After another Supreme Court term featuring reversals of the Fifth Circuit on standing grounds in high-profile cases, I wrote this op-ed in today’s Dallas Morning News about that recurring issue.

Category Archives: Standing / Ripeness / Justiciability

A recent mandamus opinion, In re Sealed Petitioner, made this provocative statement about the potential role of a mandamus writ:

But of course, “the federal courts established pursuant to Article III of the Constitution do not render advisory opinions ….” E.g., Pub. Workers v. Mitchell, 330 U.S. 75, 89 (1947). Fortunately, review of the cited case shows that it just states principles about mandamus review that are generally accepted as part of today’s standard practice (citations omitted):

But of course, “the federal courts established pursuant to Article III of the Constitution do not render advisory opinions ….” E.g., Pub. Workers v. Mitchell, 330 U.S. 75, 89 (1947). Fortunately, review of the cited case shows that it just states principles about mandamus review that are generally accepted as part of today’s standard practice (citations omitted):

Although the Company correctly observes that mandamus has historically been a drastic remedy generally reserved for really “extraordinary” cases, the federal courts of appeals (as well as the Supreme Court) have shown an increasing willingness in recent years to use the writ as a one-time-only device to “settle new and important problems” that might have otherwise evaded expeditious review. As the District of Columbia Circuit explained … “Schlagenhauf authorizes departure from the final judgment rule when the appellate court is convinced that resolution of an important, undecided issue will forestall future error in trial courts, eliminate uncertainty and add importantly to the efficient administration of justice.”

In  Paxton v. Dettelbach, individual plainitffs challenged a law about firearm silencers, making these statements about their standing:

Paxton v. Dettelbach, individual plainitffs challenged a law about firearm silencers, making these statements about their standing:

I intend to personally manufacture a firearm suppressor for my own non-commercial, personal use. The firearm suppressor will be manufactured in my home from basic materials without the inclusion of any part imported from another state other than a generic and insignificant part, such as a spring, screw, nut, or pin.

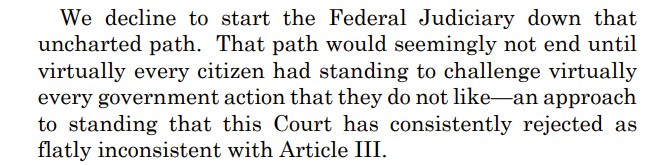

The Fifth Circuit found those statements inadequate for two reasons:

- “[T]he declarations do not state any intention to engage in conduct

proscribed by law,” because the federal law at issue was not a blanket prohibition (emphasis added). - “[T]he declarations lack the necessary detail to establish that the Individual Plaintiffs’ professed intent to make a silencer is sufficiently ‘serious’ to render their feared injury ‘imminent’ rather than merely speculative or hypothetical. As the Supreme Court explained in Lujan, at the summary-judgment stage, declarants’ profession of “‘some day’ intentions [to engage in certain conduct]—without any description of concrete plans, or indeed even any specification of when the some day will be—do not support a finding of the ‘actual or imminent’ injury” required for standing.”

And the Court rejected Texas’s claim to standing based on its “quasi-sovereign interests in its citizens’ health and well-being” and “its sovereign interest in the power to create and enforce a legal code.” No. 23-10802 (June 21, 2024).

As I argued a year ago, more than once, the Supreme Court holds 9-0 this morning that the mifepristone plaintiffs lacked standing:

In a counterpoint to some treatments of standing in the mifepristone litigation, the Fifth Circuit rejected Texas’s standing to challenge an SEC disclosure requirement, reasoning:

As the States conceded during oral argument, there is no guarantee that regulated parties will always pass costs on to their consumers. Some costs may be too small to warrant a cost pass-through. So any cost pass-through must be established through evidence. We look to the evidence in the record to determine whether the facts of a specific case support “likely . . . pecuniary harm” to a suing party. Evidence couched in hypothetical language cannot support such an injury. Here, the record provides only speculation about the possibility of increased costs to investors as a result of new regulatory burdens on the funds.

State of Texas v. SEC, No. 23-60079 (May 10, 2024) (citations omitted, paragraph breaks removed, emphasis added).

Members of the Lipan-Apache Native American Church sued the City of San Antonio about its plans for a large city park that contains an area of particular religious significance to this church. One aspect of the case involved physical access to that area. After the City complied with the trial-court’s order on that issue, the Fifth Circuit held that part of the case was moot, and did not apply the “voluntary cessation” (i.e., “a defendant could … pick up where he left off”) exception to mootness:

Members of the Lipan-Apache Native American Church sued the City of San Antonio about its plans for a large city park that contains an area of particular religious significance to this church. One aspect of the case involved physical access to that area. After the City complied with the trial-court’s order on that issue, the Fifth Circuit held that part of the case was moot, and did not apply the “voluntary cessation” (i.e., “a defendant could … pick up where he left off”) exception to mootness:

[T]he City affirmed that it undertook several additional efforts “going beyond what the district court ordered.” The City conceded that removing the limb allowed it to reconfigure the construction fencing and it subsequently granted public access to the entire area. Likewise, the City granted Appellants access to conduct a religious ceremony at the Sacred Area from midnight to 4 a.m. on November 18, 2023, during hours when the Park is normally closed. Furthermore, on November 21, 2023, the City moved to dismiss its crossappeal in this action, deciding to no longer pursue the issue of access to the Sacred Area. Based on these subsequent developments, “[i]t is therefore clear that [the City officials] harbor no animosity toward [Appellants].” Appellants now have “no reasonable expectation that the wrong challenged by [them] would be repeated.” Thus, the voluntary cessation exception does not apply.

Perez v. City of San Antonio, No. 23-50746 (April 11, 2024) (citations omitted).

In a muscular display of appellate review, in Career Colleges & Schools of Texas v. U.S. Dep’t of Educ., the Fifth Circuit:

- Disagreed with the district court’s conclusion that an association of career schools lacked standing due to a lack of immediate irreparable injury, identifying three types of injury suffered as a result of new DOE regulations about certain defenses to student-loan repayment;

- Concluded that, as a matter of law, the association had satisfied the requirements for a preliminary injunction;

- Gave the resulting injunction nationwide effect; and

- Ordered: “The stay pending appeal remains in effect until the district court enters the preliminary injunction.”

No. 23-50491 (April 4, 2024).

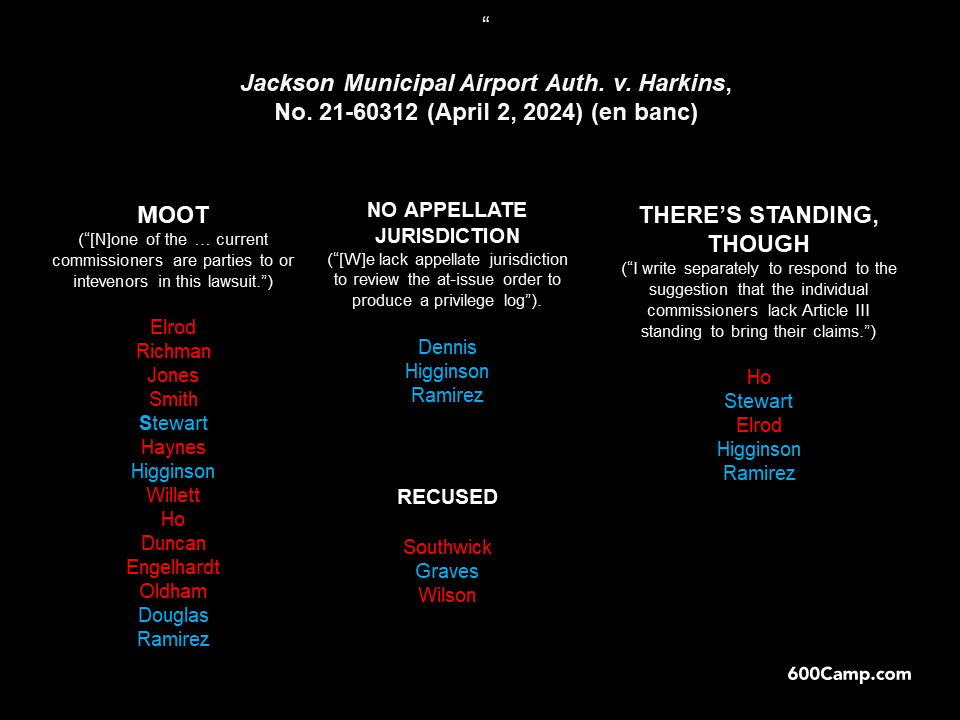

Long-running litigation about control of the Jackson airport led to the en banc court holding on April 2 that the appeal was moot. A breakdown of the viewpoints appears below:

Deanda v. Becerra presents a conflict between Title X (a federal law about the availability of contraception), and a Texas parental-consent statute. The Fifth Circuit found no conflict, and thus no preemption. On the threshold question of standing, the Court rejected the argument that any parent could sue about this issue, observing, inter alia: “This case does not concern all ‘parents or potential parents.’ It concerns only a parent with particular religious beliefs about raising his children.” No. 23-10159 (March 12, 2024).

