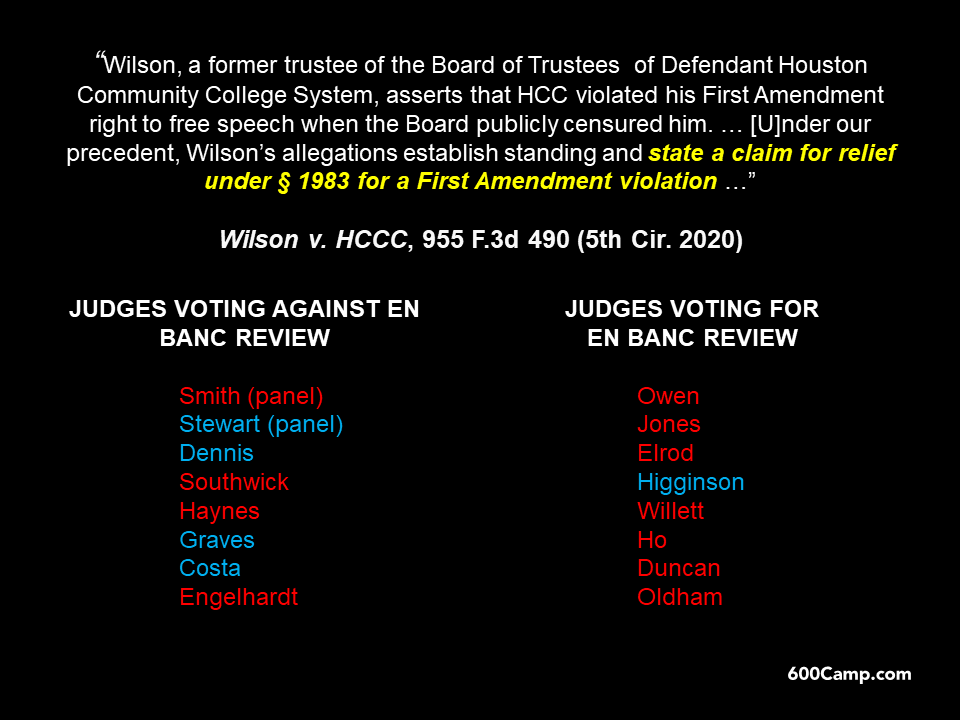

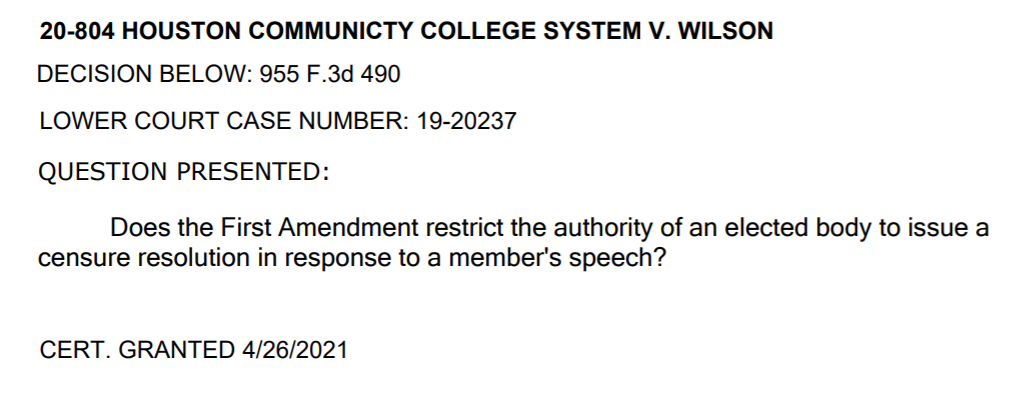

The difficult First Amendment case of Wilson v. Harris County Community College System, 955 F.3d 490 (5th Cir. 2020), produced a panel opinion that allowed an elected member of a community-college board to bring a claim about alleged retaliation for his exercise of First Amendment rights, followed by an 8-8 tie on the question of en banc review. The Supreme Court has now granted review of this fundamental issue about the relationship between elected officials’ rights and the interests of the institutions they serve:  (The first episode of the “Coale Mind” podcast considers this case along with the “Cancel Culture” phenomenon.)

(The first episode of the “Coale Mind” podcast considers this case along with the “Cancel Culture” phenomenon.)

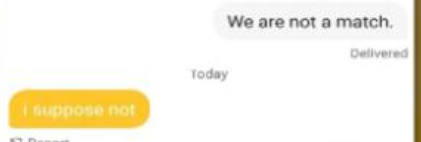

CNN recently reported on a Capitol rioter who was turned in by an unimpressed Bumble match (right). This story illustrates precisely the kind of “red-blue” interaction (admittedly, with less romanticism) that jury service forces when it brings together people of different backgrounds and interactions. These interactions are increasingly important in our divided times, and have taken on new dimensions after the difficult year of 2020. I discuss this topic (jury selection, not date-getting) with top jury consultant Jason Bloom in the most recent episode of the Coale Mind podcast.

CNN recently reported on a Capitol rioter who was turned in by an unimpressed Bumble match (right). This story illustrates precisely the kind of “red-blue” interaction (admittedly, with less romanticism) that jury service forces when it brings together people of different backgrounds and interactions. These interactions are increasingly important in our divided times, and have taken on new dimensions after the difficult year of 2020. I discuss this topic (jury selection, not date-getting) with top jury consultant Jason Bloom in the most recent episode of the Coale Mind podcast.

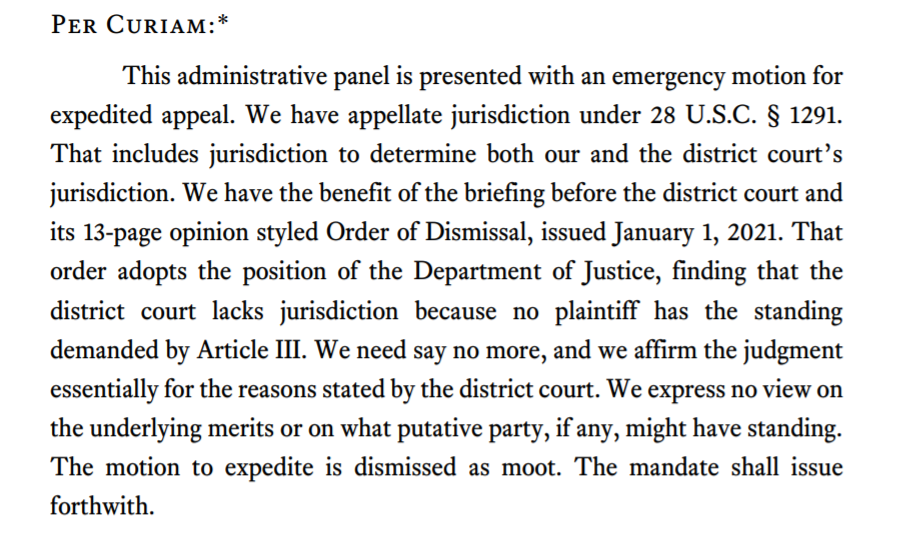

During the course of a long-running contract dispute, the Fifth Circuit remanded the case for further development of the record about diversity jurisdiction. Problems with appellate deadlines for a later appeal ensued; in reviewing the parties’ arguments the Court noted:

During the course of a long-running contract dispute, the Fifth Circuit remanded the case for further development of the record about diversity jurisdiction. Problems with appellate deadlines for a later appeal ensued; in reviewing the parties’ arguments the Court noted:

- “Full” v. “partial” remand. “It is true that in some cases where this court has remanded with a specific directive to the district court, we have retained jurisdiction over the appeal, obviating the need for the appellant to file a new notice of appeal after the district court’s remand proceedings. However, in those cases, this court specified that we retained jurisdiction over the appeal.”

- Effect of an attorneys-fee appeal. “[W]hen the merits judgment has already become final and unappealable, a mere delay of that judgment is no longer possible, and the court lacks any authority under FRAP 4(a)(4)(A)(iii) and FRCP 58[(e)] to modify the finality or the effect of the merits judgment.” (citation omitted).

- Good cause is not GOOD CAUSE. “Rule 4(a)(5), unlike Rule 4(a)(4)(A)(iii) and Rule 58(e), does allow a district court to revive an untimely notice of appeal after the original time to appeal has expired. … Pathway’s motion cannot be construed as a Rule 4(a)(5) motion, however. The extension motion cites Rule 58(e) rather than Rule 4(a)(5), and its arguments are relevant only to the former ….”

Midcap Media Finance LLC v. Pathway Data, Inc., No. 20-50259 (April 20, 2021).

In one corner, there is “Metchup”: “Mr. Dennis Perry makes Metchup, which depending on the batch is a blend of either Walmart-brand mayonnaise and ketchup or Walmart-brand mustard and ketchup. Mr. Perry sells Metchup exclusively from the lobby of a nine-room motel adjacent to his used-car dealership in Lacombe, Louisiana. He has registered Metchup as an incontestable trademark. Though he had big plans for Metchup, sales have been slow. Since 2010, Mr. Perry has produced only 50 to 60 bottles of Metchup, which resulted in sales of around $170 and profits of around $50. He owns www.metchup.com but has never sold Metchup online. For better or worse, the market is not covered in Metchup.”

In one corner, there is “Metchup”: “Mr. Dennis Perry makes Metchup, which depending on the batch is a blend of either Walmart-brand mayonnaise and ketchup or Walmart-brand mustard and ketchup. Mr. Perry sells Metchup exclusively from the lobby of a nine-room motel adjacent to his used-car dealership in Lacombe, Louisiana. He has registered Metchup as an incontestable trademark. Though he had big plans for Metchup, sales have been slow. Since 2010, Mr. Perry has produced only 50 to 60 bottles of Metchup, which resulted in sales of around $170 and profits of around $50. He owns www.metchup.com but has never sold Metchup online. For better or worse, the market is not covered in Metchup.”

In the other corner, there is Heinz: “Along comes Heinz. It makes Mayochup, which is solely a blend of mayonnaise and ketchup. To promote Mayochup’s United States launch, Heinz held an online naming contest where fans proposed names. A fan submitted Metchup, and Heinz posted a mock-up bottle bearing the name Metchup on its website alongside mock-up bottles for the other proposed names. Heinz never sold a product labeled Metchup.”

