Superior MRI Services sued for tortious interference with contract; the defendant argued that Superior lacked standing because it never acquired rights under the relevant contracts, and the Fifth Circuit agreed. Superior MRI Services, Inc. v. Alliance Imaging, Inc., No. 14-60087 (Feb. 18, 2015). The record showed that P&L Imaging, a bankruptcy debtor, listed “MRI service agreements” on its schedule of assignments to Superior, with an assignment date of October 1, 2011. Superior, however, did not exist as a legal entity until November 28, 2011. No evidence showed that Superior ratified the contract after its formation, and the Court was unwilling to accept Mississippi’s approval of Superior as a vendor as evidence of a ratification. The Court distinguished the recent case of Lexmark, Int’l v. Static Control Components, 134 S. Ct. 1377 (2014), as relating to another aspect of the standing requirement.

Superior MRI Services sued for tortious interference with contract; the defendant argued that Superior lacked standing because it never acquired rights under the relevant contracts, and the Fifth Circuit agreed. Superior MRI Services, Inc. v. Alliance Imaging, Inc., No. 14-60087 (Feb. 18, 2015). The record showed that P&L Imaging, a bankruptcy debtor, listed “MRI service agreements” on its schedule of assignments to Superior, with an assignment date of October 1, 2011. Superior, however, did not exist as a legal entity until November 28, 2011. No evidence showed that Superior ratified the contract after its formation, and the Court was unwilling to accept Mississippi’s approval of Superior as a vendor as evidence of a ratification. The Court distinguished the recent case of Lexmark, Int’l v. Static Control Components, 134 S. Ct. 1377 (2014), as relating to another aspect of the standing requirement.

Pearl Seas sued Lloyd’s Register North America (“LRNA”) for inadequate performance in certifying a cruise ship (the “Pearl Mist,” seen to the right.) LRNA moved to dismiss on the grounds of forum non conveniens in favor of England, citing a forum selection clause contained in its rules. The district court denied the motion without explanation and the Fifth Circuit reversed in a 2-1 panel opinion. In re Lloyd’s Register North America, Inc.. No. 14-20554 (Feb. 24, 2015), re-released after initial publication as a per curiam opinion on February 18.

Pearl Seas sued Lloyd’s Register North America (“LRNA”) for inadequate performance in certifying a cruise ship (the “Pearl Mist,” seen to the right.) LRNA moved to dismiss on the grounds of forum non conveniens in favor of England, citing a forum selection clause contained in its rules. The district court denied the motion without explanation and the Fifth Circuit reversed in a 2-1 panel opinion. In re Lloyd’s Register North America, Inc.. No. 14-20554 (Feb. 24, 2015), re-released after initial publication as a per curiam opinion on February 18.

The Court held: (1) as in the case of In re: Volkswagen, 545 F.3d 304 (5th Cir. 2008) (en banc), which involved the denial of a motion to transfer venue, mandamus is appropriate in the context of forum non conveniens; (2) it is an abuse of discretion to “grant or deny a[n FNC] motion without written or oral explanation” as to the relevant factors; and (3) the plaintiff was plainly bound by LRNA’s rules under the doctrine of direct-benefit estoppel, since its claim “referenced duties that must be resolved by reference to the classification society’s rules.” (citing Hellenic Inv. Fund v. Det Norkse Veritas, 464 F.3d 514 (5th Cir. 2006)). (A panel reached a similar result in Vloeibare Pret Limited v. Lloyd’s Register North America, Inc., No. 14-20538 (April 16, 2015, unpublished).

A dissent by Judge Elrod argued that the majority’s analysis of direct-benefit estoppel expanded the Court’s prior holdings in two areas — the degree to which the claim incorporated the relevant rules, and the timing of when the plaintiff learns of the rules. The dissent also expressed concern that the substantive claim would not be recognized in England.

