On Dallas’s Fox 4 News, following the lead of the Matrix movies, I characterize the nominee as “Scalia Reloaded”:

Defendants removed, the plaintiff moved to remand, and the the district court granted the motion. It found a waiver of the right to remove, noting this contract provision: “The Parties hereto hereby irrevocably and unconditionally consent to the sole and exclusive jurisdiction of the courts of Harris County in the State of Texas for any action, suit or proceeding arising out of or relating to this Agreement or the Proposed Transaction . . . .” The defendants claimed ambiguity (which would make the waiver no longer be “clear and unambiguous,” and thus not satisfy the demanding standard in this area) from (1) the definition of “Proposed Transaction,” (2) the definitions of the relevant parties, and the use of “Proposed Transaction” in the above part of the relevant clause, but not in another, similar provision later in it. The Fifth Circuit rejected these arguments and affirmed, but also affirmed the denial of any award of attorneys’ fees. Grand View PV Solar Two, LLC v. Helix Elec., Inc., No. 16-20384 (Feb. 1, 2017). The opinion is a good summary of the law on this topic, which has not been addressed in detail recently.

Defendants removed, the plaintiff moved to remand, and the the district court granted the motion. It found a waiver of the right to remove, noting this contract provision: “The Parties hereto hereby irrevocably and unconditionally consent to the sole and exclusive jurisdiction of the courts of Harris County in the State of Texas for any action, suit or proceeding arising out of or relating to this Agreement or the Proposed Transaction . . . .” The defendants claimed ambiguity (which would make the waiver no longer be “clear and unambiguous,” and thus not satisfy the demanding standard in this area) from (1) the definition of “Proposed Transaction,” (2) the definitions of the relevant parties, and the use of “Proposed Transaction” in the above part of the relevant clause, but not in another, similar provision later in it. The Fifth Circuit rejected these arguments and affirmed, but also affirmed the denial of any award of attorneys’ fees. Grand View PV Solar Two, LLC v. Helix Elec., Inc., No. 16-20384 (Feb. 1, 2017). The opinion is a good summary of the law on this topic, which has not been addressed in detail recently.

The receiver of the Allen Stanford businesses sued several investors for receiving fraudulent conveyances. In earlier appeals, the Fifth Circuit resolved other thresehold issues in these cases; in Janvey v. Alguire, the Court reviewed the denials of the defendants’ motions to compel arbitration. It affirmed, rejecting their arguments based on arbitration clauses in various Stanford-related documents: “Because the Receiver may sue on behalf of any of the Stanford entities that has a claim against the defendants, becausehe has chosen to sue on behalf of the Bank, which has not consented to arbitrate claims against any of the defendants [except for one, who waived the issue], and because none of the equitable doctrines urged by the defendants applies, the Receiver cannot be compelled to arbitate his claims against these defendants.” No. 14-10945 et al. (Jan. 31, 2017).

defendants, becausehe has chosen to sue on behalf of the Bank, which has not consented to arbitrate claims against any of the defendants [except for one, who waived the issue], and because none of the equitable doctrines urged by the defendants applies, the Receiver cannot be compelled to arbitate his claims against these defendants.” No. 14-10945 et al. (Jan. 31, 2017).

Heniff Transportation, a trucking company, sued Trimac Transportation, alleging that Trimac did not properly clean a tanker-trailer, resulting in contamination and a damages claim against Heniff by its customer. Trimac argued that Heniff’s state law claims were preempted by the Carmack Amendment, a federal law that addresses actions about lost or damaged goods, arising from interstate transportation of the goods by a common carrier. The Fifth Circuit agreed, finding that washing a tanker-trailer was “plainly” such a service, directly analogous to specific examples given by the statute. This statute, not widely known outside trucking litigation, can bear significantly on UCC claims involving transported goods. Heniff Transportation v. Trimac Transportation, No. 16-40553 (Jan. 30, 2017).

Heniff Transportation, a trucking company, sued Trimac Transportation, alleging that Trimac did not properly clean a tanker-trailer, resulting in contamination and a damages claim against Heniff by its customer. Trimac argued that Heniff’s state law claims were preempted by the Carmack Amendment, a federal law that addresses actions about lost or damaged goods, arising from interstate transportation of the goods by a common carrier. The Fifth Circuit agreed, finding that washing a tanker-trailer was “plainly” such a service, directly analogous to specific examples given by the statute. This statute, not widely known outside trucking litigation, can bear significantly on UCC claims involving transported goods. Heniff Transportation v. Trimac Transportation, No. 16-40553 (Jan. 30, 2017).

The “Gulf Council” manages fisheries in the federal waters of the Gulf of Mexico.With respect to red snapper, its statutory grant of authority requires it to establish “seprate quotas for recreational fishing . . . and commercial fishing.” A group of private anglers complained that the authority to set those two quotas precluded the ability to set a quota for fishing from charter vessels. The Fifth Circuit disagreed, finding that neither the canon that “expressing one item of a commonly associated group or series excludes another left unmentioned,” nor that “a specific statute prevails over an inconsistent general statute” compelled a ruling in favor of the anglers: “Amendment 40 does not create a separate quota for charter fishing; it subdivides the recreational sector into private and charter components.” Coastal Conservation Association v. U.S. Dep’t of Commerce, No. 16-30137 (revised Jan. 26, 2017).

The “Gulf Council” manages fisheries in the federal waters of the Gulf of Mexico.With respect to red snapper, its statutory grant of authority requires it to establish “seprate quotas for recreational fishing . . . and commercial fishing.” A group of private anglers complained that the authority to set those two quotas precluded the ability to set a quota for fishing from charter vessels. The Fifth Circuit disagreed, finding that neither the canon that “expressing one item of a commonly associated group or series excludes another left unmentioned,” nor that “a specific statute prevails over an inconsistent general statute” compelled a ruling in favor of the anglers: “Amendment 40 does not create a separate quota for charter fishing; it subdivides the recreational sector into private and charter components.” Coastal Conservation Association v. U.S. Dep’t of Commerce, No. 16-30137 (revised Jan. 26, 2017).

A church in Hattiesburg, Mississippi proved that its insurer did not properly handle its claim resulting from tornado damage (right), resulting in a damages award of over $1,000,000. The Fifth Circuit affirmed against challenges by both sides; as to the church’s request for punitive damages, it held: “Taking the facts in the light most favorable to Mount Carmel, GuideOne’s alleged conduct did not rise to the necessary level of an independent tort that would warrant punitive damages. Mount Carmel merely alleges that GuideOne had ‘knowledge of the financial harm that would result’ from its cancellation of the policy. But this type of knowledge is likely present for many cancellations and alone is not sufficient to rise to the level of an independent tort. Accordingly, it does not warrant punitive damages.” GuideOne Elite Ins. Co. v. Mount Carmel Ministries, No. 15-60915 (Jan. 23, 2017, unpublished).

A church in Hattiesburg, Mississippi proved that its insurer did not properly handle its claim resulting from tornado damage (right), resulting in a damages award of over $1,000,000. The Fifth Circuit affirmed against challenges by both sides; as to the church’s request for punitive damages, it held: “Taking the facts in the light most favorable to Mount Carmel, GuideOne’s alleged conduct did not rise to the necessary level of an independent tort that would warrant punitive damages. Mount Carmel merely alleges that GuideOne had ‘knowledge of the financial harm that would result’ from its cancellation of the policy. But this type of knowledge is likely present for many cancellations and alone is not sufficient to rise to the level of an independent tort. Accordingly, it does not warrant punitive damages.” GuideOne Elite Ins. Co. v. Mount Carmel Ministries, No. 15-60915 (Jan. 23, 2017, unpublished).

The relator in a reverse False Claims Act case alleged that DuPont concealed its obligation to pay penalties under the Toxic Substances Control Act. After a careful review of the statute, its history, and policy considerations, the Fifth Circuit reversed the denial of summary judgment to DuPont: “Simoneaux’s position yields an extraordinarily broad construction of the FCA. If his reading . . . were correct, reverse-FCA liability could attach from the violation of any federal statute or regulation that imposes penalties. . . . For example, 45 C.F.R. § 3.42(e) prohibits roller-skating at the National Institutes of Health, and a person violating that regulation “shall be fined under title 18, United States Code, imprisoned for not more than 30 days, or both.” 40 U.S.C. § 1315(c)(A). Under Simoneaux’s reasoning, roller-skating at the NIH results in a penalty ‘of not less than $5,000’ and three times the fine assessed under Title 18. And any private person who saw the roller-skater could bring a qui tam action against him. The statutory definition of ‘obligation’ cannot bear the weight of that interpretation.” United States ex rel. Simoneaux v. duPont, No. 16-30141 (revised Dec. 14, 2016).