In the other corner, there is Heinz: “Along comes Heinz. It makes Mayochup, which is solely a blend of mayonnaise and ketchup. To promote Mayochup’s United States launch, Heinz held an online naming contest where fans proposed names. A fan submitted Metchup, and Heinz posted a mock-up bottle bearing the name Metchup on its website alongside mock-up bottles for the other proposed names. Heinz never sold a product labeled Metchup.”

Sadly for Perry’s trademark-infringement claim, the Fifth Circuit concluded: “It would be a coincidence to ever encounter both Mayochup and Metchup in the market, much less get confused about the affiliation, sponsorship, or origin of the two products. Accordingly, no reasonable jury could conclude that Heinz’s use of Metchup in advertising or the sale of its own product, Mayochup, created a likelihood of confusion.” Perry v. H.J. Heinz, No. 20-30418 (April 12, 2021).

This week on the “Coale Mind” podcast, I had top-flight jury consultant Jason Bloom as a special guest; in the episode we touch on the many pervasive effects that 2020 will have on jurors and jury selection, including:

This week on the “Coale Mind” podcast, I had top-flight jury consultant Jason Bloom as a special guest; in the episode we touch on the many pervasive effects that 2020 will have on jurors and jury selection, including:

– A surprising eagerness of people to show up and serve on juries, in part driven by widespread feelings of frustration after months of shutdown;

– Concern about what Jason calls the “massive exercise in confirmation bias” that potential jurors bring to the courthouse with them, depending on how restricted a juror’s information sources may be;

– The once-obscure psychological terms “ultracrepidarian” and “pareidolia” (you have to listen to the podcast to explore those terms’ meaning 🙂;

– Remembering that 2020 changed potential jurors not only because of COVID, but because of Black Lives Matter, the Biden-Trump election and its aftermath, etc.

– And a reminder that jury service—unlike the similar civic-engagement exercise of voting—forces jurors to form a consensus among their different beliefs; and

– Why 1-page written questionnaires for potential jurors may be particularly useful now in light of the above issues.

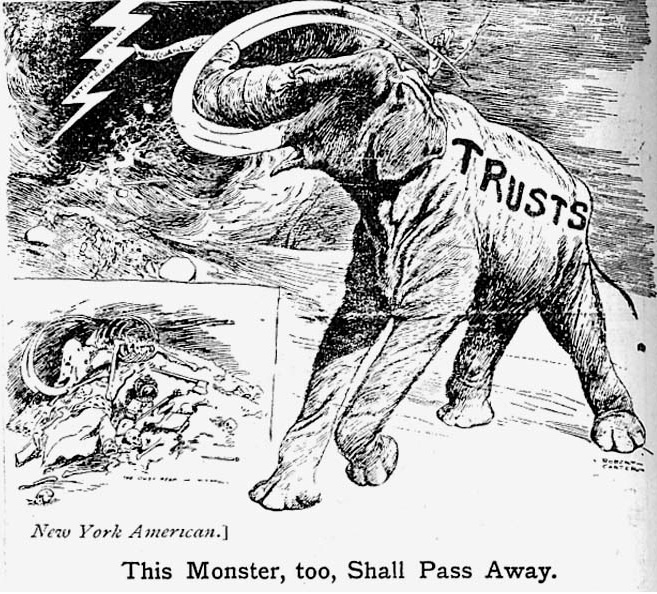

Confronted with the impossibly tangled Gordian Knot, Alexander the Great famously sliced it in half with his sword (right). Confronted with a “counterintuitive flow of money” in the complex intersection between pharmaceutical patents and the antitrust laws, in the Fifth Circuit affirmed the outcome of an FTC proceeding on the narrowest available ground in Impax Labs v. FTC, No. 19-60394 (April 13, 2021). The case arose from the settlement of a patent case between a brand-drug manufacturer and a generic drug maker, which presented these considerations about competition:

Confronted with the impossibly tangled Gordian Knot, Alexander the Great famously sliced it in half with his sword (right). Confronted with a “counterintuitive flow of money” in the complex intersection between pharmaceutical patents and the antitrust laws, in the Fifth Circuit affirmed the outcome of an FTC proceeding on the narrowest available ground in Impax Labs v. FTC, No. 19-60394 (April 13, 2021). The case arose from the settlement of a patent case between a brand-drug manufacturer and a generic drug maker, which presented these considerations about competition:

- The legal monopoly created by the brand-drug maker’s patent, and the challenge to it posed by the patent dispute;

- The framework established by the Hatch-Waxman Act for FDA approval of a generic drug, which has the practical effect of shifting all of the generic maker’s products into the first six months of manufacture;

- The settlement of the patent dispute by lengthening the brand-drug maker’s

monopoly in exchange for consideration given to the the generic manufacturer (which in turn, potentially worsens the approval “bottleneck” created by the Hatch-Waxman Act);

monopoly in exchange for consideration given to the the generic manufacturer (which in turn, potentially worsens the approval “bottleneck” created by the Hatch-Waxman Act); - The pro-competitive effect of ending a patent monopoly earlier than it might otherwise have ended;

- Whether certain pro-competitive features of the parties’ settlement had a “nexus” to the above payments.

The FTC concluded that these factors made the settlement anticompetitive, and also concluded that the parties had a “less restrictive alternative” available that would have avoided these issues. The Fifth Circuit affirmed on the less-restrictive-alternative ground, finding it supported by “[t]hree evidentiary legs–industry practice, credibility determinations about settlement negotiations, and economic analysis ….”

In an arbitrability dispute, the Fifth Circuit reviewed the basis for federal jurisdiction, noting: “[Vaden v. Discover Bank, 556 U.S. 49 (2009)] then went on to point out a wrinkle. ‘As for jurisdiction over controversies touching arbitration, however, the [Federal Arbitration] Act is something of an anomaly in the realm of federal legislation: It bestows no federal jurisdiction but rather requires for access to a federal forum an independent jurisdictional basis over the parties’ dispute.'” Applied to the case at hand: “Under that “look through” analysis, we hold that this underlying dispute presents a federal question. Polyflow’s arbitration demand included at least three federal statutory claims under the Lanham Act …. What matters is that a federal question—the Lanham Act claims—animated the underlying dispute, not whether Polyflow listed them in its original complaint.” Polyflow LLC v. Specialty RTP LLC, No. 20-20416 (March 30, 2021).

In an arbitrability dispute, the Fifth Circuit reviewed the basis for federal jurisdiction, noting: “[Vaden v. Discover Bank, 556 U.S. 49 (2009)] then went on to point out a wrinkle. ‘As for jurisdiction over controversies touching arbitration, however, the [Federal Arbitration] Act is something of an anomaly in the realm of federal legislation: It bestows no federal jurisdiction but rather requires for access to a federal forum an independent jurisdictional basis over the parties’ dispute.'” Applied to the case at hand: “Under that “look through” analysis, we hold that this underlying dispute presents a federal question. Polyflow’s arbitration demand included at least three federal statutory claims under the Lanham Act …. What matters is that a federal question—the Lanham Act claims—animated the underlying dispute, not whether Polyflow listed them in its original complaint.” Polyflow LLC v. Specialty RTP LLC, No. 20-20416 (March 30, 2021).

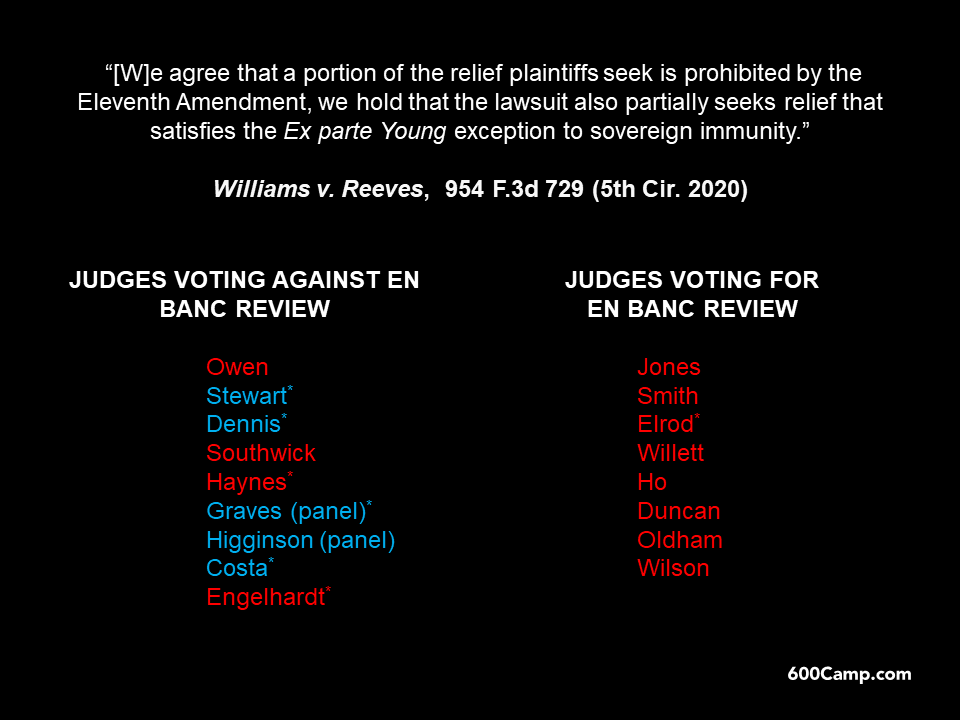

The full Fifth Circuit declined to grant en banc review to State of Texas v. Rettig, 987 F.3d 518 (5th Cir. 2021), which involved constitutional challenges by certain states to two aspects of the Affordable Care Act. They contended that the “Certification Rule” violated the nondelegation doctrine, and that section 9010 of the ACA violated the Spending Clause and the Tenth Amendment’s doctrine of intergovernmental tax immunity. The panel found the laws constitutional, in an opinion by Judge Haynes that was joined by Judges Barksdale and Willett. “In the en banc poll, five judges voted in favor of rehearing (Judges Jones, Smith, Elrod, Ho, and Duncan), and eleven judges voted against rehearing (Chief Judge Owen, and Judges Stewart, Dennis, Southwick, Haynes, Graves, Higginson, Costa, Willett, Engelhardt, and Wilson),” with Judge Oldham not participating, and the five pro-rehearing judges joining a dissent.

