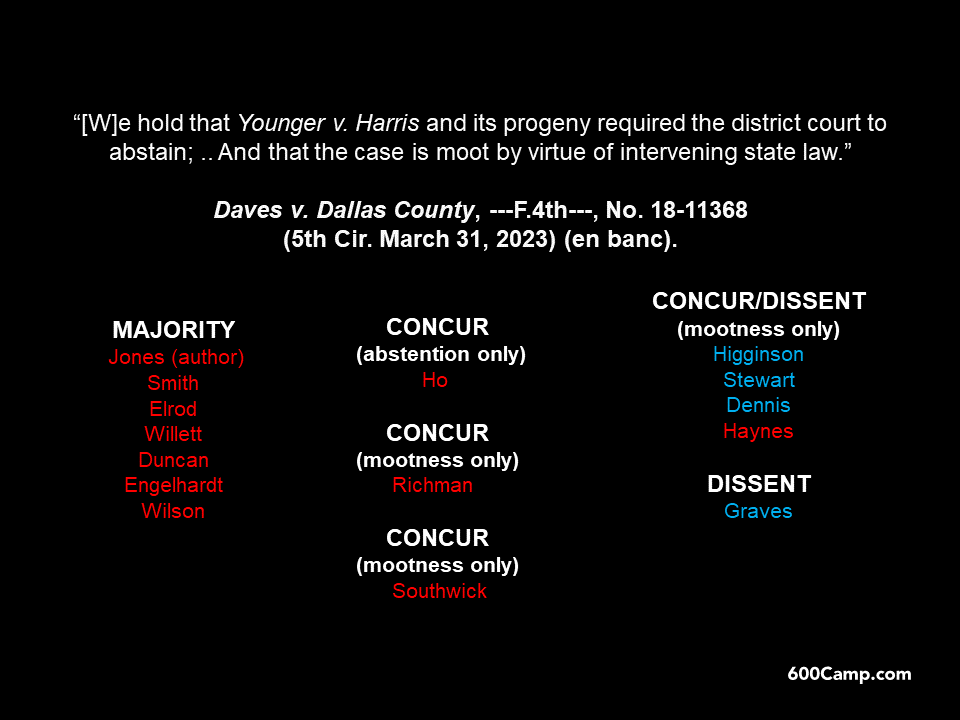

As noted previously, the Fifth Circuit denied en banc review by an 8-8 vote in a contentious forum dispute. The breakdown of the votes is follows (the entire panel majority opinion appears in the chart, and the panel dissent is reproduced as an exhibit to the dissent from the denial of en banc review):

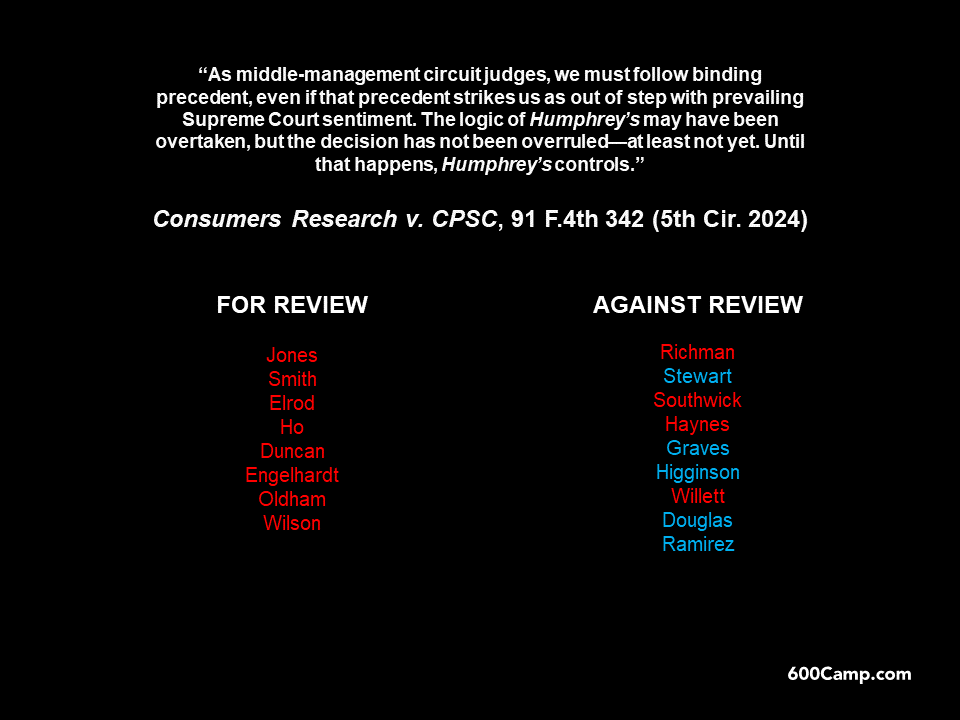

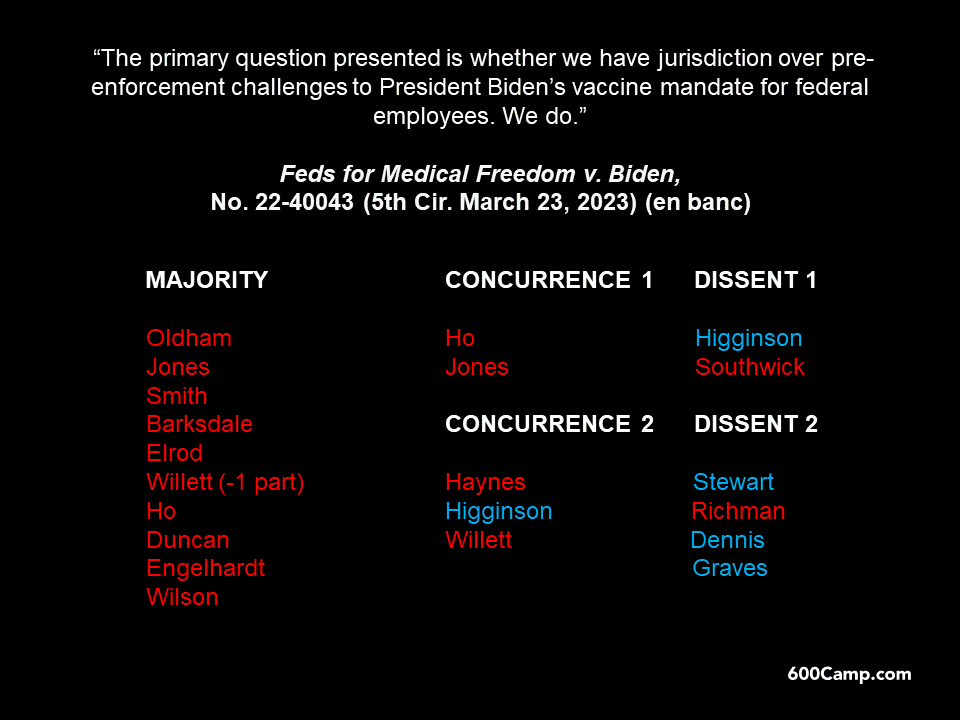

The Fifth Circuit’s recent en banc vote in Consumers’ Research v. CPSC, an unsuccessful constitutional structure to the Consumer Product Safety Commission in light of recent Supreme Court precedent, is summarized in the below chart. The vote was accompanied by a concurrence and two dissenting opinions.

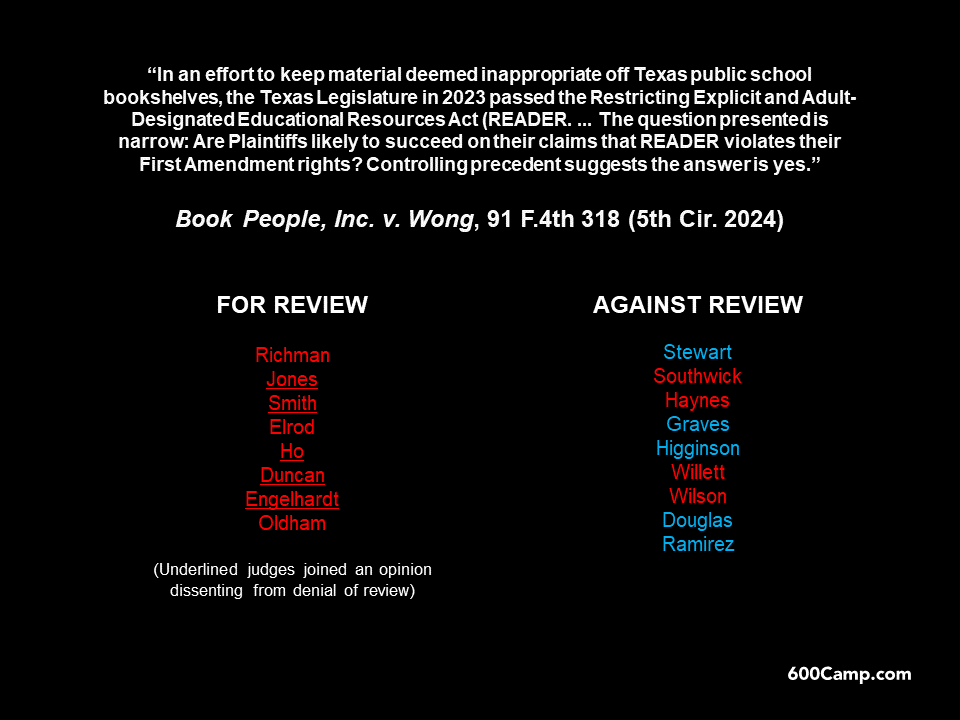

The Fifth Circuit’s recent en banc vote in Book People, Inc. v. Wong, a successful constitutional challenge to a prior-restraintish law involving the content of books in school libraries, is summarized in the below chart:

The Fifth Circuit reversed the dismissal of securities-fraud claims in Oklahoma Firefighters Pension & Retirement System v. Six Flags Entertainment Corp., holding that the district court had misread a prior appellate opinion. The Court stated, inter alia:

The Fifth Circuit reversed the dismissal of securities-fraud claims in Oklahoma Firefighters Pension & Retirement System v. Six Flags Entertainment Corp., holding that the district court had misread a prior appellate opinion. The Court stated, inter alia:

Any fair reading shows why our prior opinion very clearly did not hold the alleged fraud was fully disclosed by October 2019. The most obvious sign is the absence of any statement expressly concluding that all purported fraud was fully disclosed by October 2019 and that therefore, the class period was truncated. Given that such a conclusion would all but end the case as to Oklahoma Firefighters, it stands to reason that if that was actually our decision, we would have said so explicitly. To borrow a familiar phrase from statutory interpretation principles, we do not “hide elephants in mouseholes.”

No. 23-10696 (April 18, 2024) (citation omitted).

Recent dialogue about the benefits and drawbacks of single-judge judicial district has led to further public remarks, which have in turn drawn interesting rebuttal from commentators in Above the Law and Balls and Strikes.

Recent dialogue about the benefits and drawbacks of single-judge judicial district has led to further public remarks, which have in turn drawn interesting rebuttal from commentators in Above the Law and Balls and Strikes.

(It bears mention in this discussion that the Alliance for Hippocratic Medicine – the lead plaintiff in the mifepristone litigation that touched off the present debate – was created three months before that litigation by several out-of-state anti-abortion groups, as explained in an informative Intercept article that discusses the broader history of such groups.)

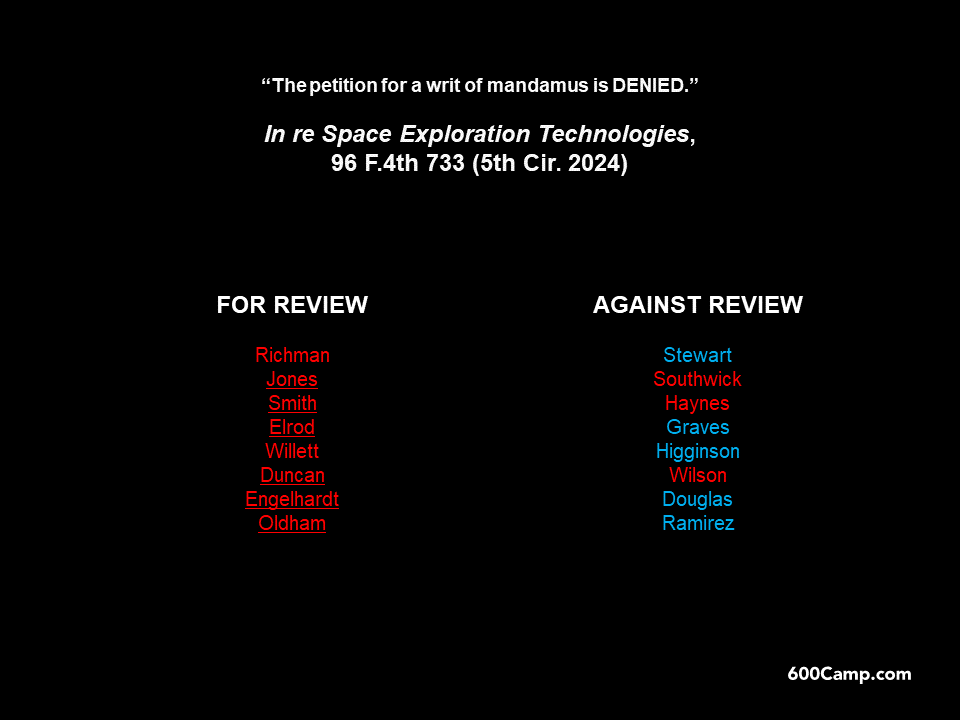

Resolving another of the simmering venue disputes that have drawn considerable attention in recent weeks, the full Fifth Circuit denied en banc review (an 8-8 tie vote) of the denial of mandamus relief in In re SpaceX – a challenge to the district court’s order that transferred a dispute between SpaceX and the NLRB to the Central District of California.

