The Fifth Circuit’s new opinion in Seeligson v. Devon Energy changed its holding about a class-wide damages theory from its earlier opinion. The Court now concludes that while “it is possible that Plaintiffs could demonstrate that [Defendant] breached its implied duty to market” at a certain price, and “[i]f so, this is precisely the type of common question” that would support certification – “this court remains open as to whether damages can be ascertained on a classwide basis” and remanded for further evaluation of whether breach and damages “can be evaluated classwide or if a well-by-well analysis is required.” No. 17-10320 (revised February 20, 2019).

The Fifth Circuit’s new opinion in Seeligson v. Devon Energy changed its holding about a class-wide damages theory from its earlier opinion. The Court now concludes that while “it is possible that Plaintiffs could demonstrate that [Defendant] breached its implied duty to market” at a certain price, and “[i]f so, this is precisely the type of common question” that would support certification – “this court remains open as to whether damages can be ascertained on a classwide basis” and remanded for further evaluation of whether breach and damages “can be evaluated classwide or if a well-by-well analysis is required.” No. 17-10320 (revised February 20, 2019).

Monthly Archives: February 2019

Contemporary mandamus practice in the Fifth Circuit is well-illustrated by In re JPMorgan Chase, in which the Court concluded:

Contemporary mandamus practice in the Fifth Circuit is well-illustrated by In re JPMorgan Chase, in which the Court concluded:

- An order requiring individual notice to 42,000 former Chase employees, as part of the conditional certification of a collective action under the FLSA, was not remediable by an ordinary appeal;

- The issue of whether notice should be sent to employees with arbitration agreements — roughly 30,000 of the relevant employees — “has importance well beyond this case, so mandamus relief would be appropriate;

- The district court’s decision to require notice to those “Arbitration Employees” was not a “clear and indisputable” error, given the state of the case law at the time of its decision; but

- After review of the law, the Court concluded that the district court was in fact wrong. As the court had now “issue[d] this published as a holding on these legal issues,” it stayed the case for thirty days “[t]o facilitate . . . review” of “its decision in light of this opinion, which is now binding precedent throughout the Fifth Circuit.”

No. 18-20825 (Feb. 21, 2019) (applying, inter alia. In re: Depuy Orthopaedics, Inc., 870 F.3d 345, 350 (5th Cir. 2017)).

A Mississippi regulatory board for engineers sought to ban the use of the phrase “Tire Engineers” by an oil-change business (right); the Fifth Circuit disagreed with it: “Evidence offered by both parties, particularly when viewed in the light most favorable to Express as the non-moving party, demonstrates that other states with similar statutes have not challenged the use of the trademark. Thus, despite claims to the contrary, the Board is an outlier in this respect, and it fails to address why alternative, less-restrictive means, such as a disclaimer, would not accomplish its stated goal of protecting the public. The Board thereby fails to satisfy the required burden of demonstrating a reasonable fit between its regulation and the constitutionally-protected speech.” Express Oil Change LLC v. Mississippi Board of Licensure for Profesional Engineers & Surveyors, No. 18-60144 (Feb. 19, 2019).

A Mississippi regulatory board for engineers sought to ban the use of the phrase “Tire Engineers” by an oil-change business (right); the Fifth Circuit disagreed with it: “Evidence offered by both parties, particularly when viewed in the light most favorable to Express as the non-moving party, demonstrates that other states with similar statutes have not challenged the use of the trademark. Thus, despite claims to the contrary, the Board is an outlier in this respect, and it fails to address why alternative, less-restrictive means, such as a disclaimer, would not accomplish its stated goal of protecting the public. The Board thereby fails to satisfy the required burden of demonstrating a reasonable fit between its regulation and the constitutionally-protected speech.” Express Oil Change LLC v. Mississippi Board of Licensure for Profesional Engineers & Surveyors, No. 18-60144 (Feb. 19, 2019).

In a borrower’s lawsuit against the servicer of a home equity loan, the district court entered a partial final judgment pursuant to Fed. R. Civ. P. 54(b) on January 4, 2018. Then, after further review of a remaining claim by a magistrate judge, it entered a second judgment resolving the rest of the case on January 31. The Fifth Circuit held that the notice of appeal was timely as to the second judgment, but not the first. The Court had considerable doubt about whether the appeal of the second judgment could be used to question whether Rule 54(b) had properly been invoked in the first, and also found that the district court had properly used that Rule to handle the borrower’s various claims. Johnson v. Ocwen Loan Servicing LLC, No. 18-10257 (Feb. 21, 2019).