“Here, ‘all parties have agreed from the beginning of this case that Houston’s voter registration provisions governing circulators’ are unconstitutional. The City also agreed that it ‘would and could not enforce the provisions.’ The City has repeatedly and consistently emphasized its agreement with the plaintiffs throughout this suit. Such faux disputes do not belong in federal court.”

Pool v. City of Houston, No. 22-20491 (Dec. 11, 2023) (citations omitted).

After resolving threshold matters about justiciability, the Fifth Circuit rejected facial First Amendment challenges to Texas laws about the use of drones in Nat’l Press Photographers Ass’n v. McCraw, as follows:

After resolving threshold matters about justiciability, the Fifth Circuit rejected facial First Amendment challenges to Texas laws about the use of drones in Nat’l Press Photographers Ass’n v. McCraw, as follows:

- “No-Fly” provisions. “Plaintiffs’ First Amendment challenge to the No-Fly provisions falters because ‘only conduct that is “inherently expressive” is entitled to First Amendment protection.’ The operation of a drone is not inherently expressive—nor is it expressive to fly a drone 400 feet over a prison, sports venue, or critical infrastructure facility. And nothing in the No-Fly provisions has anything to do with speech or expression. These are flight restrictions, not speech restrictions.” (footnotes omitted, emphasis in original).

- “Surveillance” provisions (which prohibit the use of a drone to capture images “with the intent to conduct surveillance ….”). “Though most drone operators harbor no harmful intent, drones have singular potential to help individuals invade the privacy rights of others because they are small, silent, and able to capture images from angles and altitudes no ordinary photographer, snoop, or voyeur would be able to reach. … The law is also tailored to bar only surveillance

that could not be achieved through ordinary means …. We therefore conclude that the law survives intermediate scrutiny.”

No. 22-50337 (Oct. 23, 2023). The opinion was later revised.

In Louisiana Fair Housing Action Center, Inc. v. Azalea Garden Properties, LLC, “a nonprofit entity with a mission to eradicate housing discrimination in Louisiana” sued when a “tester” used by that entity experienced allegedly unlawful behavior at an apartment complex.

A Fifth Circuit panel (notably, the same panel that found standing in the high-profile mifepristone case) found that the entity lacked standing, but offered three different analyses of that issue:

- The majority opinion found no cognizable injury had been pleaded, remanding with instructions to dismiss without prejudice;

- A concurrence offered additional thoughts about how cognizable injury could be established on remand (either with new allegations, or by adding individual plaintiffs);

- A dissent saw the standing issue as controlled by a 1982 Supreme Court case about a similarly situated housing nonprofit.

No 22-30609 (Sept. 14, 2023).

I had an op-ed in today’s Dallas Morning News about recent friction between the Supreme Court and Fifth Circuit on standing in some high-profile constitutional/administrative-law cases.

The Satanic Temple–an enthusiastic, if not particularly coherent, litigant–appealed the denial of a preliminary injunction that it sought as to several Texas abortion laws. The Fifth Circuit thoroughly reviewed the principles that govern when a preliminary-injunction appeal can become moot with time, and concluded that they applied here to require dismissal of this particular appeal:

Plaintiffs have already appealed the dismissal of their claims; that appeal is docketed as No. 23-20329. To the extent that plaintiffs want to litigate further any issues that were raised in the preliminary injunction motion and remain live, they may do so in their appeal from the district court’s final judgment.

No. 22-20459 (Aug. 18, 2023) (footnote omitted).

Biology teaches that form follows function; similarly, Crown Castle Fiber v. City of Pasadena teaches that “aesthetic design standards incorporating spacing and undergrounding requirements” cannot flout federal telecommunications law, anymore than a tax on federally-protected commercial activity could.

Specificaly, the Fifth Circuit held that the Federal Telecommunications Act preempted local regulations that effectively prohibited the installation of small cell nodes needed for 5G networks. As for standing, “[e]ven though § 253 does not confer a private right [of action], a plaintiff is not prevented from gaining equitable relief on preemption grounds.” And on the merits, the “spacing and undergrounding” regulations were not reasonable or competitively neutral under the FTA’s safe harbor provision. No. 22-20454 (Aug. 4, 2023).

A&R Engineering sued the Texas Attorney General, complaining about a state law forbidding boycotts of Israel by municipal contractors, and arguing that his enforcement of the law made it lose a valuable contract with the City of Houston. The Fifth Circuit held that A&R lacked standing, concluding:

- Injury in fact. “The lost opportunity is connected to a financial loss. And the loss isn’t speculative. A&R retained records of how much it made in previous contracts ….”

- Traceablity. “The economic harm and lost opportunity are traceable to the City. The City after all is the party responsible for contracting with A&R. But it’s unclear how A&R can trace its economic injury to the Attorney General. Traceability is particularly difficult to show where the proffered chain of causation turns on the government’s speculative future decisions regarding whether and to what extent it will bring enforcement actions in hypothetical cases.”

- Redessability. “[T]he City’s conduct severs any link between A&R’s economic injury and the Attorney General. The City told the district court it would follow state law and include the provision. But the City never attributed its actions to any enforcement or threatened enforcement by the Attorney General. A&R’s injury depended on the ‘unfettered,’ ‘independent’ choices of the City, ‘whose exercise of broad and legitimate discretion [we] cannot presume either to control or to predict,’ so the injury isn’t traceable to the Attorney General.”

A&R Engineering v. Scott, No. 22-20047 (July 10, 2023) (all citations omitted). (The Court’s analysis of redressability echoes Justice Gorsuch’s recent analysis of a similar issue in his concurrence for United States v. Texas, No. 22-58 (U.S. June 23, 2023)).

In United States v. Texas, last Friday, the Supreme Court reversed a Fifth Circuit judgment because Texas had no standing to bring a particular claim about immigration policy. The case echoes the proceedings in California v. Texas, a 2021 matter in which the Supreme Court also reversed a Fifth Circuit judgment for lack of standing — in that case, an issue about the enforceability of the Affordable Care Act.

In United States v. Texas, last Friday, the Supreme Court reversed a Fifth Circuit judgment because Texas had no standing to bring a particular claim about immigration policy. The case echoes the proceedings in California v. Texas, a 2021 matter in which the Supreme Court also reversed a Fifth Circuit judgment for lack of standing — in that case, an issue about the enforceability of the Affordable Care Act.

As Texas’s Attorney General, Greg Abbott famously quipped: “I go into the office in the morning. I sue Barack Obama, and then I go home.” In a recent interview, I suggest that these opinions are a yellow light for that approach to public-law litigation; Mark Stern makes a similar point in more colorful language for Slate. Time will tell whether that traffic signal is heeded.

In Abdullah v. Paxton, a former state employee sued about potential future injuries, resulting from a state law that requires certain retirement funds to divest from companies that boycott Israel. The Fifth Circuit affirmed the dismissal of his suit on standing grounds, reminding:

The only way Abdullah could demonstrate he will “actually” suffer future economic harm is if he plausibly alleged that, as a result of § 808’s constraints, the Systems will not be able to pay out his benefits at all when he reaches retirement. Abdullah tries his hand at this argument, urging that the Systems are underfunded, so there is a credible threat the fund will fail. But we are unconvinced—this theory is simply too speculative (and also ignores Texas’s ability to obtain funds by taxes, fees, assessments, etc.).

No. 22-50315 (April 11, 2023) (citations omitted).

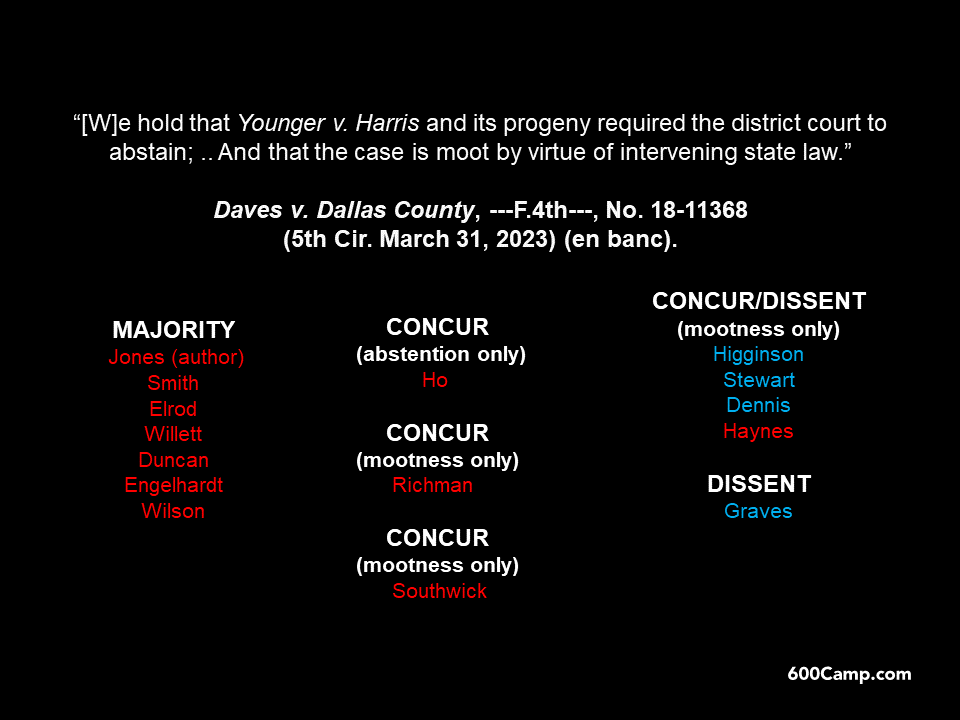

Longrunning litigation about pretrial bail in Texas criminal cases came to an end with a second en banc opinion, Daves v. Dallas County, No. 18-11368 (March 31, 2023). It held by a substantial majority that legislative changes to the relevant laws had mooted the case, and (8-7) that Younger abstention should have barred the case from proceeding in federal court in the first instance. The breakdown of votes and opinions is as follows:

The panel majority in Freedom From Religion Foundation v. Mack found no coercion, and thus no standing for the plaintiff, in an Establishment Clause challenge to a Texas Justice of the Peace’s practices regarding a prayer at the beginning of court sessions. No. 21-20279 (Sept. 29, 2022).