The relator in a reverse False Claims Act case alleged that DuPont concealed its obligation to pay penalties under the Toxic Substances Control Act. After a careful review of the statute, its history, and policy considerations, the Fifth Circuit reversed the denial of summary judgment to DuPont: “Simoneaux’s position yields an extraordinarily broad construction of the FCA. If his reading . . . were correct, reverse-FCA liability could attach from the violation of any federal statute or regulation that imposes penalties. . . . For example, 45 C.F.R. § 3.42(e) prohibits roller-skating at the National Institutes of Health, and a person violating that regulation “shall be fined under title 18, United States Code, imprisoned for not more than 30 days, or both.” 40 U.S.C. § 1315(c)(A). Under Simoneaux’s reasoning, roller-skating at the NIH results in a penalty ‘of not less than $5,000’ and three times the fine assessed under Title 18. And any private person who saw the roller-skater could bring a qui tam action against him. The statutory definition of ‘obligation’ cannot bear the weight of that interpretation.” United States ex rel. Simoneaux v. duPont, No. 16-30141 (revised Dec. 14, 2016).

Defendants moved for summary judgment, on the ground of qualified immunity, in a case arising from a fatal police shooting. The district court “disregarded the testimony of [Officer] Copeland and two eyewitnesses, finding that because there was ‘no video evidence of the actual shooting[,]’ the ‘testimony of Copeland, the eyewitness, and the 9-1-1 caller . . . should not be accepted until subjected to cross examination.'” The Fifth Circuit reversed; in addition to a ground based on qualfied immunity law, the Court held that under general Rule 56 principles: ”There is no evidence to suggest that the pair was biased, and the district court specifically found that the heirs ‘[did] not offer any evidence to contradict the eyewitnesses’ statements.’ Because their testimony was ‘uncontradicted and unimpeached,’ the district court was required to give it credence. Failure to do so amounted to an inappropriate ‘credibility determination[].'” Orr v. Copeland, No. 16-50023 (Dec. 22, 2016).

Defendants moved for summary judgment, on the ground of qualified immunity, in a case arising from a fatal police shooting. The district court “disregarded the testimony of [Officer] Copeland and two eyewitnesses, finding that because there was ‘no video evidence of the actual shooting[,]’ the ‘testimony of Copeland, the eyewitness, and the 9-1-1 caller . . . should not be accepted until subjected to cross examination.'” The Fifth Circuit reversed; in addition to a ground based on qualfied immunity law, the Court held that under general Rule 56 principles: ”There is no evidence to suggest that the pair was biased, and the district court specifically found that the heirs ‘[did] not offer any evidence to contradict the eyewitnesses’ statements.’ Because their testimony was ‘uncontradicted and unimpeached,’ the district court was required to give it credence. Failure to do so amounted to an inappropriate ‘credibility determination[].'” Orr v. Copeland, No. 16-50023 (Dec. 22, 2016).

In Netsch v. Sherman, the appellants’ counsel missed the 14-day deadline for an appeal from bankruptcy court. The district court denied relief and the Fifth Circuit affirmed; while noting that all relevant factors were either neutral or favored appellants, it concluded:”[T]he bankruptcy court concluded that the reason for the delay weighed strongly against finding excusable neglect. In its analysis of this factor, the bankruptcy court emphasized that the parties had been subject to the Federal Rules of Bankruptcy Procedure throughout the adversary proceeding, these rules were unambiguous, and Appellants’ counsel confused the Federal Rules of Bankruptcy Procedure with the Federal Rules of Civil Procedure. The bankruptcy court also indicated that confusing bankruptcy procedure with civil procedure does not constitute excusable neglect. Consequently, the court held that the reason for the delay should be given greater weight than other factors.” No. 16-10432 (Dec. 22, 2016, unpublished).

In Netsch v. Sherman, the appellants’ counsel missed the 14-day deadline for an appeal from bankruptcy court. The district court denied relief and the Fifth Circuit affirmed; while noting that all relevant factors were either neutral or favored appellants, it concluded:”[T]he bankruptcy court concluded that the reason for the delay weighed strongly against finding excusable neglect. In its analysis of this factor, the bankruptcy court emphasized that the parties had been subject to the Federal Rules of Bankruptcy Procedure throughout the adversary proceeding, these rules were unambiguous, and Appellants’ counsel confused the Federal Rules of Bankruptcy Procedure with the Federal Rules of Civil Procedure. The bankruptcy court also indicated that confusing bankruptcy procedure with civil procedure does not constitute excusable neglect. Consequently, the court held that the reason for the delay should be given greater weight than other factors.” No. 16-10432 (Dec. 22, 2016, unpublished).

Defendants won an intellectual property dispute with Plaintiff, and then sought recovery of $1 million in attorneys fees. This request led to the surprisingly complicated question of exactly what claims were in the case when the Defendants won. The Fifth Circuit concluded: “The [Texas Theft Liability Act] claim in the [First Amended Complaint]–the operative complaint at

Defendants won an intellectual property dispute with Plaintiff, and then sought recovery of $1 million in attorneys fees. This request led to the surprisingly complicated question of exactly what claims were in the case when the Defendants won. The Fifth Circuit concluded: “The [Texas Theft Liability Act] claim in the [First Amended Complaint]–the operative complaint at

the time of the attorneys’ fee award—was never held to be preempted [by federal copyright law]. [Our earlier opinion on the merits] addressed only the TTLA claim as it was pleaded in the Original Petition and did not consider the TTLA claim in the FAC. This is significant because the TTLA claim in the FAC was distinct from that in the Original Petition and specifically omitted allegations that were equivalent to copyright, with the intention of avoiding preemption. And the district court also never held that the FAC’s TTLA claim was preempted. Rather, the TTLA claim in the FAC was litigated and dismissed on the merits during summary judgment, and therefore it was proper to award attorneys’ fees under the TTLA because that law supplied the rule of decision.” Spear Marketing v. Bancorpsouth Bank, No. 16-10155 (revised Jan. 12, 2017). This opinion echoes the complexity in other recent cases that addressed the substance of preemption issues involving federal copyright law.

Foremost Insurance declined to pay a claim made by Charles Pendleton about the destruction in a fire of his 1956 Mercedes 190SL (an example of which appears to the right), arguing that he set the fire. A jury agreed and the Fifth Circuit affirmed. One of Pendleton’s grounds was that the district judge exceeded the scope of Fed. R. Evid. 404(b) by allowing evidence about other “similar accidents surrounded by similar circumstances regarding insurance” involving Pendleton. The Court found no harm as “ample evidence” supported the jury’s verdict in favor of Foremost, including the police investigation of the accident scene, further review of the accident by a forensic fire investigator and a mechanic/accident reconstructionist, and evidence about ownership of the other vehicle. Foremost Ins. Co. v. Pendleton, No. 16-60240 (Jan. 13, 2017, unpublished).

Foremost Insurance declined to pay a claim made by Charles Pendleton about the destruction in a fire of his 1956 Mercedes 190SL (an example of which appears to the right), arguing that he set the fire. A jury agreed and the Fifth Circuit affirmed. One of Pendleton’s grounds was that the district judge exceeded the scope of Fed. R. Evid. 404(b) by allowing evidence about other “similar accidents surrounded by similar circumstances regarding insurance” involving Pendleton. The Court found no harm as “ample evidence” supported the jury’s verdict in favor of Foremost, including the police investigation of the accident scene, further review of the accident by a forensic fire investigator and a mechanic/accident reconstructionist, and evidence about ownership of the other vehicle. Foremost Ins. Co. v. Pendleton, No. 16-60240 (Jan. 13, 2017, unpublished).

