The Fifth Circuit denied en banc review of ExxonMobil v. NLRB, a dispute about the NLRB’s decision to vacate an earlier decision and retry the matter (decried by Exxon as a political maneuver; defended by the NLRB as the result of a conflict for a board member involved in the earlier proceeding). A dissent from the denial of en banc review states the case against excessive “independence” for independent agencies, and also has some observations about party-presentation as applied to the evolution of the parties’ arguments during this long-lived case. No. 23-60495 (Dec. 17, 2025).

Category Archives: Administrative Law

The reticulated python (right) can be found in South Asia. A “reticulated statute” was at issue in Baylor All Saints Medical Center v. Kennedy, in which the Fifth Circuit concluded that the district court had no jurisdiction to hear a Medicare-reimbursement dispute when agency review had not been exhausted. The Court noted: “To be sure, a court may waive the administrative exhaustion requirement if administrative remedies would be exhaustive … Howeer, the court does not reach [that issue] because the case does not satisfy the ‘jurisdictional requirement that claims be presented to the agency.'” No. 24-10934 (Dec. 9, 2025).

The reticulated python (right) can be found in South Asia. A “reticulated statute” was at issue in Baylor All Saints Medical Center v. Kennedy, in which the Fifth Circuit concluded that the district court had no jurisdiction to hear a Medicare-reimbursement dispute when agency review had not been exhausted. The Court noted: “To be sure, a court may waive the administrative exhaustion requirement if administrative remedies would be exhaustive … Howeer, the court does not reach [that issue] because the case does not satisfy the ‘jurisdictional requirement that claims be presented to the agency.'” No. 24-10934 (Dec. 9, 2025).

A challenging administrative law issue, about certain airline fee-disclosure requirements, produced a panel opinion that agreed with FAA’s authority but remanded for consideration of new information. The Fifth Circuit recently voted to take the case en banc.

A challenging administrative law issue, about certain airline fee-disclosure requirements, produced a panel opinion that agreed with FAA’s authority but remanded for consideration of new information. The Fifth Circuit recently voted to take the case en banc.

In State of Texas v. EPA, the Fifth Circuit upheld the EPA’s authority to substantively evaluate and disapprove a State Implementation Plan under the Clean Air Act’s Good Neighbor Provision. The court confirmed that EPA may require SIPs to address both “significant[] contribut[ion] to nonattainment” and independent “interfere[nce] with maintenance” in other states, including areas not formally designated nonattainment, and emphasized that “The text puts EPA in the driver’s seat for evaluating a SIP’s compliance with the CAA.”

In State of Texas v. EPA, the Fifth Circuit upheld the EPA’s authority to substantively evaluate and disapprove a State Implementation Plan under the Clean Air Act’s Good Neighbor Provision. The court confirmed that EPA may require SIPs to address both “significant[] contribut[ion] to nonattainment” and independent “interfere[nce] with maintenance” in other states, including areas not formally designated nonattainment, and emphasized that “The text puts EPA in the driver’s seat for evaluating a SIP’s compliance with the CAA.”

The court also approved EPA’s reliance on up-to-date interstate transport modeling and a 2017 projection year as reasonable, reiterating that “nothing in the statute places the EPA under an obligation to provide specific metrics to States before they undertake to fulfill their good neighbor obligations.” Because Texas’s SIP lacked analysis quantifying downwind impacts and ignored maintenance receptors, EPA’s disapproval was neither arbitrary nor capricious. 16-60670; Sept. 22, 2025. A dissent would vacate the EPA’s action for missing the 12-month deadline established by a statute.

In Texas Corn Producers v. U.S. EPA, the EPA disputed the plaintiffs’ standing; among its arguments it “counters that automakers might respond to the inflated CAFE stringency in four different ways—not all of which decrease gasoline demand. Thus, EPA contends, the petitioners’ alleged injury is too speculative to support Article III standing.”

The Fifth Circuit expressed skepticism, noting that this argument was not consistent with the purpose of the challenged regulation in the first instance: “But EPA misses the forest for the trees. Indeed, reducing fuel demand is the core purpose of the CAFE standards. As NHTSA explained in its latest CAFE rulemaking, the current standards are estimated to ‘reduce gasoline consumption by 64 billion gallons relative to reference baseline levels for passenger cars and light trucks … through calendar year 2050.’ If EPA additionally increases CAFE stringency through the backdoor, then gasoline consumption will predictably fall even further.” No. 24-60209 (June 24, 2025) (footnote omitted, emphasis in original).

While the long-running friction between the Fifth Circuit and U.S. Supreme Court about standing did not produce cert grants on the topic this term (after last year’s 9-0 reversal on standing in theg mifepristone litigation), three recent Supreme Court reviews of Fifth Circuit opinions involve similar topics, with mixed results:

- The Supreme Court held that the Fifth Circuit erred by hearing a challenge to a Nuclear Regulatory Commission decision about a waste facility, when the challenger – the State of Texas – had not been a party to the agency proceeding. NRC v. Texas, No. 23-1300 (U.S. June 18, 2025).

- In EPA v. Calumet, the Supreme Court held that the Fifth Circuit erred because challenges to the EPA’s denials of small-refinery exemption petitions under the Clean Air Act belong only in the D.C. Circuit. While each such denial is “only locally or regionally applicable” because it applies to a specific refinery, they fall within the statute’s “nationwide scope or effect” exception when they are “based on a determination of nationwide scope or effect.” No. 23-1229 (U.S. June 18, 2025); cf. Oklahoma v. EPA, No. 23-1067 (U.S. June 18, 2025) (holding that challenges to state-specific emission plans belonged in a regional circuit, not the D.C. Circuit, because they were “locally or regionally applicable action”).

- And in FDA v. R.J. Reynolds, the Supreme Court affirmed the Fifth Circuit’s venue decision about a retailer’s challenge to the FDA’s denial of a permit about a “vaping” product. he FDA argued that only the manufacturer (the applicant) was “adversely affected” and thus eligible to seek judicial review, and that the case should be dismissed or transferred to a different circuit. The Fifth Circuit denied the FDA’s motion and the Supreme Court agreed, olding that retailers who would sell a new tobacco product but for the FDA’s denial are “adversely affected” and may seek judicial review under the TCA. No. 23-1187 (June 20, 2025).

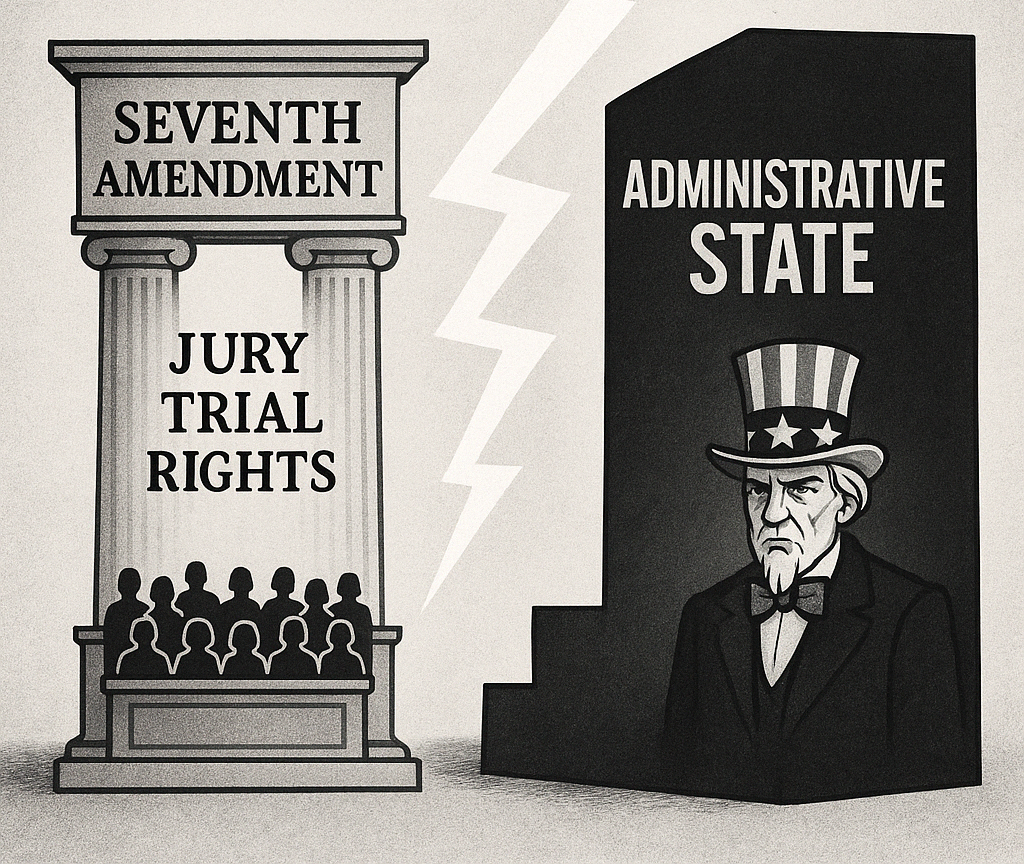

After affirmance of the Fifth Circuit in SEC v. Jarkesy, that Court returned to the interaction between the Seventh Amendment and the admininistrative state in AT&T Inc. v. FCC. The specific issue was whether the FCC’s in-house enforcement procedures for imposing civil penalties violate the constitutional right to a jury trial, as clarified by Jarkesy.

After affirmance of the Fifth Circuit in SEC v. Jarkesy, that Court returned to the interaction between the Seventh Amendment and the admininistrative state in AT&T Inc. v. FCC. The specific issue was whether the FCC’s in-house enforcement procedures for imposing civil penalties violate the constitutional right to a jury trial, as clarified by Jarkesy.

The court held that the FCC’s process ran afoul of the Seventh Amendment, emphasizing that these civil penalties are “the prototypical common law remedy,” designed to punish or deter, and thus “a type of remedy at common law that could only be enforced in courts of law.” In particular, and FCC enforcement action under section 222 of the Telecommunications Act resembles a negligence action, as it centers on whether the carrier took “reasonable measures” to protect customer data, notwithstanding the technical nature of the factual situation.

The Court also rejected the FCC’s argument that the availability of a later trial in federal court—after the agency has already found liability and imposed penalties—satisfies the Seventh Amendment. In such a trial, explained the Court, the defendant cannot challenge the legal conclusions of the agency, only the factual basis, and that this structure forces companies to choose between a jury trial and the ability to challenge the legality of the order. No. 24-60223, Apr. 17, 2025. (A third judge concurred without opinion).

