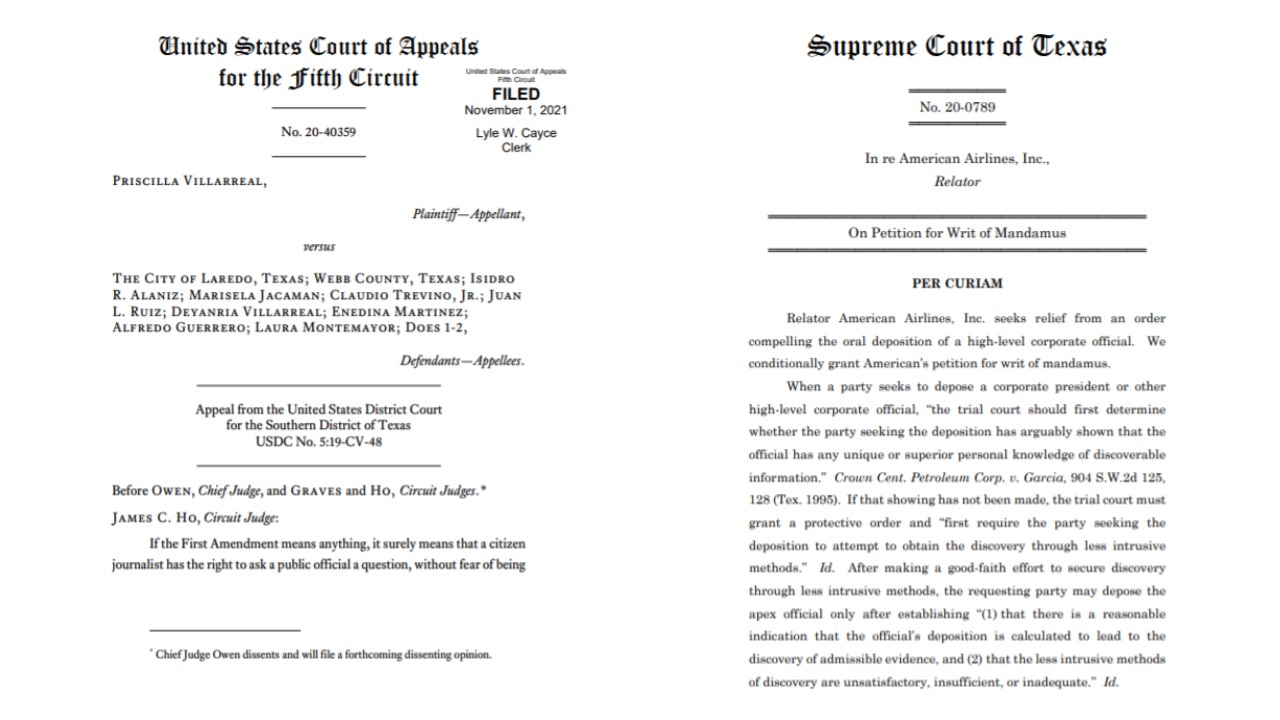

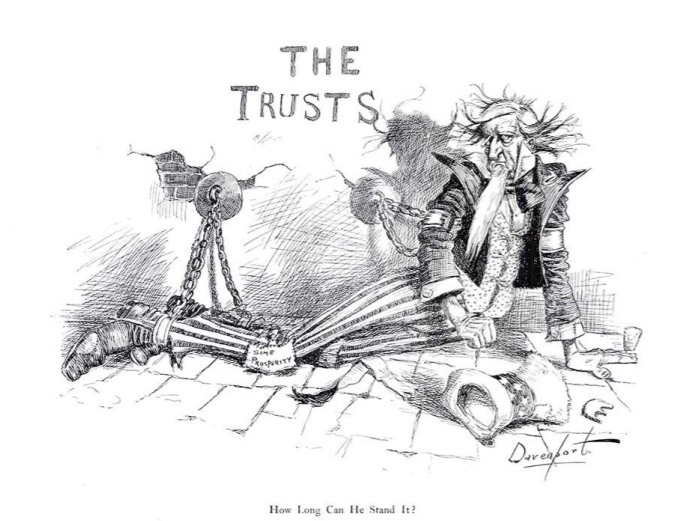

In reaching an important holding about the scope of “federal officer” removal, as applied to “critical infrastructure” businesses operating during the pandemic:

In this case, we must decide whether Tyson Foods, Inc. was “acting under” direction from the federal government when it chose to keep its poultry processing plants open during the early months of the COVID-19 pandemic. Tyson argues that it was, and that the district courts erred in remanding these cases back to state court. But the record simply does not bear out Tyson’s theory. Tyson received, at most, strong encouragement from the federal government. But Tyson was never told that it must keep its facilities open. Try as it might, Tyson cannot transmogrify suggestion and concern into direction and control.

(emphasis in original), the Fifth Circuit provided some interesting history about that important statute:

Congress enacted the first “federal officer removal statute” during the War of 1812 to protect U.S. customs officials. New England states were generally opposed to the war, and shipowners from the region took to suing federal agents charged with enforcing the trade embargo against England. Congress responded by giving customs officials the right to remove state-court actions brought against them to federal court. Since that time Congress has given the right of removal to more and more federal officers. Today all federal officers as well as “any person acting under that officer” are eligible.

(footnotes omitted). Glenn v. Tyson Foods, Inc., No. 21-40622 (July 7, 2022).

In

In