The point of division between the majority and dissent — whether an error is “clear” or not — resembles a similar split between the majority and dissent in the mandamus case of In re Radmax, 720 F.3d 285 (5th Cir. 2013), which granted the writ as to the erroneous denial of an “intra-district” motion to transfer venue. Interestingly, Judge Higginson was the dissenter in Radmax, and also dissented from the denial of en banc review of that panel opinion, while here he forms part of the two-judge majority that grants mandamus relief. Judge Smith, who was in the majority of the Radmax panel opinion, is the author of this opinion after its initial release as per curiam.

In the case of In re Deepwater Horizon, the Texas Supreme Court has answered the certified questions raised in a significant insurance case about BP’s coverage related to the Deepwater Horizon disaster. (No. 130670, Tex. Feb. 13, 2015.) The issue is whether BP was an additional insured under policies obtained by Transocean, the operator of the ill-fated rig. Applying Evanston Ins. Co. v. ATOFINA Petrochemicals, Inc., 256 S.W.3d 660 (Tex. 2008), the Court held that “it is possible for a named insured to purchase a greater amount of coverage for an additional insured than an underlying service contract requires,” and that “the scope of indemnity and insurance clauses in service contracts is not necessarily congruent.” From that foundation, the court concluded: “The Drilling Contract required Transocean to name BP as an additional insured only for the liability Transocean assumed under the contract. Accordingly, Transocean had separate duties to indemnify and insure BP for certain risk, but the scope of that risk for either indemnity or insurance purposes extends only to above-surface pollution.”

Monday evening, a district judge in South Texas enjoined President Obama’s immigration program; the full text of his opinion is available here. (The case has the remarkably awkward caption of “Texas v. United States.”) An appeal has not yet been docketed with the Fifth Circuit. As with the recent gay marriage arguments, the makeup of the panel will be critical to the resolution of this extremely important case. The Washington Post story is a good example of the media coverage of the ruling.

Fernando Ramirez died after a beating by security guards at a nightclub. His estate sued the guards and the business that owned the club, as well as subsequent owners, alleging a scheme to hide assets. This lawsuit led to an insurance coverage dispute between the subsequent owners and the CGL carrier at the time of the incident. Colony Ins. Co. v. Price, No. 14-10317 (Feb. 12, 2015, unpublished). The specific allegations against the later owners in the underlying suit are far from clear, and appear to be obscured by broad use of the term “Defendants.” Nevertheless, the district court and Fifth Circuit agreed that these parties were not covered as “employees” under the policy: “Most obviously, the Price Defendants fail to explain how MTP and TOM, a partnership and a limited liability company, can be employees at all, let alone employees who falsely imprisoned Ramirez on October 1, 2008, particularly given that the Petition alleges that they were not formed until December 31 of the following year.”

1. I am speaking at the Dallas Bar Appellate Section meeting on March 19 at the Belo Mansion, with an update on recent Fifth Circuit opinions of general interest.

2. This year’s Super Lawyers nomination deadline is Wednesday, February 18 (two days from now). Take a few minutes to support the publication and your colleagues; the nomination form is here.

The defendants in a wrongful foreclosure case removed and the district court dismissed the borrower’s claims on the pleadings. The Fifth Circuit reversed for jurisdictional reasons. Smith v. Bank of America, No. 14-50256 (revised March 20, 2015, unpublished).

As to diversity jurisdiction, which was based on improper joinder of several defendants, the Court reminded: “[W]hen confronted with an allegation of improper joinder, the court must determine whether the removing party has discharged its substantial burden before proceeding to analyze the merits of the action.”

‘Blanton sued for employment discrimination, and after trial, “[t]here is no question that Blanton was subjected to egregious verbal sexual and racial harassment by the general manager of the Pizza Hut store where he worked.” Blanton v. Newton Associates, Inc., No. 14-50087 (Feb. 10, 2015, unpublished). The issue on appeal was whether the employer had established “the Ellerth/Faragher affirmative defense”; essentially, that the employer acted reasonably to stop the harassment and the employee unreasonably failed to enlist the employer’s aid. The evidence showed a lack of training about the employer’s anti-discrimination policies, and that two low-level supervisors hesitated to report the harassment for fear of retaliation by the general manager, but that “[o]nce Blanton did complain to a manager with authority over the general manager, Pizza Hut completed an investigation and fired her within four days.” Accordingly, the verdict and resulting judgment for the employer was affirmed.