NNN Realty disputed its obligations under a guaranty, noting that the definition of “borrower” in the instrument listed sixteen entities (all of which contained “NNN” in some fashion), concluding with the conjunction “and.” Thus, argued NNN, all of those entities had to be in default to trigger its obligations. The Court rejected this argument, noting the overall structure of the guaranty and related security instrument, as well as the usage of similar terms. It gave little weight to textual arguments about the definition that arose from a misplaced parenthetical. While many of the grammatical arguments – especially as to the the erroneous parenthetical – are unique to the facts of this case, the broader analysis about the interplay between a collectively-defined term and individual obligations applies in many business settings. WBCMT 2007 C33 Office 9720, LLC v. NNN Realty Advisors, Inc., No. 15-20086 (Dec. 22, 2016).

NNN Realty disputed its obligations under a guaranty, noting that the definition of “borrower” in the instrument listed sixteen entities (all of which contained “NNN” in some fashion), concluding with the conjunction “and.” Thus, argued NNN, all of those entities had to be in default to trigger its obligations. The Court rejected this argument, noting the overall structure of the guaranty and related security instrument, as well as the usage of similar terms. It gave little weight to textual arguments about the definition that arose from a misplaced parenthetical. While many of the grammatical arguments – especially as to the the erroneous parenthetical – are unique to the facts of this case, the broader analysis about the interplay between a collectively-defined term and individual obligations applies in many business settings. WBCMT 2007 C33 Office 9720, LLC v. NNN Realty Advisors, Inc., No. 15-20086 (Dec. 22, 2016).

Lowe brough a class action, alleging that company management breached its fiduciary duties to the employee pension plan, and that KPMG aided those breaches by ignoring the underfunding of the plan. KPMG contended that these claims necessarily implicated its engagement agreement with the company, which contained an arbitration clause, and thus required arbitration under the “direct-benefit estoppel” doctrine. Here, “Lowe did not know about the Engagement Letters, and has disclaimed any reliance on the Letters, and her claims rely on common law tort theories, not on the Letters.” The Court concluded that “[i]f that choice makes it harder for [Lowe] to prove her case, so be it,” but her claims as currently stated did not depend on KPMG’s engagment agreement and thus did not have to be arbitrated.” Lowe v. KPMG, No. 16-60263 (Jan. 5, 2017, unpublished).

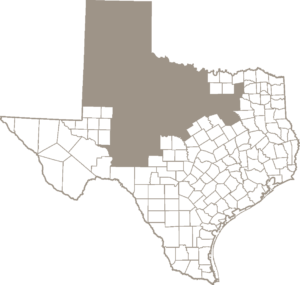

The first ever Bench-Bar conference for the Northern District of Texas will be held on January 27 at the Four Seasons in Las Colinas. Here is the schedule and registration information; it looks to be a great program and the beginning of a strong tradition.

The first ever Bench-Bar conference for the Northern District of Texas will be held on January 27 at the Four Seasons in Las Colinas. Here is the schedule and registration information; it looks to be a great program and the beginning of a strong tradition.

Several u npublished opinions from the Fifth Circuit in recent weeks, most recently Smitherman v. Bayview Loan Servicing LLC, No. 16-20328 (Jan. 11, 2017, unpublished), have ordered limited remands to the district court “to permit supplementation of the record and to make findings regarding . . . citizenship.” Once completed, “the district court’s amended opinion shall return” to the panel “for appropriate action.” It appears that the Court is reviewing case files not only to confirm appellate jurisdiction, but also the necessary facts to support federal subject matter jurisdiction as well.

npublished opinions from the Fifth Circuit in recent weeks, most recently Smitherman v. Bayview Loan Servicing LLC, No. 16-20328 (Jan. 11, 2017, unpublished), have ordered limited remands to the district court “to permit supplementation of the record and to make findings regarding . . . citizenship.” Once completed, “the district court’s amended opinion shall return” to the panel “for appropriate action.” It appears that the Court is reviewing case files not only to confirm appellate jurisdiction, but also the necessary facts to support federal subject matter jurisdiction as well.

Jarrod Burle, a commercial fisherman, made a claim for lost income with the Deepwater Horizon settlement. He then obtained loans, in the form of “pre-settlement funding contracts,” from Woodbridge Baric Pre-Settlement Funding, LLC. After receiving payment from the settlement system, he paid $20,000 back to Woodbridge. A special master then sought to recover that payment from Woodbridge after Burle was found to have made a fraudulent claim. The Fifth Circuit reversed a judgment against Woodbridge, rejecting an analogy between Woodbridge and an attorney with a contingent fee contract, and applying the more general rule that “[b]ecause Woodbridge Baric’s claim for the repayment of the loan was not purely contingent upon the success of Burrle’s claims for compensation, the failure of this contingency did not extinguish [its] claim and does not prevent [it] from asserting its valid interest in defense of its right to retain the funds as a bona fide payee.” In re Deepwater Horizon, No. 15-30599 (revised Jan. 9, 2017).

Jarrod Burle, a commercial fisherman, made a claim for lost income with the Deepwater Horizon settlement. He then obtained loans, in the form of “pre-settlement funding contracts,” from Woodbridge Baric Pre-Settlement Funding, LLC. After receiving payment from the settlement system, he paid $20,000 back to Woodbridge. A special master then sought to recover that payment from Woodbridge after Burle was found to have made a fraudulent claim. The Fifth Circuit reversed a judgment against Woodbridge, rejecting an analogy between Woodbridge and an attorney with a contingent fee contract, and applying the more general rule that “[b]ecause Woodbridge Baric’s claim for the repayment of the loan was not purely contingent upon the success of Burrle’s claims for compensation, the failure of this contingency did not extinguish [its] claim and does not prevent [it] from asserting its valid interest in defense of its right to retain the funds as a bona fide payee.” In re Deepwater Horizon, No. 15-30599 (revised Jan. 9, 2017).

Johnson-Williams sued MERS about a foreclosure. She lost a Rule 12(b)(6) motion filed by MERS, then her own motion for leave to amend, and finally a motion for reconsideration. She appealed, and the Fifth Circuit observed the limited scope of her appeal, as the notice referred only to the district court’s order as to the amendment. Johnson-Williams v. MERS, No. 16-10276 (Jan. 4, 2017, unpublished).

Johnson-Williams sued MERS about a foreclosure. She lost a Rule 12(b)(6) motion filed by MERS, then her own motion for leave to amend, and finally a motion for reconsideration. She appealed, and the Fifth Circuit observed the limited scope of her appeal, as the notice referred only to the district court’s order as to the amendment. Johnson-Williams v. MERS, No. 16-10276 (Jan. 4, 2017, unpublished).

“In 2004, an Iraqi insurgent group kidnapped and murdered twelve Nepali men as they traveled through Iraq to a United States military base to work for . . . a Jordanian corporation that had a subcontract with . . . Kellogg Brown Root.” Adhikari v. Kellogg Brown & Root, Inc., No. 15-20225 (Jan. 3, 2017). The Fifth Circuit affirmed the dismissal of tort claims against KBR brought by the representatives of the deceased, including a claim based on the Alien Tort Statute.

The ATS is a cryptic part of the Judiciary Act of 1798, stating: “The district courts shall have original jurisdiction of any civil action by an alien for a tort only, committed in violation of the law of nations or a treaty of the United States.” In 2013, the Supreme Court clarified and limited the extraterritorial scope of the statute in Kiobel v. Royal Dutch Petroleum Co., 133 S. Ct. 1658. Applying Kiobel, the panel majority found no ATS claim stated, despite the strong policy against the human trafficking that was alleged to be involved in this case. A dissent read Kiobel to establish a “touch and concern” test as to contact with the United States, and would have found a cognizable ATS claim pleaded on these facts.

The unsuccessful plaintiff in Dawson v. RockTenn Services, Inc. sued because of injuries he suffered while delivering sulfuric acid to a paper mill. In yet another opinion that endorses careful recordkeeping, the Fifth Circuit affirmed judgment for the defendants: “Under Rock-Tenn’s operating procedures, Martin Transport’s drivers were required to, and apparently did, check that the pressure-release line was ‘free from defects and

The unsuccessful plaintiff in Dawson v. RockTenn Services, Inc. sued because of injuries he suffered while delivering sulfuric acid to a paper mill. In yet another opinion that endorses careful recordkeeping, the Fifth Circuit affirmed judgment for the defendants: “Under Rock-Tenn’s operating procedures, Martin Transport’s drivers were required to, and apparently did, check that the pressure-release line was ‘free from defects and

void of other materials’ prior to each delivery. Martin Transport’s drivers delivered acid to the mill at least daily, often twice daily, without ever apparently notifying Rock-Tenn of any defect in the pressure-release line. In the absence of any countervailing evidence to suggest that a reasonable person in Rock-Tenn’s position would have undertaken further inspection or maintenance of the pressure-release line, there is no basis for imputing RockTenn with constructive knowledge of an alleged defect in that line.” No. 16-30112 (Dec. 27, 2016, unpublished).

