A complicated bankruptcy proceeding led to a straightforward holding: “Courts cannot award value under Section 550(a) [the preferential-transfer statute] when the estate has recovered its transferred property in kind” elsewhere in the plan. Ad Hoc Group of Senior Secured Noteholders v Del. Trust Co. (In re Sanchez Energy Corp.), No. 23-20557 (May 30, 2025).

Category Archives: Bankruptcy

American Warrior v. Foundation Energy Fund provides a useful reminder that “finality” can mean different things in different settings:

American Warrior v. Foundation Energy Fund provides a useful reminder that “finality” can mean different things in different settings:

AWI’s position elides the distinction between “finality” for the purposes of appealability and “finality” for the purposes of res judicata. These are related, but separate concepts. Thus, “finality for purposes of appeal is not the same as finality for purposes of preclusion.”

… Just as new facts or circumstances may warrant the modification of an injunction on behalf of a party that previously failed to obtain relief or modification, new facts or circumstances may also warrant an order modifying or lifting a bankruptcy automatic stay for a party previously denied relief. Res judicata does not tie a bankruptcy court’s hands to prevent the protection, disposition, or sale of estate property by lifting or modifying the automatic stay as changed conditions warrant.

… [P]arties may appeal the denial of a lift-stay motion, their failure to do so immediately does not prejudice their ability to obtain stay relief later, when the legal and factual landscape of the bankruptcy case changes.

No. 23-30529 (Aug. 1, 2024) (emphais removed).

Aggrieved creditors argued that a recent Supreme Court opinion, which held that section 363(b) of the Bankruptcy Code was not jurisdictional (and could thus be waived), also impacted the scope of that statute when it applied. The Fifth Circuit rejected that argument in Swiss Re v. Fieldwood Energy, stating: “We perceive no narrowing of the effect of Section 363(b) other than to clarify that a party can lose the benefit of its terms.” No. 23-20104 (Feb. 20, 2024). From there, the Court found that the creditors’ appeal was moot because a stay had not been obtained, and the issues presented did not relate to anything left open by the bankruptcy plan.

Aggrieved creditors argued that a recent Supreme Court opinion, which held that section 363(b) of the Bankruptcy Code was not jurisdictional (and could thus be waived), also impacted the scope of that statute when it applied. The Fifth Circuit rejected that argument in Swiss Re v. Fieldwood Energy, stating: “We perceive no narrowing of the effect of Section 363(b) other than to clarify that a party can lose the benefit of its terms.” No. 23-20104 (Feb. 20, 2024). From there, the Court found that the creditors’ appeal was moot because a stay had not been obtained, and the issues presented did not relate to anything left open by the bankruptcy plan.

(The illustration is from DALL-E, I asked it to illustrate the bankruptcy concept of statutory mootness, and it came up with that image, for no reason that I can ascertain. I offer it to you as a good example of generative AI doing something that is both very sophisticated and very weird.)

A litigation trust, created as part of a bankruptcy plan confirmation, sued Raymond James. The trust asserted claims that had been assigned to the trust by aggrieved bondholders for the bankrupt entity, who contended that they had been misled about the bonds by Raymond James. (Remarkably, $300 million in bonds were sold in connection with a facility in rural Lousiana that would have refined raw wood into specialized fuel pellets.)

A litigation trust, created as part of a bankruptcy plan confirmation, sued Raymond James. The trust asserted claims that had been assigned to the trust by aggrieved bondholders for the bankrupt entity, who contended that they had been misled about the bonds by Raymond James. (Remarkably, $300 million in bonds were sold in connection with a facility in rural Lousiana that would have refined raw wood into specialized fuel pellets.)

In defense, Raymond James cited an indemnity agreement that it made with the debtor pre-bankruptcy. The Fifth Circuit affirmed the lower courts’ conclusion that the plan barred Raymond James from defending with that agreement. The Court said:

- Notice. “Even though [Debtor] failed to list Raymond James as a creditor when it filed for bankruptcy, Raymond James is nevertheless subject to the confirmation plan because of its actual knowledge of the underlying proceedings.”

- Plan. “Even if Raymond James was not subject to the plan, [Debtor] no longer exists, and neither the bondholders nor post-confirmation entity are its successors-in-interest.”

Raymond James & Assoc. v. Jalbert, No. 23-30040 (Jan. 30, 2024).

A challenge to the sale of a preference claim was rejected by the Fifth Circuit in Briar Capital v. Remmert: “[P]reference actions may be sold pursuant to 11 U.S.C. § 363(b)(1) because they are property of the estate under 11 U.S.C. §§ 541(a)(1) and (7). ” No. 22-20536 (Jan. 22, 2024).

Anytime Fitness LLC v. Thornhill Bros. Fitness LLC, acknowledging that a bankruptcy debtor may assign or assume an executory contract, provided an important reminder about the extent of that power: “We reiterate our prior holdings: a debtor assuming an executory contract cannot separate the wheat from the chaff. And we make clear that, when a trustee relies on § 365(f) to assign an executory contract in bankruptcy, it must assign the contract in whole, not in part.” No. 22-30757 (Oct. 27, 2023).

Anytime Fitness LLC v. Thornhill Bros. Fitness LLC, acknowledging that a bankruptcy debtor may assign or assume an executory contract, provided an important reminder about the extent of that power: “We reiterate our prior holdings: a debtor assuming an executory contract cannot separate the wheat from the chaff. And we make clear that, when a trustee relies on § 365(f) to assign an executory contract in bankruptcy, it must assign the contract in whole, not in part.” No. 22-30757 (Oct. 27, 2023).

A trucking company went into bankruptcy after its insurer paid a substantial sum to settle a personal-injury case. Other claimaints claimed that the payment was a preferential transfer, and the Fifth Circuit agreed that the claim could proceed:

As the Supreme Court explained in Begier, “[b]ecause the purpose of the avoidance provision is to the preserve the property includable within the bankruptcy estate . . . ‘property of the debtor’ subject to the preferential transfer provision is best understood as that property that would have been part of the estate had it not been transferred before the commencement of bankruptcy proceedings.” The Policy Proceeds would have been property of the estate at the time the petition was filed if they had not been transferred. Thus, for the purposes of the avoidance provision as stated in Begier, the Policy Proceeds are the property of the estate.

Law Office of Rogelio Solis PLLC v. Curtis, No. 23-40125 (Oct. 6, 2023) (citations omitted).

The Fifth Circuit was unwilling to extend a bankruptcy court’s “core” or “related-to” jurisdiction to reach a settlement agreement when:

“[T]he settlements contradict the plan. Whereas the plan discharged debts unless a timely proof of claim was filed, the settlements require Chesapeake to pay the non-filing lessors a portion of their royalty claims far higher than other creditors’ timely filed general unsecured claims. Whereas the plan assumed that Chesapeake’s leases would ride through bankruptcy unaffected, the settlement requires a mandatory alteration in the terms of thousands of Pennsylvania leases. Far from merely enforcing the plan, the settlement accomplished a self-described ‘fundamental reset of Chesapeake’s relationship with its Pennsylvania lessors.'”

No. 21-20232 (June 8, 2023).

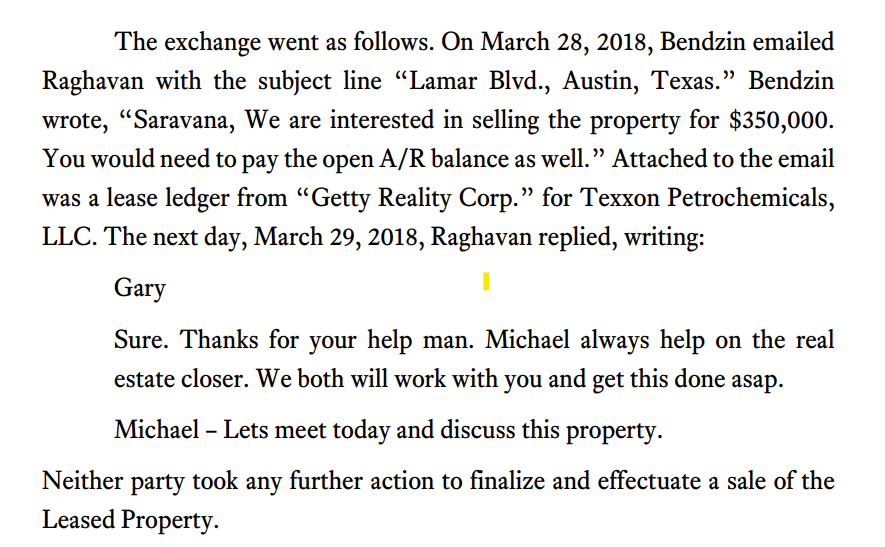

Sidestepping questions of equitable mootness, in Texxon Petrochemicals LLC v. Getty Leasing, Inc., No. 22-40357 (May 3, 2023), the Fifth Circuit affirmed the lower courts’ conclusions that this two-email exchange did not establish a contract to sell a North Austin gas station:

