Gurule, a waitress, sued her employer for violations of federal labor law about its handling of overtime and tips. After rejecting a Rule 68 settlement offer of $3,133.34, she went to trial and won $1,131.39. The district court awarded her that amount, as well as $25,089.30 in attorneys’ fees – a significant reduction from the $129,565 requested by her counsel – minus a cost award of $1,517.57, given her rejection of the Rule 68 offer. The Fifth Circuit affirmed, finding that the rejection of the Rule 68 offer should be considered as a relevant factor in determining an appropriate fee award, but not a dispositive one. Gurule v. Land Guardian, Inc., No. 17-20710 (Dec. 27, 2018).

Gurule, a waitress, sued her employer for violations of federal labor law about its handling of overtime and tips. After rejecting a Rule 68 settlement offer of $3,133.34, she went to trial and won $1,131.39. The district court awarded her that amount, as well as $25,089.30 in attorneys’ fees – a significant reduction from the $129,565 requested by her counsel – minus a cost award of $1,517.57, given her rejection of the Rule 68 offer. The Fifth Circuit affirmed, finding that the rejection of the Rule 68 offer should be considered as a relevant factor in determining an appropriate fee award, but not a dispositive one. Gurule v. Land Guardian, Inc., No. 17-20710 (Dec. 27, 2018).

In a residential foreclosure case, the borrower alleged that the bank/lender was vicariously liable for alleged RESPA violations by the servicer. Noting that it was the first federal circuit court to address the point, the Fifth Circuit found that the lender could not be held vicariously liable. The regulation at issue imposed duties only on

In a residential foreclosure case, the borrower alleged that the bank/lender was vicariously liable for alleged RESPA violations by the servicer. Noting that it was the first federal circuit court to address the point, the Fifth Circuit found that the lender could not be held vicariously liable. The regulation at issue imposed duties only on

servicers. (12 C.F.R. § 1024.41(c)(1) (“[A] servicer shall . . .”)) And when Congress wanted to expand liability, it used language showing its intent to do so. (12 U.S.C. § 2607 (saying that “no person” will pay kickbacks or unearned fees)). Christiana Trust v. Riddle, No. 17-11429 (Dec. 21, 2018).

Together with LPCH colleagues John Adams and Paulette Miniter, I’ve written three articles about the effect of the 2018 judicial elections in three areas:

Together with LPCH colleagues John Adams and Paulette Miniter, I’ve written three articles about the effect of the 2018 judicial elections in three areas:

- Removal. “Removal to Federal Court After the November 2018 Elections:

More Incentive, But Less Receptiveness?” - Standards of Review. The Return of Factual Sufficiency Review?

- Roles of judge and jury. Three Sentences to Study: Potential New Court of Appeals Perspectives

Ironshore, an excess insurance carrier, alleged that the Schiff Hardin law firm made negligent misrepresentations to it while reporting on litigation involving Dorel – the firm’s client and Ironshore’s insured. The Fifth Circuit made “an Erie guess that the Supreme Court of Texas would apply the attorney immunity doctrine to shield attorneys for such negligent misrepresentation claims.” It then concluded:

Ironshore, an excess insurance carrier, alleged that the Schiff Hardin law firm made negligent misrepresentations to it while reporting on litigation involving Dorel – the firm’s client and Ironshore’s insured. The Fifth Circuit made “an Erie guess that the Supreme Court of Texas would apply the attorney immunity doctrine to shield attorneys for such negligent misrepresentation claims.” It then concluded:

“The factual allegations of the complaint in this case reflect that all of the alleged misrepresentations and omissions were related to Schiff Hardin’s representation of Dorel in the Hinson litigation. Looking beyond Ironshore’s characterization of the firm’s conduct as wrongful, as we must, the type of conduct at issue in this case includes: (1) reporting on the status of litigation and settlement discussions; (2) providing opinions as to the strength and valuation of plaintiffs’ claims; (3) providing opinions as to the perceived litigation strategies employed by opposing counsel and the potential prejudice of pre-trial developments; (4) providing estimates of potential liability; (5) reporting on the progress of a jury trial; and (6) reporting on pre-trial rulings and pre-trial settlement offers. We are satisfied that the kinds of conduct at issue in

this case fall within the routine conduct attorneys engage in when handling this type of litigation. Schiff Hardin’s conduct falls squarely within the scope of the firm’s representation of its client.”

Ironshore Europe DAC v. Schiff Hardin LLP, No. 18-40101 (Jan. 2, 2019).

A textbook example of the “rule of orderliness” appears in Gahagan v. U.S. Dep’t of Justice, a dispute about the recovery of attorneys’ fees under FOIA by an attorney proceeding pro se:

A textbook example of the “rule of orderliness” appears in Gahagan v. U.S. Dep’t of Justice, a dispute about the recovery of attorneys’ fees under FOIA by an attorney proceeding pro se:

- In Cazalas v. DOJ, 709 F.2d 1051, 1057 (5th Cir. 1983), a panel majority of the Fifth Circuit held that “a litigant attorney represent[ing] herself or himself” is eligible for “an award of attorney fees under the FOIA.”

- In Kay v. Ehrler, 499 U.S. 432, 438, 435 (1991), which arose under 42 U.S.C. § 1988, the Supreme Court rejected “[a] rule that authorizes awards of counsel fees to pro se litigants— even if limited to those who are members of the bar,” for fear it “would create a disincentive to employ counsel whenever such a plaintiff considered himself competent to litigate on his own behalf.” Therefore, “a pro se litigant who is also a lawyer may [not] be awarded attorney’s fees.”

- In Texas v. ICC, 935 F.2d 728, 733 (5th Cir. 1991), citing Cazalas, the Fifth Circuit held that :”courts can in appropriate circumstances award attorneys fees to states” under FOIA.

“Whether Cazalas is still binding turns on first- and second-order questions under the rule of orderliness. The first question is whether ICC requires us to follow Cazalas. It does not. The second question is whether Kay requires us to abandon Cazalas. It does.” Kay overruled the rationale of Cazalas, and while ICC nominally followed Cazalas, it did not analyze the effect of Kay.

Nall, who worked for BNSF as a trainman, suffered from Parkinson’s disease, and sued BNSF for disability discrimination. The panel majority noted that BNSF had provided different descriptions of a trainman’s duties at different times, and that a key BNSF witness agreed with a version that helped Nall’s position. It thus found a fact issue, specifically described as follows:

Nall, who worked for BNSF as a trainman, suffered from Parkinson’s disease, and sued BNSF for disability discrimination. The panel majority noted that BNSF had provided different descriptions of a trainman’s duties at different times, and that a key BNSF witness agreed with a version that helped Nall’s position. It thus found a fact issue, specifically described as follows:

We emphasize that our inquiry on the issue of objective reasonableness does not ask whether BNSF’s conclusion that Nall could not perform his job duties safely was a reasonable medical judgment. Instead, we ask whether BNSF actually exercised that judgment. In other words, the question on appeal is not whether it was reasonable for BNSF to conclude that Parkinson’s disease symptoms prevented Nall from safely performing his duties; the question is whether BNSF came to that conclusion via a reasonable process that was not, as Nall alleges, manipulated midstream to achieve BNSF’s desired result of disqualifying him. More precisely, the question is whether there is any evidence in the record which, if believed, would be sufficient to support a jury finding.

(emphasis in original). A dissent observed: “There is no basis for imposing liability under the ADA based on process concerns alone. There is liability only if the employer’s determination of a direct threat is objectively unreasonable.” A concurrence noted the “kudzu-like creep” of the McDonnell-Douglas burden-shifting framework, and as to dissent, observed that it “reminds me of the baseball player who said, ‘They should move back first base a step to eliminate all those close plays.'” Nall v. BNSF Railway Co., No. 17-20113 (Dec. 27, 2018).

(emphasis in original). A dissent observed: “There is no basis for imposing liability under the ADA based on process concerns alone. There is liability only if the employer’s determination of a direct threat is objectively unreasonable.” A concurrence noted the “kudzu-like creep” of the McDonnell-Douglas burden-shifting framework, and as to dissent, observed that it “reminds me of the baseball player who said, ‘They should move back first base a step to eliminate all those close plays.'” Nall v. BNSF Railway Co., No. 17-20113 (Dec. 27, 2018).

