Jeff Heck sought to buy property at a foreclosure sale for $63,000; given 20 minutes to obtain a cashier’s check for that amount, he did not return in time and the property was sold to another buyer. The underlying Texas Property Code provision — the product of a surprising amount of controversy over the years — provides: “The purchase price in a sale held by a trustee . . . is due and payable without delay on acceptance of the bid or within such reasonable time as may be agreed upon[.]” Here, Heck did not pay without delay on acceptance, and he took more time than had been agreed upon, meaning that no violation of the statute occurred. Heck v. Citimortgage, Inc., No. 15-40964 (Jan. 29, 2016, unpublished).

Jeff Heck sought to buy property at a foreclosure sale for $63,000; given 20 minutes to obtain a cashier’s check for that amount, he did not return in time and the property was sold to another buyer. The underlying Texas Property Code provision — the product of a surprising amount of controversy over the years — provides: “The purchase price in a sale held by a trustee . . . is due and payable without delay on acceptance of the bid or within such reasonable time as may be agreed upon[.]” Here, Heck did not pay without delay on acceptance, and he took more time than had been agreed upon, meaning that no violation of the statute occurred. Heck v. Citimortgage, Inc., No. 15-40964 (Jan. 29, 2016, unpublished).

The Houston Professional Towing Association, a persistent if unsuccessful litigant, brought its third challenge to the City of Houston’s “SafeClear” freeway towing program. It argued that recent changes to those ordinances had changed the facts enough to remove a res judicata bar from a previous lawsuit. The Fifth Circuit disagreed, concluding that the purpose of the law remained the same (“to promote safety by expeditiously clearing stalled and wrecked vehicles”), and statistics about collisions after the program began were either indeterminate or showed that it enhanced safety. Houston Professional Towing Association v. City of Houston, No. 15-20117 (Feb. 3, 2016).

The Houston Professional Towing Association, a persistent if unsuccessful litigant, brought its third challenge to the City of Houston’s “SafeClear” freeway towing program. It argued that recent changes to those ordinances had changed the facts enough to remove a res judicata bar from a previous lawsuit. The Fifth Circuit disagreed, concluding that the purpose of the law remained the same (“to promote safety by expeditiously clearing stalled and wrecked vehicles”), and statistics about collisions after the program began were either indeterminate or showed that it enhanced safety. Houston Professional Towing Association v. City of Houston, No. 15-20117 (Feb. 3, 2016).

National Casualty sued its insured in federal court for a declaratory judgment that there was no coverage. The insured sued National Casualty and the insured’s insurance brokers in state court for misleading it about coverage. The district court found that those additional parties were indispensable for the federal action (and would destroy diversity if joined), and abstained under Colorado River from proceeding further. Reminding “that it is not necessary for all joint tortfeasors to be named as defendants in a single lawsuit,” the Fifth Circuit reversed as to the joinder analysis, and also as to abstention, noting in particular that “the federal action has proceeded to summary judgment . . . [and] the state court action has involved little more than an original petition, answers, and a stay of proceedings.” National Casualty Co. v. Gonzalez, No. 15-10478 (Feb. 4, 2016, unpublished).

National Casualty sued its insured in federal court for a declaratory judgment that there was no coverage. The insured sued National Casualty and the insured’s insurance brokers in state court for misleading it about coverage. The district court found that those additional parties were indispensable for the federal action (and would destroy diversity if joined), and abstained under Colorado River from proceeding further. Reminding “that it is not necessary for all joint tortfeasors to be named as defendants in a single lawsuit,” the Fifth Circuit reversed as to the joinder analysis, and also as to abstention, noting in particular that “the federal action has proceeded to summary judgment . . . [and] the state court action has involved little more than an original petition, answers, and a stay of proceedings.” National Casualty Co. v. Gonzalez, No. 15-10478 (Feb. 4, 2016, unpublished).

In Banco Popular v. Kanning, a dispute over entitlement to life insurance proceeds produced two reminders about important, but not often-litigated, principles in business law. No. 15-50342 (Jan. 29, 2016, unpublished). First, an argument that a purported assignment required further actions to become effective failed when the document in question unambiguously said “hereby assign.” The opinion reviews other language in other cases that obscured the assignor’s intent. Second, insurance policy proceeds — while obviously monetary in nature — are sufficiently specific to support an action for conversion (applying Paschal v. Great Western Drilling, 215 S.W.3d 437 (Tex. App.–Eastland 2006, pet. denied)).

In Banco Popular v. Kanning, a dispute over entitlement to life insurance proceeds produced two reminders about important, but not often-litigated, principles in business law. No. 15-50342 (Jan. 29, 2016, unpublished). First, an argument that a purported assignment required further actions to become effective failed when the document in question unambiguously said “hereby assign.” The opinion reviews other language in other cases that obscured the assignor’s intent. Second, insurance policy proceeds — while obviously monetary in nature — are sufficiently specific to support an action for conversion (applying Paschal v. Great Western Drilling, 215 S.W.3d 437 (Tex. App.–Eastland 2006, pet. denied)).

Dr. Barrash, a member of a professional association of neurosurgeons, testified against Dr. Oishi, who was also a group member. Dr. Oishi settled his case and filed a complaint with the association about Dr. Barrash, alleging (among other claims) that Dr. Barrash failed to review all relevant records. The association censured Dr. Barrash, who then sued the association, claiming a denial of due process and a breach of the association’s contract with its members.

Dr. Barrash, a member of a professional association of neurosurgeons, testified against Dr. Oishi, who was also a group member. Dr. Oishi settled his case and filed a complaint with the association about Dr. Barrash, alleging (among other claims) that Dr. Barrash failed to review all relevant records. The association censured Dr. Barrash, who then sued the association, claiming a denial of due process and a breach of the association’s contract with its members.

The district court found a denial of due process as to part of the censure, which the association did not appeal. The Fifth Circuit affirmed the Rule 12 dismissal of the rest of Dr. Barrash’s claims: “Dr. Barrash received sufficient due process, including notice, a hearing, and multiple levels of appeal, before he was censured for failing to review all pertinent and available records prior to testifying. Because the district court found only one basis of the censure to be unsupported by due process, the district court was correct in setting aside only that portion of the censure. Furthermore, no Texas court has recognized a breach of contract challenge to a private association’s disciplinary process.” Barrash v. American Association of Neurological Surgeons, No. 14-20764 (Feb. 3, 2016).

The forum selection clause in Weber v. Pact XPP Technologies AG, written in German, referred to the “Sitz” of defendant Pact AG, which could be translated as “residence” or “corporate seat.” After determining that a mixed de novo / abuse of discretion standard of review was appropriate after Atlantic Marine, the Fifth Circuit affirmed dismissal of a Texas case in favor of Germany. The Court found that the defendant’s broader reading of the clause was better-reasoned, that German law applied to its review (“A contract betwee

The forum selection clause in Weber v. Pact XPP Technologies AG, written in German, referred to the “Sitz” of defendant Pact AG, which could be translated as “residence” or “corporate seat.” After determining that a mixed de novo / abuse of discretion standard of review was appropriate after Atlantic Marine, the Fifth Circuit affirmed dismissal of a Texas case in favor of Germany. The Court found that the defendant’s broader reading of the clause was better-reasoned, that German law applied to its review (“A contract betwee n a German corporation and a member of its board seems strongly to implicate German policy”), and that the plaintiff did not have a legally cognizable policy argument against enforcing the clause. No. 15-40432 (Jan. 26, 2016).

n a German corporation and a member of its board seems strongly to implicate German policy”), and that the plaintiff did not have a legally cognizable policy argument against enforcing the clause. No. 15-40432 (Jan. 26, 2016).

Plan your New Orleans Mardi Gras trip with this calendar; the next parade is Saturday the 29th, featuring the Krewe of Cork.

Cal Dive settled a hard-fought lawsuit against Schmidt, one of its divers, who alleged that he suffered a debilitating brain injury on the job. A year after the settlement, having continued with surveillance that it conducted during the litigation, Cal Dive brought an “independent action” under Fed. R. Civ. P. 60(b)(1) to set aside the settlement, alleging “that, after reaching the Agreement but before signing the Release, Schmidt had acquired a driver’s license and purchased a new car. In the months following the settlement, Schmidt was observed “cutting his grass, shopping, driving, and jogging for at least two miles.” The Fifth Circuit affirmed dismissal of Cal Dive’s action for failure to plead reliance, noting that during the litigation, “Cal Dive did not believe Schmidt’s allegations or testimony and hired its own experts to examine him over several years.” Cal Dive Int’l v. Schmidt, No. 15-30300 (Jan. 21, 2016, unpublished).