In LLOG Exploration Co. v. Signet Maritime Corp., after affirming a declaratory judgment about delay damages under a maritime towage contract, the Fifth Circuit found that it lacked jurisdiction over the related award of attorneys’ fees: “[I]n its award of fees and costs to LLOG, the district court did not set a set a specific amount. This court held in S. Travel Club, Inc. v. Carnival Air Lines, Inc., 986 F.2d 125, 131 (5th Cir. 1993), ‘that an order awarding attorney’s fees or costs is not reviewable on appeal until the award is reduced to a sum certain.'” No. 15-31123 (Dec. 23, 2016, unpublished).

In LLOG Exploration Co. v. Signet Maritime Corp., after affirming a declaratory judgment about delay damages under a maritime towage contract, the Fifth Circuit found that it lacked jurisdiction over the related award of attorneys’ fees: “[I]n its award of fees and costs to LLOG, the district court did not set a set a specific amount. This court held in S. Travel Club, Inc. v. Carnival Air Lines, Inc., 986 F.2d 125, 131 (5th Cir. 1993), ‘that an order awarding attorney’s fees or costs is not reviewable on appeal until the award is reduced to a sum certain.'” No. 15-31123 (Dec. 23, 2016, unpublished).

In a dispute about a home loan, the district court wrote an opinion found for the defendant mortgage servicer in all respects, including its counterclaim for judicial foreclosure. The final judgment, unfortunately, did not address that claim or otherwise contain “catch-all” language. Because “[t]he district court’s ‘final judgment’ neither adjudicates ‘all claims . . . of all parties,’ nor expressly styles itself as a partial final judgment pursuant to Rule 54(b). . . . this Court has no appellate jurisdiction and cannot review the merits of the case.” Wease v. Ocwen Loan Servicing LLC, No. 16-10521 (Dec. 29, 2016, unpublished).

In a dispute about a home loan, the district court wrote an opinion found for the defendant mortgage servicer in all respects, including its counterclaim for judicial foreclosure. The final judgment, unfortunately, did not address that claim or otherwise contain “catch-all” language. Because “[t]he district court’s ‘final judgment’ neither adjudicates ‘all claims . . . of all parties,’ nor expressly styles itself as a partial final judgment pursuant to Rule 54(b). . . . this Court has no appellate jurisdiction and cannot review the merits of the case.” Wease v. Ocwen Loan Servicing LLC, No. 16-10521 (Dec. 29, 2016, unpublished).

Sessa Capital, a hedge fund, supported the election of certain directors to the board of Ashford Prime, a hotel business. Ashford’s management rejected their applications, contending that they were incomplete. Litigation ensued, in which Sessa sought an injunction against the June 10, 2016 board election. The district court denied relief; Sessa appealed, and a motions panel of the Fifth Circuit denied an interim stay.

Sessa Capital, a hedge fund, supported the election of certain directors to the board of Ashford Prime, a hotel business. Ashford’s management rejected their applications, contending that they were incomplete. Litigation ensued, in which Sessa sought an injunction against the June 10, 2016 board election. The district court denied relief; Sessa appealed, and a motions panel of the Fifth Circuit denied an interim stay.

Since that election proceeded, mootness became an obvious appellate issue. The Fifth Circuit noted that “Sessa did not ask the district court to stay the [June 10] election,” and also “never sought the invalidation of the shareholder election in the district court” — requests that, had they been made, could potentially have kept the dispute alive. To the contrary, the Court observed that “Sessa repeatedly made a tactical decision to seek only prospective relief. When the district court contemplated pressing the reset button by staying the shareholder election and allowing Sessa to resubmit the questionnaires, Sessa vehemently opposed this solution.” Accordingly, the Court dismissed the appeal as moot. Ashford Hospitality Prime, Inc. v. Sessa Capital, No. 16-10671 (Dec. 16, 2016, unpublished).

Two manufacturers of baby products (specifically, pacifiers and “sippy cups”), disputed the enforcement of a contract provision that said: “Distributor hereby acknowledges and agrees not to copy or utilize any of LNC’s . . . product design . . . without LNC’s written permission.” While “the district court imposed the requirement that the design be either confidential or protectable as intellectual property in order to fall within the definition of ‘product design,'” the Fifth Circuit disagreed and reversed because of the plain meaning of the terms chosen by the parties: “On its face, the clause applies to any of LNC’s product designs, which would include those in the public domain.” The court rejected arguments based on analogies and appeals to principles of (non-contractual) intellectual property law. Luv N’ Care, Ltd. v. Gruopo Rimar, No. 16-30039 (Dec. 16, 2016).

Two manufacturers of baby products (specifically, pacifiers and “sippy cups”), disputed the enforcement of a contract provision that said: “Distributor hereby acknowledges and agrees not to copy or utilize any of LNC’s . . . product design . . . without LNC’s written permission.” While “the district court imposed the requirement that the design be either confidential or protectable as intellectual property in order to fall within the definition of ‘product design,'” the Fifth Circuit disagreed and reversed because of the plain meaning of the terms chosen by the parties: “On its face, the clause applies to any of LNC’s product designs, which would include those in the public domain.” The court rejected arguments based on analogies and appeals to principles of (non-contractual) intellectual property law. Luv N’ Care, Ltd. v. Gruopo Rimar, No. 16-30039 (Dec. 16, 2016).

While the Court did address the merits, and its enthusiasm for the appeal was tempered by the many cases brought to it about the BP Deepwater Horizon settlement, the Fifth Circuit offered this cautionary note about briefing the standard of review: “Bailey’s opening brief skips this step — it does not acknowledge the standard of review, and offers no arguments to show that the district court abused its discretion. Bailey therefore has waived an issue necessary to the success of the appeal.” Claimant v. BP Exploration & Production, No. 16-30642 (Dec. 13, 2016, unpublished).

While the Court did address the merits, and its enthusiasm for the appeal was tempered by the many cases brought to it about the BP Deepwater Horizon settlement, the Fifth Circuit offered this cautionary note about briefing the standard of review: “Bailey’s opening brief skips this step — it does not acknowledge the standard of review, and offers no arguments to show that the district court abused its discretion. Bailey therefore has waived an issue necessary to the success of the appeal.” Claimant v. BP Exploration & Production, No. 16-30642 (Dec. 13, 2016, unpublished).

Plaintiff accused defendant (and his employer) of sexual assault while incarcerated at a privately-run detention center. Defense counsel had recordings of calls made by the plaintiff, from the facility, suggesting that the encounters were consensual. Counsel did not identify the recordings in their Rule 26 initial disclosures, and did not make the recordings available until the plaintiff’s deposition, after questioning her about the conversations. The district court sanctioned defense counsel for inadequate disclosure and the Fifth Circuit affirmed, concluding that “some evidence serves both substantive and impeachment functions and thus should not be treated as ‘solely’ impeachment evidence” under Rule 26. Olivarez v. GRO Group, Inc., No. 16-50191 (Dec. 12, 2016).

Plaintiff accused defendant (and his employer) of sexual assault while incarcerated at a privately-run detention center. Defense counsel had recordings of calls made by the plaintiff, from the facility, suggesting that the encounters were consensual. Counsel did not identify the recordings in their Rule 26 initial disclosures, and did not make the recordings available until the plaintiff’s deposition, after questioning her about the conversations. The district court sanctioned defense counsel for inadequate disclosure and the Fifth Circuit affirmed, concluding that “some evidence serves both substantive and impeachment functions and thus should not be treated as ‘solely’ impeachment evidence” under Rule 26. Olivarez v. GRO Group, Inc., No. 16-50191 (Dec. 12, 2016).

A good reminder about following the right substantive standard appears in Clark v. Boyd-Tunica Inc., in which an employee of “Sam’s Town” disputed her termination for drinking at work. The employer relied on tests performed by a reputable company, which it rechecked after she complained about them. The Fifth Circuit sided with the employer: “The focus of the pretext inquiry is not whether the alcohol in Clark’s sample was, in fact, attributable to her improper consumption of alcohol, but whether Sam’s Town reasonably believed it was and acted on that basis.” No. 16-60167 (Dec. 9, 2016).