The issue in Lowman v. Jerry Whitaker Timber Contractors, LLC was whether certain timber companies had vicarious liability for allegedly unlawful logging activities, in DeSoto Parish, Louisiana, in violation of that state’s timber cutting statute. Evidence showed that the loggers sold timber to the mills and in return received a “scale ticket” — a sort of commercial paper that can be bought and sold and allows small loggers immediate access to sale proceeds — which featured a description of the wood. Plaintiffs offered an affidavit from a state investigator who described the defendants’ “prior schemes involving the theft of timber and the falsifying of scale tickets,” and opined that he saw “‘the same pattern’ of activity” here. The Fifth Circuit affirmed summary judgment for the defendants, finding that the evidence showed no connection between the tickets he reviewed and the timber at issue, much less any “right of control or supervision” by the defendants over the loggers. No. 14-30787 (Feb. 10, 2015, unpublished).

The issue in Lowman v. Jerry Whitaker Timber Contractors, LLC was whether certain timber companies had vicarious liability for allegedly unlawful logging activities, in DeSoto Parish, Louisiana, in violation of that state’s timber cutting statute. Evidence showed that the loggers sold timber to the mills and in return received a “scale ticket” — a sort of commercial paper that can be bought and sold and allows small loggers immediate access to sale proceeds — which featured a description of the wood. Plaintiffs offered an affidavit from a state investigator who described the defendants’ “prior schemes involving the theft of timber and the falsifying of scale tickets,” and opined that he saw “‘the same pattern’ of activity” here. The Fifth Circuit affirmed summary judgment for the defendants, finding that the evidence showed no connection between the tickets he reviewed and the timber at issue, much less any “right of control or supervision” by the defendants over the loggers. No. 14-30787 (Feb. 10, 2015, unpublished).

An attorney challenged sanctions and contempt orders on appeal; one of her major points was inability to pay. The Fifth Circuit reminded that inability to pay is a defense to a charge of civil contempt, as to which “[t]he alleged contemnor bears the burden of producing evidence of his inability to comply. Failure to do so waives further consideration of this issue, even in the face of an order that added $100/day for noncompliance. Garrett v. Coventry, No. 14-10525 (Feb. 6, 2015).

BNSF Railway Co. v. Alstom Transportation presented a challenge to an arbitration award, in a contract dispute about the maintenance of rail cars. No. 13-11274 (Feb. 5, 2015). The Fifth Circuit brushed aside a number of challenges to the arbitrator’s legal analysis, quoting the Seventh Circuit: “As we have said too many times to want to repeat again, the question for decision by a federal court asked to set aside an arbitration award . . . is not whether the arbitrator or arbitrators erred in interpreting the contract; it is not whether they clearly erred in interpreting the contract; it is not whether they grossly erred in interpreting the contract; it is whether they interpreted the contract.”

BNSF Railway Co. v. Alstom Transportation presented a challenge to an arbitration award, in a contract dispute about the maintenance of rail cars. No. 13-11274 (Feb. 5, 2015). The Fifth Circuit brushed aside a number of challenges to the arbitrator’s legal analysis, quoting the Seventh Circuit: “As we have said too many times to want to repeat again, the question for decision by a federal court asked to set aside an arbitration award . . . is not whether the arbitrator or arbitrators erred in interpreting the contract; it is not whether they clearly erred in interpreting the contract; it is not whether they grossly erred in interpreting the contract; it is whether they interpreted the contract.”

Also, on procedural grounds, the Court rejected a challenge to the propriety of having arbitrated “gateway questions” of arbitrability. The district court had partially vacated the arbitrator’s award, the appellant (successfully) challenged that ruling, and BNSF had considerable latitude to defend it. But the “gateway” argument that arbitration should never have occurred, and that the award should thus be vacated in full, could not be presented on appeal absent a cross-appeal because it “asks for an expansion of the judgment.”