Koerner sued CMR about problems with a roof; to support his fraud claim, he cited an email from a CMR superintendent after an inspection of the roof: “I did not disclose or offer any info on my findings [to Koerner] and simply left [Koerner] assured we are working on correcting his leak issue, after all he is a lawyer and I know they are sneaky :).” The Fifth Circuit was unimpressed, observing: “The email . . . does not say that [the superintendent] did not intend to fix the other problems in addition to the leak. He just did not want to tell Koerner about them because he thought Koerner was a sneaky lawyer.” Koerner v. CMR Const. & Roofing, LLC, No. 18-30019 (Dec. 7, 2018).

Koerner sued CMR about problems with a roof; to support his fraud claim, he cited an email from a CMR superintendent after an inspection of the roof: “I did not disclose or offer any info on my findings [to Koerner] and simply left [Koerner] assured we are working on correcting his leak issue, after all he is a lawyer and I know they are sneaky :).” The Fifth Circuit was unimpressed, observing: “The email . . . does not say that [the superintendent] did not intend to fix the other problems in addition to the leak. He just did not want to tell Koerner about them because he thought Koerner was a sneaky lawyer.” Koerner v. CMR Const. & Roofing, LLC, No. 18-30019 (Dec. 7, 2018).

A serious car accident involving a texting driver led to a products-liability claim based on the human “neurobiological response” to a text message – “They alleged that the accident was caused by Apple’s failure to implement the [lockout mechanism] patent on the iPhone 5 and by Apple’s failure to warn iPhone 5 users about the risks of distracted driving. In particular, the plaintiffs alleged that receipt of a text message triggers in the recipient ‘an unconscious and automatic, neurobiological compulsion to engage in texting behavior.

A serious car accident involving a texting driver led to a products-liability claim based on the human “neurobiological response” to a text message – “They alleged that the accident was caused by Apple’s failure to implement the [lockout mechanism] patent on the iPhone 5 and by Apple’s failure to warn iPhone 5 users about the risks of distracted driving. In particular, the plaintiffs alleged that receipt of a text message triggers in the recipient ‘an unconscious and automatic, neurobiological compulsion to engage in texting behavior. ‘” The Fifth Circuit declined to extend Texas products law to this theory in this Erie case, recognizing an analogy to the development of dram-shop liability but ultimately finding that it weighed against recognizing this theory. Meador v. Apple, Inc., No. 17-40968 (Dec. 18, 2018).

‘” The Fifth Circuit declined to extend Texas products law to this theory in this Erie case, recognizing an analogy to the development of dram-shop liability but ultimately finding that it weighed against recognizing this theory. Meador v. Apple, Inc., No. 17-40968 (Dec. 18, 2018).

Mauldin sued Gonzalez, Hernandez, and Allstate Insurance. The district court denied Mauldin’s motion to remand as to Gonzalez and entered a final judgment in Gonzalez’s favor. Two weeks later, it transferred the remaining claims to Oklahoma under § 1404(a). As to Gonzalez, it found that the remand ruling was appealable because it was combined with a final judgment – an exception to the general rule that denials of motions to remand are interlocutory and not appealable. And it found that the Fifth Circuit retained jurisdiction over the appeal about Gonzalez notwithstanding the transfer – an important if rarely-encountered point about the interplay among the jurisdiction of the federal circuits. Mauldin v. Allstate Ins. Co., No. 17-11274 (Dec. 10, 2018, unpublished).

Mauldin sued Gonzalez, Hernandez, and Allstate Insurance. The district court denied Mauldin’s motion to remand as to Gonzalez and entered a final judgment in Gonzalez’s favor. Two weeks later, it transferred the remaining claims to Oklahoma under § 1404(a). As to Gonzalez, it found that the remand ruling was appealable because it was combined with a final judgment – an exception to the general rule that denials of motions to remand are interlocutory and not appealable. And it found that the Fifth Circuit retained jurisdiction over the appeal about Gonzalez notwithstanding the transfer – an important if rarely-encountered point about the interplay among the jurisdiction of the federal circuits. Mauldin v. Allstate Ins. Co., No. 17-11274 (Dec. 10, 2018, unpublished).

- On the one hand, there is

Texas v. Travis County, in which the Fifth Circuit rejected, on standing grounds, a declaratory judgment case brought by the State of Texas, which sought a ruling the constitutionality of new “sanctuary cities” legislation before its enforcement: “States are not significantly prejudiced by an inability to come to federal court for a declaratory judgment in advance of a possible injunctive suit by a person subject to federal regulation.” No. 17-50763 (Dec. 12, 2018)). (quoting Franchise Tax Board v. Constr. Laborers Vac. Trust, 463 U.S. 1 (1983)).

Texas v. Travis County, in which the Fifth Circuit rejected, on standing grounds, a declaratory judgment case brought by the State of Texas, which sought a ruling the constitutionality of new “sanctuary cities” legislation before its enforcement: “States are not significantly prejudiced by an inability to come to federal court for a declaratory judgment in advance of a possible injunctive suit by a person subject to federal regulation.” No. 17-50763 (Dec. 12, 2018)). (quoting Franchise Tax Board v. Constr. Laborers Vac. Trust, 463 U.S. 1 (1983)). - And on the other, headed to the Fifth Circuit from the Northern District of Texas, is Texas v. United States, finding that the entire Affordable Care Act was unconstitutional after elimination of the “individual mandate” in 2017: “In some ways, the question before the Court involves the intent of both the 2010 and 2017 Congresses. The former enacted the ACA. The latter sawed off the last leg it stood on. But however one slices it, the following is clear: The 2010 Congress memorialized that it knew the Individual Mandate was the ACA keystone; the Supreme Court stated repeatedly that it knew Congress knew that; and knowing the Supreme Court knew what the 2010 Congress had known, the 2017 Congress did not repeal the Individual Mandate and did not repeal § 18091.” No. 4:18-cv-00167-O (N.D. Tex. Dec. 14, 2018).

This blog has a page of my tips about legal writing; several of those tips involve different tests to eliminate unhelpful extra words and passive voice. I recently learned of a new such test called “Anglish” that focuses on the origin of words, and seeks to use only words that entered the language before the Norman Conquest. (An example of the resulting prose, from Wikipedia: “I am of this opinion that our own tung should be written cleane and pure, unmixt and unmangeled with borowing of other tunges; wherein if we take not heed by tiim, ever borowing and never paying, she shall be fain to keep her house as bankrupt.“) I don’t recommend it for legal writing, but it is an interesting exercise that shows the remarkable ability of English to absorb words from other languages.

This blog has a page of my tips about legal writing; several of those tips involve different tests to eliminate unhelpful extra words and passive voice. I recently learned of a new such test called “Anglish” that focuses on the origin of words, and seeks to use only words that entered the language before the Norman Conquest. (An example of the resulting prose, from Wikipedia: “I am of this opinion that our own tung should be written cleane and pure, unmixt and unmangeled with borowing of other tunges; wherein if we take not heed by tiim, ever borowing and never paying, she shall be fain to keep her house as bankrupt.“) I don’t recommend it for legal writing, but it is an interesting exercise that shows the remarkable ability of English to absorb words from other languages.

The Fifth Circuit found a waiver of the right to arbitrate in Forby v. One Technologies, finding as to the requirement of prejudice: “The district court erred in concluding that Forby failed to establish prejudice to her legal position. When a party will have to re-litigate in the arbitration forum an issue already decided by the district court in its favor, that party is prejudiced.” No.17-10883 (Nov. 28, 2018).

The Fifth Circuit found a waiver of the right to arbitrate in Forby v. One Technologies, finding as to the requirement of prejudice: “The district court erred in concluding that Forby failed to establish prejudice to her legal position. When a party will have to re-litigate in the arbitration forum an issue already decided by the district court in its favor, that party is prejudiced.” No.17-10883 (Nov. 28, 2018).

