“Sharing liability is not the same as sharing an identity. As our colleagues in the Ninth Circuit explained, ‘Liability and jurisdiction are independent. . . . Regardless of their joint liability, jurisdiction over each defendant must be established individually.’ Lumping defendants together for jurisdictional purposes merely because they are solidary obligors ‘is plainly unconstitutional.'” Libersat v. Sundance Energy, No. 20-30121 (Oct. 26, 2020) (citation omitted, emphasis added).

“Sharing liability is not the same as sharing an identity. As our colleagues in the Ninth Circuit explained, ‘Liability and jurisdiction are independent. . . . Regardless of their joint liability, jurisdiction over each defendant must be established individually.’ Lumping defendants together for jurisdictional purposes merely because they are solidary obligors ‘is plainly unconstitutional.'” Libersat v. Sundance Energy, No. 20-30121 (Oct. 26, 2020) (citation omitted, emphasis added).

The novelty of the international-discovery procedure in 28 USC § 1782 intersected with the collateral-order doctrine about interlocutory appeals in Banca Pueyo SA v. Lone Star Fund: “While we readily conclude that this appeal was premature, we recognize that the unusual nature of section 1782 proceedings results in some uncertainty about when to appeal. Indeed, respondents acknowledged that this might not be the right time, but they appealed now in an abundance of caution. They also worry that an appeal may never be ripe due to the possibility of a future dispute over privilege. But appellate jurisdiction is a ‘practical’ determination, not a speculative one. Once the district court fully resolves the second motion to quash, the scope of section 1782 discovery should be definitively resolved. When that conclusive determination comes, an appeal would be appropriate.” No. 20-10049 (Oct. 27, 2020) (mem. op.).

The novelty of the international-discovery procedure in 28 USC § 1782 intersected with the collateral-order doctrine about interlocutory appeals in Banca Pueyo SA v. Lone Star Fund: “While we readily conclude that this appeal was premature, we recognize that the unusual nature of section 1782 proceedings results in some uncertainty about when to appeal. Indeed, respondents acknowledged that this might not be the right time, but they appealed now in an abundance of caution. They also worry that an appeal may never be ripe due to the possibility of a future dispute over privilege. But appellate jurisdiction is a ‘practical’ determination, not a speculative one. Once the district court fully resolves the second motion to quash, the scope of section 1782 discovery should be definitively resolved. When that conclusive determination comes, an appeal would be appropriate.” No. 20-10049 (Oct. 27, 2020) (mem. op.).

Richardson v. Flores reviewed the standards for intervention into an ongoing appeal, noting: “There is no appellate rule allowing intervention generally. Instead, the Federal Rules of Appellate Procedure contemplate intervention only in

Richardson v. Flores reviewed the standards for intervention into an ongoing appeal, noting: “There is no appellate rule allowing intervention generally. Instead, the Federal Rules of Appellate Procedure contemplate intervention only in

proceedings to review agency action. Fed. R. App. P. 15(d). But despite the lack of an on-point rule, we have allowed intervention in cases outside the scope of Rule 15(d). . . . Perhaps because there is no rule explicitly allowing intervention on appeal, the caselaw explicating the standards for such motions is scarce. In Bursey, when granting a similar motion to intervene, we said ‘a court of appeals may,  but only in an exceptional case for imperative reasons, permit intervention where none was sought in the district court.'” (footnote and citations omitted, emphasis in original). The Court also noted: “Motions to intervene on appeal are different from motions to intervene for purposes of appeal. Motions to intervene for purposes of appeal are used where ‘the existing parties have decided not to pursue [an appeal]’ and are filed in district courts in the first instance under the Federal Rules of Civil Procedure.” (citation omitted).

but only in an exceptional case for imperative reasons, permit intervention where none was sought in the district court.'” (footnote and citations omitted, emphasis in original). The Court also noted: “Motions to intervene on appeal are different from motions to intervene for purposes of appeal. Motions to intervene for purposes of appeal are used where ‘the existing parties have decided not to pursue [an appeal]’ and are filed in district courts in the first instance under the Federal Rules of Civil Procedure.” (citation omitted).

Who knew? The federal bench in Houston just released an inspiring rendition of “We’ll Be Back” from Hamilton, revised to reflect life in the COVID-19 pandemic. Bravo!

Who knew? The federal bench in Houston just released an inspiring rendition of “We’ll Be Back” from Hamilton, revised to reflect life in the COVID-19 pandemic. Bravo!

The defendant in Coastal Bridge Co. v. Heatec, No. 19-31030 (revised Nov. 6, 2020) made a spoliation claim about the loss of a heater involved in a fire. The Fifth Circuit reasoned:

- “As a threshold matter, Because Coastal Bridge reasonably should have anticipated litigation over the fire damage, it had a duty to preserve the equipment.”

- But bad faith was not shown: “Adherence to normal operating procedures may counter a contention of bad faith. Here, an outdoor piece of industrial equipment was stored outdoors. The record does not support the finding that Coastal Bridge acted with a culpable state of mind.”

- And as to relevance: “Heatec did not specifically request to examine the pumps at the joint inspection. As such, the pumps are of questionable relevance for the purposes of its underlying claim that poor pump maintenance can be a cause of a heater fire.”

Billy Joel disputed causation about starting the fire. So did the parties in Coastal Bridge Co. v. Heatec, in which the Fifth Circuit reversed a summary judgment, holding: “Here, genuine disputes of material fact exist as to: (1) the significance of the heating pumps; (2) what

Billy Joel disputed causation about starting the fire. So did the parties in Coastal Bridge Co. v. Heatec, in which the Fifth Circuit reversed a summary judgment, holding: “Here, genuine disputes of material fact exist as to: (1) the significance of the heating pumps; (2) what  equipment was disassembled and disposed of; (3) the origin of the subject fire and whether the inlet pipe moved; and (4) the extent of communication4 that occurred between the parties before the formal notice of the fire. These factual disputes cannot be resolved without weighing the evidence and making credibility determinations, which are matters for the factfinder.” No. 19-31030 (Nov. 6, 2020, revised).

equipment was disassembled and disposed of; (3) the origin of the subject fire and whether the inlet pipe moved; and (4) the extent of communication4 that occurred between the parties before the formal notice of the fire. These factual disputes cannot be resolved without weighing the evidence and making credibility determinations, which are matters for the factfinder.” No. 19-31030 (Nov. 6, 2020, revised).

Each of the four factors for a deadline extension was in play in AIG Europe, Inc. v. Caterpillar, Inc., No. 19-40934, where the Fifth Circuit observed:

Each of the four factors for a deadline extension was in play in AIG Europe, Inc. v. Caterpillar, Inc., No. 19-40934, where the Fifth Circuit observed:

- Explanation. “If AIG needed information from Caterpillar’s experts to allow Faherty to complete his expert report, AIG should have moved to compel the depositions of those experts.”

- Importance. “AIG’s claims do not turn on Faherty’s report. Despite the exclusion, AIG had experts on causation.”

- Prejudice. “Faherty’s report responded to the analysis of Caterpillar’s experts, it also contained new analyses and conclusions. Defendants were not given the opportunity to challenge these conclusions on the critical issue of causation.”

- Continuance? “Yet another continuance would have delayed summary judgment and a potential trial even further.”

An “area developer” for Pizza Inn did not timely renew his option contract related to the potential development of new stores. The Fifth Circuit reversed a judgment for the developer, finding that Texas’s doctrine of “equitable intervention” did not apply. The alleged harms from nonrenewal–“a partial forfeiture of a $1,250,000 purchase price, a forfeiture of future profits . . . , and the shuttering of a Pizza Inn franchise store”–were either within the scope of the contractual bargain or simply not unconscionable, as required by the doctrine. Pizza Inn v. Cairday, No. 19-11302 (Nov. 4, 2020).