In a borrower’s lawsuit against the servicer of a home equity loan, the district court entered a partial final judgment pursuant to Fed. R. Civ. P. 54(b) on January 4, 2018. Then, after further review of a remaining claim by a magistrate judge, it entered a second judgment resolving the rest of the case on January 31. The Fifth Circuit held that the notice of appeal was timely as to the second judgment, but not the first. The Court had considerable doubt about whether the appeal of the second judgment could be used to question whether Rule 54(b) had properly been invoked in the first, and also found that the district court had properly used that Rule to handle the borrower’s various claims. Johnson v. Ocwen Loan Servicing LLC, No. 18-10257 (Feb. 21, 2019).

Mardi Gras comes late this year – Tuesday, March 5 – here is the energy-filled parade schedule leading up to New Orleans’ big day.

Mardi Gras comes late this year – Tuesday, March 5 – here is the energy-filled parade schedule leading up to New Orleans’ big day.

Wallace alleged that he had been retaliated against in violation of the Sarbanes-Oxley Act; the dispute about the objective reasonableness of his beliefs about the disclosure of sales tax payments in turn led to an accounting dispute, which Wallace lost after his expert was found to not have been properly disclosed. Wallace argued that the pertinent testimony was lay rather than expert, but the Fifth Circuit disagreed:

Wallace alleged that he had been retaliated against in violation of the Sarbanes-Oxley Act; the dispute about the objective reasonableness of his beliefs about the disclosure of sales tax payments in turn led to an accounting dispute, which Wallace lost after his expert was found to not have been properly disclosed. Wallace argued that the pertinent testimony was lay rather than expert, but the Fifth Circuit disagreed:

Rule [the expert]’s training, education, and experience included “‘refinery economics, strategy management for commercial crude oil, business development,’ and . . . ‘transfer pric[ing] between operating segments.’” Notably, Rule did not deal explicitly with tax calculations, SEC reporting requirements, or investor relations. We conclude that Rule’s declaration as to paragraph 22 could not have been based on his lay experience as a Tesoro employee but rather on specialized accounting knowledge. Rule’s opinion on the application of tax accounting definitions to the SEC disclosures is an example of Rule applying his “specialized knowledge” to “help the trier of fact . . . understand the evidence.

Wallace v. Andeavor Corp., No. 17-50927 (Feb. 15, 2019).

The Coen Brothers’ 2008 movie, Burn After Reading, a comedy about spy agencies in pursuit of a “secret” document that is anything but, ends with the leaders of the CIA saying: “‘I guess we learned not to do it again,’ . . . despite not knowing exactly what they did[,]” Similarly, the revised panel majority in Nall v. BNSF Railway Co., in again finding a triable issue on the plaintiff’s disability-discrimination claim, observes:

The Coen Brothers’ 2008 movie, Burn After Reading, a comedy about spy agencies in pursuit of a “secret” document that is anything but, ends with the leaders of the CIA saying: “‘I guess we learned not to do it again,’ . . . despite not knowing exactly what they did[,]” Similarly, the revised panel majority in Nall v. BNSF Railway Co., in again finding a triable issue on the plaintiff’s disability-discrimination claim, observes:

“The dissent from our original opinion, as well as the petition for rehearing en banc and two amicus curiae submissions in support of it, expressed concern that the panel majority had imposed a new requirement for assertion of the direct-threat defense, to-wit: that in addition to showing that the employment decision was objectively reasonable, the employer must also establish that the process itself that was utilized in reaching that decision, considered separately, was objectively reasonable. Without commenting further on the efficacy of such an approach or on whether the panel majority actually adopted it, we emphasize that nothing in this substitute opinion should be understood as employing that reasoning.”

No. 17-20113 (revised Feb. 15, 2019) (emphasis added).A revised special concurrence continued to mourn the sprawl of the McDonnell-Douglas framework; a revised dissent praised the “well articulated” en banc petition and “persuasive” amicus submissions. The original opinions can be read here.

Xitronix Corp. alleged that KLA-Tencor Corp. violated the antitrust laws by fraudulently obtaining a patent from the U.S. Patent and Trademark Office. The trial court granted summary judgment to KLA, appeal was taken to the Federal Circuit, which then transferred the appeal to the Fifth Circuit – who then transferred the case back to the Federal Circuit in Xitronix Corp. v. KLA-Tencor Corp. Distinguishing the recent Supreme Court case about an attorney malpractice claim involving patent law, Gunn v. Minton, 133 S.Ct. 1059 (2013), the Fifth Circuit observed:

Xitronix Corp. alleged that KLA-Tencor Corp. violated the antitrust laws by fraudulently obtaining a patent from the U.S. Patent and Trademark Office. The trial court granted summary judgment to KLA, appeal was taken to the Federal Circuit, which then transferred the appeal to the Fifth Circuit – who then transferred the case back to the Federal Circuit in Xitronix Corp. v. KLA-Tencor Corp. Distinguishing the recent Supreme Court case about an attorney malpractice claim involving patent law, Gunn v. Minton, 133 S.Ct. 1059 (2013), the Fifth Circuit observed:

“This case concerns a patent that is currently valid and enforceable, issued following a PTO proceeding heretofore viewed as lawful. This litigation has the potential to render that patent effectively unenforceable and to declare the PTO proceeding tainted by illegality. This alone distinguishes the present case from Gunn. The adjudication of this Walker Process claim also implicates the interaction between the PTO and Article III courts. The district court’s acerbic statements about the PTO at summary judgment point to the complexity of relations between proceedings in federal court and before the PTO.”