The full Fifth Circuit declined to grant en banc review to State of Texas v. Rettig, 987 F.3d 518 (5th Cir. 2021), which involved constitutional challenges by certain states to two aspects of the Affordable Care Act. They contended that the “Certification Rule” violated the nondelegation doctrine, and that section 9010 of the ACA violated the Spending Clause and the Tenth Amendment’s doctrine of intergovernmental tax immunity. The panel found the laws constitutional, in an opinion by Judge Haynes that was joined by Judges Barksdale and Willett. “In the en banc poll, five judges voted in favor of rehearing (Judges Jones, Smith, Elrod, Ho, and Duncan), and eleven judges voted against rehearing (Chief Judge Owen, and Judges Stewart, Dennis, Southwick, Haynes, Graves, Higginson, Costa, Willett, Engelhardt, and Wilson),” with Judge Oldham not participating, and the five pro-rehearing judges joining a dissent.

In Tejero v. Portfolio Recovery Associates, a plaintiff who successfully settled a Fair Debt Collection Practices Act case sought recovery of attorneys’ fees, noting that the FDCPA allows a fee award for a “successful action to enforce …. liability.” The Fifth Circuit held that this language “means a lawsuit that generates a favorable end result compelling accountability and legal compliance with a formal command or decree under the FDCPA. Tejero won no such relief because he settled before his lawsuit reached any end result, let alone a favorable one. And by settling, Portfolio Recovery avoided a formal legal command or decree from Tejero’s lawsuit.” No. 20-50543 (April 7, 2021).

Several years ago, mathematicians rejoiced at the mapping of the world’s most complex structure, the 248-dimension “Lie Group E8” (right). Not to be outdone, the en banc Fifth Circuit has issued Brackeen v. Haaland, a 325-page set of opinions about the constitutionality of the Indian Child Welfare Act–a work so complicated that a six-page per curiam introduction is needed to explain the Court’s divisions on the issues. No. 18-11479 (April 6, 2021). The splits, opinions, and holdings will be reviewed in future posts.

Several years ago, mathematicians rejoiced at the mapping of the world’s most complex structure, the 248-dimension “Lie Group E8” (right). Not to be outdone, the en banc Fifth Circuit has issued Brackeen v. Haaland, a 325-page set of opinions about the constitutionality of the Indian Child Welfare Act–a work so complicated that a six-page per curiam introduction is needed to explain the Court’s divisions on the issues. No. 18-11479 (April 6, 2021). The splits, opinions, and holdings will be reviewed in future posts.

While applying a Louisiana statute, the Fifth Circuit reviewed federal securities law in Firefighters’ Retirement System v. Citco Group Ltd. and concluded that the defendants were not “control persons.” The substantive issue involved “material omissions from [an] offering memorandum”; thus, “to establish that the [defendants] were control persons, the pension plans must show that they had the ability to control the content of the offering memorandum.” The Court noted evidence that (a) the defendants “provided back-office administrative services” to the company at issue and could have stopped providing those services, (b) had made a loan that could have been called, and (c) “held … voting shares for administrative convenience” in a relevant entity, and found this evidence insufficient. No. 20-30654 (March 31, 2021).

While applying a Louisiana statute, the Fifth Circuit reviewed federal securities law in Firefighters’ Retirement System v. Citco Group Ltd. and concluded that the defendants were not “control persons.” The substantive issue involved “material omissions from [an] offering memorandum”; thus, “to establish that the [defendants] were control persons, the pension plans must show that they had the ability to control the content of the offering memorandum.” The Court noted evidence that (a) the defendants “provided back-office administrative services” to the company at issue and could have stopped providing those services, (b) had made a loan that could have been called, and (c) “held … voting shares for administrative convenience” in a relevant entity, and found this evidence insufficient. No. 20-30654 (March 31, 2021).

In an appeal from a reduction of an attorney-fee award in an unpaid-overtime case, the Fifth Circuit affirmed. Among other matters, it noted the interplay of the required “lodestar” calculation with other factors to be considered later in the analysis: “As to the fifteen-percent reduction of the lodestar under the Johnson actors, the magistrate judge was careful to avoid so-

In an appeal from a reduction of an attorney-fee award in an unpaid-overtime case, the Fifth Circuit affirmed. Among other matters, it noted the interplay of the required “lodestar” calculation with other factors to be considered later in the analysis: “As to the fifteen-percent reduction of the lodestar under the Johnson actors, the magistrate judge was careful to avoid so- called ‘double counting’ to the extent that a factor was already accounted for in the initial lodestar determination. Among the factors that were not already subsumed by the lodestar calculation, the magistrate judge emphasized that the success achieved is the most important factor and then also considered the novelty of the issues and preclusion of other employment.” Rodney v. Elliott Security Solutions, No. 20-30251 (April 1, 2021) (unpublished).

called ‘double counting’ to the extent that a factor was already accounted for in the initial lodestar determination. Among the factors that were not already subsumed by the lodestar calculation, the magistrate judge emphasized that the success achieved is the most important factor and then also considered the novelty of the issues and preclusion of other employment.” Rodney v. Elliott Security Solutions, No. 20-30251 (April 1, 2021) (unpublished).

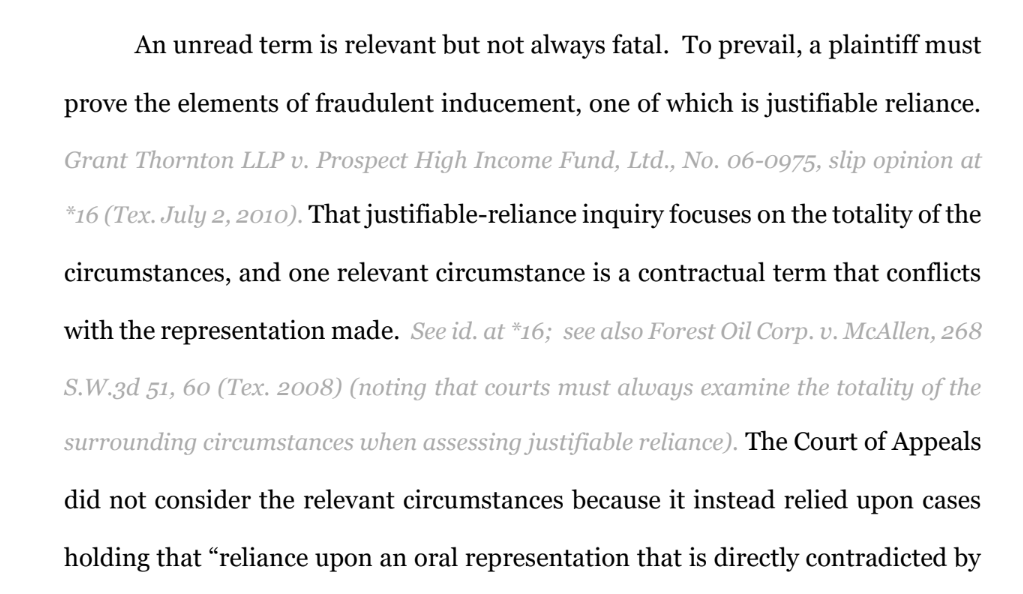

Plaintiffs, businesses that supply information to credit bureaus, sued Lexington Law, a consumer-advocacy organization, for fraud in its preparation of demand letters by consumers. CBE Group v. Lexington Law Firm, No. 20-10166 (April 1, 2021). The Fifth Circuit affirmed JNOV for the law firm, observing problems with the plaintiff’s evidence of:

- A contract. “While Chavarria and Garza may have misunderstood the process through which Lexington Law would represent them (and that misunderstanding may have been prompted by the firm’s actions), they were still bound by the terms of an engagement agreement the validity of which is not in doubt.”

- Reasonable reliance. “Once Plaintiffs developed suspicions that the letters may not have been sent from consumers themselves, they incurred costs in investigating correspondence on their own accord rather than because of the FCRA or the FDCPA. Indeed, Plaintiffs’ internal policies require them to investigate and respond to dispute letters sent by consumers and third parties alike. Thus, Plaintiffs fraud claim falls short for the additional reason that they did not justifiably rely on any alleged misrepresentation.”

The empire of  Genghis Khan stretched across thousands of miles, conquering all that it encountered. While at times, the doctrine of ERISA preemption seems to have a similar track record, it encountered a limit in Atkins v. CB&I, LLC, a dispute about whether a severance plan came within ERISA’s scope. The Fifth Circuit observed that the plan lacked “the ongoing administrative scheme characteristic of an ERISA plan,” specifically noting that it “calls only for a single payment,” the “simplicity of calculating the one-time payment,” that no discretionary decisions were called for as to the specific plaintiffs in this case, and that the situation did not present “any special administrative apparatus dedicated to overseeing the Plan.” No. 20-30004 (March 22, 2021).

Genghis Khan stretched across thousands of miles, conquering all that it encountered. While at times, the doctrine of ERISA preemption seems to have a similar track record, it encountered a limit in Atkins v. CB&I, LLC, a dispute about whether a severance plan came within ERISA’s scope. The Fifth Circuit observed that the plan lacked “the ongoing administrative scheme characteristic of an ERISA plan,” specifically noting that it “calls only for a single payment,” the “simplicity of calculating the one-time payment,” that no discretionary decisions were called for as to the specific plaintiffs in this case, and that the situation did not present “any special administrative apparatus dedicated to overseeing the Plan.” No. 20-30004 (March 22, 2021).

Douglas v. Wells Fargo Bank notes two different approaches that the Fifth Circuit has taken to an aspect of summary-judgment practice: “We have previously addressed the issue of new claims raised for the first time in response to a motion for summary judgment. We have taken two different approaches. The first approach states that a ‘claim which is not raised in the complaint but, rather, is raised only in response to a motion for summary judgment is not properly before the court.’ The second approach

instructs the district court to treat a new claim raised in response to a motion for summary judgment as a request for leave to amend. The district court must then determine whether leave should be granted.” No. 18-11567 (March 26, 2021) (footnotes omitted).

