While arising from the Federal Circuit’s patent jurisdiction rather than the Fifth Circuit, the Supreme Court’s unanimous May 22 decision in TC Heartland LLC v. Kraft Foods Group Brands LLC is of great interest to all local corporations involved in patent litigation: “As applied to domestic corporations, ‘reside[nce]’ in [28 U.S.C.] § 1400(b) refers only to the State of incorporation.”

Green Tree Servicing, LLC v. Clayton involved an unusual argument about the “first-to-file rule, in the context of two actions pending before the same district judge. The Fifth Circuit observed: “[T]he concerns undergirding the firstto-file rule are not triggered when the cases are before the same judge. The first-to-file rule is aimed at avoiding both conflicting rulings on similar issues and duplicative rulings. But when the same judge is deciding both cases, there is no danger of conflicting rulings.” No. 16-60726 (May 18, 2017, unpublished).

Green Tree Servicing, LLC v. Clayton involved an unusual argument about the “first-to-file rule, in the context of two actions pending before the same district judge. The Fifth Circuit observed: “[T]he concerns undergirding the firstto-file rule are not triggered when the cases are before the same judge. The first-to-file rule is aimed at avoiding both conflicting rulings on similar issues and duplicative rulings. But when the same judge is deciding both cases, there is no danger of conflicting rulings.” No. 16-60726 (May 18, 2017, unpublished).

Document logs are a necessary, if unloved, feature of privilege disputes. A privilege log is inherently difficult to create, since it must describe the relevant documents but not reveal the privileged information in them. And because a log often lists many documents on the same subject, it can quickly become dull and repetitive. But proper preparation of a log is key to litigating about privilege, as the Fifth Circuit recently held in EEOC v. BDO Seidman LLP when it rejected the sufficiency of the defendant’s log in an employment case. No. 16-20314 (May 4, 2017). The opinion provides four practical tips for attorneys involved in privilege disputes.

Document logs are a necessary, if unloved, feature of privilege disputes. A privilege log is inherently difficult to create, since it must describe the relevant documents but not reveal the privileged information in them. And because a log often lists many documents on the same subject, it can quickly become dull and repetitive. But proper preparation of a log is key to litigating about privilege, as the Fifth Circuit recently held in EEOC v. BDO Seidman LLP when it rejected the sufficiency of the defendant’s log in an employment case. No. 16-20314 (May 4, 2017). The opinion provides four practical tips for attorneys involved in privilege disputes.

The case began when Hang Bower, a former HR manager at BDO Seidman, alleged that she had been subjected to gender discrimination. In response to an EEOC subpoena, BDO prepared a privilege log listing 278 documents. The EEOC filed an enforcement action in federal court, offering a declaration from Bower in support. In it, she said that many of the communications “were made for the primary purpose of conveying business directives or factual information.” She also said that “BDO required her . . . to include in HR-related emails a false designation that the communication was prepared ‘at the request of legal counsel.’”

The case began when Hang Bower, a former HR manager at BDO Seidman, alleged that she had been subjected to gender discrimination. In response to an EEOC subpoena, BDO prepared a privilege log listing 278 documents. The EEOC filed an enforcement action in federal court, offering a declaration from Bower in support. In it, she said that many of the communications “were made for the primary purpose of conveying business directives or factual information.” She also said that “BDO required her . . . to include in HR-related emails a false designation that the communication was prepared ‘at the request of legal counsel.’”

The magistrate judge found that BDO’s log was adequate, declined to do an in camera review of the documents, and denied relief to the EEOC. The district judge affirmed and the Fifth Circuit reversed, identifying four particular areas of concern:

- Substance. “[N]umerous log entries fail to identify a sender, recipient, date, or provide a substantive description of the subject matter . . . [s]ome entries have only vague descriptions such as ‘discrimination claim,’ ‘internal investigation,’ or ‘work environment claim’”

- Email chains. “Emails involving counsel are also problematic, as the log’s descriptions do not indicate whether a particular entry consists of one email or a string of emails – a distinction that may be dispositive as to whether the privilege applies.”

- Business/Legal distinction. “[N]ot only does the log include conclusory descriptions of ‘legal advice,’ it does so in the context of communications with in-house counsel – an area court have acknowledged presents unique challenges . . . further compounded where HR personnel, such as Bower, are involved.” The Court noted the issues raised in Bower’s declaration.

- Disclosure. “[T]he log leaves open questions about (1) whether emails courtesy copied to a third party remained privileged . . . (2) whether matters communicated to attorneys were done so with the intention of remaining privileged . . . and (3) whether non-attorney individuals to whom communications were sent were within the sphere of confidence . . . .”

Because the log lacked sufficient detail to establish BDO’s prima facie case of attorney-client privilege as to all the entries, the Fifth Circuit found that the magistrate judge’s legal analysis was flawed and remanded. The Court observed: “Although we leave to the district court’s discretion how to proceed on remand, we note that in camera review will likely be necessary given the facts and circumstances of this case.”

In addition to reminding about four key components of a good privilege log, this opinion reinforces the importance of evidence in resolving a privilege dispute. Bower’s declaration raised questions about the information in the log, which could not be resolved by the log entries themselves. Counsel preparing a privilege log thus needs to not only consider the completeness of the log entries, but how those entries will be supported by evidence and in camera review if there are further proceedings.

For a recent CLE presentation, I prepared the attached one-page chart to summarize the Fifth Circuit’s recent holdings about discovery.

The district court in Salas v. GE Oil & Gas ordered arbitration in 2014 and dismissed the case. The arbitration did not proceed. Each side blamed the other; the district court had a status conference in 2016; and afterwards, withdrew its earlier order and reopened the case. The Fifth Circuit found that the district court lacked jurisdiction to do so, as its 2016 order “did not fall within the narrow scope of th[e] ancillary jurisdiction” provided by section 4 of the FAA: “The court neither determined whether the parties’ agreement to arbitrate was valid nor enforced that agreement. Instead, the court found that the parties had ‘failed’ to arbitrate and withdrew its prior order compelling arbitration. This was not permitted under the FAA.” No. 16-20379 (May 12, 2017).

In Slade v. Progressive Insurance, a putative class survived a challenge to its damages model based on Comcast Corp. v. Behrend, 133 S. Ct. 1426 (2013). The Fifth Circuit concluded that the class avoided Scylla “by essentially rerunning Defendant’s calculation of actual cash value [for a damaged car] but with a lawful base value, Plaintiffs’ damages theory only pays damages resulting from the allegedly unlawful base value.” But the class then encountered Charybdis when a new issue arose from that calculation: “[B]y accepting Defendant’s condition score calculation as is, [named] Plaintiffs may have impermissibly waived unnamed class members’ ability to assert a future claim contesting Defendants’s computation” of a figure called “the condition factor.” This potential waiver raised a question as to whether the class representatives could adequately represent the class memebrs who might wish to challenge that factor, and the Court remanded for further consideration of that aspect of class certification. The Court also reminded that “a fraud class action cannot be certified when individual reliance will be an issue”; a particularly relevant reminder after the recent approval of class certification in Torres v. SGE Management, 838 F.3d 629 (5th Cir. 2016) (en banc). No. 15-30010 (May 9, 2017).

In Slade v. Progressive Insurance, a putative class survived a challenge to its damages model based on Comcast Corp. v. Behrend, 133 S. Ct. 1426 (2013). The Fifth Circuit concluded that the class avoided Scylla “by essentially rerunning Defendant’s calculation of actual cash value [for a damaged car] but with a lawful base value, Plaintiffs’ damages theory only pays damages resulting from the allegedly unlawful base value.” But the class then encountered Charybdis when a new issue arose from that calculation: “[B]y accepting Defendant’s condition score calculation as is, [named] Plaintiffs may have impermissibly waived unnamed class members’ ability to assert a future claim contesting Defendants’s computation” of a figure called “the condition factor.” This potential waiver raised a question as to whether the class representatives could adequately represent the class memebrs who might wish to challenge that factor, and the Court remanded for further consideration of that aspect of class certification. The Court also reminded that “a fraud class action cannot be certified when individual reliance will be an issue”; a particularly relevant reminder after the recent approval of class certification in Torres v. SGE Management, 838 F.3d 629 (5th Cir. 2016) (en banc). No. 15-30010 (May 9, 2017).

