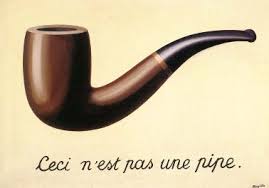

Two manufacturers of baby products (specifically, pacifiers and “sippy cups”), disputed the enforcement of a contract provision that said: “Distributor hereby acknowledges and agrees not to copy or utilize any of LNC’s . . . product design . . . without LNC’s written permission.” While “the district court imposed the requirement that the design be either confidential or protectable as intellectual property in order to fall within the definition of ‘product design,'” the Fifth Circuit disagreed and reversed because of the plain meaning of the terms chosen by the parties: “On its face, the clause applies to any of LNC’s product designs, which would include those in the public domain.” The court rejected arguments based on analogies and appeals to principles of (non-contractual) intellectual property law. Luv N’ Care, Ltd. v. Gruopo Rimar, No. 16-30039 (Dec. 16, 2016).

Two manufacturers of baby products (specifically, pacifiers and “sippy cups”), disputed the enforcement of a contract provision that said: “Distributor hereby acknowledges and agrees not to copy or utilize any of LNC’s . . . product design . . . without LNC’s written permission.” While “the district court imposed the requirement that the design be either confidential or protectable as intellectual property in order to fall within the definition of ‘product design,'” the Fifth Circuit disagreed and reversed because of the plain meaning of the terms chosen by the parties: “On its face, the clause applies to any of LNC’s product designs, which would include those in the public domain.” The court rejected arguments based on analogies and appeals to principles of (non-contractual) intellectual property law. Luv N’ Care, Ltd. v. Gruopo Rimar, No. 16-30039 (Dec. 16, 2016).

While the Court did address the merits, and its enthusiasm for the appeal was tempered by the many cases brought to it about the BP Deepwater Horizon settlement, the Fifth Circuit offered this cautionary note about briefing the standard of review: “Bailey’s opening brief skips this step — it does not acknowledge the standard of review, and offers no arguments to show that the district court abused its discretion. Bailey therefore has waived an issue necessary to the success of the appeal.” Claimant v. BP Exploration & Production, No. 16-30642 (Dec. 13, 2016, unpublished).

While the Court did address the merits, and its enthusiasm for the appeal was tempered by the many cases brought to it about the BP Deepwater Horizon settlement, the Fifth Circuit offered this cautionary note about briefing the standard of review: “Bailey’s opening brief skips this step — it does not acknowledge the standard of review, and offers no arguments to show that the district court abused its discretion. Bailey therefore has waived an issue necessary to the success of the appeal.” Claimant v. BP Exploration & Production, No. 16-30642 (Dec. 13, 2016, unpublished).

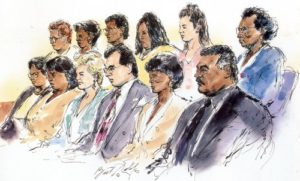

Plaintiff accused defendant (and his employer) of sexual assault while incarcerated at a privately-run detention center. Defense counsel had recordings of calls made by the plaintiff, from the facility, suggesting that the encounters were consensual. Counsel did not identify the recordings in their Rule 26 initial disclosures, and did not make the recordings available until the plaintiff’s deposition, after questioning her about the conversations. The district court sanctioned defense counsel for inadequate disclosure and the Fifth Circuit affirmed, concluding that “some evidence serves both substantive and impeachment functions and thus should not be treated as ‘solely’ impeachment evidence” under Rule 26. Olivarez v. GRO Group, Inc., No. 16-50191 (Dec. 12, 2016).

Plaintiff accused defendant (and his employer) of sexual assault while incarcerated at a privately-run detention center. Defense counsel had recordings of calls made by the plaintiff, from the facility, suggesting that the encounters were consensual. Counsel did not identify the recordings in their Rule 26 initial disclosures, and did not make the recordings available until the plaintiff’s deposition, after questioning her about the conversations. The district court sanctioned defense counsel for inadequate disclosure and the Fifth Circuit affirmed, concluding that “some evidence serves both substantive and impeachment functions and thus should not be treated as ‘solely’ impeachment evidence” under Rule 26. Olivarez v. GRO Group, Inc., No. 16-50191 (Dec. 12, 2016).

A good reminder about following the right substantive standard appears in Clark v. Boyd-Tunica Inc., in which an employee of “Sam’s Town” disputed her termination for drinking at work. The employer relied on tests performed by a reputable company, which it rechecked after she complained about them. The Fifth Circuit sided with the employer: “The focus of the pretext inquiry is not whether the alcohol in Clark’s sample was, in fact, attributable to her improper consumption of alcohol, but whether Sam’s Town reasonably believed it was and acted on that basis.” No. 16-60167 (Dec. 9, 2016).

On December 7, Judges Graves, Higginbotham, and Jolly heard oral argument in the high-profile False Claims Act case of Harman v. Trinity Industries. A recording of the full argument is available online, and the Texas Lawbook published a thorough summary shortly after the argument.

Montano v. Orange County, in affirming a substantial jury verdict about the mistreatment of a county prisoner, states several important principles about the appellate review of jury trials. This post focuses on one — the degree of specificity required of a defendant’s JMOL motion under FRCP 50(a), such that arguments in a later 50(b) motion will be seen as renewed rather than new (and thus waived).

Montano v. Orange County, in affirming a substantial jury verdict about the mistreatment of a county prisoner, states several important principles about the appellate review of jury trials. This post focuses on one — the degree of specificity required of a defendant’s JMOL motion under FRCP 50(a), such that arguments in a later 50(b) motion will be seen as renewed rather than new (and thus waived).

The applicable legal standard had three elements; the county moved on the ground that the plaintiff had “no evidence of a constitutionally deficient policy, custom or practice,” going on to focus on the first element. The county later argued that the phrase “constitutionally deficient” necessarily included the other two elements, but the district court and Fifth Circuit disagreed. The purpose of the “specific grounds” requirement in Rule 50(a) is “to make the trial court aware of the movant’s position and to give the opposing party an opportunity to mend its case” – here, the County “did not clearly separate the points upon which [it] requested judgment, did not delineate which of its arguments applied to which of Plaintiffs’ claims, and blurred the lines of Plainitffs’ claims through its obtuse recitation of the case law.” No. 15-41432 (Nov. 29, 2016). Later posts will address other points made by this opinion about the review of jury verdicts.

Plaintiff sued Defendant for breach of contract, alleging a failure to deliver Defendant’s 2010 cotton crop to Plaintiff. Defendant contended that an anticipatory repudiation occurred. The Fifth Circuit reminded that the proposal of new contract terms, absent a statement of intent not to perform the present contract, does not create an anticipatory repudiation. As a counterpoint, the Court cited a Texas appellate case in which the appellant not only proposed new terms, but also “‘definitely manifested’ that he would not longer perform the terms of his original contract when he . . . drove the appellee out to a deserted county road, threatened to sue him, [and] stated that he was ‘mad enough to smash the appellee’s face in.'” Plains Cotton Cooperative Ass’n v. Gray, No. 16-10806 (Dec. 5, 2016) (unpublished).

Plaintiff sued Defendant for breach of contract, alleging a failure to deliver Defendant’s 2010 cotton crop to Plaintiff. Defendant contended that an anticipatory repudiation occurred. The Fifth Circuit reminded that the proposal of new contract terms, absent a statement of intent not to perform the present contract, does not create an anticipatory repudiation. As a counterpoint, the Court cited a Texas appellate case in which the appellant not only proposed new terms, but also “‘definitely manifested’ that he would not longer perform the terms of his original contract when he . . . drove the appellee out to a deserted county road, threatened to sue him, [and] stated that he was ‘mad enough to smash the appellee’s face in.'” Plains Cotton Cooperative Ass’n v. Gray, No. 16-10806 (Dec. 5, 2016) (unpublished).

After the recent opinion of Retractable Technologies v. Becton Dickinson Co., followers of the Fifth Circuit’s antitrust cases should also note that on October 31, the Supreme Court declined to review MM Steel v. JSW Steel, 806 F.3d 835 (5th Cir. 2015).

After the recent opinion of Retractable Technologies v. Becton Dickinson Co., followers of the Fifth Circuit’s antitrust cases should also note that on October 31, the Supreme Court declined to review MM Steel v. JSW Steel, 806 F.3d 835 (5th Cir. 2015).

The Fifth Circuit’s recent opinion in Retractable Technologies Inc. v. Becton Dickinson Co. reversed a $340 million antitrust judgment and placed significant limits on the activity to which the antitrust laws apply. Judge Edith Jones wrote for the panel, joined by Judges Jacques Wiener and Stephen Higginson. No. 14-41384 (Dec. 2, 2016).