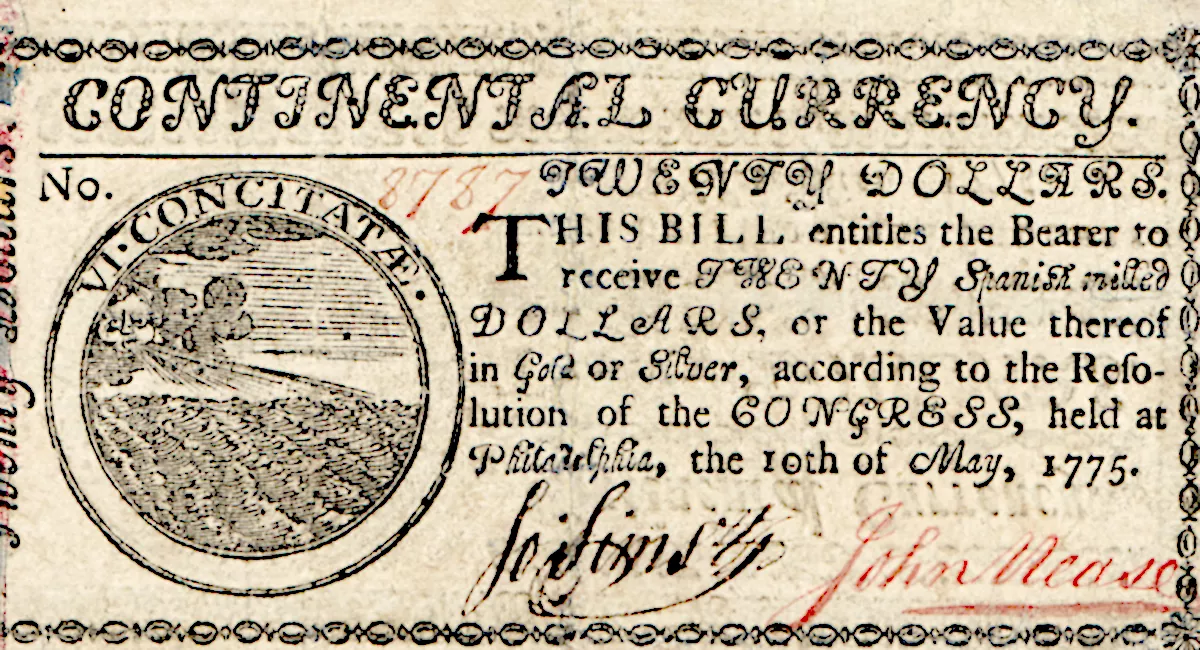

In review of a court-supervised sale of real property in a bankruptcy case, the Fifth Circuit provided a deft summary of how bankruptcy came to be an area of concern to the framers of the Constitution:

In review of a court-supervised sale of real property in a bankruptcy case, the Fifth Circuit provided a deft summary of how bankruptcy came to be an area of concern to the framers of the Constitution:

Federal bankruptcy provisions date to the Founding, embedded into our Constitution as a core tenet of the country’s economic vitality. And with good reason: “[d]ebt was an inescapable fact of life in early America . . . [that] cut across regional, class, and occupational lines,” and debtor’s prisons were antithetical to the new democratic ideal. So, in parallel with the industrialization and modernization of our markets, the Bankruptcy Code matured, its execution shifting to an independent court staffed by an array of able judges selected by merit and expert in the field, giving bankruptcy courts with their new status a crucial role in freeing the entrepreneurial energy indispensable to our nation’s economy.

SR Construction, Inc. v. Hall Palm Springs LLC, No. 21-11244 (April 17, 2023) (citations omitted).

Ultra Petroleum entered bankruptcy because of a sharp decline in natural gas prices. During the bankruptcy case, however, the price of gas recovered and soared and “propelled the debtors back into solvency.” That fortunate situation led to the question whether the “solvent debtor” concept survived recent Bankruptcy Code amendments.

Ultra Petroleum entered bankruptcy because of a sharp decline in natural gas prices. During the bankruptcy case, however, the price of gas recovered and soared and “propelled the debtors back into solvency.” That fortunate situation led to the question whether the “solvent debtor” concept survived recent Bankruptcy Code amendments.

The Fifth Circuit’s panel majority applied the relevant statutory-interpretation framework:

We must defer to prior bankruptcy practice unless expressly abrogated. The [Supreme] Court has endorsed a substantive canon of interpretation regarding the Bankruptcy Code vis-à-vis preexisting bankruptcy doctrine. Namely, abrogation of a prior bankruptcy practice generally requires an “unmistakably clear” statement on the part of Congress; any ambiguity will be construed in favor of prior practice.

(citations omitted), and concluded that the exception continued to apply:

The reason for this traditional, judicially-crafted exception is straightforward: Solvent debtors are, by definition, able to pay their debts in full on their contractual terms, and absent a legitimate bankruptcy reason to the contrary, they should. Unlike the typical insolvent bankrupt, a solvent debtor’s pie is large enough for every creditor to have his full slice. With an insolvent debtor, halting contractual interest from accruing serves the legitimate bankruptcy interest of equitably distributing a limited pie among competing creditors as of the time of the debtor’s filing. With a solvent debtor, that legitimate bankruptcy interest is not present.

Ultra Petroleum Corp. v. Ad Hoc Committee, No. 21-20008 (Oct. 14, 2022) (citations omitted). A dissent read the Code differently.

Chevrolet’s Caprice Classic was a popular sedan in the late 1970s. But the term “caprice,” applied to the business-judgment rule in the bankruptcy context, was less popular with the Fifth Circuit in In re J.C. Penney, No. 22-40371 (Oct. 6, 2022).

Chevrolet’s Caprice Classic was a popular sedan in the late 1970s. But the term “caprice,” applied to the business-judgment rule in the bankruptcy context, was less popular with the Fifth Circuit in In re J.C. Penney, No. 22-40371 (Oct. 6, 2022).

Specifically, a sublessee from J.C. Penney challenged that debtor’s decision to reject that sublease, noting irregularities in the relevant bidding process, and urging adoption a view of the business-judgment rule that would not defer to “the product of bad faith, or whim, or caprice.” The Court disagreed, observing:

The question is not whether the debtor’s decision reasonably protects the interests of other parties, but rather whether the decision “appears to enhance a debtor’s estate.” This distinction proves fatal to Klairmont’s claim, as bankruptcy, by definition, often adversely affects the interests of other parties. The long-standing purpose of allowing debtors to shed executory contracts is to afford trustees and assignees the opportunity to reject “property of an onerous or unprofitable character.” The correct inquiry under the business judgment standard is whether the debtor’s decision regarding executory contracts benefits the debtor, not whether the decision harms third parties.

No. 22-40371 (Oct. 6, 2022).

The Fifth Circuit found that the federal courts had “related to” jurisdiction because of the relationship between litigation and a bankruptcy plan:

“In Zale, the dispute between NUFIC and Cigna risked disrupting Zale’s reorganization by threatening Zale’s recovery from and access to the Cigna policy funds. Here, NFC’s claims risked the same disruptions: GenMa had pledged to pay the Lessors lots of money and to keep specified cash reserves as part of a global settlement between several parties to GenOn’s restructuring. By threatening GenMa’s ability to fulfill those commitments, NFC’s claims pertained to ‘the implementation and execution’ of that crucial settlement, which was part of GenOn’s plan. Craig’s Stores, 266 F.3d at 390. So we have related-to jurisdiction. 28 U.S.C. § 1334(b).”

Natixis Funding Corp. v. Gen-On Mid-Atlantic, LLC, No. 21-20557 (July 29, 2022).

The Bankruptcy Code allows debtors to breach and cease performing executory contracts if the bankruptcy court approves. We thus have held that debtors may “reject” regulated energy contracts even if the Federal Energy

Regulatory Commission (“FERC”) would not like them to. A sister circuit agrees, and we confirmed our view mere months ago[.]Nevertheless, FERC persisted. Anticipating the petitioner’s insolvency, FERC issued four orders purporting to bind the petitioner to continue performing its gas transit contracts even if it rejected them during bankruptcy. The petitioner asks us to vacate those orders. Because FERC cannot countermand a debtor’s bankruptcy-law rights or the bankruptcy court’s powers, we grant the petitions for review and vacate the orders.

Gulfport Energy Corp. v. FERC, No. 21-60017 (July 19, 2022) (citations omitted).

FERC v. Ultra Resources presented a novel question about the interaction of the Bankruptcy Court and a filed-rate contract, and held “that under the particular circumstances presented here, Ultra Resources is not subject to a separate public-law obligation to continue performance of its rejected contract, and that 11 U.S.C. § 1129(a)(6) did not require the bankruptcy court to seek FERC’s approval before it confirmed Ultra Resource’s reorganization plan.” No. 21-20126 (March 14, 2022).

Reminder: “Standing to appeal a bankruptcy court order is, of necessity, quite limited. … [t]his test is an even more exacting standard than traditional constitutional standing.” Dean v. Seidel, No. 21-10468 (Dec. 7, 2021) (citations omitted).

Therefore: “Here, the order on appeal — approval of a litigation funding agreement — does not affect whether Dean’s debts will be discharged. Neither does it affect Reticulum’s related pending case in which it ‘objected to Dean’s bankruptcy discharge and to discharge of its claims against Dean.’ Dean thus does not have bankruptcy standing because he cannot show how the order approving the litigation funding agreement would directly, adversely, and financially impact him.”