The receiver for the Allen Stanford businesses alleged that Stanford Coins and Bullion made fraudulent transfers to Dilllon Gage, a wholesaler of coins and precious metals. The receiver lost at trial and the Fifth Circuit affirmed in Janvey v. Dillon Gage, Inc., No. 15-1121 (May 5, 2017). The Court noted conflicting evidence about SCB’s subjective belief as to its ability to pay all creditors, supported by objective evidence about its saleable inventory at the relevant time. The Court also found no reversible error in a jury charge that did not expressly define “intent,” or in the instructions given on other aspects of a fraudulent transfer claim under Texas law.

The receiver for the Allen Stanford businesses alleged that Stanford Coins and Bullion made fraudulent transfers to Dilllon Gage, a wholesaler of coins and precious metals. The receiver lost at trial and the Fifth Circuit affirmed in Janvey v. Dillon Gage, Inc., No. 15-1121 (May 5, 2017). The Court noted conflicting evidence about SCB’s subjective belief as to its ability to pay all creditors, supported by objective evidence about its saleable inventory at the relevant time. The Court also found no reversible error in a jury charge that did not expressly define “intent,” or in the instructions given on other aspects of a fraudulent transfer claim under Texas law.

I am speaking on the topic “Ethics 2017: Recent Federal Court Decisions to Know” on Friday, May 5, to the Plano Bar Association (noon at Palio’s Pizza, yum) – here is the PowerPoint that I will be using.

In the case of In re Hermesmeyer, No. 16-11189 (May 2, 2017, unpublished), the Fifth Circuit found no abuse of discretion in the $500 sanction imposed by the district court as a result of the below Q-and-A between the court and counsel:

In the case of In re Hermesmeyer, No. 16-11189 (May 2, 2017, unpublished), the Fifth Circuit found no abuse of discretion in the $500 sanction imposed by the district court as a result of the below Q-and-A between the court and counsel:

THE COURT: Okay. Let’s see. There were some—there were two objections filed, and I believe both of them were related to the possibility of a sentence above the top of the advisory guideline range. Did I read those correctly, Mr. Hermesmeyer?

MR. HERMESMEYER: Your Honor, I think they have more to do with legality of whether such a sentence would be permissible or appropriate.

THE COURT: I’m sorry, I was wondering if I’m correct in thinking that both of the objections have to do with the possibility of a sentence above the top of the advisory guideline range. What is the answer to that?

MR. HERMESMEYER: Your Honor, just what I said.

THE COURT: I’m not sure I understand how that answered my question. I’ve asked the question again. Would you please answer the question either yes or no.

MR. HERMESMEYER: Your Honor, I would stand on what I previously said. Thank you.

THE COURT: Mr. Hermesmeyer, you get very close to being held in contempt of court. Would you answer my question?

MR. HERMESMEYER: I have no further response, your Honor.

THE COURT: Okay. Mr. Hermesmeyer, I’ve ordered you to answer my question, and you’ve refused to answer it. I conside that you’re in civil contempt of court, and also you’re in violation of one of the local rules that requires attorneys to appropriately conduct themselves and to respond and answer orders of the Court. I’m going to give you another opportunity to answer my question. And if you would like, if you decline to answer my question, I’ll give you an opportunity at this time to respond to my suggestion that you will be held in civil contempt of court and held in violation of the local rule concerning the conduct of attorneys, if you refuse to answer my question. You may proceed.

[Pause in proceedings.]

THE COURT: Okay. Apparently you’re not going to respond. I’m ordering that you are in violation of the local rule. Let me get the exact number of it.

HERMESMEYER: Your Honor, at this point I would move to withdraw from the representation of [the defendant] given the indications that the Court has made. [He] needs an attorney that’s not under the threat of civil contempt or whatever sort of contempt

that the Court is indicating at this point.THE COURT: I deny that motion. Rule of Criminal Procedure LCR 57.8(b) says: A presiding judge, after giving an opportunity to show cause to the contrary, may take any appropriate disciplinary action against a member of the bar for conduct unbecoming a member of the bar and failure to comply with any order of the Court. I consider that you have violated that rule in both respects. I’ll give you an opportunity—I’ve given you an opportunity to show cause why you shouldn’t be disciplined for that and you’ve declined to respond, so I’m ordering that you pay a $500 fine, and that it be paid by 2:00 today, and be paid to the office of the clerk of court here in Fort Worth.

In Austin v. Kroger Texas LP, the Fifth Circuit reversed a summary judgment for the defendant in a slip-and-fall case. On the merits, among other holdings of general interest, the Court noted:

In Austin v. Kroger Texas LP, the Fifth Circuit reversed a summary judgment for the defendant in a slip-and-fall case. On the merits, among other holdings of general interest, the Court noted:

- “[A] janitor with fifteen years’ experience is competent to testify about the effectiveness of cleaning products and methods.”;

- When coupled with evidence from “Kroger’s handbook” and the manager’s testimony about “the safety practice at the store,” the plaintiff raised a fact issue;

- “[T]he fact that [Plaintiff] had successfuly cleaned a much smaller spill . . . with a dry mop does not conclusively demonstrate that Spill Magic was not necessary for [him] to safely clean a much larger and more serious spill.”

Procedurally, the Court instructed that the trial court should proceed under “the more flexible Rule 54(b)” on remand rather than “the heightened standard of Rule 59(e),” asking that it “construe the procedural rules with a preference toward resolving the case on the merits and avoiding any dismissal based on a technicality.” No. 16-10502 (April 14, 2017).

An insured disputed whether he had claimed ownership of a particular piece of property in a conversation with an insurance agent, Specifically, while testifying in his deposition that he did not remember the specific questions asked, the conversation did not last very long – implying that the agent simply assumed his ownership of the propertuy. “[H]owever, n both his answer to State Farm’s complaint and his response to State Farm’s request for admission, [the insured] admitted to telling the agent who took his insurance application that he was the owner of the property and to stating as much in his application. The district court concluded that these facts were judicially admitted, and therefore rejected Appellants’ argument as an impermissible ‘attempt to create a dispute around a material fact already admitted.’” State Farm v. Flowers, No. 16-60310 (April 26, 2017).

An insured disputed whether he had claimed ownership of a particular piece of property in a conversation with an insurance agent, Specifically, while testifying in his deposition that he did not remember the specific questions asked, the conversation did not last very long – implying that the agent simply assumed his ownership of the propertuy. “[H]owever, n both his answer to State Farm’s complaint and his response to State Farm’s request for admission, [the insured] admitted to telling the agent who took his insurance application that he was the owner of the property and to stating as much in his application. The district court concluded that these facts were judicially admitted, and therefore rejected Appellants’ argument as an impermissible ‘attempt to create a dispute around a material fact already admitted.’” State Farm v. Flowers, No. 16-60310 (April 26, 2017).

In a break from the usual topics about federal procedure, today’s post about the case of Foster v. Woods provides some practical advice for private investigators. Foster, a licensed private investigator, tailed a car into a school parking lot and observed it for a short period before realizing that the driver was his target’s teenaged son. Unfortunately for Foster, the son observed him and told a friend, whose father was the local sheriff. After Foster left the school grounds the sheriff arrested him and unsuccessfully attempted to prosecute him for having brought a firearm onto school grounds (although Foster held a concealed-carry permit, and neither he nor the firearm left the car while in the school parking lot. Foster sued for wrongful arrest; the Fifth Circuit affirmed summary judgment for the sheriff: “Relevant here, Woods knew that Foster was not a student, that he followed a student’s vehicle into a student parking lot posted with a ‘no trespassing” sign, and that Foster remained in the lot for some time as students were arriving for school. . . . Given the facts known to Woods, he had knowledge that would warrant a reasonable officer to believe that Foster violated the trespass statute.” Advice – use caution when entering private property.