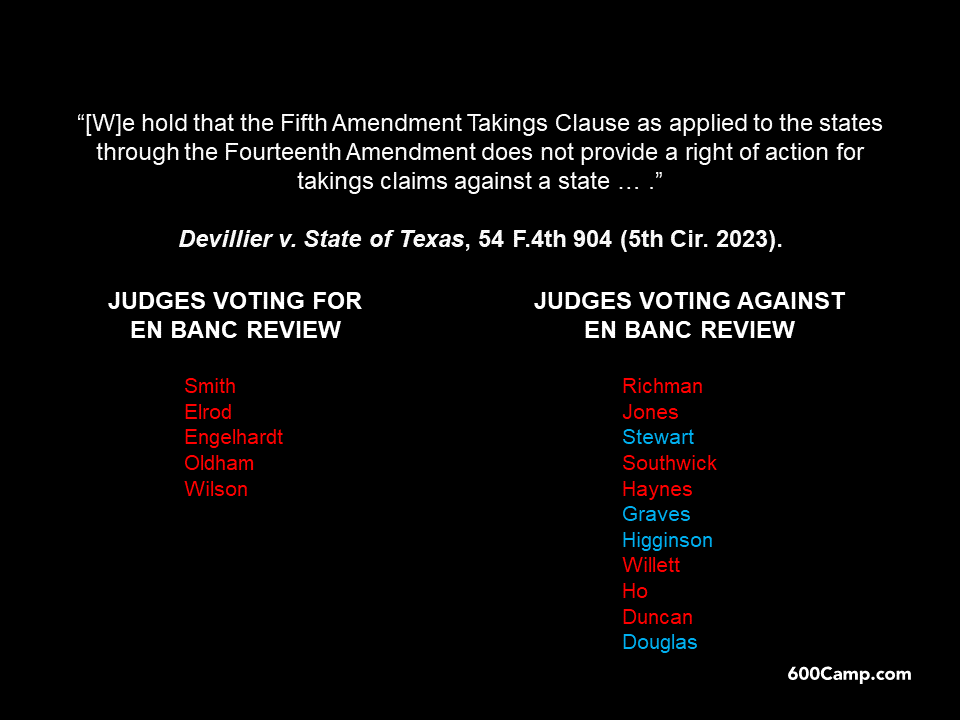

The surprisingly slippery question whether Texas law allows a takings claim to proceed against the state came to an anticlimactic end with the Supreme Court’s opinion in DeVillier v. Texas:

The surprisingly slippery question whether Texas law allows a takings claim to proceed against the state came to an anticlimactic end with the Supreme Court’s opinion in DeVillier v. Texas:

As Texas explained at oral argument, its state-law inverse-condemnation cause of action provides a vehicle for takings claims based on both the Texas Constitution and the Takings Clause. … And, although Texas asserted that proceeding under the state-law cause of action would require an amendment to the complaint, it also assured the Court that it would not oppose any attempt by DeVillier and the other petitioners to seek one.

No. 22-913 (U.S. April 16, 2024).

Members of the Lipan-Apache Native American Church sued the City of San Antonio about its plans for a large city park that contains an area of particular religious significance to this church. One aspect of the case involved physical access to that area. After the City complied with the trial-court’s order on that issue, the Fifth Circuit held that part of the case was moot, and did not apply the “voluntary cessation” (i.e., “a defendant could … pick up where he left off”) exception to mootness:

Members of the Lipan-Apache Native American Church sued the City of San Antonio about its plans for a large city park that contains an area of particular religious significance to this church. One aspect of the case involved physical access to that area. After the City complied with the trial-court’s order on that issue, the Fifth Circuit held that part of the case was moot, and did not apply the “voluntary cessation” (i.e., “a defendant could … pick up where he left off”) exception to mootness:

[T]he City affirmed that it undertook several additional efforts “going beyond what the district court ordered.” The City conceded that removing the limb allowed it to reconfigure the construction fencing and it subsequently granted public access to the entire area. Likewise, the City granted Appellants access to conduct a religious ceremony at the Sacred Area from midnight to 4 a.m. on November 18, 2023, during hours when the Park is normally closed. Furthermore, on November 21, 2023, the City moved to dismiss its crossappeal in this action, deciding to no longer pursue the issue of access to the Sacred Area. Based on these subsequent developments, “[i]t is therefore clear that [the City officials] harbor no animosity toward [Appellants].” Appellants now have “no reasonable expectation that the wrong challenged by [them] would be repeated.” Thus, the voluntary cessation exception does not apply.

Perez v. City of San Antonio, No. 23-50746 (April 11, 2024) (citations omitted).

After a Fifth Circuit panel granted mandamus relief about a transfer of a case involving the CFPB to the District of Columbia, the district court there entered this Minute Order on April 10:

After a Fifth Circuit panel granted mandamus relief about a transfer of a case involving the CFPB to the District of Columbia, the district court there entered this Minute Order on April 10:

This case was received from the U.S. District Court in the Northern District of Texas on March 29, 2024. On April 8, 2024, the Court received a copy of the Order Reopening Case and Providing Notice to the United States District Court of the District of Columbia … issued by the Texas district court in accordance with In re Fort Worth Chamber of Commerce, No. 24-10266 (5th Cir. Apr. 5, 2024) (attached to Notice and Order). The Fifth Circuit found that the district court lacked jurisdiction to transfer the case while an appeal was pending before the Court of Appeals, and it ordered the district court to “reopen the case and to give notice to D.D.C. that its transfer was without jurisdiction and should be disregarded.” While the Court is not inclined to “disregard” a case on its docket, and it has considerable discretion to supervise its own cases, a review of the Notice and Order, as well as the docket in the Northern District of Texas, reflects that the case is now proceeding there under the supervision of another district court. Therefore, the case will be terminated on this court’s docket at this time without prejudice. This order should not be read to express any view on the transfer question, which has not been presented to this Court to decide. The Clerk of Court is directed to terminate this case on the docket of the District Court for the District of Columbia.

Meanwhile, back in New Orleans, the Fifth Circuit has asked for supplemental briefing about “whether or not an ownership interest in a nonparty large credit card issuer would be substantially affected by the outcome of this litigation,” for purposes of evaluation potential judicial recusal.

I hope you find this cross-post from 600 Commerce to be informative!

The most recent Advocate (the quarterly publication of the State Bar of Texas Litigation Section) has several articles about how the new Fifteenth Court of Appeals will get off the ground. I have a short piece on where the new court is likely to look for precedent, since it will have none of its own to start. I hope you find it useful in thinking about this important new appellate forum.

In D&T Partners LLC v. Baymark Partners Mgmnt., LLC, “[a] group of individuals allegedly sought to steal the assets and trade secrets of an e-commerce company,” and “did so with shell entities, corrupt lending practices, and a fraudulent bankruptcy.” The plainitffs’ complaint did not state a RICO claim, however:

In D&T Partners LLC v. Baymark Partners Mgmnt., LLC, “[a] group of individuals allegedly sought to steal the assets and trade secrets of an e-commerce company,” and “did so with shell entities, corrupt lending practices, and a fraudulent bankruptcy.” The plainitffs’ complaint did not state a RICO claim, however:

“While the complaint alleges coordinated theft, the alleged victims are limited in number, and the scope and nature of the scheme was finite and focused on a singular objective. … [T]his does not constitute a “pattern” of racketeering conduct sufficient to state a RICO claim ….”

No. 22-11148 (Apr. 4, 2024).

In a muscular display of appellate review, in Career Colleges & Schools of Texas v. U.S. Dep’t of Educ., the Fifth Circuit:

- Disagreed with the district court’s conclusion that an association of career schools lacked standing due to a lack of immediate irreparable injury, identifying three types of injury suffered as a result of new DOE regulations about certain defenses to student-loan repayment;

- Concluded that, as a matter of law, the association had satisfied the requirements for a preliminary injunction;

- Gave the resulting injunction nationwide effect; and

- Ordered: “The stay pending appeal remains in effect until the district court enters the preliminary injunction.”

No. 23-50491 (April 4, 2024).

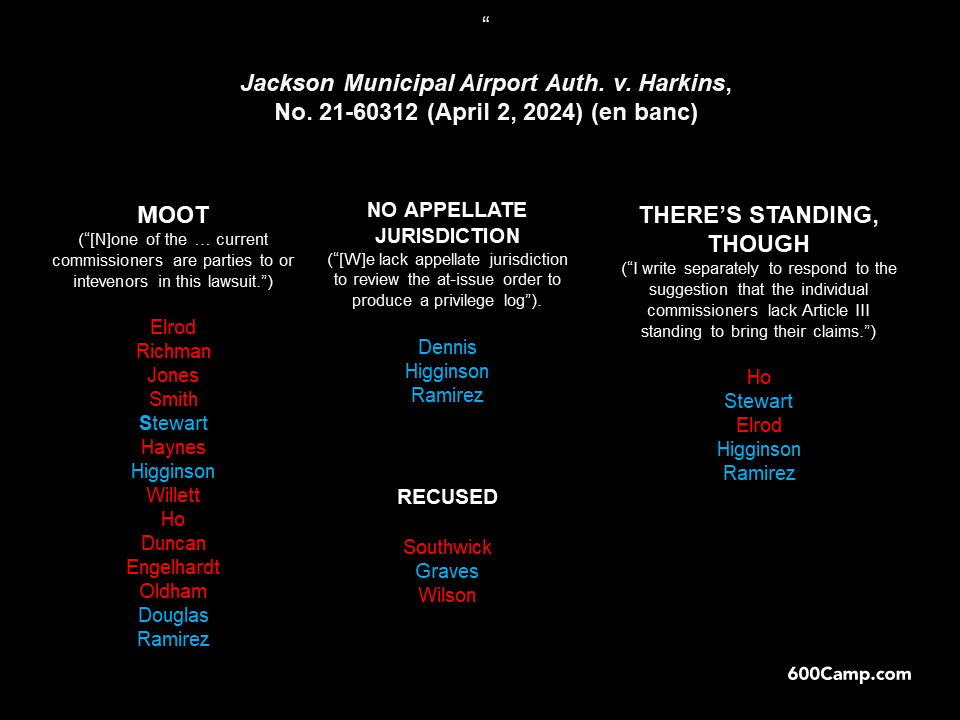

Long-running litigation about control of the Jackson airport led to the en banc court holding on April 2 that the appeal was moot. A breakdown of the viewpoints appears below:

Several disputes about inter-circuit venue transfers are ongoing (I was recently interviewed by Bloomberg about this phenomenon):

Several disputes about inter-circuit venue transfers are ongoing (I was recently interviewed by Bloomberg about this phenomenon):

- SpaceX. In a dispute between SpaceX and the NLRB, the Fifth Circuit is considering whether to review a transfer order en banc. The NLRB recently filed its response to an unusual order from the panel asking the NLRB to explain several actions taken earlier in the proceedings. The gist of the NLRB’s response was:

Only one court may have jurisdiction at a time. The transferee court was notobliged to follow the February 26 order, and zealous advocacy required the NLRB to present its legal arguments as to why it should not be followed to the Central District of California. Thus, the NLRB urged that court, not to ignore this Court’sorder, but to acknowledge it and respectfully decline retransfer.

- CFTC. In a dispute involving the Commodities Futures Trading Commission, the District of the District of Columbia has received the district court’s request to return the case, along with briefing and argument from the parties about the appropriate next step, and as of April 6 continued to have that request under consideration.

- CFPB. In a dispute involving the CFPB and a new rule about credit-card late fees, a 2-1 panel decision granted mandamus relief on April 5–after a case had been transferred to the District of the District of Columbia, concluding:

Because the Chamber had a short window of time to either (1) comply with the Final Rule, or (2) seek a preliminary injunction, the district court’s inaction amounted to an effective denial of the Chamber’s motion for a preliminary injunction. That effective denial is properly before us on appeal. The district court lacked jurisdiction to transfer the case after this appeal was docketed because doing so would alter its status. … The district court is ORDERED to reopen the case and to give notice to D.D.C. that its transfer was without jurisdiction and should be disregarded.

- CFPB dissent. The dissent in the CFPB case concluded: “For the foregoing reasons, I believe that the new proposition of law created by the majority is incompatible with district court discretion over docket management and prudent policing of forum shopping. Finally, I am confident the District Court for the District of Columbia will give the suggestion that it should disregard a case docketed by it its closest attention.”

- HHS. The Court has expedited argument (to May 1) of National Infusion Center v. Becerra , a challenge to the dismissal of a case about 2022 drug-reimbursement regulations on venue grounds (after the dismissal of a party for jurisdictional reasons).

Several matters involving inter-circuit venue transfers are ongoing:

- In a dispute between SpaceX and the NLRB, the Fifth Circuit is considering whether to review a transfer order en banc. The panel recently issued this unusual order asking the NLRB’s counsel to explain several actions taken earlier in the proceedings.

- In a dispute involving the CFTC, the District of the District of Columbia has received the district court’s request to return the case, and is receiving briefing and argument from the parties about the appropriate next step.