Also, on procedural grounds, the Court rejected a challenge to the propriety of having arbitrated “gateway questions” of arbitrability. The district court had partially vacated the arbitrator’s award, the appellant (successfully) challenged that ruling, and BNSF had considerable latitude to defend it. But the “gateway” argument that arbitration should never have occurred, and that the award should thus be vacated in full, could not be presented on appeal absent a cross-appeal because it “asks for an expansion of the judgment.”

In the press of year-end business, I neglected to cover a notable mandamus opinion in 2014 from the Federal Circuit, In re Google, Inc, No. 2014-147, 2014 WL 5032336 (Oct. 9, 2014). Reminiscent of that Court’s opinion in In re Genentech, 566 F.3d 1338 (2009), and the Volkswagen/Radmax line of cases from the Fifth Circuit, In re: Google addresses the denial of a motion to transfer patent litigation from the Eastern District of Texas.

The district court focused on “each defendant mobile phone manufacturer’s ability to modify and customize” the relevant platform. The Federal Circuit disagreed and granted mandamus relief, emphasizing the “substantial similarity involving the infringement and invalidity issues in all the suits.” That Court also rejected an argument based on the first-filed rule, finding that on these facts, “the equities of the situation do not depend on this argument.” (quoting Kerotest Mfg. Co. v. C-O-Two Fire Equip Co., 342 U.S. 180, 186 n.6 (1952). Concluding with a review of the practical considerations listed by 1404(a), the Court noted that the product at issue was developed in the Northern District of California, and thus the “bulk of the relevant evidence” is there as well.

In an earlier opinion, the Fifth Circuit reversed a summary judgment in favor of an insured, finding a fact issue as to whether late notice caused prejudice to the carrier. “Berkley I,” Berkley Regional Ins. Co. v. Philadelphia Indemnity Ins. Co., 690 F.3d 342 (5th Cir. 2012). After further proceedings, the district court granted summary judgment to the carrier and the Court affirmed. “Berkley II,” Berkley Regional Ins. Co. v. Philadelphia Indemnity Ins. Co., No. 13-51180 c/w No. 14-50099 (Jan. 27, 2015, unpublished). The key issue was whether notice to the broker sufficed to give notice the the carrier; the Court reasoned that even if the broker had a limited agency relationship with the carrier, notice of claims fell outside its scope: “Under the 2002 Agreement, Philadelphia expressly allowed [Agent] to act as an insurance broker and sell Philadelphia policies as Philadelphia’s representative, subject to Philadelphia’s approval. The 2002 Agreement is silent as to whether [Agent] had the ability to accept notice of claims on behalf of Philadelphia. Thus, [Agent] did not have express authority to accept notice of claims.” For the same reasons, an implied agency theory was also rejected.

The insurance coverage case of Mt. Hawley Ins. Co. v. Advance Products & Systems, Inc. illustrates the recurring differences of opinion between the Fifth Circuit and district courts about contract ambiguity. 14-30068 (Jan. 27, 2015, unpublished). When APS made a claim on its commercial property policy with Mt. Hawley, APS’s recovery was limited by a “coinsurance provision” that applies if it “has not insured the full value of its income.” The parties differed on whether “income” referred to projected or actual net income; the district court found ambiguity, and the Fifth Circuit reversed: “Although APS has a point—the language used in calculating the coinsurance penalty is imprecise—it does not render the contract ambiguous.” Based on the relationship between this provision and other parts of the policy, and the general purposes of coinsurance clauses, the Court reversed a summary judgment for the insured.