Official Committee of Unsecured Creditors v. Walker County Hosp. Dist. presented a debtor’s challenge to the terms of a bankruptcy court’s sale order. The Fifth Circuit dismissed: “In this opinion, we have held that § 363(m) forecloses the creditor’s appeal because it failed to seek the required stay of the Sale Order. Established precedent leads us to this conclusion, and the Committee’s argument that it appealed an order not subject to § 363(m) is unpersuasive. In short: no stay, no pay.” No. 20-20572 (July 12, 2021) (emphasis added).

Official Committee of Unsecured Creditors v. Walker County Hosp. Dist. presented a debtor’s challenge to the terms of a bankruptcy court’s sale order. The Fifth Circuit dismissed: “In this opinion, we have held that § 363(m) forecloses the creditor’s appeal because it failed to seek the required stay of the Sale Order. Established precedent leads us to this conclusion, and the Committee’s argument that it appealed an order not subject to § 363(m) is unpersuasive. In short: no stay, no pay.” No. 20-20572 (July 12, 2021) (emphasis added).

Judicial-estoppel issues often surface when a debtor a seeks to assert a claim and dispute arises about the adequacy of the debtor’s disclosures about that claim. Wal-Mart Stores, Inc. v. Parker involved a debtors personal-injury claim, and the Fifth Circuit concluded: “After declining to apply judicial estoppel and thus allowing Parker to proceed with his personal injury suit against Wal-Mart, the bankruptcy court ordered Parker to turn over any recovery to the Chapter 13 trustee to be administered for the benefit of creditors. In cases similar to Wal-Mart’s—when a potential defendant argues that a debtor is estopped from bringing a lawsuit for failure to disclose it to the bankruptcy court—we have held that, while a debtor may be estopped from pursuing the claim on his own behalf, his bankruptcy trustee is not similarly estopped and may pursue the claim for the benefit of the creditors.” No. 18-30378 (Jan. 8, 2020). “Though the bankruptcy court’s decision is certainly odd and not the route we would have chosen, we cannot say that it contained clearly erroneous factual findings or the application of incorrect legal standards that amount to an abuse of discretion.”

Judicial-estoppel issues often surface when a debtor a seeks to assert a claim and dispute arises about the adequacy of the debtor’s disclosures about that claim. Wal-Mart Stores, Inc. v. Parker involved a debtors personal-injury claim, and the Fifth Circuit concluded: “After declining to apply judicial estoppel and thus allowing Parker to proceed with his personal injury suit against Wal-Mart, the bankruptcy court ordered Parker to turn over any recovery to the Chapter 13 trustee to be administered for the benefit of creditors. In cases similar to Wal-Mart’s—when a potential defendant argues that a debtor is estopped from bringing a lawsuit for failure to disclose it to the bankruptcy court—we have held that, while a debtor may be estopped from pursuing the claim on his own behalf, his bankruptcy trustee is not similarly estopped and may pursue the claim for the benefit of the creditors.” No. 18-30378 (Jan. 8, 2020). “Though the bankruptcy court’s decision is certainly odd and not the route we would have chosen, we cannot say that it contained clearly erroneous factual findings or the application of incorrect legal standards that amount to an abuse of discretion.”

Ms. Whitlock received a large amount of money from the DeBerrys in September 2013, and returned $241,000 of it to them in October. In early 2014, Mr. DeBerry filed for bankruptcy. The trustee of his bankruptcy estate sought recovery of the 2013 transfer from Ms. Whitlock. The Fifth Circuit agreed with her that the $241,000 was not recoverable because it had already been returned to the estate before filing of the bankruptcy petition:

Ms. Whitlock received a large amount of money from the DeBerrys in September 2013, and returned $241,000 of it to them in October. In early 2014, Mr. DeBerry filed for bankruptcy. The trustee of his bankruptcy estate sought recovery of the 2013 transfer from Ms. Whitlock. The Fifth Circuit agreed with her that the $241,000 was not recoverable because it had already been returned to the estate before filing of the bankruptcy petition:

In matters of statutory interpretation, text is always the alpha. Here, it’s also the omega. Section 550(a) permits the trustee to “recover” the property. To “recover” means “[t]o get back or regain in full or in equivalence.” Obtaining a duplicate of something is not getting it back; it’s getting a windfall. Property that has already been returned cannot be “recovered” in any meaningful sense. And that principle defeats the Trustee’s claims against Ms. Whitlock. Once the fraudulently transferred property has been returned, the bankruptcy trustee cannot “recover” it again using § 550(a)

Whitlock v. Lowe, No. 18-50335 (Dec. 23, 2019) (citations omitted) (emphasis added).

The question in French v. Linn Energy LLC was subordination; the analysis reviewed the Bankruptcy Code’s policy goals: “Section 510(b) serves to effectuate one of the general principles of corporate and bankruptcy law: that creditors are entitled to be paid ahead of shareholders in the distribution of corporate assets.” The Court reviewed this issue: “whether In this case we decide that payments owed to a shareholder by a bankrupt debtor, which are not quite dividends but which certainly look a lot like dividends, should be treated like the equity interests of a shareholder and subordinated to claims by creditors of the debtor,’ and concluded that they should be. No. 18-40369 (Sept. 3, 2019).

The question in French v. Linn Energy LLC was subordination; the analysis reviewed the Bankruptcy Code’s policy goals: “Section 510(b) serves to effectuate one of the general principles of corporate and bankruptcy law: that creditors are entitled to be paid ahead of shareholders in the distribution of corporate assets.” The Court reviewed this issue: “whether In this case we decide that payments owed to a shareholder by a bankrupt debtor, which are not quite dividends but which certainly look a lot like dividends, should be treated like the equity interests of a shareholder and subordinated to claims by creditors of the debtor,’ and concluded that they should be. No. 18-40369 (Sept. 3, 2019).

Double Eagle Energy Services filed for Chapter 11 bankruptcy protection and then sued two defendants for breach of contract in federal district court. Double Eagle then assigned that claim to one of its creditors; the defendants argued that this assignment destroyed federal subject matter jurisdiction. The Fifth Circuit disagreed, relying upon the “time-of-filing” rule to find that the “related to bankruptcy” jurisdiction existing when the case was filed continued to exist after the assignment. The separate question–whether the district court should nevertheless its exercise discretion to dismiss the case–was remanded, as the Court’s “ordinary practice for discretionary decisions is remanding to ‘allow the district court to exercise its discretion in the first instance.'” Double Eagle Energy Services v. Markwest Utica EMG, No. 19-30207 (Aug. 26, 2019).

Double Eagle Energy Services filed for Chapter 11 bankruptcy protection and then sued two defendants for breach of contract in federal district court. Double Eagle then assigned that claim to one of its creditors; the defendants argued that this assignment destroyed federal subject matter jurisdiction. The Fifth Circuit disagreed, relying upon the “time-of-filing” rule to find that the “related to bankruptcy” jurisdiction existing when the case was filed continued to exist after the assignment. The separate question–whether the district court should nevertheless its exercise discretion to dismiss the case–was remanded, as the Court’s “ordinary practice for discretionary decisions is remanding to ‘allow the district court to exercise its discretion in the first instance.'” Double Eagle Energy Services v. Markwest Utica EMG, No. 19-30207 (Aug. 26, 2019).

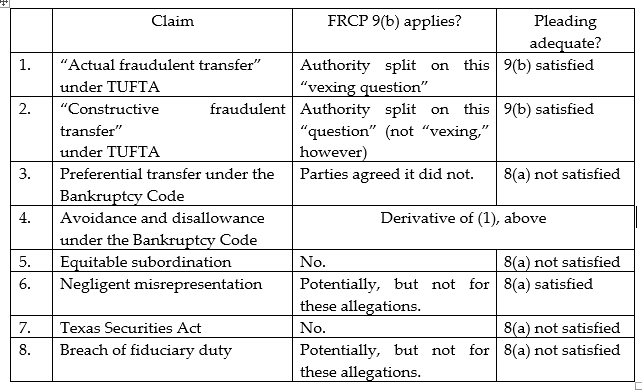

Life Partners’ Creditors’ Trust v. Cowley, No. 17-11477 (May 31, 2019), reviewed the dismissal of several highly-technical claims brought by a bankruptcy trustee about the sale of “viaticals” (investments in life insurance policies sold to third parties by the insureds). For each claim, the Fifth Circuit reviewed whether FRCP 9(b) or 8(a) applied, and then assessed the pleaded allegations, reaching these conclusions:

A multi-million dollar judgment, in favor of a bankruptcy trustee suing for the estate, foundered on two problems about party identity:

A multi-million dollar judgment, in favor of a bankruptcy trustee suing for the estate, foundered on two problems about party identity:

- Injury? The estate (LSI) had no standing to seek damages about a substantial debt incurred to an alleged insider (Jabil), because: “[T]he millions of dollars awarded under Damage Element No. 1 represent Jabil’s injury, not LSI’s. Jabil manufactured and delivered the contractually agreed upon equipment to LSI. LSI benefitted from the equipment, and Ebert even leased and sold the equipment in Chapter 11 proceedings. Moreover, LSI did not pay the invoices on the equipment. Therefore, LSI benefitted and even had cash available for other needs.” (emphasis in original)

- Benefit? Stock sales involving affiliated entities did not established a personal benefit to alleged insiders (Apfel and Bartlett): “[E]bert tacitly admits that she

provided evidence only for the nominee companies’ gains, not for Appel and Bartlett in their individual capacity. Manz’s calculations were based primarily on two documents: Schedule 7.B, which showed market sales of LSI stock, and a list of nominee companies with how many shares of LSI each owned as of September 9, 2011. Yet these documents only list companies and provide no proof of or insight into Appel and Bartlett as individuals.”

provided evidence only for the nominee companies’ gains, not for Appel and Bartlett in their individual capacity. Manz’s calculations were based primarily on two documents: Schedule 7.B, which showed market sales of LSI stock, and a list of nominee companies with how many shares of LSI each owned as of September 9, 2011. Yet these documents only list companies and provide no proof of or insight into Appel and Bartlett as individuals.”