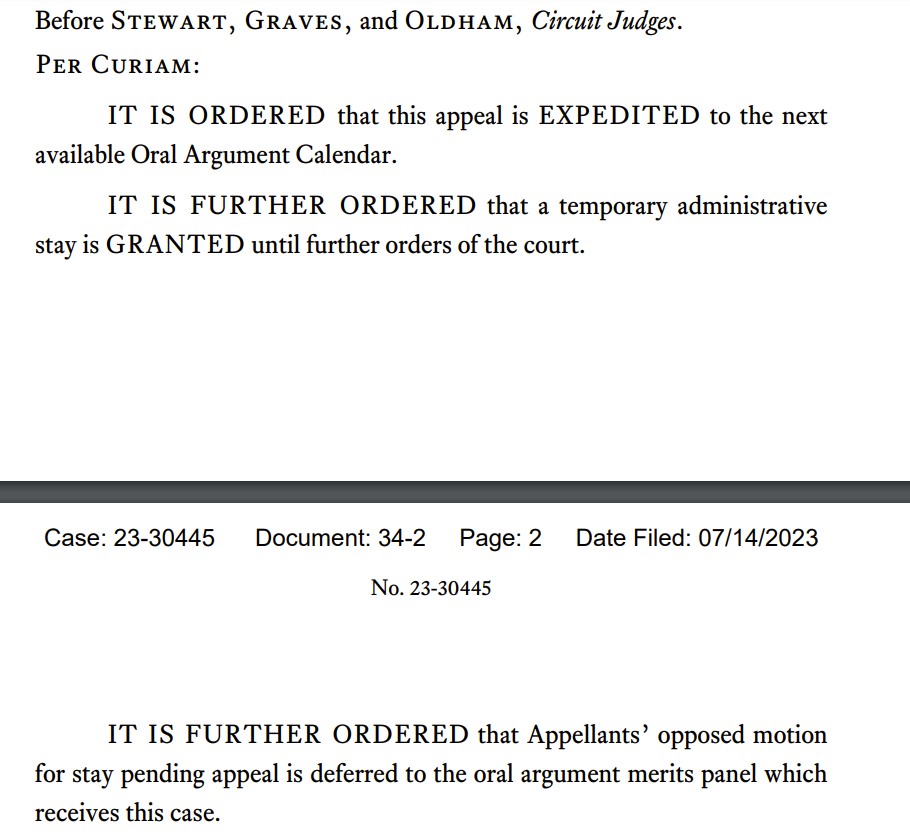

- In another dispute involving the CFPB, the Fifth Circuit has administratively stayed a transfer order and referred the matter to the next available argument panel.

A recent policy statement from the Judicial Conference of the United States recommended changes to judge-assignment practices in district courts. The statement has drawn considerable attention both pro and con; this Volokh Conspiracy post is a good summary of the “con” side. A recent letter from the Chief Judge of the Northern District of Texas says that its judges have declined to materially change that district’s judge-assignment policies.

A recent policy statement from the Judicial Conference of the United States recommended changes to judge-assignment practices in district courts. The statement has drawn considerable attention both pro and con; this Volokh Conspiracy post is a good summary of the “con” side. A recent letter from the Chief Judge of the Northern District of Texas says that its judges have declined to materially change that district’s judge-assignment policies.

Applying the international convention about arbitration, the Fifth Circuit found an abuse of discretion in not compelling arbitration because of equitable estoppel, reasoning:

While Bufkin was certainly free to name and then dismiss the foreign insurers, the district court was not free to disregard them in considering the domestic insurers’ motion to compel arbitration. Yet in focusing on Bufkin’s dismissal of the foreign insurers, the district court neglected to consider the foreign insurers’ part in the seamless coverage agreement struck by the parties, and Bufkin’s interactions with the insurers. Honing in, that coverage arrangement included the arbitration clause that afforded the insurers–foreign and domestic—“predictability in resolving disputes dealing with the substantial risks presented by a surplus lines insurance policy.” … The upshot is that indulging Bufkin’s pleading-and-then-dismissing gamesmanship by denying arbitration turns on its head the axiom that “[t]he linchpin for equitable estoppel is equity—fairness.”

Bufkin Enterprises, LLC v. Indian Harbor Ins. Co., No. 23-30171 (March 4, 2024) (emphasis added).

After an earler (unexplained) grant of an administrative stay touched off weeks of fast-paced appellate litigation about Texas’s “SB4” immigration law, a majority of the Fifth Circuit’s merits panel denied any further stay of the trial court’s injunction against enforcement of that law. USA v. Texas, No. 24-50149 (March 26, 2024). Argument is scheduled next week; barring Supreme Court intervention, merits opinions similar to these are likely.

The Fifth Circuit made/ an interesting observation about the comparative weight of Erie precedent in SXSW LLC v. Fed. Ins. Co.:

The Fifth Circuit made/ an interesting observation about the comparative weight of Erie precedent in SXSW LLC v. Fed. Ins. Co.:

Federal cites two federal district courts to support its broader interpretation. … But these authorities are worth relatively little in this case. Our focus is on Texas law as interpreted by the Texas state courts.

No. 22-50933 (March 21, 2024) (unpublished).

This morning’s Supreme Court arguments in the mifepristone cases (which will be available here when ready) lead to a couple of observations about legal issues of the day:

- Standing. As the Washington Post effectively summarized: “A majority of justices from across the ideological spectrum expressed skepticism that the antiabortion doctors challenging the government’s loosening of regulations have sufficient legal grounds — or standing — to bring the lawsuit.” (Last year, I wrote about the “conservative” approach to standing in high-profile constitutional cases in a Slate article, and the application of basic standing principles in the mifepristone cases in this Dallas Morning News editorial.)

- Comstock. Justice Holmes famously observed: “The common law is not a brooding omnipresence in the sky.” But the Comstock Act is, and Congress should do something about the law before its 1870s-era moralism is inflicted on modern society. Mark Stern’s X feed on the mifepristone arguments summarizes some of the present state of play.

A propane grill exploded; the injured plaintiff won a judgment against the supplier of the propane tank, and the Fifth Circuit reversed in Johnston v. Ferrellgas, Inc.:

[T]he circumstantial evidence on which the Johnstons rely does not cure the want of proof that the tank was defective when it left Ferrellgas’s possession. This is not a res ipsa case. Indeed, the Johnstons did not advance that theory of liability before the district court or before us. In sum, the Plaintiff’s expert admitted that he could not say the tank was defective at the time it left Ferrellgas, making his prior comments about the tank’s condition at that time pure speculation; the tank functioned properly before Johnston used it; the tank and seal are not sealed containers; and both parties agree Ferrellgas successfully refilled the tank with gas under highpressure months before the accident. There is no reasonable basis on which the jury could find the Johnstons met their burden.

No. 23-10019 (March 21, 2024). A dissent saw matters differently.

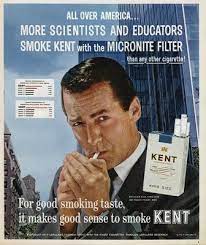

In the 1950s, Big Tobacco advertised the safety of “Kent with the Micronite Filter,” which was unfortunately made with an exceptionally dangerous form of asbestos. After decades of advertising bans and mandatory disclosures, the battle over cigarette ads continues, leading most recently to R.J. Reynolds Tobacco Co. v. FDA – a First Amendment challenge to new, more graphic disclosures about the potential harms of smoking.

In the 1950s, Big Tobacco advertised the safety of “Kent with the Micronite Filter,” which was unfortunately made with an exceptionally dangerous form of asbestos. After decades of advertising bans and mandatory disclosures, the battle over cigarette ads continues, leading most recently to R.J. Reynolds Tobacco Co. v. FDA – a First Amendment challenge to new, more graphic disclosures about the potential harms of smoking.

The Fifth Circuit rejected the challenge (reversing a contrary district-court opinion) and remanded for consideration of claims involving the Administrative Procedure Act. As to the First Amendment issues, the Court summarized:

When determining whether Zauderer applies, (1) images can be factual; (2) ideological or emotion-inducing statements are not per se controversial or non-factual; (3) “uncontroversial” means not subject to good-faith dispute about the accuracy of the factual statement; and (4) legitimate state interests other than the prevention of consumer deception are cognizable under Zauderer. For the reasons detailed above, the district court erred by finding Zauderer inapplicable to the FDA’s newest Warnings. Applying Zauderer, the Warnings survive constitutional muster against the First Amendment challenge.

No. 23-40076 (March 21, 2024).

In Wilmington Savings Fund Society, FSB v. Myers, the appellant argued that its notice of appeal was timely, when filed within 30 days of a second judgment, and when the first judgment “was mislabeled because even though it purported to dispose of all claims and parties in the case, the title of the order did not signal that it was a final judgment.”

In Wilmington Savings Fund Society, FSB v. Myers, the appellant argued that its notice of appeal was timely, when filed within 30 days of a second judgment, and when the first judgment “was mislabeled because even though it purported to dispose of all claims and parties in the case, the title of the order did not signal that it was a final judgment.”

The Fifth Circuit agreed. Noting that “[o]rdinarily, such minor changes to an order do not ‘disturb or revise legal rights and obligations’ of the parties” (cleaned up), it concluded that “there was in this case a clear discrepancy between the label and the body of the district court’s order” that was sufficient to treat it as a substantive revision for purposes of calculating the appeal deadline. No. 24-20018 (March 18, 2024) (applying FTC v. Minneapolis-Honeywell Regulator Co., 344 U.S. 206, 211 (1952)).

(The graphic was provided by DALL-E, and explained by it as follows: “The images above illustrate the concept of a substantive change versus a change solely of form, through the comparison of a caterpillar’s transformation into a butterfly (substantive change) and a chameleon’s color change (change of form).”

All eyes will be on New Orleans this morning, for the (videoconferenced) arguments in United States v. Texas, where last night’s order suggests a 2-1 decision will be forthcoming that continues to bar enforcement of Texas’s SB4 during the pendency of its appeal. The Supreme Court will likely be asked about the resulting order, whatever it may be.

Earlier this month, the Fifth Circuit granted mandamus relief, including the issuance of a writ of mandamus to the Western District of Texas, requiring that the district court request the return of a case from the District of the District of Columbia. That request was made on March 7. As of March 19, that court had not ruled on the request, and the CFTC continues to urge that the court delay action until it has received further briefing on the venue issue.

Earlier this month, the Fifth Circuit granted mandamus relief, including the issuance of a writ of mandamus to the Western District of Texas, requiring that the district court request the return of a case from the District of the District of Columbia. That request was made on March 7. As of March 19, that court had not ruled on the request, and the CFTC continues to urge that the court delay action until it has received further briefing on the venue issue.

In Calogero v. Shows, Cali & Walsh, LLP, (discussed earlier this week for stylistic reasons), a panel majority found that two recipients of certain Hurricane Katrina relief stated a viable Fair Debt Collection Act claim when:

- The longest possible limitations period (10 years) had run by the time the demand letters requested payment; and

- The demand letters threatened a claim for attorneys fees, when the relevant documents only created a specific right to potential fee recovery that did not include the alleged debt at issue.

The third judge, without opinion, concurred in the result only. No. 22-30487 (March 15, 2024).

Michael Cloud, a former NFL running back, sued the NFL’s retirement fund for additional disability benefits. The Fifth Circuit reversed a trial-court ruling in his favor, noting the one-sided nature of the plan’s operations, but concluding:

Michael Cloud, a former NFL running back, sued the NFL’s retirement fund for additional disability benefits. The Fifth Circuit reversed a trial-court ruling in his favor, noting the one-sided nature of the plan’s operations, but concluding:

Cloud’s claim fails because he did not and cannot show any changed circumstances entitling him to reclassification to the highest tier of benefits. He could have appealed the 2014 denial of reclassification to Active Football status—but he did not do so. Instead, Cloud filed another claim for reclassification in 2016, which subjected him to a changed-circumstances requirement that he cannot meet—and did not try to meet. He therefore forfeited the issue at the administrative level and at any rate has not pointed to any clear and convincing evidence supporting his claim.

The district court’s findings about the NFL Plan’s disregard of players’ rights under ERISA and the Plan are disturbing. Again, this is a Plan jointly managed by the league and the players’ union. And we commend the trial court judge for her diligent work chronicling a lopsided system aggressively stacked against disabled players. But we also must enforce the Plan’s terms in accordance with the law.

Cloud v. Bell-Rozelle NFL Player Retirement Plan, No. 22-10710 (revised March 17, 2024).

You can tell your argument isn’t working when the Fifth Circuit summarizes it as follows:

You can tell your argument isn’t working when the Fifth Circuit summarizes it as follows:

“SCW’s last remaining counterargument is that it should be able to pick and choose different clauses from the LSAA and the Grant Agreement and then mush them together to demand money from debtors.”

and when the Court begins its opinion:

“Widowed octogenarians Iris Calogero and Margie Nell Randolph received dunning letters from a Louisiana law firm … .”

Calogero v. Shows, Cali & Walsh, LLP, No. 22-30487 (March 15, 2024). More substantive review to follow in the week ahead!

The Judicial Conference has voted to strenghen its policy about random case assignment, as set forth here.

Deanda v. Becerra presents a conflict between Title X (a federal law about the availability of contraception), and a Texas parental-consent statute. The Fifth Circuit found no conflict, and thus no preemption. On the threshold question of standing, the Court rejected the argument that any parent could sue about this issue, observing, inter alia: “This case does not concern all ‘parents or potential parents.’ It concerns only a parent with particular religious beliefs about raising his children.” No. 23-10159 (March 12, 2024).

The Fifth Court ordered a rare reversal for a new trial because of improper closing argument in Clapper v. American Realty Investors. The Court summarized the improper statements as “employ[ing] nearly every type of improper argument identified by our court, including highly improper and personal attacks against opposing counsel, remarks about Clapper’s wealth, a discussion of matters not in the record, insinuations that Clapper had lower moral standards because he was from Michigan, and suggestions of Clapper’s bad motives through counsels’ opinion.”

The Fifth Court ordered a rare reversal for a new trial because of improper closing argument in Clapper v. American Realty Investors. The Court summarized the improper statements as “employ[ing] nearly every type of improper argument identified by our court, including highly improper and personal attacks against opposing counsel, remarks about Clapper’s wealth, a discussion of matters not in the record, insinuations that Clapper had lower moral standards because he was from Michigan, and suggestions of Clapper’s bad motives through counsels’ opinion.”

The Court concluded: “We remind all practitioners in our court that zealous advocacy must not be obtained at the expense of incivility. As Judge Reavley aptly explained, ‘Although earnest, forceful, and devoted representation is both zealous and proper, Rambo and kamikaze lawyers lead themselves and their clients to zealous extinction.'” No. 21-10805 (March 8, 2024).

Notably, footnote two dismisses several arguments about preservation, concluding that “[t]he serious nature of the argument in this trial … indicates that substantial justice requires a new trial ….”