The panel majority in Freedom From Religion Foundation v. Mack found no coercion, and thus no standing for the plaintiff, in an Establishment Clause challenge to a Texas Justice of the Peace’s practices regarding a prayer at the beginning of court sessions. No. 21-20279 (Sept. 29, 2022).

This case contrasts with Sambrano v. United States, in which the panel majority found standing in a Title VII case about a company’s vaccination requirement, concluding that the employer’s policies had a coercive effect as to certain employees’ religious beliefs. No. 21-11159 (Feb. 17, 2022, en banc review denied).

Scylla and Charybdis, the “double threat” foes of Ulysses in the Odyssey (right), would have been interested in Denning v. Bond Pharmacy, Inc., where the plaintiff successfully “show[ed] an injury in fact through her breach of contract claims.” So far so good. But the Court continued: “Athough Denning has established injury in fact, she cannot get past the redressability prong required to establish standing. This is because her injury, as she alleges it, is not redressable by the compensatory and punitive damages that she seeks. Put another way, rendering an award of damages in favor of Denning does not redress her insurer’s injury of being subjected to AIS’s unauthorized billing practices.” No. 21-30534 (Sept. 30, 2022).

Scylla and Charybdis, the “double threat” foes of Ulysses in the Odyssey (right), would have been interested in Denning v. Bond Pharmacy, Inc., where the plaintiff successfully “show[ed] an injury in fact through her breach of contract claims.” So far so good. But the Court continued: “Athough Denning has established injury in fact, she cannot get past the redressability prong required to establish standing. This is because her injury, as she alleges it, is not redressable by the compensatory and punitive damages that she seeks. Put another way, rendering an award of damages in favor of Denning does not redress her insurer’s injury of being subjected to AIS’s unauthorized billing practices.” No. 21-30534 (Sept. 30, 2022).

In the unlikely event that any litigation proceeds under Texas’ SB8 law after Dobbs, a useful reference will be Perez v. McCreary, Veselka, Bragg & Allen, P.C., which found that a plaintiff’s claim under the Fair Debt Collection Act about an inaccurate demand letter failed to satisfy Article III standing requirements:

“’Congress’s creation of a statutory prohibition or obligation and a cause of action does not relieve courts of their responsibility to independently decide whether a plaintiff has suffered a concrete harm under Article III.’ Any other rule would allow Congress to grant private plaintiffs a personal stake in enforcing regulatory law and ultimately usurp the President’s Article II authority to execute the laws. And that would aggrandize our power by letting us resolve disputes that are not ‘of a Judiciary Nature.’

No. 21-50958 (Aug. 15, 2022) (citations omitted) (applying TransUnion LLC v. Ramirez, 141 S. Ct. 2190 (2021)).

The panel majority in E.T. v. Paxton held that a group of students lacked standing (based on their concerns about catching COVID-19) to challenge Governor Abbott’s order prohibiting school mask mandates, noting:

The panel majority in E.T. v. Paxton held that a group of students lacked standing (based on their concerns about catching COVID-19) to challenge Governor Abbott’s order prohibiting school mask mandates, noting:

“This circuit does not ‘recognize the concept of probabilistic standing based on a non-particularized increased risk—that is, an increased risk that equally affects the general public.’ And even where increased-risk claims are particularized, they generally ‘cannot satisfy the actual or imminent requirement,’ which necessitates ‘evidence of a certainly impending harm or substantial risk of harm.’ That’s because ‘[m]uch government regulation slightly increases a citizen’s risk of injury—or insufficiently decreases the risk compared to what some citizens might prefer.'”

But cf. Sambrano v. United Airlines, No. 21-11159 (Feb. 17, 2022) (unpublished) (finding standing in a COVID vaccine-mandate case when: “Plaintiffs are several United employees who requested religious or medical accommodations from United. Those requesting religious accommodations did so out of concern that aborted fetal tissue was used to develop or test the COVID-19 vaccines.”).

The long shadow of Edward Young (right), who served as Minnesota’s well-mustachioed Attorney General in the early 20th century, fell upon two companion cases about Texas election laws, in which a panel majority found that the Texas Secretary of State was not a proper defendant under Ex Parte Young. A dissent (from both panel opinions) saw matters otherwise:

The long shadow of Edward Young (right), who served as Minnesota’s well-mustachioed Attorney General in the early 20th century, fell upon two companion cases about Texas election laws, in which a panel majority found that the Texas Secretary of State was not a proper defendant under Ex Parte Young. A dissent (from both panel opinions) saw matters otherwise:

I write to remind failing memories of the signal role of Ex parte Young in directly policing the path of cases and controversies to the Supreme Court from our state and federal courts and warn against its further diminution. … ‘Ex parte Young poses no threat to the Eleventh Amendment or to the fundamental tenets of federalism. To the contrary, it is a powerful implementation of federalism necessary to the Supremacy Clause, a stellar companion to Marbury and Martin v. Hunter’s Lessee.’

…

The majority continues this Court’s effort to shrink the role of Ex parte Young, by overly narrow readings of the state officer’s duty to enforce Texas’s election laws. … [T]he Texas Secretary of State is the “chief election officer of the state” and is directly instructed by statute to “obtain and maintain uniformity in the application, operation, and

interpretation of this code and of the election laws outside this code.” Moreover, the Secretary is charged to “take appropriate action to protect the voting rights of the citizens of this state from abuse by the authorities administering the state’s electoral processes” and “to correct offending conduct.” Although recent decisions by this Court have split hairs regarding the level of enforcement authority required to satisfy Ex parte Young, the Secretary is charged to interpret both the Texas Election Code and the election laws outside the Code, including federal law, to gain uniformity, tasks it is clearly bound to do. The allegation in these cases is that the Secretary is failing in that duty. This charge should satisfy our Ex parte Young inquiry.

TARC v. Scott, No. 20-40643 (March 16, 2022); Richardson v. Flores, No. 20-50744 (March 16, 2022) (footnotes and citations omitted). (I was recently interviewed about the case by KDFW-TV in Dallas.)

A technical setting illustrated a basic requirement for a justiciable claim in Continental Automotive Systems v. Avanci:

“[A]ssuming Continental is contractually entitled to a license on FRAND [‘fair, reasonable, and nondiscriminatory’] terms as a third-party beneficiary, the pleadings reflect that it has suffered no cognizable injury. Put another way, even if Continental has rights under FRAND contracts, the contracts have not been breached because the SEP [‘standard-essential patent’] holders have fulfilled their obligations to the SSOs [“standard-setting organizations”] with respect to Continental. The supplier acknowledges that Avanci and Patent-Holder Defendants are ‘actively licensing the SEPs to the OEMs[,]’ which means that they are making SEP licenses available to Continental on FRAND terms. As it does not need to personally own SEP licenses to operate its business, it has not been denied property to which it was entitled. And absent a ‘denial of property to which a plaintiff is entitled,’ Continental did not suffer an injury in fact. ”

No. 20-11032 (Feb. 28, 2022).

“Karen does indeed have Article III standing to bring this suit. She seeks money damages to address the death of her son, which was allegedly caused by Defendants’ conduct. So she has sufficiently alleged all three elements required to establish Article III standing at this stage. … The defect here, by contrast, is one of prudential standing. And prudential standing does not present a jurisdictional question, but ‘a merits question: who, according to the governing substantive law, is entitled to enforce the right?’ … And a violation of this rule is a failure of “prudential” standing. ‘[N]ot one

“Karen does indeed have Article III standing to bring this suit. She seeks money damages to address the death of her son, which was allegedly caused by Defendants’ conduct. So she has sufficiently alleged all three elements required to establish Article III standing at this stage. … The defect here, by contrast, is one of prudential standing. And prudential standing does not present a jurisdictional question, but ‘a merits question: who, according to the governing substantive law, is entitled to enforce the right?’ … And a violation of this rule is a failure of “prudential” standing. ‘[N]ot one

[of our precedents] holds that the inquiry is jurisdictional.’ It goes only to the validity of the cause of action. And ‘the absence of a valid … cause of action does not implicate subject-matter jurisdiction.'” Abraugh v. Altimus, No. 21-30205 (Feb. 14, 2022) (citations omitted) (emphasis added, citations omitted).