The question whether an administrative agency has unfairly “changed the rules” is central in many challenges to regulations. On April 2, the Supreme Court addressed a particularly hard-fought dispute about that issue in FDA v. Wages & White Lion Investments, LLC, a case about the FDA’s denial of marketing authorization for flavored e-cigarette products.

The question whether an administrative agency has unfairly “changed the rules” is central in many challenges to regulations. On April 2, the Supreme Court addressed a particularly hard-fought dispute about that issue in FDA v. Wages & White Lion Investments, LLC, a case about the FDA’s denial of marketing authorization for flavored e-cigarette products.

The en banc Fifth Circuit held that the FDA acted arbitrarily and capriciously by applying different standards than those stated in its predecisional guidance documents, and by failing to review marketing plans previously deemed critical.

The Supreme Court held that the FDA’s denial orders were consistent with its predecisional guidance about scientific evidence, comparative efficacy, and device type. The Court concluded that the FDA’s guidance documents did not commit to any specific type of study, and that the FDA’s requirement for manufacturers to compare their flavored products to tobacco-flavored products was a natural consequence of its guidance. No. 23-1038 (U.S. Apr. 2, 2025).

The Supreme Court today reversed the Fifth Circuit’s invalidation of an ATF regulation about “ghost guns,” noting that the relevant statute applied to “any weapon (including a starter gun) which will or is designed to or may readily be converted to expel a projectile by the action of an explosive.”

The Supreme Court today reversed the Fifth Circuit’s invalidation of an ATF regulation about “ghost guns,” noting that the relevant statute applied to “any weapon (including a starter gun) which will or is designed to or may readily be converted to expel a projectile by the action of an explosive.”

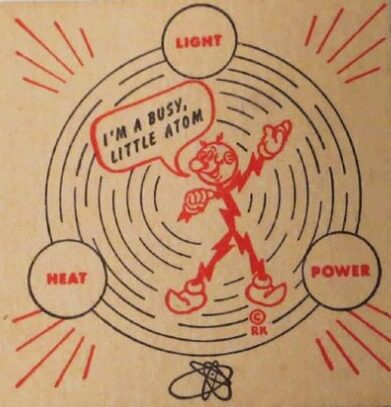

That grant of authority is readily distinguished from last Term’s opinion in Cargill v. Garland, which involved a statute focused on a specific type of firing mechanism.

In State of Texas v. Trump, the Fifth Circuit considered whether an executive order by President Biden, mandating a $15 minimum wage for federal contractors, fell within his authority under the Federal Property and Administrative Services Act (FPASA). That statute lets the President “prescribe policies and directives that the President considers necessary to carry out this subtitle,” provided that these policies are consistent with the Act’s objectives. The court found that the Executive Order’s purpose of promoting “economy and efficiency in procurement by contracting with sources that adequately compensate their workers” aligns with the FPASA’s goals, and that the minimum-wage requirement was within the scope of his discretion. No. 23-40671 (Feb. 4, 2025).

In National Automobile Dealers Assoc. v. FTC, the Fifth Circuit vacated the FTC’s “Combating Auto Retail Scams Trade Regulation Rule” (CARS Rule) because the FTC failed to to issue an advance notice of proposed rulemaking (ANPRM) as required by its own regulations.

In National Automobile Dealers Assoc. v. FTC, the Fifth Circuit vacated the FTC’s “Combating Auto Retail Scams Trade Regulation Rule” (CARS Rule) because the FTC failed to to issue an advance notice of proposed rulemaking (ANPRM) as required by its own regulations.

The court rejected the FTC’s argument that the Dodd-Frank Act exempted it from the ANPRM requirement. While the Dodd-Frank Act allows the FTC to use regular APA procedures for rulemaking concerning auto dealers, it does not eliminate the FTC’s internal procedural safeguards. A dissent argued that the petitioners failed to show prejudice from the lack of an ANPRM, given their extensive participation in the rulemaking process. No. 24-60013, Jan. 27, 2025

Airlines for America v. DOT addressed when additional rulemaking notice is called for because of new factual information. The Fifth Circuit concluded that the Department of Transportation (DOT) had relied on new data from a study study, to justify its rule on airline fee disclosures without providing an opportunity for public comment on this data.

Airlines for America v. DOT addressed when additional rulemaking notice is called for because of new factual information. The Fifth Circuit concluded that the Department of Transportation (DOT) had relied on new data from a study study, to justify its rule on airline fee disclosures without providing an opportunity for public comment on this data.

This omission was material because the study supplied basic assumptions used by the DOT to estimate the net benefits of the rule, which ranged from $30 million to $254 million annually. The Court stated that the DOT’s reliance on this new data without public input constituted a “serious procedural error.” Nos. No. 24-60231 and 24-60373 (Jan. 28, 2025).

While the rescission of the recent “funding freeze” memo seems to end the present dispute, history teaches that the issues will return in new form, as was seen with the travel ban at the start of the first Trump Administration, vaccine mandates, and the efforts of the Biden Administration to forgive substantial amounts of student-loan observations. “Round Two” will doubtless feature a more focused assertion of executive power by the Trump Administration, and also more sophisticated challenges to that assertion – including the selection of substantive legal arguments and the identification of plaintiffs who have strong standing positions.

A new lawsuit brought by several state AGs expands the legal claims about the “funding freeze” to include several constitutional issues – whether those additional issues survive standing / justiciability challenges remains to be seen. To date, the Administrative Procedure Act claims have focused on OMB’s authority and not the longer-term issue of just what exactly agencies are supposed to do while the “freeze” is in place – and how that comports with the APA and those agencies’ enabling statutes and mandates.

Today’s ultra-aggressive “funding freeze” memo appears to be right out of the Dobbs playbook – take an action that is not allowed under current law (the Mississippi law at issue in that case, which was plainly unconstitutional under Roe/Casey) and present it to the modern-day Supreme Court conservative supermajority.

Understandably, public comment on the memo has focused on the Nixon-era Impoundment Act. But at the courthouse, the first filed lawsuit focused on the old warhorse of the Administrative Procedure Act – the law that repeatedly stymied aggressive administrative-agency action in both the Biden and the first Trump administration.

That’s wise as a matter of substantive law – there are fruitful arguments to be made under the APA – and as a matter of avoiding the Dobbs playbook of presenting a flashy constitutional issue. “Another” APA case is simply a less compelling topic for the Supreme Court to address.

Illustrating the choppy waters that can surround a nationwide injunction, in December, Fifth Circit judges reached three different conclusions about whether to stay the Corporate Transparency Act and related administrative rules. The motions-panel majority held:

Illustrating the choppy waters that can surround a nationwide injunction, in December, Fifth Circit judges reached three different conclusions about whether to stay the Corporate Transparency Act and related administrative rules. The motions-panel majority held:

The district court concluded that both are unconstitutional and issued nationwide injunctions against each, despite no party requesting it do so and despite every other court to have considered this issue tailoring relief to the parties before it or denying relief altogether.

The third member of the motions panel concurred in part:

[She] agrees for an expedited appeal and agrees that a national injunction is not appropriate here, so she would grant a temporary stay of the preliminary injunction pending the decision of the merits panel regarding whether to deny a stay pending appeal as to the non-parties. However, she would deny the temporary stay as to the parties (while, of course, deferring to the merits panel on this point as well), including the members of NFIB, as long as their identities are disclosed to the government.

A later per curiam order, which may have issued from the merits panel, or may simply reflect communication with that panel, reached a different conclusion:

The merits panel now has the appeal, which remains expedited, and a briefing schedule will issue forthwith. However, in order to preserve the constitutional status quo while the merits panel considers the parties’ weighty substantive arguments, that part of the motions-panel order granting the Government’s motion to stay the district court’s preliminary injunction enjoining enforcement of the CTA and the Reporting Rule is VACATED.

These changes show how minor variations in panel makeup can have profound consequences when nationwide equitable relief is at issue. (The party-presentation issue referred to by the motions-panel majority is also addressed in my recent Cornell Law Review essay.)

In Alliance for Fair Board Recruitment v. SEC, the en banc Fifth Circuit held that the SEC should not have approved Nasdaq’s “Board Diversity Proposal.”

In Alliance for Fair Board Recruitment v. SEC, the en banc Fifth Circuit held that the SEC should not have approved Nasdaq’s “Board Diversity Proposal.”

The Court reminded that the Act is focused on protecting investors from speculative, manipulative, and fraudulent practices, and promoting competition in the securities market; therefore: “SEC may not approve even an a disclosure rule unless it can establish the rule has some connection to an actual, enumerated purpose of the Act.” It rejected the SEC’s argument that the proposal would satisfy investor demand for diversity information, holding: “The purpose of satisfying investor demand for any and every kind of information about exchange-listed companies is not remotely similar to any of those stated purposes.”

Cf. McCullough v. Maryland,17 U.S. 316 (1819) (“Among the enumerated powers, we do not find that of establishing a bank or creating a corporation. But there is no phrase in the instrument which, like the articles of confederation, excludes incidental or implied powers; and which requires that everything granted shall be expressly and minutely described.”).

The Court also found support for its holding in the major questions doctrine, given the expansive regulatory authority that it concluded would be needed for the SEC to implement the proposal. A dissent argued that the SEC had received substantial evidence that investors sought standardized information on board diversity, and noted the SEC’s limited statutory authority to review the rules of Nasdaq, a distinct and private entity (albeit one that is heavily regulated). No. 21-60626, Dec. 11, 2024 (9-8 vote).

In Van Loon v. Dep’t of the Treasury, the Fifth Circuit addressed the Treasury Department’s authority to regulate “property” under the International Emergency Economic Powers Act. After a detailed explanation of the blockchain technology involved, the Court held that certain “immutable smart contracts” do not qualify as “property” under IEEPA. The Court emphasized that “property” must be capable of being owned, and since the immutable smart contracts are unchangeable and unremovable, they cannot be owned or controlled by any entity, including their creators.

In Van Loon v. Dep’t of the Treasury, the Fifth Circuit addressed the Treasury Department’s authority to regulate “property” under the International Emergency Economic Powers Act. After a detailed explanation of the blockchain technology involved, the Court held that certain “immutable smart contracts” do not qualify as “property” under IEEPA. The Court emphasized that “property” must be capable of being owned, and since the immutable smart contracts are unchangeable and unremovable, they cannot be owned or controlled by any entity, including their creators.