In the ongoing proceedings about the transfer of venue in a dispute between SpaceX and the NLRB, a Fifth Circuit judge has held the mandate – a step often seen in difficult cases where en banc review is possible. Interestingly, in Texas state practice, a mandate does not issue in a mandamus proceeding, because a mandamus petition is an original proceeding in the court of appeals and there is no jurisdiction to return to a trial court.

I apologize for the peculiar look of many of the site’s posts. A WordPress “plug in” has malfunctioned and until it is replaced, the site’s graphics will just look a little funny.

Last week, the Central District of California returned a case to Texas district court, after the Fifth Circuit pointed out that it had issued a stay order (in a mandamus proceeding brought to challenge the venue transfer) before the California court had docketed the transferred matter.

Then, after the return of the case to Texas, the Court denied mandamus relief. The majority did not write an opinion. A dissent would have granted the writ. In re SpaceX, No. 24-40103 (March 5, 2024). It remains to be seen what court will act next.

In Cheapside Minerals, Ltd. v. Devon Energy Prod Co., L.P., the Fifth Circuit concluded that CAFA’s “local controversy” exception did not apply, and thus reversed a remand to state court in an oil-and-gas royalties dispute:

[T]he “principal injury” each Plaintiff sustained is obvious because there was only one type of injury: a financial harm resulting from Devon’s alleged underpayment of their royalties. While most Plaintiffs sustained that injury in Texas, others did not. Therefore, the principal injuries prong is not satisfied in this case, and Plaintiffs have failed to demonstrate that the local controversy exception applies.

No. 24-40026 (March 1, 2024).

After a case was transfered to the District of Columbia, the Fifth Circuit granted mandamus relief about that transfer in In re Clarke, focusing on the district court’s analysis of the “local interest” factor

[E]vents giving rise to the suit can be separated into two categories: The first concerns individual traders who purchased contracts on the marketplace. Five of them are based in Austin, bought their contracts from Austin, and have been harmed in Austin. The second category deals with marketplace service providers—Aristotle and PredictIt. Based in D.C., they “expended significant resources to assist Victoria University in developing and operating the PredictIt Market” and “will be forced to incur massive administrative, labor, time, and other costs if forced to liquidate pending contracts prematurely.”

Given those events, there is an obvious connection between the facts giving rise to this case and the Western District of Texas. And, if we assume that Aristotle’s and PredictIt’s development and operations activities occurred in D.C., there is also a factual connection with D.D.C.

Additionally, the effect of this suit is completely diffuse. Should plaintiffs prevail on their APA challenge, this court must “set aside” CFTC’s ultra vires recission action, with nationwide effect. That affects persons in all judicial districts equally.

No. 24-50079 (March 1, 2024) (footnote omitted). As with last week’s decision in a similar posture involving SpaceX, it remains to be seen whether the transferee district court will return the case.

Together with Marcy Greer, I recently gave an update about recent Fifth Circuit cases at the first-ever Central Texas Bench-Bar meeting. This is our PowerPoint from the March 1 presentation.

Together with Marcy Greer, I recently gave an update about recent Fifth Circuit cases at the first-ever Central Texas Bench-Bar meeting. This is our PowerPoint from the March 1 presentation.

In 2022, a venue skirmish in a contentious firerarms-manufacturing case led to a Pennsylvania district court declining to return a transferred case to the Fifth Circuit. Echoes of that skirmish can be heard in In re Space Exploration Technologies Corp., a dispute between SpaceX and the NLRB, where the following occurred:

In 2022, a venue skirmish in a contentious firerarms-manufacturing case led to a Pennsylvania district court declining to return a transferred case to the Fifth Circuit. Echoes of that skirmish can be heard in In re Space Exploration Technologies Corp., a dispute between SpaceX and the NLRB, where the following occurred:

SpaceX petitioned this court for a writ of mandamus on February 16, 2024, requesting that we direct the district court to vacate its transfer order. Our court stayed the Southern District of Texas’s transfer order on February 19, 2024. Nevertheless, the Central District of California docketed the case four days later, on February 23, 2024, as case number 2:24-cv-1352-CBM-AGR.

Accordingly, the Fifth Circuit directed the district court to ask the California court to return the case. The Fifth Circuit’s order points out that the California court lacks jurisdiction, since the docketing did not occur until after the stay issued. And unlike the 2022 gun case, the transferee court agreed with the Fifth Circuit, and has indicated that it will return the case to Texas when it receives the official request from the Texas trial court. No. 24-40103 (Feb. 26, 2024) (unpublished order).

The plaintiffs’ takings claim failed in Treme v. St. John the Baptist Parish Council, when the relevant mineral lease was “for a period of Three (3) years from the date Lessee procures approval to commence operations frm local, state and federal authorities, as needed ….” The requirement of government approvals created a “suspensive condition” to the lease’s effectiveness, and “[b]ecuase they have not been obtained, the district court was correct in determining that the lease had not yet become effective.” No. 23-30084 (Feb. 16, 2024).

The plaintiffs’ takings claim failed in Treme v. St. John the Baptist Parish Council, when the relevant mineral lease was “for a period of Three (3) years from the date Lessee procures approval to commence operations frm local, state and federal authorities, as needed ….” The requirement of government approvals created a “suspensive condition” to the lease’s effectiveness, and “[b]ecuase they have not been obtained, the district court was correct in determining that the lease had not yet become effective.” No. 23-30084 (Feb. 16, 2024).

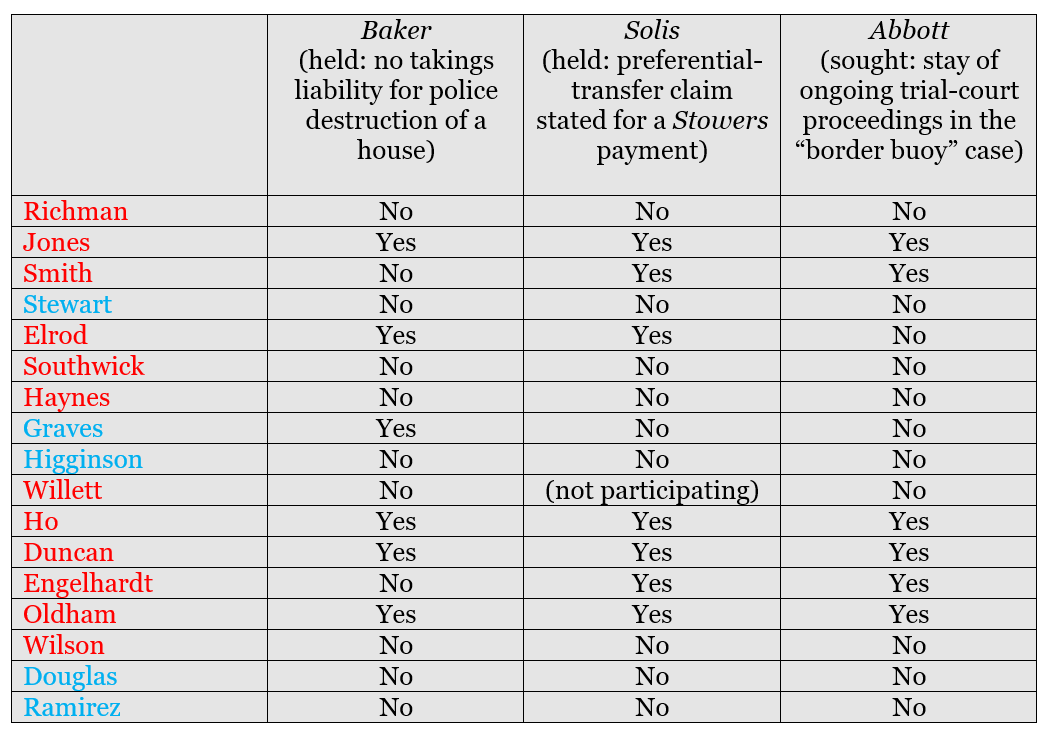

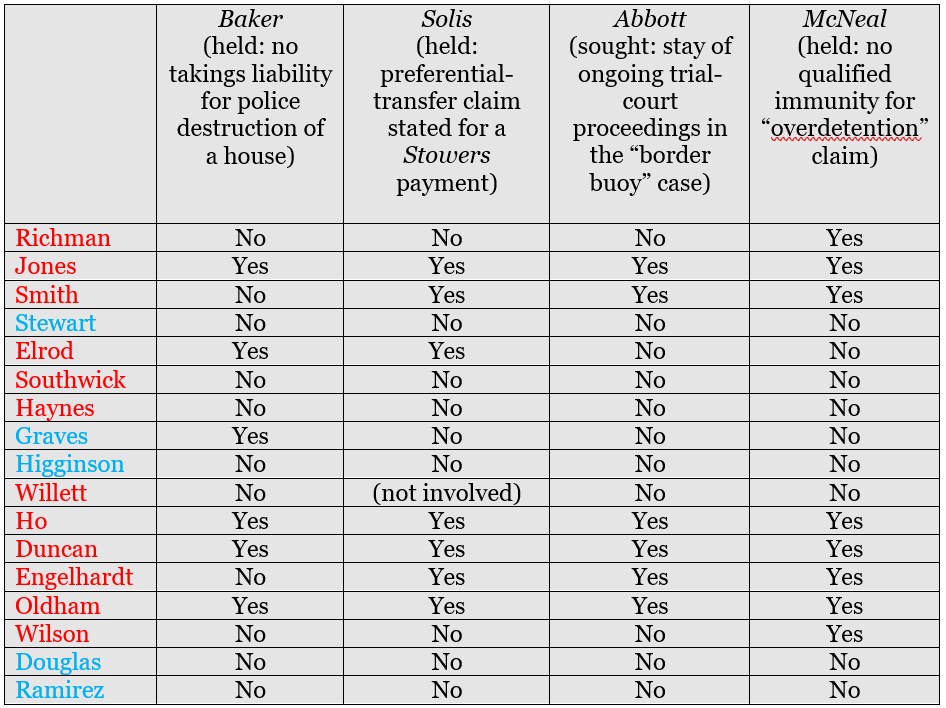

February 2024 has been a busy month for en banc votes. The recent vote by the full court about a stay in U.S. v. Abbott, as well as votes to deny en banc review of Baker (a takings case about police destruction of a home) and Solis (holding that a preferential-transfer claim was stated as to a Stowers-related payment) provided an unusual snapshot of the full court’s views on multiple issues at the same time.

Those votes are now supplemented by an 8-9 vote to deny review in McNeal v. LeBlanc, a panel opinion that denied qualified immunity in an “overdetention” case. The below chart summarizes those votes (a “yes” vote is for en banc review or issuance of a stay, as appropriate):

Judges Jones, Ho, and Oldham voted “yes” for review of each of these four cases. Judges Southwick, Haynes, Higginson, Douglas, and Ramirez voted “no” for review of each of these four cases.

Judges Jones, Ho, and Oldham voted “yes” for review of each of these four cases. Judges Southwick, Haynes, Higginson, Douglas, and Ramirez voted “no” for review of each of these four cases.

The contract between Catalyst (a consulting firm) and CBS (an equipment-rental company), required payment of a substantial fee if CBS satisfied the contract’s requirements as to a “Transaction.” The Fifth Circuit held that the contract supplanted the “procuring cause doctrine” recognized by Texas law as a default rule for such business situations, and further held that under the contract, Catalyst had made the required showing to recover its fee. Catalyst Strategic Advisors LLC v. Three Diamond Capital SBC LLC, No. 23-20030 (Feb. 22, 2024).

The contract between Catalyst (a consulting firm) and CBS (an equipment-rental company), required payment of a substantial fee if CBS satisfied the contract’s requirements as to a “Transaction.” The Fifth Circuit held that the contract supplanted the “procuring cause doctrine” recognized by Texas law as a default rule for such business situations, and further held that under the contract, Catalyst had made the required showing to recover its fee. Catalyst Strategic Advisors LLC v. Three Diamond Capital SBC LLC, No. 23-20030 (Feb. 22, 2024).

Aggrieved creditors argued that a recent Supreme Court opinion, which held that section 363(b) of the Bankruptcy Code was not jurisdictional (and could thus be waived), also impacted the scope of that statute when it applied. The Fifth Circuit rejected that argument in Swiss Re v. Fieldwood Energy, stating: “We perceive no narrowing of the effect of Section 363(b) other than to clarify that a party can lose the benefit of its terms.” No. 23-20104 (Feb. 20, 2024). From there, the Court found that the creditors’ appeal was moot because a stay had not been obtained, and the issues presented did not relate to anything left open by the bankruptcy plan.

Aggrieved creditors argued that a recent Supreme Court opinion, which held that section 363(b) of the Bankruptcy Code was not jurisdictional (and could thus be waived), also impacted the scope of that statute when it applied. The Fifth Circuit rejected that argument in Swiss Re v. Fieldwood Energy, stating: “We perceive no narrowing of the effect of Section 363(b) other than to clarify that a party can lose the benefit of its terms.” No. 23-20104 (Feb. 20, 2024). From there, the Court found that the creditors’ appeal was moot because a stay had not been obtained, and the issues presented did not relate to anything left open by the bankruptcy plan.

(The illustration is from DALL-E, I asked it to illustrate the bankruptcy concept of statutory mootness, and it came up with that image, for no reason that I can ascertain. I offer it to you as a good example of generative AI doing something that is both very sophisticated and very weird.)

After the Texas Supreme Court answered a certified question about an arcane Texas limitations-tolling statute, the Fifth Court applied that answer in a later case presenting the same issue, Bullock v. UT-Arlington:

After the Texas Supreme Court answered a certified question about an arcane Texas limitations-tolling statute, the Fifth Court applied that answer in a later case presenting the same issue, Bullock v. UT-Arlington:

“The state trial court dismissed her case on June 8, 2020, for lack of jurisdiction. The dismissal was affirmed by the state appellate court on May 20, 2021. The appellate court’s plenary power expired on July 19, 2021. Under the Texas Supreme Court’s interpretation of Section 16.064(a)(2), Plaintiff had sixty days from July 19, 2021, in which she could refile her action in a court of proper jurisdiction. Plaintiff filed this instant lawsuit on July 16, 2021, before the state appellate court’s plenary power expired and well within the sixty-day grace period.”