The district court found improper joinder and thus denied a motion to remand; the Fifth Circuit reversed in Cumpian v. Alcoa World Alumina LLC. The Court dissected the sometimes-confusing standard for determining whether a party’s joinder should be disregarded in determining the basis for a removal based on diversity jurisdiction, specifically concluding: “On a question of improper joinder at the early stage of a case, it is error to use the no-evidence summary judgment standard because the determination is being made before discovery has been allowed. . . . the evidence that is dispositive . . . are the facts that could be easily disproved if not true.” No. 17-40825 (Dec. 6, 2018)

The district court found improper joinder and thus denied a motion to remand; the Fifth Circuit reversed in Cumpian v. Alcoa World Alumina LLC. The Court dissected the sometimes-confusing standard for determining whether a party’s joinder should be disregarded in determining the basis for a removal based on diversity jurisdiction, specifically concluding: “On a question of improper joinder at the early stage of a case, it is error to use the no-evidence summary judgment standard because the determination is being made before discovery has been allowed. . . . the evidence that is dispositive . . . are the facts that could be easily disproved if not true.” No. 17-40825 (Dec. 6, 2018)

“Sethi sold in terests in an oil and gas joint venture.” The SEC then sued Sethi for selling unregistered securities, and the Fifth Circuit agreed with the SEC’s position that the joint venture interests at issue qualified as securities under federal law. That legal analysis turned on a 3-part test for whether an investment contract is a security: “(1) an investment of money; (2) in a common enterprise; and (3) on an expectation of profits to be derived solely from the efforts of individuals other than the investor,” followed by a flexible, multi-factor analysis of the term “solely,” designed “to ensure that the securities laws are not easily circumvented by agreements requiring a ‘modicum of effort’ on the part of investors.” SEC v. Sethi, No. 17-41022 (Dec. 4, 2018) (applying, inter alia, Williamson v. Tucker, 645 F.2d 404 (5th Cir. 1981)).

terests in an oil and gas joint venture.” The SEC then sued Sethi for selling unregistered securities, and the Fifth Circuit agreed with the SEC’s position that the joint venture interests at issue qualified as securities under federal law. That legal analysis turned on a 3-part test for whether an investment contract is a security: “(1) an investment of money; (2) in a common enterprise; and (3) on an expectation of profits to be derived solely from the efforts of individuals other than the investor,” followed by a flexible, multi-factor analysis of the term “solely,” designed “to ensure that the securities laws are not easily circumvented by agreements requiring a ‘modicum of effort’ on the part of investors.” SEC v. Sethi, No. 17-41022 (Dec. 4, 2018) (applying, inter alia, Williamson v. Tucker, 645 F.2d 404 (5th Cir. 1981)).

In this article, my colleague Paulette Miniter and I analyze the potential effect on federal-court removals of the recent changes to the Texas state bench (elections installing Democratic majorities on the largest intermediate appellate courts) and the Fifth Circuit (several new appointments by President Trump.

In this article, my colleague Paulette Miniter and I analyze the potential effect on federal-court removals of the recent changes to the Texas state bench (elections installing Democratic majorities on the largest intermediate appellate courts) and the Fifth Circuit (several new appointments by President Trump.

The Smiths lost a hard-fought wrongful death case against Chrysler; at the end of the day, Chrysler was awarded $29,412 in costs – approximately half of what it had requested after objections were sustained to some deposition-related expenses. The Smiths appealed and the Fifth Circuit affirmed under the factors in Pacheco v. Mineta, 448 F.3d 783 (5th Cir. 2006):

The Smiths lost a hard-fought wrongful death case against Chrysler; at the end of the day, Chrysler was awarded $29,412 in costs – approximately half of what it had requested after objections were sustained to some deposition-related expenses. The Smiths appealed and the Fifth Circuit affirmed under the factors in Pacheco v. Mineta, 448 F.3d 783 (5th Cir. 2006):

. . . wherein this Court explained that a district court may, but is not required to, deny a prevailing party costs where suit was brought in good faith and denial is based on at least one of the following factors: “(1) the losing party’s limited financial resources; (2) misconduct by the prevailing party; (3) close and difficult legal issues presented; (4) substantial benefit conferred to the public; and (5) the prevailing party’s enormous financial resources.” Importantly, we withheld judgment on whether “any of [the above factors] is a sufficient reason to deny costs.”

(citation omitted). Under those factors, “[w]e can assume that the plaintiffs brought suit in good faith and their financial condition is dire; even so the district court was not required to deny Chrysler its costs because of its comparative ability to more easily bear the costs. . . . Although the court sympathetically found that the plaintiffs had established financial hardship, it felt compelled to overrule their general objection because they had not established misconduct by Chrysler, their suit did not present a close and difficult issue of unsettled law, and their case did not confer a substantial benefit to the public.” Smith v. Chrysler, No. 17-40901 (Nov. 26, 2018).

The mandamus petition in  In re: Bryant, No. 18-60703 (Nov. 30, 2018, unpublished) arose from a dispute about governance of the airport in Jackson, Mississippi; the Governor sought to quash a court-ordered deposition of his chief of staff. The Fifth Circuit denied the petition – nominally – but essentially invited a return trip if the magistrate judge’s analysis was not sharpened on four key points:

In re: Bryant, No. 18-60703 (Nov. 30, 2018, unpublished) arose from a dispute about governance of the airport in Jackson, Mississippi; the Governor sought to quash a court-ordered deposition of his chief of staff. The Fifth Circuit denied the petition – nominally – but essentially invited a return trip if the magistrate judge’s analysis was not sharpened on four key points:

We therefore deny the petition for writ of mandamus, but we do so without prejudice to the renewal of the petition, if needed, after the magistrate judge adequately addresses:

a) whether the information desired can be sought from alternative witnesses or must exclusively come from the Chief of Staff;

b) whether the legislators involved in the communications can be deposed;

c) whether the information desired can be obtained in another form; and

d) if it cannot be obtained in another form, whether the scope of the inquiry can be more closely tailored to target only the specific questions raised at the Rule 30(b)(6) deposition.

By denying the petition without prejudice in this manner, the Bryant case presents a new variation on a long-running theme in Fifth Circuit mandamus opinions. See In re DuPuy Orthopaedics, Inc., 870 F.3d 345 (5th Cir. 2017) (finding “the MDL court clearly abused any discretion it might have had and, in doing so, reached a ‘patently erroneous’ result,” but concluding: “[P]etitioners have the usual and adequate remedy of ordinary appeal. In fact, they have taken advantage of that remedy by appealing the judgment in the third bellwether trial on personal-jurisdiction grounds.”). In re: Crystal Power Co., 641 F.3d 82 (5th Cir. 2011) (“We confess puzzlement over why respondents insist on litigating this case in federal court even though . . . any judgment issued by the district court will surely be reversed . . . . “); In re: Trinity Industries, 872 F.3d 645 (5th Cir. 2014) (“The court is compelled to note, however, that this is a close case.”)

The dusky gopher frog returns to the Fifth Circuit; the Supreme Court has reversed a decision about judicial review of the Fish & Wildlife Service’s treatment of the endangered frog’s habitat, reached after a close denial of en banc review. In the meantime, the Fifth Circuit’s makeup has materially changed in ways that likely predispose the full court toward a different view of the underlying administrative-law issues.

The dusky gopher frog returns to the Fifth Circuit; the Supreme Court has reversed a decision about judicial review of the Fish & Wildlife Service’s treatment of the endangered frog’s habitat, reached after a close denial of en banc review. In the meantime, the Fifth Circuit’s makeup has materially changed in ways that likely predispose the full court toward a different view of the underlying administrative-law issues.