The question whether “manifest disregard of the law” allows a court to vacate an arbitration award lingered in the case law since Hall Street Assocs. v. Mattel, Inc., 552 U.S. 576 (2008), which held that an arbitration agreement cannot create a ground for vacatur or modification beyond those set out in the FAA.

The question whether “manifest disregard of the law” allows a court to vacate an arbitration award lingered in the case law since Hall Street Assocs. v. Mattel, Inc., 552 U.S. 576 (2008), which held that an arbitration agreement cannot create a ground for vacatur or modification beyond those set out in the FAA.

Jones v. Michaels Stores provided “an opportunity to resolve at least one thing that we have directly resolved [about Hall Street]: ‘manifest disregard of the law as an independent, nonstatutory ground for setting aside an award must be abandoned and rejected.” No. 20-30428 (March 15, 2021) (quoting Citigroup Global Markets, Inc. v. Bacon, 562 F.3d 349, 358 (5th Cir. 2009)).

But what of McKool Smith, P.C. v. Curtis Int’l, Ltd., 650 F. App’x 208 (5th Cir. 2016) (per curiam)? Jones clarified that McKool Smith was a case “in which a party argued that an arbitrator’s manifest disregard of the law showed that he had ‘exceeded [his] powers within the meaning of 9 U.S.C. § 10(a)(4).” In that case, “[b]eecause of uncertainty about whether the manifest-disregard standard could still be used as a means of establishing one of the statutory factors, McKool Smith assumed arguendo that it could because the standard was not met in any event.” In this case, however, “[a]s Jones does not invoke any statutory ground for vacatur, Citigroup Global was dispositive of Jones’s challenge to the arbitration award.

The DC Circuit’s recent style manual amendment that criticized the use of “Garamond” font has drawn national attention. As this matter has now become a pressing issue facing the federal courts, 600Camp weighs in with these thoughts, all of which are written in 14-point size:

Accordingly, if you really like Garamond and are writing a brief with a word limit rather than a page limit, you should consider bumping the size up to 15-point. And of course, in a jurisdiction with page limits rather than word limits, Garamond offers a way to add more substance to your submission–but be careful that this extra substance does not come at the price of less visibility.

Recent orders set these matters for en banc reconsideration:

US v. Dubin, in which the panel held: “An issue of first impression for our court is whether David Dubin’s fraudulently billing Medicaid for services not rendered constitutes an illegal ‘use’ of ‘a means of identification of another person’, in violation of 18 U.S.C. § 1028A.”

Daves v. Dallas County, an Ex Parte Young case in which the panel held: “With one exception, we agree with the district court that the Plaintiffs have standing. This suit was properly allowed to proceed against most of the judges and the County. As for the Criminal District Court Judges, though, we hold that they are not proper defendants because the Plaintiffs lack standing as to them and cannot overcome sovereign immunity. We also disagree with the district court and hold that the Sheriff can be enjoined to prevent that official’s enforcement of measures violative of federal law.”

Daves v. Dallas County, an Ex Parte Young case in which the panel held: “With one exception, we agree with the district court that the Plaintiffs have standing. This suit was properly allowed to proceed against most of the judges and the County. As for the Criminal District Court Judges, though, we hold that they are not proper defendants because the Plaintiffs lack standing as to them and cannot overcome sovereign immunity. We also disagree with the district court and hold that the Sheriff can be enjoined to prevent that official’s enforcement of measures violative of federal law.”

Hewitt v. Helix Energy Solutions Group, a 2-1 decision involving “a legal question common to all executive, administrative, and professional employees—and to the modestly and highly compensated alike: whether a worker is paid ‘on a salary basis’ under” the Fair Labor Standards Act.

The Fifth Circuit granted a motion for sanctions as to a motion to supplement the record in Texas Alliance for Retired Americans v. Hugh); the key fact involved the duty of candor to the tribunal: “Appellees did not notify the court that their latest motion to supplement the record filed on February 10, 2021 was nearly identical to the motion to supplement the record filed several months ago by the same attorneys, on September 29, 2020. Critically, Appellees likewise failed to notify the court that their previous and nearly identical motion was denied. This inexplicable failure to disclose the earlier denial of their motion violated their duty of candor to the court.” No. No. 20-40643 (March 11, 2021).

While written in a criminal appeal, Judge Oldham’s recent concurrence about specificity in error preservation is of broad general interest; he concludes:

While written in a criminal appeal, Judge Oldham’s recent concurrence about specificity in error preservation is of broad general interest; he concludes:

“[A] general declaration of ‘insufficient evidence!’ is not a meaningful objection. It challenges no particular legal error. It identifies no particular factual deficiency. It does nothing to focus the district judge’s mind on anything. It’s the litigator’s equivalent of freeing the beagles in a field that might contain truffles. Cf. del Carpio Frescas, 932 F.3d at 331 (“Judges are not like pigs, hunting for truffles buried in the record.” (quotation omitted)). Rather, if the defendant wants to preserve an insufficient-evidence challenge for de novo review, he must make a proper motion under Federal Rule of Criminal Procedure 29 and ‘specify at trial the particular basis on which acquittal is sought so that the Government and district court are provided notice.'”

United States v. Kieffer, No. 19-30225-CR (March 19, 2021). Notes: (1) A big 600Camp thanks to Jeff Levinger for drawing my attention to this case, and (2) Judge Oldham correctly notes that beagles are superior to pigs for finding truffles, as pigs tend to eat the valuable truffles after locating them.

28 USC § 1631 says: “Whenever a civil action is filed in a court as defined in section 610 of this title . . . and that court finds that there is a want of jurisdiction, the court shall, if it is in the interest of justice, transfer such action or appeal to any other such court . . . in which the action or appeal could have been brought at the time it was filed . . ., and the action or appeal shall proceed as if it had been filed in . . . the court to which it is transferred on the date upon which it was actually filed in . . . the court from which it is transferred.” In Franco v. Mabe Trucking Co., the Fifth Circuit concluded that “want of jurisdiction” included both personal and subject-matter jurisdiction, observing: “[I]t appears no circuit split currently exists on this issue, and while we cannot predict how those circuits who have left the question open will ultimately resolve the matter, we decline to now create a split by adopting an overly restrictive reading of § 1631. Because no amount of legislative history can defeat unambiguous statutory text, we join the weight of circuit authority and conclude that the use of the term ‘jurisdiction’ in § 1631 encompasses both subject-matter and personal jurisdiction.” No. 19-30316 (March 18, 2021) (footnote and citation omitted). The Court also found no Erie problem in section 1631’s definition of the relevant filing date for limitations purposes.

28 USC § 1631 says: “Whenever a civil action is filed in a court as defined in section 610 of this title . . . and that court finds that there is a want of jurisdiction, the court shall, if it is in the interest of justice, transfer such action or appeal to any other such court . . . in which the action or appeal could have been brought at the time it was filed . . ., and the action or appeal shall proceed as if it had been filed in . . . the court to which it is transferred on the date upon which it was actually filed in . . . the court from which it is transferred.” In Franco v. Mabe Trucking Co., the Fifth Circuit concluded that “want of jurisdiction” included both personal and subject-matter jurisdiction, observing: “[I]t appears no circuit split currently exists on this issue, and while we cannot predict how those circuits who have left the question open will ultimately resolve the matter, we decline to now create a split by adopting an overly restrictive reading of § 1631. Because no amount of legislative history can defeat unambiguous statutory text, we join the weight of circuit authority and conclude that the use of the term ‘jurisdiction’ in § 1631 encompasses both subject-matter and personal jurisdiction.” No. 19-30316 (March 18, 2021) (footnote and citation omitted). The Court also found no Erie problem in section 1631’s definition of the relevant filing date for limitations purposes.

My colleague Michael Hurst wrote an insightful op-ed in the Dallas Morning News about a proposed system of specialized business courts for Texas. He questions whether it fits well with constitutional guaranties of the right to jury trial.

My colleague Michael Hurst wrote an insightful op-ed in the Dallas Morning News about a proposed system of specialized business courts for Texas. He questions whether it fits well with constitutional guaranties of the right to jury trial.

Another voice joined the chorus of appellate observations about perceived excesses involving sealed records in Le v. Exeter Fin. Corp.: “[E]ntrenched litigation practices harden over time, including overbroad sealing practices that shield judicial records from public view for unconvincing (or unarticulated) reasons. Such stipulated sealings are not uncommon. But they are often unjustified. With great respect, we urge litigants and our judicial colleagues to zealously guard the public’s right of access to judicial records their judicial records—so ‘that justice may not be done in a corner.'” No. 20-10377 (March 3, 2021).

Another voice joined the chorus of appellate observations about perceived excesses involving sealed records in Le v. Exeter Fin. Corp.: “[E]ntrenched litigation practices harden over time, including overbroad sealing practices that shield judicial records from public view for unconvincing (or unarticulated) reasons. Such stipulated sealings are not uncommon. But they are often unjustified. With great respect, we urge litigants and our judicial colleagues to zealously guard the public’s right of access to judicial records their judicial records—so ‘that justice may not be done in a corner.'” No. 20-10377 (March 3, 2021).

Equity takes many forms; in Louisiana landlord-tenant law, it manifests as the doctrine of “judicial control.” In Richards Clearview LLC v. Bed Bath & Beyond, the Fifth Circuit observed: “[E]ven assuming arguendo that BB&B defaulted on the lease, the ‘unusual circumstances’ of this case—pandemic-related office closures causing delays in the receipt of notice coupled with prompt efforts to rectify the asserted underpayments— warranted the district court’s exercise of judicial control.” No. 20-30614 (March 8, 2021) (unpublished).

The Fifth Circuit concluded that a magistrate judge lacked jurisdiction to enter final judgment. The parties had conducted an entire wrongful-foreclosure case before a magistrate judge–but, early in the case, on the standard form, PNC expressly declined to allow trial by a magistrate judge. The Court concluded that consent could not be implied in the face of this express refusal. PNC Bank v. Ruiz, No. 20-50255 (March 2, 2021).