No. 22-10013 (Feb. 15, 2024) (citations omitted).

Shaw v. Restoration Hardware, Inc. carefully describes the unique heritage of Louisiana law, and then reached a holding well known to the common law:

Shaw v. Restoration Hardware, Inc. carefully describes the unique heritage of Louisiana law, and then reached a holding well known to the common law:

“By Shaw’s own allegations, the alleged contract was conditioned on RH wanting to use the at-issue artisans to produce nonlicensed designs and the outcome of the parties’ future negotiations regarding compensation. Because the at-issue agreement left the terms of potential compensation “wide open” to future negotiation, RH and Shaw never entered into an enforceable contract.”

No. 22-30277 (Feb. 15, 2024).

The recent vote by the full court about a stay in U.S. v. Abbott, as well as votes to deny en banc review of Baker (a takings case about police destruction of a home) and Solis (holding that a preferential-transfer claim was stated as to a Stowers-related payment) provide an unusual snapshot of the full court’s views on multiple issues at the same time. The below chart summarizes those votes (a “yes” vote is for en banc review or issuance of a stay, as appropriate):

In an opinion reversing the denial of a TCPA motion to dismiss, the Texas Supreme Court made a helpful observation for the legal blogging community:

[A]nyone who appreciates lawyerly precision has probably read plenty of news stories about legal affairs that gloss over lawyerly distinctions or contain inadvertent mischaracterizations of legal or procedural concepts. These journalistic imprecisions are not to be applauded, and they certainly can mislead the average reader in some cases. But errors of law by those reporting on the law are not automatically actionable as defamation.

Polk County Publ. Co. v. Coleman, No. 22-0103 (Tex. Feb. 16, 2024).

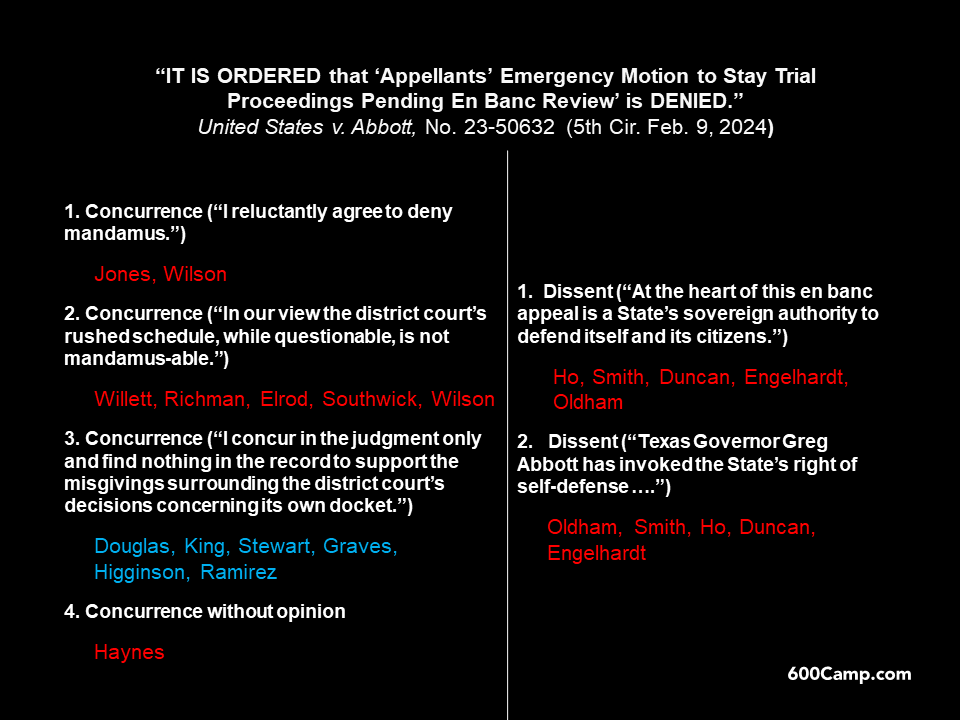

In United States v. Abbott, Texas contends that the Rio Grande is not navigable, which allows it to place a floating barrier in the river to deter navigation. After a Fifth Circuit panel affirmed the district court’s injunction against the barrier, the Court voted to take the case en banc, after which the district court placed the underlying case on a rapid schedule. Texas sought a stay, which the en banc Court denied for a variety of reasons:

A litigation trust, created as part of a bankruptcy plan confirmation, sued Raymond James. The trust asserted claims that had been assigned to the trust by aggrieved bondholders for the bankrupt entity, who contended that they had been misled about the bonds by Raymond James. (Remarkably, $300 million in bonds were sold in connection with a facility in rural Lousiana that would have refined raw wood into specialized fuel pellets.)

A litigation trust, created as part of a bankruptcy plan confirmation, sued Raymond James. The trust asserted claims that had been assigned to the trust by aggrieved bondholders for the bankrupt entity, who contended that they had been misled about the bonds by Raymond James. (Remarkably, $300 million in bonds were sold in connection with a facility in rural Lousiana that would have refined raw wood into specialized fuel pellets.)

In defense, Raymond James cited an indemnity agreement that it made with the debtor pre-bankruptcy. The Fifth Circuit affirmed the lower courts’ conclusion that the plan barred Raymond James from defending with that agreement. The Court said:

- Notice. “Even though [Debtor] failed to list Raymond James as a creditor when it filed for bankruptcy, Raymond James is nevertheless subject to the confirmation plan because of its actual knowledge of the underlying proceedings.”

- Plan. “Even if Raymond James was not subject to the plan, [Debtor] no longer exists, and neither the bondholders nor post-confirmation entity are its successors-in-interest.”

Raymond James & Assoc. v. Jalbert, No. 23-30040 (Jan. 30, 2024).

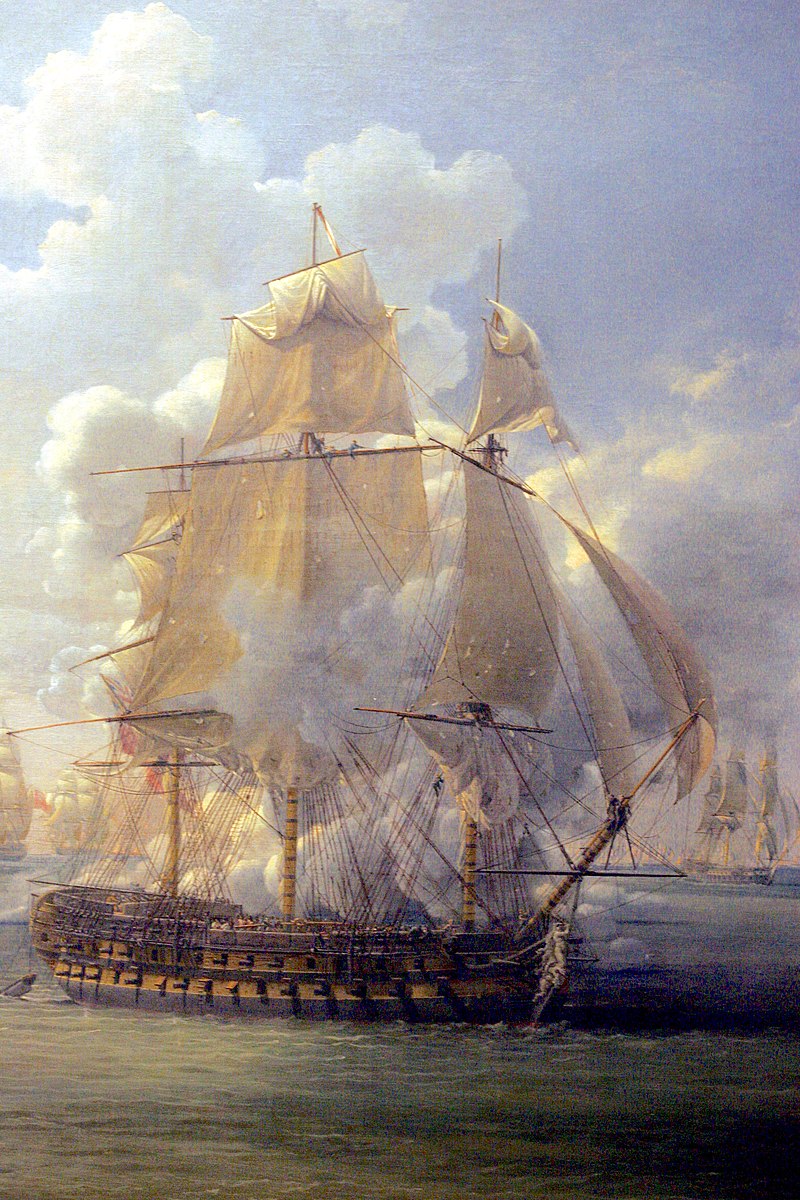

An explosion on the M/V FLAMINIA (right) led to a $200 million arbitration award, which in turn led to an action to confirm that award in New Orleans federal court. The Fifth Circuit reversed for a lack of personal jurisdiction, concluding:

An explosion on the M/V FLAMINIA (right) led to a $200 million arbitration award, which in turn led to an action to confirm that award in New Orleans federal court. The Fifth Circuit reversed for a lack of personal jurisdiction, concluding:

- Forum. “When assessing personal jurisdiction in a confirmation action under the New York Convention, a Convention, a federal court should consider contacts related to the parties’ underlying dispute and not only contacts related to the arbitration proceeding itself. That holding aligns our court with every other circuit to address this issue.”

- Waiver. Unlike the facts of an earlier case involving a “letter of understanding,” the defendant’s LOU in tihs case said that it was “given without prejudice to any and all rights or defenses MSC, its agents or affiliates have or may have in the Proceedings.”

- Contacts. “[T]he dispute’s sole contact with the forum—the DVB’s shipping from the Port of New Orleans—did not occur as a result of MSC’s ‘own choice.’ … [The fact that the DVB was loaded onto the FLAMINIA in New Orleans was the result of “the unilateral activity” of other parties, not MSC.” (citations omitted).

No. 22-30808 (Jan. 29, 2024).

The trademark-infringement issue in Rolex Watch USA, Inc. v Beckertime, LLC turned on whether the customary “digits-of-confusion” analysis should have been augmented by additional considerations involving the refurbishment of trademarked products. The Fifh Circuit agreed with the district court’s treatment of the issue:

The trademark-infringement issue in Rolex Watch USA, Inc. v Beckertime, LLC turned on whether the customary “digits-of-confusion” analysis should have been augmented by additional considerations involving the refurbishment of trademarked products. The Fifh Circuit agreed with the district court’s treatment of the issue:

Champion instructs that a reseller may utilize the trademark of another, so long as it involves nothing more than a restoration to the original condition, and not a new design. In that case, “[f]ull disclosure gives themanufacturer all the protection to which he is entitled.” Here, BeckerTime does more than recondition or repair vintage Rolex watches. As the district court found, BeckerTime produced “modified watches,” with “added diamonds,” “aftermarket bezels,” and aftermarket bracelets or straps. It found that the watches sold by BeckerTime were “materially different than those sold by Rolex.” In fact, the district court found that Rolex has never sold watches matching the descriptions provided by BeckerTime. Unlike the plugs in Champion that “are nevertheless Champion plugs and not those of another make,” BeckerTime’s watches are of another make and cannot properly be called genuine Rolex watches. … Champion’s misnomer exception properly applied to the facts of this case and the district court did not err by conducting a traditional digits of confusion analysis.

No. 22-10866 (Jan. 27, 2024) (citations omitted).

This Instagram video with fonts talking to each other is really funny. Thanks to my law partner Mary Nix for sending it my way.

Rolex Watch USA, Inc. v Beckertime, LLC affirmed a finding of infringement, while also affirming the trial court’s finding that laches precluded a disgorgement award:

Rolex Watch USA, Inc. v Beckertime, LLC affirmed a finding of infringement, while also affirming the trial court’s finding that laches precluded a disgorgement award:

The district court concluded that at a minimum, Rolex’s agent “should have known about BeckerTime in 2010, ten years prior to the filing of the lawsuit, and no later than 2013 when [a Rolex employee] wrote that BeckerTime watches were junk.” … On appeal, Rolex offers no justification for the delay, instead arguing that BeckerTime failed to show prejudice. But the record supports that the ten years of permitted sales enabled BeckerTime to build up a successful business that it would not otherwise have invested in absent Rolex’s delay in filing suit. This is clear prejudice.

No. 22-10866 (Jan. 26, 2024).

After a massive computer failure, Southwest sued one of its cyber risk insures about five categories of damages (vouchers, frequent-flier miles, etc. used to mitigate the effects of the outage). The district court ruled against Southwest, describing the losses as arising from “purely discretionary” decisions.

After a massive computer failure, Southwest sued one of its cyber risk insures about five categories of damages (vouchers, frequent-flier miles, etc. used to mitigate the effects of the outage). The district court ruled against Southwest, describing the losses as arising from “purely discretionary” decisions.

The Fifth Circuit reversed. Acknowledging that the policy covered “all Loss … that in Insured incurs … solely as a result of a System Failure,” the Court reasoned:

Here, Liberty argues that the system failure cannot be the sole cause of Southwest’s claimed costs because the “independent” and “more direct” cause of those losses was Southwest’s decision to incur them. But those decisions can only be independent, sole causes of the costs if they were the precipitating causes of the costs. The decisions, like the infection in Wright or the medical complications in Wells, were not precipitating causes that competed with the system failure, but links in a causal chain that led back to the system failure.