In a break from the usual topics about federal procedure, today’s post about the case of Foster v. Woods provides some practical advice for private investigators. Foster, a licensed private investigator, tailed a car into a school parking lot and observed it for a short period before realizing that the driver was his target’s teenaged son. Unfortunately for Foster, the son observed him and told a friend, whose father was the local sheriff. After Foster left the school grounds the sheriff arrested him and unsuccessfully attempted to prosecute him for having brought a firearm onto school grounds (although Foster held a concealed-carry permit, and neither he nor the firearm left the car while in the school parking lot. Foster sued for wrongful arrest; the Fifth Circuit affirmed summary judgment for the sheriff: “Relevant here, Woods knew that Foster was not a student, that he followed a student’s vehicle into a student parking lot posted with a ‘no trespassing” sign, and that Foster remained in the lot for some time as students were arriving for school. . . . Given the facts known to Woods, he had knowledge that would warrant a reasonable officer to believe that Foster violated the trespass statute.” Advice – use caution when entering private property.

In DeLeon v. Abbott, the Fifth Circuit affirmed an award of $585,470.30 in attorneys’ fees and $20,202.90 in costs arising from the Texas counterpart to Obergefell v. Hodges, 135 S. Ct. 2584 (2015). The panel majority observed that “the essential goal in shifting fees (to either party) is to do rough justice,” and that as a result, “[w]e can hardly think of a sphere of judicial decisionmaking in which appellate micromanagement has less to recommend it.” A dissent, observing that “deference is a blank check,” approved of the bulk of the award but took issue with it as to time spent on (a) an unsuccessful third-party motion to intervene; (b) interacting with the media; and (c) coordinating with supportin amici. No. 15-51241 (April 18, 2017, unpublished).

In DeLeon v. Abbott, the Fifth Circuit affirmed an award of $585,470.30 in attorneys’ fees and $20,202.90 in costs arising from the Texas counterpart to Obergefell v. Hodges, 135 S. Ct. 2584 (2015). The panel majority observed that “the essential goal in shifting fees (to either party) is to do rough justice,” and that as a result, “[w]e can hardly think of a sphere of judicial decisionmaking in which appellate micromanagement has less to recommend it.” A dissent, observing that “deference is a blank check,” approved of the bulk of the award but took issue with it as to time spent on (a) an unsuccessful third-party motion to intervene; (b) interacting with the media; and (c) coordinating with supportin amici. No. 15-51241 (April 18, 2017, unpublished).

The case of Decatur Hospital Authority v. Aetna Health Inc. involved a remand order, granted on the basis of timelieness (a ruling not ordinarily appealable because of 28 USC § 1447(c)), but where the notice of removal referred to the federal officer removal statute (made reviewable by the less-well-known § 1447(d)). The Fifth Circuit concluded that its review involved “[n]ot particular reasons for an order, but the order itself,” and went to affirm the remand and a related fee award, finding that the defendant did not learn new facts from an interrogatory answer that were not also contained in the original petition. No. 16-10313 (April 18, 2017).

Oubre, struck by an errant forklift, sued Schlumberger for his injuries. To avoid a limitations problem, he cited a choice-of-law provision in the Master Service Agreement between his employer and Schlumberger. The provision ultimately did not help him, and the Fifth Circuit observed that it “does not pose a renvoi issue.” Oubre v. Schlumberger, Ltd., No. 16-41446 (April 5, 2017, unpublished). That term, accurate although infrequently-used, is defined by Black’s as “[t]he doctrine under which a court, in resorting to foreign law, also adopts the foreign law’s conflict-of-laws principles, which may in turn refer the court back to the law of the forum.”

Oubre, struck by an errant forklift, sued Schlumberger for his injuries. To avoid a limitations problem, he cited a choice-of-law provision in the Master Service Agreement between his employer and Schlumberger. The provision ultimately did not help him, and the Fifth Circuit observed that it “does not pose a renvoi issue.” Oubre v. Schlumberger, Ltd., No. 16-41446 (April 5, 2017, unpublished). That term, accurate although infrequently-used, is defined by Black’s as “[t]he doctrine under which a court, in resorting to foreign law, also adopts the foreign law’s conflict-of-laws principles, which may in turn refer the court back to the law of the forum.”

At oral argument, the appellant in a technical dispute about the appointment of arbitrators “argued for the first time that ‘if maritime jurisdiction applies, then . . . there is appellate jurisdiction over the appeal.'” The Fifth Circuit observed: “We do not usually allow parties to raise a new argument for the first time at oral argument. . . . Of course, an argument that this court lacks jurisdiction cannot be waived, but here the argument is that the court has jurisdiction, a matter the appellant is required to prove.” Bordelon Marine, LLC v. Bibby Subsea ROV, LLC, No. 16-30847 (April 14, 2017, unpublished).

At oral argument, the appellant in a technical dispute about the appointment of arbitrators “argued for the first time that ‘if maritime jurisdiction applies, then . . . there is appellate jurisdiction over the appeal.'” The Fifth Circuit observed: “We do not usually allow parties to raise a new argument for the first time at oral argument. . . . Of course, an argument that this court lacks jurisdiction cannot be waived, but here the argument is that the court has jurisdiction, a matter the appellant is required to prove.” Bordelon Marine, LLC v. Bibby Subsea ROV, LLC, No. 16-30847 (April 14, 2017, unpublished).

Streamline Production Systems v. Streamline Manufacturing involved trademark litigation between businesses with similar names. The Fifth Circuit affirmed theury’s findings about the distinctiveness of the plaintiff’s mark and the likelihood of confusion, observing that the various factors did not all point the same way but “there is not a complete absence of evidence” to support what the jury found. The court reversed on remedy, however, finding that the “reasonable royalty” damages went beyond the scope of the infringement, and that the award of unjust enrichment was not supported by evidence of lost profits or willful action by the defendant. No. 16-20046 (revised April 14, 2017).

Streamline Production Systems v. Streamline Manufacturing involved trademark litigation between businesses with similar names. The Fifth Circuit affirmed theury’s findings about the distinctiveness of the plaintiff’s mark and the likelihood of confusion, observing that the various factors did not all point the same way but “there is not a complete absence of evidence” to support what the jury found. The court reversed on remedy, however, finding that the “reasonable royalty” damages went beyond the scope of the infringement, and that the award of unjust enrichment was not supported by evidence of lost profits or willful action by the defendant. No. 16-20046 (revised April 14, 2017).

Sun-Tzu famously counseled, “[a]ll armies prefer high ground to low and sunny places to dark.” The defendant airline in Conservation Force v. Delta Air Lines artfully changed the ground for conflict in a case about its policies toward shipments involving big game hunts. The plaintiff complained that the airlines’ policy of not accepting the shipment of lion, leopard, elephant, rhino and buffalo hunting trophies violated the airlines’ legal duty to treat all shippers equally. The Fifth Circuit agreed with the district court’s conclusion “that, despite a duty to treat all shippers equally, a common carrier does not have to treat all cargo equally.” No. 16-11062 (March 20, 2017, unpublished).

Sun-Tzu famously counseled, “[a]ll armies prefer high ground to low and sunny places to dark.” The defendant airline in Conservation Force v. Delta Air Lines artfully changed the ground for conflict in a case about its policies toward shipments involving big game hunts. The plaintiff complained that the airlines’ policy of not accepting the shipment of lion, leopard, elephant, rhino and buffalo hunting trophies violated the airlines’ legal duty to treat all shippers equally. The Fifth Circuit agreed with the district court’s conclusion “that, despite a duty to treat all shippers equally, a common carrier does not have to treat all cargo equally.” No. 16-11062 (March 20, 2017, unpublished).