Cal Dive settled a hard-fought lawsuit against Schmidt, one of its divers, who alleged that he suffered a debilitating brain injury on the job. A year after the settlement, having continued with surveillance that it conducted during the litigation, Cal Dive brought an “independent action” under Fed. R. Civ. P. 60(b)(1) to set aside the settlement, alleging “that, after reaching the Agreement but before signing the Release, Schmidt had acquired a driver’s license and purchased a new car. In the months following the settlement, Schmidt was observed “cutting his grass, shopping, driving, and jogging for at least two miles.” The Fifth Circuit affirmed dismissal of Cal Dive’s action for failure to plead reliance, noting that during the litigation, “Cal Dive did not believe Schmidt’s allegations or testimony and hired its own experts to examine him over several years.” Cal Dive Int’l v. Schmidt, No. 15-30300 (Jan. 21, 2016, unpublished).

In unsurprising but still important news, the Supreme Court has decided to review the Fifth Circuit’s opinion in Texas v. United States, the challenge to President Obama’s immigration initiatives. The order granting the petition notes: “In addition to the questions presented by the  petition, the parties are directed to brief and argue the following question: ‘Whether the Guidance violates the Take Care Clause of the Constitution, Art. II, §3.'”

petition, the parties are directed to brief and argue the following question: ‘Whether the Guidance violates the Take Care Clause of the Constitution, Art. II, §3.'”

Construction Funding filed a timely, sworn, proof of loss that “itemized the claim into general categories” such as “building structures” and “personal property.” Unfortunately, the relevant policy (incorporating a background federal law), required a “complete” inventory with attached documents. In this context “substantial compliance . . . is not enough,” and Construction Funding had no coverage for its loss. Construction Funding, LLC v. Fidelity Nat’l Indem. Ins. Co., No. 15-30040 (Jan. 8, 2016, unpublished).

Here is a reprint of my article this week in the Texas Lawbook, Federal Litigation in the Fifth Circuit in the New Year. I hope you find it informative and helpful.

In the cases of In re: Radmax and In re: Volkswagen of America, the Fifth Circuit asserted its power to oversee the transfer of cases under 28 USC § 1404(a). In the recent case of In re: Archer Directional Drilling Co., the Court stayed and partially remanded a venue appeal for the district court to make findings on the relevant factors: “Here, unlike in Volkswagen and Radmax, the district court failed to provide any analysis supporting its denial of Archer’s motion to transfer the case. Articulating the basis for the denial of a change of venue motion is ‘the better practice’ for a district court. . . . In the present case, the lack of explanation makes it impossible for us to determine whether the district court clearly abused its discretion, which is required in order for us to decide whether to

grant mandamus relief.” (citations omitted). No. 15-41539 (Jan. 13, 2016, unpublished).

In Local 731 Pension Trust Fund v. Diodes, Inc., the Fifth Circuit affirmed the dismissal of securities claims related to the alleged nondisclosure of labor problems at a Shanghai manufacturing plant, finding a failure to adequately allege scienter. Most basically, the Court observed — “It is important to note the curious nature of the Fund’s claims. To recap the relevant facts: during the class period, Diodes repeatedly warned investors of a labor shortage that would affect its output in the first two quarters of 2011; Diodes accurately warned the precise impact this labor shortage would have on its financial results, not once, but twice. Yet the Fund contends that more disclosure was required.” The Court went on to reject arguments about the unique knowledge of the relevant executives, the company’s decision to make an early product shipment (noting this would have made the labor problem worse and more apparent), and circumstances of an insider’s stock sales. No. 14-41141 (Jan. 13, 2016).

In Local 731 Pension Trust Fund v. Diodes, Inc., the Fifth Circuit affirmed the dismissal of securities claims related to the alleged nondisclosure of labor problems at a Shanghai manufacturing plant, finding a failure to adequately allege scienter. Most basically, the Court observed — “It is important to note the curious nature of the Fund’s claims. To recap the relevant facts: during the class period, Diodes repeatedly warned investors of a labor shortage that would affect its output in the first two quarters of 2011; Diodes accurately warned the precise impact this labor shortage would have on its financial results, not once, but twice. Yet the Fund contends that more disclosure was required.” The Court went on to reject arguments about the unique knowledge of the relevant executives, the company’s decision to make an early product shipment (noting this would have made the labor problem worse and more apparent), and circumstances of an insider’s stock sales. No. 14-41141 (Jan. 13, 2016).

Boaz Legacy LP sued Roberts about ownership of land. Roberts argued that the land was located to the north of “the vegetation line along the south bank of the Red River,” which places the land in Oklahoma under the terms of the Red River Boundary Compact. Accordingly, Texas state and federal courts lacked subject matter jurisdiction under the “local action doctrine.” Boaz argued that the Compact did not apply to a boundary dispute among private landowners, but the Fifth Circuit disagreed: “[T]his argument conflates the underlying dispute with the present determination, which is purely jurisdictional.” Boaz Legacy LP v. Roberts, No. 15-10439 (Jan. 11, 2016, unpublished).

Boaz Legacy LP sued Roberts about ownership of land. Roberts argued that the land was located to the north of “the vegetation line along the south bank of the Red River,” which places the land in Oklahoma under the terms of the Red River Boundary Compact. Accordingly, Texas state and federal courts lacked subject matter jurisdiction under the “local action doctrine.” Boaz argued that the Compact did not apply to a boundary dispute among private landowners, but the Fifth Circuit disagreed: “[T]his argument conflates the underlying dispute with the present determination, which is purely jurisdictional.” Boaz Legacy LP v. Roberts, No. 15-10439 (Jan. 11, 2016, unpublished).

Collins challenged bankruptcy court jurisdiction over “illusory indemnity and contribution claims” that he alleged had no conceivable effect on the bankruptcy estate due to their lack of merit. The Fifth Circuit rejected his argument: “Both the Supreme Court and this court have gravitated away from conflating jurisdiction and merits, and Collins’s proposed standard results in exactly that conflation.” The Court also noted that the claims, based on a principal’s alleged commitment to indemnify its agent, were not “wholly insubstantial and frivolous” on their merits. Collins v. Sidharthan, No. 14-41226 (Dec. 15, 2015).

Collins challenged bankruptcy court jurisdiction over “illusory indemnity and contribution claims” that he alleged had no conceivable effect on the bankruptcy estate due to their lack of merit. The Fifth Circuit rejected his argument: “Both the Supreme Court and this court have gravitated away from conflating jurisdiction and merits, and Collins’s proposed standard results in exactly that conflation.” The Court also noted that the claims, based on a principal’s alleged commitment to indemnify its agent, were not “wholly insubstantial and frivolous” on their merits. Collins v. Sidharthan, No. 14-41226 (Dec. 15, 2015).

The district court abstained under the “primary jurisdiction” doctrine in deference to a FERC proceeding. On the threshold question of appellate jurisdiction, the Court concluded that Hines v. D’Artois, 531 F.2d 726 (5th Cir. 1976) was still good law, and allowed it to consider an otherwise-interlocutory appeal: “[T]he district court’s order resulted in Occidental being ‘effectively out of court’ and therefore functioned as a final decision.” On the merits, the Court remanded with instructions to not stay the court case indefinitely, but to instead stay for 180 days and assess the status then. Occidental Chem. Corp. v. Louisiana Public Service Comm’n, No. 15-30100 (Jan. 4, 2016).

The district court abstained under the “primary jurisdiction” doctrine in deference to a FERC proceeding. On the threshold question of appellate jurisdiction, the Court concluded that Hines v. D’Artois, 531 F.2d 726 (5th Cir. 1976) was still good law, and allowed it to consider an otherwise-interlocutory appeal: “[T]he district court’s order resulted in Occidental being ‘effectively out of court’ and therefore functioned as a final decision.” On the merits, the Court remanded with instructions to not stay the court case indefinitely, but to instead stay for 180 days and assess the status then. Occidental Chem. Corp. v. Louisiana Public Service Comm’n, No. 15-30100 (Jan. 4, 2016).

A plaintiff class alleged that Chesapeake’s oil and gas production in the Fort Worth area trespassed on their property interests. The defendants removed under CAFA, the district court remanded under that statute’s “local controversy exception,” and the Fifth Circuit reversed. The key appellate issue was whether the plaintiff class was “narrow” — only current owners of mineral interests — or “broad” — current and former interests since a series of foreclosures began in 2004. The plaintiffs could prove the requisite citizenship to establish the exception for the narrow class, but not the broad. The panel majority found the plaintiffs’ pleading was ambiguous on this point, and based on that conclusion, remanded for a failure to prove that element of the exception. A dissent took issue with the construction of the pleading and what it called “a new rule” of a “presumption in favor of federal jurisdiction.” Arbuckle Mountain Ranch of Texas v. Chesapeake Energy Corp., No. 15-10955 (Jan. 7, 2016).