An “area developer” for Pizza Inn did not timely renew his option contract related to the potential development of new stores. The Fifth Circuit reversed a judgment for the developer, finding that Texas’s doctrine of “equitable intervention” did not apply. The alleged harms from nonrenewal–“a partial forfeiture of a $1,250,000 purchase price, a forfeiture of future profits . . . , and the shuttering of a Pizza Inn franchise store”–were either within the scope of the contractual bargain or simply not unconscionable, as required by the doctrine. Pizza Inn v. Cairday, No. 19-11302 (Nov. 4, 2020).

The issue in 9503 Middlex, Inc. v. Continental Motors, Inc., No. 19-50361 (Nov. 2, 2020) (unpublished), was whether a commercial tenant was “holding over in possession,” and the Fifth Circuit held it was not: “Here, the district court found that the combination of (1) the retention of the keys to the gate, (2) the use of the gate as a shortcut, and (3) the use of the premises as a break area “constituted holding over.” We agree they are relevant evidence, but we do not agree that they are sufficient. Continental did not occupy the premises of Buildings E and F, nor did Continental exercise dominion over the premises. Continental surrendered the properties to the plaintiffs, though it retained a key to an outside gate. We do not see support in the caselaw that a tenant occupies or controls property when something occurs as insignificant as when employees eat lunch at picnic tables on that property.”

The issue in 9503 Middlex, Inc. v. Continental Motors, Inc., No. 19-50361 (Nov. 2, 2020) (unpublished), was whether a commercial tenant was “holding over in possession,” and the Fifth Circuit held it was not: “Here, the district court found that the combination of (1) the retention of the keys to the gate, (2) the use of the gate as a shortcut, and (3) the use of the premises as a break area “constituted holding over.” We agree they are relevant evidence, but we do not agree that they are sufficient. Continental did not occupy the premises of Buildings E and F, nor did Continental exercise dominion over the premises. Continental surrendered the properties to the plaintiffs, though it retained a key to an outside gate. We do not see support in the caselaw that a tenant occupies or controls property when something occurs as insignificant as when employees eat lunch at picnic tables on that property.”

The University of Texas’s rules about campus speech did not fare well in Speech First, Inc. v. Fenves, in which the Fifth Circuit found that a preliminary-injunction action could proceed. The Court found that the case was not moot and stated a strong claim on the merits: “Of course, not every utterance is worth protecting under the First Amendment. In our current national condition, however, in which ‘institutional leaders, in a spirit of panicked damage control, are delivering hasty and disproportionate punishment instead of considered reforms,’ courts must be especially vigilant against assaults on speech in the Constitution’s care. Otherwise, the people may not be free to generate, debate, and discuss both general and specific ideas, hopes, and experiences,’ to ‘transmit their resulting views and conclusions to their elected representatives,’ ‘to influence the public policy enacted by elected representatives,’ and thereby to realize the political and human common good.” No. 19-50529 (revised Oct. 30, 2020) (footnotes omitted).

The University of Texas’s rules about campus speech did not fare well in Speech First, Inc. v. Fenves, in which the Fifth Circuit found that a preliminary-injunction action could proceed. The Court found that the case was not moot and stated a strong claim on the merits: “Of course, not every utterance is worth protecting under the First Amendment. In our current national condition, however, in which ‘institutional leaders, in a spirit of panicked damage control, are delivering hasty and disproportionate punishment instead of considered reforms,’ courts must be especially vigilant against assaults on speech in the Constitution’s care. Otherwise, the people may not be free to generate, debate, and discuss both general and specific ideas, hopes, and experiences,’ to ‘transmit their resulting views and conclusions to their elected representatives,’ ‘to influence the public policy enacted by elected representatives,’ and thereby to realize the political and human common good.” No. 19-50529 (revised Oct. 30, 2020) (footnotes omitted).

Belcher complained about the FDIC’s power to take his deposition. The parties, and the panel majority, agreed that his lawsuit did not become moot even after the challenged deposition occurred: ‘Because the district court on remand can ‘fashion some form of meaningful relief,’ appeal is not moot. Exactly what that relief might entail is beyond the scope of our concern. However, it is undisputed by the parties that the district court could strike Belcher’s deposition testimony before the FDIC.” The majority also noted that the district court could address the FDIC’s sharing of the transcript. A dissent observed: “I see no reason to override what common sense suggests: the appeal of an order requiring a deposition is moot once the deposition is over.” FDIC v. Belcher, No. 19-31023 (Oct. 26, 2020).

Belcher complained about the FDIC’s power to take his deposition. The parties, and the panel majority, agreed that his lawsuit did not become moot even after the challenged deposition occurred: ‘Because the district court on remand can ‘fashion some form of meaningful relief,’ appeal is not moot. Exactly what that relief might entail is beyond the scope of our concern. However, it is undisputed by the parties that the district court could strike Belcher’s deposition testimony before the FDIC.” The majority also noted that the district court could address the FDIC’s sharing of the transcript. A dissent observed: “I see no reason to override what common sense suggests: the appeal of an order requiring a deposition is moot once the deposition is over.” FDIC v. Belcher, No. 19-31023 (Oct. 26, 2020).

In one of many recent election-law disputes, the panel majority in Richardson v. Hughs painstakingly reviewed, and rejected, the plaintiffs’ challenge to Texas’s practices about signature verification for mail-in ballots. The procedural posture was a motion to stay; a concurrence cauti

In one of many recent election-law disputes, the panel majority in Richardson v. Hughs painstakingly reviewed, and rejected, the plaintiffs’ challenge to Texas’s practices about signature verification for mail-in ballots. The procedural posture was a motion to stay; a concurrence cauti oned: “[T]he reality is that the ultimate legality of the present system cannot be settled by the federal courts at this juncture when voting is already underway, and any opinion on a motions panel is essentially written in sand with no precedential value ….” footnote omitted). No. 20-50774 (Oct. 20, 2020).

oned: “[T]he reality is that the ultimate legality of the present system cannot be settled by the federal courts at this juncture when voting is already underway, and any opinion on a motions panel is essentially written in sand with no precedential value ….” footnote omitted). No. 20-50774 (Oct. 20, 2020).

If the law had an attic, it would hold the subject matter of Pool v. City of Houston, No. 19-20828 (Oct. 23, 2020):

It is often said that courts “strike down” laws when ruling them unconstitutional. That’s not quite right. Courts hold laws unenforceable; they do not erase them. Many laws that are plainly unconstitutional remain on the statute books. Jim Crow-era segregation laws are one example. The City of Houston contends that it’s being sued for one of these so-called “zombie” laws. Its Charter allows only registered voters to circulate petitions for initiatives and referenda, even though the Supreme Court held a similar law unconstitutional twenty years ago. This case thus requires us to decide when the threat of continued enforcement is enough to reanimate a zombie law and bring it from the statutory graveyard into federal court.

(citations omitted). Held: the zombie walked, based both on the City’s history of enforcement of this specific law, and the inadequacy of its effort to disclaim further enforcement: “At least based on the current record, the City’s addition of the ‘Editor’s note’ on its website does not moot this case. Voluntarily stopping an unconstitutional practice renders a case moot only ‘if subsequent events ma[k]e it absolutely clear that the allegedly wrongful behavior c[an] not reasonably be expected to recur.'” You can hear more about this case on the Coale Mind Halloween Special – “Attack of the Zombie Statute!”

(citations omitted). Held: the zombie walked, based both on the City’s history of enforcement of this specific law, and the inadequacy of its effort to disclaim further enforcement: “At least based on the current record, the City’s addition of the ‘Editor’s note’ on its website does not moot this case. Voluntarily stopping an unconstitutional practice renders a case moot only ‘if subsequent events ma[k]e it absolutely clear that the allegedly wrongful behavior c[an] not reasonably be expected to recur.'” You can hear more about this case on the Coale Mind Halloween Special – “Attack of the Zombie Statute!”