The Court further clarified that even under the Treasury’s own regulatory definitions, the immutable smart contracts do not fit within the scope of “property.” The court noted that these smart contracts are neither contracts nor services, as they do not involve any human effort or control once they are deployed. No. 23-50669 (Nov. 26, 2024).

In State of Texas v. U.S. Dep’t of Homeland Security, the Fifth Circuit addressed a challenge by Texas to a federal plan to cut razor wire installed by Texas at a border crossing. A 2-1 opinion ordered entry of a preliminary injunction against the planned wire-cutting.

In State of Texas v. U.S. Dep’t of Homeland Security, the Fifth Circuit addressed a challenge by Texas to a federal plan to cut razor wire installed by Texas at a border crossing. A 2-1 opinion ordered entry of a preliminary injunction against the planned wire-cutting.

The panel majority held the Administrative Procedure Act “clearly waives the United States’ sovereign immunity for Texas’s common law claims,” allowing Texas to seek injunctive relief against federal agencies and officers. In particular, Texas’s claims sought non-monetary relief and were based on the destruction of its property, which falls under the definition of “agency action” in the APA.

The majority also held that Texas showed a strong likelihood of success on its state law trespass-to-chattels claim–the concertina wire is state property, and Texas had shown that the federal agents’ actions were not justified by any exigency or statutory authority. As a result, the court granted Texas’s request for a preliminary injunction, enjoining federal agents from damaging or interfering with Texas’s concertina wire fence.

A dissent argued that Texas did not show the alleged “wire-cutting policy” constituted final agency action, which is a prerequisite for judicial review under the Administrative Procedure Act (APA). It also concluded that Texas’s state law claims were barred by intergovernmental immunity, as applying Texas tort law to federal agents would improperly control federal operations. No. 23-50869 (Nov. 27, 2024).

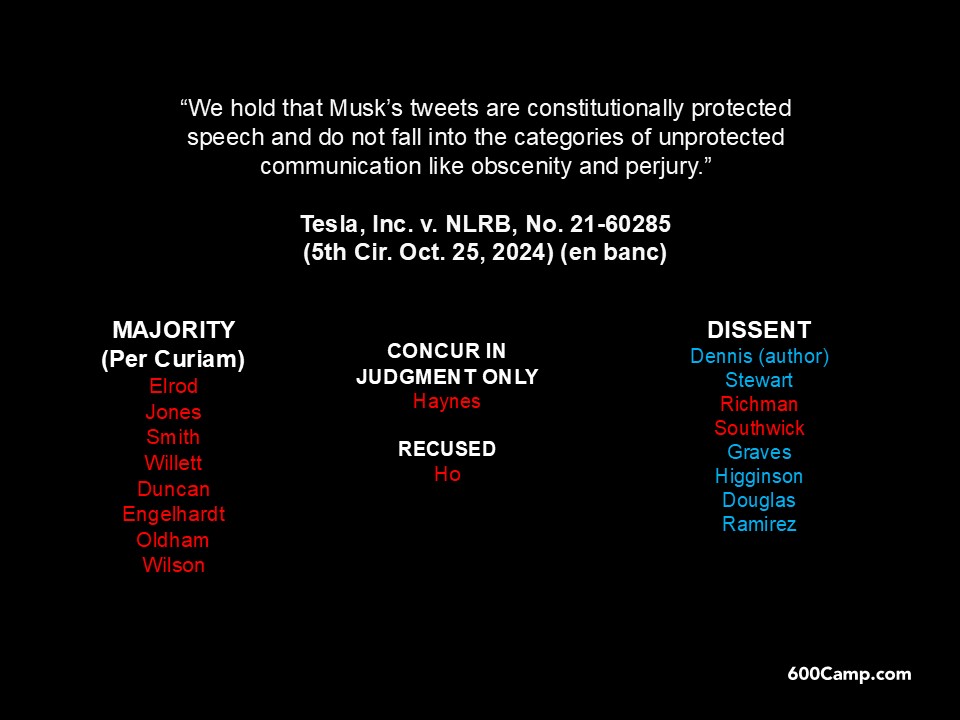

In a per curiam opinion joined by eight judges, the Fifth Circuit held in Tesla v. NLRB that an NLRB decision about unfair labor practices by Tesla would be vacated and remanded for further proceedings:

We hold that Musk’s tweets are constitutionally protected speech and do not fall into the categories of unprotected communication like obscenity and perjury. And the Board does not dispute the general rule that it (like every other part of the Government) is powerless to delete protected speech.

But nine other judges didn’t join that opinion. As detailed below, Judge Haynes concurred in the judgment only, and eight judges joined a dissent. So what the NLRB is supposed to do on remand is not entirely clear.

Restaurant Law Center v. U.S. Dep’t of Labor presents a case study in review of an agency regulation after Loper-Bright:

Restaurant Law Center v. U.S. Dep’t of Labor presents a case study in review of an agency regulation after Loper-Bright:

- 29 U.S.C. § 203(t) says, in relevant part, that a “tipped employee” means “any employee engaged in an occupation in which he customarily and regularly receives more than $30 a month in tips.” (emphasis added).

- The Labor Department regulation implementing that statute focused on the amount of time, during the work period, that the employee engaged in tip-eligible activity; in summary: “An employer may take the tip credit for tip-producing work. But if more than 20 percent of an employee’s workweek is spent on directly supporting work, the employer cannot claim the tip credit for that excess. Nor can directly supporting work be performed for more than 30 minutes at any given time. An employer may not take the tip credit for any time spent on work not part of the tipped occupation.” (footnote omitted).

- Without the Chevron backstop, that regulation was invalid because it didn’t fit the statute’s unambiguous terms: “'[E]ngaged in an occupation in which [the employee] customarily and regularly receives more than $30 a month in tips’ cannot be twisted to mean being ‘engaged in duties that directly produce tips, or in duties that directly support such tip-producing duties (but only if those supporting duties have not already made up 20 percent of the work week and have not been occurring for 30 consecutive minutes) and not engaged in duties that do not produce tips.'”

“In short, as to supporting work, the Final Rule replaces the Congressionally chosen touchstone of the tip-credit analysis—the occupation—with one of DOL’s making—the timesheet.” No. 23-505762 (Aug. 23, 2024).

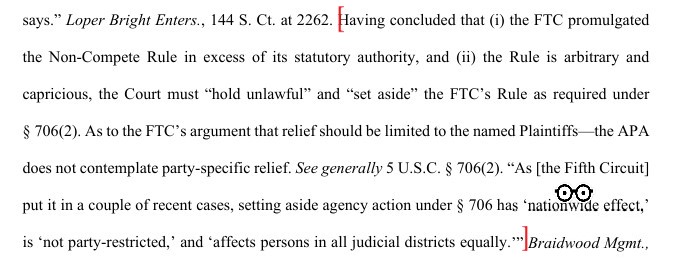

In the high-profile Dallas case challenging the FTC’s new rule about noncompete enforcement, Judge Ada Brown ruled for the plaintiffs in all respects. Ryan LLC v. FTC (N.D. Tex. Aug. 20, 2024). The opinion sidesteps nagging questions about the propriety of a nationwide injunction by focusing on the plain terms of the Administrative Procedure Act:

I take the reins in this Bloomberg article today about the U.S. Chamber of Commerce choosing to file lawsuits about administrative-agency rules in Texas / the Fifth Circuit.

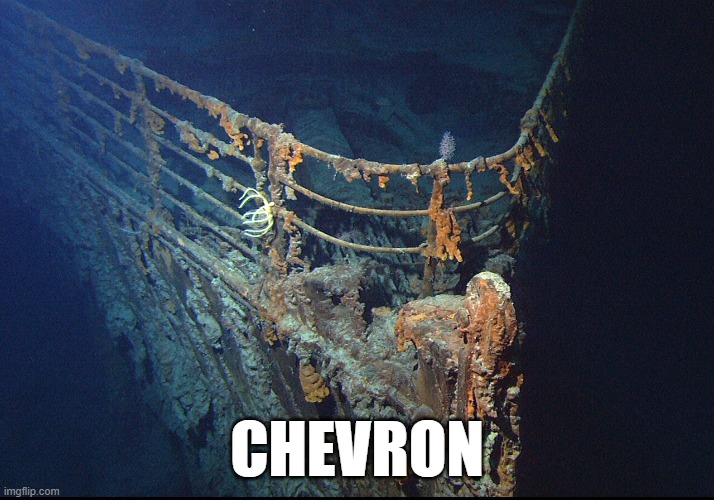

A high-ranking sergeant in the Armed Forces has a lot of chevrons (right). So too, today’s federal courts, after the overruling of Chevron. In Utah v. Su, the Fifth Circuit remanded a pending case that presented a post-Chevron issue of regulatory authority, reasoning:

A high-ranking sergeant in the Armed Forces has a lot of chevrons (right). So too, today’s federal courts, after the overruling of Chevron. In Utah v. Su, the Fifth Circuit remanded a pending case that presented a post-Chevron issue of regulatory authority, reasoning:

Whatever efficiency or economy is gained by taking up the parties’ invitation to decide their dispute in light of the intervening changes, both we and the circuit at large would be better served by the slight delay occasioned by remanding to the district court for its reasoned judgment.

No. 23-11097 (July 18, 2024).

Late last week, Judge Ada Brown from the Northern District of Texas held that the FTC exceeded its authority by its new rule about noncompetition agreements, granted a preliminary injunction, and set the matter for trial in late August. Notably, as of now, the relief granted does not include a nationwide injunction about the rule.

Fifth Circuit affirmed in SEC v. Jarkesy:

A defendant facing a fraud suit has the right to be tried by a jury of his peers before a neutral adjudicator. Rather than recognize that right, the dissent would permit Congress to concentrate the roles of prosecutor, judge, and jury in the hands of the Executive Branch. That is the very opposite of the separation of powers that the Constitution demands. Jarkesy and Patriot28 are entitled to a jury trial in an Article III court.

No. 22-859 (U.S. June 27, 2024).

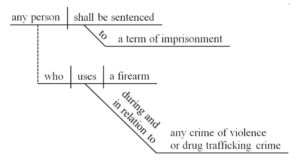

I didn’t really understand the issues in the bump-stock case until I saw the below graphic in Judge Elrod’s majority opinion for the en banc Fifth Circuit. Once I saw that, I realized why ATF had gone out over its skiis, and why the Supreme Court affirmed today.