Walmart sued the U.S. government, seeking declaratory judgments on several issues about the enforcement of laws related to opioids. In the meantime, the the US brought an enforcement action against Walmart in Delaware. The panel in Walmart, Inc. v. U.S. Dep’t of Justice concluded that the Delaware action made this declaratory-judgment case unnecessary; two judges also concluded that Wal-Mart had not identified a specific type of action or decision as to which the United States had waived sovereign immunity in the Administrative Procedure Act. No. 21-40157 (Dec. 22, 2021).

Walmart sued the U.S. government, seeking declaratory judgments on several issues about the enforcement of laws related to opioids. In the meantime, the the US brought an enforcement action against Walmart in Delaware. The panel in Walmart, Inc. v. U.S. Dep’t of Justice concluded that the Delaware action made this declaratory-judgment case unnecessary; two judges also concluded that Wal-Mart had not identified a specific type of action or decision as to which the United States had waived sovereign immunity in the Administrative Procedure Act. No. 21-40157 (Dec. 22, 2021).

A frequent international traveler alleged that he had been placed on a TSA list that required additional, invasive searches of him when he flew. The Fifth Circuit affirmed the dismissal of the several Constitutional claims that he raised in a lawsuit against the leaders of the relevant federal agencies:

A frequent international traveler alleged that he had been placed on a TSA list that required additional, invasive searches of him when he flew. The Fifth Circuit affirmed the dismissal of the several Constitutional claims that he raised in a lawsuit against the leaders of the relevant federal agencies:

“In short, Ghedi has no right to hassle-free travel. In the Supreme Court’s view, international travel is a ‘freedom’ subject to ‘reasonable governmental regulation.’ And when it comes to reasonable governmental regulation, our sister circuits have held that Government-caused inconveniences during international travel do not deprive a traveler’s right to travel. In the Sixth Circuit’s view, ‘incidental or negligible’ delays of ‘ten minutes’ to ‘an entire day’ do not ‘implicate the right to travel.’ The Second and Tenth Circuits have held the same. Ghedi has therefore failed to plausibly allege that he has been deprived of his right to travel internationally by the extra security measures he has experienced.”

Ghedi v. Mayorkas, No. 20-10995 (Oct. 25, 2021) (footnotes omitted).

The Fifth Circuit denied the stay application in the appeal of the DOJ’s lawsuit against SB8, stating: While the referenced Fifth Circuit opinion primarily focused on Ex Parte Young (not relevant in a suit by the US, see West Virginia v. United States, 479 U.S. 305 (1987)), it made other observations about justiciability that this order suggests will now be central in the resolution of the merits. Professor Steve Vladeck further analyzes the relationship of the two cases in a recent Twitter thread.

While the referenced Fifth Circuit opinion primarily focused on Ex Parte Young (not relevant in a suit by the US, see West Virginia v. United States, 479 U.S. 305 (1987)), it made other observations about justiciability that this order suggests will now be central in the resolution of the merits. Professor Steve Vladeck further analyzes the relationship of the two cases in a recent Twitter thread.

The United States successfully seized the M/Y Galactic Star, a valuable yacht, in connection with a massive bribery scheme involving Nigerian government officials. The Fifth Circuit agreed with the district court that the majority shareholder of the yacht’s corporate owner lacked standing to complain: “LightRay chose to maintain Earnshaw as a separate corporate entity, thereby securing all the attendant advantages of doing so, including an attempt by its principals to support the argument that LightRay is an innocent owner. We agree with the Eighth Circuit that ‘[a] court of equity will not disregard a corporation’s exclusive ownership of assets and claims ‘where those in control have deliberately adopted the corporate form in order to secure its advantages.’'” United States v. The M/Y Galactic Star, No. 20-20471 (Sept. 13, 2021) (citations omitted).

The United States successfully seized the M/Y Galactic Star, a valuable yacht, in connection with a massive bribery scheme involving Nigerian government officials. The Fifth Circuit agreed with the district court that the majority shareholder of the yacht’s corporate owner lacked standing to complain: “LightRay chose to maintain Earnshaw as a separate corporate entity, thereby securing all the attendant advantages of doing so, including an attempt by its principals to support the argument that LightRay is an innocent owner. We agree with the Eighth Circuit that ‘[a] court of equity will not disregard a corporation’s exclusive ownership of assets and claims ‘where those in control have deliberately adopted the corporate form in order to secure its advantages.’'” United States v. The M/Y Galactic Star, No. 20-20471 (Sept. 13, 2021) (citations omitted).

A chapter of the United Daughters of the Confederacy complained about the recent removal of a statue of a Confederate soldier from a San Antonio park. The Fifth Circuit affirmed the dismissal of its claim, observing (1) an 1899 document relating to the construction of the statue did not create a conveyance or use privilege for the relevant land; and (2) if it had done so, any such conveyance expired when an earlier chapter that actually received the document ceased operations in 1972, without conveying any such interest to its successor. Albert Sidney Johnston Chapter, Chapter No. 2060, UDC v. City of San Antonio, No. 20-50155 (Aug. 25, 2021).

A chapter of the United Daughters of the Confederacy complained about the recent removal of a statue of a Confederate soldier from a San Antonio park. The Fifth Circuit affirmed the dismissal of its claim, observing (1) an 1899 document relating to the construction of the statue did not create a conveyance or use privilege for the relevant land; and (2) if it had done so, any such conveyance expired when an earlier chapter that actually received the document ceased operations in 1972, without conveying any such interest to its successor. Albert Sidney Johnston Chapter, Chapter No. 2060, UDC v. City of San Antonio, No. 20-50155 (Aug. 25, 2021).

“‘Lost debt’ cases present a unique type of claim. They allege ‘a RICO violation whose central purpose [i]s to prevent the collection of a claim or judgment.’ The substantive RICO violation is the act of preventing collection. And the plaintiff’s injury is the inability to collect the lawful debt. So, when the plaintiff successfully recovers that debt, it is no longer lost. And because that unrecovered debt is the only source of the plaintiff’s injury, there is no RICO claim in its absence. As a result, a plaintiff cannot rely on its lost debt to animate a RICO suit after it has recovered that debt. The ‘debt is “lost” and thereby

“‘Lost debt’ cases present a unique type of claim. They allege ‘a RICO violation whose central purpose [i]s to prevent the collection of a claim or judgment.’ The substantive RICO violation is the act of preventing collection. And the plaintiff’s injury is the inability to collect the lawful debt. So, when the plaintiff successfully recovers that debt, it is no longer lost. And because that unrecovered debt is the only source of the plaintiff’s injury, there is no RICO claim in its absence. As a result, a plaintiff cannot rely on its lost debt to animate a RICO suit after it has recovered that debt. The ‘debt is “lost” and thereby

becomes a basis for RICO trebling only if the debt (1) cannot be collected (2)

“by reason of” a RICO violation.’ ‘In other words, to the extent of a successful collection, the RICO claim is abated pro tanto, prior to any application of trebling.'” HCB Fin. Corp. v. McPherson, No. 20-50718 (Aug. 4, 2021) (citations omitted). Put another way: “There must be independent damages to treble; the possibility of treble damages alone cannot confer statutory RICO standing.”

The Fifth Circuit rejected class claims about the handling of funds in an ERISA plan, identifying a basic standing problem arising from the links in the causal chain of the plaintiffs’ damages theory: “[Plaintiffs’] expert has provided calculations for the returns that they would have earned had they not invested in the FCU Option but had instead placed their money in a stable value fund. This ‘lost investment income’ is a ‘concrete’ and redressable injury for the purposes of standing. That said, another question we must ask is whether Plaintiffs would have in fact invested in a stable value fund to earn the higher returns had [Defendants] never offered the FCU Option. In other words, the question is whether Plaintiffs have demonstrated that it is ‘substantially probable that the challenged acts of the defendant, not of some . . . third party[]’ (including themselves) caused the injury. If anything, the record reveals that Plaintiffs would not have invested in a stable value fund in a counterfactual world since they did not place their money in one when given the opportunity to do so.” (citations omitted, emphasis added). Oritz v. American Airlines, No. 20-10817 (July 19, 2021).

The Fifth Circuit rejected class claims about the handling of funds in an ERISA plan, identifying a basic standing problem arising from the links in the causal chain of the plaintiffs’ damages theory: “[Plaintiffs’] expert has provided calculations for the returns that they would have earned had they not invested in the FCU Option but had instead placed their money in a stable value fund. This ‘lost investment income’ is a ‘concrete’ and redressable injury for the purposes of standing. That said, another question we must ask is whether Plaintiffs would have in fact invested in a stable value fund to earn the higher returns had [Defendants] never offered the FCU Option. In other words, the question is whether Plaintiffs have demonstrated that it is ‘substantially probable that the challenged acts of the defendant, not of some . . . third party[]’ (including themselves) caused the injury. If anything, the record reveals that Plaintiffs would not have invested in a stable value fund in a counterfactual world since they did not place their money in one when given the opportunity to do so.” (citations omitted, emphasis added). Oritz v. American Airlines, No. 20-10817 (July 19, 2021).