The dispute in Smith v. Toyota Motor Corp., No 19-60938 (Oct. 20, 2020), was whether there was diversity jurisdiction over two business entities with diverse business activities, one of which was named . . . Diversity Vuteq LLC. Despite the abundant diversity in the case, the Fifth Circuit reminded that there is not a diversity of opinion about how to properly plead citizenship:

The dispute in Smith v. Toyota Motor Corp., No 19-60938 (Oct. 20, 2020), was whether there was diversity jurisdiction over two business entities with diverse business activities, one of which was named . . . Diversity Vuteq LLC. Despite the abundant diversity in the case, the Fifth Circuit reminded that there is not a diversity of opinion about how to properly plead citizenship:

- “To adequately allege the citizenship of Toyota, a corporation, Smith needed to ‘set out the principal place of business of the corporation as well as the stat e of its incorporation.'” (citations omitted);

- “To adequately allege the citizenship of Diversity, a limited liability corporation, Smith needed to ‘specifically allege the citizenship of every member of every LLC or partnership involved in a litigation.'”

A challenging case about the Texas foster-care system returned to the Fifth Circuit in M.D. v. Abbott, No. 19-41015 (Oct. 16, 2020), and the panel did not approve of revisions to an injunction that went beyond its mandate in the previous appeal: “Plaintiffs claim that the district court did not violate the mandate rule

A challenging case about the Texas foster-care system returned to the Fifth Circuit in M.D. v. Abbott, No. 19-41015 (Oct. 16, 2020), and the panel did not approve of revisions to an injunction that went beyond its mandate in the previous appeal: “Plaintiffs claim that the district court did not violate the mandate rule

because a court ‘invok[ing] equity’s power to remedy a constitutional

violation by an injunction mandating systemic changes to an institution’ generally has ‘the continuing duty and responsibility to assess the efficacy and consequences of its order.’ As Plaintiffs point out, we recited this general principle in Stukenberg II,  stating that ‘[a] district court undoubtedly has the equitable power to oversee compliance with its own injunction.’ ‘E]quitable decrees that impose a continuing supervisory function on the court commonly . . . contemplate the subsequent issuance of specific implementing injunctions.’ But judges disagree on occasion over the proper exercise of equitable powers, just as judges disagree on occasion over the proper interpretation o statutes. When that happens, appellate courts must make the final decision—and once the decision is made, it must be followed. And that, of course, is the whole purpose of the mandate rule: ‘A district court on remand . . . may not disregard the explicit directives of [the appellate] court'”.’ A (citations omitted).

stating that ‘[a] district court undoubtedly has the equitable power to oversee compliance with its own injunction.’ ‘E]quitable decrees that impose a continuing supervisory function on the court commonly . . . contemplate the subsequent issuance of specific implementing injunctions.’ But judges disagree on occasion over the proper exercise of equitable powers, just as judges disagree on occasion over the proper interpretation o statutes. When that happens, appellate courts must make the final decision—and once the decision is made, it must be followed. And that, of course, is the whole purpose of the mandate rule: ‘A district court on remand . . . may not disregard the explicit directives of [the appellate] court'”.’ A (citations omitted).

John Dierlam doggedly pursued his religious-freedom challenge to the Affordable Care Act throughout that statute’s “serpentine history.” After considering his persistence in the face of constant statutory change, the Fifth Circuit reversed a finding of mootness, observing: “Ordinarily, when a case ‘has become moot on appeal,’ the court

John Dierlam doggedly pursued his religious-freedom challenge to the Affordable Care Act throughout that statute’s “serpentine history.” After considering his persistence in the face of constant statutory change, the Fifth Circuit reversed a finding of mootness, observing: “Ordinarily, when a case ‘has become moot on appeal,’ the court  should “vacate the judgment with directions to dismiss.” But ‘in instances where the mootness is attributable to a change in the legal framework governing the case, and where the plaintiff may have some residual claim under the new framework that was understandably not asserted previously,’ we ‘vacate the judgment and remand for further proceedings in which the parties may, if necessary, amend their pleadings or develop the record more fully.’” Dierlam v. Trump, No. 18-20440 (Oct. 15, 2020).

should “vacate the judgment with directions to dismiss.” But ‘in instances where the mootness is attributable to a change in the legal framework governing the case, and where the plaintiff may have some residual claim under the new framework that was understandably not asserted previously,’ we ‘vacate the judgment and remand for further proceedings in which the parties may, if necessary, amend their pleadings or develop the record more fully.’” Dierlam v. Trump, No. 18-20440 (Oct. 15, 2020).

The most recent episode of the Coale Mind podcast discusses Mi Familia Vota v. Abbott, No. 20-50793 (Oct. 14, 2020), a challenge to several Texas voting laws in light of the COVID-19 pandemic. The case reminds of two important limits on federal judicial power in such disputes:

The most recent episode of the Coale Mind podcast discusses Mi Familia Vota v. Abbott, No. 20-50793 (Oct. 14, 2020), a challenge to several Texas voting laws in light of the COVID-19 pandemic. The case reminds of two important limits on federal judicial power in such disputes:

- Under Ex parte Young (Mr. Young appears to the right): “Although a court can enjoin state officials from enforcing statutes, such an injunction must be directed to those who have the authority to enforce those statutes. In the present case, that would be county or other local officials.”

- And naming the right defendant is only the first hurdle posed by federalism: “An examination of the relief that the Plaintiffs seek in the case before us reveals that in many instances, court-ordered-relief would require the Governor or the Secretary of State to issue an executive order or directive or to take other sweeping affirmative action. If implemented by the district court, many of the directives requested by the Plaintiffs would violate principles of federalism.”

The Fifth Circuit reversed on an issue about arbitrator disclosure, observing, inter alia: “OOGC hypothesizes that these possible, incidental harms to FTS flowing from a unanimous arbitration panel ruling would make [the arbitrator] think that he needed to rule in FTS’s favor or else it would take him personally to task by declining to retain him in future matters. This is simply too much conjecture. Accepting OOGC’s argument would create an ‘incentive to conduct intensive, after-the-fact investigations to discover the most trivial of relationships,’ undercutting the purpose of arbitration ‘as an

efficient and cost-effective alternative to litigation.'” OOGC America v. Chesapeake Exploration, No. 19-20002 (Sept. 14, 2020).

Early voting begins today in Texas. The Fifth Circuit stayed the district court’s order that would have let large Texas counties have more than one early-ballot pickup location. The panel majority concluded, inter alia, that the plaintiffs misconstrued the entirety of the Governor’s actions: “The July 27 and October 1 Proclamations—which must be read together to make sense—are beyond any doubt measures that ‘make[] it easier’ for eligible Texans to vote absentee. How this expansion of voting opportunities burdens anyone’s right to vote is a mystery” (citation omitted). From there, the majority concluded that the plaintiffs overstated the claimed burden, and failed to give sufficient weight to the Governor’s asserted interest in preventing voter fraud. A concurrence criticized the Governor’s use of emergency power: “If a governor can unilaterally suspend early voting laws to reach policy outcomes that you prefer, it stands to reason that a governor can also unilaterally suspend other election laws to achieve policies that you oppose.” Texas LULAC v. Hughs, No. 20-50867 (Oct. 12, 2020).

Early voting begins today in Texas. The Fifth Circuit stayed the district court’s order that would have let large Texas counties have more than one early-ballot pickup location. The panel majority concluded, inter alia, that the plaintiffs misconstrued the entirety of the Governor’s actions: “The July 27 and October 1 Proclamations—which must be read together to make sense—are beyond any doubt measures that ‘make[] it easier’ for eligible Texans to vote absentee. How this expansion of voting opportunities burdens anyone’s right to vote is a mystery” (citation omitted). From there, the majority concluded that the plaintiffs overstated the claimed burden, and failed to give sufficient weight to the Governor’s asserted interest in preventing voter fraud. A concurrence criticized the Governor’s use of emergency power: “If a governor can unilaterally suspend early voting laws to reach policy outcomes that you prefer, it stands to reason that a governor can also unilaterally suspend other election laws to achieve policies that you oppose.” Texas LULAC v. Hughs, No. 20-50867 (Oct. 12, 2020).