During Hurricane Harvey, “to prevent the Lake Conroe Dam from overflowing and failing, the San Jacinto River Authority released from the dam 79,141 cubic feet of water per second—nearly the flow rate of Niagara Falls.” The resulting surge of water destroyed 22 boat slips owned by a condo association, which sought to recover from its insurer. The Fifth Circuit affirmed judgment for the condo association, noting:

During Hurricane Harvey, “to prevent the Lake Conroe Dam from overflowing and failing, the San Jacinto River Authority released from the dam 79,141 cubic feet of water per second—nearly the flow rate of Niagara Falls.” The resulting surge of water destroyed 22 boat slips owned by a condo association, which sought to recover from its insurer. The Fifth Circuit affirmed judgment for the condo association, noting:

- legally, while the policy’s Flood Endorsement says: “We will not pay for loss or damage caused by ‘flood’, arising from . . . [a h]urricane or tropical storm,” it defined a “flood” as “a general and temporary condition of partial or

complete inundation of 2 or more acres of normally dry land areas or of 2 or

more distinct parcels of land (at least one of which is your property) with

water”–and thus does not reach the boat slips, which were on water; - factually, the association offered evidence that the water release “created a suction effect, like a sink drain that is unplugged, but on a much greater scale. Because of the rate at which water was being released, the water on the north side of [the] lake (where the Boat Slips are located) was below normal levels afterwards, despite the rainfall brought by Harvey.”

Playa Vista Conroe v. Ins. Co. of the West, No. 20-20307 (March 5, 2021).

A class of plaintiffs settled with several insurance companies, resolving various disputes about a large sinkhole caused by years of salt mining by Texas Brine Co. Texas Brine objected to the settlement and the Fifth Circuit found that it lacked standing to do so. While “[n]on-settling

A class of plaintiffs settled with several insurance companies, resolving various disputes about a large sinkhole caused by years of salt mining by Texas Brine Co. Texas Brine objected to the settlement and the Fifth Circuit found that it lacked standing to do so. While “[n]on-settling  parties generally lack standing to object to a settlement agreement,” “[a] potential exception exists ‘if the settlement agreement purports tot strip non-settling defendants of rights to contribution or indemnity.” Here, Texas Brine did not not have any right to indemnification or contribution from these insurers for the remaining claims, so it lacked standing to object to the settlement. LeBlanc v. Texas Brine Co., LLC, No. 20-30208 (March 1, 2021).

parties generally lack standing to object to a settlement agreement,” “[a] potential exception exists ‘if the settlement agreement purports tot strip non-settling defendants of rights to contribution or indemnity.” Here, Texas Brine did not not have any right to indemnification or contribution from these insurers for the remaining claims, so it lacked standing to object to the settlement. LeBlanc v. Texas Brine Co., LLC, No. 20-30208 (March 1, 2021).

WickFire won a tortious-interference judgment against TriMax. It claimed that TriMax “committed ‘click fraud’ by repeatedly clicking on WickFire’s advertisements without any intention of making purchases,” which has the effect of driving up WickFire’s costs without any corresponding increase in revenues. The Fifth Circuit reversed, noting:

- Tortious interference with contract. “WickFire produced evidence that a third party had a deleterious financial effect on its bottom line. But as was the case in El Paso Healthcare System, the record here fails to indicate that WickFire’s damages occurred because a co-contracting party breached its agreement with WickFire.”

- Tortious interference with prospective business relations. “WickFire’s damages theory for this claim was grounded in the assertions that TriMax’s tortious conduct delayed the development of TheCoupon.co website by six months and that WickFire lost $334,000 in profits because of that delay. When WickFire’s damages expert was asked how he calculated that dollar figure, the expert said that he had ‘quantified those damages by calculating the amount of profits that [WickFire] lost because of the six-month delay.’ He did not testify as to how he performed that calculation, nor did he point to any data concerning the business generated by TheCoupon.co. This evidence is threadbare and conclusory.”

Wickfire LLC v. Woodruff, No. 17-50340 (Feb. 26, 2021).

The plaintiff in Fontana v. H O V G L L C alleged that a debt collector violated the Fair Debt Collection Act by speaking with his sister. His claim failed because the FDCA requires a “communication,” and in this case: “[T]he conversation between HOVG’s representative and Fontana’s sister did not convey any information regarding a debt, either directly or indirectly. HOVG’s representative did not mention Fontana’s debt at all and did not directly provide any information about it. Instead, HOVG’s representative mentioned ‘an important personal business matter.’ That does not even suggest the existence of a debt, much less provide information about it. The closest HOVG’s representative came to giving information about a debt was providing the name of the debt collector.” No. 20-30471 (Feb. 26, 2021).

A Louisiana statute lets private citizens sue to enforce certain state environmental laws, provided that “any injunction the citizen might obtain must be entered in favor of the Commissioner of Louisiana’s Office of Conservation.” Straightforward substantively, this statute raises federal-jurisdiction questions “that would make for a tough Federal Courts exam.” Grace Ranch LLC v. BP Am. Prod. Co., No. 20-30224 (Feb. 26, 2021). Specifically:

A Louisiana statute lets private citizens sue to enforce certain state environmental laws, provided that “any injunction the citizen might obtain must be entered in favor of the Commissioner of Louisiana’s Office of Conservation.” Straightforward substantively, this statute raises federal-jurisdiction questions “that would make for a tough Federal Courts exam.” Grace Ranch LLC v. BP Am. Prod. Co., No. 20-30224 (Feb. 26, 2021). Specifically:

- Is Louisiana a party to the suit? If so, diversity jurisdiction does not apply. The Fifth Circuit concluded that it was not a party, notwithstanding the potential for relief issued in its name, “because [Louisiana] has not authorized landowners to

sue in its name” in the relevant statute. Similarly, Louisiana is not a real party in interest because the potential for an injunction in its favor is a “contingency,” which would make it “highly inefficient to remand the case to state court only at the end stage of the lawsuit when the injunction might issue.”

sue in its name” in the relevant statute. Similarly, Louisiana is not a real party in interest because the potential for an injunction in its favor is a “contingency,” which would make it “highly inefficient to remand the case to state court only at the end stage of the lawsuit when the injunction might issue.” - Does the 5th Circuit have jurisdiction? The matter was removed to federal court and the district court decided to abstain. Reviewing the not-always-clear history of 28 USC § 1447(c) and the cases applying it, the Court concluded that “a discretionary remand such as one on abstention grounds does not involve a removal ‘defect’ within the meaning of section 1447(c).”

Was Burford abstention appropriate? Grace Ranch involved the remediation of environmental damage caused by a now-outlawed way of storing waste from oil and gas production. The Court reversed the district court’s decision to abstain, agreeing that the case presented “the potential need to decide an unsettled question of state law, in an area of general importance to the State”–but also finding that the case does not involve “an integrated state regulatory scheme in which a federal court’s tapping on one block in the Jenga tower might cause the whole thing to crumble.”

Was Burford abstention appropriate? Grace Ranch involved the remediation of environmental damage caused by a now-outlawed way of storing waste from oil and gas production. The Court reversed the district court’s decision to abstain, agreeing that the case presented “the potential need to decide an unsettled question of state law, in an area of general importance to the State”–but also finding that the case does not involve “an integrated state regulatory scheme in which a federal court’s tapping on one block in the Jenga tower might cause the whole thing to crumble.”

Just over two years ago, in a single-judge order, Judge Costa rejected a request to seal the oral argument in a Deepwater Horizon claim dispute: “As its right, Claimant ID 100246928 has used the federal courts in its attempt to obtain millions of dollars it believes BP owes because of the oil spill. But it should not able to benefit from this public resource while treating it like a private tribunal when there is no good reason to do so. On Monday, the public will be able to access the courtroom it pays for.” BP Expl. & Prod. v. Claimant ID 100246928, 920 F.3d 209 (5th Cir. 2019). An echo of that order appears in a footnote in a mandamus order from earlier this week–unanimous as to substantive relief but with Judge Costa dissenting on the issue of sealing certain filings: “Judge Costa would not grant the motions to seal the motions and briefing, except for sealing the appendices filed in support of the petition in No. 21-40117, based on his conclusion that the parties have not overcome the right of public access to court filings.” A 2016 National Law Journal article further illustrated his views on these issues.

Just over two years ago, in a single-judge order, Judge Costa rejected a request to seal the oral argument in a Deepwater Horizon claim dispute: “As its right, Claimant ID 100246928 has used the federal courts in its attempt to obtain millions of dollars it believes BP owes because of the oil spill. But it should not able to benefit from this public resource while treating it like a private tribunal when there is no good reason to do so. On Monday, the public will be able to access the courtroom it pays for.” BP Expl. & Prod. v. Claimant ID 100246928, 920 F.3d 209 (5th Cir. 2019). An echo of that order appears in a footnote in a mandamus order from earlier this week–unanimous as to substantive relief but with Judge Costa dissenting on the issue of sealing certain filings: “Judge Costa would not grant the motions to seal the motions and briefing, except for sealing the appendices filed in support of the petition in No. 21-40117, based on his conclusion that the parties have not overcome the right of public access to court filings.” A 2016 National Law Journal article further illustrated his views on these issues.

In Texas practice, “a judgment is final either if ‘it actually disposes of every pending claim and party’ or ‘it clearly and unequivocally states that it finally disposes of all claims and all parties.'” Bella Palma LLC v. Young, 601 S.W.3d 799, 801 (Tex. 2021) (emphasis in original, quoting Lehmann v. Har-Con Corp., 39 S.W.3d 191, 205 (Tex. 2001).

In Texas practice, “a judgment is final either if ‘it actually disposes of every pending claim and party’ or ‘it clearly and unequivocally states that it finally disposes of all claims and all parties.'” Bella Palma LLC v. Young, 601 S.W.3d 799, 801 (Tex. 2021) (emphasis in original, quoting Lehmann v. Har-Con Corp., 39 S.W.3d 191, 205 (Tex. 2001).