A plaintiff class alleged that Chesapeake’s oil and gas production in the Fort Worth area trespassed on their property interests. The defendants removed under CAFA, the district court remanded under that statute’s “local controversy exception,” and the Fifth Circuit reversed. The key appellate issue was whether the plaintiff class was “narrow” — only current owners of mineral interests — or “broad” — current and former interests since a series of foreclosures began in 2004. The plaintiffs could prove the requisite citizenship to establish the exception for the narrow class, but not the broad. The panel majority found the plaintiffs’ pleading was ambiguous on this point, and based on that conclusion, remanded for a failure to prove that element of the exception. A dissent took issue with the construction of the pleading and what it called “a new rule” of a “presumption in favor of federal jurisdiction.” Arbuckle Mountain Ranch of Texas v. Chesapeake Energy Corp., No. 15-10955 (Jan. 7, 2016).

A creditor argued that the bankruptcy court should have used the same property valuation in both the debtor’s bankruptcy case and the creditor’s adversary proceeding against the debtor, citing the doctrines of judicial estoppel and res judicata. The Fifth Circuit disagreed: “The district court correctly held that the valuations under [Bankruptcy Code] §§ 1129 and 506 are two distinct, separate valuations required for different purposes. The feasibility projections under § 1129 were based on [the debtor’s] estimate of ‘monies to be realized from the sale of lots over time’ and anticipated continued development of the Property. The estimate under § 506, on the other hand, was based on an appraisal of the present fair market value of the Property. As a result, [the debtor] did not assume inconsistent positions by presenting two different valuations for two different purposes, nor does the bankruptcy court’s acceptance of a § 1129 feasibility plan constitute a final judgment on the value of the Property under § 506. The doctrines of judicial estoppel and res judicata are not applicable.” Gold Star Construction, Inc. v. Cavu Rock Properties Project I, LLC, No. 15-50455 (Jan. 4, 2015, unpublished).

A creditor argued that the bankruptcy court should have used the same property valuation in both the debtor’s bankruptcy case and the creditor’s adversary proceeding against the debtor, citing the doctrines of judicial estoppel and res judicata. The Fifth Circuit disagreed: “The district court correctly held that the valuations under [Bankruptcy Code] §§ 1129 and 506 are two distinct, separate valuations required for different purposes. The feasibility projections under § 1129 were based on [the debtor’s] estimate of ‘monies to be realized from the sale of lots over time’ and anticipated continued development of the Property. The estimate under § 506, on the other hand, was based on an appraisal of the present fair market value of the Property. As a result, [the debtor] did not assume inconsistent positions by presenting two different valuations for two different purposes, nor does the bankruptcy court’s acceptance of a § 1129 feasibility plan constitute a final judgment on the value of the Property under § 506. The doctrines of judicial estoppel and res judicata are not applicable.” Gold Star Construction, Inc. v. Cavu Rock Properties Project I, LLC, No. 15-50455 (Jan. 4, 2015, unpublished).

TransCanada has sued in Houston federal court about the Keystone Pipeline, alleging that President Obama exceeded his Constitutional authority by denying the necessary permission to proceed. While this just-filed lawsuit is a long way from Fifth Circuit review, and TransCanada has a substantial business presence in Houston, it comes as no surprise after the rejection of President Obama’s immigration policies in Texas v. United States that this challenge to executive power would be filed in this Circuit. Here is the complaint in TransCanada v. Kerry.

TransCanada has sued in Houston federal court about the Keystone Pipeline, alleging that President Obama exceeded his Constitutional authority by denying the necessary permission to proceed. While this just-filed lawsuit is a long way from Fifth Circuit review, and TransCanada has a substantial business presence in Houston, it comes as no surprise after the rejection of President Obama’s immigration policies in Texas v. United States that this challenge to executive power would be filed in this Circuit. Here is the complaint in TransCanada v. Kerry.

The bankruptcy debtor owned a large candle factory; after a year of effort, the trustee gave up trying to realize more value on the factory property than what was owed on the outstanding mortgages, and abandoned the property to Southwest Securities. The remaining legal issue was: “Should the estate or the secured creditor pay the property’s maintenance expenses incurred while the trustee was trying to sell the property?”

The bankruptcy debtor owned a large candle factory; after a year of effort, the trustee gave up trying to realize more value on the factory property than what was owed on the outstanding mortgages, and abandoned the property to Southwest Securities. The remaining legal issue was: “Should the estate or the secured creditor pay the property’s maintenance expenses incurred while the trustee was trying to sell the property?”

Section 506(c) of the Bankruptcy Code provides: “The trustee may recover from property securing an allowed secured claim the reasonable, necessary costs and expenses of

preserving, or disposing of, such property to the extent of any benefit to the holder of such claim, including the payment of all ad valorem property taxes with respect to the property.” The Fifth Circuit found that Southwest benefited, and that the costs were fairly taxed against it from sales proceeds: “[W]e accept that an expense which was not incurred primarily to preserve or dispose of encumbered property cannot meet the requirement of being incurred primarily for the benefit of the secured creditor. But we also accept the inverse: that an expense incurred primarily to preserve or dispose of encumbered property meets the requirement. The necessary direct relationship between the expenses and the collateral is obvious here; all of the surcharged expenses related only to preserving the value of the Property and preparing it for sale.” Southwest Securities v. Segner, No. 14-41463 (Dec. 29, 2015).

Diversity jurisdiction brings unusual claims to the federal courts, none more so than E.C. v. Saraco, in which a girl sued for injuries caused when the neighbors’ poodle attacked her. The poodle owners won summary judgment, and the Fifth Circuit affirmed. The legal issue was the foreseeability of violence by the poodle — whether it was known to have a “vicious and dangerous disposition.” The Court concluded that no fact issue was raised by evidence of (1) the poodle’s tendency to jump when excited, (2) the poodle’s allegedly tender ears, and (3) the girl’s unfamiliarity with the proper way to pet the poodle. No. 15-60434 (Jan. 4, 2016, unpublished). (The above poodle art was drawn by the great Banksy.)

Diversity jurisdiction brings unusual claims to the federal courts, none more so than E.C. v. Saraco, in which a girl sued for injuries caused when the neighbors’ poodle attacked her. The poodle owners won summary judgment, and the Fifth Circuit affirmed. The legal issue was the foreseeability of violence by the poodle — whether it was known to have a “vicious and dangerous disposition.” The Court concluded that no fact issue was raised by evidence of (1) the poodle’s tendency to jump when excited, (2) the poodle’s allegedly tender ears, and (3) the girl’s unfamiliarity with the proper way to pet the poodle. No. 15-60434 (Jan. 4, 2016, unpublished). (The above poodle art was drawn by the great Banksy.)

Despite the combined starpower of Danny Trejo, Lady Gaga, and Mel Gibson, the movie “Machete Kills” holds a 29% rating on Rotten Tomatoes. That site’s “Critical Consensus” says: “While possessed with the same schlocky lunacy as its far superior predecessor, Machete Kills loses the first installment’s spark in a less deftly assembled sequel.” Perhaps motivated by one of the worst theater openings of all time, the makers of this movie raised constitutional claims about the denial of funding by Texas’s filmmaker incentive program.

Despite the combined starpower of Danny Trejo, Lady Gaga, and Mel Gibson, the movie “Machete Kills” holds a 29% rating on Rotten Tomatoes. That site’s “Critical Consensus” says: “While possessed with the same schlocky lunacy as its far superior predecessor, Machete Kills loses the first installment’s spark in a less deftly assembled sequel.” Perhaps motivated by one of the worst theater openings of all time, the makers of this movie raised constitutional claims about the denial of funding by Texas’s filmmaker incentive program.

The Fifth Circuit affirmed dismissal on the pleadings: “Despite the denial of an Incentive Program grant, Machete Kills was still filmed in Texas, produced, and released. Machete does not dispute that it was free to engage in protected First Amendment activity without the benefit of an Incentive Program grant, and in fact did engage in such activity by making the film. Machete has not shown that it is clearly established that the First Amendment requires a state which has an incentive program like this one to fund films casting the state in a negative light.” Machete Productions LLC v. Page, No. 15-50120 (Dec. 28, 2015).