On December 7, Judges Graves, Higginbotham, and Jolly heard oral argument in the high-profile False Claims Act case of Harman v. Trinity Industries. A recording of the full argument is available online, and the Texas Lawbook published a thorough summary shortly after the argument.

Montano v. Orange County, in affirming a substantial jury verdict about the mistreatment of a county prisoner, states several important principles about the appellate review of jury trials. This post focuses on one — the degree of specificity required of a defendant’s JMOL motion under FRCP 50(a), such that arguments in a later 50(b) motion will be seen as renewed rather than new (and thus waived).

Montano v. Orange County, in affirming a substantial jury verdict about the mistreatment of a county prisoner, states several important principles about the appellate review of jury trials. This post focuses on one — the degree of specificity required of a defendant’s JMOL motion under FRCP 50(a), such that arguments in a later 50(b) motion will be seen as renewed rather than new (and thus waived).

The applicable legal standard had three elements; the county moved on the ground that the plaintiff had “no evidence of a constitutionally deficient policy, custom or practice,” going on to focus on the first element. The county later argued that the phrase “constitutionally deficient” necessarily included the other two elements, but the district court and Fifth Circuit disagreed. The purpose of the “specific grounds” requirement in Rule 50(a) is “to make the trial court aware of the movant’s position and to give the opposing party an opportunity to mend its case” – here, the County “did not clearly separate the points upon which [it] requested judgment, did not delineate which of its arguments applied to which of Plaintiffs’ claims, and blurred the lines of Plainitffs’ claims through its obtuse recitation of the case law.” No. 15-41432 (Nov. 29, 2016). Later posts will address other points made by this opinion about the review of jury verdicts.

Plaintiff sued Defendant for breach of contract, alleging a failure to deliver Defendant’s 2010 cotton crop to Plaintiff. Defendant contended that an anticipatory repudiation occurred. The Fifth Circuit reminded that the proposal of new contract terms, absent a statement of intent not to perform the present contract, does not create an anticipatory repudiation. As a counterpoint, the Court cited a Texas appellate case in which the appellant not only proposed new terms, but also “‘definitely manifested’ that he would not longer perform the terms of his original contract when he . . . drove the appellee out to a deserted county road, threatened to sue him, [and] stated that he was ‘mad enough to smash the appellee’s face in.'” Plains Cotton Cooperative Ass’n v. Gray, No. 16-10806 (Dec. 5, 2016) (unpublished).

Plaintiff sued Defendant for breach of contract, alleging a failure to deliver Defendant’s 2010 cotton crop to Plaintiff. Defendant contended that an anticipatory repudiation occurred. The Fifth Circuit reminded that the proposal of new contract terms, absent a statement of intent not to perform the present contract, does not create an anticipatory repudiation. As a counterpoint, the Court cited a Texas appellate case in which the appellant not only proposed new terms, but also “‘definitely manifested’ that he would not longer perform the terms of his original contract when he . . . drove the appellee out to a deserted county road, threatened to sue him, [and] stated that he was ‘mad enough to smash the appellee’s face in.'” Plains Cotton Cooperative Ass’n v. Gray, No. 16-10806 (Dec. 5, 2016) (unpublished).

After the recent opinion of Retractable Technologies v. Becton Dickinson Co., followers of the Fifth Circuit’s antitrust cases should also note that on October 31, the Supreme Court declined to review MM Steel v. JSW Steel, 806 F.3d 835 (5th Cir. 2015).

After the recent opinion of Retractable Technologies v. Becton Dickinson Co., followers of the Fifth Circuit’s antitrust cases should also note that on October 31, the Supreme Court declined to review MM Steel v. JSW Steel, 806 F.3d 835 (5th Cir. 2015).

The Fifth Circuit’s recent opinion in Retractable Technologies Inc. v. Becton Dickinson Co. reversed a $340 million antitrust judgment and placed significant limits on the activity to which the antitrust laws apply. Judge Edith Jones wrote for the panel, joined by Judges Jacques Wiener and Stephen Higginson. No. 14-41384 (Dec. 2, 2016).

The Fifth Circuit’s recent opinion in Retractable Technologies Inc. v. Becton Dickinson Co. reversed a $340 million antitrust judgment and placed significant limits on the activity to which the antitrust laws apply. Judge Edith Jones wrote for the panel, joined by Judges Jacques Wiener and Stephen Higginson. No. 14-41384 (Dec. 2, 2016).

Plaintiff Retractable Technologies Inc. (“RTI”) and Defendant Beckton Dickinson (“BD”) were competing manufacturers of syringes. Retractable sued for false advertising under the Lanham Act, and alleged that BD attempted to monopolize the syringe market in violation of section 2 of Sherman Act.

As summarized by the Court, the antitrust verdict in RTI’s favor “rest[ed] upon three types of ‘deception’ by its rival: [1] patent infringement . . . [2] two false advertising claims made persistently; and [3] BD’s alleged ‘tainting the market’ for retractable syringes in which it alone competed with RTI.”

The Court found that each of these three liability theories failed.

First, as to patent infringement, the Court observed that by its very nature, a patent grants a limited monopoly. Thus, “patent infringement invades the patentee’s monopoly rights, causes competing products to enter the market, and thereby increases competition,” meaning that it “is not an injury cognizable under the Sherman Act.”

Second, the false advertising claims involved BD’s admittedly inaccurate claims to have the “world’s sharpest” needles with “low waste space.” But even these statements “may have been wrong, misleading, or debatable,’ . . . they were all “arguments on the merits, indicative of competition on the merits.” (quoting Stearns Airport Equip. Co. v. FMC Corp., 170 F.3d 518, 522 (5th Cir. 1999)).

After a thorough analysis of different standards used to evaluate antitrust claims based on allegedly false advertising, the Court concluded: “The broader point . . . is the distinction embodied in our precedents between business torts, which harm competitors, and truly anticompetitive activities, which harm the market.” RTI did not make such a showing here.

After a thorough analysis of different standards used to evaluate antitrust claims based on allegedly false advertising, the Court concluded: “The broader point . . . is the distinction embodied in our precedents between business torts, which harm competitors, and truly anticompetitive activities, which harm the market.” RTI did not make such a showing here.

Finally, the “taint” claim alleged that BD refused to make needed repairs to its retractable needle design, in hopes of persuading purchasers that all such syringes – including RTI’s – were inherently unreliable, until some time after RTI’s patents expired and BD could use RTI’s design to revitalize and take over the retractable syringe market. The Court called this theory “illogical,” since selling a bad product would only serve to benefit RTI’s competitors, and would not serve BD well in any attempt to expand its brand once RTI’s technology became available.

While reversing on the antitrust claim and the substantial damages associated with it, the Court went on to remand for reconsideration of what Lanham Act remedies for false advertising might still be appropriate.

This case is a forceful reminder that a good business tort claim does not equate to a good antitrust claim – or, even any antitrust claim at all. It is also a reminder of two broader points about how the Fifth Circuit approaches business tort claims arising from federal law.

On the one hand, that Court allows vigorous litigation of federal claims within their proper boundaries, as it recently did in affirming a nine-figure judgment arising from an antitrust conspiracy claim in MM Steel LP v. JSW Steel (USA), Inc., 806 F.3d 835 (5th Cir. 2015). (Notably, Judge Stephen Higginson, who was on the panel in the Retractable case, wrote the opinion in MM Steel.)

But on the other hand, the Court carefully polices the boundaries of those claims, as it did here, and as it also did in its painstaking comparison between state law trade secret claims and federal copyright claims in GlobeRanger Corp. v. Software AG, 836 F.3d 477 (5th Cir. 2016). The “siren song” of treble damages under the Sherman Act is a compelling one, but the pathway to such damages is carefully guarded.