The loser of a Florida arbitration sought to challenge it in Texas; the Fifth Circuit affirmed dismissal for lack of personal jurisdiction in Sayers Construction v. Timberline Construction, No. 19-51099 (Oct. 2, 2020), observing as to the categories of facts alleged:

The loser of a Florida arbitration sought to challenge it in Texas; the Fifth Circuit affirmed dismissal for lack of personal jurisdiction in Sayers Construction v. Timberline Construction, No. 19-51099 (Oct. 2, 2020), observing as to the categories of facts alleged:

- Solicitation. “Reid and Duffy are irrelevant because the ‘unilateral activity of a third party’ cannot establish minimum contacts on behalf of a corporate defendant.”

- Communications. “[M]ailing payments to the forum state, engaging in communications related to the execution and performance of the contract, and the existence of a contract between the nonresident defendant and a resident of the forum are insufficient to establish . . . minimum contacts . . . .” (citation omitted); and

- Texas choice-of-law clause. “[T]he choice-of-law clause in the Master Services Agreement does not suggest the parties expected to resolve their disputes in Texas. That’s because the same Agreement also required that arbitration take place in accordance with the AAA’s venue-selection rules—i.e., as close as possible to the project in Florida.”

All journeys must end, and at long last the journey of the transferee’s good-faith defense has ended in Janvey v. GMAG LLC: “This case requires us to determine whether the Texas Uniform Fraudulent Transfer Act’s … good faith affirmative defense allows Defendants-Appellees to retain fraudulent transfers received while on inquiry notice of a Ponzi scheme. We initially held it does not. We then vacated that decision so that the Supreme Court of Texas could clarify whether good faith requires a transferee on inquiry notice to conduct an investigation into the fraud, or, alternatively, show that such an investigation would have been futile. Having received an answer to our question, we once again hold that the Defendants-Appellees’ good faith defense must fail.” No. 17-11526 (Oct. 8, 2020).

Motion in limine? “Even though the motion in limine initially excluded post-sale evidence, nothing prohibited the Jordans from seeking to revisit that ruling later. Though the record indicates that the Jordans contemplated asking the district court to reconsider its ruling on the motion in limine, they never did.”

Motion in limine? “Even though the motion in limine initially excluded post-sale evidence, nothing prohibited the Jordans from seeking to revisit that ruling later. Though the record indicates that the Jordans contemplated asking the district court to reconsider its ruling on the motion in limine, they never did.”- Offer of Proof? “Federal Rule of Evidence 103(a)(2) requires parties to proffer excluded evidence to the court unless the ‘substance was apparent from the context.’ The Jordans do not argue that the substance of their bias evidence against Nord was apparent from the context, so they were required to proffer this evidence to preserve the alleged error on appeal. The Jordans failed to proffer evidence of Nord’s alleged bias, so the district court was unable to rule on the evidence’s admissibility. Therefore, we cannot review the exclusion of this evidence.” (citations omitted).

Jordan v. Maxfield & Oberton Holdings, LLC, Ni. 19-60364 (Oct. 7, 2020).

A nonprofit complained about a lack of press access to the Texas legislative session in 2019, and argued that the case avoided mootness because of the “capable of repetition yet evading review” exception to that doctrine. The Fifth Circuit disagreed, noting that the nonprofit had not fully used the available tools to move its case along: “Crucially, Empower never asked this court to expedite its appeal. Both the Federal Rules of Appellate Procedure and this court’s local rules allow a party to move the court for an expedited appeal. Empower did not take advantage of these rules. That relaxed approach can be contrasted with a

A nonprofit complained about a lack of press access to the Texas legislative session in 2019, and argued that the case avoided mootness because of the “capable of repetition yet evading review” exception to that doctrine. The Fifth Circuit disagreed, noting that the nonprofit had not fully used the available tools to move its case along: “Crucially, Empower never asked this court to expedite its appeal. Both the Federal Rules of Appellate Procedure and this court’s local rules allow a party to move the court for an expedited appeal. Empower did not take advantage of these rules. That relaxed approach can be contrasted with a  recent case in this court involving a plaintiff who similarly sought an injunction against public officials so that he could attend school-district meetings and activities. … In [that case], two days after the appealed was docketed, the plaintiff–appellant filed a motion for expedited appeal which, he argued, was “necessary to redress [the] ‘irreparable injury.’” We granted that motion and moved the case along with appropriate dispatch.

recent case in this court involving a plaintiff who similarly sought an injunction against public officials so that he could attend school-district meetings and activities. … In [that case], two days after the appealed was docketed, the plaintiff–appellant filed a motion for expedited appeal which, he argued, was “necessary to redress [the] ‘irreparable injury.’” We granted that motion and moved the case along with appropriate dispatch.

In contrast, Empower demonstrated no such urgency. When time is of the essence, a party must act like it.” Empower Texas, Inc. v. Geren, No. 19-50577 (Oct. 5, 2020) (citations omitted).

Basic Capital Management v. Dynex, No. 20-40643 (Sept. 30, 2020), reminds about the proper record for evaluating a Rule 12 dismissal mo tion:

tion:

- “[A]s the district court correctly observed, the Form 10-K and the state-court [case] record ‘are al publicly available governmental filings and the existence of the documents, and the contents therein, cannot reasonably be questioned.’ Therefore, the Form 10-K and the state-court record fall squarely within the ambit of [Fed. R. Evid.] 201(b).”

- “Rule 201(d) expressly provides that a court ‘may take judicial notice at any stage of the proceeding,’ and our precedents confirm judicially noticed facts may be considered in ruling on a 12(b)(6) motion. Therefore, in ruling on the 12(b)(6) motion, ‘the district court appropriately used judicial notice.'”

“[C]ourt changes of election laws close in time to the election are strongly disfavored. … [I]n staying a preliminary injunction that would change election laws eighteen days before early voting begins, we recognize the value of preserving the status quo in a voting case on the eve of an election, and we find that the traditional factors for granting a stay favor granting one here.” Texas Alliance for Retired Americans v. Hughs, No. 20-40643 (Sept. 30, 2020).

“[C]ourt changes of election laws close in time to the election are strongly disfavored. … [I]n staying a preliminary injunction that would change election laws eighteen days before early voting begins, we recognize the value of preserving the status quo in a voting case on the eve of an election, and we find that the traditional factors for granting a stay favor granting one here.” Texas Alliance for Retired Americans v. Hughs, No. 20-40643 (Sept. 30, 2020).

If the details of the virgule are not obscure enough for you, then you will love this wonderful article from Smithsonian Magazine about the “pilcrow,” a/k/a the paragraph symbol.

If the details of the virgule are not obscure enough for you, then you will love this wonderful article from Smithsonian Magazine about the “pilcrow,” a/k/a the paragraph symbol.

While Adams v. Alcolac, Inc. presents an exotic dispute –civil liability for the use of mustard gas by Saddam Hussein’s regime–it turns on a fundamental issue of foreseeability under Texas tort (conspiracy) law: “The plaintiffs argue that it was foreseeable that the exported TDG [chemical] would be turned into mustard gas by some ‘nefarious character’ and that it would then be ‘used for terrorist activity.’ Perhaps so, but that misses the point. The question is not whether the plaintiffs’ battery was a foreseeable result of the alleged conspiracy but whether the battery was ‘done in pursuance of the common purpose of the conspiracy[.]’ Because there is no evidence of a common purpose beyond the initial sale and exportation of the TDG, any eventual use of mustard gas on the plaintiffs, even if foreseeable, was not in furtherance of the alleged conspiracy. The plaintiffs’ conspiracy claim thus fails for lack of an underlying tort.” No. 19-40899 (revised, Sept. 25, 2020) (citations and footnote omitted, emphasis added).

