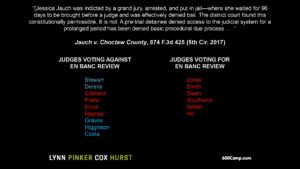

O’Donnell v. Harris County substantially affirmed the district court’s handling of a major civil rights case about Harris County’s pretrial bail system. The key liability holding is of general interest as an important application of equal protection; the key remedy holding is of broader application to any equitable remedy involving a process rather than a substantive result.

O’Donnell v. Harris County substantially affirmed the district court’s handling of a major civil rights case about Harris County’s pretrial bail system. The key liability holding is of general interest as an important application of equal protection; the key remedy holding is of broader application to any equitable remedy involving a process rather than a substantive result.

As to liability, the Court held: “[T]he essence of the district court’s equal protection analysis can be boiled down to the following: take two misdemeanor arrestees who are identical in every way—same charge, same criminal backgrounds, same circumstances, etc.—except that one is wealthy and one is indigent. Applying the County’s current custom and practice, with their lack of individualized assessment and mechanical application of the secured bail schedule, both arrestees would almost certainly receive identical secured bail amounts. One arrestee is able to post bond, and the other is not. As a result, the wealthy arrestee is less likely to plead guilty, more likely to receive a shorter sentence or be acquitted, and less likely to bear the social costs of incarceration. The poor arrestee, by contrast, must bear the brunt of all of these, simply because he has less money than his wealthy counterpart. The district court held that this state of affairs violates the equal protection clause, and we agree.”

And as to remedy: “There is a significant mismatch between the district court’s procedure-focused legal analysis and the sweeping injunction it implemented. The fundamental source of constitutional deficiency in the due process and equal protection analyses is the same: the County’s mechanical application of the secured bail schedule without regard for the individual arrestee’s personal circumstances. Thus,  the equitable remedy necessary to cure the constitutional infirmities arising under both clauses is the same: the County must implement the constitutionally-necessary procedures to engage in a caseby-case evaluation of a given arrestee’s circumstances, taking into account the various factors required by Texas state law (only one of which is ability to pay). These procedures are: notice, an opportunity to be heard and submit evidence within 48 hours of arrest, and a reasoned decision by an impartial decisionmaker. That is not what the preliminary injunction does, however. Rather, it amounts to the outright elimination of secured bail for indigent misdemeanor arrestees.”

the equitable remedy necessary to cure the constitutional infirmities arising under both clauses is the same: the County must implement the constitutionally-necessary procedures to engage in a caseby-case evaluation of a given arrestee’s circumstances, taking into account the various factors required by Texas state law (only one of which is ability to pay). These procedures are: notice, an opportunity to be heard and submit evidence within 48 hours of arrest, and a reasoned decision by an impartial decisionmaker. That is not what the preliminary injunction does, however. Rather, it amounts to the outright elimination of secured bail for indigent misdemeanor arrestees.”

No. 17-2033 (Feb. 14, 2018).

Xitronix Corp. alleged that KLA-Tencor Corp. violated the antitrust laws by fraudulently obtaining a patent from the U.S. Patent and Trademark Office. The trial court granted summary judgment to KLA, appeal was taken to the Federal Circuit, which then transferred the appeal to the Fifth Circuit – who then transferred the case back to the Federal Circuit in Xitronix Corp. v. KLA-Tencor Corp. Distinguishing the recent Supreme Court case about an attorney malpractice claim involving patent law, Gunn v. Minton, 133 S.Ct. 1059 (2013), the Fifth Circuit observed:

Xitronix Corp. alleged that KLA-Tencor Corp. violated the antitrust laws by fraudulently obtaining a patent from the U.S. Patent and Trademark Office. The trial court granted summary judgment to KLA, appeal was taken to the Federal Circuit, which then transferred the appeal to the Fifth Circuit – who then transferred the case back to the Federal Circuit in Xitronix Corp. v. KLA-Tencor Corp. Distinguishing the recent Supreme Court case about an attorney malpractice claim involving patent law, Gunn v. Minton, 133 S.Ct. 1059 (2013), the Fifth Circuit observed:

pects of a deed of trust. With respect to when a servicer could pay the borrower’s property taxes by the servicer, the key provision used the fact-specific phrase “reasonable or appropriate”; other provisions both suggested that the power was limited to back taxes, but also that it could be made “at any time.” Accordingly, “Wease was entitled to proceed to trial on his claim that Ocwen breached the contract by paying his 2010 taxes before the tax lien attached and before they became delinquent.” This analysis led to finding a triable fact issue as to whether Ocwen provided adequate notice of its actions.

pects of a deed of trust. With respect to when a servicer could pay the borrower’s property taxes by the servicer, the key provision used the fact-specific phrase “reasonable or appropriate”; other provisions both suggested that the power was limited to back taxes, but also that it could be made “at any time.” Accordingly, “Wease was entitled to proceed to trial on his claim that Ocwen breached the contract by paying his 2010 taxes before the tax lien attached and before they became delinquent.” This analysis led to finding a triable fact issue as to whether Ocwen provided adequate notice of its actions.  ned to the “good faith” defense to a claim under the Texas Uniform Fraudulent Transfer Act – a defense that potentially allows an innocent third-party to retain the benefit of a transfer made by a debtor with intent to defraud creditors. The specific question was whether the Texas Supreme Court would accept a “futility” defense to inquiry notice, and the Court concluded that it would not: “No prior court considering TUFTA good faith has applied a futility exception to this exception, and we decline to hold that the Supreme Court of Texas would do so. Transferees seeking to retain fraudulent transfers might offer up evidence of undertaken investigations to prove a reasonable person’s suspicions would not have been aroused when the transfer was received. But the fact that a fraud or scheme is later determined to be too complex for discovery does not excuse a finding of inquiry notice and does not warrant the application of TUFTA good faith.” No. 17-11526 (Jan. 9, 2019).

ned to the “good faith” defense to a claim under the Texas Uniform Fraudulent Transfer Act – a defense that potentially allows an innocent third-party to retain the benefit of a transfer made by a debtor with intent to defraud creditors. The specific question was whether the Texas Supreme Court would accept a “futility” defense to inquiry notice, and the Court concluded that it would not: “No prior court considering TUFTA good faith has applied a futility exception to this exception, and we decline to hold that the Supreme Court of Texas would do so. Transferees seeking to retain fraudulent transfers might offer up evidence of undertaken investigations to prove a reasonable person’s suspicions would not have been aroused when the transfer was received. But the fact that a fraud or scheme is later determined to be too complex for discovery does not excuse a finding of inquiry notice and does not warrant the application of TUFTA good faith.” No. 17-11526 (Jan. 9, 2019).

(4) a Daubert challenge to the plaintiff’s expert on warnings

(4) a Daubert challenge to the plaintiff’s expert on warnings