In yet another opinion showing that the seemingly simple language of CAFA is anything but, in Robertson v. Exxon Mobil the Fifth Circuit reversed the remand of a mass action, concluding that the district court erred in finding that no plaintiff satisfied the $75,000 amount-in-controversy requirement. No. 15-30920 (Dec. 31, 2015). In a footnote, the Court declined to engage the broader issue of whether at least 100 plaintiffs had to satisfy that requirement, and the Court declined to rule on potentially applicable exceptions to jurisdiction (such as “local controversy”) until the district court addressed them on remand. On the proof point, the Court noted: “(1) [Plaintiff] Eddie Ashley claims that she has suffered, among other harms, emphysema and the wrongful death of her husband from lung cancer; and (2) [Plaintiff] Tommie Jones avers that he developed prostate cancer and a host of other ailments. We hold that it is more likely than not that these plaintiffs seek to recover more than $75,000. Indeed, Plaintiffs’ counsel acknowledged at oral argument that for the plaintiffs who contracted cancer, he would be ‘asking [the] jury, come trial, for a whole lot more than $75,000.'”

In yet another opinion showing that the seemingly simple language of CAFA is anything but, in Robertson v. Exxon Mobil the Fifth Circuit reversed the remand of a mass action, concluding that the district court erred in finding that no plaintiff satisfied the $75,000 amount-in-controversy requirement. No. 15-30920 (Dec. 31, 2015). In a footnote, the Court declined to engage the broader issue of whether at least 100 plaintiffs had to satisfy that requirement, and the Court declined to rule on potentially applicable exceptions to jurisdiction (such as “local controversy”) until the district court addressed them on remand. On the proof point, the Court noted: “(1) [Plaintiff] Eddie Ashley claims that she has suffered, among other harms, emphysema and the wrongful death of her husband from lung cancer; and (2) [Plaintiff] Tommie Jones avers that he developed prostate cancer and a host of other ailments. We hold that it is more likely than not that these plaintiffs seek to recover more than $75,000. Indeed, Plaintiffs’ counsel acknowledged at oral argument that for the plaintiffs who contracted cancer, he would be ‘asking [the] jury, come trial, for a whole lot more than $75,000.'”

A failed class action alleging sex discrimination by Wal-Mart concluded as follows:

A failed class action alleging sex discrimination by Wal-Mart concluded as follows:

- The named plaintiffs settled with Wal-Mart, and the district court entered final judgment on May 15, 2015;

- Appellants intervened on June 2; and then

- Appellants filed a notice of appeal (as to the dismissed class claims) on June 12.

While the notice of appeal divested the district court of jurisdiction over the pending motion to intervene, the Fifth Circuit may dismiss such an appeal and remand for purposes of considering the motion, which it did here with the agreement of the parties. Odle v. Wal-Mart Stores, Inc., No. 15-10571 (Dec. 16, 2015, unpublished).

Plaintiffs sued about insulation installed in their home by the defendants, alleging that they “failed to seal off completely areas in which vapors could be transported from the areas under renovation and construction to the existing area[] of the house[,] in which the Commarotos, their three minor children, and their houseguest, Schlegel, were living and sleeping during the construction process.” The district court found that these allegations unambigously fell within the pollution exclusion of the relevant insurance policy and the Fifth Circuit affirmed. The Court declined to consider “deposition testimony by two of the plaintiffs stating that they physically touched and examined the spray foam insulation.” While an exception to the “eight corners rule” could allow consideration of such evidence if “it is initially impossible to discern whether coverage is potentially implicated” (among other matters), the clarity of this pleading precluded its application here. Evanston Ins. Co. v. Lapolla Indus, Inc., No. 15-20213 (Dec. 23, 2015, unpublished) (applying Star-Tex Resources, LLC v. Granite State Ins. Co., 553 F. App’x 366 (5th Cir. 2014)).

Plaintiffs sued about insulation installed in their home by the defendants, alleging that they “failed to seal off completely areas in which vapors could be transported from the areas under renovation and construction to the existing area[] of the house[,] in which the Commarotos, their three minor children, and their houseguest, Schlegel, were living and sleeping during the construction process.” The district court found that these allegations unambigously fell within the pollution exclusion of the relevant insurance policy and the Fifth Circuit affirmed. The Court declined to consider “deposition testimony by two of the plaintiffs stating that they physically touched and examined the spray foam insulation.” While an exception to the “eight corners rule” could allow consideration of such evidence if “it is initially impossible to discern whether coverage is potentially implicated” (among other matters), the clarity of this pleading precluded its application here. Evanston Ins. Co. v. Lapolla Indus, Inc., No. 15-20213 (Dec. 23, 2015, unpublished) (applying Star-Tex Resources, LLC v. Granite State Ins. Co., 553 F. App’x 366 (5th Cir. 2014)).

The Allens filed for Chapter 13 bankruptcy protection; during the pendency of that case, they sued Mrs. Allen’s employer for injuries allegedly suffered in the workplace. The Fifth Circuit affirmed summary judgment for the employer, finding the three elements of judicial estoppel satisfied by the Allens’ failure to disclose the personal injury suit in the bankruptcy – (1) inconsistent positions, (2) one of which was accepted by a court, and (3) lack of inadvertence by the Allens. The Court also found that the overall balance of equities weighed against the Allens, given the importance of full disclosure to the bankruptcy process. The Court modified the judgment to be without prejudice so the Allens’ trustee could pursue the suit if he or she so desired (although acknowledging potential limitations issues). Allen v. C&H Distributors, Inc., No. 15-30330 (Dec. 23, 2015). The opinion is of broad interest because of its detailed analysis of judicial estoppel under the general three-part test, rather than a more truncated version sometimes employed in bankruptcy cases.

The Allens filed for Chapter 13 bankruptcy protection; during the pendency of that case, they sued Mrs. Allen’s employer for injuries allegedly suffered in the workplace. The Fifth Circuit affirmed summary judgment for the employer, finding the three elements of judicial estoppel satisfied by the Allens’ failure to disclose the personal injury suit in the bankruptcy – (1) inconsistent positions, (2) one of which was accepted by a court, and (3) lack of inadvertence by the Allens. The Court also found that the overall balance of equities weighed against the Allens, given the importance of full disclosure to the bankruptcy process. The Court modified the judgment to be without prejudice so the Allens’ trustee could pursue the suit if he or she so desired (although acknowledging potential limitations issues). Allen v. C&H Distributors, Inc., No. 15-30330 (Dec. 23, 2015). The opinion is of broad interest because of its detailed analysis of judicial estoppel under the general three-part test, rather than a more truncated version sometimes employed in bankruptcy cases.

Greenwich Insurance Company made a number of errors in its internal accounting about crop insurance premiums. When those mistakes ultimately led to a substantial assessment against it by a state authority, Greenwich argued that the state standards were preempted by regulations associated with the Federal Crop Insurance Act. The Fifth Circuit agreed with the district court that they were not, as the true source of Greenwich’s problems was not the state rules but its own “acts of unjustifiable incompetence”: “The FCIC did not intend to hamstring . . . the operations of state programs . . . simply to protect inattentive insurers from their own mistakes.” Greenwich Ins. Co. v. Mississippi Windstorm Underwrting Ass’n, No. 15-60405 (Dec. 15, 2015).

Greenwich Insurance Company made a number of errors in its internal accounting about crop insurance premiums. When those mistakes ultimately led to a substantial assessment against it by a state authority, Greenwich argued that the state standards were preempted by regulations associated with the Federal Crop Insurance Act. The Fifth Circuit agreed with the district court that they were not, as the true source of Greenwich’s problems was not the state rules but its own “acts of unjustifiable incompetence”: “The FCIC did not intend to hamstring . . . the operations of state programs . . . simply to protect inattentive insurers from their own mistakes.” Greenwich Ins. Co. v. Mississippi Windstorm Underwrting Ass’n, No. 15-60405 (Dec. 15, 2015).

Emerald City Management, d/b/a the band “Downtown Fever,” won a preliminary injunction against another band with the same name. The Fifth Circuit affirmed, noting the importance of “los[ing] control over the mark’s reputation and goodwill” in establishing irreparable injury, and citing evidence of the plaintiff’s history with the band name, the defendant’s plans to play in the same area, and the defendant’s marketing using that name. Emerald City Management LLC v. Kahn, No. 14-40856 (Dec. 11, 2015, unpublished) (citing Paulsson Geophysical Servs., Inc. v. Sigmar, 529 F.3d 303 (5th Cir. 2008)). (In a later skirmish among these parties, the Court reversed a later preliminary injunction about the use of a Facebook page: “neither shutting down a Facebook account nor blocking administrator access to a Facebook account constitutes ‘use in commerce’ of a trademark.” Emerald City Management LLC v. Kahn, No. 15-40446 (March 8, 2016, unpublished)).