In Smitherman v. Bayview Loan Servicing LLC, the Fifth Circuit order a limited remand to the district court, so that court could supplement the record about the defendant’s citizenship and then make findings. The district court, however, went on to vacate the judgment it had entered previously and remand the case to state court. The Fifth Circuit observed: “Because the district court lacked the authority to do so, we construe it[]s order to be an indicative ruling made pursuant to Federal Rule of Civil Procedure 62.1(a)(2). Accordingly, we REMAND this case to the district court and DISMISS the appeal as moot and relinquish jurisdiction pursuant to Federal Rule of Appellate Procedure 12.1(b).” No. 16-20328 (March 29, 2017, unpublished).

In Smitherman v. Bayview Loan Servicing LLC, the Fifth Circuit order a limited remand to the district court, so that court could supplement the record about the defendant’s citizenship and then make findings. The district court, however, went on to vacate the judgment it had entered previously and remand the case to state court. The Fifth Circuit observed: “Because the district court lacked the authority to do so, we construe it[]s order to be an indicative ruling made pursuant to Federal Rule of Civil Procedure 62.1(a)(2). Accordingly, we REMAND this case to the district court and DISMISS the appeal as moot and relinquish jurisdiction pursuant to Federal Rule of Appellate Procedure 12.1(b).” No. 16-20328 (March 29, 2017, unpublished).

“[W]here a plaintiff seeks to rely on epidemiological evidence, Texas law requires that the stifues show a statistically significant doubling of the risk of developing their alleged inuiries. . . . The studies relied on by the Plaintiffs and their experts do not . . . One of these studies did not quantify the risk of developing Plaintiffs’ chromuim-related-acute-irritation injuries at all and the other study did not find a doubling of the risk.” McManaway v. KBR, Inc., No. 15-20641 (March 27, 2017) (applying Merck & Co. v. Garza, 347 S.W.3d 256 (Tex. 2011)).

“[W]here a plaintiff seeks to rely on epidemiological evidence, Texas law requires that the stifues show a statistically significant doubling of the risk of developing their alleged inuiries. . . . The studies relied on by the Plaintiffs and their experts do not . . . One of these studies did not quantify the risk of developing Plaintiffs’ chromuim-related-acute-irritation injuries at all and the other study did not find a doubling of the risk.” McManaway v. KBR, Inc., No. 15-20641 (March 27, 2017) (applying Merck & Co. v. Garza, 347 S.W.3d 256 (Tex. 2011)).

In Ocwen Loan Servicing LLC v. Berry, a dispute about a home equity loan, the Fifth Circuit confirmed that “we now must follow the Texas Supreme Court’s holding in [Wood v. HSBC Bank USA, N.A., 505 S.W.3d 542 (Tex. 2016)] that no statute of limitations applies to a borrower’s allegations of violations of section 50(a)(6) of the Texas Constitution in a quiet title action, rather than our prior holding in [Priester v. JP Morgan Chase Bank, N.A., 708 F.3d 667 (5th Cir. 2013)].” In so doing, the Court reminded that “the issues-not-briefed-are-waived rule is a prudential construct that requires the exercise of discretion,” and addressed the applicability of Wood notwithstanding the appellant not discussing the case in its opening brief, noting that the underlying issues had been briefed, and that the Court had received supplemental briefing on the pure question of law presented about the application of Wood. No. 16-10604 (March 29, 2017).

In Ocwen Loan Servicing LLC v. Berry, a dispute about a home equity loan, the Fifth Circuit confirmed that “we now must follow the Texas Supreme Court’s holding in [Wood v. HSBC Bank USA, N.A., 505 S.W.3d 542 (Tex. 2016)] that no statute of limitations applies to a borrower’s allegations of violations of section 50(a)(6) of the Texas Constitution in a quiet title action, rather than our prior holding in [Priester v. JP Morgan Chase Bank, N.A., 708 F.3d 667 (5th Cir. 2013)].” In so doing, the Court reminded that “the issues-not-briefed-are-waived rule is a prudential construct that requires the exercise of discretion,” and addressed the applicability of Wood notwithstanding the appellant not discussing the case in its opening brief, noting that the underlying issues had been briefed, and that the Court had received supplemental briefing on the pure question of law presented about the application of Wood. No. 16-10604 (March 29, 2017).

Moore sued the Governor of Mississippi, alleging that the presence of the Confederate battle flag in the Mississippi state flag (right) violated Moore’s rights under the Equal Protection Clause. The Fifth Circuit affirmed dismissal on standing grounds, distinguishing cases involving the First Amendment’s Establishment Clause because of the distinct injuries addressed by the two Constitutional provisions. The Court concluded: “The assumption that if [Plainitff] had no standing to sue, no one would have standing, is not a reason to find standing.” (citations omitted). Moore v. Bryant, No. 16-60616 (March 31, 2017).

Moore sued the Governor of Mississippi, alleging that the presence of the Confederate battle flag in the Mississippi state flag (right) violated Moore’s rights under the Equal Protection Clause. The Fifth Circuit affirmed dismissal on standing grounds, distinguishing cases involving the First Amendment’s Establishment Clause because of the distinct injuries addressed by the two Constitutional provisions. The Court concluded: “The assumption that if [Plainitff] had no standing to sue, no one would have standing, is not a reason to find standing.” (citations omitted). Moore v. Bryant, No. 16-60616 (March 31, 2017).

Plaintiffs alleged that a terrible crime would have been averted with a faster response to a 9-1-1 call. The Fifth Circuit, applying City of Dallas v. Sanchez, 494 S.W.3d 722 (Tex. 2016), found a lack of proximate cause (and thus, immunity applied) because “plaintiffs have not plausibly alleged that any of the intervening parties would have acted differently,” including the call center operator and emergency personnel on the scene. The allegations on the general subject of response time were too speculative to satisfy Twombly (footnote 4). And “‘even if the brief delay in relaying Cook’s location ‘contributed to circumstances that delayed potentially life-saving assistance, the [delay] was too attenuated from the cause of [Cook’s] death . . . to be a proximate cause.” Cook v. City of Dallas, No. 16-10105 (March 29, 2017).

Several crawfishermen sued about the effects of canal dredging on the Atchafalaya Basin fisheries. As to one defendant company, the Fifth Circuit affirmed summary judgment in its favor, reviewing each of the documents cited by plaintiffs and finding that none raised a genuine issue of material fact as to actual dredging activity by that company, on the pipelines at issue in this case. As to another, the Court reversed on procedural grounds, finding that the district court should have considered a deposition transcript and responses to requests for admissions offered by the plaintiffs when (1) their proffer had a foundation in the terms of the case management order, (2) the evidence was probative, and (3) it was information obtained from that defendant. In re Louisiana Crawfish Producers, No. 16-30353 (March 28, 2017). (The opinion notes that crawfish are known by several other names, including “yabbies,” a tidbit that was not known to this author.)

Several crawfishermen sued about the effects of canal dredging on the Atchafalaya Basin fisheries. As to one defendant company, the Fifth Circuit affirmed summary judgment in its favor, reviewing each of the documents cited by plaintiffs and finding that none raised a genuine issue of material fact as to actual dredging activity by that company, on the pipelines at issue in this case. As to another, the Court reversed on procedural grounds, finding that the district court should have considered a deposition transcript and responses to requests for admissions offered by the plaintiffs when (1) their proffer had a foundation in the terms of the case management order, (2) the evidence was probative, and (3) it was information obtained from that defendant. In re Louisiana Crawfish Producers, No. 16-30353 (March 28, 2017). (The opinion notes that crawfish are known by several other names, including “yabbies,” a tidbit that was not known to this author.)