The Fifth Circuit’s recent opinion in Retractable Technologies Inc. v. Becton Dickinson Co. reversed a $340 million antitrust judgment and placed significant limits on the activity to which the antitrust laws apply. Judge Edith Jones wrote for the panel, joined by Judges Jacques Wiener and Stephen Higginson. No. 14-41384 (Dec. 2, 2016).

Plaintiff Retractable Technologies Inc. (“RTI”) and Defendant Beckton Dickinson (“BD”) were competing manufacturers of syringes. Retractable sued for false advertising under the Lanham Act, and alleged that BD attempted to monopolize the syringe market in violation of section 2 of Sherman Act.

As summarized by the Court, the antitrust verdict in RTI’s favor “rest[ed] upon three types of ‘deception’ by its rival: [1] patent infringement . . . [2] two false advertising claims made persistently; and [3] BD’s alleged ‘tainting the market’ for retractable syringes in which it alone competed with RTI.”

The Court found that each of these three liability theories failed.

First, as to patent infringement, the Court observed that by its very nature, a patent grants a limited monopoly. Thus, “patent infringement invades the patentee’s monopoly rights, causes competing products to enter the market, and thereby increases competition,” meaning that it “is not an injury cognizable under the Sherman Act.”

Second, the false advertising claims involved BD’s admittedly inaccurate claims to have the “world’s sharpest” needles with “low waste space.” But even these statements “may have been wrong, misleading, or debatable,’ . . . they were all “arguments on the merits, indicative of competition on the merits.” (quoting Stearns Airport Equip. Co. v. FMC Corp., 170 F.3d 518, 522 (5th Cir. 1999)).

After a thorough analysis of different standards used to evaluate antitrust claims based on allegedly false advertising, the Court concluded: “The broader point . . . is the distinction embodied in our precedents between business torts, which harm competitors, and truly anticompetitive activities, which harm the market.” RTI did not make such a showing here.

After a thorough analysis of different standards used to evaluate antitrust claims based on allegedly false advertising, the Court concluded: “The broader point . . . is the distinction embodied in our precedents between business torts, which harm competitors, and truly anticompetitive activities, which harm the market.” RTI did not make such a showing here.

Finally, the “taint” claim alleged that BD refused to make needed repairs to its retractable needle design, in hopes of persuading purchasers that all such syringes – including RTI’s – were inherently unreliable, until some time after RTI’s patents expired and BD could use RTI’s design to revitalize and take over the retractable syringe market. The Court called this theory “illogical,” since selling a bad product would only serve to benefit RTI’s competitors, and would not serve BD well in any attempt to expand its brand once RTI’s technology became available.

While reversing on the antitrust claim and the substantial damages associated with it, the Court went on to remand for reconsideration of what Lanham Act remedies for false advertising might still be appropriate.

This case is a forceful reminder that a good business tort claim does not equate to a good antitrust claim – or, even any antitrust claim at all. It is also a reminder of two broader points about how the Fifth Circuit approaches business tort claims arising from federal law.

On the one hand, that Court allows vigorous litigation of federal claims within their proper boundaries, as it recently did in affirming a nine-figure judgment arising from an antitrust conspiracy claim in MM Steel LP v. JSW Steel (USA), Inc., 806 F.3d 835 (5th Cir. 2015). (Notably, Judge Stephen Higginson, who was on the panel in the Retractable case, wrote the opinion in MM Steel.)

But on the other hand, the Court carefully polices the boundaries of those claims, as it did here, and as it also did in its painstaking comparison between state law trade secret claims and federal copyright claims in GlobeRanger Corp. v. Software AG, 836 F.3d 477 (5th Cir. 2016). The “siren song” of treble damages under the Sherman Act is a compelling one, but the pathway to such damages is carefully guarded.

The issue in Moneygram Int’l v. Commissioner of Internal Revenue was whether MoneyGram could take advantage of a favorable deduction rule for “banks,” unhelpfully defined in the Internal Revenue Code with a sentence beginning: “[T]he term ‘bank’ means a bank or trust company . . . .” Turning to the specific requirements of the definition, the Fifth Circuit concluded that the Tax Court “erred by interpreting

The issue in Moneygram Int’l v. Commissioner of Internal Revenue was whether MoneyGram could take advantage of a favorable deduction rule for “banks,” unhelpfully defined in the Internal Revenue Code with a sentence beginning: “[T]he term ‘bank’ means a bank or trust company . . . .” Turning to the specific requirements of the definition, the Fifth Circuit concluded that the Tax Court “erred by interpreting  ‘deposit’ to include the requirement that MoneyGram ‘hold its customers’ funds for extended periods of time,'” and by requiring that a “loan” be made for interest. A dissent criticized the majority’s “[n]itpicking some of the definitions of a loan . . . .” No. 15-60527 (Nov. 15, 2016, unpublished).

‘deposit’ to include the requirement that MoneyGram ‘hold its customers’ funds for extended periods of time,'” and by requiring that a “loan” be made for interest. A dissent criticized the majority’s “[n]itpicking some of the definitions of a loan . . . .” No. 15-60527 (Nov. 15, 2016, unpublished).

I was on the trial team that won a $146 million verdict in Pecos, Texas last week;here is the Dallas Morning News’s recent story on the case.

I was on the trial team that won a $146 million verdict in Pecos, Texas last week;here is the Dallas Morning News’s recent story on the case.

Plaintiffs alleged that the government of Antigua was complicit in Allen Stanford’s fraudulent scheme; it defended under the Foreign Sovereign Immunities Act. With respect to liabilty under the “commercial activity” exception to the Act, the Fifth Circuit found too attenuated a connection to the United States. As to the scheme itself, “[w]hile Antigua may have helped facilitate Stanford’s sale of the fraudulent CDs, Stanford’s criminal activity served as an intervening act interrupting the causal chain between Antigua’s actions and any effect on investors.” And as to a more specific claim based on Antigua’s failure to repay loans to Stanford, “the financial loss in this case was not directly felt by Plaintiffs, who are investors and customers of Stanford . . . The financial loss due to Antigua’s failure to repay the loans was most directly felt by Stanford who was the actual lender in the loan transactions.” Frank v. Commonwealth of Antigua & Barbuda, No. 15-10788 (Nov. 22, 2016).

Plaintiffs alleged that the government of Antigua was complicit in Allen Stanford’s fraudulent scheme; it defended under the Foreign Sovereign Immunities Act. With respect to liabilty under the “commercial activity” exception to the Act, the Fifth Circuit found too attenuated a connection to the United States. As to the scheme itself, “[w]hile Antigua may have helped facilitate Stanford’s sale of the fraudulent CDs, Stanford’s criminal activity served as an intervening act interrupting the causal chain between Antigua’s actions and any effect on investors.” And as to a more specific claim based on Antigua’s failure to repay loans to Stanford, “the financial loss in this case was not directly felt by Plaintiffs, who are investors and customers of Stanford . . . The financial loss due to Antigua’s failure to repay the loans was most directly felt by Stanford who was the actual lender in the loan transactions.” Frank v. Commonwealth of Antigua & Barbuda, No. 15-10788 (Nov. 22, 2016).

OneBeacon Ins. Co. v. Welch & Assocs. involved insurance coverage for an attorney malpractice claim, arising for an exclusion for knowledge about “any actual or alleged act, error, omission or breach of duty arising out of the rendering or the failure to render professional legal services.” Since even the carrier agreed that “[o]n its face, this covers every single thing an attorney does or does not do, wrongful or not,” the Fifth Circuit found that the exclusion could not be applied literally without making the contract illusory. Focusing on the alleged “wrongful act,” the Court found that the relevant lawyer’s awareness of a discovery order and potential dispute was not equivalent to knowledge that a rare death-penalty sanction award would result. The Court also sustained an award of additional violations for an intentional violation of the Insurance Code with respect to the handling of the claim. No. 15-20402 (Nov. 14, 2016).

OneBeacon Ins. Co. v. Welch & Assocs. involved insurance coverage for an attorney malpractice claim, arising for an exclusion for knowledge about “any actual or alleged act, error, omission or breach of duty arising out of the rendering or the failure to render professional legal services.” Since even the carrier agreed that “[o]n its face, this covers every single thing an attorney does or does not do, wrongful or not,” the Fifth Circuit found that the exclusion could not be applied literally without making the contract illusory. Focusing on the alleged “wrongful act,” the Court found that the relevant lawyer’s awareness of a discovery order and potential dispute was not equivalent to knowledge that a rare death-penalty sanction award would result. The Court also sustained an award of additional violations for an intentional violation of the Insurance Code with respect to the handling of the claim. No. 15-20402 (Nov. 14, 2016).