A gruesome series of automobile accidents led to a fundamental question about causation and insurance coverage in Evanston Ins. Co. v. Mid-Continent Casualty Co.: “Over a ten-minute period on November 15, 2013, the insured’s Mack truck struck (1) a Dodge Ram, (2) a Ford F150, (3) a Honda Accord, (4) a toll plaza, and (5) a Dodge Charger. . . . [T]he Mack truck’s primary insurer refused to contribute more than $1 million toward the settlements of the final three collisions, claiming that they were part of a single ‘accident’ under its policy.” Examining the reference points about this question under Texas law, the Fifth Circuit noted that:

A gruesome series of automobile accidents led to a fundamental question about causation and insurance coverage in Evanston Ins. Co. v. Mid-Continent Casualty Co.: “Over a ten-minute period on November 15, 2013, the insured’s Mack truck struck (1) a Dodge Ram, (2) a Ford F150, (3) a Honda Accord, (4) a toll plaza, and (5) a Dodge Charger. . . . [T]he Mack truck’s primary insurer refused to contribute more than $1 million toward the settlements of the final three collisions, claiming that they were part of a single ‘accident’ under its policy.” Examining the reference points about this question under Texas law, the Fifth Circuit noted that:

- Eight specific sales from one shipment of contaminated bird seed created eight separate occurrences;

- Two fires, set by the same arsonist “several blocks and at least two hours apart,” created two separate occurrences; and

- “[A]n HEB employee’s sexual abuse of two different children, a week apart, at an HEB store” created separate occurrences; however,

- A flawed three-hour crop dusting that damaged the land of several neighbors created one occurrence, even though “the plane had landed several times to refuel . . . [and] the temperature, wind, and altitude varied during the several passes over different sections of thee property”; and

- Two separate storms that damaged the same drilling rig created two separate occurrences.

Under the principles behind these cases, the Court found that the harm caused by the Mack truck’s driver created a single occurrence: “Absent any indication that the driver regained control of the truck or that his negligence was otherwise interrupted between collisions . . . all of the collisions resulted from the same continuous condition – the unbroken negligence of the Mack truck driver.” No. 17-20812 (Nov. 19, 2018).

The Fifth Circuit noted that “[t]he parties agree that we have jurisdiction over this appeal” in Aggreko LLC v. Chartis Specialty Ins. Co., which arose from rulings on cross-motions for summary judgment in a dispute about insurance coverage. Unfortunately for the parties seeking appellate review, the Court also reminded that “we must sua sponte examine the basis of our own jurisdiction when necessary.” Here, the disposition on summary judgment below did not end the litigation, as it resolved only some claims between some parties, and did not expressly result in the dismissal or entry of relief with respect to any parties’ claims.” No. 18-40325 (Nov. 21, 2018).

The Fifth Circuit noted that “[t]he parties agree that we have jurisdiction over this appeal” in Aggreko LLC v. Chartis Specialty Ins. Co., which arose from rulings on cross-motions for summary judgment in a dispute about insurance coverage. Unfortunately for the parties seeking appellate review, the Court also reminded that “we must sua sponte examine the basis of our own jurisdiction when necessary.” Here, the disposition on summary judgment below did not end the litigation, as it resolved only some claims between some parties, and did not expressly result in the dismissal or entry of relief with respect to any parties’ claims.” No. 18-40325 (Nov. 21, 2018).

In JCB, Inc. v. Horsburgh & Scott Co., the Fifth Circuit certified two questions of state law to the Texas Supreme Court, which involved important but sparsely-litigated topics about remedies under the Texas Sales Representative Act. The Court noted that “[o]n occasion, we have considered the following factors when deciding whether to certify: “(1) the closeness of the question and the existence of sufficient sources of state law; (2) the degree to which considerations of comity are relevant in light of the particular issue and case to be decided; and (3) practical limitations of the certification process: significant delay and possible inability to frame the issue so as to produce a helpful response on the part of the state court.” Two concurrences addressed potential answers that the Texas Supreme Court might provide. No. 17-51023 (Nov. 14, 2018).

In JCB, Inc. v. Horsburgh & Scott Co., the Fifth Circuit certified two questions of state law to the Texas Supreme Court, which involved important but sparsely-litigated topics about remedies under the Texas Sales Representative Act. The Court noted that “[o]n occasion, we have considered the following factors when deciding whether to certify: “(1) the closeness of the question and the existence of sufficient sources of state law; (2) the degree to which considerations of comity are relevant in light of the particular issue and case to be decided; and (3) practical limitations of the certification process: significant delay and possible inability to frame the issue so as to produce a helpful response on the part of the state court.” Two concurrences addressed potential answers that the Texas Supreme Court might provide. No. 17-51023 (Nov. 14, 2018).

Three erotic dancers brought a First Amendment challenge to a Louisiana law that imposed a 21-year age minimum on that line of work. As to overbreadth (i.e., the coverage of the law), the Fifth Circuit found “no suggestion in this record that the legislature was seeking to affect dancers other than those at establishments in which erotic dancing was the norm, or . . . specifically intended to cover those at traditional theater and ballet.” As to vagueness, the Court observed that the dancers “want to wear the bare minimum, but the Constitution does not guarantee them that level of specificity.” Doe v. Landry, No. 17-30292 (Nov. 16, 2018, on rehearing) (emphasis added).

Three erotic dancers brought a First Amendment challenge to a Louisiana law that imposed a 21-year age minimum on that line of work. As to overbreadth (i.e., the coverage of the law), the Fifth Circuit found “no suggestion in this record that the legislature was seeking to affect dancers other than those at establishments in which erotic dancing was the norm, or . . . specifically intended to cover those at traditional theater and ballet.” As to vagueness, the Court observed that the dancers “want to wear the bare minimum, but the Constitution does not guarantee them that level of specificity.” Doe v. Landry, No. 17-30292 (Nov. 16, 2018, on rehearing) (emphasis added).

2018 has offered several close votes about en banc review, often showing the importance of the new Trump appointees to the overall makup of the Fifth Circuit. The Court recently voted to rehear en banc the case of Collins v. Mnuchin, an important administrative law dispute about the structure and authority of the Federal Housing Finance Agency (a regulator for Fannie Mae and Freddie Mac created by Congress after the 2008 financial crisis). The difficult issues produced three opinions by the panel members. The Court’s order requested supplemental briefing about, inter alia, the appropriate remedy if the Court concluded that the agency had a structural problem. The argument will be in January 2019 and should bring more insight about the direction of the modern Fifth Circuit.

Iberiabank v. Broussard, among many other issues, addressed the “century-old” uncalled witness rule, under which, “if a party has it peculiarly within his power to produce witnesses whose testimony would elucidate the transaction, the fact that he does not do it creates the presumption that the testimony, if produced, would be unfavorable.” Also, there is “an important exception to the applicability of

Iberiabank v. Broussard, among many other issues, addressed the “century-old” uncalled witness rule, under which, “if a party has it peculiarly within his power to produce witnesses whose testimony would elucidate the transaction, the fact that he does not do it creates the presumption that the testimony, if produced, would be unfavorable.” Also, there is “an important exception to the applicability of  the presumption: if the witness is ‘equally available’ to both parties, any negative inference from one party’s failure to call that witness is impermissible.” Here, the Fifth Circuit found that a witness with knowledge about a particular computer-access issue could have been called by either side, making this rule inapplicable. No. 17-30662 (Oct. 25, 2018).

the presumption: if the witness is ‘equally available’ to both parties, any negative inference from one party’s failure to call that witness is impermissible.” Here, the Fifth Circuit found that a witness with knowledge about a particular computer-access issue could have been called by either side, making this rule inapplicable. No. 17-30662 (Oct. 25, 2018).

Despite the Trump Administration’s blazingly-hot pace for Fifth Circuit appointments, with five successful nominations before the midterm elections, the process of replacing Judge Jolly of Mississippi has lagged and the Court continues to have that one vacancy. Philip Thompson’s outstanding blog about Mississippi litigation recently had a detailed analysis of the political situation surrounding this vacancy.

Despite the Trump Administration’s blazingly-hot pace for Fifth Circuit appointments, with five successful nominations before the midterm elections, the process of replacing Judge Jolly of Mississippi has lagged and the Court continues to have that one vacancy. Philip Thompson’s outstanding blog about Mississippi litigation recently had a detailed analysis of the political situation surrounding this vacancy.

Inadvertent calendaring errors can justify relief from some deadlines, but not Rule 60(b)(1), which says that a court “may relieve a party or its legal representative from a final judgment, order, or proceeding,” on the grounds of “mistake, inadvertence, surprise, or excusable neglect.” “A district court does not abuse its discretion when it denies a Rule 60(b)(1) motion due to the ‘careless mistake of counsel.’ In fact, our case law establishes the opposite: ‘a court would abuse its discretion if it were to reopen a case under Rule 60(b)(1) when the reason asserted as justifying relief is one attributable solely to counsel’s carelessness with or misapprehension of the law or the applicable rules of court.'” Rayford v. Karl Storz Endoscopy Am., Inc., No. 18-30602 (Oct. 23, 2018, unpublished) (citations omitted).