A wheelchair-bound potential juror complained about the inaccessibility of the courthouse to him when he was called for jury duty. The Fifth Circuit reviewed two guideposts about standing for such claims in its earlier opinions, noting:

O’Hair and Herman can be summarized as holding that a plaintiff with a substantial risk of being called for jury duty has standing to seek an injunction against a systemic exclusionary practice but not a one-off, episodic exclusion related to a particular judge’s actions. Thus, the plaintiff in O’Hair had standing for injunctive relief against a state constitutional provision that systemically excluded atheists from jury service, but the plaintiff in Herman lacked standing for injunctive relief against a particular judge’s conduct.

Applied to this case, the Fifth Circuit held: “[Plaintiff] has a substantial risk of being called for jury duty again. He was called twice between 2012 and 2017. Those past incidents, though insufficient to confer standing, are still ‘evidence bearing on whether there is a real and immediate threat of repeated injury.’ Moreover, Hinds County is not extremely populous, and only a subset of its population is eligible for jury service, so it’s fairly likely that Crawford will again, at some point, be called for jury duty.” Crawford v. Hinds County Board of Supervisors, No. 20-60372 (June 16, 2021) (citations omitted).

DM Arbor Court v. City of Houston explains that a case may become ripe during the course of the appeal process: “Although some of the ripeness-on-appeal caselaw is couched in the language of discretion, our best reading of the decisions—especially those from the Supreme Court—is that ‘[i]ntervening events that occur after decision in lower courts should be included’ when an appellate court assesses ripeness. Supporting this view is the City’s inability to cite any case in which an appellate court declined to find a dispute ripe when postjudgment events had made it so. And we have an obligation to exercise the jurisdiction Article III and Congress grant us when any impediments, such as prudential concerns, have been eliminated. Cf.Colo. River Water Conservation Dist. v. United States, 424 U.S. 800, 813, 817 (1976) (recognizing that abstention ‘is an extraordinary and narrow exception’ to the ‘virtually unflagging obligation of the federal courts to exercise the jurisdiction given them’).” No. 20-20194 (Feb. 12, 2021) (other citations omitted).

DM Arbor Court v. City of Houston explains that a case may become ripe during the course of the appeal process: “Although some of the ripeness-on-appeal caselaw is couched in the language of discretion, our best reading of the decisions—especially those from the Supreme Court—is that ‘[i]ntervening events that occur after decision in lower courts should be included’ when an appellate court assesses ripeness. Supporting this view is the City’s inability to cite any case in which an appellate court declined to find a dispute ripe when postjudgment events had made it so. And we have an obligation to exercise the jurisdiction Article III and Congress grant us when any impediments, such as prudential concerns, have been eliminated. Cf.Colo. River Water Conservation Dist. v. United States, 424 U.S. 800, 813, 817 (1976) (recognizing that abstention ‘is an extraordinary and narrow exception’ to the ‘virtually unflagging obligation of the federal courts to exercise the jurisdiction given them’).” No. 20-20194 (Feb. 12, 2021) (other citations omitted).

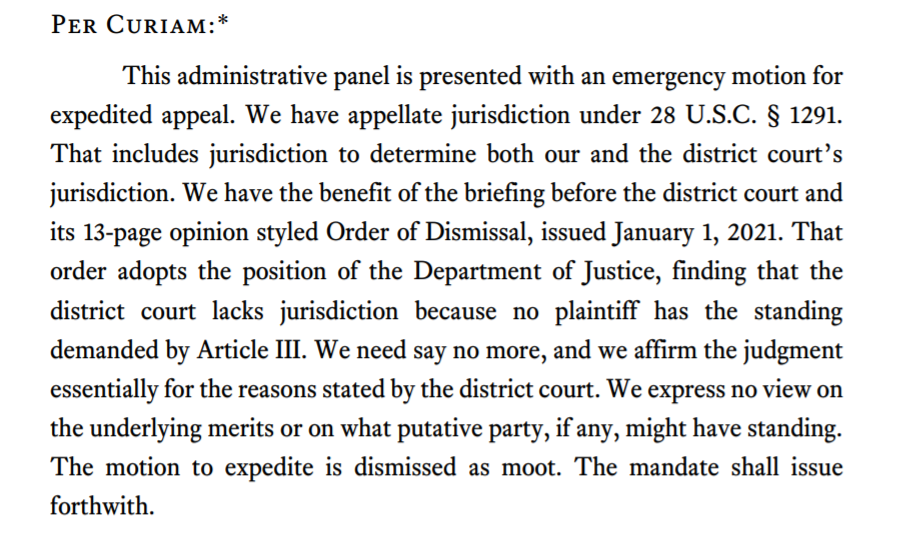

The Twelfth Amendment says: “The President of the Senate shall, in the presence of the Senate and House of Representatives, open all the certificates and the votes shall then be counted.” By statute, that is to occur this year on January 6. That statute also lays out a procedure for handling objections to votes. Judge Jeremy Kernodle of Tyler rejected a challenge to that process, as the process is in detailed in Section 15 of 1887’s Electoral Count Act, stating: “Plaintiff Louie Gohmert, the United States Representative for Texas’s First Congressional District, alleges at most an institutional injury to the House of Representatives. Under well settled Supreme Court authority, that is insufficient to support standing.” Gohmert v. Pence, No. 6:20-cv-660-JDK (E.D. Tex. Jan. 1, 2020).

The Twelfth Amendment says: “The President of the Senate shall, in the presence of the Senate and House of Representatives, open all the certificates and the votes shall then be counted.” By statute, that is to occur this year on January 6. That statute also lays out a procedure for handling objections to votes. Judge Jeremy Kernodle of Tyler rejected a challenge to that process, as the process is in detailed in Section 15 of 1887’s Electoral Count Act, stating: “Plaintiff Louie Gohmert, the United States Representative for Texas’s First Congressional District, alleges at most an institutional injury to the House of Representatives. Under well settled Supreme Court authority, that is insufficient to support standing.” Gohmert v. Pence, No. 6:20-cv-660-JDK (E.D. Tex. Jan. 1, 2020).

A Fifth Circuit motions panel (Higginbotham, Smith, Oldham) dismissed an effort at immediate appeal:

The Supreme Court’s rejection of Texas v. Pennsylvania (despite support from an amicus brief by two nonexistent states) has sparked an unusual national dialogue about the concept of standing (including the President’s accurate observation: “All they were interested in is ‘standing’, which makes it very difficult for the President to present a case on the merits.” (emphasis added)). The capable Rory Ryan at Baylor Law School has analyzed and critiqued the dissenters’ position; for reference, the entire order appears below:

The Supreme Court’s rejection of Texas v. Pennsylvania (despite support from an amicus brief by two nonexistent states) has sparked an unusual national dialogue about the concept of standing (including the President’s accurate observation: “All they were interested in is ‘standing’, which makes it very difficult for the President to present a case on the merits.” (emphasis added)). The capable Rory Ryan at Baylor Law School has analyzed and critiqued the dissenters’ position; for reference, the entire order appears below:

The State of Texas’s motion for leave to file a bill of complaint is denied for lack of standing under Article III of the Constitution. Texas has not demonstrated a judicially cognizable interest in the manner in which another State conducts its elections. All other pending motions are dismissed as moot. Statement of Justice Alito, with whom Justice Thomas joins: In my view, we do not have discretion to deny the filing of a bill of complaint in a case that falls within our original jurisdiction. See Arizona v. California, 589 U. S. ___ (Feb. 24, 2020) (Thomas, J., dissenting). I would therefore grant the motion to file the bill of complaint but would not grant other relief, and I express no view on any other issue.

The University of Texas’s rules about campus speech did not fare well in Speech First, Inc. v. Fenves, in which the Fifth Circuit found that a preliminary-injunction action could proceed. The Court found that the case was not moot and stated a strong claim on the merits: “Of course, not every utterance is worth protecting under the First Amendment. In our current national condition, however, in which ‘institutional leaders, in a spirit of panicked damage control, are delivering hasty and disproportionate punishment instead of considered reforms,’ courts must be especially vigilant against assaults on speech in the Constitution’s care. Otherwise, the people may not be free to generate, debate, and discuss both general and specific ideas, hopes, and experiences,’ to ‘transmit their resulting views and conclusions to their elected representatives,’ ‘to influence the public policy enacted by elected representatives,’ and thereby to realize the political and human common good.” No. 19-50529 (revised Oct. 30, 2020) (footnotes omitted).

The University of Texas’s rules about campus speech did not fare well in Speech First, Inc. v. Fenves, in which the Fifth Circuit found that a preliminary-injunction action could proceed. The Court found that the case was not moot and stated a strong claim on the merits: “Of course, not every utterance is worth protecting under the First Amendment. In our current national condition, however, in which ‘institutional leaders, in a spirit of panicked damage control, are delivering hasty and disproportionate punishment instead of considered reforms,’ courts must be especially vigilant against assaults on speech in the Constitution’s care. Otherwise, the people may not be free to generate, debate, and discuss both general and specific ideas, hopes, and experiences,’ to ‘transmit their resulting views and conclusions to their elected representatives,’ ‘to influence the public policy enacted by elected representatives,’ and thereby to realize the political and human common good.” No. 19-50529 (revised Oct. 30, 2020) (footnotes omitted).