Longtime fans of the Phantom comic strip know that, when the plot becomes particularly complex, the strip’s author will make a cameo and give an update, announced by the phrase “For Those Who Came in Late!” In that spirit, 600Camp provides an update about the ongoing litigation about a CFPB rule involving credit-card late fees:

Longtime fans of the Phantom comic strip know that, when the plot becomes particularly complex, the strip’s author will make a cameo and give an update, announced by the phrase “For Those Who Came in Late!” In that spirit, 600Camp provides an update about the ongoing litigation about a CFPB rule involving credit-card late fees:

- On May 7, President Biden touted the rule in his State of the Union address.

- May 10, Judge Pittman enjoined the rule, based on a Fifth Circuit case about the CFPB’s funding that the Supreme Court overruled a few days later;

- On May 28, Judge Pittman granted the CFPB’s renewed motion to transfer the case to the District of Columbia (after an earlier transfer order was reversed by the Fifth Circuit, based on the procedural interplay between the injunction application and transfer motion);

- A new mandamus petition followed, leading to an administrative stay of the transfer order until mid-June along with a request for a reponse to the petition.

“Double, double, toil and trouble,” chanted the three witches of Macbeth. “Double insulated,” said the Fifth Circuit in CFSA v. CFPB, holding that the Consumer Financial Protection Bureau’s funding mechanism was so far removed from Congress’s ordinary appropriations process that it violated the Appropriation Clause of the Constitution. Parting company with the above, the Supreme Court didn’t use the word “double” in reversing the Fifth Circuit, and holding that the CFPB is appropriately funded, considering history and practicality. CFPB v. CFSA, No. 22-448 (U.S. March 16, 2024).

“Double, double, toil and trouble,” chanted the three witches of Macbeth. “Double insulated,” said the Fifth Circuit in CFSA v. CFPB, holding that the Consumer Financial Protection Bureau’s funding mechanism was so far removed from Congress’s ordinary appropriations process that it violated the Appropriation Clause of the Constitution. Parting company with the above, the Supreme Court didn’t use the word “double” in reversing the Fifth Circuit, and holding that the CFPB is appropriately funded, considering history and practicality. CFPB v. CFSA, No. 22-448 (U.S. March 16, 2024).

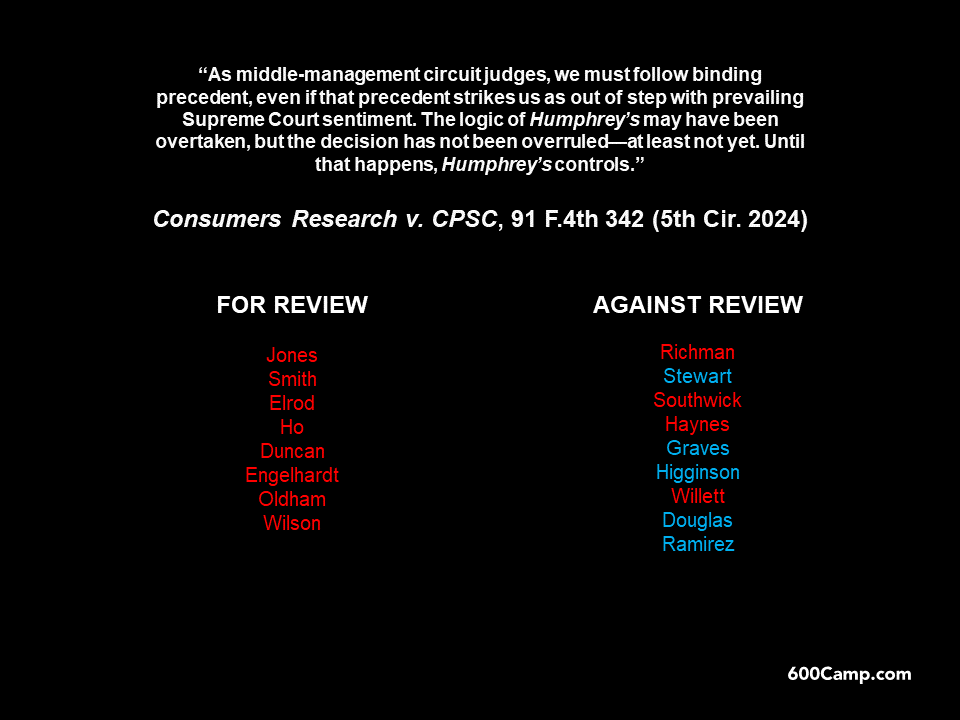

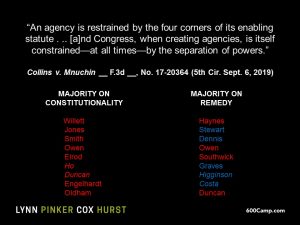

The Fifth Circuit’s recent en banc vote in Consumers’ Research v. CPSC, an unsuccessful constitutional structure to the Consumer Product Safety Commission in light of recent Supreme Court precedent, is summarized in the below chart. The vote was accompanied by a concurrence and two dissenting opinions.

In a muscular display of appellate review, in Career Colleges & Schools of Texas v. U.S. Dep’t of Educ., the Fifth Circuit:

- Disagreed with the district court’s conclusion that an association of career schools lacked standing due to a lack of immediate irreparable injury, identifying three types of injury suffered as a result of new DOE regulations about certain defenses to student-loan repayment;

- Concluded that, as a matter of law, the association had satisfied the requirements for a preliminary injunction;

- Gave the resulting injunction nationwide effect; and

- Ordered: “The stay pending appeal remains in effect until the district court enters the preliminary injunction.”

No. 23-50491 (April 4, 2024).

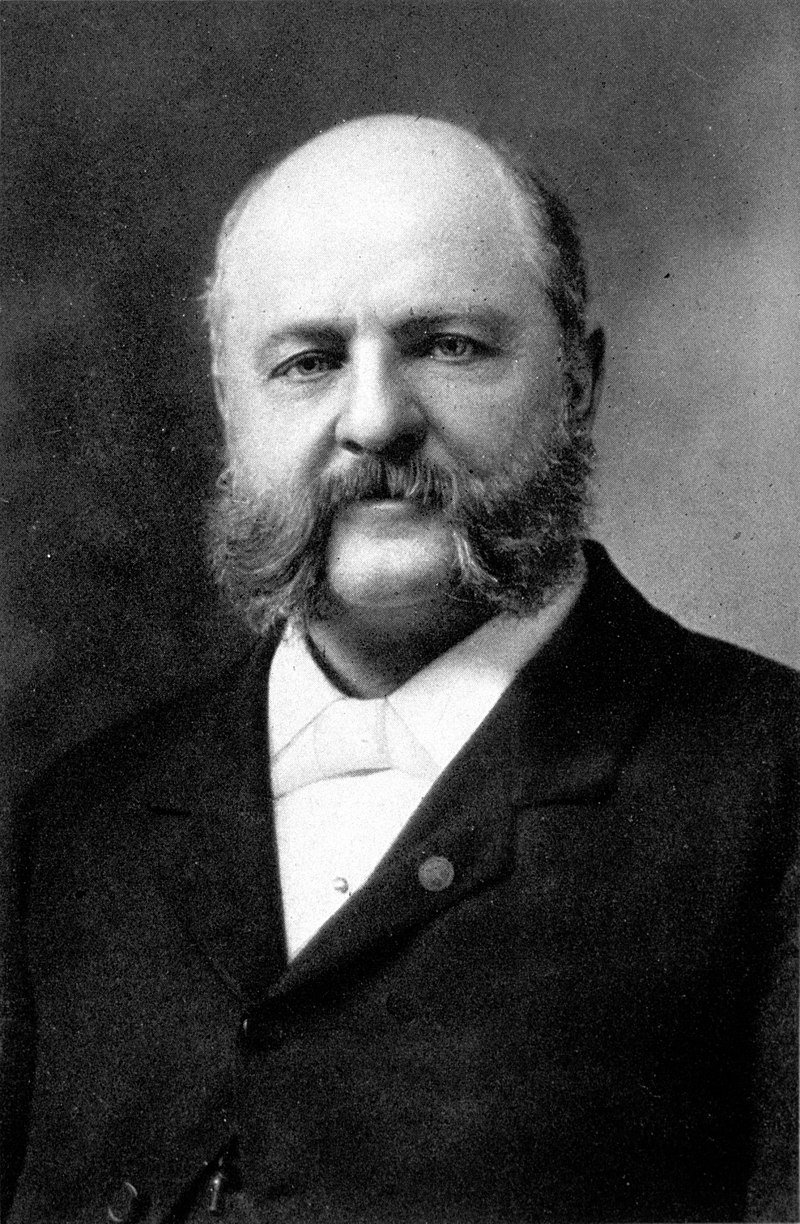

To the right appears William Humphrey, who like William Marbury, is known to history as the subject matter of a famous opinion. President Roosevelt’s efforts to remove Humphrey from the Federal Trade Commission led to the 1935 Supreme Court case of Humphrey’s Executor v. United States, about constitutional limits on the structure of administrative agencies. (Humphrey died during the litigation so his executor continued with the matter). In Consumers’ Research v. CPSC, the Fifth Circuit summarized the current state of the issue addressed by Humphrey’s Executor as follows:

To the right appears William Humphrey, who like William Marbury, is known to history as the subject matter of a famous opinion. President Roosevelt’s efforts to remove Humphrey from the Federal Trade Commission led to the 1935 Supreme Court case of Humphrey’s Executor v. United States, about constitutional limits on the structure of administrative agencies. (Humphrey died during the litigation so his executor continued with the matter). In Consumers’ Research v. CPSC, the Fifth Circuit summarized the current state of the issue addressed by Humphrey’s Executor as follows:

The Humphrey’s exception traditionally “has applied only to multimember bodies of experts.” Sitting en banc, we recently described the exception like this: Congress’s decision “limiting the President to ‘for cause’ removal is not sufficient to trigger a separation-of-powers violation.” Instead, for-cause removal creates a separation-of-powers problem only if it “combine[s]” with “other independence-promoting mechanisms” that “work[] together” to “excessively insulate” an independent agency from presidential control.