The issue in Moneygram Int’l v. Commissioner of Internal Revenue was whether MoneyGram could take advantage of a favorable deduction rule for “banks,” unhelpfully defined in the Internal Revenue Code with a sentence beginning: “[T]he term ‘bank’ means a bank or trust company . . . .” Turning to the specific requirements of the definition, the Fifth Circuit concluded that the Tax Court “erred by interpreting

The issue in Moneygram Int’l v. Commissioner of Internal Revenue was whether MoneyGram could take advantage of a favorable deduction rule for “banks,” unhelpfully defined in the Internal Revenue Code with a sentence beginning: “[T]he term ‘bank’ means a bank or trust company . . . .” Turning to the specific requirements of the definition, the Fifth Circuit concluded that the Tax Court “erred by interpreting  ‘deposit’ to include the requirement that MoneyGram ‘hold its customers’ funds for extended periods of time,'” and by requiring that a “loan” be made for interest. A dissent criticized the majority’s “[n]itpicking some of the definitions of a loan . . . .” No. 15-60527 (Nov. 15, 2016, unpublished).

‘deposit’ to include the requirement that MoneyGram ‘hold its customers’ funds for extended periods of time,'” and by requiring that a “loan” be made for interest. A dissent criticized the majority’s “[n]itpicking some of the definitions of a loan . . . .” No. 15-60527 (Nov. 15, 2016, unpublished).

I was on the trial team that won a $146 million verdict in Pecos, Texas last week;here is the Dallas Morning News’s recent story on the case.

I was on the trial team that won a $146 million verdict in Pecos, Texas last week;here is the Dallas Morning News’s recent story on the case.

Plaintiffs alleged that the government of Antigua was complicit in Allen Stanford’s fraudulent scheme; it defended under the Foreign Sovereign Immunities Act. With respect to liabilty under the “commercial activity” exception to the Act, the Fifth Circuit found too attenuated a connection to the United States. As to the scheme itself, “[w]hile Antigua may have helped facilitate Stanford’s sale of the fraudulent CDs, Stanford’s criminal activity served as an intervening act interrupting the causal chain between Antigua’s actions and any effect on investors.” And as to a more specific claim based on Antigua’s failure to repay loans to Stanford, “the financial loss in this case was not directly felt by Plaintiffs, who are investors and customers of Stanford . . . The financial loss due to Antigua’s failure to repay the loans was most directly felt by Stanford who was the actual lender in the loan transactions.” Frank v. Commonwealth of Antigua & Barbuda, No. 15-10788 (Nov. 22, 2016).

Plaintiffs alleged that the government of Antigua was complicit in Allen Stanford’s fraudulent scheme; it defended under the Foreign Sovereign Immunities Act. With respect to liabilty under the “commercial activity” exception to the Act, the Fifth Circuit found too attenuated a connection to the United States. As to the scheme itself, “[w]hile Antigua may have helped facilitate Stanford’s sale of the fraudulent CDs, Stanford’s criminal activity served as an intervening act interrupting the causal chain between Antigua’s actions and any effect on investors.” And as to a more specific claim based on Antigua’s failure to repay loans to Stanford, “the financial loss in this case was not directly felt by Plaintiffs, who are investors and customers of Stanford . . . The financial loss due to Antigua’s failure to repay the loans was most directly felt by Stanford who was the actual lender in the loan transactions.” Frank v. Commonwealth of Antigua & Barbuda, No. 15-10788 (Nov. 22, 2016).

OneBeacon Ins. Co. v. Welch & Assocs. involved insurance coverage for an attorney malpractice claim, arising for an exclusion for knowledge about “any actual or alleged act, error, omission or breach of duty arising out of the rendering or the failure to render professional legal services.” Since even the carrier agreed that “[o]n its face, this covers every single thing an attorney does or does not do, wrongful or not,” the Fifth Circuit found that the exclusion could not be applied literally without making the contract illusory. Focusing on the alleged “wrongful act,” the Court found that the relevant lawyer’s awareness of a discovery order and potential dispute was not equivalent to knowledge that a rare death-penalty sanction award would result. The Court also sustained an award of additional violations for an intentional violation of the Insurance Code with respect to the handling of the claim. No. 15-20402 (Nov. 14, 2016).

OneBeacon Ins. Co. v. Welch & Assocs. involved insurance coverage for an attorney malpractice claim, arising for an exclusion for knowledge about “any actual or alleged act, error, omission or breach of duty arising out of the rendering or the failure to render professional legal services.” Since even the carrier agreed that “[o]n its face, this covers every single thing an attorney does or does not do, wrongful or not,” the Fifth Circuit found that the exclusion could not be applied literally without making the contract illusory. Focusing on the alleged “wrongful act,” the Court found that the relevant lawyer’s awareness of a discovery order and potential dispute was not equivalent to knowledge that a rare death-penalty sanction award would result. The Court also sustained an award of additional violations for an intentional violation of the Insurance Code with respect to the handling of the claim. No. 15-20402 (Nov. 14, 2016).

Robert dePerrodil successfully sued for the injuries he suffered when a wave hit the boat he was on. He recovered damages based upon his plan to work until age 75; the defendant argued that the “court erred by using the plaintiff’s stated retirement goal, rather than the BLS average.” The Fifth Circuit affirmed, noting that dePerrodil had a “‘very reasonable’ goal, considering his medical history, work history, and future medical prognosis,” distinguishing other cases in the area that turned on more vague testimony. Perrodil v. Bozovic Marine, Inc., No. 16-30009 (Nov. 17, 2016, unpublished).

Robert dePerrodil successfully sued for the injuries he suffered when a wave hit the boat he was on. He recovered damages based upon his plan to work until age 75; the defendant argued that the “court erred by using the plaintiff’s stated retirement goal, rather than the BLS average.” The Fifth Circuit affirmed, noting that dePerrodil had a “‘very reasonable’ goal, considering his medical history, work history, and future medical prognosis,” distinguishing other cases in the area that turned on more vague testimony. Perrodil v. Bozovic Marine, Inc., No. 16-30009 (Nov. 17, 2016, unpublished).

Last year, the Fifth Circuit certified these two questions to the Texas Supreme Court:

Last year, the Fifth Circuit certified these two questions to the Texas Supreme Court:

1. Does a lender or holder violate Article XVI, Section 50(a)(6)(Q)(vii) of the Texas Constitution, becoming liable for forfeiture of principal and interest, when the loan agreement incorporates the protections of Section 50(a)(6)(Q)(vii), but the lender or holder fails to return the cancelled note and release of lien upon full payment of the note and within 60 days after the borrower informs the lender or holder of the failure to comply?

2. If the answer to Question 1 is “no,” then, in the absence of actual damages, does a lender or holder become liable for forfeiture of principal and interest under a breach of contract theory when the loan agreement incorporates the protections of Section 50(a)(6)(Q)(vii), but the lender or holder, although filing a release of lien in the deed records, fails to return the cancelled note and release of lien upon full payment of the note and within 60 days after the borrower informs the lender or holder of the failure to comply?

The T exas Supreme Court answered both questions “no” in Garofolo v. Ocwen Loan Servicing, No. 15-0437 (Tex. May 20, 2016). Accordingly, the Fifth Circuit affirmed the dismissal of the plaintiff’s contract claim in Garofolo v. Ocwen Loan Servicing, No. 14-51156 (Oct. 3, 2016, unpublished).

exas Supreme Court answered both questions “no” in Garofolo v. Ocwen Loan Servicing, No. 15-0437 (Tex. May 20, 2016). Accordingly, the Fifth Circuit affirmed the dismissal of the plaintiff’s contract claim in Garofolo v. Ocwen Loan Servicing, No. 14-51156 (Oct. 3, 2016, unpublished).

Color Star Growers (a wholesale distributor of flowers) went into bankruptcy; their lenders sued the Verbeeks in Texas state court, alleging that they fraudulently induced the loans to Color Star. The Verbeeks sought a defense from the D&O carrier for their company. The insurer successfully obtained summary judgment based on the policy’s “Creditor Exclusion” and the Fifth Circuit affirmed. The exclusion said: “The Insurer shall not be liable to pay any Loss on account of, and shall not be obligated to defend, any Claim brought or maintained by or on behalf of . . . [a]ny creditor of a company or organization in the creditor’s capacity as such, whether or not a bankruptcy or insolvency proceeding involving the company or organization has been commenced.” Rejecting the Verbeeks’ arguments that the state court plaintiffs were suing as “administrative agents” or “investors” rather than creditors, the Court observed that “the alleged facts giving rise to the underlying litigation relate entirely to the state court plaintiffs’ loan agreements with Color Star . . . .” The Court went on to affirm as to the duty to indemnify as well. Marke Am. Ins. Co. v. Verbeek, No. 15-51099 (Sept. 27, 2016, unpublished).