Accordingly, the Court reversed and remanded. Southwest Airlines Co. v. Liberty Ins. Underwriters, Inc., No. 22-10942 (Jan. 16, 2024). The Court noted that “[t]he parties concede that there are no cases directly on point in the context of business interruption insurance.”

A challenge to the sale of a preference claim was rejected by the Fifth Circuit in Briar Capital v. Remmert: “[P]reference actions may be sold pursuant to 11 U.S.C. § 363(b)(1) because they are property of the estate under 11 U.S.C. §§ 541(a)(1) and (7). ” No. 22-20536 (Jan. 22, 2024).

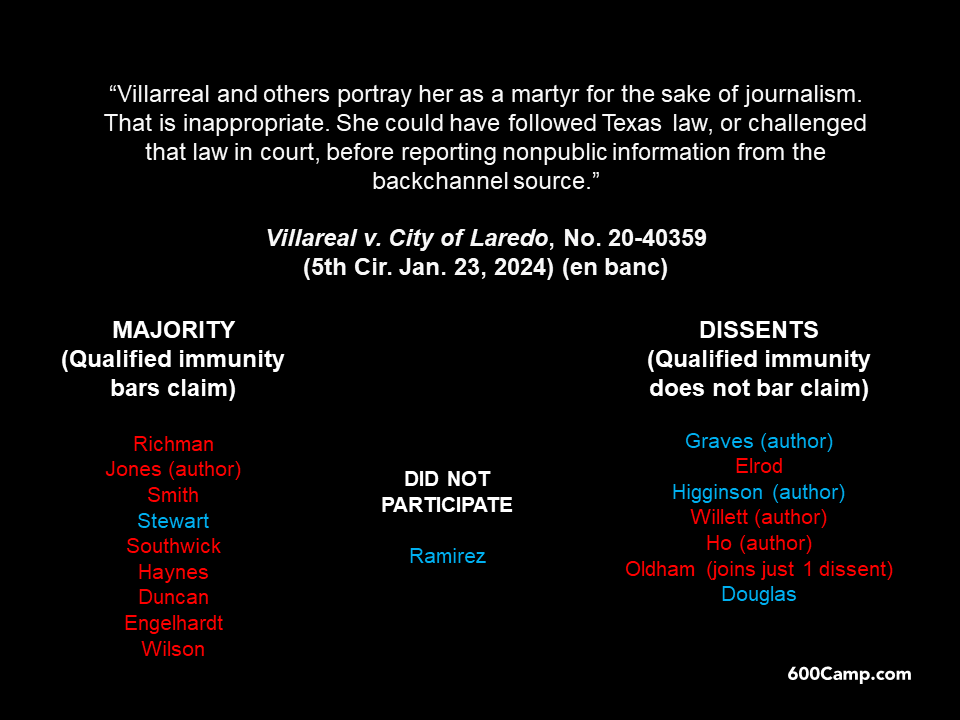

By a 9-7 margin, the full Fifth Circuit held that qualified immunity barred the wrongful-arrest claims of a Laredo “citizen-journalist.” Villarreal v. City of Laredo, No. 20-40359 (Jan. 23, 2024). The breakdown of votes appears below:

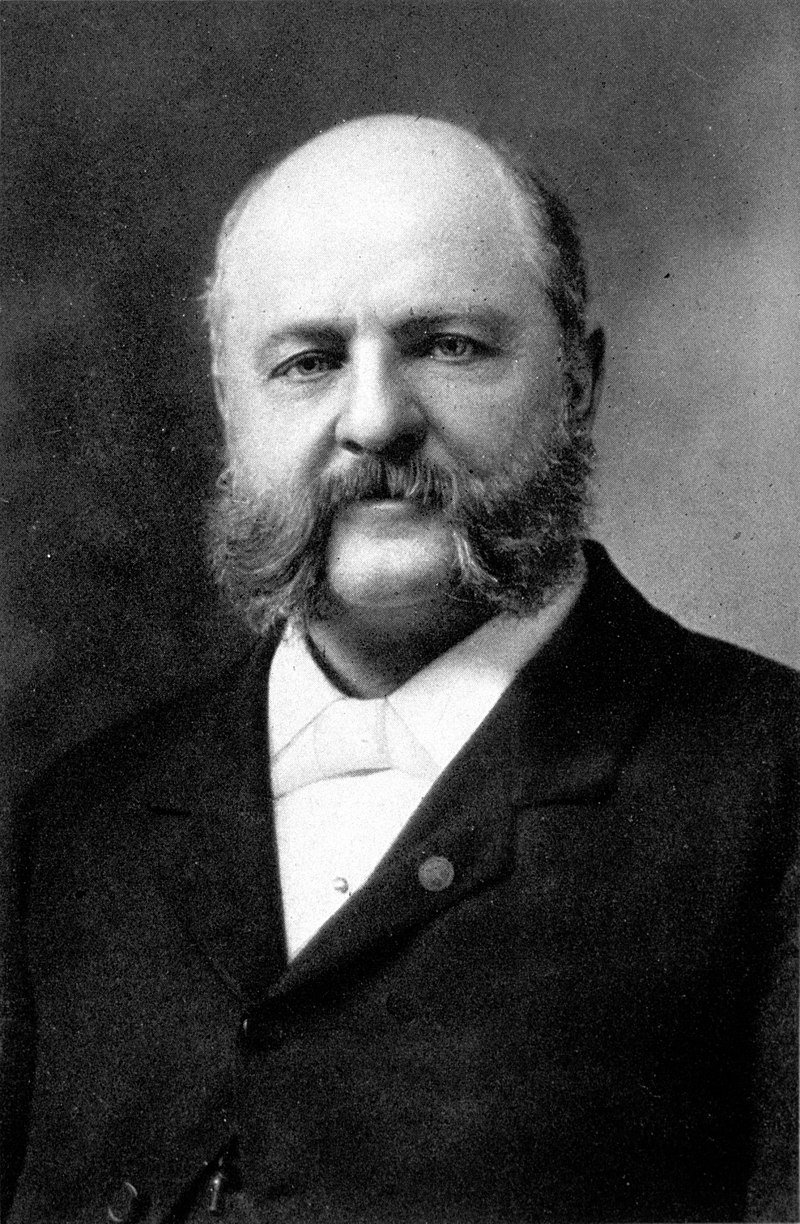

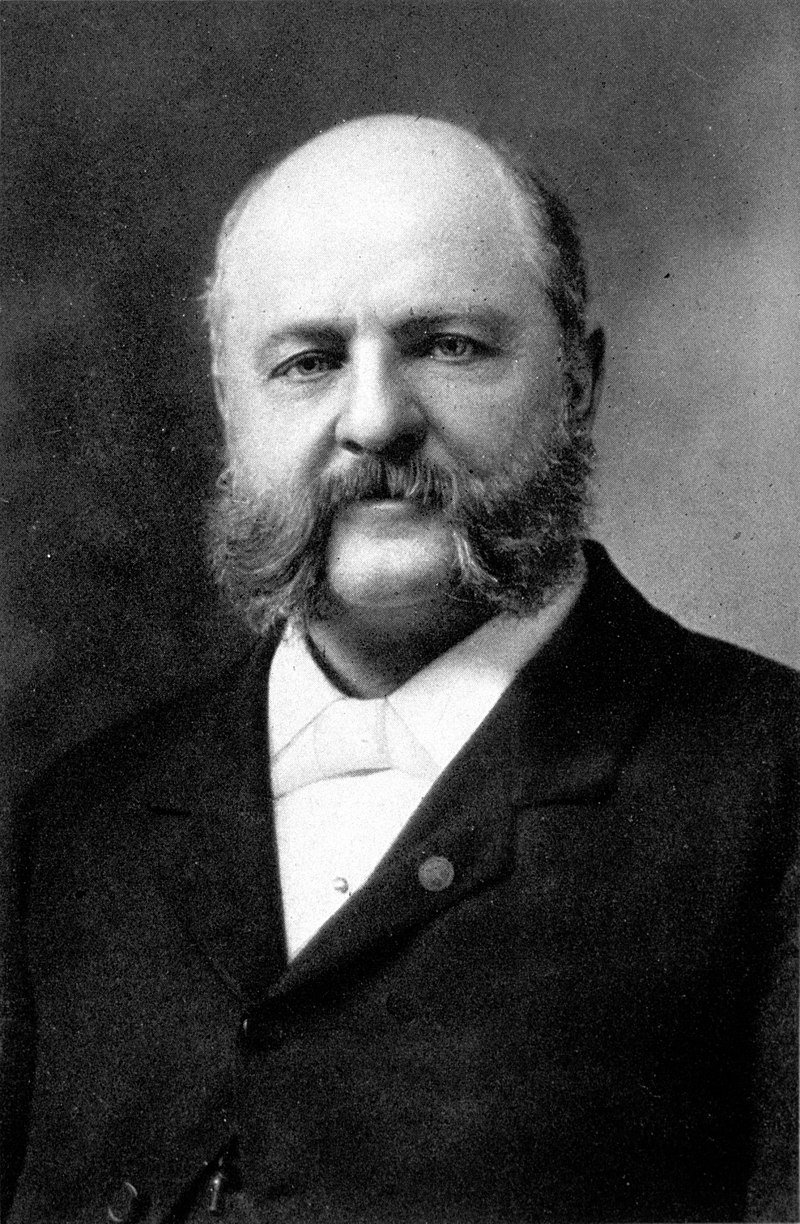

To the right appears William Humphrey, who like William Marbury, is known to history as the subject matter of a famous opinion. President Roosevelt’s efforts to remove Humphrey from the Federal Trade Commission led to the 1935 Supreme Court case of Humphrey’s Executor v. United States, about constitutional limits on the structure of administrative agencies. (Humphrey died during the litigation so his executor continued with the matter). In Consumers’ Research v. CPSC, the Fifth Circuit summarized the current state of the issue addressed by Humphrey’s Executor as follows:

To the right appears William Humphrey, who like William Marbury, is known to history as the subject matter of a famous opinion. President Roosevelt’s efforts to remove Humphrey from the Federal Trade Commission led to the 1935 Supreme Court case of Humphrey’s Executor v. United States, about constitutional limits on the structure of administrative agencies. (Humphrey died during the litigation so his executor continued with the matter). In Consumers’ Research v. CPSC, the Fifth Circuit summarized the current state of the issue addressed by Humphrey’s Executor as follows:

The Humphrey’s exception traditionally “has applied only to multimember bodies of experts.” Sitting en banc, we recently described the exception like this: Congress’s decision “limiting the President to ‘for cause’ removal is not sufficient to trigger a separation-of-powers violation.” Instead, for-cause removal creates a separation-of-powers problem only if it “combine[s]” with “other independence-promoting mechanisms” that “work[] together” to “excessively insulate” an independent agency from presidential control.

The plaintiffs in this case argue that the Supreme Court recently upended this framework in Seila Law. In their view, that 2020 decision held that for-cause removal always creates a separation-of-powers violation—at least if the agency at issue exercises substantial executive power (which nearly all agencies do). This is so, the plaintiffs argue, even if for-cause removal is the only structural feature insulating an agency from total presidential control. We do not read Seila Law so broadly. On the contrary, and as in Free Enterprise Fund, the Supreme Court in Seila Law left the Humphrey’s Executor exception “in place.”

No. 22-40328 (Jan. 17, 2024) (citations and footnote omitted).

After carefully reviewing what arguments were properly before it, the Fifth Circuit went on to hold in Shambaugh & Son, LP v. Steadfast Ins. Co. that the plaintiff had not established jurisdiction over an out-of-state insurer: “Steadfast could not have reasonably anticipated being haled into court in Texas simply because Shambaugh’s records were kept in an office (in Austin) maintained by a division (Northstar) of a subsidiary (Shambaugh).” No. 23-50004 (Jan. 18, 2024). The Court noted the insurer’s involvement with other Texas litigation but found those contacts irrelevant and inadequate to establishe jurisdiction.

After carefully reviewing what arguments were properly before it, the Fifth Circuit went on to hold in Shambaugh & Son, LP v. Steadfast Ins. Co. that the plaintiff had not established jurisdiction over an out-of-state insurer: “Steadfast could not have reasonably anticipated being haled into court in Texas simply because Shambaugh’s records were kept in an office (in Austin) maintained by a division (Northstar) of a subsidiary (Shambaugh).” No. 23-50004 (Jan. 18, 2024). The Court noted the insurer’s involvement with other Texas litigation but found those contacts irrelevant and inadequate to establishe jurisdiction.

Shambaugh & Son, LP v. Steadfast Ins. Co. presents a dispute about personal jurisdiction in an insurance-coverage case. The Fifth Circuit began by identifying the arguments properly before it, noting the distinction between waiver and forfeiture:

Shambaugh & Son, LP v. Steadfast Ins. Co. presents a dispute about personal jurisdiction in an insurance-coverage case. The Fifth Circuit began by identifying the arguments properly before it, noting the distinction between waiver and forfeiture:

“The terms waiver and forfeiture—though often used interchangeably by jurists and litigants—are not synonymous.” “Whereas forfeiture is the failure to make the timely assertion of a right, waiver is the ‘intentional relinquishment or abandonment of a known right.’”

Applying those standards, the Court observed, inter alia:

- “… if complaint allegations alone prevented subsequent forfeiture, then

it is difficult to imagine when any claim or argument could ever be forfeited”; - “… if including a claim in a complaint fails to preserve that claim … then a fortiori attaching an exhibit to a pleading does not insulate arguments derived from that exhibit“;

- A statement about choice of law did not avoid forfeiture when that “statement is nested within a broader discussion about forum shopping”;

- An argument about a specific statute was forfeited, and was not saved by a broader discussion about minimum contacts, when the lower-court briefing did not cite that statute and the statutory argument “is narrower and conceptually distinct from [appellant’s] other minimum contacts arguments.”

No. 23-50004 (Jan. 18, 2024).