While Adams v. Alcolac, Inc. presents an exotic dispute –civil liability for the use of mustard gas by Saddam Hussein’s regime–it turns on a fundamental issue of foreseeability under Texas tort (conspiracy) law: “The plaintiffs argue that it was foreseeable that the exported TDG [chemical] would be turned into mustard gas by some ‘nefarious character’ and that it would then be ‘used for terrorist activity.’ Perhaps so, but that misses the point. The question is not whether the plaintiffs’ battery was a foreseeable result of the alleged conspiracy but whether the battery was ‘done in pursuance of the common purpose of the conspiracy[.]’ Because there is no evidence of a common purpose beyond the initial sale and exportation of the TDG, any eventual use of mustard gas on the plaintiffs, even if foreseeable, was not in furtherance of the alleged conspiracy. The plaintiffs’ conspiracy claim thus fails for lack of an underlying tort.” No. 19-40899 (revised, Sept. 25, 2020) (citations and footnote omitted, emphasis added).

Badgerow v. REJ Properties, Inc., No 19-30584 (Sept. 11, 2020), applying the McDonnell-Douglas burden-shifting framework, reached the issue of whether there was a fact question on pretext and concluded that there was:

Badgerow v. REJ Properties, Inc., No 19-30584 (Sept. 11, 2020), applying the McDonnell-Douglas burden-shifting framework, reached the issue of whether there was a fact question on pretext and concluded that there was:

“The timing of Badgerow’s firing is highly indicative of motive. According to Badgerow’s version of events the day she was fired, she received a call from Walters who said that he had ‘just got off the phone with Marc Cohen’ and would call her back. When Walters called Badgerow back, he asked her to travel from her office in Houma to his office in Thibodaux so that he could speak with her in person. During their in-person meeting, Walters terminated Badgerow’s employment. Thus, Badgerow’s firing occurred in the immediate aftermath of Walters being informed of Badgerow’s complaints to Cohen. And Badgerow has adduced other significant evidence of pretext. For example, although REJ states that Walters fired Badgerow due to constant complaints from her coworkers, Badgerow asserts that the only explanation he gave for her firing was that she had ‘dinged his perfect . . . record’ with Ameriprise. And Walters admits that immediately before firing Badgerow he ‘told her that Cohen had said he needed to hire a labor attorney and asked “[d]o I have to worry about you suing me?” Finally, although Walters testified that Badgerow’s coworkers had been complaining to him about her behavior for months, Walters seemed determined to keep Badgerow as one of his AFAs until his conversation with Cohen. A reasonable fact finder could infer from this evidence that REJ’s proffered reason for Badgerow’s firing was pretext for unlawful retaliation.”

(citation omitted, emphasis added).

Certain motions toll the deadline for filing a notice of appeal — but not multiple times: “Here, the Employees filed a motion for judgment as a matter of law and, alternatively, a new trial, on March 12, 2019. The district court entered final judgment on March 27 without expressly addressing that motion, thus implicitly denying it. On April 10, the Employees refiled the motion. The refiled version was identical to the March 12 version that the judgment implicitly denied. It therefore did not toll the appeal deadline and the 30 days began to run with the entry of judgment on March 27. The Employees did not file a notice of appeal until June 12. Because that notice was untimely under 28 U.S.C. § 2107, the Employees’ appeal must be dismissed for lack of jurisdiction.” Edwards v 4JLJ, LLC, No. 19-40553 (Sept. 21, 2020) (on rehearing, footnotes omitted).

Certain motions toll the deadline for filing a notice of appeal — but not multiple times: “Here, the Employees filed a motion for judgment as a matter of law and, alternatively, a new trial, on March 12, 2019. The district court entered final judgment on March 27 without expressly addressing that motion, thus implicitly denying it. On April 10, the Employees refiled the motion. The refiled version was identical to the March 12 version that the judgment implicitly denied. It therefore did not toll the appeal deadline and the 30 days began to run with the entry of judgment on March 27. The Employees did not file a notice of appeal until June 12. Because that notice was untimely under 28 U.S.C. § 2107, the Employees’ appeal must be dismissed for lack of jurisdiction.” Edwards v 4JLJ, LLC, No. 19-40553 (Sept. 21, 2020) (on rehearing, footnotes omitted).

As society, and the civil justice system, plan a return to more normal operations as the pandemic recedes, Judges Patrick Higginbotham and Lee Rosenthal, and Professor Steven Gensler, have written a perusasive article in Judicature about the importance of 12-person juries in civil cases: “Over the last 40-plus years, the 12- person civil jury has gone from being a fixture in the federal courts to a relative rarity. We should all be concerned. That the Supreme Court has allowed us to use smaller juries does not require us to use them. We can use 12-person juries. The benefits are large; the disadvantages marginal. We’re not suggesting this as a rule or a requirement. We are simply suggesting that judges not reflexively pick six, or eight, or even ten, and instead remember their authority to seat 12. And the great benefits of doing so.”

As society, and the civil justice system, plan a return to more normal operations as the pandemic recedes, Judges Patrick Higginbotham and Lee Rosenthal, and Professor Steven Gensler, have written a perusasive article in Judicature about the importance of 12-person juries in civil cases: “Over the last 40-plus years, the 12- person civil jury has gone from being a fixture in the federal courts to a relative rarity. We should all be concerned. That the Supreme Court has allowed us to use smaller juries does not require us to use them. We can use 12-person juries. The benefits are large; the disadvantages marginal. We’re not suggesting this as a rule or a requirement. We are simply suggesting that judges not reflexively pick six, or eight, or even ten, and instead remember their authority to seat 12. And the great benefits of doing so.”

In Franklin v. Regions Bank. “Plaintiffs contracted with Regions Bank for it to manage, as their agent, their mineral interests in a large tract of land.” Under Louisiana law, the parties had “a principal-mandatary relationship, which is equivalent to a common-law principal-agent relationship.” In an Erie analysis, the Fifth Circuit noted that after the Louisiana Supreme Court limited a plaintiff’s ability to choose between a contract or tort remedy (with a large potential effect on limitations) in some mandatary relationships, the legislature then “shortened the limitations periods for claims against engineers, surveyors, professional interior designers, architects, real-estate developers, and home inspectors. Instead of shortening the limitations period for all mandataries, the legislature chose to single-out certain professions for special treatment.” After then coupling that observation with general Louisiana legal principles about strict construction of limitation statutes, the Court held that the plaintiffs wereable to choose a tort remedy with a 10-year limitations period. No. 19-30684 (Sept. 18, 2020).

In Franklin v. Regions Bank. “Plaintiffs contracted with Regions Bank for it to manage, as their agent, their mineral interests in a large tract of land.” Under Louisiana law, the parties had “a principal-mandatary relationship, which is equivalent to a common-law principal-agent relationship.” In an Erie analysis, the Fifth Circuit noted that after the Louisiana Supreme Court limited a plaintiff’s ability to choose between a contract or tort remedy (with a large potential effect on limitations) in some mandatary relationships, the legislature then “shortened the limitations periods for claims against engineers, surveyors, professional interior designers, architects, real-estate developers, and home inspectors. Instead of shortening the limitations period for all mandataries, the legislature chose to single-out certain professions for special treatment.” After then coupling that observation with general Louisiana legal principles about strict construction of limitation statutes, the Court held that the plaintiffs wereable to choose a tort remedy with a 10-year limitations period. No. 19-30684 (Sept. 18, 2020).

A home health care provider, feeling trapped by Medicare’s slow and complex administrative review process, sought relief in court. The Fifth Circuit affirmed the denial of its application for an injunction, observing: “The Constitution entrusts the political branches, not the judiciary, with making difficult and value-laden policy decisions. There were an infinite number of schemes Congress could have reasonably selected. Congress settled on one that guarantees at least two levels of administrative review and judicial review. And in the case of a backlog, Congress provided the ability to bypass long waits on the way to judicial review. Sahara rejected that option. At bottom, Sahara believes a different scheme would be better. But we lack the power to change it.” Sahara Health Care v. Azar, No. 18-41120 (Sept. 18, 2020) (emphasis added).