Emerald City Management, d/b/a the band “Downtown Fever,” won a preliminary injunction against another band with the same name. The Fifth Circuit affirmed, noting the importance of “los[ing] control over the mark’s reputation and goodwill” in establishing irreparable injury, and citing evidence of the plaintiff’s history with the band name, the defendant’s plans to play in the same area, and the defendant’s marketing using that name. Emerald City Management LLC v. Kahn, No. 14-40856 (Dec. 11, 2015, unpublished) (citing Paulsson Geophysical Servs., Inc. v. Sigmar, 529 F.3d 303 (5th Cir. 2008)). (In a later skirmish among these parties, the Court reversed a later preliminary injunction about the use of a Facebook page: “neither shutting down a Facebook account nor blocking administrator access to a Facebook account constitutes ‘use in commerce’ of a trademark.” Emerald City Management LLC v. Kahn, No. 15-40446 (March 8, 2016, unpublished)).

Jose Guzman, writer of the Tejano song Triste Aventuerera, sued Hacienda Records, alleging that its affiliated band “The Hometown Boys” infringed his copyright with their song Cartas de Amor (link below). The Fifth Circuit affirmed judgment for the defendants. After reminding about the significant deference due to the trial court on credibility issues, the Court agreed that Guzman’s evidence about radio play and live performance was properly rejected as to the issue of the defendants’ “opportunity to view” his song. Similarly, while acknowledging similarity in the first sixteen words of both songs, expert testimony showed that the words were set to different music and appeared in other songs as well, thus supporting the trial court’s rejection of his alternative “striking similarity” theory. The Court also declined to adopt a “sliding scale” test for infringement that would be weighted by the degree of similarity between the works at issue.

Jose Guzman, writer of the Tejano song Triste Aventuerera, sued Hacienda Records, alleging that its affiliated band “The Hometown Boys” infringed his copyright with their song Cartas de Amor (link below). The Fifth Circuit affirmed judgment for the defendants. After reminding about the significant deference due to the trial court on credibility issues, the Court agreed that Guzman’s evidence about radio play and live performance was properly rejected as to the issue of the defendants’ “opportunity to view” his song. Similarly, while acknowledging similarity in the first sixteen words of both songs, expert testimony showed that the words were set to different music and appeared in other songs as well, thus supporting the trial court’s rejection of his alternative “striking similarity” theory. The Court also declined to adopt a “sliding scale” test for infringement that would be weighted by the degree of similarity between the works at issue.

Defendants sought to remove several cases under the “mass action” provisions of CAFA, arguing: “the fact that plaintiffs’ counsel broke up their client base into multiple suits making identical allegations is not a tactic that prevents the assertion of jurisdiction under CAFA.” The Fifth Circuit disagreed, declining to “pierce the pleadings across multiple state court actions,” noting that there had been no effort to consolidate the cases below, and

Defendants sought to remove several cases under the “mass action” provisions of CAFA, arguing: “the fact that plaintiffs’ counsel broke up their client base into multiple suits making identical allegations is not a tactic that prevents the assertion of jurisdiction under CAFA.” The Fifth Circuit disagreed, declining to “pierce the pleadings across multiple state court actions,” noting that there had been no effort to consolidate the cases below, and  observing: “Every other court of appeals confronted with this question has come to the same conclusion: that plaintiffs have the ability to avoid [CAFA ‘mass action’] jurisdiction by filing separate complaints naming less than 100 plaintiffs by not moving for or otherwise proposing joint trial in the state court.” Eagle US 2, LLC v. Abraham et al. (Dec. 11, 2015, unpublished) (on petition for rehearing en banc of denial of petition for review).

observing: “Every other court of appeals confronted with this question has come to the same conclusion: that plaintiffs have the ability to avoid [CAFA ‘mass action’] jurisdiction by filing separate complaints naming less than 100 plaintiffs by not moving for or otherwise proposing joint trial in the state court.” Eagle US 2, LLC v. Abraham et al. (Dec. 11, 2015, unpublished) (on petition for rehearing en banc of denial of petition for review).

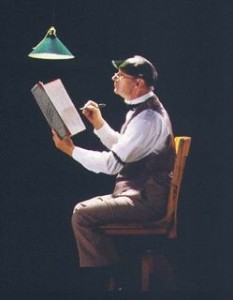

The plaintiff in Stagliano v. Cincinnati Ins. Co. submitted this expert affidavit to establish that alleged hail damage occurred within the insurance policy period. No. 15-10137 (Dec. 11, 2015, unpublished). The affidavit did not succeed, as the Fifth Circuit found it “was little more that an allusion to his credentials, a recitation of the hail damage observed, and a conclusory, ‘subjective opinion’ that the damage resulted from a hail storm within the policy period.” Footnote 2 reviews a “perceived . . . tension between the admissibility requirements for expert testimony and the burdens at summary judgment when expert affidavits are utilized” in a past opinion of the Court.

The plaintiff in Stagliano v. Cincinnati Ins. Co. submitted this expert affidavit to establish that alleged hail damage occurred within the insurance policy period. No. 15-10137 (Dec. 11, 2015, unpublished). The affidavit did not succeed, as the Fifth Circuit found it “was little more that an allusion to his credentials, a recitation of the hail damage observed, and a conclusory, ‘subjective opinion’ that the damage resulted from a hail storm within the policy period.” Footnote 2 reviews a “perceived . . . tension between the admissibility requirements for expert testimony and the burdens at summary judgment when expert affidavits are utilized” in a past opinion of the Court.

In USHealth Group v. South, applying Texas law, the Fifth Circuit rejected the use of “concerted misconduct estoppel” to compel arbitration against a nonsignatory (citing In re: Merrill Lynch Trust Co. FSB, 235 S.W.3d 185 (Tex. 2007)), and also found no basis for “direct benefits estoppel” because the claims did not arise solely from the contracts with the arbitration clause, and the issues in dispute could be resolved without reference to those contracts (citing In re: Weekley Homes, L.P., 180 S.W.3d 127 (Tex. 2005)). No. 15-10117 (Dec. 8, 2015, unpublished).

In USHealth Group v. South, applying Texas law, the Fifth Circuit rejected the use of “concerted misconduct estoppel” to compel arbitration against a nonsignatory (citing In re: Merrill Lynch Trust Co. FSB, 235 S.W.3d 185 (Tex. 2007)), and also found no basis for “direct benefits estoppel” because the claims did not arise solely from the contracts with the arbitration clause, and the issues in dispute could be resolved without reference to those contracts (citing In re: Weekley Homes, L.P., 180 S.W.3d 127 (Tex. 2005)). No. 15-10117 (Dec. 8, 2015, unpublished).

Plaintiffs obtained a preliminary injunction freezing many of the Defendants’ assets. The Fifth Circuit affirmed, noting the strong proof on two key topics. As to likelihood of success on RICO and fraud claims: “The [district[ court examined in detail three representative transactions, tracing funds from [Plaintiff] that were intended for legitimate vendors but ended up in accounts owned wholly by the defendants. In each case, [Plaintiff] netted less money than it should have, with the profit going to [Defendant] or his associates.” As to irreparable injury: “[Defendant] had already closed personal and corporate accounts in Hong Kong, containing exclusively money diverted from [Plainitff], transferring some of the funds to his father-in-law. [Defendant] also has international ties, including the co-defendants – natural persons and shell companies alike – who have yet to appear in court. He has experience and sophistication transferring money internationally, suggesting a high risk that funds allegedly belonging to plaintiffs could disappear.” ATN Indus. v. Gross, No. 15-20102 (Dec. 7, 2015, unpublished).

Plaintiffs obtained a preliminary injunction freezing many of the Defendants’ assets. The Fifth Circuit affirmed, noting the strong proof on two key topics. As to likelihood of success on RICO and fraud claims: “The [district[ court examined in detail three representative transactions, tracing funds from [Plaintiff] that were intended for legitimate vendors but ended up in accounts owned wholly by the defendants. In each case, [Plaintiff] netted less money than it should have, with the profit going to [Defendant] or his associates.” As to irreparable injury: “[Defendant] had already closed personal and corporate accounts in Hong Kong, containing exclusively money diverted from [Plainitff], transferring some of the funds to his father-in-law. [Defendant] also has international ties, including the co-defendants – natural persons and shell companies alike – who have yet to appear in court. He has experience and sophistication transferring money internationally, suggesting a high risk that funds allegedly belonging to plaintiffs could disappear.” ATN Indus. v. Gross, No. 15-20102 (Dec. 7, 2015, unpublished).