Inadvertent calendaring errors can justify relief from some deadlines, but not Rule 60(b)(1), which says that a court “may relieve a party or its legal representative from a final judgment, order, or proceeding,” on the grounds of “mistake, inadvertence, surprise, or excusable neglect.” “A district court does not abuse its discretion when it denies a Rule 60(b)(1) motion due to the ‘careless mistake of counsel.’ In fact, our case law establishes the opposite: ‘a court would abuse its discretion if it were to reopen a case under Rule 60(b)(1) when the reason asserted as justifying relief is one attributable solely to counsel’s carelessness with or misapprehension of the law or the applicable rules of court.'” Rayford v. Karl Storz Endoscopy Am., Inc., No. 18-30602 (Oct. 23, 2018, unpublished) (citations omitted).

In an Erie guess based on prior Circuit precedent and intermediate Texas authority, this limitation-of-liability provision was found to not waive a claim for attorneys’ fees under CPRC § 38.001: “[E]ither Party’s liability, if any, for damages to the other Party for any cause whatsoever arising out of or related to this Agreement, and regardless of the form of the action, shall be limited to the damaged Party’s actual damages. Neither Party shall be liable for any indirect, incidental, punitive, exemplary, special or consequential damages of any kind whatsoever sustained as a result of a breach of this Agreement or any action, inaction, alleged tortuous conduct, or delay by the other party.” Ferrari v. Aetna Life Ins. Co., No. 17-20556 (Nov. 7, 2018, unpublished).

In an Erie guess based on prior Circuit precedent and intermediate Texas authority, this limitation-of-liability provision was found to not waive a claim for attorneys’ fees under CPRC § 38.001: “[E]ither Party’s liability, if any, for damages to the other Party for any cause whatsoever arising out of or related to this Agreement, and regardless of the form of the action, shall be limited to the damaged Party’s actual damages. Neither Party shall be liable for any indirect, incidental, punitive, exemplary, special or consequential damages of any kind whatsoever sustained as a result of a breach of this Agreement or any action, inaction, alleged tortuous conduct, or delay by the other party.” Ferrari v. Aetna Life Ins. Co., No. 17-20556 (Nov. 7, 2018, unpublished).

Dubrow sued 2200 West Alabama Inc., alleging that Dubrow was the “rightful tenant” of space leased by 2200 West. Western World declined to defend the action, noting that its coverage only extended to claims about “[t]he wrongful eviction from, wrongful entry into, or invasion of the right of private occupancy of a . . . premises that a person occupies.” (emphasis added). While the meaning of “occupies” could be debated in the abstract, the term has a clear and unambiguous meaning under Texas case law, that “requires physical presence or possession.” Because Dubow never became a tenant, he never “occupied” the premises and coverage did not arise. 2200 West Alabama v. Western World Ins. Co., No. 17-20640 (Oct. 22, 2018).

Dubrow sued 2200 West Alabama Inc., alleging that Dubrow was the “rightful tenant” of space leased by 2200 West. Western World declined to defend the action, noting that its coverage only extended to claims about “[t]he wrongful eviction from, wrongful entry into, or invasion of the right of private occupancy of a . . . premises that a person occupies.” (emphasis added). While the meaning of “occupies” could be debated in the abstract, the term has a clear and unambiguous meaning under Texas case law, that “requires physical presence or possession.” Because Dubow never became a tenant, he never “occupied” the premises and coverage did not arise. 2200 West Alabama v. Western World Ins. Co., No. 17-20640 (Oct. 22, 2018).

If you are a lawyer in the Dallas area, you should read today’s post on 600Commerce, about the new Democratic majority and Democratic Chief Justice on the Dallas Court of Appeals.

If you are a lawyer in the Dallas area, you should read today’s post on 600Commerce, about the new Democratic majority and Democratic Chief Justice on the Dallas Court of Appeals.

Property rights are often called a “bundle of sticks”; a particularly tangled bundle was the subject of RPD Holdings LLC v. Tech Pharmacy Servcs. Careful examination of both sides’ specific obligations under a patent license led to the conclusion that it was an executory contract, rejected by operation of law during one of the parties’ Chapter 7 bankruptcy case. No. 17-11113 (Oct. 29, 2018).

Property rights are often called a “bundle of sticks”; a particularly tangled bundle was the subject of RPD Holdings LLC v. Tech Pharmacy Servcs. Careful examination of both sides’ specific obligations under a patent license led to the conclusion that it was an executory contract, rejected by operation of law during one of the parties’ Chapter 7 bankruptcy case. No. 17-11113 (Oct. 29, 2018).

The issue in SCF Waxler Marine LLC v. Aris T MV was whether the excess insurers for a multi-vessel accident could enforce a “Crown Zellerbach clause,” and thus limit their liability to the value of the insured vessel. (The vessel at issue, the Aris T (right) is presently in the Atlantic en route to Rotterdam from Mobile.) The Fifth Circuit found that it lacked appellate jurisdiction over the district court’s ruling that the excess insurers could enforce such a clause: “The fundamentals of Bucher-Guyer bear a striking resemblance to this case. There, the district court determined the boundaries of a party’s liability— $500—based on the applicability of statutory language. Nevertheless, whether the opposing party was entitled to anything and, if so, how much was still to be determined. In this case, the court decided the boundaries of a party’s liability through determination of whether a contractual provision permitted them to do so. Whether Valero, Shell, and Motiva are legally permitted to recover anything from the Excess Insurers and, if so, how much remains to be determined.” No. 17-30805 (Oct. 30, 2018).

The issue in SCF Waxler Marine LLC v. Aris T MV was whether the excess insurers for a multi-vessel accident could enforce a “Crown Zellerbach clause,” and thus limit their liability to the value of the insured vessel. (The vessel at issue, the Aris T (right) is presently in the Atlantic en route to Rotterdam from Mobile.) The Fifth Circuit found that it lacked appellate jurisdiction over the district court’s ruling that the excess insurers could enforce such a clause: “The fundamentals of Bucher-Guyer bear a striking resemblance to this case. There, the district court determined the boundaries of a party’s liability— $500—based on the applicability of statutory language. Nevertheless, whether the opposing party was entitled to anything and, if so, how much was still to be determined. In this case, the court decided the boundaries of a party’s liability through determination of whether a contractual provision permitted them to do so. Whether Valero, Shell, and Motiva are legally permitted to recover anything from the Excess Insurers and, if so, how much remains to be determined.” No. 17-30805 (Oct. 30, 2018).

William Pearson won a modest judgment in an overtime dispute and appealed in Pearson v. Frequency Car Audio, seeking more. The Fifth Circuit affirmed; as to a challenge to the accuracy of the employer’s records, it observed:

William Pearson won a modest judgment in an overtime dispute and appealed in Pearson v. Frequency Car Audio, seeking more. The Fifth Circuit affirmed; as to a challenge to the accuracy of the employer’s records, it observed:

“[T]he question before the district court was not whether Frequency kept proper records—it was whether Pearson worked overtime. And although the district court noted that Frequency’s books were “incomplete and not in evidence,” its conclusion that Pearson did not work overtime was based on its findings that: (1) Pearson’s claim that his work at Khalsa’s and Singh’s residences constituted work for Frequency was “incredible”; (2) Khalsa’s testimony that Pearson worked no overtime was credible; and (3) Pearson’s claim that he worked on cars before the shop opened was “unquantifiable.” Thus, the district court’s conclusion was largely based on the witnesses’ credibility, so we must give that conclusion due regard.”

No. 17-20769 (Nov. 2, 2018, unpublished) (emphasis added).