Robert dePerrodil successfully sued for the injuries he suffered when a wave hit the boat he was on. He recovered damages based upon his plan to work until age 75; the defendant argued that the “court erred by using the plaintiff’s stated retirement goal, rather than the BLS average.” The Fifth Circuit affirmed, noting that dePerrodil had a “‘very reasonable’ goal, considering his medical history, work history, and future medical prognosis,” distinguishing other cases in the area that turned on more vague testimony. Perrodil v. Bozovic Marine, Inc., No. 16-30009 (Nov. 17, 2016, unpublished).

Robert dePerrodil successfully sued for the injuries he suffered when a wave hit the boat he was on. He recovered damages based upon his plan to work until age 75; the defendant argued that the “court erred by using the plaintiff’s stated retirement goal, rather than the BLS average.” The Fifth Circuit affirmed, noting that dePerrodil had a “‘very reasonable’ goal, considering his medical history, work history, and future medical prognosis,” distinguishing other cases in the area that turned on more vague testimony. Perrodil v. Bozovic Marine, Inc., No. 16-30009 (Nov. 17, 2016, unpublished).

Last year, the Fifth Circuit certified these two questions to the Texas Supreme Court:

Last year, the Fifth Circuit certified these two questions to the Texas Supreme Court:

1. Does a lender or holder violate Article XVI, Section 50(a)(6)(Q)(vii) of the Texas Constitution, becoming liable for forfeiture of principal and interest, when the loan agreement incorporates the protections of Section 50(a)(6)(Q)(vii), but the lender or holder fails to return the cancelled note and release of lien upon full payment of the note and within 60 days after the borrower informs the lender or holder of the failure to comply?

2. If the answer to Question 1 is “no,” then, in the absence of actual damages, does a lender or holder become liable for forfeiture of principal and interest under a breach of contract theory when the loan agreement incorporates the protections of Section 50(a)(6)(Q)(vii), but the lender or holder, although filing a release of lien in the deed records, fails to return the cancelled note and release of lien upon full payment of the note and within 60 days after the borrower informs the lender or holder of the failure to comply?

The T exas Supreme Court answered both questions “no” in Garofolo v. Ocwen Loan Servicing, No. 15-0437 (Tex. May 20, 2016). Accordingly, the Fifth Circuit affirmed the dismissal of the plaintiff’s contract claim in Garofolo v. Ocwen Loan Servicing, No. 14-51156 (Oct. 3, 2016, unpublished).

exas Supreme Court answered both questions “no” in Garofolo v. Ocwen Loan Servicing, No. 15-0437 (Tex. May 20, 2016). Accordingly, the Fifth Circuit affirmed the dismissal of the plaintiff’s contract claim in Garofolo v. Ocwen Loan Servicing, No. 14-51156 (Oct. 3, 2016, unpublished).

Color Star Growers (a wholesale distributor of flowers) went into bankruptcy; their lenders sued the Verbeeks in Texas state court, alleging that they fraudulently induced the loans to Color Star. The Verbeeks sought a defense from the D&O carrier for their company. The insurer successfully obtained summary judgment based on the policy’s “Creditor Exclusion” and the Fifth Circuit affirmed. The exclusion said: “The Insurer shall not be liable to pay any Loss on account of, and shall not be obligated to defend, any Claim brought or maintained by or on behalf of . . . [a]ny creditor of a company or organization in the creditor’s capacity as such, whether or not a bankruptcy or insolvency proceeding involving the company or organization has been commenced.” Rejecting the Verbeeks’ arguments that the state court plaintiffs were suing as “administrative agents” or “investors” rather than creditors, the Court observed that “the alleged facts giving rise to the underlying litigation relate entirely to the state court plaintiffs’ loan agreements with Color Star . . . .” The Court went on to affirm as to the duty to indemnify as well. Marke Am. Ins. Co. v. Verbeek, No. 15-51099 (Sept. 27, 2016, unpublished).

Color Star Growers (a wholesale distributor of flowers) went into bankruptcy; their lenders sued the Verbeeks in Texas state court, alleging that they fraudulently induced the loans to Color Star. The Verbeeks sought a defense from the D&O carrier for their company. The insurer successfully obtained summary judgment based on the policy’s “Creditor Exclusion” and the Fifth Circuit affirmed. The exclusion said: “The Insurer shall not be liable to pay any Loss on account of, and shall not be obligated to defend, any Claim brought or maintained by or on behalf of . . . [a]ny creditor of a company or organization in the creditor’s capacity as such, whether or not a bankruptcy or insolvency proceeding involving the company or organization has been commenced.” Rejecting the Verbeeks’ arguments that the state court plaintiffs were suing as “administrative agents” or “investors” rather than creditors, the Court observed that “the alleged facts giving rise to the underlying litigation relate entirely to the state court plaintiffs’ loan agreements with Color Star . . . .” The Court went on to affirm as to the duty to indemnify as well. Marke Am. Ins. Co. v. Verbeek, No. 15-51099 (Sept. 27, 2016, unpublished).

Hays, a cardiologist suffering from epilepsy, sued HCA for wrongful discharge as a result of mishandling his illness. The Fifth Circuit agreed that his tortious interference claim against HCA had to be arbitrated, because its viability depended on reference to the employment agreement between him and the specific hospital where he worked. It also affirmed on the theory of “intertwined claims estoppel,” making an Erie guess that the Texas Supreme Court would recognize this theory, and concluding that “Hays’s current efforts to distinguish amongst defendants and claims are the archetype of strategic pleading intended to avoid the arbitral forum, precisely what intertwined claims estoppel is designed to prevent.” Hays v. HCA Holdings, No. 15-51002 (Sept. 29, 2016).

Hays, a cardiologist suffering from epilepsy, sued HCA for wrongful discharge as a result of mishandling his illness. The Fifth Circuit agreed that his tortious interference claim against HCA had to be arbitrated, because its viability depended on reference to the employment agreement between him and the specific hospital where he worked. It also affirmed on the theory of “intertwined claims estoppel,” making an Erie guess that the Texas Supreme Court would recognize this theory, and concluding that “Hays’s current efforts to distinguish amongst defendants and claims are the archetype of strategic pleading intended to avoid the arbitral forum, precisely what intertwined claims estoppel is designed to prevent.” Hays v. HCA Holdings, No. 15-51002 (Sept. 29, 2016).

The high-profile injunction case of Defense Distributed, Inc. v. U.S. Dep’t of State involved the federal government’s effort to prevent the online distribution of 3D printing files for the critical “lower receiver” component of the AR-15 rifle. The district court declined to grant a preliminary injunction against enforcement of the relevant laws and the Fifth Circuit affirmed. In an observation broadly applicable to litigation about online postings, the Court noted: “If we reverse the district court’s denial and instead grant the preliminary injunction, Plaintiffs-Appellants would legally be permitted to post on the internet as many . . . files as they wish . . . [which] would remain online essentially forever, hosted by foreign websites such as the Pirate Bay and freely available worldwide.” A thorough and strongly-worded dissent took issue with the First Amendment ramifications of the panel opinion; a petition for en banc rehearing has been filed and is pending as of this post. No. 15-50759 (Sept. 20, 2016).

The high-profile injunction case of Defense Distributed, Inc. v. U.S. Dep’t of State involved the federal government’s effort to prevent the online distribution of 3D printing files for the critical “lower receiver” component of the AR-15 rifle. The district court declined to grant a preliminary injunction against enforcement of the relevant laws and the Fifth Circuit affirmed. In an observation broadly applicable to litigation about online postings, the Court noted: “If we reverse the district court’s denial and instead grant the preliminary injunction, Plaintiffs-Appellants would legally be permitted to post on the internet as many . . . files as they wish . . . [which] would remain online essentially forever, hosted by foreign websites such as the Pirate Bay and freely available worldwide.” A thorough and strongly-worded dissent took issue with the First Amendment ramifications of the panel opinion; a petition for en banc rehearing has been filed and is pending as of this post. No. 15-50759 (Sept. 20, 2016).

On September 16, 2013, Defendants obtained a magistrate judge’s report that recommended dismissal of Plaintiffs’ complaint. On September 18, Defendants served – but did not file – a motion for sanctions, stating that it would not be filed until the 21-day Rule 11(c)(2) “safe harbor” period passed. Plaintiffs objected to the report on September 30; Defendants filed their motion on October 18; and after adoption of the report and further briefing, the district imposed $25,000 in sanctions in mid-2014. The Fifth Circuit rejected Plaintiffs’ challenge to the sanction based on the safe harbor period, reasoning — “Given that Plaintiffs could have formally or informally disavowed their claims during the 21-day period after Defendants served their motion, but instead elected to continue pursuing their claims, the district court did not abuse its discretion in rejecting Plaintiffs’ ‘safe harbor’ argument.” Margetis v. Ferguson, No. 16-40563 (Nov. 10, 2016, unpublished).