Belcher complained about the FDIC’s power to take his deposition. The parties, and the panel majority, agreed that his lawsuit did not become moot even after the challenged deposition occurred: ‘Because the district court on remand can ‘fashion some form of meaningful relief,’ appeal is not moot. Exactly what that relief might entail is beyond the scope of our concern. However, it is undisputed by the parties that the district court could strike Belcher’s deposition testimony before the FDIC.” The majority also noted that the district court could address the FDIC’s sharing of the transcript. A dissent observed: “I see no reason to override what common sense suggests: the appeal of an order requiring a deposition is moot once the deposition is over.” FDIC v. Belcher, No. 19-31023 (Oct. 26, 2020).

Belcher complained about the FDIC’s power to take his deposition. The parties, and the panel majority, agreed that his lawsuit did not become moot even after the challenged deposition occurred: ‘Because the district court on remand can ‘fashion some form of meaningful relief,’ appeal is not moot. Exactly what that relief might entail is beyond the scope of our concern. However, it is undisputed by the parties that the district court could strike Belcher’s deposition testimony before the FDIC.” The majority also noted that the district court could address the FDIC’s sharing of the transcript. A dissent observed: “I see no reason to override what common sense suggests: the appeal of an order requiring a deposition is moot once the deposition is over.” FDIC v. Belcher, No. 19-31023 (Oct. 26, 2020).

In one of many recent election-law disputes, the panel majority in Richardson v. Hughs painstakingly reviewed, and rejected, the plaintiffs’ challenge to Texas’s practices about signature verification for mail-in ballots. The procedural posture was a motion to stay; a concurrence cauti

In one of many recent election-law disputes, the panel majority in Richardson v. Hughs painstakingly reviewed, and rejected, the plaintiffs’ challenge to Texas’s practices about signature verification for mail-in ballots. The procedural posture was a motion to stay; a concurrence cauti oned: “[T]he reality is that the ultimate legality of the present system cannot be settled by the federal courts at this juncture when voting is already underway, and any opinion on a motions panel is essentially written in sand with no precedential value ….” footnote omitted). No. 20-50774 (Oct. 20, 2020).

oned: “[T]he reality is that the ultimate legality of the present system cannot be settled by the federal courts at this juncture when voting is already underway, and any opinion on a motions panel is essentially written in sand with no precedential value ….” footnote omitted). No. 20-50774 (Oct. 20, 2020).

If the law had an attic, it would hold the subject matter of Pool v. City of Houston, No. 19-20828 (Oct. 23, 2020):

It is often said that courts “strike down” laws when ruling them unconstitutional. That’s not quite right. Courts hold laws unenforceable; they do not erase them. Many laws that are plainly unconstitutional remain on the statute books. Jim Crow-era segregation laws are one example. The City of Houston contends that it’s being sued for one of these so-called “zombie” laws. Its Charter allows only registered voters to circulate petitions for initiatives and referenda, even though the Supreme Court held a similar law unconstitutional twenty years ago. This case thus requires us to decide when the threat of continued enforcement is enough to reanimate a zombie law and bring it from the statutory graveyard into federal court.

(citations omitted). Held: the zombie walked, based both on the City’s history of enforcement of this specific law, and the inadequacy of its effort to disclaim further enforcement: “At least based on the current record, the City’s addition of the ‘Editor’s note’ on its website does not moot this case. Voluntarily stopping an unconstitutional practice renders a case moot only ‘if subsequent events ma[k]e it absolutely clear that the allegedly wrongful behavior c[an] not reasonably be expected to recur.'” You can hear more about this case on the Coale Mind Halloween Special – “Attack of the Zombie Statute!”

(citations omitted). Held: the zombie walked, based both on the City’s history of enforcement of this specific law, and the inadequacy of its effort to disclaim further enforcement: “At least based on the current record, the City’s addition of the ‘Editor’s note’ on its website does not moot this case. Voluntarily stopping an unconstitutional practice renders a case moot only ‘if subsequent events ma[k]e it absolutely clear that the allegedly wrongful behavior c[an] not reasonably be expected to recur.'” You can hear more about this case on the Coale Mind Halloween Special – “Attack of the Zombie Statute!”

John Dierlam doggedly pursued his religious-freedom challenge to the Affordable Care Act throughout that statute’s “serpentine history.” After considering his persistence in the face of constant statutory change, the Fifth Circuit reversed a finding of mootness, observing: “Ordinarily, when a case ‘has become moot on appeal,’ the court

John Dierlam doggedly pursued his religious-freedom challenge to the Affordable Care Act throughout that statute’s “serpentine history.” After considering his persistence in the face of constant statutory change, the Fifth Circuit reversed a finding of mootness, observing: “Ordinarily, when a case ‘has become moot on appeal,’ the court  should “vacate the judgment with directions to dismiss.” But ‘in instances where the mootness is attributable to a change in the legal framework governing the case, and where the plaintiff may have some residual claim under the new framework that was understandably not asserted previously,’ we ‘vacate the judgment and remand for further proceedings in which the parties may, if necessary, amend their pleadings or develop the record more fully.’” Dierlam v. Trump, No. 18-20440 (Oct. 15, 2020).

should “vacate the judgment with directions to dismiss.” But ‘in instances where the mootness is attributable to a change in the legal framework governing the case, and where the plaintiff may have some residual claim under the new framework that was understandably not asserted previously,’ we ‘vacate the judgment and remand for further proceedings in which the parties may, if necessary, amend their pleadings or develop the record more fully.’” Dierlam v. Trump, No. 18-20440 (Oct. 15, 2020).

The most recent episode of the Coale Mind podcast discusses Mi Familia Vota v. Abbott, No. 20-50793 (Oct. 14, 2020), a challenge to several Texas voting laws in light of the COVID-19 pandemic. The case reminds of two important limits on federal judicial power in such disputes:

The most recent episode of the Coale Mind podcast discusses Mi Familia Vota v. Abbott, No. 20-50793 (Oct. 14, 2020), a challenge to several Texas voting laws in light of the COVID-19 pandemic. The case reminds of two important limits on federal judicial power in such disputes:

- Under Ex parte Young (Mr. Young appears to the right): “Although a court can enjoin state officials from enforcing statutes, such an injunction must be directed to those who have the authority to enforce those statutes. In the present case, that would be county or other local officials.”

- And naming the right defendant is only the first hurdle posed by federalism: “An examination of the relief that the Plaintiffs seek in the case before us reveals that in many instances, court-ordered-relief would require the Governor or the Secretary of State to issue an executive order or directive or to take other sweeping affirmative action. If implemented by the district court, many of the directives requested by the Plaintiffs would violate principles of federalism.”

A nonprofit complained about a lack of press access to the Texas legislative session in 2019, and argued that the case avoided mootness because of the “capable of repetition yet evading review” exception to that doctrine. The Fifth Circuit disagreed, noting that the nonprofit had not fully used the available tools to move its case along: “Crucially, Empower never asked this court to expedite its appeal. Both the Federal Rules of Appellate Procedure and this court’s local rules allow a party to move the court for an expedited appeal. Empower did not take advantage of these rules. That relaxed approach can be contrasted with a

A nonprofit complained about a lack of press access to the Texas legislative session in 2019, and argued that the case avoided mootness because of the “capable of repetition yet evading review” exception to that doctrine. The Fifth Circuit disagreed, noting that the nonprofit had not fully used the available tools to move its case along: “Crucially, Empower never asked this court to expedite its appeal. Both the Federal Rules of Appellate Procedure and this court’s local rules allow a party to move the court for an expedited appeal. Empower did not take advantage of these rules. That relaxed approach can be contrasted with a  recent case in this court involving a plaintiff who similarly sought an injunction against public officials so that he could attend school-district meetings and activities. … In [that case], two days after the appealed was docketed, the plaintiff–appellant filed a motion for expedited appeal which, he argued, was “necessary to redress [the] ‘irreparable injury.’” We granted that motion and moved the case along with appropriate dispatch.

recent case in this court involving a plaintiff who similarly sought an injunction against public officials so that he could attend school-district meetings and activities. … In [that case], two days after the appealed was docketed, the plaintiff–appellant filed a motion for expedited appeal which, he argued, was “necessary to redress [the] ‘irreparable injury.’” We granted that motion and moved the case along with appropriate dispatch.

In contrast, Empower demonstrated no such urgency. When time is of the essence, a party must act like it.” Empower Texas, Inc. v. Geren, No. 19-50577 (Oct. 5, 2020) (citations omitted).

Earlier this month, the Fifth Circuit found an abuse of discretion, under Texas substantive law, in not modifying a noncompetition agreement at the preliminary-injunction stage. Calhoun v. Jack Doheny Cos., Inc. But because the parties had settled their case in the meantime, notifying the district court but not the Fifth Circuit, the case had become moot at the time of that opinion, prompting the Court to withdraw its opinion and dismiss the matter with prejudice. No. 20-20068 (Aug. 28, 2020).