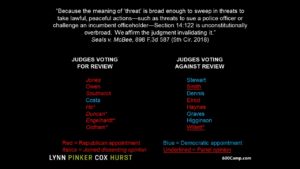

A Fifth Circuit panel struck down a Louisiana criminal statute about “threats” in Seals v. McBee, which led to an 8-8 vote and denial of en banc review. The full breakdown appears in the chart to the right; again, the new appointments by President Trump brought a case to the cusp of en banc review that likely would not have gotten so far before. No. 17-30667 (Oct. 31, 2018). A dissent from the denial of en banc review, joined by 4 of the 5 Trump appointees, would have dismissed the case on standing grounds. (The chart has been corrected from the original post, which misidentified Judge Dennis as a Republican appointee.)

A Fifth Circuit panel struck down a Louisiana criminal statute about “threats” in Seals v. McBee, which led to an 8-8 vote and denial of en banc review. The full breakdown appears in the chart to the right; again, the new appointments by President Trump brought a case to the cusp of en banc review that likely would not have gotten so far before. No. 17-30667 (Oct. 31, 2018). A dissent from the denial of en banc review, joined by 4 of the 5 Trump appointees, would have dismissed the case on standing grounds. (The chart has been corrected from the original post, which misidentified Judge Dennis as a Republican appointee.)

A freak accident involving a compound bow killed Dr. Alan Sandifer, which led to litigation, which led to the plaintiff’s expert testifying as follows:

Dr. Kelkar conceded that from a biomechanical perspective, it was just as likely that Dr. Sandifer was killed by volitionally placing his head inside the bow as it was by an accidental twisting of the bowstring. But he added that he believed the second scenario was more likely because of statements from Dr. Sandifer’s friends and family describing him as a careful bow hunter and the difficulty of volitionally placing one’s head into a drawn bowstring. When pressed, Dr. Kelkar conceded that, without the statements about Dr. Sandifer’s careful nature as a hunter, he could not say his theory was more likely than the expert opinion offered by Hoyt.

This reliance on “propensity” evidence led to affirmance of the expert’s exclusion under Daubert: “Apart from exceeding the scope of his qualification as a biomechanical expert, the propensity evidence Dr. Kelkar based his opinion upon is not a reliable basis to draw a conclusion regarding Dr. Sandifer’s use of the bow at the time of the accident. The propensity evidence was offered by witnesses who testified that Dr. Sandifer was safety-conscious in using and handling the bow as a hunter and when hunting. Dr. Sandifer was not hunting when the accident occurred; he was in his home office and he was engaged in modifying his bow.” Sandifer v. Hoyt Archery Inc., No. 17-30124 (Oct. 24, 2018).

The high-profile litigation about use of Dallas’s convention center by “Exxxotica,” which bills itself as “The Largest Adult Event in the USA Dedicated to Love & Sex,” was brought back to life by a divided Fifth Circuit panel in Three Expo Events LLC v. City of Dallas, No. 17-10632 (Oct. 24, 2018). The issue was standing; two judges agreed that the named plaintiff had alleged a direct injury, with one writing a detailed opinion and the other concurring in the result. A dissent would have affirmed, agreeing with the district court’s distinction between the entity that sued and the entity that would have operated the event in question.

The high-profile litigation about use of Dallas’s convention center by “Exxxotica,” which bills itself as “The Largest Adult Event in the USA Dedicated to Love & Sex,” was brought back to life by a divided Fifth Circuit panel in Three Expo Events LLC v. City of Dallas, No. 17-10632 (Oct. 24, 2018). The issue was standing; two judges agreed that the named plaintiff had alleged a direct injury, with one writing a detailed opinion and the other concurring in the result. A dissent would have affirmed, agreeing with the district court’s distinction between the entity that sued and the entity that would have operated the event in question.

In a win for our firm’s client, the Fifth Circuit affirmed last year’s $3 million trial win by Mike Lynn and John Volney for Prince Mansour bin Abdullah Al-Saud, in a succinct opinion touching on the parol evidence rule, speculative damages, and ways to cure a pleading problem with respect to the recovery of attorneys’ fees. Al-Saud v. Youtoo Media, No. 17-10622 (Oct. 22, 2018).

The Fifth Circuit reversed a defense summary judgment in a trade secrets dispute in Brand Services LLC v. Irex Corp., noting inter alia –

The Fifth Circuit reversed a defense summary judgment in a trade secrets dispute in Brand Services LLC v. Irex Corp., noting inter alia –

- Discovery. In its summary judgment analysis, the district court should have addressed a discovery motion filed by the non-movant: “Brand Services claims it moved to compel immediately after discovering the responsive documents in the Pennsylvania litigation. There is some indication that Brand Services could not have reasonably discovered these documents sooner: Irex’s initial blanket objections to Brand Services’s discovery request were grossly improper, and thereafter Irex did little to comply with Brand Services’s requests. Therefore, Brand Services was arguably diligent in seeking these documents even though it did not discover them until after the discovery deadline had passed. At a minimum, Irex’s conduct in this discovery proceeding is highly questionable and bears further examination in light of the exemplar documents.”

- Damages. “Although Brand Services provided little in the way of detail about its

claim that it spent ‘millions’ to design the software allegedly stolen, it has, at a minimum, provided some evidence from which a jury could reasonably estimate unjust enrichment damages. For example, it demonstrated that Irex’s use of the

claim that it spent ‘millions’ to design the software allegedly stolen, it has, at a minimum, provided some evidence from which a jury could reasonably estimate unjust enrichment damages. For example, it demonstrated that Irex’s use of the

allegedly stolen information saved Irex at least two to three days a month in time spent invoicing. Even assuming that Irex’s administrative personnel worked only an eight-hour day for minimum wage during those two to three days saved, this is a reasonable inference of unjust-enrichment damages.”

No. 17-30660 (revised Nov. 21, 2018).

A defendant adjusted its arguments about appropriate overtime calculation in light of the trial court’s rulings; the Fifth Circuit found no invited error, waiver, or judicial estoppel. As to judicial estoppel in particular, the Court observed: “In arguing for the comparator model, Saybolt never conceded that the FWW plaintiffs were paid based on a 40-hour workweek or were owed overtime at one and one-half times the “regular rate.” There was thus no inconsistency. Nor did the district court accept Saybolt’s initial position as is required for judicial estoppel. Indeed, the court rejected the comparator model by requiring that incentive payments be included in the “regular rate” calculation. This is why Saybolt fell back on the alternative argument that, since incentive payments must be included, the FWW method should be used to calculate the plaintiffs’ damages.” Dacar v. Saybolt LP. No. 16-20751 (Oct. 18, 2018). A brief opinion on rehearing clarified the scope of the opinion.

defendant adjusted its arguments about appropriate overtime calculation in light of the trial court’s rulings; the Fifth Circuit found no invited error, waiver, or judicial estoppel. As to judicial estoppel in particular, the Court observed: “In arguing for the comparator model, Saybolt never conceded that the FWW plaintiffs were paid based on a 40-hour workweek or were owed overtime at one and one-half times the “regular rate.” There was thus no inconsistency. Nor did the district court accept Saybolt’s initial position as is required for judicial estoppel. Indeed, the court rejected the comparator model by requiring that incentive payments be included in the “regular rate” calculation. This is why Saybolt fell back on the alternative argument that, since incentive payments must be included, the FWW method should be used to calculate the plaintiffs’ damages.” Dacar v. Saybolt LP. No. 16-20751 (Oct. 18, 2018). A brief opinion on rehearing clarified the scope of the opinion.

Even in the complex world of the modern administrative state, the Social Security Administration stands alone as “the Mount Everest of bureaucratic structures.” Barrett v. Berryhill, No. 17-41177 (revised Oct. 16, 2018) (citation omitted). Surveying that landscape, the Fifth Circuit concluded that a person claiming disability benefits did not have an automatic right to cross-examine a “medical consultant,” a doctor who reviews records without examining the claimant: “We do not mean to say that the opinions of medical consultants are unimportant or error free. But granting an automatic right to subpoena them is too strong a medicine. We do not see why examination of a medical consultant will always, or even usually, lead to meaningful impeachment. That is especially true when, as in this case, the [relevant] form is reviewed by a second medical consultant, lessening the risk of error. When a claimant has legitimate concerns that a[] . . . form is inaccurate or misleading, existing regulations provide the opportunity to question the drafter.” (emphasis in original).