A home health care provider, feeling trapped by Medicare’s slow and complex administrative review process, sought relief in court. The Fifth Circuit affirmed the denial of its application for an injunction, observing: “The Constitution entrusts the political branches, not the judiciary, with making difficult and value-laden policy decisions. There were an infinite number of schemes Congress could have reasonably selected. Congress settled on one that guarantees at least two levels of administrative review and judicial review. And in the case of a backlog, Congress provided the ability to bypass long waits on the way to judicial review. Sahara rejected that option. At bottom, Sahara believes a different scheme would be better. But we lack the power to change it.” Sahara Health Care v. Azar, No. 18-41120 (Sept. 18, 2020) (emphasis added).

The opinion also provides an original source for the saying, “[t]he best laid plans of mice and men oft go awry” —

Last week I spoke (virtually) at the State Bar’s Advanced Civil Appellate Course. My topic was post-verdict motions in state in federal court; here is a copy of my PowerPoint.

Last week I spoke (virtually) at the State Bar’s Advanced Civil Appellate Course. My topic was post-verdict motions in state in federal court; here is a copy of my PowerPoint.

A dispute about an allegedly malfunctioning power generator led to an ingenious but flawed attempt to resolve it in Imperial Indus. Supply Co. v.. Thomas, in two steps:

A dispute about an allegedly malfunctioning power generator led to an ingenious but flawed attempt to resolve it in Imperial Indus. Supply Co. v.. Thomas, in two steps:

- “[Thomas] began by sending Imperial a document titled “ConditionalAcceptance for the Value/For Proof of Claim/Agreement” (“Alleged Agreement”) which purported to be a “binding self-executing irrevocable contractual agreement” evidencing Thomas’s acceptance of Imperial’s offer. , , , The Alleged Agreement further provided that Imperial would need to propound fifteen different “Proofs of Claim” to Thomas in order to avoid (1) breaching the Alleged Agreement; (2) admitting, by “tacit acquiescence,” that the generator caused the fire; and (3) participating in arbitration proceedings.”

- “Then, Thomas sent Imperial two notices related to the Alleged Agreement. The first notice purported that Imperial breached the Alleged Agreement by failing to provide the proofs of claim. This notice allowed Imperial to cure the alleged breach by providing the proofs of claim within three days. In addition, the notice stated that Imperial’s refusal to follow the curing mechanism would result in Imperial’s admission and confessed judgment to the alleged breach. The second notice stated that Imperial owed the balance for the “entire contract value”1 because it did not cure the breach.”

Thomas than obtained a favorable arbitration award against Imperial. Unimpressed, the Fifth Circuit affirmed the district court’s order that vacated the award, noting: “If Thomas’s argument was valid, it would turn the notion of mutual assent on its head in ordinary purchase cases like this one: buy an item from a dealer or manufacturer, then mail a letter saying “you agree if you don’t object,” and you can have whatever deal you want if the dealer/manufacturer doesn’t respond. Thomas fails to cite a single case that would support such a ridiculous notion.” No. 20-60121 (Sept. 2, 2020).

The Department of Health & Human Services promulgated a new Medicare regulation about compensation for inpatient psychiatric facilities. It established a formula to run from January 1 of one year to January 1 of the next. For 364 days of the year, that worked well enough, but the confusion about what formula applied on January 1 led to litigation. Relying on the concept that a court should “attempt to reconcile . . . competing provisions in a manner that gives effect to each one”–which at times may require it to “dishonor some bit of text” as a preferred alternative to “apply[ing] the unintelligibility canon . . . and . . . deny[ing] effect to both provisions”–the Fifth Circuit concluded that the new year formula would apply on January 1: “That is what context indicates. It is what the agency proposes.” Greenbrier Hospitall, L.L.C. v. Azar, No. 19-30331 (Sept. 9, 2020).

The Department of Health & Human Services promulgated a new Medicare regulation about compensation for inpatient psychiatric facilities. It established a formula to run from January 1 of one year to January 1 of the next. For 364 days of the year, that worked well enough, but the confusion about what formula applied on January 1 led to litigation. Relying on the concept that a court should “attempt to reconcile . . . competing provisions in a manner that gives effect to each one”–which at times may require it to “dishonor some bit of text” as a preferred alternative to “apply[ing] the unintelligibility canon . . . and . . . deny[ing] effect to both provisions”–the Fifth Circuit concluded that the new year formula would apply on January 1: “That is what context indicates. It is what the agency proposes.” Greenbrier Hospitall, L.L.C. v. Azar, No. 19-30331 (Sept. 9, 2020).

Many opinions address briefing waiver issues by an appellant. But what about an appellee? The Fifth Circuit examined that procedural point in Texas Democratic Party v. Abbott:

Many opinions address briefing waiver issues by an appellant. But what about an appellee? The Fifth Circuit examined that procedural point in Texas Democratic Party v. Abbott:

“Appellate rules regarding how we treat absent issues differ depending on whether it is the appellant or the appellee who has neglected them. An appellant can intentionally waive or inadvertently forfeit the right to present an argument by failure to press it on appeal, a higher threshold than simply mentioning the issue. On the other hand, even an appellee’s failure to file a brief does not cause an automatic reversal of the judgment being appealed. By appellate rule, so extreme a lapse does cause the appellee to lose the right to appear at oral argument. Fed. R. App. P. 31(c). We also know that if we disagree with the grounds relied upon by a district court to enter judgment but discover another fully supported by the record, we can affirm on that alternative basis. . . . There are a few cases that consider rules of waiver even for appellees. For example, our discretion to consider an argument not properly presented is ‘more leniently [applied] when the party who fails to brief an issue is the appellee.'”

No. 20-50407 (Sept. 10, 2020).

Following two recent opinions about Fed. R. Civ. P. 9(b), the Fifth Circuit again applied it in Waste Management v. AIG: “We need not resolve this dispute because, even assuming that an adjuster can be held liable under [the] Texas Insurance Code . . . Waste did not allege facts that, taken as true, demonstrate a violation of these provisions. The only relevant, AIG Claims-specific facts that Waste alleged in its

Following two recent opinions about Fed. R. Civ. P. 9(b), the Fifth Circuit again applied it in Waste Management v. AIG: “We need not resolve this dispute because, even assuming that an adjuster can be held liable under [the] Texas Insurance Code . . . Waste did not allege facts that, taken as true, demonstrate a violation of these provisions. The only relevant, AIG Claims-specific facts that Waste alleged in its

complaint are that (1) AIG Claims served as the adjuster for ASIC and (2) ‘On July 9, 2013, AIG Claims sent Waste Management a letter denying [certain] coverage . . . .’ These threadbare factual allegations, along with Waste’s conclusory recitation of the elements of a claim under the Texas Insurance Code, are insufficient to state a plausible claim for relief. Notably, Waste did not allege that AIG Claims failed to investigate, delayed any investigation, misevaluated, misprocessed, made any misrepresentation of the policy, or otherwise failed to ‘effectuate’ a fair settlement.” (citations omitted).

Samuel Williston reviewed many opinions (right) in drafting his influential works on contract law. So too did D2 Excavating, “[a] subcontractor doing excavation work [who] ended up having to remove a lot more dirt from the construction site than the parties anticipated.” But D2 was unable to escape Williston’s black-letter principles, as the Fifth Circuit held:

Samuel Williston reviewed many opinions (right) in drafting his influential works on contract law. So too did D2 Excavating, “[a] subcontractor doing excavation work [who] ended up having to remove a lot more dirt from the construction site than the parties anticipated.” But D2 was unable to escape Williston’s black-letter principles, as the Fifth Circuit held:

- As to the original contract, it noted “tthe basic contract principle that ‘where one agrees to do, for a fixed sum, a thing possible to be performed, he will not be excused or become entitled to additional compensation, because unforeseen difficulties are encountered.'”