Earlier this month, the Fifth Circuit found an abuse of discretion, under Texas substantive law, in not modifying a noncompetition agreement at the preliminary-injunction stage. Calhoun v. Jack Doheny Cos., Inc. But because the parties had settled their case in the meantime, notifying the district court but not the Fifth Circuit, the case had become moot at the time of that opinion, prompting the Court to withdraw its opinion and dismiss the matter with prejudice. No. 20-20068 (Aug. 28, 2020).

(This activity about a case named Calhoun prompted me to check in on the M/V CALHOUN, a ship that under another name created a memorable mootness argument– “The ship has sailed!” – when it left the Fifth Circuit before creditors could seize it. The ship continues to be elsewhere, arriving in Venezuela as of the date of this post.)

(This activity about a case named Calhoun prompted me to check in on the M/V CALHOUN, a ship that under another name created a memorable mootness argument– “The ship has sailed!” – when it left the Fifth Circuit before creditors could seize it. The ship continues to be elsewhere, arriving in Venezuela as of the date of this post.)

“Mistah Kurtz — he dead.” Joseph Conrad, Heart of Darkness.

Spell v. Edwards presented a challenge to a COVID-19 restriction that became moot with the passage of time: “A Louisiana church and its pastor ask us enjoin stay-at-home orders restricting in-person church services to ten congregants. But there is nothing for us to enjoin. The challenged orders expired more than a month ago. That means this appeal and the related request for an injunction … are moot.” Notably, the restriction expired by its own terms, showing that it was not abandoned as a litigation tactic, and thus making inapplicable the “capable of repetition, yet evading review” exception to mootness. No. 20-30358 (June 18, 2020).

The COVID-19 crisis has required the courts to deftly juggle conflicting, and important, interests when asked to review emergency regulation. A good summary of such a balancing exercise appears in First Pentecostal Church of Holly Springs v. City of Holly Springs: “Our sole appellate jurisdiction in this case rests upon denial of an injunction implied from the choice by the district court not to rule in an expedited fashion. After briefing, it remains plain that the court is being requested to enjoin a shifting regulatory regime not yet settled as to its regulation and regulatory effect, such as the apparent acceptance by the Church of the Governor’s regulations. That settlement is best made by the district court in the first instance. Lest we in error step upon treasured values of religious freedom and personal liberties we stay our hand and return this case to the district court for decision footed upon a record reflecting current conditions.” No. 20-60399 (May 22, 2020) (emphasis added).

The COVID-19 crisis has required the courts to deftly juggle conflicting, and important, interests when asked to review emergency regulation. A good summary of such a balancing exercise appears in First Pentecostal Church of Holly Springs v. City of Holly Springs: “Our sole appellate jurisdiction in this case rests upon denial of an injunction implied from the choice by the district court not to rule in an expedited fashion. After briefing, it remains plain that the court is being requested to enjoin a shifting regulatory regime not yet settled as to its regulation and regulatory effect, such as the apparent acceptance by the Church of the Governor’s regulations. That settlement is best made by the district court in the first instance. Lest we in error step upon treasured values of religious freedom and personal liberties we stay our hand and return this case to the district court for decision footed upon a record reflecting current conditions.” No. 20-60399 (May 22, 2020) (emphasis added).

Continuing a line of thought from earlier 2019 authority about standing to challenge administrative-agency action, the Fifth Circuit found an organization’s alleged standing was too attenuated when it “contend[ed] that its injuries are traceable to Treasury’s actions because Treasury has plenary authority over the [Low-Income Housing Tax Credit] program, including the power both to issue regulations and to recapture LIHTCs from investors who violate the [Fair Housing Act].” Inclusive Communities Project, Inc. v. Dep’t of the Treasury also shows that the style trend toward use of contractions hasn’t lessened as 2019’s continued. No. 19-10377 (Dec. 30, 2019).

Continuing a line of thought from earlier 2019 authority about standing to challenge administrative-agency action, the Fifth Circuit found an organization’s alleged standing was too attenuated when it “contend[ed] that its injuries are traceable to Treasury’s actions because Treasury has plenary authority over the [Low-Income Housing Tax Credit] program, including the power both to issue regulations and to recapture LIHTCs from investors who violate the [Fair Housing Act].” Inclusive Communities Project, Inc. v. Dep’t of the Treasury also shows that the style trend toward use of contractions hasn’t lessened as 2019’s continued. No. 19-10377 (Dec. 30, 2019).

The Fifth Circuit has ruled in the closely-watched constitutional challenge to the Affordable Care Act, Texas v. United States, No. 19-10011 (Dec. 18, 2019). The panel majority opinion, written by Judge Elrod and joined by Judge Englehardt, held:

First, there is a live case or controversy because the intervenor-defendant states have standing to appeal and, even if they did not, there remains a live case or controversy between the plaintiffs and the federal defendants. Second, the plaintiffs have Article III standing to bring this challenge to the ACA; the individual mandate injures both the individual plaintiffs, by requiring them to buy insurance that they do not want, and the state plaintiffs, by increasing their costs of complying with the reporting requirements that accompany the individual mandate. Third, the individual mandate is unconstitutional because it can no longer be read as a tax, and there is no other constitutional provision that justifies this exercise of congressional power. Fourth, on the severability question, we remand to the district court to provide additional analysis of the provisions of the ACA as they currently exist.

(emphasis added). Judge King dissented, stating: “I would vacate the district court’s order because none of the plaintiffs have standing to challenge the coverage requirement. And although I would not reach the merits or remedial issues, if I did, I would conclude that the coverage requirement is constitutional, albeit unenforceable, and entirely severable from the remainder of the Affordable Care Act.”

The Fifth Circuit will not ordinarily grant a writ of mandamus about the erroneous denial of a motion to dismiss for lack of subject matter jurisdiction. But in In re Gee, a sweeping challenge to Louisiana’s abortion laws, the Court observed:

The Fifth Circuit will not ordinarily grant a writ of mandamus about the erroneous denial of a motion to dismiss for lack of subject matter jurisdiction. But in In re Gee, a sweeping challenge to Louisiana’s abortion laws, the Court observed:

“Here, the combination of five federalism concerns makes this a special circumstance and distinguishes it from an ordinary case: (1) A sovereign State is requesting the writ; (2) Plaintiffs seek sweeping review of an entire body of state law; (3) Plaintiffs seek structural injunctions that would give the district court de facto control of state law; (4) the type of discovery waiting on the other side of Louisiana’s motion to dismiss is categorically different than what awaits an ordinary civil litigant; and (5) the ordinary civil litigant cannot demand attorneys’ fees from the State’s taxpayers.”

The Court declined to grant the writ at this stage and after its detailed analysis of the relevant issues, observing

“. . . two reasons. First, it’s not clear from the district court’s order how it would resolve the State’s jurisdictional challenge. And second, much of the State’s argument in its mandamus petition goes beyond jurisdiction. In particular, the State argues that Plaintiffs’ “cumulative-effects challenge” is not cognizable. But that challenge might change after the district court conducts its claim-by-claim analysis of Plaintiffs’ standing. So in our view, resolution of whether that challenge is cognizable should await the district court’s jurisdictional analysis.”

No. 19-30353 (Oct. 18, 2019).

A securities-fraud class action lived to fight another day in Broyles v. Commonwealth Advisors: “The district court erred in deciding that plaintiffs lacked standing under Delaware law to bring a direct action against their investment advisers rather than initiating a derivative action in behalf of the hedge funds that the advisers had assembled and managed for fraudulent inducement purposes. The investor plaintiffs adequately supported their motion for partial summary judgment demonstrating their Article III standing with appropriate evidence of their injury-in-fact that arose :immediately upon their purchase of the falsely overvalued securities; were induced and caused by the defendant advisers’ fraudulent advice and solicitations; and likely will be redressed by a favorable decision on the merits.” No. 17-30092 (Aug. 28, 2019).

A securities-fraud class action lived to fight another day in Broyles v. Commonwealth Advisors: “The district court erred in deciding that plaintiffs lacked standing under Delaware law to bring a direct action against their investment advisers rather than initiating a derivative action in behalf of the hedge funds that the advisers had assembled and managed for fraudulent inducement purposes. The investor plaintiffs adequately supported their motion for partial summary judgment demonstrating their Article III standing with appropriate evidence of their injury-in-fact that arose :immediately upon their purchase of the falsely overvalued securities; were induced and caused by the defendant advisers’ fraudulent advice and solicitations; and likely will be redressed by a favorable decision on the merits.” No. 17-30092 (Aug. 28, 2019).