Ebert v. DeJoria, No 18-10382 (April 30, 2019).

The Fifth Circuit sidestepped a question about the scope of the “equitable mootness” doctrine, in favor of reliance on section 363(m) of the Bankruptcy Code, which (in the Court’s summary of the statute’s clunky terms) “limits the ability of appellate courts to review the sale of estate property when the order approving the transaction is not stayed.” To avoid the statute, the would-be appellant “says it does not challenge the sale of the property but only challenges the disbursement of cash to the probate estate.” That distinction did not moo-ve the Court, as it reasoned: “Without the more than $8 million payment, the probate estate would not have released its claim that it owned the Channelview shipyard. And without that release, San Jac Marine likely would have walked away from the deal. As the bankruptcy court noted, there is no way to sever

The Fifth Circuit sidestepped a question about the scope of the “equitable mootness” doctrine, in favor of reliance on section 363(m) of the Bankruptcy Code, which (in the Court’s summary of the statute’s clunky terms) “limits the ability of appellate courts to review the sale of estate property when the order approving the transaction is not stayed.” To avoid the statute, the would-be appellant “says it does not challenge the sale of the property but only challenges the disbursement of cash to the probate estate.” That distinction did not moo-ve the Court, as it reasoned: “Without the more than $8 million payment, the probate estate would not have released its claim that it owned the Channelview shipyard. And without that release, San Jac Marine likely would have walked away from the deal. As the bankruptcy court noted, there is no way to sever

the settlement from the sale; they are mutually dependent.” No. 18-40350 (Feb.5, 2019).

The novel situation of a bankruptcy debtor, who emerged from bankruptcy proceedings solvent thanks to a luckily-timed rise in crude oil prices, gave rise to a fundamental if infrequently-encountered question: “whether the . . . creditors are ‘impaired’ by a plan that paid them everything allowed by the Bankruptcy Code.” The bankruptcy court said that they were, reasoning that a plan impairs a creditor if it refuses to pay an amount the Bankruptcy Code independently disallows; accordingly, it required a “make-whole” payment to certain creditors and set postpetition interest at a contractual rate. The Fifth Circuit saw a “monolithic mountain” of contrary authority, and reversed and remanded, holding that “the Code—not the reorganization plan—defines and limits the claim in these circumstances.” Ultra Petroleum Corp. v. Ad Hoc Committee, No. 17-20793 (Jan. 17, 2019), revised/shortened on rehearing, Nov 26, 2019.

The novel situation of a bankruptcy debtor, who emerged from bankruptcy proceedings solvent thanks to a luckily-timed rise in crude oil prices, gave rise to a fundamental if infrequently-encountered question: “whether the . . . creditors are ‘impaired’ by a plan that paid them everything allowed by the Bankruptcy Code.” The bankruptcy court said that they were, reasoning that a plan impairs a creditor if it refuses to pay an amount the Bankruptcy Code independently disallows; accordingly, it required a “make-whole” payment to certain creditors and set postpetition interest at a contractual rate. The Fifth Circuit saw a “monolithic mountain” of contrary authority, and reversed and remanded, holding that “the Code—not the reorganization plan—defines and limits the claim in these circumstances.” Ultra Petroleum Corp. v. Ad Hoc Committee, No. 17-20793 (Jan. 17, 2019), revised/shortened on rehearing, Nov 26, 2019.

Property rights are often called a “bundle of sticks”; a particularly tangled bundle was the subject of RPD Holdings LLC v. Tech Pharmacy Servcs. Careful examination of both sides’ specific obligations under a patent license led to the conclusion that it was an executory contract, rejected by operation of law during one of the parties’ Chapter 7 bankruptcy case. No. 17-11113 (Oct. 29, 2018).

Property rights are often called a “bundle of sticks”; a particularly tangled bundle was the subject of RPD Holdings LLC v. Tech Pharmacy Servcs. Careful examination of both sides’ specific obligations under a patent license led to the conclusion that it was an executory contract, rejected by operation of law during one of the parties’ Chapter 7 bankruptcy case. No. 17-11113 (Oct. 29, 2018).

OGA Charters entered bankruptcy after a tragic accident involving one of its buses. Applying Louisiana World Exposition Inc. v. Fed. Ins. Co., 832 F.2d 1391 (5th Cir. 1987), and Houston v. Edgeworth, 993 F.2d 51 (5th Cir. 1993), the Fifth Circuit held: “We now make official what our cases have long contemplated: In the ‘limited circumstances,’ as here, where a siege of tort claimants threaten the debtor’s estate over and above the policy limits, we classify the proceeds as property of the estate. Here, over $400 million in related claims threaten the debtor’s estate over and above the $5 million policy limit, giving rise to an equitable interest of the debtor in having the proceeds applied to satisfy as much of those claims as possible.” Martinez v. OGA Charters LLC, No. 17-40920 (Aug. 24, 2018).

An element of judicial estoppel is that “a court accepted the prior position” that is inconsistent with a party’s position in the case at hand. In Fornesa v. Fifth Third Mortgage Co., a bankruptcy debtor’s failure to amend his financial schedules satisfied that requirement, as “the bankruptcy court . . . implicitly accepted the representation by operating as though [Debtor’s] financial status were unchanged. ‘Had the court been aware . . . it may well have altered the plan.'” No. 17-20324 (July 27, 2018).

An element of judicial estoppel is that “a court accepted the prior position” that is inconsistent with a party’s position in the case at hand. In Fornesa v. Fifth Third Mortgage Co., a bankruptcy debtor’s failure to amend his financial schedules satisfied that requirement, as “the bankruptcy court . . . implicitly accepted the representation by operating as though [Debtor’s] financial status were unchanged. ‘Had the court been aware . . . it may well have altered the plan.'” No. 17-20324 (July 27, 2018).

“Federal law does not prevent a bona fide shareholder from exercising its right to vote against a bankruptcy petition just because it is also an unsecured creditor. Under these circumstances, the issue of corporate authority to file a bankruptcy petition is left to state law.” Accordingly, when (a) the debtor is a Delaware corporation, (b) governed by that state’s General Corporation Law, and (c) nothing in that law would nullify the sole preferred shareholder’s right to vote against the bankruptcy petition, that shareholder has the right to vote against – and thus prevent – the corporation’s filing of a voluntary bankruptcy petition. Franchise Services. v. U.S. Trustee, No. 18-60093 (May 22, 2018).

“Federal law does not prevent a bona fide shareholder from exercising its right to vote against a bankruptcy petition just because it is also an unsecured creditor. Under these circumstances, the issue of corporate authority to file a bankruptcy petition is left to state law.” Accordingly, when (a) the debtor is a Delaware corporation, (b) governed by that state’s General Corporation Law, and (c) nothing in that law would nullify the sole preferred shareholder’s right to vote against the bankruptcy petition, that shareholder has the right to vote against – and thus prevent – the corporation’s filing of a voluntary bankruptcy petition. Franchise Services. v. U.S. Trustee, No. 18-60093 (May 22, 2018).

Comcast loaned $100 million to a sports television network, secured by a lien on substantially all the network’s assets. When the network had financial problems, Comcast entities placed it into an involuntary Chapter 11 proceeding. The Fifth Circuit reversed on, inter alia, a subtle but very significant point – at what point in time should unpaid media fees be valued, to credit against the potential value to Comcast of a valuable agreement? The Court concluded that “a court is not required to use either the petition date or the effective date,” but should rather “follow a flexible approach to valuation timing that allows the bankruptcy court to take into account the development of the proceedings, as the value of the collateral may vary dramatically based on its proposed use under any given plan.” Houston SportsNet Finance LLC v. Houston Astros LLC, No. 15-20497 (March 29, 2018).

Comcast loaned $100 million to a sports television network, secured by a lien on substantially all the network’s assets. When the network had financial problems, Comcast entities placed it into an involuntary Chapter 11 proceeding. The Fifth Circuit reversed on, inter alia, a subtle but very significant point – at what point in time should unpaid media fees be valued, to credit against the potential value to Comcast of a valuable agreement? The Court concluded that “a court is not required to use either the petition date or the effective date,” but should rather “follow a flexible approach to valuation timing that allows the bankruptcy court to take into account the development of the proceedings, as the value of the collateral may vary dramatically based on its proposed use under any given plan.” Houston SportsNet Finance LLC v. Houston Astros LLC, No. 15-20497 (March 29, 2018).

Because the Texas homestead exemption, like the Texas exemption for retirement accounts, applies at the time a Chapter 7 bankruptcy petition is filed, the Fifth Circuit rejected a trustee’s attempt to seize the proceeds from a sale of the debtor’s home. The Court concluded that a “snapshot” approach to the exemption, as it had previously used for retirement accounts, did not let the trustee reach the proceeds, concluding: “He is trying to transform the [proceeds rule] from one that extends the homestead exemption to some situations when the home is not owned on the filing date into one that limits the homestead exemption even when the debtor owns the home on the filing date.” Lowe v. DeBerry, No. 17-50315 (March 7, 2018).