Defendant hosted a website with a public forum called “HairTalk.” Plaintiffs sued for copyright infringement when celebrity photos, to which they owned the rights, were posted by third-party users on HairTalk without their consent. The Fifth Circuit affirmed summary judgment for Defendant, adopting

a website with a public forum called “HairTalk.” Plaintiffs sued for copyright infringement when celebrity photos, to which they owned the rights, were posted by third-party users on HairTalk without their consent. The Fifth Circuit affirmed summary judgment for Defendant, adopting  the “volitional conduct” requirement for direct infringement cases, and observing: “[I]t does not make sense to adopt a rule that could lead to the liability of countless parties whose role in the infringement is nothing more than setting up and operating a system that is necessary for the functioning of the Internet.” BWP Media USA v. T&S Software, No. 16-10510 (March 27, 2017).

the “volitional conduct” requirement for direct infringement cases, and observing: “[I]t does not make sense to adopt a rule that could lead to the liability of countless parties whose role in the infringement is nothing more than setting up and operating a system that is necessary for the functioning of the Internet.” BWP Media USA v. T&S Software, No. 16-10510 (March 27, 2017).

An architecture firm held a large judgment against a bankruptcy debtor, and contended that the failure of the debtor’s insurer to object to that claim barred further dispute about the insurer’s liability. The Fifth Circuit disagreed, concluding that “in this no asset bankruptcy case, nothing in the court proceedings required claims allowance, no notice was provided to parties in interest to object to claims, and no bankruptcy purpose would have been served by the bankruptcy court’s adjudicating [the firm’s claim.” Kipp Flores Architects v. Mid-Continent Casualty Co., No. 16-20255 (March 24, 2017).

An architecture firm held a large judgment against a bankruptcy debtor, and contended that the failure of the debtor’s insurer to object to that claim barred further dispute about the insurer’s liability. The Fifth Circuit disagreed, concluding that “in this no asset bankruptcy case, nothing in the court proceedings required claims allowance, no notice was provided to parties in interest to object to claims, and no bankruptcy purpose would have been served by the bankruptcy court’s adjudicating [the firm’s claim.” Kipp Flores Architects v. Mid-Continent Casualty Co., No. 16-20255 (March 24, 2017).

Reviewing the requirements for the application of judicial estoppel, the Fifth Circuit reversed the resolution of a case about insurance coverage of attorneys fees in Aldous v. Darwin Nat’l Assurance Co., No. 16-10537 (March 16, 2017). The Court found that the district court misapplied judicial estoppel when it “unjustifiably read the [key] supplemental declaration in isolation,” and made several “small antecedent errors” leading up to that ruling, including its reading of the relevant earlier decision.

Reviewing the requirements for the application of judicial estoppel, the Fifth Circuit reversed the resolution of a case about insurance coverage of attorneys fees in Aldous v. Darwin Nat’l Assurance Co., No. 16-10537 (March 16, 2017). The Court found that the district court misapplied judicial estoppel when it “unjustifiably read the [key] supplemental declaration in isolation,” and made several “small antecedent errors” leading up to that ruling, including its reading of the relevant earlier decision.

Air Evac contended that the Airline Deregulation Act preempted Texas workers compensation laws about reimbursement for air-ambulance services. This claim led to a dispute about the scope of Eleventh Amendment liability and the landmark Constitutional case of Ex parte Young, 209 U.S. 123 (1908). In a methodical analysis of Young’s history and purpose, the Fifth Circuit concluded that Air Evac could sue: “[T]he balance-billing prohibition works in concert with state defendants’ implementation of the reimbursement system, serving as a backstop against alternative methods of fee collection. State defendants’ pervasive authority to oversee and enforce Texas’ workers’-compensation system satisfies the Ex parte Young exception.” Air Evac EMS, Inc. v. State of Texas, No. 16-51023 (March 20, 2017).

Air Evac contended that the Airline Deregulation Act preempted Texas workers compensation laws about reimbursement for air-ambulance services. This claim led to a dispute about the scope of Eleventh Amendment liability and the landmark Constitutional case of Ex parte Young, 209 U.S. 123 (1908). In a methodical analysis of Young’s history and purpose, the Fifth Circuit concluded that Air Evac could sue: “[T]he balance-billing prohibition works in concert with state defendants’ implementation of the reimbursement system, serving as a backstop against alternative methods of fee collection. State defendants’ pervasive authority to oversee and enforce Texas’ workers’-compensation system satisfies the Ex parte Young exception.” Air Evac EMS, Inc. v. State of Texas, No. 16-51023 (March 20, 2017).

Adams LLC, formed in July 2010, bought a number of assets from Adams Produce Company, Inc., and sought to prosecute a Deepwater Horizon claim for damages suffered by Adams Inc. Unfortunately, “[a]lthough substantially alll of Adams Inc.’s assets

Adams LLC, formed in July 2010, bought a number of assets from Adams Produce Company, Inc., and sought to prosecute a Deepwater Horizon claim for damages suffered by Adams Inc. Unfortunately, “[a]lthough substantially alll of Adams Inc.’s assets  and liabilities were transferred as part of the transaction, it is undisputed that Adams Inc. retained certain assets and liabilities. Adams Inc. and Adams LLC are two distinct entities, and the asset transfer that occurred here was not just a change in form.” BP Exploration v. Claimant ID 100169608, No. 16-30482 (March 8, 2017, unpublished).

and liabilities were transferred as part of the transaction, it is undisputed that Adams Inc. retained certain assets and liabilities. Adams Inc. and Adams LLC are two distinct entities, and the asset transfer that occurred here was not just a change in form.” BP Exploration v. Claimant ID 100169608, No. 16-30482 (March 8, 2017, unpublished).

The Fifth Circuit affirmed a summary judgment for the defendants in the FCA case of Abbott v. BP Exploration & Production; after describing the alleged fact issues about “whether engineers approved the various stages of construction of the Atlantis [offshore oil platform],” it noted: “Rarely does the pursuit of an individual’s FCA claims lead to an investigation requested by Congress. But that is the case with these Plaintiffs, whose insistence on the alleged issues with the Atlantis led to Congressional hearings, an investigation by a federal agency, and the [De[artment of the Interior] Report,” which “found no grounds to suspend the operation of the Atlantis or revoke BP’s designation as an operator.” No. 16-20028 (March 14, 2017).

The Fifth Circuit affirmed a summary judgment for the defendants in the FCA case of Abbott v. BP Exploration & Production; after describing the alleged fact issues about “whether engineers approved the various stages of construction of the Atlantis [offshore oil platform],” it noted: “Rarely does the pursuit of an individual’s FCA claims lead to an investigation requested by Congress. But that is the case with these Plaintiffs, whose insistence on the alleged issues with the Atlantis led to Congressional hearings, an investigation by a federal agency, and the [De[artment of the Interior] Report,” which “found no grounds to suspend the operation of the Atlantis or revoke BP’s designation as an operator.” No. 16-20028 (March 14, 2017).

The Clarion-Ledger reports that Judge E. Grady Jolly of Mississippi will retire on his 80th birthday in October 2017, creating another vacancy on the Fifth Circuit for President Trump to fill. The same paper has a good description of the process for filling the vacancy. Judge Jolly has served the Fifth Circuit with distinction for 35 years; his skill and grace will be greatly missed.

The Clarion-Ledger reports that Judge E. Grady Jolly of Mississippi will retire on his 80th birthday in October 2017, creating another vacancy on the Fifth Circuit for President Trump to fill. The same paper has a good description of the process for filling the vacancy. Judge Jolly has served the Fifth Circuit with distinction for 35 years; his skill and grace will be greatly missed.

In an interesting parallel to the ongoing litigation about travel bans (which most recently produced a District of Hawaii opinion granting a TRO), the Fifth Circuit denied en banc review in Defense Distributed v. U.S. Dep’t of State, which affirmed a preliminary injunction about the use of 3-D printing technology to make certain firearms. A dissent observes: “Certainly there is a strong public interest in national security. But there is a paramount public interest in the exercise of constitutional rights, particularly those guaranteed by the First Amendment . . . ” No. 15-50759 (March 15, 2017).