The insurance coverage case of Mt. Hawley Ins. Co. v. Advance Products & Systems, Inc. illustrates the recurring differences of opinion between the Fifth Circuit and district courts about contract ambiguity. 14-30068 (Jan. 27, 2015, unpublished). When APS made a claim on its commercial property policy with Mt. Hawley, APS’s recovery was limited by a “coinsurance provision” that applies if it “has not insured the full value of its income.” The parties differed on whether “income” referred to projected or actual net income; the district court found ambiguity, and the Fifth Circuit reversed: “Although APS has a point—the language used in calculating the coinsurance penalty is imprecise—it does not render the contract ambiguous.” Based on the relationship between this provision and other parts of the policy, and the general purposes of coinsurance clauses, the Court reversed a summary judgment for the insured.

Felder’s Collision Parts sells aftermarket parts for GM cars; it sued GM and several dealers in original equipment manufactured parts made by GM, alleging that they ran a pricing and rebate program (with the unfortunate name of “Bump the Competition”) that amounted to predatory pricing. The district court dismissed and the Fifth Circuit affirmed in Felder’s Collision Parts, Inc. v. All Star Advertising Agency, No. 14-30410 (Jan. 27, 2015).

Felder’s Collision Parts sells aftermarket parts for GM cars; it sued GM and several dealers in original equipment manufactured parts made by GM, alleging that they ran a pricing and rebate program (with the unfortunate name of “Bump the Competition”) that amounted to predatory pricing. The district court dismissed and the Fifth Circuit affirmed in Felder’s Collision Parts, Inc. v. All Star Advertising Agency, No. 14-30410 (Jan. 27, 2015).

Under the program, a dealer would offer a price significantly lower than the ordinary aftermarket part price. Felder’s argued the dealer was pricing beneath average variable cost — and thus engaging in predatory pricing — and offered an example of a dealer selling a part for $119 that it bought from GM for $135. The defendants pointed out that a key part of the program was a rebate to the dealer from GM based on sales, and including that rebate in the “cost” calculation turned the seeming $15 loss in this example into a 14% profit.

The Fifth Circuit agreed: “The price versus cost comparison focuses on whether the money flowing in for a particular transaction exceeds the money flowing out. The rebate undoubtedly affects that bottom line for All Star by guaranteeing that it makes a profit on any Bump the Competition sale. That undisputed fact resolves the case, as a ‘firm that is selling at a shortrun profit maximizing (or loss-minimizing) price is clearly not a predator.'” The Court acknowledged: “Felder’s no doubt is having a tougher time selling aftermarket equivalent parts for GM vehicles . . . But antitrust law welcomes those lower prices for consumers of collision parts so long as neither GM nor its dealers is selling parts at below-cost levels.” (Or, “parts is parts . . . “)

Ratliff Ready-Mix, a creditor of Barry Pledger’s construction business, argued that its claim was not dischargeable in Pledger’s bankrupcty because it arose from a violation of the Texas Construction Trust Fund Statute. Reviewing the case law about this statute and the defenses it provides, the Fifth Circuit affirmed judgment for the debtor. To overcome Pledger’s statutory affirmative defense, “Ratliff had to establish that the payments made by Pledger were not ‘actual expenses directly related to the construction.’ Specifically, Ratliff must show that (a) these were not payments made on the project or overhead, or (b) they were made for Pledger’s own uses rather than to benefit the health of his failing business.” Ratliff Ready-Mix v. Pledger, No. 14-50023 (Jan. 23, 2015, unpublished). Here, “[i]t would be hard to argue that paying taxes, repairing vehicles and equipment, and compensating employees could be categorized as anything other than maintaining the business.”

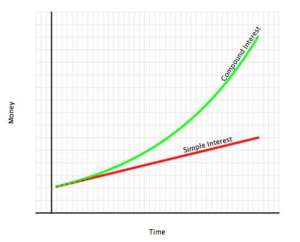

The note said: “So long as an Event of Default remains outstanding: (a) interest shall accrue at the Default Rate and, to the extent not paid when due, shall be added to the Principal Amount . . . .” The lender said this language meant that interest should be compounded, and the lower courts agreed — in the amount of almost $5 million. The borrower argued that this language only meant “that any unpaid interest will be added

The note said: “So long as an Event of Default remains outstanding: (a) interest shall accrue at the Default Rate and, to the extent not paid when due, shall be added to the Principal Amount . . . .” The lender said this language meant that interest should be compounded, and the lower courts agreed — in the amount of almost $5 million. The borrower argued that this language only meant “that any unpaid interest will be added

to the principal amount as the total debt due.” The Fifth Circuit disagreed, finding that this reading would impermissibly make the provision redundant “because it would operate only to label the accrued interest as money owed by [borrower] to [lender], and the interest was already owed. TCI Courtyard, Inc. v. Wells Fargo Bank, N.A., No. 14-10635 (Jan. 22, 2015, unpublished).