Because the Texas homestead exemption, like the Texas exemption for retirement accounts, applies at the time a Chapter 7 bankruptcy petition is filed, the Fifth Circuit rejected a trustee’s attempt to seize the proceeds from a sale of the debtor’s home. The Court concluded that a “snapshot” approach to the exemption, as it had previously used for retirement accounts, did not let the trustee reach the proceeds, concluding: “He is trying to transform the [proceeds rule] from one that extends the homestead exemption to some situations when the home is not owned on the filing date into one that limits the homestead exemption even when the debtor owns the home on the filing date.” Lowe v. DeBerry, No. 17-50315 (March 7, 2018).

The problem in LeJeune v. JFK Capital Holdings LLC was the following: “Two approaches for determining the appropriate ‘commission’ for Chapter 7 trustees have emerged in recent years. Under the first approach, some courts hold that Section 326(a) is not simply a maximum but also a presumptively reasonable fixed commission rate to be reduced only in rare instances.Other courts hold that the presumptively reasonable approach is nonetheless subject to adjustment in ‘extraordinary circumstances.’ Some courts similarly presume that the Section 326(a) percentages are reasonable, but perform a more in-depth review of the trustee’s services to ensure the presumption is justified.'” (citations omitted). After reviewing the applicable statutes, the Fifth Circuit aligned itself with the first approach and the analysis of Mohns, Inc. v. Lanser, 522 B.R. 594, 601 (E.D. Wis.), aff’d sub nom. In re Wilson, 796 F.3d 818 (7th Cir. 2015). No. 16-31151-CV (Jan. 26, 2018).

The problem in LeJeune v. JFK Capital Holdings LLC was the following: “Two approaches for determining the appropriate ‘commission’ for Chapter 7 trustees have emerged in recent years. Under the first approach, some courts hold that Section 326(a) is not simply a maximum but also a presumptively reasonable fixed commission rate to be reduced only in rare instances.Other courts hold that the presumptively reasonable approach is nonetheless subject to adjustment in ‘extraordinary circumstances.’ Some courts similarly presume that the Section 326(a) percentages are reasonable, but perform a more in-depth review of the trustee’s services to ensure the presumption is justified.'” (citations omitted). After reviewing the applicable statutes, the Fifth Circuit aligned itself with the first approach and the analysis of Mohns, Inc. v. Lanser, 522 B.R. 594, 601 (E.D. Wis.), aff’d sub nom. In re Wilson, 796 F.3d 818 (7th Cir. 2015). No. 16-31151-CV (Jan. 26, 2018).

The question in Peake v. Ayobami was whether a bankruptcy debtor, who asserts a 100% exemption as to a particular estate asset, is asserting that exemption as to the asset itself or its value. The practical consequence is whether “claiming a 100% interest in an asset as exempt allows the debtor to ‘walk away’ with the asset itself and potentially benefit from any post-petition appreciation of it.” The Fifth Circuit gave a limited answer, noting that the statute allows the debtor to claim “a 100% interest in an asset,” and also noting Supreme Court precedent that expressed skepticism about whether a debtor could use this ability to get clear title to a valuable asset, but not providing an ultimate answer to the question. Ni. 16-20589 (Jan. 3, 2018).

The question in Peake v. Ayobami was whether a bankruptcy debtor, who asserts a 100% exemption as to a particular estate asset, is asserting that exemption as to the asset itself or its value. The practical consequence is whether “claiming a 100% interest in an asset as exempt allows the debtor to ‘walk away’ with the asset itself and potentially benefit from any post-petition appreciation of it.” The Fifth Circuit gave a limited answer, noting that the statute allows the debtor to claim “a 100% interest in an asset,” and also noting Supreme Court precedent that expressed skepticism about whether a debtor could use this ability to get clear title to a valuable asset, but not providing an ultimate answer to the question. Ni. 16-20589 (Jan. 3, 2018).

Among other Twombly problems, the Fifth Circuit criticized a bankruptcy trustee’s claims about excessive bonuses, noting: “The Trustee does not explain how ATP’s compensation was excessive in comparison to other similarly sized public companies in the oil and gas industry at the time. Indeed,the Trustee offers no metric or explanation for finding the bonuses ‘exorbitant.'” And in this procedural setting, “these pleading deficiencies are ‘particularly striking’ because the Trustee has ample access to ATP’s books and records.” Tow v. Bulmahn, No. 17-30077 (Oct. 27, 2017, unpublished).

Among other Twombly problems, the Fifth Circuit criticized a bankruptcy trustee’s claims about excessive bonuses, noting: “The Trustee does not explain how ATP’s compensation was excessive in comparison to other similarly sized public companies in the oil and gas industry at the time. Indeed,the Trustee offers no metric or explanation for finding the bonuses ‘exorbitant.'” And in this procedural setting, “these pleading deficiencies are ‘particularly striking’ because the Trustee has ample access to ATP’s books and records.” Tow v. Bulmahn, No. 17-30077 (Oct. 27, 2017, unpublished).

In ASARCO LLC v. Montana Resources, Inc., a case involving the interplay of a business’s bankruptcy with a later lawsuit for breach of contract by that business, the Fifth Circuit observed:

In ASARCO LLC v. Montana Resources, Inc., a case involving the interplay of a business’s bankruptcy with a later lawsuit for breach of contract by that business, the Fifth Circuit observed:

- “[A] declaratory claim on its own typically will not preclude future claims involving the same circumstances (as noted, issue preclusion may still apply to any declaration the court issues). But in a case involving both declaratory claims and ones seeking coercive relief, the former will not serve as an antidote that undoes the preclusive force that traditional claims would ordinarily have.” (applying the “seminal case” on the point, Kaspar Wire Works, Inc. v. Leco Engineering & Machine, Inc., 575 F.2d 530 (5th Cir. 1978))

- As to the damages claim, “ASARCO’s claim for failure to reinstate did not accrue until MRI rejected the tender in 2011. . . . ASARCO may or may not have attempted to cure, and MRI may or may not have denied ASARCO’s reinstatement. Because the present breach of contract claim was contingent on future events, ASARCO could not have brought it during the adversary proceeding.”

- For the same reasons, the plaintiff was not judicially estopped by allegedly inadequate disclosures during the earlier bankruptcy: “MRI cites no case requiring a party to disclose a potential claim for breach of contract when the contract had not yet been breached. This makes sense, because MRI’s position would require a debtor to scour its contracts looking for hypothetical claims that another party could maybe breach in the future.”

No. 16-40682 (June 2, 2017).

An architecture firm held a large judgment against a bankruptcy debtor, and contended that the failure of the debtor’s insurer to object to that claim barred further dispute about the insurer’s liability. The Fifth Circuit disagreed, concluding that “in this no asset bankruptcy case, nothing in the court proceedings required claims allowance, no notice was provided to parties in interest to object to claims, and no bankruptcy purpose would have been served by the bankruptcy court’s adjudicating [the firm’s claim.” Kipp Flores Architects v. Mid-Continent Casualty Co., No. 16-20255 (March 24, 2017).

An architecture firm held a large judgment against a bankruptcy debtor, and contended that the failure of the debtor’s insurer to object to that claim barred further dispute about the insurer’s liability. The Fifth Circuit disagreed, concluding that “in this no asset bankruptcy case, nothing in the court proceedings required claims allowance, no notice was provided to parties in interest to object to claims, and no bankruptcy purpose would have been served by the bankruptcy court’s adjudicating [the firm’s claim.” Kipp Flores Architects v. Mid-Continent Casualty Co., No. 16-20255 (March 24, 2017).

Tower Credit garnished the debtor’s wages. In defense of a later preference action, Tower argued that its garnishment was effective when served (taking it outside the preference period), not when the debtor in fact received money. The Fifth Circuit disagreed: “The combination of Supreme Court precedent and the overwhelming weight of persuasive authority applying §

Tower Credit garnished the debtor’s wages. In defense of a later preference action, Tower argued that its garnishment was effective when served (taking it outside the preference period), not when the debtor in fact received money. The Fifth Circuit disagreed: “The combination of Supreme Court precedent and the overwhelming weight of persuasive authority applying §  547(e)(3) make clear that a debtor’s wages cannot be transferred until they are earned. Thus, we hold that a creditor’s collection of garnished wages earned during the preference period is an avoidable transfer made during the preference period even if the garnishment was served prior to that period.” Tower Credit v. Schott, No. 16-30274 (March 13, 2017).

547(e)(3) make clear that a debtor’s wages cannot be transferred until they are earned. Thus, we hold that a creditor’s collection of garnished wages earned during the preference period is an avoidable transfer made during the preference period even if the garnishment was served prior to that period.” Tower Credit v. Schott, No. 16-30274 (March 13, 2017).