Even in the complex world of the modern administrative state, the Social Security Administration stands alone as “the Mount Everest of bureaucratic structures.” Barrett v. Berryhill, No. 17-41177 (revised Oct. 16, 2018) (citation omitted). Surveying that landscape, the Fifth Circuit concluded that a person claiming disability benefits did not have an automatic right to cross-examine a “medical consultant,” a doctor who reviews records without examining the claimant: “We do not mean to say that the opinions of medical consultants are unimportant or error free. But granting an automatic right to subpoena them is too strong a medicine. We do not see why examination of a medical consultant will always, or even usually, lead to meaningful impeachment. That is especially true when, as in this case, the [relevant] form is reviewed by a second medical consultant, lessening the risk of error. When a claimant has legitimate concerns that a[] . . . form is inaccurate or misleading, existing regulations provide the opportunity to question the drafter.” (emphasis in original).

I n Seeligson v. Devon Energy, the Fifth Circuit made a good, and a not-good, finding for a putative class of mineral-interest holders.

n Seeligson v. Devon Energy, the Fifth Circuit made a good, and a not-good, finding for a putative class of mineral-interest holders.

- Good: The Court found that a putative class had established commonality as to the question whether the defendant “breached its implied duty to market by basing its price on a higher processing fee than the fee that a ‘reasonably prudent operator would have received at the wellhead,’ reasoning that “[t]his issue is precisely the type of common question ‘that . . . will resolve an issue that is central to the validity of each one of the claims in one stroke.'”

- Not good: “Despite the potential for individual questions based on [Defendant’s] statute of limitations defense, the district court did not mention the role, if any, the tolling or limitations issues would play in this class action litigation,” and remanded for analysis of whether the common questions would predominate over individual issues raised by these defenses.

No. 17-10320 (Oct. 16, 2018).

“The district court also abused its discretion in excluding Sharma’s testimony regarding his trend analyses. The district court found this testimony misleading because Sharma only plotted some of the data points from the testing of the pond, which indicated a steady decline moving away from Fairway View, but some of the omitted data points were inconsistent with this trend. We find that this critique of Sharma’s method does not justify excluding the trend analysis testimony entirely. Rather, this question as to the basis for Sharma’s opinion is fodder for cross-examination, “affect[s] the weight to be assigned that opinion rather than its admissibility[,] and should be left for the jury’s consideration.'” Cedar Lodge Plantation v. CSHV Fairway View I, LLC, No.. 17-30742 (Oct. 10, 2018, unpublished) (emphasis added).

“The district court also abused its discretion in excluding Sharma’s testimony regarding his trend analyses. The district court found this testimony misleading because Sharma only plotted some of the data points from the testing of the pond, which indicated a steady decline moving away from Fairway View, but some of the omitted data points were inconsistent with this trend. We find that this critique of Sharma’s method does not justify excluding the trend analysis testimony entirely. Rather, this question as to the basis for Sharma’s opinion is fodder for cross-examination, “affect[s] the weight to be assigned that opinion rather than its admissibility[,] and should be left for the jury’s consideration.'” Cedar Lodge Plantation v. CSHV Fairway View I, LLC, No.. 17-30742 (Oct. 10, 2018, unpublished) (emphasis added).

The plaintiff in SureShot Golf Ventures, Inc. v. Topgolf Int’l, Inc. alleged that the defendant engaged in anticompetitive conduct by acquiring a company that made critical technology for its golf-related entertainment facilities. The Fifth Circuit affirmed dismissal on the ground that the case was not ripe: “[A]l of the allegations SureShot identifies for us are phrased in future terms, and SureShot has not alleged that any of the federal antitrust violations have resulted in the above-referenced feared actions.” No 17-20607 (Oct. 9, 2018, unpublished) (per curiam). (The district court’s opinion also dismissed for lack of antitrust injury, a point that the Fifth Circuit did not reach.)

The plaintiff in SureShot Golf Ventures, Inc. v. Topgolf Int’l, Inc. alleged that the defendant engaged in anticompetitive conduct by acquiring a company that made critical technology for its golf-related entertainment facilities. The Fifth Circuit affirmed dismissal on the ground that the case was not ripe: “[A]l of the allegations SureShot identifies for us are phrased in future terms, and SureShot has not alleged that any of the federal antitrust violations have resulted in the above-referenced feared actions.” No 17-20607 (Oct. 9, 2018, unpublished) (per curiam). (The district court’s opinion also dismissed for lack of antitrust injury, a point that the Fifth Circuit did not reach.)

In Kiewit Offshore v. Dresser-Rand, the Fifth Circuit affirmed a summary judgment for the plaintiff in a large construction matter; as the final point addressed, the Court observed: “Dresser-Rand contends, for the first time on appeal, that Kiewit submitted insufficient, conclusory summaries of the work reflected in Invoices DR-04b, 05, and 06, preventing the district court from verifying the total amount of damages Kiewit claimed. Dresser-Rand failed to raise this argument below, and we therefore decline to consider it here.” The Court also noted that “it was undisputed that the invoices accurately reflected actual costs incurred . . . for work performed and accepted . . . .” It is a fair question whether the same result would obtain under Texas state practice, which among other matters distinguishes between “substantive” and “form” objections to summary judgment affidavits – “form” issues requiring objection, but not substantive ones. See Seim v. Allstate Texas Lloyds, No. 17-0488, 2018 WL 3189568, at *3 (Tex. June 29, 2018) (per curiam).

In Kiewit Offshore v. Dresser-Rand, the Fifth Circuit affirmed a summary judgment for the plaintiff in a large construction matter; as the final point addressed, the Court observed: “Dresser-Rand contends, for the first time on appeal, that Kiewit submitted insufficient, conclusory summaries of the work reflected in Invoices DR-04b, 05, and 06, preventing the district court from verifying the total amount of damages Kiewit claimed. Dresser-Rand failed to raise this argument below, and we therefore decline to consider it here.” The Court also noted that “it was undisputed that the invoices accurately reflected actual costs incurred . . . for work performed and accepted . . . .” It is a fair question whether the same result would obtain under Texas state practice, which among other matters distinguishes between “substantive” and “form” objections to summary judgment affidavits – “form” issues requiring objection, but not substantive ones. See Seim v. Allstate Texas Lloyds, No. 17-0488, 2018 WL 3189568, at *3 (Tex. June 29, 2018) (per curiam).

The modern administrative state often requests documents for compliance and enforcement purposes; such a request led to a Fourth Amendment challenge to a subpoena from the Texas Medical Board in Barry v. Freshour. The challenge was made by a doctor who practiced at the facility that received the request. The Fifth Circuit rejected the doctor’s challenge and reversed the district court’s ruling in his favor: “The district court concluded Barry had standing because the records were sought in a proceeding against him and the subpoena was addressed to him personally (though it was also addressed to the records custodian). But the Supreme Court has rejected a ‘target’ approach to Fourth Amendment standing that would look to whether the evidence obtained could be used against the person seeking to challenge the search.” Here, “Barry relies on a list of pure privacy interests in the information the records contain. All but one, as he concedes, are specifically tied to his patients’ privacy interests in their own medical records. To the extent such interests are constitutionally cognizable, they cannot be asserted by Barry.” No. 17-20726 (Oct. 4, 2018).

The modern administrative state often requests documents for compliance and enforcement purposes; such a request led to a Fourth Amendment challenge to a subpoena from the Texas Medical Board in Barry v. Freshour. The challenge was made by a doctor who practiced at the facility that received the request. The Fifth Circuit rejected the doctor’s challenge and reversed the district court’s ruling in his favor: “The district court concluded Barry had standing because the records were sought in a proceeding against him and the subpoena was addressed to him personally (though it was also addressed to the records custodian). But the Supreme Court has rejected a ‘target’ approach to Fourth Amendment standing that would look to whether the evidence obtained could be used against the person seeking to challenge the search.” Here, “Barry relies on a list of pure privacy interests in the information the records contain. All but one, as he concedes, are specifically tied to his patients’ privacy interests in their own medical records. To the extent such interests are constitutionally cognizable, they cannot be asserted by Barry.” No. 17-20726 (Oct. 4, 2018).