A general contractor began an arbitration against several subcontractors about problems with the Sea Breeze Condominiums and Resort in Biloxi, Mississippi. One of the subcontractors resisted the arbitration demand; while it won in district court, the Fifth Circuit reversed, based on this contract language: “If the Contractor has a claim or dispute involving the same general subject matter, either in whole or in part, with any third party if elected by the Contractor, the Subcontractor shall assert its claims and defenses in and shall be bound

A general contractor began an arbitration against several subcontractors about problems with the Sea Breeze Condominiums and Resort in Biloxi, Mississippi. One of the subcontractors resisted the arbitration demand; while it won in district court, the Fifth Circuit reversed, based on this contract language: “If the Contractor has a claim or dispute involving the same general subject matter, either in whole or in part, with any third party if elected by the Contractor, the Subcontractor shall assert its claims and defenses in and shall be bound  by the same forum and in the same proceeding which has jurisdiction over the claims or disputes between the Contractor and such third party.” Unlike other contract terms about arbitration, this clause had no limitation as to the Subcontractor’s claims against a particular party. New Orleans Glass Co. Roy Anderson Corp., No. 15-60083 (Dec. 1, 2015, unpublished).

by the same forum and in the same proceeding which has jurisdiction over the claims or disputes between the Contractor and such third party.” Unlike other contract terms about arbitration, this clause had no limitation as to the Subcontractor’s claims against a particular party. New Orleans Glass Co. Roy Anderson Corp., No. 15-60083 (Dec. 1, 2015, unpublished).

The defendant appealed a summary judgment against it on a multi-million dollar claim for breach of a settlement agreement, alleging that a novation had replaced that agreement with a new bargain. Taj Al Khairat, Ltd. v. Swiftships Shipbuilders, LLC, No. 15-30195 (Dec. 4, 2015, unpublished). The Fifth Circuit affirmed, noting that while both principals of the defendant were confident about an agreement to resolve the liability under the settlement, a number of unanswered questions remained about subsequent conditions; for example, one testified that the understanding “we will settle all the past dues, and we will move forward if we can procure this contract, the SOC contract, and the performance bond.” (emphasis in opinion). (Another “conditional agreement” case is discussed today on sister blog 600Commerce.)

The defendant appealed a summary judgment against it on a multi-million dollar claim for breach of a settlement agreement, alleging that a novation had replaced that agreement with a new bargain. Taj Al Khairat, Ltd. v. Swiftships Shipbuilders, LLC, No. 15-30195 (Dec. 4, 2015, unpublished). The Fifth Circuit affirmed, noting that while both principals of the defendant were confident about an agreement to resolve the liability under the settlement, a number of unanswered questions remained about subsequent conditions; for example, one testified that the understanding “we will settle all the past dues, and we will move forward if we can procure this contract, the SOC contract, and the performance bond.” (emphasis in opinion). (Another “conditional agreement” case is discussed today on sister blog 600Commerce.)

In a wrongful foreclosure case, the borrower alleged that PNC Bank had not proved its ownership of the note. Then, “an attorney representing [defendants] showed an attorney employed by [Barrett-Bowie’s law firm] the original blue ink note signed by Barrett-Bowie. The Firm’s attorney acknowledged that the note was indorsed from the original lender to First Franklin Financial Corporation and from First Franklin Financial Corporation to PNC Bank. The Firm’s attorney retained a copy of the original note and reported what she had seen to her colleagues at the Firm.” Nevertheless, the firm filed two more pleadings repeating the standing allegations, and in response to a summary judgment motion — while not directly disputing the servicer’s proof of standing in response — asked that the court “deny [the servicer’s ]motion ‘in its entirety’ and argued that genuine issues of material fact existed ‘on elements in each of Plaintiff’s remaining causes of action.'” An award of Rule 11 sanctions against the plaintiff’s firm was affirmed in Barrett-Bowie v. Select Portfolio Servicing, Inc., No. 14-11249 (Nov. 25, 2015, unpublished).

In a wrongful foreclosure case, the borrower alleged that PNC Bank had not proved its ownership of the note. Then, “an attorney representing [defendants] showed an attorney employed by [Barrett-Bowie’s law firm] the original blue ink note signed by Barrett-Bowie. The Firm’s attorney acknowledged that the note was indorsed from the original lender to First Franklin Financial Corporation and from First Franklin Financial Corporation to PNC Bank. The Firm’s attorney retained a copy of the original note and reported what she had seen to her colleagues at the Firm.” Nevertheless, the firm filed two more pleadings repeating the standing allegations, and in response to a summary judgment motion — while not directly disputing the servicer’s proof of standing in response — asked that the court “deny [the servicer’s ]motion ‘in its entirety’ and argued that genuine issues of material fact existed ‘on elements in each of Plaintiff’s remaining causes of action.'” An award of Rule 11 sanctions against the plaintiff’s firm was affirmed in Barrett-Bowie v. Select Portfolio Servicing, Inc., No. 14-11249 (Nov. 25, 2015, unpublished).

Concerto Labs, a chiropractic practice, sued another practice for copyright infringement as to “a short video outlining a diagnostic procedure and a blank form to be filled in while conducting that procedure.” The Fifth Circuit affirmed summary judgment for the defendant as neither interest could be copyrighted. As to the video, “[b]ecause the Appellants cannot own a copyright in a procedure, it does not matter if the procedure presented in one work is the same as or identical to that presented in another.” As to the form, it was “merely ‘designed for recording information and does not in itself convey information.'” Concentro Laboratories, LLC v. Practice Wealth, Ltd., No. 15-10325 (Nov. 30, 2015, unpublished).

Concerto Labs, a chiropractic practice, sued another practice for copyright infringement as to “a short video outlining a diagnostic procedure and a blank form to be filled in while conducting that procedure.” The Fifth Circuit affirmed summary judgment for the defendant as neither interest could be copyrighted. As to the video, “[b]ecause the Appellants cannot own a copyright in a procedure, it does not matter if the procedure presented in one work is the same as or identical to that presented in another.” As to the form, it was “merely ‘designed for recording information and does not in itself convey information.'” Concentro Laboratories, LLC v. Practice Wealth, Ltd., No. 15-10325 (Nov. 30, 2015, unpublished).

Judgment creditors garnished two oil tankers (including the M/V FMPC 30, right); the garnishees appealed as to the connection between them and the judgment debtors. After reviewing the distinction between “alter ego” theories at the jurisdictional and merits stages, the Fifth Circuit reversed. Finding that “[t]he [district court relied almost exclusively on two ‘organizational charts’ submitted by Plaintiffs (taken from Garnishees’ website),” the Court found that the charts “do not actually depict corporate structure” or ” show the functional relationship among the entities.” Accordingly, the case for “jurisdictional veil piercing” was not established and the garnishment proceeding was dismissed. Licea v. Curacao Drydock Co., No. 14-20619 (Nov. 23, 2015).

Judgment creditors garnished two oil tankers (including the M/V FMPC 30, right); the garnishees appealed as to the connection between them and the judgment debtors. After reviewing the distinction between “alter ego” theories at the jurisdictional and merits stages, the Fifth Circuit reversed. Finding that “[t]he [district court relied almost exclusively on two ‘organizational charts’ submitted by Plaintiffs (taken from Garnishees’ website),” the Court found that the charts “do not actually depict corporate structure” or ” show the functional relationship among the entities.” Accordingly, the case for “jurisdictional veil piercing” was not established and the garnishment proceeding was dismissed. Licea v. Curacao Drydock Co., No. 14-20619 (Nov. 23, 2015).

Abandoning its reputation as a skeptic of antitrust claims, the U.S. Court of Appeals for the Fifth Circuit recently affirmed a $150 million judgment in MM Steel, L.P. v. JSW Steel (USA) Inc., a hard-fought battle among steel distributors on the Texas Gulf Coast. No. 14-20267 (Nov. 25, 2015). Judge Stephen Higginson, a relatively recent Obama appointee, wrote the opinion, joined by Judges Edith Brown Clement and Fortunato “Pete” Benavides. A likely landmark in the modern law of antitrust conspiracy, the opinion unhesitatingly applies longstanding rules about “per se” antitrust liability instead of engaging in the more complex economic analysis that has dominated in recent years. By doing so, the opinion has the potential to invigorate antitrust litigation in many situations where competing businesses allegedly join forces against another competitor.