The district court dismissed a borrower’s breach of contract claim against a mortgage servicer because the borrower was in substantial arrears, and “as a general principle . . . an individual in breach cannot bring a cause of action for breach against another contracting party.” The Fifth Circuit reversed, finding that the borrower had alleged plausible claims that the servicer breached first; specially, that “the misapplication of [the borrrower’s] payments to an escrow account, resulting in default . . . constituted a material breach,” and that “Chase’s rejection of her mortgage payments, even if not a material breach, rendered performance impossible and that, as a result, any subsequent breach does not bar her claim.” Peters v. JP Morgan Chase, No. 13-50157 (Jan. 23, 2015, unpublished).

The district court dismissed a borrower’s breach of contract claim against a mortgage servicer because the borrower was in substantial arrears, and “as a general principle . . . an individual in breach cannot bring a cause of action for breach against another contracting party.” The Fifth Circuit reversed, finding that the borrower had alleged plausible claims that the servicer breached first; specially, that “the misapplication of [the borrrower’s] payments to an escrow account, resulting in default . . . constituted a material breach,” and that “Chase’s rejection of her mortgage payments, even if not a material breach, rendered performance impossible and that, as a result, any subsequent breach does not bar her claim.” Peters v. JP Morgan Chase, No. 13-50157 (Jan. 23, 2015, unpublished).

The actual pleading is available here, the key averment appears in paragaph 8: “According to the information received from the bank, Defendant believes Plaintiff is over $50,000 in arrears. According to the accounting done by Plaintiff, Plaintiff only owes $31, 437.30. Only $15,000 of this amount is on past due payments. Plaintiff believes that the disparity between the two figures is due to the fact that Chase has misapplied her payments under the mortgage to escrow fund, thereby causing her to be in default under the mortgage.”

I hope you enjoy this article on “Fact Issues in the Fifth Circuit,” which I published earlier this month in the State Bar Litigation Section’s periodical, “News for the Bar.”

The Fifth Circuit revised its original opinion in BNSF Railway Co. v. United States to expand and revise the discussion of ambiguity as part of the Chevron analysis of an IRS regulation; the outcome remained unchanged. No. 13-10014 (Jan. 15, 2015). The new discussion includes a reminder about the limited role of dictionaries, from the venerable en banc opinion about regulations for chicken processing in Mississippi Poultry Association, Inc. v. Madigan, 31 F.3d 293 (5th Cir.1994). The canon of “noscitur a sociis” (“an ambiguous term may be given more precise context by the neighboring words with which it is associated” also makes one of its infrequent appearances.

The Fifth Circuit revised its original opinion in BNSF Railway Co. v. United States to expand and revise the discussion of ambiguity as part of the Chevron analysis of an IRS regulation; the outcome remained unchanged. No. 13-10014 (Jan. 15, 2015). The new discussion includes a reminder about the limited role of dictionaries, from the venerable en banc opinion about regulations for chicken processing in Mississippi Poultry Association, Inc. v. Madigan, 31 F.3d 293 (5th Cir.1994). The canon of “noscitur a sociis” (“an ambiguous term may be given more precise context by the neighboring words with which it is associated” also makes one of its infrequent appearances.