In an interesting parallel to the ongoing litigation about travel bans (which most recently produced a District of Hawaii opinion granting a TRO), the Fifth Circuit denied en banc review in Defense Distributed v. U.S. Dep’t of State, which affirmed a preliminary injunction about the use of 3-D printing technology to make certain firearms. A dissent observes: “Certainly there is a strong public interest in national security. But there is a paramount public interest in the exercise of constitutional rights, particularly those guaranteed by the First Amendment . . . ” No. 15-50759 (March 15, 2017).

Tower Credit garnished the debtor’s wages. In defense of a later preference action, Tower argued that its garnishment was effective when served (taking it outside the preference period), not when the debtor in fact received money. The Fifth Circuit disagreed: “The combination of Supreme Court precedent and the overwhelming weight of persuasive authority applying §

Tower Credit garnished the debtor’s wages. In defense of a later preference action, Tower argued that its garnishment was effective when served (taking it outside the preference period), not when the debtor in fact received money. The Fifth Circuit disagreed: “The combination of Supreme Court precedent and the overwhelming weight of persuasive authority applying §  547(e)(3) make clear that a debtor’s wages cannot be transferred until they are earned. Thus, we hold that a creditor’s collection of garnished wages earned during the preference period is an avoidable transfer made during the preference period even if the garnishment was served prior to that period.” Tower Credit v. Schott, No. 16-30274 (March 13, 2017).

547(e)(3) make clear that a debtor’s wages cannot be transferred until they are earned. Thus, we hold that a creditor’s collection of garnished wages earned during the preference period is an avoidable transfer made during the preference period even if the garnishment was served prior to that period.” Tower Credit v. Schott, No. 16-30274 (March 13, 2017).

In affirming sanctions for vexatious litigation in connection with bankruptcy proceedings, the Fifth Circuit noted, in particular: “Appellants’ . . . repeated attempts to litigate issues that have been conclusively resolved against them or that they had no standing to assert and by their unsupported and multiple attempts to remove . . . the trustee.” Carroll v. Abide, No. 16-30996 (March 13, 2017).

In affirming sanctions for vexatious litigation in connection with bankruptcy proceedings, the Fifth Circuit noted, in particular: “Appellants’ . . . repeated attempts to litigate issues that have been conclusively resolved against them or that they had no standing to assert and by their unsupported and multiple attempts to remove . . . the trustee.” Carroll v. Abide, No. 16-30996 (March 13, 2017).

Attorney Martinez sued another law firm (“HLG”) for various torts related to the firm contacting his clients about alleged overbilling. The firm asserted absolute immiunity as a defense and the Fifth Circuit agreed, in a fact-specific holding, that the evidence “demonstrate[s] that the allegedly tortious statements at issue in this case were made in relation to a proposed arbitration and are therefore absolutely privileged under Texas law.” The firm already represented two Martinez clients in connection with the potential arbitration; the new clients did not originate contact with the firm; and all of them ultimately retained the firm. Martinez v. Hellmich Law Group, PC, No. 16-50305 (March 8, 2017, unpublished). This case joins a line of similar holdings in recent years in favor of attorney immunity.

Attorney Martinez sued another law firm (“HLG”) for various torts related to the firm contacting his clients about alleged overbilling. The firm asserted absolute immiunity as a defense and the Fifth Circuit agreed, in a fact-specific holding, that the evidence “demonstrate[s] that the allegedly tortious statements at issue in this case were made in relation to a proposed arbitration and are therefore absolutely privileged under Texas law.” The firm already represented two Martinez clients in connection with the potential arbitration; the new clients did not originate contact with the firm; and all of them ultimately retained the firm. Martinez v. Hellmich Law Group, PC, No. 16-50305 (March 8, 2017, unpublished). This case joins a line of similar holdings in recent years in favor of attorney immunity.

The owner of the Golden Nugget casino in Lake Charles withheld $18.7 million from payments to its general contractor, who then filed a statutory lien (a “privilege” in Louisiana parlance) on the property. The relevant statute requires the contractor to file “within sixty days after the filing of the notice of termination or substantial completion of the work.” If “substantial completion” refers to an event, the contractor’s filing was not timely; if, however, it refers to a filing that certifies substantial completion, the contractor’s filing was timely, as the owner did not record such a certification. The Fifth Circuit concluded that, while the statute was ambiguous, the related provisions and the apparent industry practice supported the contractor’s position: “The [statute] places the burden on an owner to cut of potential claims when a contract has been recorded, whether it is a general contractor or a subcontractor.” Golden Nugget Lake Charles LLC v. W.G. Yates & Sons Constr. Co., No. 16-30496 (March 6, 2017).

The owner of the Golden Nugget casino in Lake Charles withheld $18.7 million from payments to its general contractor, who then filed a statutory lien (a “privilege” in Louisiana parlance) on the property. The relevant statute requires the contractor to file “within sixty days after the filing of the notice of termination or substantial completion of the work.” If “substantial completion” refers to an event, the contractor’s filing was not timely; if, however, it refers to a filing that certifies substantial completion, the contractor’s filing was timely, as the owner did not record such a certification. The Fifth Circuit concluded that, while the statute was ambiguous, the related provisions and the apparent industry practice supported the contractor’s position: “The [statute] places the burden on an owner to cut of potential claims when a contract has been recorded, whether it is a general contractor or a subcontractor.” Golden Nugget Lake Charles LLC v. W.G. Yates & Sons Constr. Co., No. 16-30496 (March 6, 2017).

In Richard v. Anadarko Petroleum Corp., the Fifth Circuit required reformation of a contract on the grounds of mutual mistake, to the detriment of non-party Liberty Mutual, acknowledging that “[c]ourts must guard against parties’ ‘attempts to make an end-run around the parol-evidence rule,’ which forecloses the use of parol evidence to interpret unambiguous terms, ‘by framing [their] argument[s] as a request for reformation.” Here, reformation was appropriate even considering the effect on Liberty Mutual, given (1) its lack of reliance on the contract, (2) the general consistency of the terms in the reformed contract with industry practice, and (3) course of performance. No. 16-30216 (March 2, 2017).

In Richard v. Anadarko Petroleum Corp., the Fifth Circuit required reformation of a contract on the grounds of mutual mistake, to the detriment of non-party Liberty Mutual, acknowledging that “[c]ourts must guard against parties’ ‘attempts to make an end-run around the parol-evidence rule,’ which forecloses the use of parol evidence to interpret unambiguous terms, ‘by framing [their] argument[s] as a request for reformation.” Here, reformation was appropriate even considering the effect on Liberty Mutual, given (1) its lack of reliance on the contract, (2) the general consistency of the terms in the reformed contract with industry practice, and (3) course of performance. No. 16-30216 (March 2, 2017).

Feder al Insurance agreed to pay defense costs in ongoing commercial litigation against its insureds, subject to its position that under the policy, payment of defense costs deplete the policy limits. The relevant clause said: “[T]he Limit of Liability under the Fiduciary Coverage Section is $1 million, subject to a $1 million aggregate limit, and a $10,000.00 Retention, with Defnse Costs eroding or depleting those limits.” The Fifth Circuit agreed with Federal, rejecting arguments based on the limit potentially implicating conflict-of-interest concerns for counsel, and policy issues raised by applicable state statutes in the health care area. In sum: “Under Mississippi law, insurance policies are to be enforced according to their provisions.” Federal Ins. Co. v. Singing River Health System, Ni. 15-60774 (March 1, 2017).

al Insurance agreed to pay defense costs in ongoing commercial litigation against its insureds, subject to its position that under the policy, payment of defense costs deplete the policy limits. The relevant clause said: “[T]he Limit of Liability under the Fiduciary Coverage Section is $1 million, subject to a $1 million aggregate limit, and a $10,000.00 Retention, with Defnse Costs eroding or depleting those limits.” The Fifth Circuit agreed with Federal, rejecting arguments based on the limit potentially implicating conflict-of-interest concerns for counsel, and policy issues raised by applicable state statutes in the health care area. In sum: “Under Mississippi law, insurance policies are to be enforced according to their provisions.” Federal Ins. Co. v. Singing River Health System, Ni. 15-60774 (March 1, 2017).