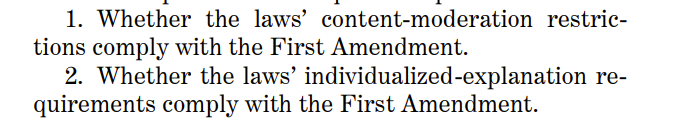

In Book People, Inc. v. Wong, the Fifth Circuit reviewed the constitutionality of the Texas “READER” law, which “requires school book vendors who want to do business with Texas public schools to issue sexual-content ratings for all library materials they have ever sold (or will sell), flagging any materials deemed to be ‘sexually explicit’ or ‘sexually relevant’ based on the materials’ depictions of or references to sex.”

The Court held that the law violated the First Amendment, in that the ratings required by the law were not government speech, and fell within no exception to the rule against “compelled speech”:

- They did not come within the “government operations” exception because they “go[] beyond a mere disclosure of demographic or similar factual information.”

- Similarly, they were not a permissible commercial-speech regulation because “[b]alancing a myriad of factors that depend on community standards is anything but the mere disclosure of factual information.

No. 23-50668 (Jan. 17, 2024).

Please join the Dallas Bar Association Appellate Section at noon on Thursday, January 18, for a lunch presentation by me. I’ll be speaking on trends and cases to know from the past year in the U.S. Court of Appeals for the Fifth Circuit and the Fifth District Court of Appeals. I’ve done a similar presentation around this time of year for a few years now.

Here’s my PowerPoint. This CLE will be in-person at the Arts District Mansion, 2101 Ross in downtown Dallas.

State of Louisiana v. U.S. Dep’t of Energy is an instructive analysis of basic administrative rulemaking concepts, in the unlikely setting of the regulation of washing machines and dishwashers. The substance will be discussed in future posts.

State of Louisiana v. U.S. Dep’t of Energy is an instructive analysis of basic administrative rulemaking concepts, in the unlikely setting of the regulation of washing machines and dishwashers. The substance will be discussed in future posts.

For today, in the “who knew?” department, the plaintiffs were several states, and their standing was based on the substantial purchases that those states made of those appliances. An affidavit quoted in the opinion, for example, describes the purchasing habits of the Montana Highway Patrol as to appliances for its bunkhouses. No. 22-60146 (Jan. 8, 2023).

The issue in Stewart v. Gruber was the exclusion of an untimely expert report; among other points made in affirming, the Fifth Circuit noted:

Plaintiffs fail to identify any precedent barring courts from considering whether the proponent of an untimely expert report declined an opportunity to cure such untimeliness by refusing to join a motion to continue that would have extended deadlines for both parties and therefore lessened any prejudice to the opposing party. Put another way, Plaintiffs were only willing to have extra time for them, not a similar extension for the Defendants who would need to, of course, have an expert that addressed the Plaintiffs’ expert. Such a notion on the part of the Plaintiffs was totally improper.

No. 23-30129 (Dec. 14, 2023, unpublished).

Illumina, Inc. v. FTC provides a comprehensive review of every aspect of an FTC antitrust decision about a merger:

Illumina, Inc. v. FTC provides a comprehensive review of every aspect of an FTC antitrust decision about a merger:

To sum up, Illumina’s constitutional challenges to the FTC’s authority are foreclosed by binding Supreme Court precedent, and substantial evidence supported the Commission’s conclusions that (1) the relevant market is the market for the research, development, and commercialization of MCED tests in the United States; (2) Complaint Counsel carried its initial burden of showing that the Illumina-Grail merger is likely to substantially lessen competition in that market under either the ability-and-incentive test or looking to the Brown Shoe factors; and (3) Illumina had not identified cognizable efficiencies to rebut the anticompetitive effects of the merger. However, in considering the Open Offer, the Commission used a standard that was incompatible with the plain language of the Clayton Act.

No. 23-60167 (Dec. 15, 2023). The “Open Offer” issue involved a dispute about precisely where an agreement, entered to stave off competition-based challenges to this merger, should be considered in the context of the relevant burdens of proof.

The concurrent causation doctrine precluded recovery under an insurance policy for alleged hurricane damage in Shree Rama, LLC v. Mt. Hawley Ins. Co.:

The concurrent causation doctrine precluded recovery under an insurance policy for alleged hurricane damage in Shree Rama, LLC v. Mt. Hawley Ins. Co.:

Shree Rama did not carry its burden under the concurrent causation doctrine. The policy issued by Mt. Hawley explicitly covers damage from wind and explicitly excludes damage from wear and tear. Viewing the facts in the light most favorable to Shree Rama, it is possible that some damage to the hotel roof came from Hurricane Hanna and some from wear and tear. But the concurrent causation doctrine requires Shree Rama to provide the jury with “a reasonable basis” for allocating the damage between wind and wear and tear. . Shree Rama provided no reasonable basis. To the contrary, Shree Rama admitted at the district court level that its causation expert “could not definitively attribute [specific damages to the roof] to Hurricane Hanna when deposed.” Without a basis for allocating damages between covered and non- covered causes, Mt. Hawley was entitled to summary judgment.

No. 23-40123 (Dec. 14, 2023) (citations omitted).

Smith v. Edwards examined whether a preliminary injunction should be vacated when the dispute became moot on appeal:

Smith v. Edwards examined whether a preliminary injunction should be vacated when the dispute became moot on appeal:

“[H]istorically, the established rule was to vacate the judgment if the case became moot on appeal.” However, in U.S. Bancorp Mortgage Co. v. Bonner Mall Partnership, “[t]he Supreme Court made clear and emphasized that vacatur is an ‘extraordinary’ and equitable remedy . . . to be determined on a case-by-case basis.” One principal consideration “is whether the party seeking relief from the judgment . . . caused the mootness by voluntary action.” “Thus, for example, ‘vacatur must be granted where mootness results from the unilateral action of the party who prevailed in the [district] court.’”

The equitable principles espoused in U.S. Bancorp and recognized by Staley apply in this case. Though Defendants complied with the preliminary injunction by removing the youths from BCCY-WF, they did not cause mootness by voluntary action. And though the injunction automatically expired under the PLRA, Plaintiffs could have sought an extension to extend its duration. . Having been “frustrated by the vagaries of circumstance, [Defendants] ought not in fairness be forced to acquiesce in the judgment.

No. 23-30634 (Dec. 19, 2023).

Start the New Year out right with “Get the Last Word in an Effective Reply Brief,” which I recently co-wrote for the Bar Association of the Fifth Federal Circuit with my skillful colleague Campbell Sode – available here along with many other valuable practice pointers by members of that great bar association.

Reiterating a recent holding in a near-identical lawsuit, in Bourque v. State Farm the Fifth Circuit rejected the certification of a class of insureds who were dissatisfied with the amount paid by State Farm for their wrecked cars:

Reiterating a recent holding in a near-identical lawsuit, in Bourque v. State Farm the Fifth Circuit rejected the certification of a class of insureds who were dissatisfied with the amount paid by State Farm for their wrecked cars:

Plaintiffs contended that they had met this standard because any class member who was paid less than the [National Automobile Dealers’ Association] value of their vehicle necessarily received less than [Actual Cash Value] and therefore suffered an injury. But we rejected that premise, explaining that NADA value was just one of many statutorily acceptable methods for calculating ACV, and therefore pinning ACV to NADA value constituted an impermissibly arbitrary choice of a liability model.

No. 22-30126 (Dec. 22, 2023).

The Bar Association of the Fifth Federal Circuit is the bar association to belong to if you’re interested in the work of the U.S. Court of Appeals for the Fifth Circuit. More information about member benefits is detailed on the BAFFC’s website. One of those benefits is a terrific set of short (c. 500 word) articles about appellate practice (here’s an example that I did about a year ago on oral-argument preparation).

The Bar Association of the Fifth Federal Circuit is the bar association to belong to if you’re interested in the work of the U.S. Court of Appeals for the Fifth Circuit. More information about member benefits is detailed on the BAFFC’s website. One of those benefits is a terrific set of short (c. 500 word) articles about appellate practice (here’s an example that I did about a year ago on oral-argument preparation).

Please consider writing one yourself! A link will be emailed out several times to the BAFFC’s thousands of members, as part of its daily updates about recent decisions, and it’ll be available to the membership online as part of the full collection of these pieces. Contact BAFFC administrator Mary Douglas at mary@baffc.org!

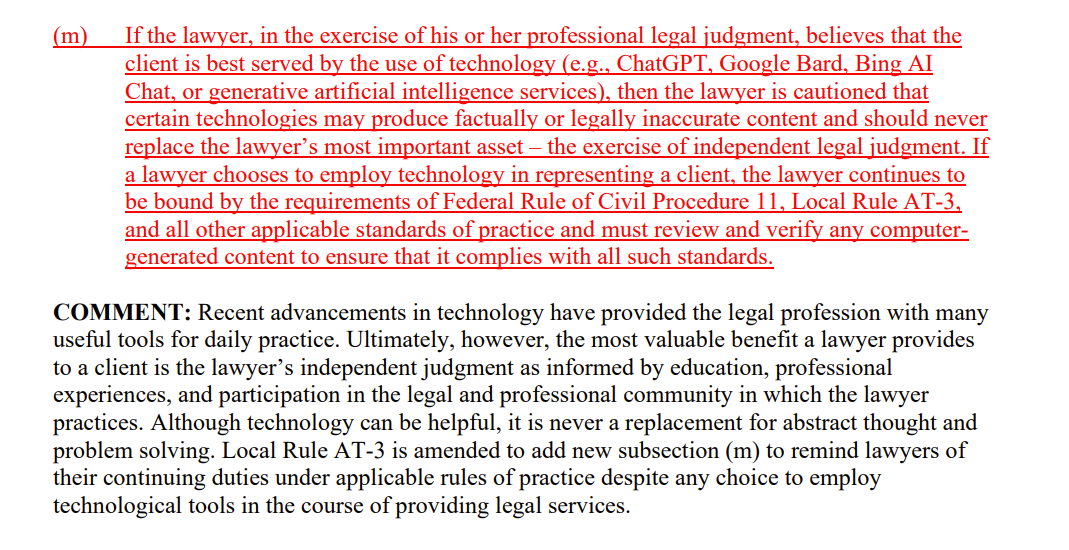

The National Court Reporters Association recently published a fascinating “white paper” about “ethical and legal issues related to the use of artificial intelligence … and digital audio recording of legal proceedings.” It’s succinct, thoughtful, and raises questions relevant to just about any area of law practice or court administration that’s touched by the influence of generative AI and related technologies.

The National Court Reporters Association recently published a fascinating “white paper” about “ethical and legal issues related to the use of artificial intelligence … and digital audio recording of legal proceedings.” It’s succinct, thoughtful, and raises questions relevant to just about any area of law practice or court administration that’s touched by the influence of generative AI and related technologies.

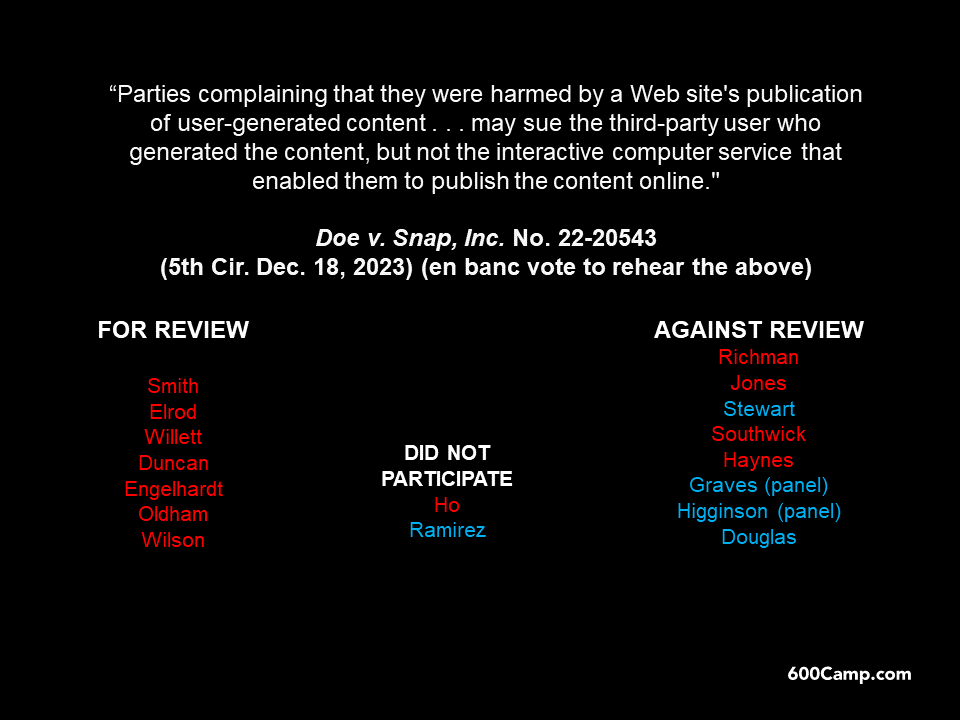

A Fifth Circuit panel applied circuit precedent to reject a liablity claim involving Snapchat in Doe v. Snap, Inc., No. 22-20543 (June 26, 2023), stating: “Parties complaining that they were harmed by a Web site’s publication of user-generated content . . . may sue the third-party user who generated the content, but not the interactive computer service that enabled them to publish the content online.” By a one-vote margin, the full court denied en banc review, as follows (notably, Edith Jones voted with the court’s Democrats to not review the panel opinion):