Lexington Relocation Services sued Gum Tree Property Management and other defendants, alleging that a former employee had been hired by them to perform “substantially the same marketing and sales tasks that she had previously performed, in violation of her employment agreement.” Nationwide Mutual Ins. Co. v. Gum Tree Property Management, No. 14-60302 (Jan. 14, 2015, unpublished). Gum Tree sought defense and indemnity under several CGL and umbrella policies; the district court ruled for the insurer and the Fifth Circuit affirmed. The Court held that the insured did not successfully invoke a “narrow exception” under Mississippi law that can base coverage on “true facts” learned by the insurer beyond what a pleading says, noting that the exception does not reach “simpl[e] denials of the allegations in the complaint” or other “mere assertions.” The Court then found that the pleading did not make allegations about disparagement, invasion of privacy, or advertising injury.

Lexington Relocation Services sued Gum Tree Property Management and other defendants, alleging that a former employee had been hired by them to perform “substantially the same marketing and sales tasks that she had previously performed, in violation of her employment agreement.” Nationwide Mutual Ins. Co. v. Gum Tree Property Management, No. 14-60302 (Jan. 14, 2015, unpublished). Gum Tree sought defense and indemnity under several CGL and umbrella policies; the district court ruled for the insurer and the Fifth Circuit affirmed. The Court held that the insured did not successfully invoke a “narrow exception” under Mississippi law that can base coverage on “true facts” learned by the insurer beyond what a pleading says, noting that the exception does not reach “simpl[e] denials of the allegations in the complaint” or other “mere assertions.” The Court then found that the pleading did not make allegations about disparagement, invasion of privacy, or advertising injury.

The issue in Vine Street LLC v. Borg Warner Corp. was whether the defendant — a seller of dry cleaning equipment and supplies — intentionally discharged “PERC” (an unpleasant chemical widely used in dry cleaning) into the ground. No. 07-40440 (Jan. 14, 2015). While most of the opinion addresses technical matters about CERCLA , the discussion about the evidence of intent is of general interest. In particular, the Court noted testimony that the defendant’s employees handled PERC with care and did not intentionally spill it, and evidence that the defendant’s intent was to “sell useful chemicals to distributors and not to dispose of them” — in other words, “there is no evidence to suggest that [Defendant] engaged in subterfuge to disguise the disposal of PERC as a legitimate transaction surrounding the operation of a dry cleaning business.”

The case of AAA Bonding Agency v. United States Dep’t of Homeland Security involved the seldom-seen world of “immigration bonds” — a type of surety bond that allows release of an alien from custody while deportation proceedings are ongoing. No. 14-20057 (Jan. 12, 2015, unpublished). The Fifth Circuit has previously held that “DHS may only enforce an immigration bond against a surety company or bonding agent that has received notice demanding delivery of the alien covered by the bond.” This case involved 23 bonds where (1) AAA, the bonding agency, was liable on the bond with Surety National, an insurance company, (2) only AAA had received notice from DHS, and (3) Surety National had settled with DHS, and as part of the settlement, agreed that AAA would not be liable to DHS on these bonds if a court held that AAA’s obligation was joint and several with Surety National’s. The Court concluded that its prior holding did not alter the joint and several liability of AAA and Surety National as set forth in the language of the bonds, and ruled for AAA.

The case of AAA Bonding Agency v. United States Dep’t of Homeland Security involved the seldom-seen world of “immigration bonds” — a type of surety bond that allows release of an alien from custody while deportation proceedings are ongoing. No. 14-20057 (Jan. 12, 2015, unpublished). The Fifth Circuit has previously held that “DHS may only enforce an immigration bond against a surety company or bonding agent that has received notice demanding delivery of the alien covered by the bond.” This case involved 23 bonds where (1) AAA, the bonding agency, was liable on the bond with Surety National, an insurance company, (2) only AAA had received notice from DHS, and (3) Surety National had settled with DHS, and as part of the settlement, agreed that AAA would not be liable to DHS on these bonds if a court held that AAA’s obligation was joint and several with Surety National’s. The Court concluded that its prior holding did not alter the joint and several liability of AAA and Surety National as set forth in the language of the bonds, and ruled for AAA.