No. 18-50114 (Feb. 15, 2019).

A nonprofit lacked standing to pursue a facial First Amendment challenge to an IRS regulation in Freedom Path, Inc. v. Internal Revenue Service: “Freedom Path’s claimed inability to know what communications will be deemed in pursuit of an exempt function is not an injury arising from the four corners of the Revenue Ruling but quite explicitly from its application beyond the facial terms. Thus, Freedom Path’s claimed chilled-speech injury is not fairly traceable to the text of Revenue Ruling 2004-6, meaning it does not have standing to bring this facial challenge.” No. 18-10092 (Jan. 16, 2019).

A nonprofit lacked standing to pursue a facial First Amendment challenge to an IRS regulation in Freedom Path, Inc. v. Internal Revenue Service: “Freedom Path’s claimed inability to know what communications will be deemed in pursuit of an exempt function is not an injury arising from the four corners of the Revenue Ruling but quite explicitly from its application beyond the facial terms. Thus, Freedom Path’s claimed chilled-speech injury is not fairly traceable to the text of Revenue Ruling 2004-6, meaning it does not have standing to bring this facial challenge.” No. 18-10092 (Jan. 16, 2019).

Alaska Electrical Pension Fund v. Flotek Industries shows how demanding the federal securities laws are as to the issue of “scienter,” The plaintiffs alleged misrepresentations by the defendant about the viability of its software product called “FracMax,” which analyzes data about hydraulically-fractured oil and gas wells. These four alleged misrepresentations were not sufficient to produce the required “strong inference of scienter:

Alaska Electrical Pension Fund v. Flotek Industries shows how demanding the federal securities laws are as to the issue of “scienter,” The plaintiffs alleged misrepresentations by the defendant about the viability of its software product called “FracMax,” which analyzes data about hydraulically-fractured oil and gas wells. These four alleged misrepresentations were not sufficient to produce the required “strong inference of scienter:

- “Defendants’ repeated use of the term “conclusive” in describing FracMax’s effect, which Plaintiffs characterize as tantamount to assuring that FracMax’s data was irrefutable”;

- “Defendants’ reference to FracMax data as “unadjusted” when, in fact, FracMax used an algorithm to adjust certain data”;

- “Defendant Chisholm [the CEO]’s presentation at the September 11, 2015, conference of direct comparisons between several wells that used CnF [a technology measured by FracMax] versus several that did not, which Defendants concede relied on incorrect data for the non-CnF wells”; and

- “Chisholm’s representation at this same conference that this data was ‘back check[ed] and validate[d],’ when Defendants later admitted that ‘Flotek had no internal controls in place to ensure the integrity of the FracMax database.'”

No. 17-20308 (Feb. 7, 2019).

The surprisingly-complex issue of voluntary dismissal, addressed by Fed. R. Civ. P. 41(a), led to the novel question in Welsh v. Correct Care LLC of whether the lack of an answer to an amended complaint, when the original pleading had been answered, allowed an automatic dismissal without prejudice. The Fifth Circuit held that it did not, and further noted that before the district court could condition such a dismissal on it being with prejudice, it would have to give the plaintiff a choice, as “[a] plaintiff typically ‘has the option to refuse a Rule 41(a)(2) voluntary dismissal and to proceed with its case if the conditions imposed by the court are too onerous.'” No. 17-11522 (Feb. 7, 2019).

The surprisingly-complex issue of voluntary dismissal, addressed by Fed. R. Civ. P. 41(a), led to the novel question in Welsh v. Correct Care LLC of whether the lack of an answer to an amended complaint, when the original pleading had been answered, allowed an automatic dismissal without prejudice. The Fifth Circuit held that it did not, and further noted that before the district court could condition such a dismissal on it being with prejudice, it would have to give the plaintiff a choice, as “[a] plaintiff typically ‘has the option to refuse a Rule 41(a)(2) voluntary dismissal and to proceed with its case if the conditions imposed by the court are too onerous.'” No. 17-11522 (Feb. 7, 2019).