- As to a change order: “D2 acknowledges that the alleged consideration was its exporting excess soil. The original contract already obligated D2 to do so without any compensation beyond the contract price. Hauling the dirt, therefore, cannot serve as consideration. The oral change order is void.”

D2 Excavating v. Thompson Thrift Constr., No. 19-40745 (Sept. 2, 2020) (citations omitted).

Applying Fed. R. Civ. P. 9(b), the Fifth Circuit found no fraud claims stated in:

Applying Fed. R. Civ. P. 9(b), the Fifth Circuit found no fraud claims stated in:

- Colonial Oaks Assisted Living v. Hannie Development, No. 19-30995 (Aug. 25, 2020): “The pleadings are devoid of allegations regarding what instructions the employees received, who gave the instructions, whether anyone followed the instructions, and whether Sellers were aware of the specific instructions given.

- Umbrella Investment Group v. Wolters Kluwer, No. 20-30078 (Aug. 25, 2020): “In this case, the only relevant fact that UIG has alleged beyond what little it alleges ‘on information and belief’ is that Wolters Kluwer provided ‘written certification that the property subject to the loan was not in a flood hazard area that required flood insurance under FEMA regulations pursuant to the Flood Disaster Protection Act of 1973.’ That fact alone can ground nothing more than speculation as to the cause of the error, and therefore, UIG has failed to state a claim for fraud.”

Earlier this month, the Fifth Circuit found an abuse of discretion, under Texas substantive law, in not modifying a noncompetition agreement at the preliminary-injunction stage. Calhoun v. Jack Doheny Cos., Inc. But because the parties had settled their case in the meantime, notifying the district court but not the Fifth Circuit, the case had become moot at the time of that opinion, prompting the Court to withdraw its opinion and dismiss the matter with prejudice. No. 20-20068 (Aug. 28, 2020).

Earlier this month, the Fifth Circuit found an abuse of discretion, under Texas substantive law, in not modifying a noncompetition agreement at the preliminary-injunction stage. Calhoun v. Jack Doheny Cos., Inc. But because the parties had settled their case in the meantime, notifying the district court but not the Fifth Circuit, the case had become moot at the time of that opinion, prompting the Court to withdraw its opinion and dismiss the matter with prejudice. No. 20-20068 (Aug. 28, 2020).

(This activity about a case named Calhoun prompted me to check in on the M/V CALHOUN, a ship that under another name created a memorable mootness argument– “The ship has sailed!” – when it left the Fifth Circuit before creditors could seize it. The ship continues to be elsewhere, arriving in Venezuela as of the date of this post.)

(This activity about a case named Calhoun prompted me to check in on the M/V CALHOUN, a ship that under another name created a memorable mootness argument– “The ship has sailed!” – when it left the Fifth Circuit before creditors could seize it. The ship continues to be elsewhere, arriving in Venezuela as of the date of this post.)

In 1971, the Five Man Electrical Band decried an overabundance of signs, complaining that they were “[b]locking out the scenery, breakin’ my mind.” Similarly, in recent years, the City of Austin grew weary of the many highway billboards in Central Texas. It enacted an ordinance that stopped a large number of them from being updated to a new, digital format, so long as the sign involved “off-premises” business activity. The Fifth Circuit found that the ordinance was unconstitutional in Reagan National Advertising of Austin v. City of Austin, No. 19-50354 (Aug. 25, 2020) (applying Reed v. Town of Gilbert, U.S. 155 (2015)).

In 1971, the Five Man Electrical Band decried an overabundance of signs, complaining that they were “[b]locking out the scenery, breakin’ my mind.” Similarly, in recent years, the City of Austin grew weary of the many highway billboards in Central Texas. It enacted an ordinance that stopped a large number of them from being updated to a new, digital format, so long as the sign involved “off-premises” business activity. The Fifth Circuit found that the ordinance was unconstitutional in Reagan National Advertising of Austin v. City of Austin, No. 19-50354 (Aug. 25, 2020) (applying Reed v. Town of Gilbert, U.S. 155 (2015)).

The specific question was whether the regulation’s limit to “off-premises” businesses was a restriction on content, or one on time, place, or manner, under the framework established by the Supreme Court in Reed. The Court focused on a series of challenging hypotheticals it has posed to the City’s counsel at oral argument, including, inter alia:

• Could Barbara and Tom maintain a digital sign in their yard that says “We love hamburgers” that contained the logo and address to a Whataburger location two miles away?

• Could Sarah place a digital sign in her yard that said “Vote for Kathy” if Kathy did not live at Sarah’s house?

• Could Sarah place a digital sign in her yard that said “Vote for Kathy” if Kathy did not live at Sarah’s house?

• How could one determine whether a digital bilboard that said “God Loves You” is on-premises or off-premises?

Finding these hypotheticals as challenging as the City’s counsel did, the Court concluded that the regulation forced a consideration of content to determine its applicability, making it a content restriction under Reed.

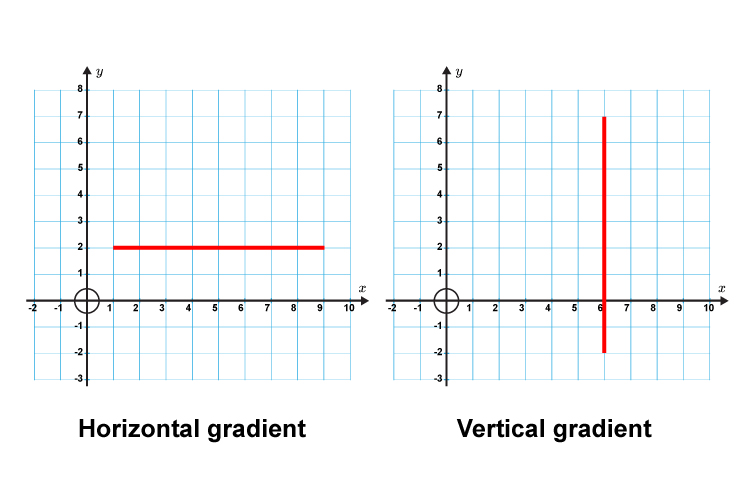

The London Underground reminds its riders to “Mind the Gap” so they do not trip when entering or exiting a train. The Fifth Circuit’s new typography places a notable gap between paragraphs and footnotes. While this sort of line-spacing does not have a technical label like “kerning,” it is nevertheless an important part of the overall look and feel of a piece of legal writing. What are your thoughts on inter-paragraph line spacing?

The London Underground reminds its riders to “Mind the Gap” so they do not trip when entering or exiting a train. The Fifth Circuit’s new typography places a notable gap between paragraphs and footnotes. While this sort of line-spacing does not have a technical label like “kerning,” it is nevertheless an important part of the overall look and feel of a piece of legal writing. What are your thoughts on inter-paragraph line spacing?

The long-running litigation about 3D printed firearms (to the right, the single-shot “Liberator” returned to the Fifth Circuit in Defense Distributed v. Grewal, in which a manufacturer sought relief in Texas from the New Jersey AG. The Court found personal jurisdiction in Texas, noting: “Grewal’s conduct beyond sending the cease-and desist letter confirms his intent to crush Defense Distributed’s operations and not simply limit the dissemination of digital files in New Jersey. Grewal’s enforcement actions are selective. He has not targeted the many similarly-situated persons who publish Defense Distributed’s files on the internet. Instead, he has focused solely on Defense Distributed.” No. 19-50723 (Aug. 19, 2020) (distinguishing Stroman Realty, Inc. v. Wercincki, 513 F.3d 476 (5th Cir. 2008).

The long-running litigation about 3D printed firearms (to the right, the single-shot “Liberator” returned to the Fifth Circuit in Defense Distributed v. Grewal, in which a manufacturer sought relief in Texas from the New Jersey AG. The Court found personal jurisdiction in Texas, noting: “Grewal’s conduct beyond sending the cease-and desist letter confirms his intent to crush Defense Distributed’s operations and not simply limit the dissemination of digital files in New Jersey. Grewal’s enforcement actions are selective. He has not targeted the many similarly-situated persons who publish Defense Distributed’s files on the internet. Instead, he has focused solely on Defense Distributed.” No. 19-50723 (Aug. 19, 2020) (distinguishing Stroman Realty, Inc. v. Wercincki, 513 F.3d 476 (5th Cir. 2008).