Abandoning its reputation as a skeptic of antitrust claims, the U.S. Court of Appeals for the Fifth Circuit recently affirmed a $150 million judgment in MM Steel, L.P. v. JSW Steel (USA) Inc., a hard-fought battle among steel distributors on the Texas Gulf Coast. No. 14-20267 (Nov. 25, 2015). Judge Stephen Higginson, a relatively recent Obama appointee, wrote the opinion, joined by Judges Edith Brown Clement and Fortunato “Pete” Benavides. A likely landmark in the modern law of antitrust conspiracy, the opinion unhesitatingly applies longstanding rules about “per se” antitrust liability instead of engaging in the more complex economic analysis that has dominated in recent years. By doing so, the opinion has the potential to invigorate antitrust litigation in many situations where competing businesses allegedly join forces against another competitor.

As background, the opinion notes: “In the Gulf Coast steel industry, steel manufacturers sell about half of their steel plate to end users, including companies such as Wal-Mart, Exxon, and General Motors, and sell the other half to distributors who then resell the plate to end users.” The dispute arose when two former employees of a distributor, named Chapel Steel, formed a new distribution company called MM Steel. Chapel’s management, angry at their departure and competition, not only sued MM and its founders for violation of a non-compete agreement, but began an aggressive boycott campaign to cut off MM’s supply of steel plate and put it out of business.

Evidence showed that Chapel’s leadership enlisted other distributors in its attack on MM, and also threatened several steel manufacturers, including Nucor Corporation and JSW Steel, with a boycott if they did not refuse to deal with MM. In particular, JSW received threats from Chapel and another distributor within several weeks of each other, and shortly afterwards, cancelled a supply contract that it had earlier negotiated with MM.

MM went out of business. It sued JSW for breach of contract, and sued Chapel (and other distributors), along with Nucor, JSW, and another manufacturer. After a six-week trial, the Southern District of Texas entered judgment for over $150 million for MM, finding that the distributors formed a conspiracy in violation of Section 1 of the Sherman Act to keep steel away from MM, and that the manufacturers knowingly joined that conspiracy. The distributors settled, leaving Nucor and JSW as the only appellants by the time of the Fifth Circuit’s decision.

The opinion’s analysis began by stating the accepted legal standards in the area. A Section 1 claim requires proof that the defendants “(1) engaged in a conspiracy (2) that restrained trade (3) in a particular market.” That proof must “tend[] to exclude the possibility of independent conduct,” which in a refusal-to-deal case such as this one, means showing that the defendants’ conduct is “inconsistent with the manufacturer’s independent self-interest.”

Applying these standards, the court affirmed the liability finding as to JSW. “The fact that both [distributors’ made . . . threats within several weeks of each other was sufficient evidence for a reasonable juror to conclude that JSW was aware of the horizontal conspiracy to exclude MM from the market.” Then, when JSW responded by terminating its contract with MM, virtually guaranteeing a suit for breach, “[a] reasonable juror also could have concluded that JSW’s abrupt decision to no longer deal with MM following those threats and JSW’s statements regarding that decision tended to exclude the possibility of conduct that was independent of the distributor’s conspiracy.” While JSW contended that its actions were motivated by concern about the Chapel lawsuit against MM, the court found that “[a] reasonable juror could have concluded that JSW’s explanation for its supposedly independent refusal to deal was pretextual.”

The court reversed as to Nucor, who had received only one threat, from Chapel. In response, Nucor introduced evidence that it had an “incumbency practice,” under which it remained loyal to established customers such as Chapel, to maintain a stable supply chain. The court reasoned that “[e]ven if the jury did not credit this practice, MM did not provide evidence that when Nucor first refused to quote MM, Nucor was aware of an agreement between the distributors to foreclose MM from the market. . . . In fact, at the time Nucor first refused to quote MM, Nucor believed that JSW, its competitor, was supplying MM.”

Returning to JSW, the court observed that “[t]he Supreme Court has consistently held that the per se rule [of antitrust liability] is applicable to group boycotts identical to the boycott alleged in this case.” JSW argued that in the recent opinion of Leegin Creative Leather Products v. PSKS, 551 U.S. 877 (2007) when the Supreme Court eliminated per se liability for price-setting vertical agreements (i.e, exclusive dealing arrangements), it necessarily did so for horizontal agreements such as the one among distributors in this case. The court disagreed, concluding: “Purely vertical refusals to deal . . . frequently have procompetitive justifications, such as limiting free riding and increasing specialization. However, the crux of the group boycotts at issue in the cases in which per se liability has always applied is that members of a horizontal conspiracy use vertical agreements anticompetitively to foreclose a competitor from the market.” The court concluded by rejecting a challenge to MM’s damage model.

The MM opinion has considerable significance, both practically and theoretically. Practically, a company in a position like JSW’s is not unsympathetic – on the one hand, it has substantial contract obligations to a new customer, while on the other hand, it confronts serious threats to substantial other and longstanding business. A tough business decision becomes harder when potential Section 1 antitrust liability – which carries with it the threat of treble damages – must be considered.

Theoretically, the court’s affirmation of per se liability connects to an older school of antitrust thought that emphasized bright-line rules over case-by-case analysis. That view has received strong criticism as anachronistic; as Robert Bork wrote many years ago in a famous Yale Law Journal article: “The current shibboleth of per se illegality in existing law conveys a sense of certainty, even of automaticity, which is delusive. The per se concept does not accurately describe the law relating to agreements eliminating competition as it is, as it has been, or as it ever can be.” Yet per se rules remain in place in the antitrust laws, and the MM opinion shows that they are not going away any time soon, absent sweeping action by Congress or the Supreme Court.

After 15-plus years of litigation, the remaining issues in Art Midwest Inc. v. Clapper related to the calculation of prejudgment interest. No. 14-10973 (Nov. 9, 2015, last before the Fifth Circuit in Art Midwest Inc. v. Atl. Ltd. P’ship XII, 742 F.3d 206 (5th Cir. 2014)). The Court reversed as to the starting date for calculating interest — even though the first judgment by the district court was reversed in part, the date of that judgment was still the proper starting point under Fed. R. App. P. 37(a) and Masinter v. Tenneco Oil Co., 929 F.2d 191 (5th Cir. 1991), aff’d in relevant part, 938 F.2d 536 (5th Cir. 1991). The opinion also touches on waiver and law-of-the-case issues addressed in the 2014 appeal.

After 15-plus years of litigation, the remaining issues in Art Midwest Inc. v. Clapper related to the calculation of prejudgment interest. No. 14-10973 (Nov. 9, 2015, last before the Fifth Circuit in Art Midwest Inc. v. Atl. Ltd. P’ship XII, 742 F.3d 206 (5th Cir. 2014)). The Court reversed as to the starting date for calculating interest — even though the first judgment by the district court was reversed in part, the date of that judgment was still the proper starting point under Fed. R. App. P. 37(a) and Masinter v. Tenneco Oil Co., 929 F.2d 191 (5th Cir. 1991), aff’d in relevant part, 938 F.2d 536 (5th Cir. 1991). The opinion also touches on waiver and law-of-the-case issues addressed in the 2014 appeal.

Fortune Natural Resources made a claim in the bankruptcy of an oil exploration company for roughly $3 million related to decommisioning a lease. Fortune alleged that adjustments to a sale order hurt its right of recovery on that claim. The Fifth Circuit disagreed and found no standing, observing: “Fortune’s argument that it meets the ‘person aggrieved’ standard because it has already received a letter from . . . mandating that it decommission its Lease misses the mark. Fortune’s payment of decommissioning costs may show an injury, but it does not show that the bankruptcy court’s order caused this injury. This court’s jurisprudence states that the order of the bankruptcy court must directly and adversely affect the appellant pecuniarily. Having failed to present sufficient evidence to show that Fortune was directly and adversely affected pecuniarily by the order of the bankruptcy court, Fortune does not meet the ‘person aggrieved” test.” Fortune Natural Resources Corp. v. United States Dep’t of the Interior, No. 15-20151 (Nov. 19, 2015, unpublished).

Fortune Natural Resources made a claim in the bankruptcy of an oil exploration company for roughly $3 million related to decommisioning a lease. Fortune alleged that adjustments to a sale order hurt its right of recovery on that claim. The Fifth Circuit disagreed and found no standing, observing: “Fortune’s argument that it meets the ‘person aggrieved’ standard because it has already received a letter from . . . mandating that it decommission its Lease misses the mark. Fortune’s payment of decommissioning costs may show an injury, but it does not show that the bankruptcy court’s order caused this injury. This court’s jurisprudence states that the order of the bankruptcy court must directly and adversely affect the appellant pecuniarily. Having failed to present sufficient evidence to show that Fortune was directly and adversely affected pecuniarily by the order of the bankruptcy court, Fortune does not meet the ‘person aggrieved” test.” Fortune Natural Resources Corp. v. United States Dep’t of the Interior, No. 15-20151 (Nov. 19, 2015, unpublished).