The plaintiffs in this case argue that the Supreme Court recently upended this framework in Seila Law. In their view, that 2020 decision held that for-cause removal always creates a separation-of-powers violation—at least if the agency at issue exercises substantial executive power (which nearly all agencies do). This is so, the plaintiffs argue, even if for-cause removal is the only structural feature insulating an agency from total presidential control. We do not read Seila Law so broadly. On the contrary, and as in Free Enterprise Fund, the Supreme Court in Seila Law left the Humphrey’s Executor exception “in place.”

No. 22-40328 (Jan. 17, 2024) (citations and footnote omitted).

State of Louisiana v. U.S. Dep’t of Energy is an instructive analysis of basic administrative rulemaking concepts, in the unlikely setting of the regulation of washing machines and dishwashers. The substance will be discussed in future posts.

State of Louisiana v. U.S. Dep’t of Energy is an instructive analysis of basic administrative rulemaking concepts, in the unlikely setting of the regulation of washing machines and dishwashers. The substance will be discussed in future posts.

For today, in the “who knew?” department, the plaintiffs were several states, and their standing was based on the substantial purchases that those states made of those appliances. An affidavit quoted in the opinion, for example, describes the purchasing habits of the Montana Highway Patrol as to appliances for its bunkhouses. No. 22-60146 (Jan. 8, 2023).

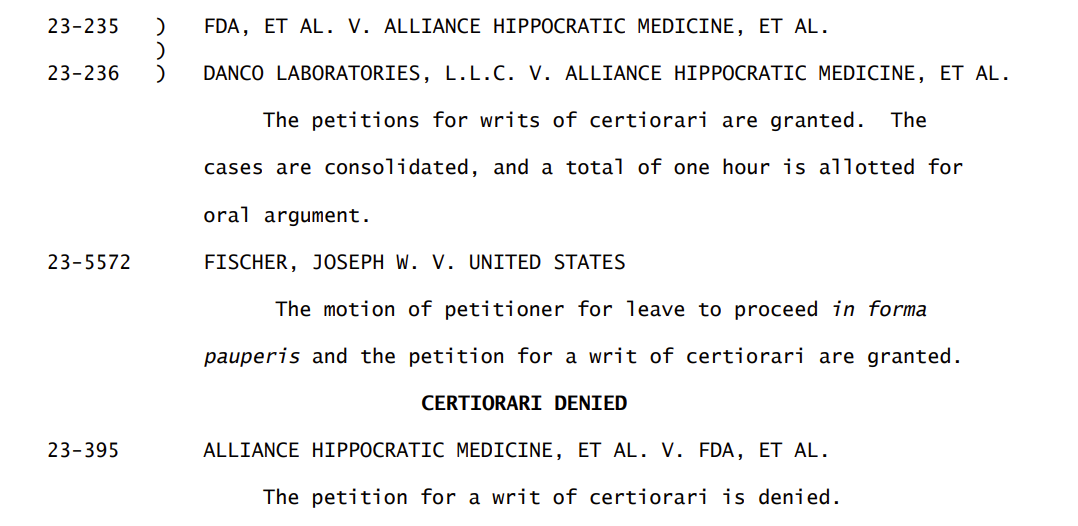

The mifepristone litigation – recently selected by Law360 as the most notable case of 2023 from the Fifth Circuit – will be heard by the Supreme Court. While it did not grant the petition about the original approval of mifepristone, a wide range of significant issues–including important standing questions, and the modern viability of the Comstock Act–are ripe for decision as part of the granted petitions:

A series of cases about the EPA’s regulation of small refineries led to a disagreement about Circuit venue over this kind of administrative-agency challenge. A majority appled a two-part test focused on whether the agency action was “nationally applicable”; the dissent rejected the majority’s analysis as inconsistent with statutory text, purpose, and structure. No. 22-60266 etc. (Nov. 22, 2023).

A series of cases about the EPA’s regulation of small refineries led to a disagreement about Circuit venue over this kind of administrative-agency challenge. A majority appled a two-part test focused on whether the agency action was “nationally applicable”; the dissent rejected the majority’s analysis as inconsistent with statutory text, purpose, and structure. No. 22-60266 etc. (Nov. 22, 2023).

In Chamber of Commerce v. U.S. Sec. & Exch. Comm’n, the Fifth Circuit found that the SEC acted too quickly in enacting a challenged rule, but then allowed it a “do-over” within a specified time:

In Chamber of Commerce v. U.S. Sec. & Exch. Comm’n, the Fifth Circuit found that the SEC acted too quickly in enacting a challenged rule, but then allowed it a “do-over” within a specified time:

The SEC acted arbitrarily and capriciously, in violation of the APA, when it failed to respond to petitioners’ comments and failed to conduct a proper cost-benefit analysis. We recognize that “there is at least a serious possibility that the agency will be able to substantiate its decision given an opportunity to do so.” Short of vacating the rule, we therefore afford the agency limited time to remedy the deficiencies in the rule. Because, for the reasons explained, the SEC’s adoption of the Share Repurchase Disclosure Modernization Rule is arbitrary and capricious, the petition for review is GRANTED, and this matter is REMANDED with direction to the SEC to correct the defects in the rule within 30 days of this opinion. This is a limited remand. This panel retains jurisdiction to consider the decision that is made on remand.

No. 23-60255 (Oct. 31, 2023); but cf. Alliance for Hippocratic Medicine v. U.S. Food & Drug Admin., No. 23-10362 (Aug. 16, 2023).

In Louisiana Creole cooking, gumbo is a flavorful, roux-based soup made with the ingredients available to the chef. Similarly, Alliance for Fair Board Recruitment v. SEC addresses a host of constitutional issues of the day, including the questions whether a board-membership disclosure requirement by Nasdaq can be “state action”; whether the SEC’s approval of such a rule exceeded its statutory authority (including the subsidiary questions whether that action infringed on state sovereignty or involved a “major question”); and whether the SEC properly assessed the relevant record in reaching its conclusion. Unusual for the Fifth Circuit, the panel consisted of three judges appointed by Democratic presidents. It remains to be seen what the view of the full court will be on these matters. No. 21-60626 (Oct. 18, 2023).

In Louisiana Creole cooking, gumbo is a flavorful, roux-based soup made with the ingredients available to the chef. Similarly, Alliance for Fair Board Recruitment v. SEC addresses a host of constitutional issues of the day, including the questions whether a board-membership disclosure requirement by Nasdaq can be “state action”; whether the SEC’s approval of such a rule exceeded its statutory authority (including the subsidiary questions whether that action infringed on state sovereignty or involved a “major question”); and whether the SEC properly assessed the relevant record in reaching its conclusion. Unusual for the Fifth Circuit, the panel consisted of three judges appointed by Democratic presidents. It remains to be seen what the view of the full court will be on these matters. No. 21-60626 (Oct. 18, 2023).

The remand of Collins v. Yellen, 141 S. Ct. 1761 (2020) did not end well for the plaintiffs, as the district court concluded that they “had not plausibly alleged that the removal restriction” on FHFA’s director caused them harm. The plaintiffs made a valiant effort to bring the case within the scope of a recent Fifth Circuit holding about the Appropriations Clause, but the Fifth Circuit found that its holding in that case did not create a change in the relevant law that was sufficient to overcome the mandate rule. Collins v. Dep’t of the Treasury, No. 22-20632 (Oct. 12, 2023).

After going to see Oppenheimer, you can read State of Texas v. Nuclear Regulatory Commission.

After going to see Oppenheimer, you can read State of Texas v. Nuclear Regulatory Commission.

The failure of the Yucca Mountain repository for spent nuclear fuel led the NRC to explore “a consent-based approach for siting nuclar waste storage facilities.” With encouragment from the governors of Texas and New Mexico, it authorized such a facility in Andrews County–a remote location at the heart of the Permian Basin oil fields. Texas changed its mind, enacting a statute that made the storage of high-level waste illegal in the state.’

This lawsuit resulted. The Fifth Circuit found that the plaintitfs (Texas, a state environmental agency, an oil producer, and an oil-industry group) had constitutional and statutory standing to challenge the NRC’s license, and from there, concluded that the NRC had overstepped its statutory authority. No. 21-60743 (Aug. 25, 2023).

The plaintiffs in Clarke v. Commodity Futures Trading Commission sought a preliminary injunction, alleging that their business (the “Predictit Market,” where users can trade on the potential outcomes of future events) would fail after the CFTC changed position on an earlier no-action letter.

Two judges agreed that a preliminary injunction was required as a matter of law–but agreed on little else, as the concurrence noted: “Plaintiffs’ theory of final agency action admittedly conflicts with the precedents of our sister circuits. To my knowledge, no circuit has held that a no-action letter or its withdrawal is sufficient to constitute ‘final agency action’ under the Administrative Procedure Act. And some have held the

opposite.”

A dissent was so unpersuaded on the issue of final agency action that it would not have required a preliminary injunction. No. 22-51124 (July 21, 2023).

Restaurant Law Center v. U.S. Dep’t of Labor presented an appeal from the denial of a preliminary injunction about a new minimum-wage rule. The dispute was the district court’s conclusion that the plaintiff did not establish irreparable injury.

Restaurant Law Center v. U.S. Dep’t of Labor presented an appeal from the denial of a preliminary injunction about a new minimum-wage rule. The dispute was the district court’s conclusion that the plaintiff did not establish irreparable injury.

The panel majority faulted the district judge for not considering Circuit precedent that “the nonrecoverable costs of complying with a putatively invalid regulation typically constitute irreparable harm.” The majority also observed that the face of the regulation imposed certain administrative requirements, and that “[s]tringently insisting on a precise dollar figure reflects an exactitude our law does not require.”

The dissent, emphasizing the standard of review, faulted the majority for “reasoning that because some employers will be harmed by the Rule’s wide net, Plaintiffs via their member restaurants will inevitably by caught in the seine” (an observation about standing that bears on a central question in the upcoming mifepristone argument). No. 22-50145 (April 28, 2023).

After the Supreme Court’s stay ruling yesterday, a Fifth Circuit panel will proceed wth oral argument on May 17 in New Orleans. (Information about the audio livestream may be found in that link.)

After the Supreme Court’s stay ruling yesterday, a Fifth Circuit panel will proceed wth oral argument on May 17 in New Orleans. (Information about the audio livestream may be found in that link.)

While the Supreme Court’s order said very little, the votes of seven Justices were consistent with the position of Judge Haynes when the stay issue was before the Fifth Circuit, and no Justice indicated agreement with the analysis of the per curiam panel majority. (I recently observed in Slate that the “Dobbs-era Supreme Court is well aware of the judicial strand of conservative thought, as well as the political.”).