In federal practice, however, “[w]ithout a [Fed. R. Civ. P.] 54(b) order, ‘any order or other decision, however designated, that adjudicates fewer than all the claims or rights and liabilities of fewer than all the parties does not end the action as to any of the claims or parties.'” Guideone Ins. Co. v. First United Methodist Church of Hereford, No. 20-10528 (Feb. 22, 2021, unpublished) (emphasis in original, quoting Fed. R. Civ. P. 54).

The Texas Lawbook has a great story about a TRO battle in McAllen federal court between Laboratorios Pisa and PepsiCo that led to mandamus proceedings before the Fifth Circuit. This round of their battle ended in a short order late Sunday night that granted the petition; the response is available online but the Court granted PepsiCo’s request to seal its petition and related materials. No. 21-40116 (Feb. 21, 2021).

On rehearing, the Fifth Circuit returned to the case of Echeverry v. Jazz Casino to make an Erie guess about Louisiana negligent-hiring law–specifically, whether it requires actual knowledge or only constructive knowledge. Finding its own precedent, and no on-point Louisiana Supreme Court opinion, the Court then reviewed intermediate-court opinions and

On rehearing, the Fifth Circuit returned to the case of Echeverry v. Jazz Casino to make an Erie guess about Louisiana negligent-hiring law–specifically, whether it requires actual knowledge or only constructive knowledge. Finding its own precedent, and no on-point Louisiana Supreme Court opinion, the Court then reviewed intermediate-court opinions and  “general Louisiana principles of negligence and negligent hiring outside of the context of independent contractors” to conclude that constructive knowledge was sufficient. It declined to certify the issue, reminding that “the availability of certification is such an important resource to this court that we will not risk its continued availability by going to that well too often.” No. 20-30038 (Feb. 17, 2021) (on rehearing).

“general Louisiana principles of negligence and negligent hiring outside of the context of independent contractors” to conclude that constructive knowledge was sufficient. It declined to certify the issue, reminding that “the availability of certification is such an important resource to this court that we will not risk its continued availability by going to that well too often.” No. 20-30038 (Feb. 17, 2021) (on rehearing).

A trial court in the Northern District of Texas dismissed a case, under Fed. R. Civ. P. 41(b), because a lawyer based in the Eastern District did not retain local counsel as required by the local rules. That rule says that a defendant, or the court, “may move to dismiss the action or any claim against it” “[i]f the plaintiff fails to prosecute or to comply with these rules or a court order.” In Campbell v. Wilkinson, the Fifth Circuit concluded: “This case does not involve a violation of either ‘these rules’—that is, the Federal Rules of Civil Procedure—or ‘a court order.’ It involves the violation of a local rule. But Rule 41(b) does not mention local rules. This absence of any express reference to ‘local rules’ in Rule 41(b) thus raises the question whether it is ever appropriate to invoke Rule 41(b) based on nothing more than the violation of a local rule.” The Court concluded that it was not, and reversed because the record did not establish a failure to prosecute. No. 20-1102 (Feb. 19, 2021).

A trial court in the Northern District of Texas dismissed a case, under Fed. R. Civ. P. 41(b), because a lawyer based in the Eastern District did not retain local counsel as required by the local rules. That rule says that a defendant, or the court, “may move to dismiss the action or any claim against it” “[i]f the plaintiff fails to prosecute or to comply with these rules or a court order.” In Campbell v. Wilkinson, the Fifth Circuit concluded: “This case does not involve a violation of either ‘these rules’—that is, the Federal Rules of Civil Procedure—or ‘a court order.’ It involves the violation of a local rule. But Rule 41(b) does not mention local rules. This absence of any express reference to ‘local rules’ in Rule 41(b) thus raises the question whether it is ever appropriate to invoke Rule 41(b) based on nothing more than the violation of a local rule.” The Court concluded that it was not, and reversed because the record did not establish a failure to prosecute. No. 20-1102 (Feb. 19, 2021).

Joint and several (or “solidary”) liability does not mean shared jurisdictional contacts: “Libersat argues that, because they are solidary obligors, each defendant’s respective contacts with Louisiana should be imputed to every other defendant. Libersat asks, ‘If two corporations are obligated for the same performance and can be judicially sanctioned for conduct related to said obligation irrespective of the presence of the other, are they not alter egos?’ No, they are not. Sharing liability is not the same as sharing an identity. As our colleagues in the Ninth Circuit explained, ‘Liability and jurisdiction are independent. . . . Regardless of their joint liability, jurisdiction over each defendant must be established individually.’ Lumping defendants together for jurisdictional purposes merely because they are solidary obligors ‘is plainly unconstitutional.'” Libersat v. Sundance Energy, No. 20-30121 (Oct. 26, 2020).

Joint and several (or “solidary”) liability does not mean shared jurisdictional contacts: “Libersat argues that, because they are solidary obligors, each defendant’s respective contacts with Louisiana should be imputed to every other defendant. Libersat asks, ‘If two corporations are obligated for the same performance and can be judicially sanctioned for conduct related to said obligation irrespective of the presence of the other, are they not alter egos?’ No, they are not. Sharing liability is not the same as sharing an identity. As our colleagues in the Ninth Circuit explained, ‘Liability and jurisdiction are independent. . . . Regardless of their joint liability, jurisdiction over each defendant must be established individually.’ Lumping defendants together for jurisdictional purposes merely because they are solidary obligors ‘is plainly unconstitutional.'” Libersat v. Sundance Energy, No. 20-30121 (Oct. 26, 2020).

Vesting both enhances the image of a distinguished law professor. and creates an exception to the ordinary rule in Mississippi that a right conveyed by a statute comes to an end if the statute is repealed or modified. To qualify as “vested,” a right must satisfy two requirements. First, there must ‘be no condition precedent to the interest’s becoming a present estate’ and, second, it must be ‘theoretically possible to identify who would get the right to possession if the interest should become a present estate at any time.’ Put another way, it must be ‘not contingent’ upon a future event taking place.” As to the claimed right in Harper v. Southern Pine Elec Coop., “the legislature left it up to the board to determine when its revenues were no longer ‘needed’ for specified purposes. Only once the board makes that determination does the statute require it to return those revenues to the members. The right that plaintiffs assert, then, is contingent upon a determination of the board. And a right that is contingent is, definitionally, not vested.” No. 20-60451 (Feb. 8, 2021) (citations omitted).

Vesting both enhances the image of a distinguished law professor. and creates an exception to the ordinary rule in Mississippi that a right conveyed by a statute comes to an end if the statute is repealed or modified. To qualify as “vested,” a right must satisfy two requirements. First, there must ‘be no condition precedent to the interest’s becoming a present estate’ and, second, it must be ‘theoretically possible to identify who would get the right to possession if the interest should become a present estate at any time.’ Put another way, it must be ‘not contingent’ upon a future event taking place.” As to the claimed right in Harper v. Southern Pine Elec Coop., “the legislature left it up to the board to determine when its revenues were no longer ‘needed’ for specified purposes. Only once the board makes that determination does the statute require it to return those revenues to the members. The right that plaintiffs assert, then, is contingent upon a determination of the board. And a right that is contingent is, definitionally, not vested.” No. 20-60451 (Feb. 8, 2021) (citations omitted).

The “Official Stanford Investors Committee” (“OSIC”), a creation of the receivership arising from the Allen Stanford Ponzi scheme, sought to intervene in ongoing tort litigation about the scheme. The Fifth Circuit affirmed the denial of OSIC’s request.

The “Official Stanford Investors Committee” (“OSIC”), a creation of the receivership arising from the Allen Stanford Ponzi scheme, sought to intervene in ongoing tort litigation about the scheme. The Fifth Circuit affirmed the denial of OSIC’s request.

Fed. R. Civ. P. 24(a)(2) sets four requirements for an application to intervene. The first requirement, timeliness, is also defined by reference to four factors. (1) the length of time the movant waited to file, (2) the prejudice to the existing parties from any delay, (3) the prejudice to the movant if intervention is denied, and (4) any unusual circumstances. Here, noting no unusual circumstances, the Court reasoned:

- Length of time. “Using the denial of class certification as the relevant starting point, Appellants waited 18 months before moving to intervene. … In many of our cases where we have found intervention motions to be timely, the delay was much shorter.”

- Prejudice to parties. “The existing parties would experience prejudice in at least two ways if Appellants were granted leave to intervene after a delay of 18 months. First, the existing parties would face a second round of fact discovery, significantly increasing litigation costs. …Second, Appellants’ tardiness will delay final distribution of any recovery.”

- Prejudice to intervenor. After reviewing the complex standing issues surrounding the Stanford claims: “The denial of intervention will not exclude Appellants from recovery even if it were to prejudice them in some way.”

Rotstain v. OSIC, No. 19-11131 (Feb. 3, 2021).

DM Arbor Court v. City of Houston explains that a case may become ripe during the course of the appeal process: “Although some of the ripeness-on-appeal caselaw is couched in the language of discretion, our best reading of the decisions—especially those from the Supreme Court—is that ‘[i]ntervening events that occur after decision in lower courts should be included’ when an appellate court assesses ripeness. Supporting this view is the City’s inability to cite any case in which an appellate court declined to find a dispute ripe when postjudgment events had made it so. And we have an obligation to exercise the jurisdiction Article III and Congress grant us when any impediments, such as prudential concerns, have been eliminated. Cf.Colo. River Water Conservation Dist. v. United States, 424 U.S. 800, 813, 817 (1976) (recognizing that abstention ‘is an extraordinary and narrow exception’ to the ‘virtually unflagging obligation of the federal courts to exercise the jurisdiction given them’).” No. 20-20194 (Feb. 12, 2021) (other citations omitted).

DM Arbor Court v. City of Houston explains that a case may become ripe during the course of the appeal process: “Although some of the ripeness-on-appeal caselaw is couched in the language of discretion, our best reading of the decisions—especially those from the Supreme Court—is that ‘[i]ntervening events that occur after decision in lower courts should be included’ when an appellate court assesses ripeness. Supporting this view is the City’s inability to cite any case in which an appellate court declined to find a dispute ripe when postjudgment events had made it so. And we have an obligation to exercise the jurisdiction Article III and Congress grant us when any impediments, such as prudential concerns, have been eliminated. Cf.Colo. River Water Conservation Dist. v. United States, 424 U.S. 800, 813, 817 (1976) (recognizing that abstention ‘is an extraordinary and narrow exception’ to the ‘virtually unflagging obligation of the federal courts to exercise the jurisdiction given them’).” No. 20-20194 (Feb. 12, 2021) (other citations omitted).