Gatheright bought sweet potatoes from Clark, paying with two post-dated checks. When they were returned for insufficient funds, Clark instituted criminal proceedings against Gatheright, which were ultimately dismissed after Gatheright spent several weeks in jail. Gatheright then sued Clark for malicious prosecution and abuse of process. The Fifth Circuit affirmed summary judgment for Clark, observing that “$16,000 in bad checks . . . [is] a sum greater than what the Mississippi Supreme Court has previously found would prompt a reasonable person to institute criminal proceedings.” Based on that observation, the Court rejected arguments about whether a post-dated

Gatheright bought sweet potatoes from Clark, paying with two post-dated checks. When they were returned for insufficient funds, Clark instituted criminal proceedings against Gatheright, which were ultimately dismissed after Gatheright spent several weeks in jail. Gatheright then sued Clark for malicious prosecution and abuse of process. The Fifth Circuit affirmed summary judgment for Clark, observing that “$16,000 in bad checks . . . [is] a sum greater than what the Mississippi Supreme Court has previously found would prompt a reasonable person to institute criminal proceedings.” Based on that observation, the Court rejected arguments about whether a post-dated  check was a proper basis for a “false pretenses” prosecution in Mississippi, and about the effect of Gatheright’s filing for personal bankruptcy. Gatheright v. Clark, No. 16-60364 (Feb. 23, 2017, unpublished).

check was a proper basis for a “false pretenses” prosecution in Mississippi, and about the effect of Gatheright’s filing for personal bankruptcy. Gatheright v. Clark, No. 16-60364 (Feb. 23, 2017, unpublished).

Just before filing for bankruptcy, Mr. Wiggins signed a “Partition Agreement” in which he and his wife divided their ownership of their home into two separate property interests. The Fifth Circuit affirmed the bankruptcy court’s conclusion that this was a fraudulent transfer: “When it became clear that Mr. Wiggains would file bankruptcy to satisfy his outstanding debts, the couple entertained various options and made their best estimate on ultimate financial benefits by having only Mr. Wiggains file after the Partition Agreement was recorded. Allowing Mrs. Wiggains to sidestep the statutory limits for homestead exemptions and obtain approximately $500,000 in proceeds that otherwise are for creditors would lay waste to the provisions of the Bankruptcy Code involved here.” Wiggains v. Reed, No. 15-11249 (Feb. 14, 2017).

In Netsch v. Sherman, the appellants’ counsel missed the 14-day deadline for an appeal from bankruptcy court. The district court denied relief and the Fifth Circuit affirmed; while noting that all relevant factors were either neutral or favored appellants, it concluded:”[T]he bankruptcy court concluded that the reason for the delay weighed strongly against finding excusable neglect. In its analysis of this factor, the bankruptcy court emphasized that the parties had been subject to the Federal Rules of Bankruptcy Procedure throughout the adversary proceeding, these rules were unambiguous, and Appellants’ counsel confused the Federal Rules of Bankruptcy Procedure with the Federal Rules of Civil Procedure. The bankruptcy court also indicated that confusing bankruptcy procedure with civil procedure does not constitute excusable neglect. Consequently, the court held that the reason for the delay should be given greater weight than other factors.” No. 16-10432 (Dec. 22, 2016, unpublished).

In Netsch v. Sherman, the appellants’ counsel missed the 14-day deadline for an appeal from bankruptcy court. The district court denied relief and the Fifth Circuit affirmed; while noting that all relevant factors were either neutral or favored appellants, it concluded:”[T]he bankruptcy court concluded that the reason for the delay weighed strongly against finding excusable neglect. In its analysis of this factor, the bankruptcy court emphasized that the parties had been subject to the Federal Rules of Bankruptcy Procedure throughout the adversary proceeding, these rules were unambiguous, and Appellants’ counsel confused the Federal Rules of Bankruptcy Procedure with the Federal Rules of Civil Procedure. The bankruptcy court also indicated that confusing bankruptcy procedure with civil procedure does not constitute excusable neglect. Consequently, the court held that the reason for the delay should be given greater weight than other factors.” No. 16-10432 (Dec. 22, 2016, unpublished).

The parties to McCloskey v. McCloskey disputed whether a debt was non-dischargeable as a child support obligation. Rejecting the application of the somewhat protean doctrine of judicial estoppel, the Fifth Circuit held: “Bankruptcy courts must ‘look beyond the labels which state courts—and even parties themselves—give obligations which debtors seek to discharge.’ A party may argue in bankruptcy

The parties to McCloskey v. McCloskey disputed whether a debt was non-dischargeable as a child support obligation. Rejecting the application of the somewhat protean doctrine of judicial estoppel, the Fifth Circuit held: “Bankruptcy courts must ‘look beyond the labels which state courts—and even parties themselves—give obligations which debtors seek to discharge.’ A party may argue in bankruptcy  court that an obligation constitutes support even if she has urged to the contrary in state court. Therefore, appellees are not judicially estopped from bringing this claim.” No. 16-20079 (Oct. 31, 2016, unpublished). (Compare the recent case of Galaz v. Katona, which applied judicial estoppel in a bankruptcy case based on inconsistent statements made in earlier state court litigation about ownership interests. No. 15-50919 (Oct. 28, 2016, unpublished).

court that an obligation constitutes support even if she has urged to the contrary in state court. Therefore, appellees are not judicially estopped from bringing this claim.” No. 16-20079 (Oct. 31, 2016, unpublished). (Compare the recent case of Galaz v. Katona, which applied judicial estoppel in a bankruptcy case based on inconsistent statements made in earlier state court litigation about ownership interests. No. 15-50919 (Oct. 28, 2016, unpublished).

In Monaco v. TAG Investments, the parties disputed the dischargeability of a $171,942.03 debt, based on the alleged misapplication of funds subject to Texas’s powerful Construction Trust Fund Act. The Fifth Circuit focused on a defense provided by that statute, which applies when “the trust funds not paid to the beneficiaries of the trust were used by the trustee to pay the trustee’s actual expenses directly related to the construction or repair of the improvement.” The Court accepted the explanation that “$124,053 went to salaries and overhead and an additional $50,400.00 went to superivision of this project,” noting that “payment of these sums as reasonable was approved by TAG’s architect.” Accordingly, the defense applied and the debt was dischargeable. No. 15-51085 (Oct. 6, 2016).

In Monaco v. TAG Investments, the parties disputed the dischargeability of a $171,942.03 debt, based on the alleged misapplication of funds subject to Texas’s powerful Construction Trust Fund Act. The Fifth Circuit focused on a defense provided by that statute, which applies when “the trust funds not paid to the beneficiaries of the trust were used by the trustee to pay the trustee’s actual expenses directly related to the construction or repair of the improvement.” The Court accepted the explanation that “$124,053 went to salaries and overhead and an additional $50,400.00 went to superivision of this project,” noting that “payment of these sums as reasonable was approved by TAG’s architect.” Accordingly, the defense applied and the debt was dischargeable. No. 15-51085 (Oct. 6, 2016).

In Kingdom Fresh Produce, Inc. v. Stokes Law Office LLP, the Fifth Circuit tended the garden of the obscure but important Perishable Agricultural Commodities Act, a Depression-era statute designed to defend vulnerable sellers of perishable produce from sharp dealing. To do so, PACA creates a “trust fund” obligation for produce buyers; here, a bankruptcy court authorized the payment of special counsel from monies in a debtor’s fund.

In Kingdom Fresh Produce, Inc. v. Stokes Law Office LLP, the Fifth Circuit tended the garden of the obscure but important Perishable Agricultural Commodities Act, a Depression-era statute designed to defend vulnerable sellers of perishable produce from sharp dealing. To do so, PACA creates a “trust fund” obligation for produce buyers; here, a bankruptcy court authorized the payment of special counsel from monies in a debtor’s fund.

Three fee applications were at issue. As to the first two, the Court found that the district  court had not granted leave to appeal and thus did not have jurisdiction to uproot the bankruptcy court’s rulings. “With these jurisdictional issues peeled away,” and after “a bit more paring” of the remaining issue, the Court held that “PACA’s unequivocal language requires that a PACA trustee—or in this case, its functional equivalent—may not be paid from trust assets ‘until full payment of the sums owing’ is paid to all claimants.” Nos. 14-51079 & 14-51080 (March 11, 2016). (Readers’ Note: 600Camp will publicly recognize the blog reader who finds all of the vegetabilia in the well-written opinion.)

court had not granted leave to appeal and thus did not have jurisdiction to uproot the bankruptcy court’s rulings. “With these jurisdictional issues peeled away,” and after “a bit more paring” of the remaining issue, the Court held that “PACA’s unequivocal language requires that a PACA trustee—or in this case, its functional equivalent—may not be paid from trust assets ‘until full payment of the sums owing’ is paid to all claimants.” Nos. 14-51079 & 14-51080 (March 11, 2016). (Readers’ Note: 600Camp will publicly recognize the blog reader who finds all of the vegetabilia in the well-written opinion.)

Collins challenged bankruptcy court jurisdiction over “illusory indemnity and contribution claims” that he alleged had no conceivable effect on the bankruptcy estate due to their lack of merit. The Fifth Circuit rejected his argument: “Both the Supreme Court and this court have gravitated away from conflating jurisdiction and merits, and Collins’s proposed standard results in exactly that conflation.” The Court also noted that the claims, based on a principal’s alleged commitment to indemnify its agent, were not “wholly insubstantial and frivolous” on their merits. Collins v. Sidharthan, No. 14-41226 (Dec. 15, 2015).