Litigation about the intellectual property rights to the name “Communicat-R” (here, applied to a specialized type of whiteboard) led to a jury trial. The Fifth Circuit affirmed, finding no abuse of discretion in this instruction: “Trademarks can be abandoned through non-use. A trademark is abandoned if it is proven by a preponderance of the evidence, that (1) the use of trademark was discontinued; and (2) an intent not to resume such use.” The Court rejected a request for additional language about “excusable nonuse,” finding that it would either be redundant or not entirely accurate in the context of this case. The Court also rejected sufficiency challenges to liability and damages, illustrating the operation of the federal standard for the grant of a new trial. Vetter v. McAtee, No. 15-20575 (March 1, 2017).

Litigation about the intellectual property rights to the name “Communicat-R” (here, applied to a specialized type of whiteboard) led to a jury trial. The Fifth Circuit affirmed, finding no abuse of discretion in this instruction: “Trademarks can be abandoned through non-use. A trademark is abandoned if it is proven by a preponderance of the evidence, that (1) the use of trademark was discontinued; and (2) an intent not to resume such use.” The Court rejected a request for additional language about “excusable nonuse,” finding that it would either be redundant or not entirely accurate in the context of this case. The Court also rejected sufficiency challenges to liability and damages, illustrating the operation of the federal standard for the grant of a new trial. Vetter v. McAtee, No. 15-20575 (March 1, 2017).

Gatheright bought sweet potatoes from Clark, paying with two post-dated checks. When they were returned for insufficient funds, Clark instituted criminal proceedings against Gatheright, which were ultimately dismissed after Gatheright spent several weeks in jail. Gatheright then sued Clark for malicious prosecution and abuse of process. The Fifth Circuit affirmed summary judgment for Clark, observing that “$16,000 in bad checks . . . [is] a sum greater than what the Mississippi Supreme Court has previously found would prompt a reasonable person to institute criminal proceedings.” Based on that observation, the Court rejected arguments about whether a post-dated

Gatheright bought sweet potatoes from Clark, paying with two post-dated checks. When they were returned for insufficient funds, Clark instituted criminal proceedings against Gatheright, which were ultimately dismissed after Gatheright spent several weeks in jail. Gatheright then sued Clark for malicious prosecution and abuse of process. The Fifth Circuit affirmed summary judgment for Clark, observing that “$16,000 in bad checks . . . [is] a sum greater than what the Mississippi Supreme Court has previously found would prompt a reasonable person to institute criminal proceedings.” Based on that observation, the Court rejected arguments about whether a post-dated  check was a proper basis for a “false pretenses” prosecution in Mississippi, and about the effect of Gatheright’s filing for personal bankruptcy. Gatheright v. Clark, No. 16-60364 (Feb. 23, 2017, unpublished).

check was a proper basis for a “false pretenses” prosecution in Mississippi, and about the effect of Gatheright’s filing for personal bankruptcy. Gatheright v. Clark, No. 16-60364 (Feb. 23, 2017, unpublished).

It is well-settled nationally that “an appellate court may not alter a judgment to benefit a nonappealing party” because “it takes a cross-appeal to justify a remedy in favor of an appellee.” Greenlaw v. United States, 554 U.S. 237, 244–45 (2008). The Fifth Circuit treats that principle as jurisdictional. See, e.g., Amazing Spaces, Inc. v. Metro Mini Storage, 608 F.3d 225, 250 (5th Cir. 2010) (“[T]his circuit follows the general rule that, in the absence of a cross-appeal, an appellate court has no jurisdiction to modify a judgment so as to enlarge the rights of the appellee or diminish the rights of the appellant.”) Some other Circuits, however, take a different view. See, e.g., Am. Roll-On Roll-Off Carrier LLC v. P&O Parts Baltimore, Inc., 479 F.3d 288, 295 (4th Cir. 2007) (“This circuit views the cross-appeal requirement as one of practice, rather than as a strict jurisdictional requirement.”) (Thanks to my LPCH colleague Russ Herman for pointing this out.)

It is well-settled nationally that “an appellate court may not alter a judgment to benefit a nonappealing party” because “it takes a cross-appeal to justify a remedy in favor of an appellee.” Greenlaw v. United States, 554 U.S. 237, 244–45 (2008). The Fifth Circuit treats that principle as jurisdictional. See, e.g., Amazing Spaces, Inc. v. Metro Mini Storage, 608 F.3d 225, 250 (5th Cir. 2010) (“[T]his circuit follows the general rule that, in the absence of a cross-appeal, an appellate court has no jurisdiction to modify a judgment so as to enlarge the rights of the appellee or diminish the rights of the appellant.”) Some other Circuits, however, take a different view. See, e.g., Am. Roll-On Roll-Off Carrier LLC v. P&O Parts Baltimore, Inc., 479 F.3d 288, 295 (4th Cir. 2007) (“This circuit views the cross-appeal requirement as one of practice, rather than as a strict jurisdictional requirement.”) (Thanks to my LPCH colleague Russ Herman for pointing this out.)

Recipients of Section 8 housing assistance sued mortgage originators, complaining that the originators either denied or discouraged the recipients’ credit applications by not considering their Section 8 income, in violation of the Equal Credit Opportunity Act. The Fifth Circuit affirmed the dismissal of claims by recipients who had only inquired about, rather than actually starting, the application process, as well as claims based on Wells Fargo’s policies about the purchase of mortgages in the secondary market. It reversed as to one group of applicants, however, finding under Iqbal and the substantive law that they “plausibly alleged that AmeriPro refused to consider their Section 8 income in assessing their creditworthiness as mortgage applicants, and that they received mortgages on less favorable terms and in lesser amounts than they would have had their Section 8 income been considered.” Alexander v. AmeriPro, No. 15-20710 (Feb. 16, 2017).

Recipients of Section 8 housing assistance sued mortgage originators, complaining that the originators either denied or discouraged the recipients’ credit applications by not considering their Section 8 income, in violation of the Equal Credit Opportunity Act. The Fifth Circuit affirmed the dismissal of claims by recipients who had only inquired about, rather than actually starting, the application process, as well as claims based on Wells Fargo’s policies about the purchase of mortgages in the secondary market. It reversed as to one group of applicants, however, finding under Iqbal and the substantive law that they “plausibly alleged that AmeriPro refused to consider their Section 8 income in assessing their creditworthiness as mortgage applicants, and that they received mortgages on less favorable terms and in lesser amounts than they would have had their Section 8 income been considered.” Alexander v. AmeriPro, No. 15-20710 (Feb. 16, 2017).

I commented today on Dallas’s Fox 4 News about how the potential deployment of the National Guard about illegal immigration could implicate the Posse Comitatus Act.

I commented today on Dallas’s Fox 4 News about how the potential deployment of the National Guard about illegal immigration could implicate the Posse Comitatus Act.

Just before filing for bankruptcy, Mr. Wiggins signed a “Partition Agreement” in which he and his wife divided their ownership of their home into two separate property interests. The Fifth Circuit affirmed the bankruptcy court’s conclusion that this was a fraudulent transfer: “When it became clear that Mr. Wiggains would file bankruptcy to satisfy his outstanding debts, the couple entertained various options and made their best estimate on ultimate financial benefits by having only Mr. Wiggains file after the Partition Agreement was recorded. Allowing Mrs. Wiggains to sidestep the statutory limits for homestead exemptions and obtain approximately $500,000 in proceeds that otherwise are for creditors would lay waste to the provisions of the Bankruptcy Code involved here.” Wiggains v. Reed, No. 15-11249 (Feb. 14, 2017).