Mississippi Silicon (“MSH”), a manufacturer, was tricked into paying approximately $1 million to a cybercriminal, believing that it was in fact paying one of its regular vendors. MSH sought reimbursement under the “Computer Transfer Fraud” provision of an insurance policy, and the Fifth Circuit affirmed the district court’s conclusion that there was no coverage.

Mississippi Silicon (“MSH”), a manufacturer, was tricked into paying approximately $1 million to a cybercriminal, believing that it was in fact paying one of its regular vendors. MSH sought reimbursement under the “Computer Transfer Fraud” provision of an insurance policy, and the Fifth Circuit affirmed the district court’s conclusion that there was no coverage.

The provision said: “The insurer will pay for loss of . . . Covered Property resulting directly from Computer Transfer Fraud that causes the transfer, payment, or delivery of Covered Property from the Premises or Transfer Account to a person, place, or account beyond the Insured Entity’s control, without the Insured Entity’s knowledge or consent.”

But here: “Coverage under the Computer Transfer Fraud provision is available only when a computer-based fraud scheme causes a transfer of funds without the Insured’s knowledge or consent. Here, three MSH employees affirmatively authorized the transfer; it therefore cannot be said that the fraud caused a transfer without the

company’s knowledge. … [T]he agreement plainly limits coverage to instances in which the transfer is made without knowledge or consent.”

Mississippi Silicon Holdings v. Axis Ins. Co., No. 20-60215 (Feb. 4, 2021) (all emphasis in original).

Section 9.343 of the Texas UCC contains a nonuniform provision, “which grants a first

Section 9.343 of the Texas UCC contains a nonuniform provision, “which grants a first

priority purchase money security interest in oil and gas produced in Texas as well as proceeds in the hands of any ‘first purchaser.’ A ‘first purchaser,’ is in pertinent part, ‘the first person that purchases oil or gas production from an operator or interest owner after the production is severed.’ The statute’s purpose is to ‘provide[] a security interest in favor of interest owners, as secured parties, to secure the obligations of the first purchaser of . . . production, as debtor, to pay the purchase price.’ It effectuates a ‘security interest’ that is ‘perfected automatically without the filing of a financing statement.'” (citations omitted). But Delaware lien-priority law does not recognize  nonuniform UCC provisions, and in Deutsche Bank Trust Co. Americas v. U.S. Energy Devel. Corp., the Fifth Circuit affirmed the bankruptcy court’s conclusion that Delaware law applied to the case before it. The Court observed: “The bankruptcy court adroitly untangled a thorny conflicts of law issue, the result of which, unfortunately, undermines the efficacy of a non-standard UCC provision intended to protect Texas oil and gas producers. . As a result, producers must beware ‘the amazing disappearing security interest’ and continue to file financing statements. The Texas legislature should take note.” No. 19-50646 (Feb. 3, 2021) (citations and footnote omitted).

nonuniform UCC provisions, and in Deutsche Bank Trust Co. Americas v. U.S. Energy Devel. Corp., the Fifth Circuit affirmed the bankruptcy court’s conclusion that Delaware law applied to the case before it. The Court observed: “The bankruptcy court adroitly untangled a thorny conflicts of law issue, the result of which, unfortunately, undermines the efficacy of a non-standard UCC provision intended to protect Texas oil and gas producers. . As a result, producers must beware ‘the amazing disappearing security interest’ and continue to file financing statements. The Texas legislature should take note.” No. 19-50646 (Feb. 3, 2021) (citations and footnote omitted).

An unusual Fed. R. Civ. P. 60(b)(5) proceeding did not create appellate jurisdiction: “This case does not yet involve a final determination of the status of the interpleaded funds. Instead, it involves Rule 60(b)(5) relief from a prior order to disburse funds. The district court was not disbursing funds to the other party, but merely ordering that they be returned to the court’s registry pending the outcome of the state court action on remand. As the district court said, there has been no decision on who is entitled to the money. The final judgment has been set aside. Thus, this court lacks jurisdiction to hear this appeal.” Reed Migraine Centers of Texas v. Chapman, No. 20-10156 (Jan. 28, 2021).

At issue in Big Binder Express LLC v. Liberty Mutual Ins. Co. was the meaning of the term “you.” The Fifth Circuit concluded that the term “you” in the key endorsement about a large deductible, when given its “ordinary and generally accepted meaning,” referred only the named insured and not additional insureds. The Court also rejected the insured’s argument that “damages” meant only a court award of damages. No. 20-60188 (Jan. 27, 2021).

At issue in Big Binder Express LLC v. Liberty Mutual Ins. Co. was the meaning of the term “you.” The Fifth Circuit concluded that the term “you” in the key endorsement about a large deductible, when given its “ordinary and generally accepted meaning,” referred only the named insured and not additional insureds. The Court also rejected the insured’s argument that “damages” meant only a court award of damages. No. 20-60188 (Jan. 27, 2021).

Belliveau v. Barco, Inc., discussed yesterday as to its holding about veil-piercing, also found that the plaintiff had not established a fiduciary relationship with the defendants under Texas law. The Court examined:

- The general principle that “one party’s subjective belief” is insufficient to establish an attorney-client relationship;

- The inadequacy of “vague and conclusory” statements about the parties’ dealings to satisfy that standard (especially if later deposition testimony undermines those statements); and

- The long-standing principle that to establish an informal relationship of “trust and confidence,” that relationship must have existed before the “agreement made

the basis of the suit.”

No. 19-5017 (Jan. 28, 2021). The dissenting judge agreed with the majority on its analysis of this claim.

In a dispute about various licensing agreements, the Fifth Circuit found that Texas law’s requirements for piercing the corporate veil had not been satisfied:

In a dispute about various licensing agreements, the Fifth Circuit found that Texas law’s requirements for piercing the corporate veil had not been satisfied:

“The evidence, when viewed as a whole, does not raise a fact issue regarding Barco’s dishonest purpose or intent to deceive Belliveau in entering into the Barco Sublicense. Piercing the corporate veil is not a cumulative remedy for creditors of corporate or other legal entities in Texas; that theory does not make owners of such entities codefendants for every breach of contract case. It is a remedy to be used when the actions of the entity’s owner amounting to ‘actual fraud’ have rendered the entity unable to pay its debts. The district court properly granted summary judgment on Belliveau’s claim to pierce the corporate veil.”

Specifically, the court reviewed (and rejected) arguments about the consideration exchanged in the licensing agreement, issues about disclosure, and a “badges of fraud” analysis under Texas’s fraudulent-transfer statute. Belliveau v. Barco, Inc., No. 19-50717 (Jan. 28, 2021). A dissent identified issues for trial on these matters.

“Mindful of the fundamental right to fairness in every proceeding–both in fact, and in appearance,” the Fifth Circuit reversed the outcome in a Title VII dispute, and ordered the reassignment to a new district judge on remand, when:

“Mindful of the fundamental right to fairness in every proceeding–both in fact, and in appearance,” the Fifth Circuit reversed the outcome in a Title VII dispute, and ordered the reassignment to a new district judge on remand, when:

From the outset of these suits, the district judge’s actions evinced a prejudgment of Miller’s claims. At the beginning of the Initial Case Management Conference, the judge dismissed sua sponte Miller’s claims against TSUS and UHS, countenancing no discussion regarding the dismissal. Later in the same conference, the judge responded to the parties’ opposition to consolidating Miller’s two cases by telling Miller’s counsel, “I will get credit for closing two cases when I crush you. . . . How will that look on your record?”

And things went downhill from there. The court summarily denied Miller’s subsequent motion for reconsideration, denied Miller’s repeated requests for leave to take discovery (including depositions of material witnesses), and eventually granted summary judgment in favor of SHSU and UHD, dismissing all claims.”

Miller v. Sam Houston State, No. 19-20752 (Jan. 29, 2021).

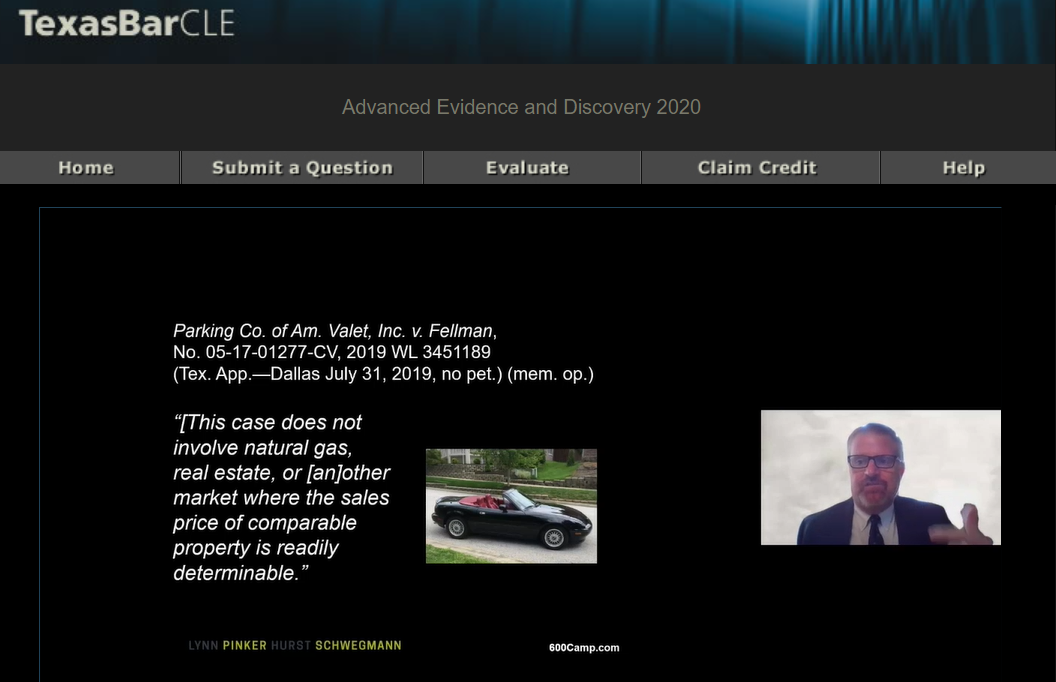

Shah sued about the alleged monopolization of pediatric anesthesiology services in Bexar County. The Fifth Circuit looked to its discussion of market definition in Surgical Care Center of Hammond, L.C. v. Hosp. Serv. Dist. No. 1, 309 F.3d 836, 840 (5th Cir. 2002), which looked for “a showing of where people could practicably go” to obtain the services at issue. Here, Shah failed to satisfy that standard: “He did not even specify individual pediatric anesthesiologists from whom patients could practicably obtain health care services. Rather, he provided tallies, by county, of pediatric anesthesiologists in Texas that fit the anesthesiology requirements of the BHS-STAR Agreement. Moreover, as the BHS parties argue, Shah’s proposed relevant market does not encompass all interchangeable substitute products because it does not include the two non-BHS facilities that the BHS parties contend serve as viable alternatives to BHS facilities. Shah has not provided evidence or any persuasive argument to raise a genuine dispute as to either of those facilities.” Shah v. VHS San Antonio Partners LLC, No. 20-50394 (Jan. 13, 2021).