The motions panel ruled in Alliance for Hippocratic Medicine v. FDA, No. 23-10362 (April 12, 2023). In a nutshell, the panel majority concludes that (1) the plaintiffs have standing based on the percentage of mifepristone users who have side effects, (2) the plaintiffs’ challenge to FDA’s original approval of mifepristone for use in medication abortions is likely time-barred, and (3) FDA did not meet its burden, as the party seeking a stay, to show that plaintiff’s other challenges to FDA’s regulation of mifepristone were time-barred or otherwise fatally flawed. Judge Haynes would have granted an administrative stay and otherwise deferred to the merits panel (who is, in fact, not constrained by any of (1)-(3)). Further proceedings in the Supreme Court appear likely.

The motions panel ruled in Alliance for Hippocratic Medicine v. FDA, No. 23-10362 (April 12, 2023). In a nutshell, the panel majority concludes that (1) the plaintiffs have standing based on the percentage of mifepristone users who have side effects, (2) the plaintiffs’ challenge to FDA’s original approval of mifepristone for use in medication abortions is likely time-barred, and (3) FDA did not meet its burden, as the party seeking a stay, to show that plaintiff’s other challenges to FDA’s regulation of mifepristone were time-barred or otherwise fatally flawed. Judge Haynes would have granted an administrative stay and otherwise deferred to the merits panel (who is, in fact, not constrained by any of (1)-(3)). Further proceedings in the Supreme Court appear likely.

Valuable 600Camp merchandise can be yours if you identify the distinguished-looking gentleman to the right.

The abortion-medication opinion has been issued, staying the FDA’s approval of mifepristone, and staying itself for seven days to allow appeal.

Without reference to the Federalist Papers or the records from the Constitutional Convention, the Fifth Circuit held in Consumers’ Research v. FCC that the six criteria in 47 U.S.C. § 254(b) gave the FCC “intelligible principles” to guide its regulation of communication, unlike the “total absence of guidance” identified last year in Jarkesy v. SEC, 34 F.4th 446 (5th Cir. 2022). No. 22-60008 (March 24, 2023).

Without reference to the Federalist Papers or the records from the Constitutional Convention, the Fifth Circuit held in Consumers’ Research v. FCC that the six criteria in 47 U.S.C. § 254(b) gave the FCC “intelligible principles” to guide its regulation of communication, unlike the “total absence of guidance” identified last year in Jarkesy v. SEC, 34 F.4th 446 (5th Cir. 2022). No. 22-60008 (March 24, 2023).

The poem Antigonish begins:

The poem Antigonish begins:

Yesterday, upon the stair,

I met a man who wasn’t there

He wasn’t there again today

I wish, I wish he’d go away.

In that spirit, the majority and concurrence in Mexican Gulf Fishing Co v. U.S. Dep’t of Commerce, No. 22-30105 (Feb. 23, 2023), disagreed about the continuing viability of Chevron.

The case presented a dispute about the authority of the Commerce Department, under a Congressional mandate to conserve the nation’s offshore fisheries, to require charter boats to carry a GPS-location device and submit specified records about fishing activity.

3-0, the Fifth Circuit concluded that the government had exceeded its boundaries. The majority used a Chevron approach to the relevant statute; a concurrence joined but argued that recent Supreme Court cases have tacitly overruled Chevron, and the third judge joined specific parts of the majority opinion.

Colorfully, the majority and concurrence disputed whether Chevron is fairly called the “Lord Voldemort of administrative law,” due to the Supreme Court’s unwillingness to refer to it recent administrative-law opinions. While that’s witty and good fun, the lack of clear guidance from the Supreme Court about this fundamental doctrine is clearly a problem–as this very opinion shows, since three judges approached the same issue in three different ways under the current state of the law. If the Supreme Court wants to overrule Chevron, it should overrule Chevron.

Colorfully, the majority and concurrence disputed whether Chevron is fairly called the “Lord Voldemort of administrative law,” due to the Supreme Court’s unwillingness to refer to it recent administrative-law opinions. While that’s witty and good fun, the lack of clear guidance from the Supreme Court about this fundamental doctrine is clearly a problem–as this very opinion shows, since three judges approached the same issue in three different ways under the current state of the law. If the Supreme Court wants to overrule Chevron, it should overrule Chevron.

An exasperated Fifth Circuit granted mandamus relief to require FERC to explain significant delay in a nuclear-power rate dispute, In re Louisiana Public Service Comm’n, No. 22-60458 (Jan. 18, 2023).

An exasperated Fifth Circuit granted mandamus relief to require FERC to explain significant delay in a nuclear-power rate dispute, In re Louisiana Public Service Comm’n, No. 22-60458 (Jan. 18, 2023).

As to jurisdiction, the Court observed: “This court has jurisdiction over the LPSC’s petition to safeguard our prospective jurisdiction to review final FERC orders under the Federal Power Act. When federal appellate courts have jurisdiction to review agency action, ‘the All Writs Act empowers those courts to issue a writ of mandamus compelling the agency to complete the action.'” (footnotes omitted).

As to the merits, the Court observed: “FERC is correct that ratemaking is challenging work, and we are fully aware of the difficulties attending the substitution of nuclear for other power sources, with its attendant difficulties of allocating huge installation costs among electrical suppliers now looking to a new power source. Yet Congress has duly charged FERC with this important duty, and FERC has yet to provide this court with a meaningful explanation for its inability to expeditiously conclude Section 206 proceedings. FERC must convince this court that it has acted ‘within a reasonable time . . . to conclude [the] matter presented to it.’ In failing to do so, FERC risks judicial intervention to protect the rights of the parties before it and the interests of consumers.” (footnotes omitted).

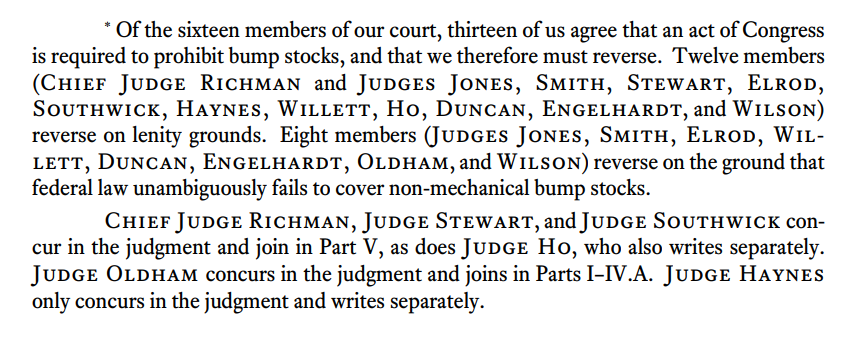

Cargill v. Garland, an en banc opinion released earlier this month, holds that the ATF’s “bump stock” rule was invalid. The diagram to the right, referenced by a link in the majority opinion, illustrates the firing mechanism for a semi-automatic firearm, which a bump stock facilitates by allowing rapid operation of the trigger.

Cargill v. Garland, an en banc opinion released earlier this month, holds that the ATF’s “bump stock” rule was invalid. The diagram to the right, referenced by a link in the majority opinion, illustrates the firing mechanism for a semi-automatic firearm, which a bump stock facilitates by allowing rapid operation of the trigger.

The majority opinions aligned as follows:

The three Democratic appointees on the court at the time (Higginson, Dennis, and Graves) dissented.

The three Democratic appointees on the court at the time (Higginson, Dennis, and Graves) dissented.

In a time of well-documented skepticism in the federal courts about the administrative state, the FTC has doubled down, seeking public comment on a rule that would ban enforcement of noncompetition agreements.

In a time of well-documented skepticism in the federal courts about the administrative state, the FTC has doubled down, seeking public comment on a rule that would ban enforcement of noncompetition agreements.

As part of the explanation for its authority, the FTC cited authority that “Section 5 reaches conduct that, while not prohibited by the Sherman or Clayton Acts, violates the spirit or policies underlying those statutes.” That broad language will sound familiar to readers of the vaccine-mandate cases and their discussions of the EEOC’s rulemaking authority.

Given the present climate in the courts about expansive claims of agency authority, it seems likely that any FTC rule in this area will lead to extensive litigation before such a rule actually takes effect.

The plaintiffs in National Horsemen’s Benevolent & Protective Ass’n v. Black sought to rein in the Horseracing Integrity and Safety Authority, a private entity created by Congress in 2020 – nominally under FTC oversight – to nationalize the regulation of thoroughbred horseracing. The Fifth Circuit scratched HISA, finding it facially unconstitutional as an excessive private delegation of federal-government power:

The plaintiffs in National Horsemen’s Benevolent & Protective Ass’n v. Black sought to rein in the Horseracing Integrity and Safety Authority, a private entity created by Congress in 2020 – nominally under FTC oversight – to nationalize the regulation of thoroughbred horseracing. The Fifth Circuit scratched HISA, finding it facially unconstitutional as an excessive private delegation of federal-government power:

A cardinal constitutional principle is that federal power can be wielded only by the federal government. Private entities may do so only if they are subordinate to an agency. But the Authority is not subordinate to the FTC. The reverse is true. … HISA restricts FTC review of the Authority’s proposed rules. If those rules are “consistent” with HISA’s broad principles, the FTC must approve them. And even if it finds inconsistency, the FTC can only suggest changes. … An agency does not have meaningful oversight if it does not write the rules, cannot change them, and cannot second-guess their substance.

No. 22-10387 (Nov. 18, 2022) (citations omitted, emphasis added).

Bloomberg Law provides a good summary of yesterday’s arguments in SEC v. Cochran, addressed by the en banc Fifth Circuit in 2021, as to the appropriate places to advance constitutional challenges to SEC enforcement actions.

The Fifth Circuit set a boundary – literally – for part of the administrative state in BP v. FERC, which reviewed a FERC fine of BP for alleged gas-price manipulation associated with Hurricane Ike. The Court held:

Contrary to FERC’s position, we hold that the Commission has jurisdiction only over transactions in interstate natural gas directly regulated by the Natural Gas Act (NGA). Specifically, we reject FERC’s broader theory that its authority to address market manipulation extends to any natural gas transaction which affects the price of a transaction under the NGA. Otherwise, however, we uphold the Commission’s order. Nevertheless, because FERC predicated its penalty assessment on its erroneous position that it had jurisdiction over all (and not just some) of BP’s transactions, we must remand for reassessment of the penalty in the light of our jurisdictional holding.