Color Star Growers (a wholesale distributor of flowers) went into bankruptcy; their lenders sued the Verbeeks in Texas state court, alleging that they fraudulently induced the loans to Color Star. The Verbeeks sought a defense from the D&O carrier for their company. The insurer successfully obtained summary judgment based on the policy’s “Creditor Exclusion” and the Fifth Circuit affirmed. The exclusion said: “The Insurer shall not be liable to pay any Loss on account of, and shall not be obligated to defend, any Claim brought or maintained by or on behalf of . . . [a]ny creditor of a company or organization in the creditor’s capacity as such, whether or not a bankruptcy or insolvency proceeding involving the company or organization has been commenced.” Rejecting the Verbeeks’ arguments that the state court plaintiffs were suing as “administrative agents” or “investors” rather than creditors, the Court observed that “the alleged facts giving rise to the underlying litigation relate entirely to the state court plaintiffs’ loan agreements with Color Star . . . .” The Court went on to affirm as to the duty to indemnify as well. Marke Am. Ins. Co. v. Verbeek, No. 15-51099 (Sept. 27, 2016, unpublished).

Hays, a cardiologist suffering from epilepsy, sued HCA for wrongful discharge as a result of mishandling his illness. The Fifth Circuit agreed that his tortious interference claim against HCA had to be arbitrated, because its viability depended on reference to the employment agreement between him and the specific hospital where he worked. It also affirmed on the theory of “intertwined claims estoppel,” making an Erie guess that the Texas Supreme Court would recognize this theory, and concluding that “Hays’s current efforts to distinguish amongst defendants and claims are the archetype of strategic pleading intended to avoid the arbitral forum, precisely what intertwined claims estoppel is designed to prevent.” Hays v. HCA Holdings, No. 15-51002 (Sept. 29, 2016).

Hays, a cardiologist suffering from epilepsy, sued HCA for wrongful discharge as a result of mishandling his illness. The Fifth Circuit agreed that his tortious interference claim against HCA had to be arbitrated, because its viability depended on reference to the employment agreement between him and the specific hospital where he worked. It also affirmed on the theory of “intertwined claims estoppel,” making an Erie guess that the Texas Supreme Court would recognize this theory, and concluding that “Hays’s current efforts to distinguish amongst defendants and claims are the archetype of strategic pleading intended to avoid the arbitral forum, precisely what intertwined claims estoppel is designed to prevent.” Hays v. HCA Holdings, No. 15-51002 (Sept. 29, 2016).

The high-profile injunction case of Defense Distributed, Inc. v. U.S. Dep’t of State involved the federal government’s effort to prevent the online distribution of 3D printing files for the critical “lower receiver” component of the AR-15 rifle. The district court declined to grant a preliminary injunction against enforcement of the relevant laws and the Fifth Circuit affirmed. In an observation broadly applicable to litigation about online postings, the Court noted: “If we reverse the district court’s denial and instead grant the preliminary injunction, Plaintiffs-Appellants would legally be permitted to post on the internet as many . . . files as they wish . . . [which] would remain online essentially forever, hosted by foreign websites such as the Pirate Bay and freely available worldwide.” A thorough and strongly-worded dissent took issue with the First Amendment ramifications of the panel opinion; a petition for en banc rehearing has been filed and is pending as of this post. No. 15-50759 (Sept. 20, 2016).

The high-profile injunction case of Defense Distributed, Inc. v. U.S. Dep’t of State involved the federal government’s effort to prevent the online distribution of 3D printing files for the critical “lower receiver” component of the AR-15 rifle. The district court declined to grant a preliminary injunction against enforcement of the relevant laws and the Fifth Circuit affirmed. In an observation broadly applicable to litigation about online postings, the Court noted: “If we reverse the district court’s denial and instead grant the preliminary injunction, Plaintiffs-Appellants would legally be permitted to post on the internet as many . . . files as they wish . . . [which] would remain online essentially forever, hosted by foreign websites such as the Pirate Bay and freely available worldwide.” A thorough and strongly-worded dissent took issue with the First Amendment ramifications of the panel opinion; a petition for en banc rehearing has been filed and is pending as of this post. No. 15-50759 (Sept. 20, 2016).

On September 16, 2013, Defendants obtained a magistrate judge’s report that recommended dismissal of Plaintiffs’ complaint. On September 18, Defendants served – but did not file – a motion for sanctions, stating that it would not be filed until the 21-day Rule 11(c)(2) “safe harbor” period passed. Plaintiffs objected to the report on September 30; Defendants filed their motion on October 18; and after adoption of the report and further briefing, the district imposed $25,000 in sanctions in mid-2014. The Fifth Circuit rejected Plaintiffs’ challenge to the sanction based on the safe harbor period, reasoning — “Given that Plaintiffs could have formally or informally disavowed their claims during the 21-day period after Defendants served their motion, but instead elected to continue pursuing their claims, the district court did not abuse its discretion in rejecting Plaintiffs’ ‘safe harbor’ argument.” Margetis v. Ferguson, No. 16-40563 (Nov. 10, 2016, unpublished).

On September 16, 2013, Defendants obtained a magistrate judge’s report that recommended dismissal of Plaintiffs’ complaint. On September 18, Defendants served – but did not file – a motion for sanctions, stating that it would not be filed until the 21-day Rule 11(c)(2) “safe harbor” period passed. Plaintiffs objected to the report on September 30; Defendants filed their motion on October 18; and after adoption of the report and further briefing, the district imposed $25,000 in sanctions in mid-2014. The Fifth Circuit rejected Plaintiffs’ challenge to the sanction based on the safe harbor period, reasoning — “Given that Plaintiffs could have formally or informally disavowed their claims during the 21-day period after Defendants served their motion, but instead elected to continue pursuing their claims, the district court did not abuse its discretion in rejecting Plaintiffs’ ‘safe harbor’ argument.” Margetis v. Ferguson, No. 16-40563 (Nov. 10, 2016, unpublished).

The NLRB consistently holds that an agreement requiring arbitration of individual claims (and thus foreclosing class actions) violates federal labor law; the Fifth Circuit consistently reverses the NLRB on this point. After again reversing the NLRB and citing the Circuit’s “rule of orderliness” about deference to prior panel decisions, the Court noted the NLRB’s remarkably candid litigation position: “The Board concedes that this court has squarely rejected both of those decisions, and that our precedents necessitate rejecting its arguments here. The Board further acknowledges that it seeks to manufacture a circuit split in order to ‘facilitate Supreme Court review.'” Employers Resource v. NLRB, No. 16-60034 (Nov. 1, 2016, unpublished).

The NLRB consistently holds that an agreement requiring arbitration of individual claims (and thus foreclosing class actions) violates federal labor law; the Fifth Circuit consistently reverses the NLRB on this point. After again reversing the NLRB and citing the Circuit’s “rule of orderliness” about deference to prior panel decisions, the Court noted the NLRB’s remarkably candid litigation position: “The Board concedes that this court has squarely rejected both of those decisions, and that our precedents necessitate rejecting its arguments here. The Board further acknowledges that it seeks to manufacture a circuit split in order to ‘facilitate Supreme Court review.'” Employers Resource v. NLRB, No. 16-60034 (Nov. 1, 2016, unpublished).

A steel-hulled tugboat, owned by Marquette, allided with the fiberglass-hulled SES Ekwata, rendering the Ekwata unusable. In the resulting litigation, the plaintiff won damages and an award of sanctions under the district court’s inherent power. On appeal, “Marquette asserts that the fee award was unwarranted because Marquette had a good faith basis to challenge the quantum of damages and thus in proceeding through a trial. But even if true, this fact did not justify Marquette’s intransigence on liability or the means by which Marquette defended [Plainitff’s] damages claim—namely, one expert who, according to the

A steel-hulled tugboat, owned by Marquette, allided with the fiberglass-hulled SES Ekwata, rendering the Ekwata unusable. In the resulting litigation, the plaintiff won damages and an award of sanctions under the district court’s inherent power. On appeal, “Marquette asserts that the fee award was unwarranted because Marquette had a good faith basis to challenge the quantum of damages and thus in proceeding through a trial. But even if true, this fact did not justify Marquette’s intransigence on liability or the means by which Marquette defended [Plainitff’s] damages claim—namely, one expert who, according to the

district court’s findings, opined on value ‘without including any comparables, without considering the equipment on the vessel, without an accurate description of the vessel, and without reliable underlying information” and a second expert who, according to the district court’s findings, “not only failed to correct the glaringly incorrect information set forth in [the first expert’s] report, but incorporated it into his own.” Accordingly, the Fifth Circuit affirmed. Moench v. Marquette Transp. Co. (revised October 13, 2016).