Shah sued about the alleged monopolization of pediatric anesthesiology services in Bexar County. The Fifth Circuit looked to its discussion of market definition in Surgical Care Center of Hammond, L.C. v. Hosp. Serv. Dist. No. 1, 309 F.3d 836, 840 (5th Cir. 2002), which looked for “a showing of where people could practicably go” to obtain the services at issue. Here, Shah failed to satisfy that standard: “He did not even specify individual pediatric anesthesiologists from whom patients could practicably obtain health care services. Rather, he provided tallies, by county, of pediatric anesthesiologists in Texas that fit the anesthesiology requirements of the BHS-STAR Agreement. Moreover, as the BHS parties argue, Shah’s proposed relevant market does not encompass all interchangeable substitute products because it does not include the two non-BHS facilities that the BHS parties contend serve as viable alternatives to BHS facilities. Shah has not provided evidence or any persuasive argument to raise a genuine dispute as to either of those facilities.” Shah v. VHS San Antonio Partners LLC, No. 20-50394 (Jan. 13, 2021).

An unusual procedural path, winding through a bankruptcy proceeding, led the Fifth Circuit to review a state-court summary judgment. On the issue of the state court’s evidentiary rulings, the Court applied a federal-court approach to a standard form of Texas practice, reasoning: “The grant of these objections improperly excluded important evidence from consideration. To start, the state trial court offered no explanation as to why it granted the objections. It simply checked boxes on a form saying that the objections were sustained. Since a trial court can abuse its discretion by failing to explain the reasons for excluding evidence, the lack of a reasoned explanation weighs in favor of overturning the objections. Courts also typically consider evidence unless the objecting party can show that it could not be reduced to an admissible form at trial.” Cohen v. Gilmore, No. 19-20152 (Dec. 15, 2020) (citations omitted).

An unusual procedural path, winding through a bankruptcy proceeding, led the Fifth Circuit to review a state-court summary judgment. On the issue of the state court’s evidentiary rulings, the Court applied a federal-court approach to a standard form of Texas practice, reasoning: “The grant of these objections improperly excluded important evidence from consideration. To start, the state trial court offered no explanation as to why it granted the objections. It simply checked boxes on a form saying that the objections were sustained. Since a trial court can abuse its discretion by failing to explain the reasons for excluding evidence, the lack of a reasoned explanation weighs in favor of overturning the objections. Courts also typically consider evidence unless the objecting party can show that it could not be reduced to an admissible form at trial.” Cohen v. Gilmore, No. 19-20152 (Dec. 15, 2020) (citations omitted).

Prantil v. Arkema, No. 19-20723 (Jan. 22, 2021), involved class claims about property damage that resulted from a chemical explosion caused by Hurricane Harvey. The Fifth Circuit vacated and remanded the trial court’s class-certification order, holding:

Prantil v. Arkema, No. 19-20723 (Jan. 22, 2021), involved class claims about property damage that resulted from a chemical explosion caused by Hurricane Harvey. The Fifth Circuit vacated and remanded the trial court’s class-certification order, holding:

- “[T]he Daubert hurdle must be cleared when scientific evidence is relevant to the decision to certify”;

- The trial court’s Rule 23(b)(3) analysis fell short in its “discussion of how proof of Arkema’s conduct will affect trial”–specifically, on plaintiff-specific defensive issues about causation, injury, and damages; and

- As to injunctive relief, the order “leaves us uncertain” as to how the extent of necessary property remediation can be determined, and whether a responsive injunction can be fashioned to account for Arkema’s past remediation efforts”–especially if the injunction will rely on the analysis of the class’s experts.

The panel in Gonzalez v. CoreCivic, Inc., No. 19-50691 (Jan. 20, 2021), in the context of an interlocutory appeal certified under 28 USC § 1292, affirmed the denial of a motion to dismiss a claim based on the Trafficking Victims Protection Act of 2000. That law imposes civil liability on on e who “knowingly provides or obtains the labor or services of a person” by certain coercive means. The panel found that the text of the statute unambiguously reached the plaintiffs’ claims against a private company that operated detention facilities for ICE.

A dissent would have found that the plaintiff did not adequately state her claim under Twombly and Iqbal; in response, a concurrence argued that the concept of “party presentation” foreclosed the Court’s review of that matter. North Texas practitioners will recognize echoes of the debate among Justices about supplemental briefing from the Flakes litigation.

Louisiana bar owners contended that a state COVID restriction violated the Equal Protection Clause. The Fifth Circuit disagreed:

Louisiana bar owners contended that a state COVID restriction violated the Equal Protection Clause. The Fifth Circuit disagreed:

“Unlike AG-permitted bars whose primary purpose is to serve alcohol, AR-permitted businesses must serve more food than alcohol to meet their monthly revenue requirements. Even if the Bar Closure Order’s classifications are based solely on the premise that venues whose primary purpose and revenue are driven by alcohol sales rather than food sales are more likely to increase the spread of COVID-19, such a rationale, as described by Dr. Billioux and the Governor and credited by both district courts, is sufficiently ‘plausible’ and not ‘irrational.”’ … [T]he Bar Closure Order’s differential treatment of bars operating with AG permits is at least rationally related to reducing the spread of COVID-19 in higher-risk environments.”

Big Tyme Investments, LLC v. Edwards, No. 20-30526 (Jan. 13, 2021) (citations omitted). The panel majority and a concurrence disputed the exact import of archaic-sounding language from Jacobson v. Massachusetts, 197 U.S. 11 (1905), but did not find it to materially impact the outcome under traditional Equal Protection principles.

The appropriate “gatekeeping” procedures for FLSA cases, which involve the question whether claims are “similarly situated” and thus trigger notice obligations, was thoroughly reviewed in Swales v. KLLM Transport Services, No. 19-60847 (Jan. 12, 2021): “This case poses an issue that has been under-studied but whose importance cannot be overstated: how stringently, and how soon, district courts should enforce § 216(b)’s ‘similarly situated’ mandate. As explained above, the FLSA’s similarity requirement is something that district courts should rigorously enforce at the outset of the litigation.” In reaching this conclusion, the Fifth Circuit disapproved of the widely-cited analysis of this issue in Lusardi v. Xerox Corp., 975 F.2d 964 (3d Cir. 1992).

The appropriate “gatekeeping” procedures for FLSA cases, which involve the question whether claims are “similarly situated” and thus trigger notice obligations, was thoroughly reviewed in Swales v. KLLM Transport Services, No. 19-60847 (Jan. 12, 2021): “This case poses an issue that has been under-studied but whose importance cannot be overstated: how stringently, and how soon, district courts should enforce § 216(b)’s ‘similarly situated’ mandate. As explained above, the FLSA’s similarity requirement is something that district courts should rigorously enforce at the outset of the litigation.” In reaching this conclusion, the Fifth Circuit disapproved of the widely-cited analysis of this issue in Lusardi v. Xerox Corp., 975 F.2d 964 (3d Cir. 1992).

Echeverry v. Jazz Casino Co., LLC, No. 20-30038 (Jan.11, 2021), discussed yesterday, also reviewed the admissibility of four pieces of evidence in a personal-injury trial. The issue was the liability of the LLC that owns Harrah’s Casino in New Orleans for hiring a wildlife-removal contractor to work on its exterior landscaping (“AWR”). The Fifth Circuit found no abuse of discretion by the trial court in admitting them:

The contractor’s “F” rating with the Better Business Bureau. “[T]he BBB evidence is not very probative of the safety and competency of AWR. Still, as we earlier discussed, it might have been properly used by jurors as evidence of the Casino’s failure to investigate AWR adequately. … The evidence of the BBB rating at least added to the jurors’ understanding that the Casino missed another of the markers that could have led to further inquiry, even if the inquiry would not have led to much of significance.”

The contractor’s “F” rating with the Better Business Bureau. “[T]he BBB evidence is not very probative of the safety and competency of AWR. Still, as we earlier discussed, it might have been properly used by jurors as evidence of the Casino’s failure to investigate AWR adequately. … The evidence of the BBB rating at least added to the jurors’ understanding that the Casino missed another of the markers that could have led to further inquiry, even if the inquiry would not have led to much of significance.”- The contractor’s certificate of insurance. “The Casino relies on Federal Rule of Evidence 411, which makes inadmissible the existence or nonexistence of insurance for purposes of proving or disproving a party’s negligence. … Here, AWR’s lack of insurance was not admitted on the issue of AWR’s negligence but to prove the Casino’s negligence in hiring AWR. Rule 411 was not violated.”

- The Casino’s internal policies. “While [an earlier unpublished case] held that internal policies did not establish the applicable standard of care, that panel did not go so far as to say that evidence that a principal violated its internal policies is irrelevant to the question of negligence. We conclude that failure to follow internal policies can be relevant. The district court did not abuse its discretion by admitting the evidence.” (citation omitted).