A mortgage servicer can violate the Texas Finance Code by asserting legal rights it does not actually have. See McCaig v. Wells Fargo Bank, 788 F.3d 463 (5th Cir. 2015). But seemingly inconsistent communications by a servicer do not violate the Code:

A mortgage servicer can violate the Texas Finance Code by asserting legal rights it does not actually have. See McCaig v. Wells Fargo Bank, 788 F.3d 463 (5th Cir. 2015). But seemingly inconsistent communications by a servicer do not violate the Code:

“[Plaintiff] does not contend that any one letter is a misrepresentation in

and of itself but rather that the amounts differ, so the letters are misleading

as a whole. But the letters explicitly state that they are describing two different

types of obligations: notices of the entire outstanding obligation and notices

of the amount due to bring the loan current. Each category is internally consistent

and consistent with the other. [Plaintiff’s] amount to bring the loan current

continued to grow over time because she was not making adequate payments

and still occupied the property. The total outstanding obligation grew for the

same reason. The letters were not misrepresentations but, instead, were

accurate descriptions of two different types of obligations and were specifically

identified as such.”

Rucker v. Bank of America, 15-10373 (Nov. 20, 2015).

Cameron International, a main defendant in the Deepwater Horizon cases, successfully sued Liberty Insurance to help cover its substantial settlement costs. After affirming on the merits, the Fifth Circuit certified this question to the Texas Supreme Court: “Whether, to maintain a cause of action under Chapter 541 of the Texas Insurance Code against an insurer that wrongfully withheld policy benefits, an insured must allege and prove an injury independent from the denied policy benefits?” Cameron International Corp. v. Liberty Ins. Underwriters, Inc., No. 14-31321 (Nov. 19, 2015).

Cameron International, a main defendant in the Deepwater Horizon cases, successfully sued Liberty Insurance to help cover its substantial settlement costs. After affirming on the merits, the Fifth Circuit certified this question to the Texas Supreme Court: “Whether, to maintain a cause of action under Chapter 541 of the Texas Insurance Code against an insurer that wrongfully withheld policy benefits, an insured must allege and prove an injury independent from the denied policy benefits?” Cameron International Corp. v. Liberty Ins. Underwriters, Inc., No. 14-31321 (Nov. 19, 2015).

The district court in Naranjo v. Thompson found that Naranjo, a prisoner in the Reeves County Detention Center, had shown “exceptional circumstances” that warranted the appointment of counsel to pursue his civil rights claims about the conditions of his incarceration. (Foremost among them was the prisoner’s inability to review a number of documents that were filed under seal due to security concerns.) The court went on to conclude, however, that no local attorneys were available and that it lacked the power to make a compulsory appointment. The Fifth Circuit reversed, finding that a district court has the inherent power to make such an appointment, but reminding that “this is a power of last resort” and that “[i]nherent powers ‘must be used with great restraint and caution.'” Accordingly, the Court reversed a summary judgment for the defendants and remanded for proceedings consistent with its ruling about inherent power.

U.S. Bank sent notices of acceleration, and began foreclosure proceedings, several times before suing for judicial foreclosure. The borrowers contended that suit was time-barred. The Fifth Circuit disagreed, finding that the bank’s second notice “unequivocally manifested an intent to abandon the previous acceleration and provided the [borrowers] with an opportunity to avoid foreclosure if they cured their arrearage. As a result, the statute of limitations period under [Tex. Civ. Prac. & Rem. Code] § 16.035(a) ceased to run at that point and a new limitations period did not begin to accrue until [they] defaulted again and U.S. Bank exercised its right to accelerate thereafter.” Boren v. U.S. Nat’l Bank Ass’n. No. 14-20718 (Oct. 26, 2015).

U.S. Bank sent notices of acceleration, and began foreclosure proceedings, several times before suing for judicial foreclosure. The borrowers contended that suit was time-barred. The Fifth Circuit disagreed, finding that the bank’s second notice “unequivocally manifested an intent to abandon the previous acceleration and provided the [borrowers] with an opportunity to avoid foreclosure if they cured their arrearage. As a result, the statute of limitations period under [Tex. Civ. Prac. & Rem. Code] § 16.035(a) ceased to run at that point and a new limitations period did not begin to accrue until [they] defaulted again and U.S. Bank exercised its right to accelerate thereafter.” Boren v. U.S. Nat’l Bank Ass’n. No. 14-20718 (Oct. 26, 2015).

Robert Namer had a Louisiana business that used the name “Voice of America,” and encountered intellectual property trouble with the Voice of America information service operated by the U.S. Government. (Incidentally, I recommend some study of the VOA’s “Simple English” programming, which uses a 1,500-word vocabulary, for anyone interested in straightforward writing.) Namer lost at trial and challenged the VOA’s audience survey on appeal. The Fifth Circuit affirmed: “It was appropriate for [the VOA’s expert] to survey potential consumers of

Robert Namer had a Louisiana business that used the name “Voice of America,” and encountered intellectual property trouble with the Voice of America information service operated by the U.S. Government. (Incidentally, I recommend some study of the VOA’s “Simple English” programming, which uses a 1,500-word vocabulary, for anyone interested in straightforward writing.) Namer lost at trial and challenged the VOA’s audience survey on appeal. The Fifth Circuit affirmed: “It was appropriate for [the VOA’s expert] to survey potential consumers of  Namer’s website to determine if they might be confused into believing they were viewing the website of the government-run VOA (and 19.1% of them were confused.)” The Court also rejected a laches argument because Namer did not show prejudice; “[c]ontinued routine use of the website during the time when the Board allegedly sat on its rights is all that Namer has established.” Namer v. Voice of America, No. 14-31353 (Oct. 26, 2015, unpublished). The opinion helpfully summarizes recent Circuit authority on both the survey and laches issues.

Namer’s website to determine if they might be confused into believing they were viewing the website of the government-run VOA (and 19.1% of them were confused.)” The Court also rejected a laches argument because Namer did not show prejudice; “[c]ontinued routine use of the website during the time when the Board allegedly sat on its rights is all that Namer has established.” Namer v. Voice of America, No. 14-31353 (Oct. 26, 2015, unpublished). The opinion helpfully summarizes recent Circuit authority on both the survey and laches issues.

T reaty Energy sued for its damages after an involuntary bankruptcy petition against it was dismissed. One of its claims sought damages for losses in connection with attempts to sell its restricted stock during that period. The Fifth Circuit affirmed summary judgment for the defendants, noting: (1) “Though the sales price of restricted shares did fluctuate, it averaged 0.5¢ immediately before, during, and after the pendency of the involuntary petition, and (2) the affiant about an alleged plan to sell restricted shares at a substantial discount lacked personal knowledge, claiming only that he “did assist in the process when requested, which included gathering information when given direct instructions by his superiors.” Treaty Energy Corp. v. Hallin, No. 15-30113 (Oct. 27, 2015, unpublished).

reaty Energy sued for its damages after an involuntary bankruptcy petition against it was dismissed. One of its claims sought damages for losses in connection with attempts to sell its restricted stock during that period. The Fifth Circuit affirmed summary judgment for the defendants, noting: (1) “Though the sales price of restricted shares did fluctuate, it averaged 0.5¢ immediately before, during, and after the pendency of the involuntary petition, and (2) the affiant about an alleged plan to sell restricted shares at a substantial discount lacked personal knowledge, claiming only that he “did assist in the process when requested, which included gathering information when given direct instructions by his superiors.” Treaty Energy Corp. v. Hallin, No. 15-30113 (Oct. 27, 2015, unpublished).

In an opinion with enormous policy impact, the Fifth Circuit has affirmed the injunction of President Obama’s executive actions about immigration. Texas v. United States, No. 15-40238 (revised Nov. 25, 2015). Judge Smith wrote for the 2-judge majority, joined by Judge Elrod — an unsurprising outcome, since they formed the majority in the Court’s earlier opinion that denied an interim stay. Judge King dissented. A petition for Supreme Court review is a certainty. A good representative article about the decision appears in The Atlantic.

In an opinion with enormous policy impact, the Fifth Circuit has affirmed the injunction of President Obama’s executive actions about immigration. Texas v. United States, No. 15-40238 (revised Nov. 25, 2015). Judge Smith wrote for the 2-judge majority, joined by Judge Elrod — an unsurprising outcome, since they formed the majority in the Court’s earlier opinion that denied an interim stay. Judge King dissented. A petition for Supreme Court review is a certainty. A good representative article about the decision appears in The Atlantic.