Conservative thinkers frequently express skepticism about the administrative state, and in particular, the Chevron doctrine about judicial deference to it. A powerful counterpoint to that line of thinking, and an equally orthodox part of conservative philosophy, appears in the Fifth Circuit’s recent opinion in Center for Biological Diversity v. EPA, which found a lack of standing to challenge an EPA discharge permit and reminded: “’For the federal courts to decide questions of law arising outside of cases and controversies would be inimical to the Constitution’s democratic character.’ It would improperly transform courts into ‘roving commissions assigned to pass judgment on the validity of the Nation’s laws’ and agency actions. In our Government, there are entities that address environmental issues outside of the case-or-controversy constraint. This Court is not one of them. As Judge Sentelle put it many years ago: ‘The federal judiciary is not a backseat Congress nor some sort of super-agency.’“ No. 18-60102 (Aug. 30, 2019) (citations omitted).

Conservative thinkers frequently express skepticism about the administrative state, and in particular, the Chevron doctrine about judicial deference to it. A powerful counterpoint to that line of thinking, and an equally orthodox part of conservative philosophy, appears in the Fifth Circuit’s recent opinion in Center for Biological Diversity v. EPA, which found a lack of standing to challenge an EPA discharge permit and reminded: “’For the federal courts to decide questions of law arising outside of cases and controversies would be inimical to the Constitution’s democratic character.’ It would improperly transform courts into ‘roving commissions assigned to pass judgment on the validity of the Nation’s laws’ and agency actions. In our Government, there are entities that address environmental issues outside of the case-or-controversy constraint. This Court is not one of them. As Judge Sentelle put it many years ago: ‘The federal judiciary is not a backseat Congress nor some sort of super-agency.’“ No. 18-60102 (Aug. 30, 2019) (citations omitted).

In Brackeen v. Bernhardt, an opinion of enormous significance to Indian law, the Fifth Circuit found the Indian Child Welfare Act to be constitutional, reversing a district-court opinion that held otherwise. The Court also affirmed various Bureau of Indian Affairs regulations under the Chevron doctrine, noting, inter alia: “The mere fact that an agency interpretation contradicts a prior agency position is not fatal. Sudden and

In Brackeen v. Bernhardt, an opinion of enormous significance to Indian law, the Fifth Circuit found the Indian Child Welfare Act to be constitutional, reversing a district-court opinion that held otherwise. The Court also affirmed various Bureau of Indian Affairs regulations under the Chevron doctrine, noting, inter alia: “The mere fact that an agency interpretation contradicts a prior agency position is not fatal. Sudden and  unexplained change, or change that does not take account of legitimate reliance on prior interpretation, may be arbitrary, capricious [or] an abuse of discretion. But if these pitfalls are avoided, change is not invalidating, since the whole point of Chevron is to leave the discretion provided by the ambiguities of a statute with the implementing agency.” No. 18-11479 (Aug. 9, 2019) (citation omitted). (My colleague Paulette Miniter and I assisted Professor Seth Davis of UC-Berkeley with an amicus brief in this case, in support of the result ultimately reached by the Court.)

unexplained change, or change that does not take account of legitimate reliance on prior interpretation, may be arbitrary, capricious [or] an abuse of discretion. But if these pitfalls are avoided, change is not invalidating, since the whole point of Chevron is to leave the discretion provided by the ambiguities of a statute with the implementing agency.” No. 18-11479 (Aug. 9, 2019) (citation omitted). (My colleague Paulette Miniter and I assisted Professor Seth Davis of UC-Berkeley with an amicus brief in this case, in support of the result ultimately reached by the Court.)

Two oft-addressed topics in 2019–the wreckage of Allen Stanford’s Ponzi scheme, and the appropriate deference to district court discretion in c omplex litigation– intersected in Zacarias v. Stanford Int’l Bank, No. 17-11703-CV (July 22, 2019).

omplex litigation– intersected in Zacarias v. Stanford Int’l Bank, No. 17-11703-CV (July 22, 2019).

The panel majority affirmed the “bar orders” entered by the district court in connection with a complicated settlement, observing: “The receiver initiated suit, negotiated, and settled with the Willis Defendants and BMB while empowered to offer global peace, that is, to deal with potential investor holdouts like the Plaintiffs-Objectors. These holdouts have been content for the receiver to pursue litigation for their benefit, then to participate as receivership claimants, collecting pro rata. Now, however, they ask to jump the queue, come what may to their fellow claimants who remain within the receivership distribution process.”

The dissent countered: “I share the majority’s appreciation for this settlement’s practical value. But in my view, the district court lacked jurisdiction to grant the bar orders. The Receiver only had standing to assert the Stanford entities’ claims. It could not release other parties’ claims, or have the court do so, in exchange for a payment to the Stanford estate. For better or worse, the objecting plaintiffs’ claims were beyond the district court’s power.”

Today’s post on 600Commerce hearkens back to a case covered by this blog several years ago when, literally, the ship had sailed. (The 600Commerce post goes on to note that a similar principle applies in a dispute about the right of possession (in Texas practice, a forcible detainer action), which becomes moot when “a writ of possession had been served on appellant” and thus “appellant is no longer in possession of [the] premises.” Jones v. Willems, No. 05-18-01191-CV (June 7, 2019). Longtime 600Camp readers will be interested to know that the ship in question, since reflagged as the M/V CALHOUN, is in Singapore as of the date of this post, still well away from Fifth Circuit jurisdiction.

Today’s post on 600Commerce hearkens back to a case covered by this blog several years ago when, literally, the ship had sailed. (The 600Commerce post goes on to note that a similar principle applies in a dispute about the right of possession (in Texas practice, a forcible detainer action), which becomes moot when “a writ of possession had been served on appellant” and thus “appellant is no longer in possession of [the] premises.” Jones v. Willems, No. 05-18-01191-CV (June 7, 2019). Longtime 600Camp readers will be interested to know that the ship in question, since reflagged as the M/V CALHOUN, is in Singapore as of the date of this post, still well away from Fifth Circuit jurisdiction.

A multi-million dollar judgment, in favor of a bankruptcy trustee suing for the estate, foundered on two problems about party identity:

A multi-million dollar judgment, in favor of a bankruptcy trustee suing for the estate, foundered on two problems about party identity:

- Injury? The estate (LSI) had no standing to seek damages about a substantial debt incurred to an alleged insider (Jabil), because: “[T]he millions of dollars awarded under Damage Element No. 1 represent Jabil’s injury, not LSI’s. Jabil manufactured and delivered the contractually agreed upon equipment to LSI. LSI benefitted from the equipment, and Ebert even leased and sold the equipment in Chapter 11 proceedings. Moreover, LSI did not pay the invoices on the equipment. Therefore, LSI benefitted and even had cash available for other needs.” (emphasis in original)

- Benefit? Stock sales involving affiliated entities did not established a personal benefit to alleged insiders (Apfel and Bartlett): “[E]bert tacitly admits that she

provided evidence only for the nominee companies’ gains, not for Appel and Bartlett in their individual capacity. Manz’s calculations were based primarily on two documents: Schedule 7.B, which showed market sales of LSI stock, and a list of nominee companies with how many shares of LSI each owned as of September 9, 2011. Yet these documents only list companies and provide no proof of or insight into Appel and Bartlett as individuals.”

provided evidence only for the nominee companies’ gains, not for Appel and Bartlett in their individual capacity. Manz’s calculations were based primarily on two documents: Schedule 7.B, which showed market sales of LSI stock, and a list of nominee companies with how many shares of LSI each owned as of September 9, 2011. Yet these documents only list companies and provide no proof of or insight into Appel and Bartlett as individuals.”

Ebert v. DeJoria, No 18-10382 (April 30, 2019).

A nonprofit lacked standing to pursue a facial First Amendment challenge to an IRS regulation in Freedom Path, Inc. v. Internal Revenue Service: “Freedom Path’s claimed inability to know what communications will be deemed in pursuit of an exempt function is not an injury arising from the four corners of the Revenue Ruling but quite explicitly from its application beyond the facial terms. Thus, Freedom Path’s claimed chilled-speech injury is not fairly traceable to the text of Revenue Ruling 2004-6, meaning it does not have standing to bring this facial challenge.” No. 18-10092 (Jan. 16, 2019).

A nonprofit lacked standing to pursue a facial First Amendment challenge to an IRS regulation in Freedom Path, Inc. v. Internal Revenue Service: “Freedom Path’s claimed inability to know what communications will be deemed in pursuit of an exempt function is not an injury arising from the four corners of the Revenue Ruling but quite explicitly from its application beyond the facial terms. Thus, Freedom Path’s claimed chilled-speech injury is not fairly traceable to the text of Revenue Ruling 2004-6, meaning it does not have standing to bring this facial challenge.” No. 18-10092 (Jan. 16, 2019).

The Fifth Circuit sidestepped a question about the scope of the “equitable mootness” doctrine, in favor of reliance on section 363(m) of the Bankruptcy Code, which (in the Court’s summary of the statute’s clunky terms) “limits the ability of appellate courts to review the sale of estate property when the order approving the transaction is not stayed.” To avoid the statute, the would-be appellant “says it does not challenge the sale of the property but only challenges the disbursement of cash to the probate estate.” That distinction did not moo-ve the Court, as it reasoned: “Without the more than $8 million payment, the probate estate would not have released its claim that it owned the Channelview shipyard. And without that release, San Jac Marine likely would have walked away from the deal. As the bankruptcy court noted, there is no way to sever