On September 16, 2013, Defendants obtained a magistrate judge’s report that recommended dismissal of Plaintiffs’ complaint. On September 18, Defendants served – but did not file – a motion for sanctions, stating that it would not be filed until the 21-day Rule 11(c)(2) “safe harbor” period passed. Plaintiffs objected to the report on September 30; Defendants filed their motion on October 18; and after adoption of the report and further briefing, the district imposed $25,000 in sanctions in mid-2014. The Fifth Circuit rejected Plaintiffs’ challenge to the sanction based on the safe harbor period, reasoning — “Given that Plaintiffs could have formally or informally disavowed their claims during the 21-day period after Defendants served their motion, but instead elected to continue pursuing their claims, the district court did not abuse its discretion in rejecting Plaintiffs’ ‘safe harbor’ argument.” Margetis v. Ferguson, No. 16-40563 (Nov. 10, 2016, unpublished).

The NLRB consistently holds that an agreement requiring arbitration of individual claims (and thus foreclosing class actions) violates federal labor law; the Fifth Circuit consistently reverses the NLRB on this point. After again reversing the NLRB and citing the Circuit’s “rule of orderliness” about deference to prior panel decisions, the Court noted the NLRB’s remarkably candid litigation position: “The Board concedes that this court has squarely rejected both of those decisions, and that our precedents necessitate rejecting its arguments here. The Board further acknowledges that it seeks to manufacture a circuit split in order to ‘facilitate Supreme Court review.'” Employers Resource v. NLRB, No. 16-60034 (Nov. 1, 2016, unpublished).

The NLRB consistently holds that an agreement requiring arbitration of individual claims (and thus foreclosing class actions) violates federal labor law; the Fifth Circuit consistently reverses the NLRB on this point. After again reversing the NLRB and citing the Circuit’s “rule of orderliness” about deference to prior panel decisions, the Court noted the NLRB’s remarkably candid litigation position: “The Board concedes that this court has squarely rejected both of those decisions, and that our precedents necessitate rejecting its arguments here. The Board further acknowledges that it seeks to manufacture a circuit split in order to ‘facilitate Supreme Court review.'” Employers Resource v. NLRB, No. 16-60034 (Nov. 1, 2016, unpublished).

A steel-hulled tugboat, owned by Marquette, allided with the fiberglass-hulled SES Ekwata, rendering the Ekwata unusable. In the resulting litigation, the plaintiff won damages and an award of sanctions under the district court’s inherent power. On appeal, “Marquette asserts that the fee award was unwarranted because Marquette had a good faith basis to challenge the quantum of damages and thus in proceeding through a trial. But even if true, this fact did not justify Marquette’s intransigence on liability or the means by which Marquette defended [Plainitff’s] damages claim—namely, one expert who, according to the

A steel-hulled tugboat, owned by Marquette, allided with the fiberglass-hulled SES Ekwata, rendering the Ekwata unusable. In the resulting litigation, the plaintiff won damages and an award of sanctions under the district court’s inherent power. On appeal, “Marquette asserts that the fee award was unwarranted because Marquette had a good faith basis to challenge the quantum of damages and thus in proceeding through a trial. But even if true, this fact did not justify Marquette’s intransigence on liability or the means by which Marquette defended [Plainitff’s] damages claim—namely, one expert who, according to the

district court’s findings, opined on value ‘without including any comparables, without considering the equipment on the vessel, without an accurate description of the vessel, and without reliable underlying information” and a second expert who, according to the district court’s findings, “not only failed to correct the glaringly incorrect information set forth in [the first expert’s] report, but incorporated it into his own.” Accordingly, the Fifth Circuit affirmed. Moench v. Marquette Transp. Co. (revised October 13, 2016).

Michael Swoboda sued Continental Enterprises, claiming that it conducted an investigation into alleged trademark infringement led to his wrongful discharge. He sought the production of documents that Continental alleged were protected as work product. The district court allowed the discovery and denied the intervention by Heckler & Koch, the gunmaker whose rights about the G36 submachine gun (above) were at issue and had retained Continental.

Michael Swoboda sued Continental Enterprises, claiming that it conducted an investigation into alleged trademark infringement led to his wrongful discharge. He sought the production of documents that Continental alleged were protected as work product. The district court allowed the discovery and denied the intervention by Heckler & Koch, the gunmaker whose rights about the G36 submachine gun (above) were at issue and had retained Continental.

The Fifth Circuit reversed, holding: “Continental’s work product privilege argument was overruled because Continental is a company that engages in investigative work, and the district court concluded that the discovery that Swoboda sought was produced in Continental’s ordinary course of business, i.e., in the course of a Continental investigation. HK is a gun manufacturer. Investigations are not a part of HK’s ordinary course of business. Some of the discovery that Swoboda sought was, from HK’s perspective, prepared in anticipation of litigation. We have held that an applicant-intervenor should be allowed to intervene when it ‘has a defense not available to the present defendant.’ HK has a defense unavailable to Continental, and it should have been allowed to present that defense in the district court.” Swoboda v. Manders, No. 16-30074 (Oct. 31, 2016, unpublished).

The parties to McCloskey v. McCloskey disputed whether a debt was non-dischargeable as a child support obligation. Rejecting the application of the somewhat protean doctrine of judicial estoppel, the Fifth Circuit held: “Bankruptcy courts must ‘look beyond the labels which state courts—and even parties themselves—give obligations which debtors seek to discharge.’ A party may argue in bankruptcy

The parties to McCloskey v. McCloskey disputed whether a debt was non-dischargeable as a child support obligation. Rejecting the application of the somewhat protean doctrine of judicial estoppel, the Fifth Circuit held: “Bankruptcy courts must ‘look beyond the labels which state courts—and even parties themselves—give obligations which debtors seek to discharge.’ A party may argue in bankruptcy  court that an obligation constitutes support even if she has urged to the contrary in state court. Therefore, appellees are not judicially estopped from bringing this claim.” No. 16-20079 (Oct. 31, 2016, unpublished). (Compare the recent case of Galaz v. Katona, which applied judicial estoppel in a bankruptcy case based on inconsistent statements made in earlier state court litigation about ownership interests. No. 15-50919 (Oct. 28, 2016, unpublished).

court that an obligation constitutes support even if she has urged to the contrary in state court. Therefore, appellees are not judicially estopped from bringing this claim.” No. 16-20079 (Oct. 31, 2016, unpublished). (Compare the recent case of Galaz v. Katona, which applied judicial estoppel in a bankruptcy case based on inconsistent statements made in earlier state court litigation about ownership interests. No. 15-50919 (Oct. 28, 2016, unpublished).

Cal Dive International sued Schmidt (a commercial diver), and Edwards (Schmidt’s attorney in a previous personal injury suit against Cal Dive), alleging that Schmidt had misrepresented his injuries, and seeking restitution of contingent fees paid to Edwards. Cal Dive specifically alleged that it did not believe Edwards knew of the purported fraud. Edwards sought coverage for defense costs, and the Fifth Circuit reversed a judgment in his favor: “Cal Dive’s complaint, for which Edwards seeks defense from Continental, contains no allegations against Edwards, save for his receipt of settlement funds in the nature of attorney’s fees as a result of his client’s alleged fraud. Acts or omissions in the rendering of legal services by Edwards to his client, Schmidt, are simply not at issue.” Edwards v. Continental Casualty Co., No. 15-30827 (Nov. 2, 2016).

Cal Dive International sued Schmidt (a commercial diver), and Edwards (Schmidt’s attorney in a previous personal injury suit against Cal Dive), alleging that Schmidt had misrepresented his injuries, and seeking restitution of contingent fees paid to Edwards. Cal Dive specifically alleged that it did not believe Edwards knew of the purported fraud. Edwards sought coverage for defense costs, and the Fifth Circuit reversed a judgment in his favor: “Cal Dive’s complaint, for which Edwards seeks defense from Continental, contains no allegations against Edwards, save for his receipt of settlement funds in the nature of attorney’s fees as a result of his client’s alleged fraud. Acts or omissions in the rendering of legal services by Edwards to his client, Schmidt, are simply not at issue.” Edwards v. Continental Casualty Co., No. 15-30827 (Nov. 2, 2016).