After reviewing comparable ethical rules nationwide, the Fifth Circuit held that under the Louisiana attorney-conduct rules: “[A] contingency fee arrangement resulting in an attorney owning part of the client’s business is a business transaction under Rule 1.8(a). Because the terms of the 2013 CFA give the Firms an ownership interest in LTSG, Rule 1.8(a) applies, and the Firms were required to advise Fox to seek the advice of independent counsel. Fox did not have to take this advice, but the Firms were obligated to give it. Thus, the 2013 CFA is void.” Wiener, Weiss, & Madison v. Fox, No. 19-30688 (Aug. 21, 2020).

After reviewing comparable ethical rules nationwide, the Fifth Circuit held that under the Louisiana attorney-conduct rules: “[A] contingency fee arrangement resulting in an attorney owning part of the client’s business is a business transaction under Rule 1.8(a). Because the terms of the 2013 CFA give the Firms an ownership interest in LTSG, Rule 1.8(a) applies, and the Firms were required to advise Fox to seek the advice of independent counsel. Fox did not have to take this advice, but the Firms were obligated to give it. Thus, the 2013 CFA is void.” Wiener, Weiss, & Madison v. Fox, No. 19-30688 (Aug. 21, 2020).

In the early 1900s, railroad shareholders sued Minnesota’s Attorney General, the spectacularly-mustachioed Edward Young (right), to enjoin the enforcement of price limitations; the Supreme Court found that their request for injunctive relief did not violate the Eleventh Amendment. Ex parte Young, 209 U.S. 123 (1908). It is easier to state the rule of Young than apply it, however, especially in often-complex jurisdictional situations.

In the early 1900s, railroad shareholders sued Minnesota’s Attorney General, the spectacularly-mustachioed Edward Young (right), to enjoin the enforcement of price limitations; the Supreme Court found that their request for injunctive relief did not violate the Eleventh Amendment. Ex parte Young, 209 U.S. 123 (1908). It is easier to state the rule of Young than apply it, however, especially in often-complex jurisdictional situations.

Green Valley Special Utility District v. City of Schertz presented an arcane regulatory dispute about “two orders of the Texas Public Utility Commission decertifying territory from the certificate of convenience and necessity issued to [Green Valley] for sewer (wastewater) service.” (cleaned up). Resolution of that dispute required en banc review, and produced a lead opinion with a two-page summary of the Court’s holdings, along with four concurrences on Young and the statutory-interpretation issue in the case. No. 18-51092 (Aug. 7, 2020).

Green Valley Special Utility District v. City of Schertz presented an arcane regulatory dispute about “two orders of the Texas Public Utility Commission decertifying territory from the certificate of convenience and necessity issued to [Green Valley] for sewer (wastewater) service.” (cleaned up). Resolution of that dispute required en banc review, and produced a lead opinion with a two-page summary of the Court’s holdings, along with four concurrences on Young and the statutory-interpretation issue in the case. No. 18-51092 (Aug. 7, 2020).

Sanchez v. Smart Fabricators, No. 19-20506 (Aug. 14, 2020), held that Sanchez was a Jones Act seaman. All three judges specially concurred in the result, observing:

Two causes of action under Texas law, frequently asserted but rarely tried, were rejected by the Fifth Circuit in BBX Operating v. Bank of America, No. 19-11050 (Aug. 11, 2020, unpublished):

- Conversion. “They are conclusory allegations, which merely ‘parrot the words needed to create a claim’ without providing any factual basis for how BBX maintained an ownership interest in the funds. Perhaps recognizing this deficiency, the amended complaint characterized the funds at issue as ‘trust funds,’ and claimed that Murphy ‘held the funds . . . in trust for BBX’—the rightful owner. Yet that label is again unsupported by any factual allegations. The complaint said nothing of when or how this alleged trust was formed. And there are no allegations that Murphy entered into an agreement to create a trust.” (emphasis added)

- Money had and received. “BBX has not alleged facts demonstrating that the funds Bank of America swept from Murphy’s account belong to BBX. Nothing in the sales contract or any other agreement between BBX and Murphy demonstrates that funds Murphy collected and placed in a Bank of America account in Murphy’s name belong to BBX. Furthermore, BBX is no more the owner of those funds than the working interest owners and royalty owners that were supposed to receive payment after Murphy remitted a portion of the funds to

BBX. At most, the amended complaint demonstrates that BBX has an unsecured breach of contract claim against Murphy for failing to satisfy whatever amounts Murphy owed BBX under the sales contract that governed their relationship. It does not demonstrate that these particular funds belong to BBX. Thus, the district court properly dismissed BBX’s money had and received claim.” (emphasis added)

A notable feature of the Fifth Circuit’s new typography is the amount of kerning (spacing between of letters) in certain elements of an opinion’s first page. (And for those who are

A notable feature of the Fifth Circuit’s new typography is the amount of kerning (spacing between of letters) in certain elements of an opinion’s first page. (And for those who are  weary of the “cases in footnotes,” “1-space, 2-space,” or “anything but Times New Roman” topics, kerning offers an entirely new topic of discussion.) What are your thoughts on appellate kerning?

weary of the “cases in footnotes,” “1-space, 2-space,” or “anything but Times New Roman” topics, kerning offers an entirely new topic of discussion.) What are your thoughts on appellate kerning?

“Applying Skidmore, we ask whether EPA’s interpretation of Title V in the Hunter Order is persuasive. Specifically, we inquire into the persuasiveness of EPA’s current view that the Title V permitting process does not require substantive reevaluation of the underlying Title I preconstruction permits applicable to a pollution source. As we read it, the Hunter Order defends the agency’s interpretation based principally on Title V’s text, Title V’s structure and purpose, and the structure of the Act as a whole. Having examined these reasons and found them persuasive, we conclude that EPA’s current approach to Title V merits Skidmore deference.” Environmental Integrity Project v. EPA, No. 18-60384 (Aug. 13, 2020) (emphasis added).

“Applying Skidmore, we ask whether EPA’s interpretation of Title V in the Hunter Order is persuasive. Specifically, we inquire into the persuasiveness of EPA’s current view that the Title V permitting process does not require substantive reevaluation of the underlying Title I preconstruction permits applicable to a pollution source. As we read it, the Hunter Order defends the agency’s interpretation based principally on Title V’s text, Title V’s structure and purpose, and the structure of the Act as a whole. Having examined these reasons and found them persuasive, we conclude that EPA’s current approach to Title V merits Skidmore deference.” Environmental Integrity Project v. EPA, No. 18-60384 (Aug. 13, 2020) (emphasis added).

My newest Coale Mind podcast episode looks forward to this fall, when the Supreme Court will consider two decisions by the en banc (full) U.S. Court of Appeals for the Fifth Circuit, the federal appellate court for Texas.

My newest Coale Mind podcast episode looks forward to this fall, when the Supreme Court will consider two decisions by the en banc (full) U.S. Court of Appeals for the Fifth Circuit, the federal appellate court for Texas.

In the first, California v. Texas, a Fifth Circuit panel found that the individual mandate of the Affordable Care Act was unconstitutional after the repeal of the relevant tax, and the en banc court denied review in a close vote. In the second, Collins v. Mnuchin, the en banc Fifth Circuit found that Fannie Mae’s regulator was structured unconstitutionally.

These cases, important in their own right, also reflect a fascinating encounter between two “conservative” federal courts. Will the Fifth Circuit, widely seen as a particularly conservative court after President Trump’s many appointments, be seen by the Roberts Court as having gone too far? Or will the two courts by “in synch” with each other on these important constitutional issues?