The Fifth Circuit sidestepped a question about the scope of the “equitable mootness” doctrine, in favor of reliance on section 363(m) of the Bankruptcy Code, which (in the Court’s summary of the statute’s clunky terms) “limits the ability of appellate courts to review the sale of estate property when the order approving the transaction is not stayed.” To avoid the statute, the would-be appellant “says it does not challenge the sale of the property but only challenges the disbursement of cash to the probate estate.” That distinction did not moo-ve the Court, as it reasoned: “Without the more than $8 million payment, the probate estate would not have released its claim that it owned the Channelview shipyard. And without that release, San Jac Marine likely would have walked away from the deal. As the bankruptcy court noted, there is no way to sever

The Fifth Circuit sidestepped a question about the scope of the “equitable mootness” doctrine, in favor of reliance on section 363(m) of the Bankruptcy Code, which (in the Court’s summary of the statute’s clunky terms) “limits the ability of appellate courts to review the sale of estate property when the order approving the transaction is not stayed.” To avoid the statute, the would-be appellant “says it does not challenge the sale of the property but only challenges the disbursement of cash to the probate estate.” That distinction did not moo-ve the Court, as it reasoned: “Without the more than $8 million payment, the probate estate would not have released its claim that it owned the Channelview shipyard. And without that release, San Jac Marine likely would have walked away from the deal. As the bankruptcy court noted, there is no way to sever

the settlement from the sale; they are mutually dependent.” No. 18-40350 (Feb.5, 2019).

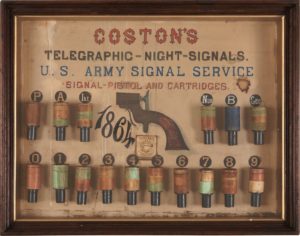

The Coston Flare, the first technically and commercially viable maritime flare, was a universal attention-getting sign at sea for many years. Similarly, the “Rule of Orderliness Opinion” attracts en banc review in the Fifth Circuit; the most recent example being a January 17 panel dissent about circuit precedent on the viability of a patient’s implied right of action under the Medicaid Act, which led to a February 5 vote to take the issue en banc. In that spirit, yesterday’s 3-opinion panel resolution of Wittmer v. Phillips 66 Co.raises the question whether circuit precedent addresses Title VII’s applicability to discrimination based on sexual orientation. No. 18-20251 (Feb. 6, 2019).

The Coston Flare, the first technically and commercially viable maritime flare, was a universal attention-getting sign at sea for many years. Similarly, the “Rule of Orderliness Opinion” attracts en banc review in the Fifth Circuit; the most recent example being a January 17 panel dissent about circuit precedent on the viability of a patient’s implied right of action under the Medicaid Act, which led to a February 5 vote to take the issue en banc. In that spirit, yesterday’s 3-opinion panel resolution of Wittmer v. Phillips 66 Co.raises the question whether circuit precedent addresses Title VII’s applicability to discrimination based on sexual orientation. No. 18-20251 (Feb. 6, 2019).

The Pugas received a substantial judgment in their favor after a jury trial, arising from a collision with a truck controlled by RXC Solutions. The Fifth Circuit substantially affirmed, holding, inter alia:

The Pugas received a substantial judgment in their favor after a jury trial, arising from a collision with a truck controlled by RXC Solutions. The Fifth Circuit substantially affirmed, holding, inter alia:

- Preservation. The defendant’s FRCP 50(b) motion, based on the argument that federal law does not allow courts to hold motor carriers liable for the acts of independent contractors, was not permissible when its 50(a) motion only attacked the sufficiency of the evidence about the driver’s employee status and alleged negligence;

- Jury charge. The district court did not abuse its discretion when it “closely examined the statute, avoided the obvious, overbroad definition of motor carrier, and picked out the correct, limited definition.”

- Expert testimony. The defendant’s objections to the testimony of an accident investigator went to weight rather than admissibility, even though “[i]t did not take into account every possible explanation for the accident, and some measurements were missing.”

- Remittitur. “We measure disproportionality by applying a percentage enhancement to past similar awards. This enhancement is 50% for jury trials.”

Puga v. RCX Solutions, Inc., No. 17-41282 (Feb. 1, 2019).

St. Bernard Parish v. Lafarge North America, the long-running litigation about damages related to Hurricane Katrina and a large Lafarge barge, led to an appeal by Seymour – a former attorney for some of the claimaints, whose attempt to intervene in the case and collect his fee was rejected. The Fifth Circuit affirmed, noting, inter alia, that he was not entitled to rely upon representation of his interests by other parties after his 2011 withdrawal, and that he appeared capable of pursuing relief in other fora. No. 18-30029 (Feb. 1, 2019).

St. Bernard Parish v. Lafarge North America, the long-running litigation about damages related to Hurricane Katrina and a large Lafarge barge, led to an appeal by Seymour – a former attorney for some of the claimaints, whose attempt to intervene in the case and collect his fee was rejected. The Fifth Circuit affirmed, noting, inter alia, that he was not entitled to rely upon representation of his interests by other parties after his 2011 withdrawal, and that he appeared capable of pursuing relief in other fora. No. 18-30029 (Feb. 1, 2019).