Texas Lawyer reports that six candidates are under consideration for the two vacancies on the Fifth Circuit – “Texas Supreme Court Justice Don Willett; U.S. District Court Judge Reed O’Connor of Fort Worth; former Texas solicitor general James Ho; Andy Oldham, a deputy general counsel to Gov. Greg Abbott; Michael Massengale, a justice on Houston’s First Court of Appeals; and Brett Busby, a justice on Houston’s Fourteenth Court of Appeals” – the full story appears here.

Texas Lawyer reports that six candidates are under consideration for the two vacancies on the Fifth Circuit – “Texas Supreme Court Justice Don Willett; U.S. District Court Judge Reed O’Connor of Fort Worth; former Texas solicitor general James Ho; Andy Oldham, a deputy general counsel to Gov. Greg Abbott; Michael Massengale, a justice on Houston’s First Court of Appeals; and Brett Busby, a justice on Houston’s Fourteenth Court of Appeals” – the full story appears here.

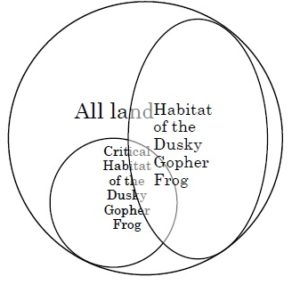

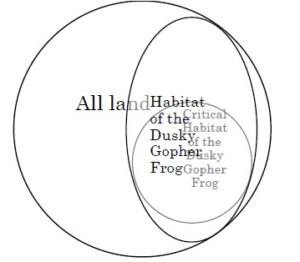

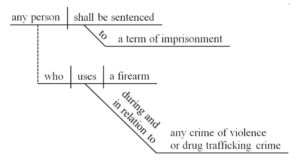

Press coverage of Judge Neil Gorsuch’s nomination to the Supreme Court has noted his intelligent and accessible writing style, including use of a sentence diagram (left) in a criminal case that turned on what elements of the crime

Press coverage of Judge Neil Gorsuch’s nomination to the Supreme Court has noted his intelligent and accessible writing style, including use of a sentence diagram (left) in a criminal case that turned on what elements of the crime  required proof of intent. In the same spirit, in dissent from the denial of en banc rehearing in a highly technical case about protection of the dusky gopher frog (right), Judge Edith Jones used a pair of Venn diagrams to illustrate her view of how the Endangered Species Act should operate (below left), contrasted with the panel opinion’s (below right). Markle Interests v. U.S. Fish & Wildlife Service, No. 14-31008 (Feb. 14, 2017).

required proof of intent. In the same spirit, in dissent from the denial of en banc rehearing in a highly technical case about protection of the dusky gopher frog (right), Judge Edith Jones used a pair of Venn diagrams to illustrate her view of how the Endangered Species Act should operate (below left), contrasted with the panel opinion’s (below right). Markle Interests v. U.S. Fish & Wildlife Service, No. 14-31008 (Feb. 14, 2017).

CitiMortgage sought to foreclose on Maldonado’s home; in the subsequent litigatoin, it offered summary judgment evidence that he owed a balance of $533,960.80. In response, Maldonado “disputed the amounts that CitiMortgage claimed in attorneys’ fees, inspection fees, escrow, taxes, and late charges,” but did “not provide any evidence of what the correct amounts should be.” Maldonado v. CitiMortgage, No. 16-20541 (Jan. 23, 2017, unpublished).

CitiMortgage sought to foreclose on Maldonado’s home; in the subsequent litigatoin, it offered summary judgment evidence that he owed a balance of $533,960.80. In response, Maldonado “disputed the amounts that CitiMortgage claimed in attorneys’ fees, inspection fees, escrow, taxes, and late charges,” but did “not provide any evidence of what the correct amounts should be.” Maldonado v. CitiMortgage, No. 16-20541 (Jan. 23, 2017, unpublished).

The issue in United States ex rel. Vavra v. Kellogg Brown & Root, Inc. was whether KBR was liable for kickbacks taken by two employees. The Fifth Circuit held that the answer is fact-specific: “[T]he proper test for imputing knowledge under [the AKA] is that corporations are liable ‘only for the knowing violations of those employees whose authority, responsibility, or managerial role within the corporation is such that their knowledge is imputable to the corporation.'” As for the effect of the alleged kickback, even though “[i]t is true that the district court did not make any findings as to particular service problems [the employee] intended to influence in an improper manner through his gratuities . . . it is enough to connect the gratuity with the specific kind of treatment sought in a way that establishes impropriety,” which was done here “[b]ecause of the nature of the treatment [the employee] sought.” No. 15-41623 (Feb. 3, 2017).

The issue in United States ex rel. Vavra v. Kellogg Brown & Root, Inc. was whether KBR was liable for kickbacks taken by two employees. The Fifth Circuit held that the answer is fact-specific: “[T]he proper test for imputing knowledge under [the AKA] is that corporations are liable ‘only for the knowing violations of those employees whose authority, responsibility, or managerial role within the corporation is such that their knowledge is imputable to the corporation.'” As for the effect of the alleged kickback, even though “[i]t is true that the district court did not make any findings as to particular service problems [the employee] intended to influence in an improper manner through his gratuities . . . it is enough to connect the gratuity with the specific kind of treatment sought in a way that establishes impropriety,” which was done here “[b]ecause of the nature of the treatment [the employee] sought.” No. 15-41623 (Feb. 3, 2017).

Foster sued about a foreclosure; the state court granted a TRO (so no foreclosure occurred); and the mortgage servicer defendants removed and obtained summary judgment. Foster challenged the denial of her motion to remand, arguing that she did not improperly join the substitute trustee appointed to conduct the foreclosure sale. The Fifth Circuit affirmed: “[B]reach of a trustee’s duty does not constitute an independent tort; rather, it yields a cause of action for wrongful foreclosure. A claim of wrongful foreclosure cannot succeed, however, when no foreclosure has occurred.” Foster v. Deutsche Bank, No. 16-11045 (Feb. 8, 2017).

Foster sued about a foreclosure; the state court granted a TRO (so no foreclosure occurred); and the mortgage servicer defendants removed and obtained summary judgment. Foster challenged the denial of her motion to remand, arguing that she did not improperly join the substitute trustee appointed to conduct the foreclosure sale. The Fifth Circuit affirmed: “[B]reach of a trustee’s duty does not constitute an independent tort; rather, it yields a cause of action for wrongful foreclosure. A claim of wrongful foreclosure cannot succeed, however, when no foreclosure has occurred.” Foster v. Deutsche Bank, No. 16-11045 (Feb. 8, 2017).

A group of real estate companies paid Prime LLC for consulting services. While the contract allowed termination with 60 days notice, the group and Prime agreed to end the contract without using the notice provision. A creditor complained that this termination made a fraudulent transfer, and the Fifth Circuit agreed that the claim was at least facially plausible: “While the value of the notice period lost by failure to adhere to the notice provision remains an issue for further development in the district court, at this stage

A group of real estate companies paid Prime LLC for consulting services. While the contract allowed termination with 60 days notice, the group and Prime agreed to end the contract without using the notice provision. A creditor complained that this termination made a fraudulent transfer, and the Fifth Circuit agreed that the claim was at least facially plausible: “While the value of the notice period lost by failure to adhere to the notice provision remains an issue for further development in the district court, at this stage  we think the notice requirement secured measurable economic benefit to Prime. Assuming the facts alleged surrounding this transaction to be true, as we must under Rule 12(b)(6), Plaintiff has alleged an asset, cognizable as such under TUFTA, that was constructively transferred.” Hometown 2006-1 1925 Valley View LLC v. Prime Income Asset Management LLC, No. 15-10881 (Feb. 2, 2017)

we think the notice requirement secured measurable economic benefit to Prime. Assuming the facts alleged surrounding this transaction to be true, as we must under Rule 12(b)(6), Plaintiff has alleged an asset, cognizable as such under TUFTA, that was constructively transferred.” Hometown 2006-1 1925 Valley View LLC v. Prime Income Asset Management LLC, No. 15-10881 (Feb. 2, 2017)