Collins challenged bankruptcy court jurisdiction over “illusory indemnity and contribution claims” that he alleged had no conceivable effect on the bankruptcy estate due to their lack of merit. The Fifth Circuit rejected his argument: “Both the Supreme Court and this court have gravitated away from conflating jurisdiction and merits, and Collins’s proposed standard results in exactly that conflation.” The Court also noted that the claims, based on a principal’s alleged commitment to indemnify its agent, were not “wholly insubstantial and frivolous” on their merits. Collins v. Sidharthan, No. 14-41226 (Dec. 15, 2015).

A creditor argued that the bankruptcy court should have used the same property valuation in both the debtor’s bankruptcy case and the creditor’s adversary proceeding against the debtor, citing the doctrines of judicial estoppel and res judicata. The Fifth Circuit disagreed: “The district court correctly held that the valuations under [Bankruptcy Code] §§ 1129 and 506 are two distinct, separate valuations required for different purposes. The feasibility projections under § 1129 were based on [the debtor’s] estimate of ‘monies to be realized from the sale of lots over time’ and anticipated continued development of the Property. The estimate under § 506, on the other hand, was based on an appraisal of the present fair market value of the Property. As a result, [the debtor] did not assume inconsistent positions by presenting two different valuations for two different purposes, nor does the bankruptcy court’s acceptance of a § 1129 feasibility plan constitute a final judgment on the value of the Property under § 506. The doctrines of judicial estoppel and res judicata are not applicable.” Gold Star Construction, Inc. v. Cavu Rock Properties Project I, LLC, No. 15-50455 (Jan. 4, 2015, unpublished).

A creditor argued that the bankruptcy court should have used the same property valuation in both the debtor’s bankruptcy case and the creditor’s adversary proceeding against the debtor, citing the doctrines of judicial estoppel and res judicata. The Fifth Circuit disagreed: “The district court correctly held that the valuations under [Bankruptcy Code] §§ 1129 and 506 are two distinct, separate valuations required for different purposes. The feasibility projections under § 1129 were based on [the debtor’s] estimate of ‘monies to be realized from the sale of lots over time’ and anticipated continued development of the Property. The estimate under § 506, on the other hand, was based on an appraisal of the present fair market value of the Property. As a result, [the debtor] did not assume inconsistent positions by presenting two different valuations for two different purposes, nor does the bankruptcy court’s acceptance of a § 1129 feasibility plan constitute a final judgment on the value of the Property under § 506. The doctrines of judicial estoppel and res judicata are not applicable.” Gold Star Construction, Inc. v. Cavu Rock Properties Project I, LLC, No. 15-50455 (Jan. 4, 2015, unpublished).

The bankruptcy debtor owned a large candle factory; after a year of effort, the trustee gave up trying to realize more value on the factory property than what was owed on the outstanding mortgages, and abandoned the property to Southwest Securities. The remaining legal issue was: “Should the estate or the secured creditor pay the property’s maintenance expenses incurred while the trustee was trying to sell the property?”

The bankruptcy debtor owned a large candle factory; after a year of effort, the trustee gave up trying to realize more value on the factory property than what was owed on the outstanding mortgages, and abandoned the property to Southwest Securities. The remaining legal issue was: “Should the estate or the secured creditor pay the property’s maintenance expenses incurred while the trustee was trying to sell the property?”

Section 506(c) of the Bankruptcy Code provides: “The trustee may recover from property securing an allowed secured claim the reasonable, necessary costs and expenses of

preserving, or disposing of, such property to the extent of any benefit to the holder of such claim, including the payment of all ad valorem property taxes with respect to the property.” The Fifth Circuit found that Southwest benefited, and that the costs were fairly taxed against it from sales proceeds: “[W]e accept that an expense which was not incurred primarily to preserve or dispose of encumbered property cannot meet the requirement of being incurred primarily for the benefit of the secured creditor. But we also accept the inverse: that an expense incurred primarily to preserve or dispose of encumbered property meets the requirement. The necessary direct relationship between the expenses and the collateral is obvious here; all of the surcharged expenses related only to preserving the value of the Property and preparing it for sale.” Southwest Securities v. Segner, No. 14-41463 (Dec. 29, 2015).

The Allens filed for Chapter 13 bankruptcy protection; during the pendency of that case, they sued Mrs. Allen’s employer for injuries allegedly suffered in the workplace. The Fifth Circuit affirmed summary judgment for the employer, finding the three elements of judicial estoppel satisfied by the Allens’ failure to disclose the personal injury suit in the bankruptcy – (1) inconsistent positions, (2) one of which was accepted by a court, and (3) lack of inadvertence by the Allens. The Court also found that the overall balance of equities weighed against the Allens, given the importance of full disclosure to the bankruptcy process. The Court modified the judgment to be without prejudice so the Allens’ trustee could pursue the suit if he or she so desired (although acknowledging potential limitations issues). Allen v. C&H Distributors, Inc., No. 15-30330 (Dec. 23, 2015). The opinion is of broad interest because of its detailed analysis of judicial estoppel under the general three-part test, rather than a more truncated version sometimes employed in bankruptcy cases.

The Allens filed for Chapter 13 bankruptcy protection; during the pendency of that case, they sued Mrs. Allen’s employer for injuries allegedly suffered in the workplace. The Fifth Circuit affirmed summary judgment for the employer, finding the three elements of judicial estoppel satisfied by the Allens’ failure to disclose the personal injury suit in the bankruptcy – (1) inconsistent positions, (2) one of which was accepted by a court, and (3) lack of inadvertence by the Allens. The Court also found that the overall balance of equities weighed against the Allens, given the importance of full disclosure to the bankruptcy process. The Court modified the judgment to be without prejudice so the Allens’ trustee could pursue the suit if he or she so desired (although acknowledging potential limitations issues). Allen v. C&H Distributors, Inc., No. 15-30330 (Dec. 23, 2015). The opinion is of broad interest because of its detailed analysis of judicial estoppel under the general three-part test, rather than a more truncated version sometimes employed in bankruptcy cases.

Fortune Natural Resources made a claim in the bankruptcy of an oil exploration company for roughly $3 million related to decommisioning a lease. Fortune alleged that adjustments to a sale order hurt its right of recovery on that claim. The Fifth Circuit disagreed and found no standing, observing: “Fortune’s argument that it meets the ‘person aggrieved’ standard because it has already received a letter from . . . mandating that it decommission its Lease misses the mark. Fortune’s payment of decommissioning costs may show an injury, but it does not show that the bankruptcy court’s order caused this injury. This court’s jurisprudence states that the order of the bankruptcy court must directly and adversely affect the appellant pecuniarily. Having failed to present sufficient evidence to show that Fortune was directly and adversely affected pecuniarily by the order of the bankruptcy court, Fortune does not meet the ‘person aggrieved” test.” Fortune Natural Resources Corp. v. United States Dep’t of the Interior, No. 15-20151 (Nov. 19, 2015, unpublished).

Fortune Natural Resources made a claim in the bankruptcy of an oil exploration company for roughly $3 million related to decommisioning a lease. Fortune alleged that adjustments to a sale order hurt its right of recovery on that claim. The Fifth Circuit disagreed and found no standing, observing: “Fortune’s argument that it meets the ‘person aggrieved’ standard because it has already received a letter from . . . mandating that it decommission its Lease misses the mark. Fortune’s payment of decommissioning costs may show an injury, but it does not show that the bankruptcy court’s order caused this injury. This court’s jurisprudence states that the order of the bankruptcy court must directly and adversely affect the appellant pecuniarily. Having failed to present sufficient evidence to show that Fortune was directly and adversely affected pecuniarily by the order of the bankruptcy court, Fortune does not meet the ‘person aggrieved” test.” Fortune Natural Resources Corp. v. United States Dep’t of the Interior, No. 15-20151 (Nov. 19, 2015, unpublished).

The district court removed a bankruptcy trustee after he sought to bill a family trip to New Orleans to the estate, noting two past situations where the court had an issue with the trustee’s practices. The Fifth Circuit affirmed, rejecting several challenges to that ruling based primarily on the consideration of the past situations, holding: “The district courts and in turn the bankruptcy courts are the keepers of the temple. These courts rely on the bar to abide by its strict rules and norms of conduct. Bankruptcy practice presents many tasks attended and girded by strict identity of duty and diligence by its officers. The courts below were only minding their role: not to end, but to redirect a distinguished presence at the bar, and to give sustenance to necessarily demanding norms of practice. That this is expected does not diminish its importance.” Smith v. Robbins, No. 14-20588 (Sept. 25, 2015).

Cypress Financial invested in Petters Company. Petters turned out to be a Ponzi scheme and its bankruptcy trustee sought to recover money transferred from Petters to Cypress. Cypress filed for Chapter 7 protection but its case was dismissed because it “serves only to delay the prosecution of a lawsuit against the debtor.” In re Cypress Financial, No. 14-10956 (Aug. 12, 2015, unpublished). “Everyone agrees there are no assets to marshal or liquidate, and applicable statutes of limitations bar any preference or fraudulent transfer actions that might lead to additional assets. . . . With no benefit conferred but considerable harm inflicted by Cypress’s Chapter 7 case, the district court properly concluded that the bankruptcy court abused its discretion. . . Even if we were to agree with Cypress that the bankruptcy court had no ’cause’ [under § 707(a)] to dismiss the case, its victory is pyrrhic.”