The defendant pharmacy in an FCA case provided “PPDs” — prompt payment discounts; the plaintiff alleged that they were intended to induce Medicare and Medicaid referrals. The Fifth Circuit disagreed, holding: “At best, the evidence supports a finding that Omnicare did not want unresolved settlement negotiations to

The defendant pharmacy in an FCA case provided “PPDs” — prompt payment discounts; the plaintiff alleged that they were intended to induce Medicare and Medicaid referrals. The Fifth Circuit disagreed, holding: “At best, the evidence supports a finding that Omnicare did not want unresolved settlement negotiations to

negatively impact its contract negotiations with  [skilled nursing facility] clients and was, likewise, avoiding confrontational collection practices . . . . Although Omnicare may have hoped for Medicare and Medicaid referrals, absent any evidence that Omnicare designed its settlement negotiations and debt collection practice to induce such referrals, Relator cannot show an [anti-kickback statute] violation.” Ruscher v. Omnicare, Inc., No. 15-20629 (Oct. 28, 2016).

[skilled nursing facility] clients and was, likewise, avoiding confrontational collection practices . . . . Although Omnicare may have hoped for Medicare and Medicaid referrals, absent any evidence that Omnicare designed its settlement negotiations and debt collection practice to induce such referrals, Relator cannot show an [anti-kickback statute] violation.” Ruscher v. Omnicare, Inc., No. 15-20629 (Oct. 28, 2016).

In Marshall v. Hunter, a removed action, the Fifth Circuit addressed a notice of appeal from a state court ruling made before ruling about personal jurisdiction. The Court declined to hear the appeal, saying: “while state court orders and rulings remain in effect upon removal, they do not become appealable orders of the district court until the district court adopts them as its own.” No. 16-20646 (Oct. 20, 2016, unpublished).

In Marshall v. Hunter, a removed action, the Fifth Circuit addressed a notice of appeal from a state court ruling made before ruling about personal jurisdiction. The Court declined to hear the appeal, saying: “while state court orders and rulings remain in effect upon removal, they do not become appealable orders of the district court until the district court adopts them as its own.” No. 16-20646 (Oct. 20, 2016, unpublished).

The receiver for Allen Stanford’s businesses sought to recover the proceeds of large certificates of deposit from two investment entities associated with the Libyan government. The district court dismissed one of the entities pursuant to the Foreign Sovereign Immunities Act, and allowed the claim against the other to proceed. The Fifth Circuit reversed as to that entity, finding that the instruments at issue “did not require any act in the United States, much less the act of funneling money through the Stanford scheme or any Stanford entities in the United States,” and that the entity’s “commercial activity was limited to its obligations under teh . . . CDs, which . . . did not require any activity in the United States.” Janvey v. Libyan Inv. Auth., Nos. 15-10545 & 10548 (Oct. 26, 2016).

The receiver for Allen Stanford’s businesses sought to recover the proceeds of large certificates of deposit from two investment entities associated with the Libyan government. The district court dismissed one of the entities pursuant to the Foreign Sovereign Immunities Act, and allowed the claim against the other to proceed. The Fifth Circuit reversed as to that entity, finding that the instruments at issue “did not require any act in the United States, much less the act of funneling money through the Stanford scheme or any Stanford entities in the United States,” and that the entity’s “commercial activity was limited to its obligations under teh . . . CDs, which . . . did not require any activity in the United States.” Janvey v. Libyan Inv. Auth., Nos. 15-10545 & 10548 (Oct. 26, 2016).

A group of optometrists won judgment against Wal-Mart for $1,395,400, consisting entirely of statutory penalties relating to Wal-Mart’s influence over their working hours. After withdrawing the initial panel opinion and then receiving answers to certified questions in Forte v. Wal-Mart Stores, Inc., No. 15-0146 (Tex. May 20, 2016), the Fifth Circuit again concluded that “the district court’s judgment regarding damages must be vacated; attorneys’ fees are the only matter that remains in the case.” Forte v. Wal-Mart Stores, Inc., No. 12-40854 (Oct. 27, 2016).

A group of optometrists won judgment against Wal-Mart for $1,395,400, consisting entirely of statutory penalties relating to Wal-Mart’s influence over their working hours. After withdrawing the initial panel opinion and then receiving answers to certified questions in Forte v. Wal-Mart Stores, Inc., No. 15-0146 (Tex. May 20, 2016), the Fifth Circuit again concluded that “the district court’s judgment regarding damages must be vacated; attorneys’ fees are the only matter that remains in the case.” Forte v. Wal-Mart Stores, Inc., No. 12-40854 (Oct. 27, 2016).

Celebrate Halloween with these Five Recent Cases to Know. And don’t forget to vote for Super Lawyers by this Friday, October 28!

Bonnie Pereida’s estate successfully brought RICO claims against a dealer in rare coins, arguing that it systematically deceived Ms. Pereida about the quality of the coins she bought from it. The Fifth Circuit agreed with the estate that the RICO claim survived her, finding that “RICO’s remedial purpose predominates” over its penal purposes. But, it reversed as to the proof of a “pattern of racketeering activity,” finding that the relevant time period was too short and did not qualify as “open-ended.” It noted that on remand, the plaintiff could potentially still elect a remedy in common-law fraud where this problem would not arise.

Bonnie Pereida’s estate successfully brought RICO claims against a dealer in rare coins, arguing that it systematically deceived Ms. Pereida about the quality of the coins she bought from it. The Fifth Circuit agreed with the estate that the RICO claim survived her, finding that “RICO’s remedial purpose predominates” over its penal purposes. But, it reversed as to the proof of a “pattern of racketeering activity,” finding that the relevant time period was too short and did not qualify as “open-ended.” It noted that on remand, the plaintiff could potentially still elect a remedy in common-law fraud where this problem would not arise.

During that analysis, the Court offered a telling general comment: “[Plaintiff] contends that the Defendants waived this challenge to the ‘pattern’ element by raising it for the first time in their motion for a new trial. It should have been raised, he argues, in a motion for summary judgment so he would have known that this was a contested issue. The argument says a lot about modern civil litigation in which summary judgment, rather than trial, has become the focus. But when a case does go to trial, the burden is on the plaintiff to prove every element.” Malvino v. Dellniversita, No. 15-41435 (Oct. 20, 2016) (emphasis added).

The preliminary injunction said: “Plaintiffs may contact former and current . . . employees . . . of the Debtor if and only if a written request is made by Plaintiffs’ counsel to counsel for SkyPort, and counsel for SkyPort either a) agrees to the proposed contact or b) does not respond within 1 business day,” and: “Plaintiffs are temporarily enjoined from: pursuing any and all claims or causes of action, derivative or direct, against all of the Defendants.”

The preliminary injunction said: “Plaintiffs may contact former and current . . . employees . . . of the Debtor if and only if a written request is made by Plaintiffs’ counsel to counsel for SkyPort, and counsel for SkyPort either a) agrees to the proposed contact or b) does not respond within 1 business day,” and: “Plaintiffs are temporarily enjoined from: pursuing any and all claims or causes of action, derivative or direct, against all of the Defendants.”

Nevertheless, the trial court found that Plaintiffs’ counsel and Plaintiffs’ financial advisor “continued to pursue evidence and witnesses―namely Cole [Skyport’s former president]. They encouraged Cole to pursue her own claims . . . in other courts by arranging for her counsel, providing for a “loan” for her counsel’s retainer, and pursuing financial support for the state court litigation.”

The Fifth Circuit affirmed a substantial award of sanctions, reflecting the attorneys fees incurred to rectify the situation. The Court rejected defenses based on whether (1) the award was civil or criminal in nature, (2) fees alone could be the basis of the sanction awarded, (3) the injunction no longer was in effect, (4) the alleged violations were inadvertent, and (5) the individuals sanctioned were not subject to the order. Goldman v. Bankton Fin. Corp., No. 15-2-243 (Oct. 12, 2016, unpublished).

Apache Corporation had an insurance policy for computer fraud, which said: “We will pay for loss of, and loss from damage to, money, securities and other property resulting directly from the use of any computer to fraudulently cause a transfer of that property from inside the premises or banking premises: (a) to a person (other than a messenger) outside those premises; or (b) to a place outside those premises.” (emphasis added) The Fifth Circuit, after a “detailed — albeit numbing — analysis of the cited authorities,” concluded that the weight of the case law did not create coverage under this policy for the following events:

Apache Corporation had an insurance policy for computer fraud, which said: “We will pay for loss of, and loss from damage to, money, securities and other property resulting directly from the use of any computer to fraudulently cause a transfer of that property from inside the premises or banking premises: (a) to a person (other than a messenger) outside those premises; or (b) to a place outside those premises.” (emphasis added) The Fifth Circuit, after a “detailed — albeit numbing — analysis of the cited authorities,” concluded that the weight of the case law did not create coverage under this policy for the following events:

- Apache received a call from a vendor (actually, a criminal posing as the vendor) asking that Apache change its payments to a new bank account.