Michael Swoboda sued Continental Enterprises, claiming that it conducted an investigation into alleged trademark infringement led to his wrongful discharge. He sought the production of documents that Continental alleged were protected as work product. The district court allowed the discovery and denied the intervention by Heckler & Koch, the gunmaker whose rights about the G36 submachine gun (above) were at issue and had retained Continental.

Michael Swoboda sued Continental Enterprises, claiming that it conducted an investigation into alleged trademark infringement led to his wrongful discharge. He sought the production of documents that Continental alleged were protected as work product. The district court allowed the discovery and denied the intervention by Heckler & Koch, the gunmaker whose rights about the G36 submachine gun (above) were at issue and had retained Continental.

The Fifth Circuit reversed, holding: “Continental’s work product privilege argument was overruled because Continental is a company that engages in investigative work, and the district court concluded that the discovery that Swoboda sought was produced in Continental’s ordinary course of business, i.e., in the course of a Continental investigation. HK is a gun manufacturer. Investigations are not a part of HK’s ordinary course of business. Some of the discovery that Swoboda sought was, from HK’s perspective, prepared in anticipation of litigation. We have held that an applicant-intervenor should be allowed to intervene when it ‘has a defense not available to the present defendant.’ HK has a defense unavailable to Continental, and it should have been allowed to present that defense in the district court.” Swoboda v. Manders, No. 16-30074 (Oct. 31, 2016, unpublished).

The parties to McCloskey v. McCloskey disputed whether a debt was non-dischargeable as a child support obligation. Rejecting the application of the somewhat protean doctrine of judicial estoppel, the Fifth Circuit held: “Bankruptcy courts must ‘look beyond the labels which state courts—and even parties themselves—give obligations which debtors seek to discharge.’ A party may argue in bankruptcy

The parties to McCloskey v. McCloskey disputed whether a debt was non-dischargeable as a child support obligation. Rejecting the application of the somewhat protean doctrine of judicial estoppel, the Fifth Circuit held: “Bankruptcy courts must ‘look beyond the labels which state courts—and even parties themselves—give obligations which debtors seek to discharge.’ A party may argue in bankruptcy  court that an obligation constitutes support even if she has urged to the contrary in state court. Therefore, appellees are not judicially estopped from bringing this claim.” No. 16-20079 (Oct. 31, 2016, unpublished). (Compare the recent case of Galaz v. Katona, which applied judicial estoppel in a bankruptcy case based on inconsistent statements made in earlier state court litigation about ownership interests. No. 15-50919 (Oct. 28, 2016, unpublished).

court that an obligation constitutes support even if she has urged to the contrary in state court. Therefore, appellees are not judicially estopped from bringing this claim.” No. 16-20079 (Oct. 31, 2016, unpublished). (Compare the recent case of Galaz v. Katona, which applied judicial estoppel in a bankruptcy case based on inconsistent statements made in earlier state court litigation about ownership interests. No. 15-50919 (Oct. 28, 2016, unpublished).

Cal Dive International sued Schmidt (a commercial diver), and Edwards (Schmidt’s attorney in a previous personal injury suit against Cal Dive), alleging that Schmidt had misrepresented his injuries, and seeking restitution of contingent fees paid to Edwards. Cal Dive specifically alleged that it did not believe Edwards knew of the purported fraud. Edwards sought coverage for defense costs, and the Fifth Circuit reversed a judgment in his favor: “Cal Dive’s complaint, for which Edwards seeks defense from Continental, contains no allegations against Edwards, save for his receipt of settlement funds in the nature of attorney’s fees as a result of his client’s alleged fraud. Acts or omissions in the rendering of legal services by Edwards to his client, Schmidt, are simply not at issue.” Edwards v. Continental Casualty Co., No. 15-30827 (Nov. 2, 2016).

Cal Dive International sued Schmidt (a commercial diver), and Edwards (Schmidt’s attorney in a previous personal injury suit against Cal Dive), alleging that Schmidt had misrepresented his injuries, and seeking restitution of contingent fees paid to Edwards. Cal Dive specifically alleged that it did not believe Edwards knew of the purported fraud. Edwards sought coverage for defense costs, and the Fifth Circuit reversed a judgment in his favor: “Cal Dive’s complaint, for which Edwards seeks defense from Continental, contains no allegations against Edwards, save for his receipt of settlement funds in the nature of attorney’s fees as a result of his client’s alleged fraud. Acts or omissions in the rendering of legal services by Edwards to his client, Schmidt, are simply not at issue.” Edwards v. Continental Casualty Co., No. 15-30827 (Nov. 2, 2016).

The defendant pharmacy in an FCA case provided “PPDs” — prompt payment discounts; the plaintiff alleged that they were intended to induce Medicare and Medicaid referrals. The Fifth Circuit disagreed, holding: “At best, the evidence supports a finding that Omnicare did not want unresolved settlement negotiations to

The defendant pharmacy in an FCA case provided “PPDs” — prompt payment discounts; the plaintiff alleged that they were intended to induce Medicare and Medicaid referrals. The Fifth Circuit disagreed, holding: “At best, the evidence supports a finding that Omnicare did not want unresolved settlement negotiations to

negatively impact its contract negotiations with  [skilled nursing facility] clients and was, likewise, avoiding confrontational collection practices . . . . Although Omnicare may have hoped for Medicare and Medicaid referrals, absent any evidence that Omnicare designed its settlement negotiations and debt collection practice to induce such referrals, Relator cannot show an [anti-kickback statute] violation.” Ruscher v. Omnicare, Inc., No. 15-20629 (Oct. 28, 2016).

[skilled nursing facility] clients and was, likewise, avoiding confrontational collection practices . . . . Although Omnicare may have hoped for Medicare and Medicaid referrals, absent any evidence that Omnicare designed its settlement negotiations and debt collection practice to induce such referrals, Relator cannot show an [anti-kickback statute] violation.” Ruscher v. Omnicare, Inc., No. 15-20629 (Oct. 28, 2016).

In Marshall v. Hunter, a removed action, the Fifth Circuit addressed a notice of appeal from a state court ruling made before ruling about personal jurisdiction. The Court declined to hear the appeal, saying: “while state court orders and rulings remain in effect upon removal, they do not become appealable orders of the district court until the district court adopts them as its own.” No. 16-20646 (Oct. 20, 2016, unpublished).

In Marshall v. Hunter, a removed action, the Fifth Circuit addressed a notice of appeal from a state court ruling made before ruling about personal jurisdiction. The Court declined to hear the appeal, saying: “while state court orders and rulings remain in effect upon removal, they do not become appealable orders of the district court until the district court adopts them as its own.” No. 16-20646 (Oct. 20, 2016, unpublished).

The receiver for Allen Stanford’s businesses sought to recover the proceeds of large certificates of deposit from two investment entities associated with the Libyan government. The district court dismissed one of the entities pursuant to the Foreign Sovereign Immunities Act, and allowed the claim against the other to proceed. The Fifth Circuit reversed as to that entity, finding that the instruments at issue “did not require any act in the United States, much less the act of funneling money through the Stanford scheme or any Stanford entities in the United States,” and that the entity’s “commercial activity was limited to its obligations under teh . . . CDs, which . . . did not require any activity in the United States.” Janvey v. Libyan Inv. Auth., Nos. 15-10545 & 10548 (Oct. 26, 2016).

The receiver for Allen Stanford’s businesses sought to recover the proceeds of large certificates of deposit from two investment entities associated with the Libyan government. The district court dismissed one of the entities pursuant to the Foreign Sovereign Immunities Act, and allowed the claim against the other to proceed. The Fifth Circuit reversed as to that entity, finding that the instruments at issue “did not require any act in the United States, much less the act of funneling money through the Stanford scheme or any Stanford entities in the United States,” and that the entity’s “commercial activity was limited to its obligations under teh . . . CDs, which . . . did not require any activity in the United States.” Janvey v. Libyan Inv. Auth., Nos. 15-10545 & 10548 (Oct. 26, 2016).