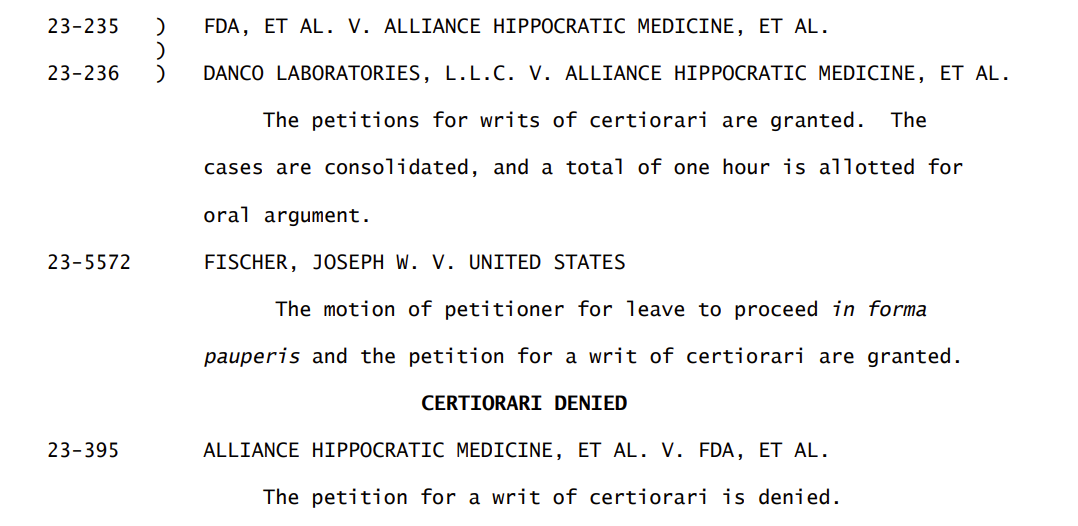

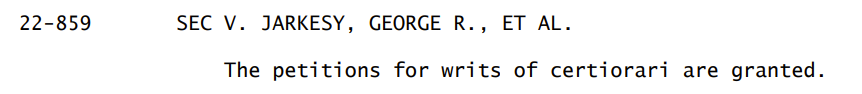

The mifepristone litigation – recently selected by Law360 as the most notable case of 2023 from the Fifth Circuit – will be heard by the Supreme Court. While it did not grant the petition about the original approval of mifepristone, a wide range of significant issues–including important standing questions, and the modern viability of the Comstock Act–are ripe for decision as part of the granted petitions:

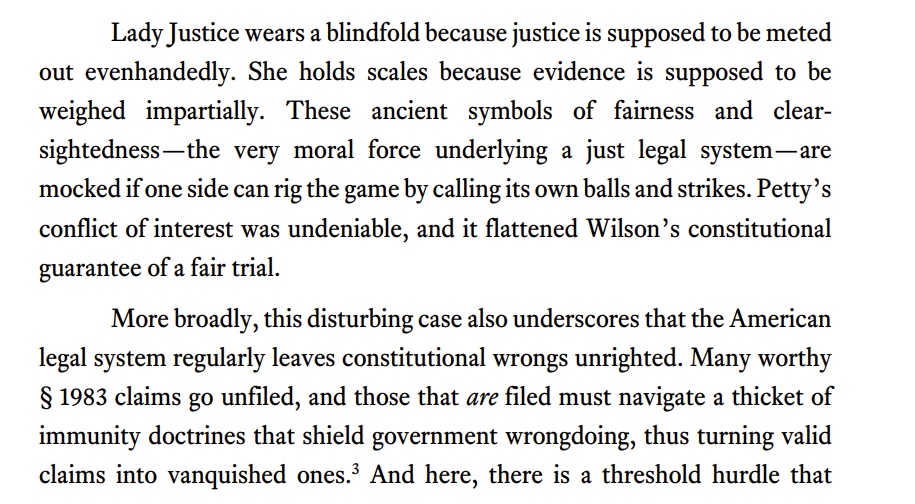

Whatever your views of the remarkable civil-rights issue presented by Wilson v. Midland County (the intersection between some highly technical immunity rules and the bizarre injustice of a county employee working simultaneously for the prosecution and the courts), one can admire the deft prose of Jude Willett’s opinion:

The Fifth Circuit reminded about the basics of issue statements in Smith v. Delta Charter Group, Inc.:

Delta also forfeited its argument that the district court should have instead applied Rule 54(b). Delta didn’t include this argument in its “Statement of the Issue” or in the body of its opening brief—rather, Delta relegated it to a footnote. We have repeatedly cautioned that arguments appearing only in footnotes are “insufficiently addressed in the body of the brief” and are thus forfeited. Delta’s Rule 54(b) argument meets this predictable fate.

No. 23-30063 (Dec. 13, 2023). Note that this is NOT a criticism of the “citational footnote”–and in fact, the concept of the citational footnote rejects this sort of stealthy, footnote-only legal argument.

“Here, ‘all parties have agreed from the beginning of this case that Houston’s voter registration provisions governing circulators’ are unconstitutional. The City also agreed that it ‘would and could not enforce the provisions.’ The City has repeatedly and consistently emphasized its agreement with the plaintiffs throughout this suit. Such faux disputes do not belong in federal court.”

Pool v. City of Houston, No. 22-20491 (Dec. 11, 2023) (citations omitted).

The defendant in a boat-collision case challenged the admission of an accident reconstruction; the plaintiff argued that this point was not preserved. The Fifth Circuit concluded that the defendant had preserved some grounds for objection in a pretrial motion to exclude, a proposed pretrial order, and another pretrial filing about evidence. Thus: “[Defendant’s] pretrial objections preserved the arguments contained in Balkan’s motion in limine concerning authrntication and expert testimony. But neither he nor Balkan argued below that the reconstruction was inadmissible summary judgment evidence. That argument thus was not preserved for appeal.” Marquette Transp. Co. v. Navigation Maritime Bulgare JSC, No. 22-30261 (Dec. 4, 2023).

The defendant in a boat-collision case challenged the admission of an accident reconstruction; the plaintiff argued that this point was not preserved. The Fifth Circuit concluded that the defendant had preserved some grounds for objection in a pretrial motion to exclude, a proposed pretrial order, and another pretrial filing about evidence. Thus: “[Defendant’s] pretrial objections preserved the arguments contained in Balkan’s motion in limine concerning authrntication and expert testimony. But neither he nor Balkan argued below that the reconstruction was inadmissible summary judgment evidence. That argument thus was not preserved for appeal.” Marquette Transp. Co. v. Navigation Maritime Bulgare JSC, No. 22-30261 (Dec. 4, 2023).

The Senate recently confirmed Hon. Irma Ramirez of Dallas as a judge on the Fifth Circuit. When she takes office the Court will again be at a full complement of active judges.

The Senate recently confirmed Hon. Irma Ramirez of Dallas as a judge on the Fifth Circuit. When she takes office the Court will again be at a full complement of active judges.

Eschewing exotic constitutional issues about a state’s rights to engage in military activity, the Fifth Circuit affirmed a preliminary injunction requiring Texas to remove an obstacle from the Rio Grande, citing the federal government’s exclusive authority as to navigable waters. United States v. Abbott, No. 23-50632 (Dec. 1, 2023). A dissent had a different view; some serious consideration of en banc review is likely.

Eschewing exotic constitutional issues about a state’s rights to engage in military activity, the Fifth Circuit affirmed a preliminary injunction requiring Texas to remove an obstacle from the Rio Grande, citing the federal government’s exclusive authority as to navigable waters. United States v. Abbott, No. 23-50632 (Dec. 1, 2023). A dissent had a different view; some serious consideration of en banc review is likely.

After resolving threshold matters about justiciability, the Fifth Circuit rejected facial First Amendment challenges to Texas laws about the use of drones in Nat’l Press Photographers Ass’n v. McCraw, as follows:

After resolving threshold matters about justiciability, the Fifth Circuit rejected facial First Amendment challenges to Texas laws about the use of drones in Nat’l Press Photographers Ass’n v. McCraw, as follows:

- “No-Fly” provisions. “Plaintiffs’ First Amendment challenge to the No-Fly provisions falters because ‘only conduct that is “inherently expressive” is entitled to First Amendment protection.’ The operation of a drone is not inherently expressive—nor is it expressive to fly a drone 400 feet over a prison, sports venue, or critical infrastructure facility. And nothing in the No-Fly provisions has anything to do with speech or expression. These are flight restrictions, not speech restrictions.” (footnotes omitted, emphasis in original).

- “Surveillance” provisions (which prohibit the use of a drone to capture images “with the intent to conduct surveillance ….”). “Though most drone operators harbor no harmful intent, drones have singular potential to help individuals invade the privacy rights of others because they are small, silent, and able to capture images from angles and altitudes no ordinary photographer, snoop, or voyeur would be able to reach. … The law is also tailored to bar only surveillance

that could not be achieved through ordinary means …. We therefore conclude that the law survives intermediate scrutiny.”

No. 22-50337 (Oct. 23, 2023). The opinion was later revised.

An antitrust case in Tennessee recently produced a remarkably contentious dispute about the definition of “double spacing,” as deftly summarized in this “Above the Law” article titled “Heated Litigation Fight Over Double Spacing Ends in Judge Telling Everyone to Shut Up.” While the dispute was picayune, the discussion of just what exactly “double spacing” means is interesting background for a modern word-processing feature that we seldom stop and think about. Thanks to my law partner Chris Schwegmann for flagging this for me.

A series of cases about the EPA’s regulation of small refineries led to a disagreement about Circuit venue over this kind of administrative-agency challenge. A majority appled a two-part test focused on whether the agency action was “nationally applicable”; the dissent rejected the majority’s analysis as inconsistent with statutory text, purpose, and structure. No. 22-60266 etc. (Nov. 22, 2023).

A series of cases about the EPA’s regulation of small refineries led to a disagreement about Circuit venue over this kind of administrative-agency challenge. A majority appled a two-part test focused on whether the agency action was “nationally applicable”; the dissent rejected the majority’s analysis as inconsistent with statutory text, purpose, and structure. No. 22-60266 etc. (Nov. 22, 2023).

The “Lyme Wars” are an ongoing medical controversy about the diagnosis and treatment of Lyme disease. Absent Supreme Court review, one front in those “wars” ended in Torrey v. Infectious Diseases Society of America, in which the Fifth Circuit affirmed the dismissal of defamation claims related to statements in a medical journal: “[T[he district court did not err in holding that IDSA’s Guidelines statements about chronic Lyme disease constitute nonactionable medical opinions.” No. 22-40728 (Nov. 16, 2023).

The “Lyme Wars” are an ongoing medical controversy about the diagnosis and treatment of Lyme disease. Absent Supreme Court review, one front in those “wars” ended in Torrey v. Infectious Diseases Society of America, in which the Fifth Circuit affirmed the dismissal of defamation claims related to statements in a medical journal: “[T[he district court did not err in holding that IDSA’s Guidelines statements about chronic Lyme disease constitute nonactionable medical opinions.” No. 22-40728 (Nov. 16, 2023).

The latest installment in the “Bar Wars” litigation about speech by compulsory bar associations is Boudreaux v. Louisiana State Bar Ass’n, holding:

The latest installment in the “Bar Wars” litigation about speech by compulsory bar associations is Boudreaux v. Louisiana State Bar Ass’n, holding:

[T]he majority of speech Boudreaux objects to is germane. Speech can be germane even if it is “controversial and ideological.” But the LSBA crossed the line when it promoted purely informational articles absent any tailoring to the legal profession. That includes the LSBA’s tweet about student-loan reform and its promotion of the History.com article through a pride flag icon. Advancing generic political and social messages in those ways violates the First Amendment rights of the LSBA’s dissenting members.

No. 22-30564 (Nov. 13, 2023).

The question in Elmen Holdings, LLC v. Martin Marietta Mat’ls, Inc. was whether a gravell-mining lease had terminated. The district court included that it had been terminated, and the appellant’s first issue was that the court’s analysis went too far under the “party-presentation” principle — a concept given new life and relevance by United States v. Sineneng-Smith, 140 S. Ct. 1575 (2020).

The question in Elmen Holdings, LLC v. Martin Marietta Mat’ls, Inc. was whether a gravell-mining lease had terminated. The district court included that it had been terminated, and the appellant’s first issue was that the court’s analysis went too far under the “party-presentation” principle — a concept given new life and relevance by United States v. Sineneng-Smith, 140 S. Ct. 1575 (2020).

The Fifth Circuit concluded that while the appellant’s argument “had some merit,” the trial court did not go too far:

The Fifth Circuit concluded that while the appellant’s argument “had some merit,” the trial court did not go too far:

“[T]he magistrate judge recommended granting Elmen’s motion for summary judgment because Martin Marietta had been late on several royalty payments. The magistrate judge did not ‘radical[ly] transform[]’ this case to such an extent as to constitute an abuse of discretion; she merely took a different route than Martin Marietta and Elmen had suggested to ;decide . . . questions presented by the parties.’ Therefore, the magistrate judge did not violate the party presentation principle by interpreting the Gravel Lease to terminate automatically upon a missed royalty payment, even if that interpretation was contrary to the parties’ reading of their contract.”

No. 23-20023 (Nov. 15, 2023); cf. United Natural Foods v. NLRB, 66 F.4th 536 (5th Cir. 2023) (majority and dissent disagree about whether a particular line of argument is allowed by the party-presentation principle).

Anytime Fitness LLC v. Thornhill Bros. Fitness LLC, acknowledging that a bankruptcy debtor may assign or assume an executory contract, provided an important reminder about the extent of that power: “We reiterate our prior holdings: a debtor assuming an executory contract cannot separate the wheat from the chaff. And we make clear that, when a trustee relies on § 365(f) to assign an executory contract in bankruptcy, it must assign the contract in whole, not in part.” No. 22-30757 (Oct. 27, 2023).

Anytime Fitness LLC v. Thornhill Bros. Fitness LLC, acknowledging that a bankruptcy debtor may assign or assume an executory contract, provided an important reminder about the extent of that power: “We reiterate our prior holdings: a debtor assuming an executory contract cannot separate the wheat from the chaff. And we make clear that, when a trustee relies on § 365(f) to assign an executory contract in bankruptcy, it must assign the contract in whole, not in part.” No. 22-30757 (Oct. 27, 2023).