A federal statute regulates towing vessels, defined as “a commercial vessel engaged in or intending to engage in the service of pulling, pushing, or hauling along side, or any combination of pulling, pushing, or hauling along side.” Shell Offshore v. Tesla Offshore LLC presented the novel question of whether pulling a “towfish” underwater, as part of an archaeological project, fell within this statute (after an unfortunate encounter not with undersea history, but with a Shell offshore drilling rig). The Fifth Circuit found the statute applicable, concluding that the statute’s language did not require the exclusion of academically-oriented activity, that the statute would not reach ordinary fishing activity because the was not “the service” of such vessels, and that applying the statute here would not produce an absurd result. No. 16-30528 (Oct. 5, 2018). (This analysis would correctly exclude a Hummer carrying a TOW missile (above), although that could be called “tow-ing”).

A federal statute regulates towing vessels, defined as “a commercial vessel engaged in or intending to engage in the service of pulling, pushing, or hauling along side, or any combination of pulling, pushing, or hauling along side.” Shell Offshore v. Tesla Offshore LLC presented the novel question of whether pulling a “towfish” underwater, as part of an archaeological project, fell within this statute (after an unfortunate encounter not with undersea history, but with a Shell offshore drilling rig). The Fifth Circuit found the statute applicable, concluding that the statute’s language did not require the exclusion of academically-oriented activity, that the statute would not reach ordinary fishing activity because the was not “the service” of such vessels, and that applying the statute here would not produce an absurd result. No. 16-30528 (Oct. 5, 2018). (This analysis would correctly exclude a Hummer carrying a TOW missile (above), although that could be called “tow-ing”).

Whole Foods admitted to mislabeling certain prepackaged foods, which in addition to other legal problems, drew a securities fraud claim. The Fifth Circuit affirmed the rejection of that claim, observing: “The relationship between the weights-and-measures fraud and the plaintiffs’ loss (the decline in the stock price) is causal; the relationship between the alleged securities fraud and the plaintiffs’ loss is spurious. Whole Foods’ overcharging caused (1) the alleged accounting problems and (2) the public-relations problems. The public-relations problems arguably led to slowed sales and the loss in stock price. But the accounting problems did not cause the public-relations problem, nor do the plaintiffs allege that the accounting problems caused a separate loss in stock price.” Employers’ Retirement System v. Whole Foods Market, No. 17-50840 (Oct. 3, 2018).

Whole Foods admitted to mislabeling certain prepackaged foods, which in addition to other legal problems, drew a securities fraud claim. The Fifth Circuit affirmed the rejection of that claim, observing: “The relationship between the weights-and-measures fraud and the plaintiffs’ loss (the decline in the stock price) is causal; the relationship between the alleged securities fraud and the plaintiffs’ loss is spurious. Whole Foods’ overcharging caused (1) the alleged accounting problems and (2) the public-relations problems. The public-relations problems arguably led to slowed sales and the loss in stock price. But the accounting problems did not cause the public-relations problem, nor do the plaintiffs allege that the accounting problems caused a separate loss in stock price.” Employers’ Retirement System v. Whole Foods Market, No. 17-50840 (Oct. 3, 2018).

The “concurrent-remedies doctrine” holds that “when the jurisdiction of the federal court is concurrent with that of law, or the suit is brought in aid of a legal right, equity will withhold its remedy if the legal right is barred by the local statute of limitations.” In Sierra Club v. Luminant Energy, that doctrine would have barred a private litigant’s claim for an injunction when a damages claim was time-barred – but it was held not to apply to a request for injunctive relief brought by the U.S. in its capacity as sovereign. On the

The “concurrent-remedies doctrine” holds that “when the jurisdiction of the federal court is concurrent with that of law, or the suit is brought in aid of a legal right, equity will withhold its remedy if the legal right is barred by the local statute of limitations.” In Sierra Club v. Luminant Energy, that doctrine would have barred a private litigant’s claim for an injunction when a damages claim was time-barred – but it was held not to apply to a request for injunctive relief brought by the U.S. in its capacity as sovereign. On the  merits of the request, the panel majority noted that “the statute of limitations that barred the legal relief [of damages] does not itself bar equitable relief unless it constitutes a penalty,” and left the question of whether the relief was in fact a penalty for the district court on remand. A dissent reasoned that “both of these so-called forms of injunctive relief are really just time-barred penalties in disguise,” would have affirmed dismissal of the entire case on limitations grounds, and avoided the issue about applying the concurrent-remedies doctrine to sovereigns. No. 17-10235 (Oct. 1, 2018).

merits of the request, the panel majority noted that “the statute of limitations that barred the legal relief [of damages] does not itself bar equitable relief unless it constitutes a penalty,” and left the question of whether the relief was in fact a penalty for the district court on remand. A dissent reasoned that “both of these so-called forms of injunctive relief are really just time-barred penalties in disguise,” would have affirmed dismissal of the entire case on limitations grounds, and avoided the issue about applying the concurrent-remedies doctrine to sovereigns. No. 17-10235 (Oct. 1, 2018).

Griggs was ordered to arbitrate his dispute with Stream Energy. Griggs refused to do so. When asked by the district court for a status report, in an echo of Bartleby the Scrivener’s famous “I would prefer not to,” Griggs responded in relevant part:

Griggs was ordered to arbitrate his dispute with Stream Energy. Griggs refused to do so. When asked by the district court for a status report, in an echo of Bartleby the Scrivener’s famous “I would prefer not to,” Griggs responded in relevant part:

“Griggs anticipated that this Court would have already dismiss[ed] this case for want of prosecution because this Court left him only an arbitration which he has not pursued. So, Griggs states the following for the Court’s consideration: 1. Griggs understands and appreciates this Court’s order compelling arbitration. Griggs believes that the Court cons[idered] all arguments before it ruled. 2. However, Griggs disagrees with this Court’s conclusion that this matter must go to arbitration. 3. Griggs will not pursue arbitration. 4. Griggs stands ready to litigate this case before this Court to a conclusion.”

The district court then dismissed the case without prejudice. After review of the various kinds of dismissals addressed by Fed. R. Civ. P. 41, the Fifth Circuit treated the dismissal order as one for “delay or contumacious conduct” under Rule 41(b) – and thus, declined to reach the merits of the arbitration ruling: “Griggs should not be permitted, through recalcitrance, to obtain the review of the arbitration clause that he was expressly denied in the district court, a review that Congress has foreclosed under the Federal Arbitration Act.” Griggs v. SGE Management LLC, No. 17-50655 (Sept. 27, 2018).

Problems with the h andling of a CJA criminal appeal led to imposition of sanctions by the district court; specifically: (1) removal from Fort Worth’s CJA panel; (2) a $750 fine; and (3) “12 hours of ethics courses at an accredited law school” within a specified period. The Fifth Circuit affirmed the imposition of sanctions and the first two specific sanctions, but set aside the third as not being “the least restrictive sanction necessary to deter the inappropriate behavior”: “To do this, [the attorney] would presumably need to take the LSAT, apply, and be admitted into a law school. He would then likely need to suspend his law practice—12 hours of classes would almost make Luttrell a fulltime student. And finally, even if he did all this, we are aware of no law school that even offers 12 hours of ethics courses in a single semester.” In re Luttrell, No. 17-10589 (Sept. 28, 2018, unpublished).

andling of a CJA criminal appeal led to imposition of sanctions by the district court; specifically: (1) removal from Fort Worth’s CJA panel; (2) a $750 fine; and (3) “12 hours of ethics courses at an accredited law school” within a specified period. The Fifth Circuit affirmed the imposition of sanctions and the first two specific sanctions, but set aside the third as not being “the least restrictive sanction necessary to deter the inappropriate behavior”: “To do this, [the attorney] would presumably need to take the LSAT, apply, and be admitted into a law school. He would then likely need to suspend his law practice—12 hours of classes would almost make Luttrell a fulltime student. And finally, even if he did all this, we are aware of no law school that even offers 12 hours of ethics courses in a single semester.” In re Luttrell, No. 17-10589 (Sept. 28, 2018, unpublished).