Cypress Financial invested in Petters Company. Petters turned out to be a Ponzi scheme and its bankruptcy trustee sought to recover money transferred from Petters to Cypress. Cypress filed for Chapter 7 protection but its case was dismissed because it “serves only to delay the prosecution of a lawsuit against the debtor.” In re Cypress Financial, No. 14-10956 (Aug. 12, 2015, unpublished). “Everyone agrees there are no assets to marshal or liquidate, and applicable statutes of limitations bar any preference or fraudulent transfer actions that might lead to additional assets. . . . With no benefit conferred but considerable harm inflicted by Cypress’s Chapter 7 case, the district court properly concluded that the bankruptcy court abused its discretion. . . Even if we were to agree with Cypress that the bankruptcy court had no ’cause’ [under § 707(a)] to dismiss the case, its victory is pyrrhic.”

Johnny Long, a former bankruptcy debtor, sought to bring FCA claims against his former employer. The defendant successfully obtained dismissal on the ground of judicial estoppel because the claim was not listed on Long’s bankruptcy schedules. After reminding that judicial estoppel, as a flexible and equitable doctrine, does not automatically compel dismissal in such a situation, the Fifth Circuit affirmed. The elements are that “(1) the party against whom judicial estoppel is sought has asserted a legal position which is plainly inconsistent with a prior position, (2) a court accepted the prior position, and (3) the party did not act inadvertently.” The specific issue was the third element, and whether Long had a motivation to conceal. The Court noted three advantageous features the payment terms in Long’s Chapter 13 plan, which disclosure could have endangered — and further noted that after judicial estoppel was raised, Long sought to reopen his case so “he may pay interest to his creditors” if he recovered on his FCA claim. United States ex rel Long v. GSD&M Idea City, LLC, 798 F.3d 265 (5th Cir. 2015). A later award to the defendant of roughly $200,000 in costs was substantially affirmed in United States ex rel Long v. GSDMidea City, LLC, No. 14-11049 (Dec. 1, 2015).

An earlier panel opinion found the Golf Channel liable for $5.9 million under the Texas Uniform Fraudulent Transfer Act (“TUFTA”), even though it delivered airtime with that market value, because the purchaser was Allen Stanford while running a Ponzi scheme. Accordingly, the airtime had no value to creditors, despite its market value. On rehearing, the Fifth Circuit vacated its initial opinion and certified the controlling issue to the Texas Supreme

An earlier panel opinion found the Golf Channel liable for $5.9 million under the Texas Uniform Fraudulent Transfer Act (“TUFTA”), even though it delivered airtime with that market value, because the purchaser was Allen Stanford while running a Ponzi scheme. Accordingly, the airtime had no value to creditors, despite its market value. On rehearing, the Fifth Circuit vacated its initial opinion and certified the controlling issue to the Texas Supreme  Court: “Considering the definition of ‘value’ in section 24.004(a) of the Texas Business and Commerce Code, the definition of ‘reasonably equivalent value’ in section 24.004(d) of the Texas Business and Commerce Code, and the comment in the Uniform Fraudulent Transfer Act stating that ‘value’ is measured ‘from a creditor’s viewpoint,’ what showing of ‘value’ under TUFTA is sufficient for a transferee to prove the elements of the affirmative defense under section 24.009(a) of the Texas Business and Commerce Code?” Janvey v. The Golf Channel, No. 13-11305 (June 30, 2015).

Court: “Considering the definition of ‘value’ in section 24.004(a) of the Texas Business and Commerce Code, the definition of ‘reasonably equivalent value’ in section 24.004(d) of the Texas Business and Commerce Code, and the comment in the Uniform Fraudulent Transfer Act stating that ‘value’ is measured ‘from a creditor’s viewpoint,’ what showing of ‘value’ under TUFTA is sufficient for a transferee to prove the elements of the affirmative defense under section 24.009(a) of the Texas Business and Commerce Code?” Janvey v. The Golf Channel, No. 13-11305 (June 30, 2015).

A revised Templeton v. O’Cheskey did not alter the Fifth Circuit’s analysis about proof of a Ponzi scheme, but slightly clarified the scope of its holding about “good faith” under the fraudulent transfer provision of the Bankruptcy Code. That holding was that the “good faith test under Section 548(c) is generally presented as a “two-step inquiry” into (1) whether the transferee had “inquiry notice” of the transferor’s possible insolvency or possible fraud and (2) if so, whether the transferee then satisfied a “diligent investigation” requirement. No. 14-10563 (June 8, 2015). (The Fifth Circuit addressed the related “good faith” requirement under TUFTA in GE Capital v. Worthington National Bank, 754 F.3d 297 (5th Cir. 2014)).

Adler, the distributing agent for a bankrupt business, sought to sue a law firm for allegedly mishandling its affairs and causing its financial problems. The business’s Third Amended Plan of Reorganization had a provision that retained its standing to pursue avoidance and fraudulent transfer actions against a list of named defendants (which did not include the law firm). The Plan also had a provision reserving “[a]ny and all other claims and causes of action which may have been asserted by the Debtor prior to the Effective Date.” The Fifth Circuit held that this was “exactly the sort of blanket reservation that is insufficient to preserve the debtor’s standing.” (citing Dynasty Oil & Gas LLC v. Citizens Bank, 540 F.3d 551 (5th Cir. 2008)). On waiver grounds, he Court declined to consider whether such a reservation would be sufficient if “(1) the defendant is a non-creditor [and thus not entitled to vote on the plan] and (2) the reorganization plan clearly identifies how the proceeds of the claim will be distributed.” Adler v. Frost, No. 14-31109 (June 11, 2015, unpublished).

As a counterpoint to the recent case of Alonso v. Abide — which required leave of court to sue a bankruptcy trustee for alleged negligence in handling a claim against a debtor’s insurer — in Carroll v. Abide, the Fifth Circuit reversed the dismissal of a claim against a trustee because leave was not required. No. 14-31230 (June 11, 2015). The debtors sued, alleging that the trustee violated their Fourth Amendment rights in seizing a computer. Again applying Barton v. Barbour, 104 U.S. 126 (1881), the Court concluded: “[B]ecause the [debtors] complain of the bankruptcy trustee’s conduct while carrying out district court orders, we conclude that the plaintiffs were not required to seek permission from the bankruptcy court before filing suit in the district court regarding the challenged conduct.” (emphasis added).

Former bankruptcy debtors sued their trustee, alleging that he failed to sue an insurer who could have satisfied many creditors’ claims. The district court dismissed because the plaintiffs did not first get leave from the bankruptcy court that appointed the trustee, and the Fifth Circuit affirmed under Barton v. Barbour, 104 U.S. 126, 128 (1881) (an opinion by the otherwise unmemorable William Burnham Woods, right).

Former bankruptcy debtors sued their trustee, alleging that he failed to sue an insurer who could have satisfied many creditors’ claims. The district court dismissed because the plaintiffs did not first get leave from the bankruptcy court that appointed the trustee, and the Fifth Circuit affirmed under Barton v. Barbour, 104 U.S. 126, 128 (1881) (an opinion by the otherwise unmemorable William Burnham Woods, right).

The debtors contended that Stern v. Marshall implicitly overruled Barton, in part, because the bankruptcy court would lack final adjudicative authority over their state law tort claims. The Fifth Circuit disagreed, holding that under Barton: “If a bankruptcy court concludes that the claim against a trustee is one that the court would not itself be able to resolve under Stern, that court can make the initial decision on the procedure to follow. Once a bankruptcy court makes such a determination, this court can review the utilized procedure.” Villegas v. Schmidt, No. 14-40423 (May 28, 2015).

In Harris v. Viegelahn, No. 14-400 (May 18, 2015), the Supreme Court resolved a split between the Third and Fifth Circuits and held 9-0 (contrary to the Fifth’s position) that “by excluding postpetition wages from the converted Chapter 7 estate (absent a bad-faith conversion), 11 U.S.C. § 348(f) removes those earnings from the pool of assets that may be liquidated and distributed to creditors.”

Among several issues addressed in the complicated bankruptcy appeal of Templeton v. O’Cheskey, the Fifth Circuit considered whether the “ordinary course of business” defense applied to alleged preferential transfers. The Court noted that a “true” Ponzi scheme is one with “operations build on the collection of funds from new investments to pay off prior investors.” Here, “only a portion of the funds controlled by [Debtor] ([Creditor] estimates 9%) was used to pay Ponzi-like returns to investors,” and the

Among several issues addressed in the complicated bankruptcy appeal of Templeton v. O’Cheskey, the Fifth Circuit considered whether the “ordinary course of business” defense applied to alleged preferential transfers. The Court noted that a “true” Ponzi scheme is one with “operations build on the collection of funds from new investments to pay off prior investors.” Here, “only a portion of the funds controlled by [Debtor] ([Creditor] estimates 9%) was used to pay Ponzi-like returns to investors,” and the  “record is clear that [Debtor] engaged in substantial legitimate business–owning or controlling approximately 14,000 housing units.” Therefore, the defense could apply, and these transfers were remanded for further consideration. No. 14-10563 (revised May 12, 2015).

“record is clear that [Debtor] engaged in substantial legitimate business–owning or controlling approximately 14,000 housing units.” Therefore, the defense could apply, and these transfers were remanded for further consideration. No. 14-10563 (revised May 12, 2015).