No. 21-60083-CV (Oct. 20, 2022, unpublished) (emphasis added).

CFSA v. CFPB finds – again – that the Consumer Financial Protection Bureau is unconstitutionally structured, but this time because its “double insulated” funding mechanisms violated the Appropriations Clause by circumventing Congress’ “power of the purse.” The arguments about that fundamental Constitutional provision are intriguing and seem likely to draw the Supreme Court’s interest. No. 21-50826 (Oct. 19, 2022). The Fifth Circuit’s treatment creates a split with seven other federal courts, including PHH Corp. v. CFPB, 881 F.3d 75 (D.C. Cir. 2018). A recent Slate article offered criticism of the opinion.

The opinion also presents a rare appearance of the word “magisterial” to describe an earlier case on this topic:  Cf. Herman Hesse, “Magister Ludi” (1943).

Cf. Herman Hesse, “Magister Ludi” (1943).

The Bankruptcy Code allows debtors to breach and cease performing executory contracts if the bankruptcy court approves. We thus have held that debtors may “reject” regulated energy contracts even if the Federal Energy

Regulatory Commission (“FERC”) would not like them to. A sister circuit agrees, and we confirmed our view mere months ago[.]Nevertheless, FERC persisted. Anticipating the petitioner’s insolvency, FERC issued four orders purporting to bind the petitioner to continue performing its gas transit contracts even if it rejected them during bankruptcy. The petitioner asks us to vacate those orders. Because FERC cannot countermand a debtor’s bankruptcy-law rights or the bankruptcy court’s powers, we grant the petitions for review and vacate the orders.

Gulfport Energy Corp. v. FERC, No. 21-60017 (July 19, 2022) (citations omitted).

Despite a contrary view of the case by a motions panel, a majority of the the panel that received the merits briefing denied the petitions for review in Wages & White Lions Investments LLC v. FDA, a case about the regulation of “vaping” products: “Petitioners advance two primary arguments: (1) FDA acted arbitrarily and capriciously by pulling a ‘surprise switcheroo‘ on Petitioners and failing to consider important aspects of the PMTAs; and (2) FDA lacks statutory authority to impose a comparative efficacy requirement. We are unpersuaded by either argument.”

Despite a contrary view of the case by a motions panel, a majority of the the panel that received the merits briefing denied the petitions for review in Wages & White Lions Investments LLC v. FDA, a case about the regulation of “vaping” products: “Petitioners advance two primary arguments: (1) FDA acted arbitrarily and capriciously by pulling a ‘surprise switcheroo‘ on Petitioners and failing to consider important aspects of the PMTAs; and (2) FDA lacks statutory authority to impose a comparative efficacy requirement. We are unpersuaded by either argument.”

A dissent saw matters otherwise: “In a mockery of ‘reasoned’ administrative decision making, FDA (1) changed the rules for private entities in the middle of their marketing application process, (2) failed to notify the public of the changes in time for compliance, and then (3) rubber-stamped the denial of their marketing applications because of the hitherto unknown requirements.” A petition for en banc rehearing seems a near certainty. No. 21-60766 (July 18, 2022).

If Woodrow Wilson and James Landis seem alarmed in the picture to the right, it may be that they had a premonition about the Fifth Circuit’s 2021-22 skepticism toward the structure of the SEC. Following a 2021 loss in Cochran v. SEC on a procedural issue about constitutional challenges to the work of the SEC’s Administrative Law Judges (featuring a blistering critique of the administrative state in a concurrence by Judge Oldham, and as to which the Supreme Court has recently granted certiorari), the Court again reached constitutional issues in Jarksey v. SEC, holding:

If Woodrow Wilson and James Landis seem alarmed in the picture to the right, it may be that they had a premonition about the Fifth Circuit’s 2021-22 skepticism toward the structure of the SEC. Following a 2021 loss in Cochran v. SEC on a procedural issue about constitutional challenges to the work of the SEC’s Administrative Law Judges (featuring a blistering critique of the administrative state in a concurrence by Judge Oldham, and as to which the Supreme Court has recently granted certiorari), the Court again reached constitutional issues in Jarksey v. SEC, holding:

“(1) the SEC’s in-house adjudication of Petitioners’ case violated their Seventh Amendment right to a jury trial; (2) Congress unconstitutionally delegated legislative power to the SEC by failing to provide an intelligible principle by which the SEC would exercise the delegated power, in violation of Article I’s vesting of “all” legislative power in Congress; and (3) statutory removal restrictions on SEC ALJs violate the Take Care Clause of Article II [of the Constitution].”

Judge Elrod wrote the panel majority opinion, joined by Judge Oldham. Judge Davis dissented as to each holding. These holdings have obvious significance to other administrative agencies and could well again draw Supreme Court attention. No. 20-61007 (May 18, 2022).

A merits panel, with a notably different makeup than the motions panel, reversed a preliminary injunction about a federal-employee vaccination requirement in Feds for Medical Freedom v. Biden, No. 22-40043 (April 7, 2022).

FERC v. Ultra Resources presented a novel question about the interaction of the Bankruptcy Court and a filed-rate contract, and held “that under the particular circumstances presented here, Ultra Resources is not subject to a separate public-law obligation to continue performance of its rejected contract, and that 11 U.S.C. § 1129(a)(6) did not require the bankruptcy court to seek FERC’s approval before it confirmed Ultra Resource’s reorganization plan.” No. 21-20126 (March 14, 2022).

The en banc case of Cochran v. SEC, No. 19-10396 (Dec. 13, 2021), presented a difficult statutory-interpretation case, overlaid on fundamental issues about the limits of the administrative state. The majority held that the 1934 Securities Exchange Act did not divest district courts of jurisdiction over “structural constitutional claims” about SEC enforcement actions: “Cochran’s removal power claim is wholly collateral to the Exchange Act’s statutory-review scheme, is outside the SEC’s expertise, and might never receive judicial review if district court jurisdiction were precluded.” An informative concurrence examined the continuing influence of Woodrow Wilson and James Landis (the SEC’s second director) on modern thinking about the power and pervasiveness of federal administrative agencies.

The en banc case of Cochran v. SEC, No. 19-10396 (Dec. 13, 2021), presented a difficult statutory-interpretation case, overlaid on fundamental issues about the limits of the administrative state. The majority held that the 1934 Securities Exchange Act did not divest district courts of jurisdiction over “structural constitutional claims” about SEC enforcement actions: “Cochran’s removal power claim is wholly collateral to the Exchange Act’s statutory-review scheme, is outside the SEC’s expertise, and might never receive judicial review if district court jurisdiction were precluded.” An informative concurrence examined the continuing influence of Woodrow Wilson and James Landis (the SEC’s second director) on modern thinking about the power and pervasiveness of federal administrative agencies.

If you think that the modern administrative state relies heavily upon acronyms, you are not alone, as the Fifth Circuit illustrated in Leigh Ann H v. Reisel ISD, No. 20-50003-CV (Nov. 22, 2021):

In a rough stretch for the administrative state, after the Fifth Circuit’s recent skeptical rejection of an FDA regulation of e-cigarettes, another panel stayed OSHA’s vaccine-mandate regulation. It based its decision on several administrative-law principles and summarized:

In a rough stretch for the administrative state, after the Fifth Circuit’s recent skeptical rejection of an FDA regulation of e-cigarettes, another panel stayed OSHA’s vaccine-mandate regulation. It based its decision on several administrative-law principles and summarized:

“[T]he Mandate’s strained prescriptions combine to make it the rare government pronouncement that is both overinclusive (applying to employers and employees in virtually all industries and workplaces in America, with little attempt to account for the obvious differences between the risks facing, say, a security guard on a lonely night shift, and a meatpacker working shoulder to shoulder in a cramped warehouse) and underinclusive (purporting to save employees with 99 or more coworkers from a “grave danger” in the workplace, while making no attempt to shield employees with 98 or fewer coworkers from the very same threat). The Mandate’s stated impetus—a purported “emergency” that the entire globe has now endured for nearly two years, and which OSHA itself spent nearly two months responding to—is unavailing as well. And its promulgation grossly exceeds OSHA’s statutory authority.”

No. 21-60845 (Nov. 12, 2021) (footnotes omitted, emphasis in original).

In Wages & White Lions Investments LLC v. FDA, the Fifth Circuit found many problems with the FDA’s denial of a company’s application to market flavored e-cigarettes. Among them, the Court identified two issues with the FDA’s review of the company’s marketing plan to avoid improper product use by young people; the Court’s reasoning is of broad general interest for Daubert practice as well as administrative law:

In Wages & White Lions Investments LLC v. FDA, the Fifth Circuit found many problems with the FDA’s denial of a company’s application to market flavored e-cigarettes. Among them, the Court identified two issues with the FDA’s review of the company’s marketing plan to avoid improper product use by young people; the Court’s reasoning is of broad general interest for Daubert practice as well as administrative law:

- The FDA’s contention “that no marketing plan would be sufficient, so it stopped working”: “That’s like an Article III judge saying that she stopped reading briefs because she previously found them unhelpful.”

- Reliance on expertise and experience. “An agency’s ‘experience and expertise’ presumably enable the agency to provide the required explanation, but they do not substitute for the explanation, any more than an expert witness’s credentials substitute for the substantive requirements applicable to the expert’s testimony under [Rule] 702.”

No. 21-60766 (Oct. 26, 2021).

A key issue facing OSHA’s new COVID regulation is whether a “grave danger” justified the agency acting so rapidly. In an unusual flash of appellate-court wit, the Fifth Circuit temporarily stayed the regulation, observing:

(Regrettably, Judge Graves was not on the panel.)

A frequent international traveler alleged that he had been placed on a TSA list that required additional, invasive searches of him when he flew. The Fifth Circuit affirmed the dismissal of the several Constitutional claims that he raised in a lawsuit against the leaders of the relevant federal agencies:

A frequent international traveler alleged that he had been placed on a TSA list that required additional, invasive searches of him when he flew. The Fifth Circuit affirmed the dismissal of the several Constitutional claims that he raised in a lawsuit against the leaders of the relevant federal agencies:

“In short, Ghedi has no right to hassle-free travel. In the Supreme Court’s view, international travel is a ‘freedom’ subject to ‘reasonable governmental regulation.’ And when it comes to reasonable governmental regulation, our sister circuits have held that Government-caused inconveniences during international travel do not deprive a traveler’s right to travel. In the Sixth Circuit’s view, ‘incidental or negligible’ delays of ‘ten minutes’ to ‘an entire day’ do not ‘implicate the right to travel.’ The Second and Tenth Circuits have held the same. Ghedi has therefore failed to plausibly allege that he has been deprived of his right to travel internationally by the extra security measures he has experienced.”