- Apache asked for a formal request on the vendor’s letterhead; one arrived about a week later by email with an attachment on letterhead (from a domain used by the criminals to further pose as the vendor);

- Apache called the number on the letterhead to verify the request, and after thinking it had confirmed the authenticity of the request, began sending payments to a new bank account.

While computer use obviously played a role in the deception, the Court noted: “To interpret the computer-fraud provision as reaching any fraudulent scheme in which an email communication was part of the process would . . . convert the computer-fraud provision to one for general fraud.” Apache Corp. v. Great Am. Ins. Co., No. 15-20499 (Oct. 18, 2016, unpublished).

The parties in AIG Specialty Ins. Co. v. Tesoro Corp. disputed whether limitations had run on an insurance coverage claim involving the identity of the named insured (and in turn, whether that entity owned a refinery subject to difficult environmental remediation orders). As a matter of contract law, the Court agreed that mere receipt of an insurance policy does not necessarily bar a reformation claim. But under Texas limitations principles, the insured could not establish that the insurer had “specialized knowledge” about the subject of refinery ownership, or that the mistake in the policy was inherently undiscoverable — especially then “the mistake is evident from the face of the document.” No. 15-50953 (Oct. 17, 2016).

The parties in AIG Specialty Ins. Co. v. Tesoro Corp. disputed whether limitations had run on an insurance coverage claim involving the identity of the named insured (and in turn, whether that entity owned a refinery subject to difficult environmental remediation orders). As a matter of contract law, the Court agreed that mere receipt of an insurance policy does not necessarily bar a reformation claim. But under Texas limitations principles, the insured could not establish that the insurer had “specialized knowledge” about the subject of refinery ownership, or that the mistake in the policy was inherently undiscoverable — especially then “the mistake is evident from the face of the document.” No. 15-50953 (Oct. 17, 2016).

The Romans sued Ford Motor Co. and a Houston AutoNation dealer. The dealer moved to compel arbitration; the district court denied the motion; and the dealer appealed. Unfortunately, the Fifth Circuit was “not satisfied, based on the record before it, that [the dealer] does not share citizenship with the Romans.” Reminding that the Federal Arbitration Act is not an independent basis for federal jurisdiction, the Court vacated the district court’s order and remanded for determination of subject matter jurisdiction — with instructions to dismiss if diversity was not established. Roman v. AutoNation Ford Gulf Freeway, No. 16-20047 (Oct. 13, 2016, unpublished).

The Romans sued Ford Motor Co. and a Houston AutoNation dealer. The dealer moved to compel arbitration; the district court denied the motion; and the dealer appealed. Unfortunately, the Fifth Circuit was “not satisfied, based on the record before it, that [the dealer] does not share citizenship with the Romans.” Reminding that the Federal Arbitration Act is not an independent basis for federal jurisdiction, the Court vacated the district court’s order and remanded for determination of subject matter jurisdiction — with instructions to dismiss if diversity was not established. Roman v. AutoNation Ford Gulf Freeway, No. 16-20047 (Oct. 13, 2016, unpublished).

The plaintiff in Isner v. Seeger Weiss LLP alleged that counsel misrepresented the compensation that she would receive under a large Vioxx settlement. The defendants won; two features of the master settlement agreement were particularly important. First, it said that claimants would receive a payment under “criteria to be determined by the Claim Administrator” and “according to guidelines to be established by the Claims

The plaintiff in Isner v. Seeger Weiss LLP alleged that counsel misrepresented the compensation that she would receive under a large Vioxx settlement. The defendants won; two features of the master settlement agreement were particularly important. First, it said that claimants would receive a payment under “criteria to be determined by the Claim Administrator” and “according to guidelines to be established by the Claims

Administrator” — thus, “the method of calculation was . . . specifically reserved for

the decision of the Claims Administrator at a later date.” Second, under the heading “NO GUARANTEE OF PAYMENT,” the release said: “I FURTHER ACKNOWLEDGE THAT I UNDERSTAND THIS RELEASE AND THE AGREEMENT AND THAT THERE IS NO GUARANTEE THAT I WILL RECEIVE ANY SETTLEMENT PAYMENT OR, IF ANY SETTLEMENT PAYMENT IS MADE, THE AMOUNT THEREOF.” No. 15-31070 (Oct. 11, 2016, unpublished).

Interlocutory appeal of discovery issues is largely foreclosed under the restrictive view of the “collateral order” doctrine adopted by Mohawk Industries v. Carpenter, 130 S. Ct. 599 (2009). Another, rarely-traveled path appears in Cazorla v. Koch Foods of Miss., in which the district court and Fifth Circuit agreed that an interlocutory appeal under 28 U.S.C. § 1292(b) of a difficult discovery issue

Interlocutory appeal of discovery issues is largely foreclosed under the restrictive view of the “collateral order” doctrine adopted by Mohawk Industries v. Carpenter, 130 S. Ct. 599 (2009). Another, rarely-traveled path appears in Cazorla v. Koch Foods of Miss., in which the district court and Fifth Circuit agreed that an interlocutory appeal under 28 U.S.C. § 1292(b) of a difficult discovery issue  involving parallel private employment litigation and immigration proceedings. The specific issue address is important but narrow; the procedural holding is notable for how unusual and important a discovery issue must be to come within the ambit of the interlocutory appeal statute. No. 15-60562 (Sept. 27, 2016).

involving parallel private employment litigation and immigration proceedings. The specific issue address is important but narrow; the procedural holding is notable for how unusual and important a discovery issue must be to come within the ambit of the interlocutory appeal statute. No. 15-60562 (Sept. 27, 2016).

In April 2014, Burger King Europe sued on a guaranty to recover allegedly unpaid franchise fees (the “Personal Guarantee Litigation”). In September 2014, that guarantor and the franchise owners sued Burger King Europe for tortious interference and a declaratory judgment (the “Franchise Agreement Litigation”). Burger King asserted the defense of forum non conveniens, in favor of Germany, as specified in the parties’ agreement. Acknowledging some confusion about the applicable legal standard for waiver, the Fifth Circuit agreed with the district court that the filing of the Personal Guarantee Litigation did not waive Burger King’s ability to assert forum non conveniens in the later case against it. That said, the Court found an abuse of discretion in denying the plaintiffs’ leave to amend to add new defendants and new tort claims, noting that the motion was timely and not obviously moot. SGIC Strategic Global Investment Capital, Inc. v. Burger King Europe GMBH, No. 15-10943 (Oct. 10, 2016).

In April 2014, Burger King Europe sued on a guaranty to recover allegedly unpaid franchise fees (the “Personal Guarantee Litigation”). In September 2014, that guarantor and the franchise owners sued Burger King Europe for tortious interference and a declaratory judgment (the “Franchise Agreement Litigation”). Burger King asserted the defense of forum non conveniens, in favor of Germany, as specified in the parties’ agreement. Acknowledging some confusion about the applicable legal standard for waiver, the Fifth Circuit agreed with the district court that the filing of the Personal Guarantee Litigation did not waive Burger King’s ability to assert forum non conveniens in the later case against it. That said, the Court found an abuse of discretion in denying the plaintiffs’ leave to amend to add new defendants and new tort claims, noting that the motion was timely and not obviously moot. SGIC Strategic Global Investment Capital, Inc. v. Burger King Europe GMBH, No. 15-10943 (Oct. 10, 2016).

In Monaco v. TAG Investments, the parties disputed the dischargeability of a $171,942.03 debt, based on the alleged misapplication of funds subject to Texas’s powerful Construction Trust Fund Act. The Fifth Circuit focused on a defense provided by that statute, which applies when “the trust funds not paid to the beneficiaries of the trust were used by the trustee to pay the trustee’s actual expenses directly related to the construction or repair of the improvement.” The Court accepted the explanation that “$124,053 went to salaries and overhead and an additional $50,400.00 went to superivision of this project,” noting that “payment of these sums as reasonable was approved by TAG’s architect.” Accordingly, the defense applied and the debt was dischargeable. No. 15-51085 (Oct. 6, 2016).

In Monaco v. TAG Investments, the parties disputed the dischargeability of a $171,942.03 debt, based on the alleged misapplication of funds subject to Texas’s powerful Construction Trust Fund Act. The Fifth Circuit focused on a defense provided by that statute, which applies when “the trust funds not paid to the beneficiaries of the trust were used by the trustee to pay the trustee’s actual expenses directly related to the construction or repair of the improvement.” The Court accepted the explanation that “$124,053 went to salaries and overhead and an additional $50,400.00 went to superivision of this project,” noting that “payment of these sums as reasonable was approved by TAG’s architect.” Accordingly, the defense applied and the debt was dischargeable. No. 15-51085 (Oct. 6, 2016).

The plaintiffs in Sims v. Kia Motors brought products liability claims about the design of a fuel tank. Their main engineering expert “employed a ‘differential diagnosis approach, a scientific technique that essentially involves the process of elimination.” While a potentially reliable technique, the Fifth Circuit noted that it “has cautioned that “the results of a differential diagnosis are far from reliable per se..’ . . . “[M]erely “ruling out” other possible explanations is not enough to establish reliability; experts must also have some scientific basis for ‘ruling in’ the phenomenon they allege.” Here, where “the record does not reflect any reliable facts or data ‘ruling in'” the expert’s theory about how the fuel tank behaved in the accident, “the district court did not abuse its discretion in excluding it.” No. 15-10636 (revised Oct. 11, 2016).

The plaintiffs in Sims v. Kia Motors brought products liability claims about the design of a fuel tank. Their main engineering expert “employed a ‘differential diagnosis approach, a scientific technique that essentially involves the process of elimination.” While a potentially reliable technique, the Fifth Circuit noted that it “has cautioned that “the results of a differential diagnosis are far from reliable per se..’ . . . “[M]erely “ruling out” other possible explanations is not enough to establish reliability; experts must also have some scientific basis for ‘ruling in’ the phenomenon they allege.” Here, where “the record does not reflect any reliable facts or data ‘ruling in'” the expert’s theory about how the fuel tank behaved in the accident, “the district court did not abuse its discretion in excluding it.” No. 15-10636 (revised Oct. 11, 2016).

Hoffman v. L&M Arts arose from the sale of a 1961 Rothko painting (right) by Sotheby’s in 2010; a previous owner alleged that this sale revealed facts about her own sale, in violation of a confidentiality provision in the sales contract that said: “All parties agree to make maximum efforts to keep all aspects of this transaction confidential indefinitely.” The Fifth Circuit ruled for the defense in all respects, concluding that:

Hoffman v. L&M Arts arose from the sale of a 1961 Rothko painting (right) by Sotheby’s in 2010; a previous owner alleged that this sale revealed facts about her own sale, in violation of a confidentiality provision in the sales contract that said: “All parties agree to make maximum efforts to keep all aspects of this transaction confidential indefinitely.” The Fifth Circuit ruled for the defense in all respects, concluding that:

- The original owner did not state a fraud claim against the relevant gallery, based on its alleged misrepresentation of its authority to act on behalf of an unnamed buyer, or its alleged misrepresentation about representing an entity or individual. (Notably, the owner did not argue in the district court that equitable relief could still be appropriate without proof of damage), or its claim that the piece would “disappear” into its client’s private collection.

- The contract did not require secrecy about the fact of the sale, based on the plain meaning of the term “aspect,” other provisions in the agreement, and the Texas policy against restraints on alienability.

- The questions about damages associated with the alleged breach either reflected speculative bargains, incorrect damages measures, or a disgorgement theory that is not well-supported as a Texas contract remedy.

No. 15-10046 (Sept. 28, 2016).

In Torres v. S.G.E. Management LLC, the en banc Fifth Circuit reversed a panel opinion about a class action involving an alleged pyramid scheme. The case alleged RICO claims about the multi-level marketing program associated with Stream Energy; the panel rejected class certification, finding that individual causation issues would predominate at trial.

In Torres v. S.G.E. Management LLC, the en banc Fifth Circuit reversed a panel opinion about a class action involving an alleged pyramid scheme. The case alleged RICO claims about the multi-level marketing program associated with Stream Energy; the panel rejected class certification, finding that individual causation issues would predominate at trial.

The en banc court disagreed, reasoning: “The Defendants’ challenge to predominance rests on their belief that th[e] causation element will require individualized proof. But that premise . . . is at odds with recent decisions from the Supreme Court and this court emphasizing that RICO claims predicated on mail and wire fraud do not require first-party reliance to establish that the injuries were proximately caused by the fraud.” Accordingly, “[b]ecause pyramid schemes are per se mail fraud, which include inherent concealment about the deceptive payment scheme, one who participates in a pyramid scheme can be harmed ‘by reason of’ the fraud regardless of whether he or she relied on a misrepresentation about the scheme.” Additionally, the Court concluded that “if the Plaintiffs prove that Ignite is a fraudulent pyramid scheme, they may use a common inference of reliance to prove proximate causation under RICO.”

This is a significant ruling from a court that is generally considered hostile to class actions, in an area of the economy – multi-level marketing programs – that involves millions of participants. No. 14-20129 (Sept. 30, 2016) (en banc).

The unfortuante Noreen Johnson sought to recover from her insurer after her home suffered wind damage from Hurricane Isaac, and then caught fire roughly two years later. The insurer successfully defended against her claim based on her failure to cooperate as required by the policy. In addition to showing her failure to provide required information, the insurer was able to establish prejudice, in that (1) “by significantly altering the state of the house before GeoVera’s agent could appraise it, Johnson effectively negated GeoVera’s appraisal right, as GeoVera could no longer inspect the extent of the smoke damage,” and (2) “by refusing to sit for an examination under oath until over a year after the fire . . . [t]he delay caused Johnson to forget information vital to protect GeoVera from fraud during the claims process.” Johnson v. GeoVera Specialty Ins. Co., No. 15-30803 (Sept. 27, 2016, unpublished).

The unfortuante Noreen Johnson sought to recover from her insurer after her home suffered wind damage from Hurricane Isaac, and then caught fire roughly two years later. The insurer successfully defended against her claim based on her failure to cooperate as required by the policy. In addition to showing her failure to provide required information, the insurer was able to establish prejudice, in that (1) “by significantly altering the state of the house before GeoVera’s agent could appraise it, Johnson effectively negated GeoVera’s appraisal right, as GeoVera could no longer inspect the extent of the smoke damage,” and (2) “by refusing to sit for an examination under oath until over a year after the fire . . . [t]he delay caused Johnson to forget information vital to protect GeoVera from fraud during the claims process.” Johnson v. GeoVera Specialty Ins. Co., No. 15-30803 (Sept. 27, 2016, unpublished).

ERISA litigation about investment management presents a tension between the administrators’ fiduciary obligations, on the one hand, and discouraging needless litigation, on the other. After the Supreme Court’s most recent guidance about an ERISA fiduciary’s “duty of prudence” in Amgen Inc. v. Harris, 136 S. Ct. 758 (2016), the Fifth Circuit found that the plaintiffs in Whitley v. BP. PLC failed to meet their pleading burden: “The amended complaint states that BP’s stock was overvalued prior to the Deepwater Horizon explosion due to “numerous undisclosed safety breaches” known only to insiders. In other words, the stockholders theorize that BP stock was overpriced because BP had a greater risk exposure to potential accidents than was known to the market. Based on this fact alone, it does not seem reasonable to say that a prudent fiduciary at that time could not have concluded that (1) disclosure of such information to the public or (2) freezing trades of BP stock—both of which would likely lower the stock price—would do more harm than good. In fact, it seems that a prudent fiduciary could very easily conclude that such actions would do more harm than good.” No. 15-20282 (Sept. 26, 2016).

ERISA litigation about investment management presents a tension between the administrators’ fiduciary obligations, on the one hand, and discouraging needless litigation, on the other. After the Supreme Court’s most recent guidance about an ERISA fiduciary’s “duty of prudence” in Amgen Inc. v. Harris, 136 S. Ct. 758 (2016), the Fifth Circuit found that the plaintiffs in Whitley v. BP. PLC failed to meet their pleading burden: “The amended complaint states that BP’s stock was overvalued prior to the Deepwater Horizon explosion due to “numerous undisclosed safety breaches” known only to insiders. In other words, the stockholders theorize that BP stock was overpriced because BP had a greater risk exposure to potential accidents than was known to the market. Based on this fact alone, it does not seem reasonable to say that a prudent fiduciary at that time could not have concluded that (1) disclosure of such information to the public or (2) freezing trades of BP stock—both of which would likely lower the stock price—would do more harm than good. In fact, it seems that a prudent fiduciary could very easily conclude that such actions would do more harm than good.” No. 15-20282 (Sept. 26, 2016).

The plaintiff in Cowart v. Erwin achieved the difficult result of winning a jury trial on an Eighth Amendment claim against a detention officer. The opinion details the proof that satisfied a sufficiency review — multiple favorable eyewitnesses (and multiple unfavorable ones as well) throughout the entire incident in question, along with helpful and contemporaneous photographs and medical records (among others). “Objective” video evidence was not dispositive when it “is not necessarily inconsistent with eye witness accounts of what transpired at the jail on the day in question.” No. 15-10404 (Sept. 20, 2016).