Ghedi v. Mayorkas, No. 20-10995 (Oct. 25, 2021) (footnotes omitted).

Johnson alleged that BOKF’s collection of “extended overdraft charges” (fees charged to customers who overdraw on their checking accounts and fail to timely pay the bank for covering the overdraft) were “interest” within the meaning of the National Bank Act. The Fifth Circuit rejected her claim, giving Auer deference to an interpretive letter of the Office of the Comptroller of the Currency, and noting as to the relevant considerations:

Johnson alleged that BOKF’s collection of “extended overdraft charges” (fees charged to customers who overdraw on their checking accounts and fail to timely pay the bank for covering the overdraft) were “interest” within the meaning of the National Bank Act. The Fifth Circuit rejected her claim, giving Auer deference to an interpretive letter of the Office of the Comptroller of the Currency, and noting as to the relevant considerations:

- Authoritative. The letter was drafted by the OCC’s chief counsel, in response to a bank’s request for OCC guidance, and thus “bears the hallmarks of an official interpretation by OCC.”

- Within the agency’s substantive expertise. OCC administers the National Bank Act, the letter “appears aimed at providing assurance to regulated parties,” and did not appear to merely take a “convenient litigating position.”

- Fair and considered judgment. The letter “is neither plainly erroneous nor inconsistent with the regulations it interprets.”

No. 18-11375 (Sept. 29, 2021).

Huawei Technologies USA v. FCC presents an exhaustive summary of modern-day administrative law, in the context of reviewing an FCC rule that excluded Huawei from federal funds as a security risk. As the Court summarized its several holdings:

Huawei Technologies USA v. FCC presents an exhaustive summary of modern-day administrative law, in the context of reviewing an FCC rule that excluded Huawei from federal funds as a security risk. As the Court summarized its several holdings:

Their most troubling challenge is that the rule illegally arrogates to the FCC the power to make judgments about national security that lie outside the agency’s authority and expertise. That claim gives us pause. The FCC deals with national communications, not foreign relations. It is not the Department of Defense, or the National Security Agency, or the President. If we were convinced that the FCC is here acting as “a sort of junior varsity [State Department],” Mistretta v. United States, 488 U.S. 361, 427 (1989) (Scalia, J., dissenting), we would set the rule aside.

But no such skullduggery is afoot. Assessing security risks to telecom networks falls in the FCC’s wheelhouse. And the agency’s judgments about national security receive robust input from other expert agencies and officials. We are therefore persuaded that, in crafting the rule, the agency reasonably acted within the broad authority Congress gave it to regulate communications.

No. 19-60896 (June 18, 2021).

The full Fifth Circuit declined to grant en banc review to State of Texas v. Rettig, 987 F.3d 518 (5th Cir. 2021), which involved constitutional challenges by certain states to two aspects of the Affordable Care Act. They contended that the “Certification Rule” violated the nondelegation doctrine, and that section 9010 of the ACA violated the Spending Clause and the Tenth Amendment’s doctrine of intergovernmental tax immunity. The panel found the laws constitutional, in an opinion by Judge Haynes that was joined by Judges Barksdale and Willett. “In the en banc poll, five judges voted in favor of rehearing (Judges Jones, Smith, Elrod, Ho, and Duncan), and eleven judges voted against rehearing (Chief Judge Owen, and Judges Stewart, Dennis, Southwick, Haynes, Graves, Higginson, Costa, Willett, Engelhardt, and Wilson),” with Judge Oldham not participating, and the five pro-rehearing judges joining a dissent.

The full Fifth Circuit declined to grant en banc review to State of Texas v. Rettig, 987 F.3d 518 (5th Cir. 2021), which involved constitutional challenges by certain states to two aspects of the Affordable Care Act. They contended that the “Certification Rule” violated the nondelegation doctrine, and that section 9010 of the ACA violated the Spending Clause and the Tenth Amendment’s doctrine of intergovernmental tax immunity. The panel found the laws constitutional, in an opinion by Judge Haynes that was joined by Judges Barksdale and Willett. “In the en banc poll, five judges voted in favor of rehearing (Judges Jones, Smith, Elrod, Ho, and Duncan), and eleven judges voted against rehearing (Chief Judge Owen, and Judges Stewart, Dennis, Southwick, Haynes, Graves, Higginson, Costa, Willett, Engelhardt, and Wilson),” with Judge Oldham not participating, and the five pro-rehearing judges joining a dissent.

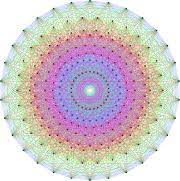

Several years ago, mathematicians rejoiced at the mapping of the world’s most complex structure, the 248-dimension “Lie Group E8” (right). Not to be outdone, the en banc Fifth Circuit has issued Brackeen v. Haaland, a 325-page set of opinions about the constitutionality of the Indian Child Welfare Act–a work so complicated that a six-page per curiam introduction is needed to explain the Court’s divisions on the issues. No. 18-11479 (April 6, 2021). The splits, opinions, and holdings will be reviewed in future posts.

Several years ago, mathematicians rejoiced at the mapping of the world’s most complex structure, the 248-dimension “Lie Group E8” (right). Not to be outdone, the en banc Fifth Circuit has issued Brackeen v. Haaland, a 325-page set of opinions about the constitutionality of the Indian Child Welfare Act–a work so complicated that a six-page per curiam introduction is needed to explain the Court’s divisions on the issues. No. 18-11479 (April 6, 2021). The splits, opinions, and holdings will be reviewed in future posts.

Belcher complained about the FDIC’s power to take his deposition. The parties, and the panel majority, agreed that his lawsuit did not become moot even after the challenged deposition occurred: ‘Because the district court on remand can ‘fashion some form of meaningful relief,’ appeal is not moot. Exactly what that relief might entail is beyond the scope of our concern. However, it is undisputed by the parties that the district court could strike Belcher’s deposition testimony before the FDIC.” The majority also noted that the district court could address the FDIC’s sharing of the transcript. A dissent observed: “I see no reason to override what common sense suggests: the appeal of an order requiring a deposition is moot once the deposition is over.” FDIC v. Belcher, No. 19-31023 (Oct. 26, 2020).

Belcher complained about the FDIC’s power to take his deposition. The parties, and the panel majority, agreed that his lawsuit did not become moot even after the challenged deposition occurred: ‘Because the district court on remand can ‘fashion some form of meaningful relief,’ appeal is not moot. Exactly what that relief might entail is beyond the scope of our concern. However, it is undisputed by the parties that the district court could strike Belcher’s deposition testimony before the FDIC.” The majority also noted that the district court could address the FDIC’s sharing of the transcript. A dissent observed: “I see no reason to override what common sense suggests: the appeal of an order requiring a deposition is moot once the deposition is over.” FDIC v. Belcher, No. 19-31023 (Oct. 26, 2020).

The most recent episode of the Coale Mind podcast discusses Mi Familia Vota v. Abbott, No. 20-50793 (Oct. 14, 2020), a challenge to several Texas voting laws in light of the COVID-19 pandemic. The case reminds of two important limits on federal judicial power in such disputes:

The most recent episode of the Coale Mind podcast discusses Mi Familia Vota v. Abbott, No. 20-50793 (Oct. 14, 2020), a challenge to several Texas voting laws in light of the COVID-19 pandemic. The case reminds of two important limits on federal judicial power in such disputes:

- Under Ex parte Young (Mr. Young appears to the right): “Although a court can enjoin state officials from enforcing statutes, such an injunction must be directed to those who have the authority to enforce those statutes. In the present case, that would be county or other local officials.”

- And naming the right defendant is only the first hurdle posed by federalism: “An examination of the relief that the Plaintiffs seek in the case before us reveals that in many instances, court-ordered-relief would require the Governor or the Secretary of State to issue an executive order or directive or to take other sweeping affirmative action. If implemented by the district court, many of the directives requested by the Plaintiffs would violate principles of federalism.”

“[C]ourt changes of election laws close in time to the election are strongly disfavored. … [I]n staying a preliminary injunction that would change election laws eighteen days before early voting begins, we recognize the value of preserving the status quo in a voting case on the eve of an election, and we find that the traditional factors for granting a stay favor granting one here.” Texas Alliance for Retired Americans v. Hughs, No. 20-40643 (Sept. 30, 2020).

“[C]ourt changes of election laws close in time to the election are strongly disfavored. … [I]n staying a preliminary injunction that would change election laws eighteen days before early voting begins, we recognize the value of preserving the status quo in a voting case on the eve of an election, and we find that the traditional factors for granting a stay favor granting one here.” Texas Alliance for Retired Americans v. Hughs, No. 20-40643 (Sept. 30, 2020).

A home health care provider, feeling trapped by Medicare’s slow and complex administrative review process, sought relief in court. The Fifth Circuit affirmed the denial of its application for an injunction, observing: “The Constitution entrusts the political branches, not the judiciary, with making difficult and value-laden policy decisions. There were an infinite number of schemes Congress could have reasonably selected. Congress settled on one that guarantees at least two levels of administrative review and judicial review. And in the case of a backlog, Congress provided the ability to bypass long waits on the way to judicial review. Sahara rejected that option. At bottom, Sahara believes a different scheme would be better. But we lack the power to change it.” Sahara Health Care v. Azar, No. 18-41120 (Sept. 18, 2020) (emphasis added).

A home health care provider, feeling trapped by Medicare’s slow and complex administrative review process, sought relief in court. The Fifth Circuit affirmed the denial of its application for an injunction, observing: “The Constitution entrusts the political branches, not the judiciary, with making difficult and value-laden policy decisions. There were an infinite number of schemes Congress could have reasonably selected. Congress settled on one that guarantees at least two levels of administrative review and judicial review. And in the case of a backlog, Congress provided the ability to bypass long waits on the way to judicial review. Sahara rejected that option. At bottom, Sahara believes a different scheme would be better. But we lack the power to change it.” Sahara Health Care v. Azar, No. 18-41120 (Sept. 18, 2020) (emphasis added).

The opinion also provides an original source for the saying, “[t]he best laid plans of mice and men oft go awry” —