The plaintiff in Cowart v. Erwin achieved the difficult result of winning a jury trial on an Eighth Amendment claim against a detention officer. The opinion details the proof that satisfied a sufficiency review — multiple favorable eyewitnesses (and multiple unfavorable ones as well) throughout the entire incident in question, along with helpful and contemporaneous photographs and medical records (among others). “Objective” video evidence was not dispositive when it “is not necessarily inconsistent with eye witness accounts of what transpired at the jail on the day in question.” No. 15-10404 (Sept. 20, 2016).

Graves v. Colvin provides an exceptionally clear illustration of harmless error:

Graves v. Colvin provides an exceptionally clear illustration of harmless error:

- Graves challenged the Social Security Administration’s determination that she was not disabled.

- A regulation governing ALJ hearings on such matters provides: “Occupational evidence provided by a VE or VS [vocational expert or vocational specialist] generally should be consistent with the occupational information supplied by the DOT [“Dictionary of Occupational Titles”] . . . At the hearings level, as part of the adjudicator’s duty to fully develop the record, the adjudicator will inquire, on the record, as to whether or not there is such consistency.”

- Graves lost, and argued in court that the ALJ failed to ask this required question.

- But — “‘Procedural perfection in administrative proceedings is not required’ as long as ‘the substantial rights of a party have not been affected.’ Graves does not even attempt to show that the vocational expert’s testimony was actually inconsistent with the DOT. Nor has she otherwise demonstrated prejudice. Hence, the ALJ’s procedural error was harmless and does not warrant reversal.”

No. 16-10340 (Sept. 21, 2016).

Insurance coverage litigation provided another example of the tension between the “Scylla” of pleading — the “plead more detail” command from Twombly and Iqbal — and its “Charybids” — the principle of insurance law that “[a]ll doubts regarding the duty to defend are resolved in favor of the insured.” Fed Ins. Co. v. Northfield Ins. Co., No. 14-20633 (Sept. 16, 2016). Here, ltigation about pollution liability led to a dispute about whether a “pollution exclusion” eliminated the duty to defend. The Fifth Circuit reversed a summary judgment in favor of the insurer, noting: “ExxonMobil’s petition does not attach any of the petitions in the Louisiana Litigation. ExxonMobil’s petition provides very little information about the nature of the claims made in the Louisiana Litigation, for which ExxonMobil seeks indemnity and defense costs from [the insured].” As a result, “because of the breadth and generality of the allegations in ExxonMobil’s state court petition, we cannot say that all of the claims fall clearly within the exclusion.”

Insurance coverage litigation provided another example of the tension between the “Scylla” of pleading — the “plead more detail” command from Twombly and Iqbal — and its “Charybids” — the principle of insurance law that “[a]ll doubts regarding the duty to defend are resolved in favor of the insured.” Fed Ins. Co. v. Northfield Ins. Co., No. 14-20633 (Sept. 16, 2016). Here, ltigation about pollution liability led to a dispute about whether a “pollution exclusion” eliminated the duty to defend. The Fifth Circuit reversed a summary judgment in favor of the insurer, noting: “ExxonMobil’s petition does not attach any of the petitions in the Louisiana Litigation. ExxonMobil’s petition provides very little information about the nature of the claims made in the Louisiana Litigation, for which ExxonMobil seeks indemnity and defense costs from [the insured].” As a result, “because of the breadth and generality of the allegations in ExxonMobil’s state court petition, we cannot say that all of the claims fall clearly within the exclusion.”

What better way to celebrate 600Camp.com’s fifth birthday than with Emeril’s muffaletta recipe? Thanks to all blog readers for years of support and encouragement.

What better way to celebrate 600Camp.com’s fifth birthday than with Emeril’s muffaletta recipe? Thanks to all blog readers for years of support and encouragement.

The plaintiff in GlobeRanger Corp. v. Software AG won a $15 million judgment for misappropriation of trade secrets. The Fifth Circuit affirmed, holding:

The plaintiff in GlobeRanger Corp. v. Software AG won a $15 million judgment for misappropriation of trade secrets. The Fifth Circuit affirmed, holding:

- After a thorough review of Circuit precedent – not all entirely consistent – “that GlobeRanger’s trade secret misappropriation claim requires establishing an additional element than what is required to make out a copyright violation: that the protected information was taken via improper means or breach of a confidential relationship. Because the state tort provides substantially different protection than copyright law, it is not preempted.”

- Recognizing the “jurisdictional Catch-22” created by that ruling, and referring back to an earlier panel opinion from the time of the case’s removal: “As the complaint [then] alleged only conversion of intangible property for which there is equivalency between the rights protected under that state tort and federal copyright law, complete preemption converted the conversion claim into one brought under the Copyright Act that supported federal question jurisdiction at the time of removal and supplemental jurisdiction after it was dismissed.”

- Found that GlobeRanger had offered sufficient evidence of: (1) what specifically constituted its claimed trade secrets; (2) whether Software AG acquired trade secrets improperly or with notice of impropriety, particularly in light of federal contracting regulations; and (3) whether Software AG “used” any trade secret.

The opinion concluded with an unfortunately apt observation about the business litigation that is the focus of this blog: “This case demonstrates the unfortunate complexity of much of modern civil litigation. A trial involving a single cause of action—misappropriation of trade secrets (plus a derivate conspiracy claim)—has resulted in an appeal raising numerous issues that span the lifecycle of the lawsuit: jurisdiction; preemption; federal contracting regulations; expert testimony on damages; and jury instructions.

In response to a summary judgment motion in a suit for unpaid overtime, plaintiff Garcia offered affidavit testimony that he “was told” certain favorable salary information. The record was unclear as to who told him that information. On appeal from an adverse ruling, the Court noted: “Garcia first argues that the district court erred by discounting, as hearsay, Garcia’s statement in his affidavit about what he was ‘told,’ because ‘taking the evidence in the light most favorable to Garcia, a party-opponent told Garcia this information.’ However, courts are not required to view evidence presented at summary judgment in the light most favorable to the nonmoving party on the question of admissibility; rather, ‘the content of summary judgment evidence must be generally admissible,’ and ‘[i]t is black-letter law that hearsay evidence cannot be considered on summary judgment’ for the truth of the matter asserted.” Garcia v. U Pull It Auto Truck Salvage, Inc., No. 16-20257 (Sept. 15, 2016, unpublished).

In response to a summary judgment motion in a suit for unpaid overtime, plaintiff Garcia offered affidavit testimony that he “was told” certain favorable salary information. The record was unclear as to who told him that information. On appeal from an adverse ruling, the Court noted: “Garcia first argues that the district court erred by discounting, as hearsay, Garcia’s statement in his affidavit about what he was ‘told,’ because ‘taking the evidence in the light most favorable to Garcia, a party-opponent told Garcia this information.’ However, courts are not required to view evidence presented at summary judgment in the light most favorable to the nonmoving party on the question of admissibility; rather, ‘the content of summary judgment evidence must be generally admissible,’ and ‘[i]t is black-letter law that hearsay evidence cannot be considered on summary judgment’ for the truth of the matter asserted.” Garcia v. U Pull It Auto Truck Salvage, Inc., No. 16-20257 (Sept. 15, 2016, unpublished).

In Smith Group JJR, PLLC v. Forrest General Hospital, a dispute about an architect’s fee, the appellant argued that “the district court erred by considering extrinsic evidence bearing on the meaning of the term ‘actual contstruction cost’ in the parties’ agreement. This issue – the proper role of extrinsic evidence in determining the meaning of a contract, produces frequent litigation and frequent differences of opinion between district courts and the Fifth Circuit. Here, the

In Smith Group JJR, PLLC v. Forrest General Hospital, a dispute about an architect’s fee, the appellant argued that “the district court erred by considering extrinsic evidence bearing on the meaning of the term ‘actual contstruction cost’ in the parties’ agreement. This issue – the proper role of extrinsic evidence in determining the meaning of a contract, produces frequent litigation and frequent differences of opinion between district courts and the Fifth Circuit. Here, the  court found a waiver of these arguments before the trial court, reminding that “citing cases that may contain a useful argument is simply inadequate to preserve that argument for appeal; ‘to be preserved, an argument must be pressed, and not merely intimated.'” No. 16-60134 (Sept. 9, 2016, unpublished). (This post was picked as one of the top five of the week by the Appellate Advocacy blog on the Law Professor Blogs Network!)