Plaintiffs — breeders of quarter horses using cloning technology — sued the American Quarter Horse Association, alleging that its bar on the registry of cloned horses was anticompetitive and violated Sections 1 and 2 of the Sherman Act. Abraham & Veneklasen Joint Venture v. American Quarter Horse Association, No. 13-11043 (Jan. 14, 2015). The district court agreed and entered an injunction; the Fifth Circuit reversed.

Plaintiffs — breeders of quarter horses using cloning technology — sued the American Quarter Horse Association, alleging that its bar on the registry of cloned horses was anticompetitive and violated Sections 1 and 2 of the Sherman Act. Abraham & Veneklasen Joint Venture v. American Quarter Horse Association, No. 13-11043 (Jan. 14, 2015). The district court agreed and entered an injunction; the Fifth Circuit reversed.

With respect to the Section 1 (conspiracy) claim, the Court expressed skepticism about whether the Association’s management could legally conspire with the Association, noting (without deciding): “American Needle‘s rejection of ‘single entity’ status for organizations with ‘separate economic actors’ [such as the NFL as to licensing] does not fit comfortably with the facts before us. AQHA is more than a sports league, it is not a trade association, and its quarter million members are involved in ranching, horse trading, pleasure riding and many other activities besides the ‘elite Quarter Horse’ market.” The Court then held that Plaintiffs had not shown a conspiracy, finding that their evidence about powerful members of the Association speaking out against cloning did not prove an actual agreement: “[T]he antitrust laws are not intended as a device to review the details of parliamentary procedure.” (citation omitted)

As to the Section 2 claim, the Court observed: “AQHA is a member organization; it is not engaged in breeding, racing, selling or showing elite Quarter Horses.” Thus, because “nothing in the record . . . shows that AQHA competes in the elite Quarter Horse Market,” no claim about its alleged monopolization of that market was cognizable. The Court distinguished other cases in which a trade association actually became a market participant and competitor.

As to the Section 2 claim, the Court observed: “AQHA is a member organization; it is not engaged in breeding, racing, selling or showing elite Quarter Horses.” Thus, because “nothing in the record . . . shows that AQHA competes in the elite Quarter Horse Market,” no claim about its alleged monopolization of that market was cognizable. The Court distinguished other cases in which a trade association actually became a market participant and competitor.

Waste Management sued Kattler, a former employee, for misappropriating confidential information and other related claims. A dispute about what information Kattler had in is possession expanded to include a contempt finding against Kattler’s attorney, Moore. Waste Management v. Kattler, No. 13-20356 (Jan. 15, 2015). The Fifth Circuit reversed, reasoning as follows:

Waste Management sued Kattler, a former employee, for misappropriating confidential information and other related claims. A dispute about what information Kattler had in is possession expanded to include a contempt finding against Kattler’s attorney, Moore. Waste Management v. Kattler, No. 13-20356 (Jan. 15, 2015). The Fifth Circuit reversed, reasoning as follows:

1. The order setting a hearing referenced a motion, by Pacer docket number, that only sought relief against Kattler and not the attorney. It was not an adequate “show-cause order naming [both] Moore and Kattler as alleged contemnors[.]”

2. On the merits, the Court found that Kattler had misled Moore as to the existence of a particular “San Disk thumb drive,” that Moore had acted prudently in consulting ethics counsel and withdrawing after he learned of the untruthfulness, and that new counsel made a prompt disclosure about the drive that avoided unfair prejudice. This part of the opinion reviews Circuit authority about the failure to correct incorrect court filings.

3. Also on the merits, “while Moore clearly failed to comply with the terms of the December 20 preliminary injunction by not producing the iPad image directly to [Waste Management] by December 22, this failure is excusable because the order required Moore to violate the attorney-client privilege.” Further, the relevant order only “required Kattler to produce an image of the device only, not the device itself,” which created a “degree of confusion” that excused the decision not to produce the actual iPad.

Law360 has also reported on this decision, and an expanded version of this article appears in the Texas Lawbook.

Eastman Chemical, the manufacturer of a plastic resin used in water bottles and food containers, successfully sued Plastipure under the Lanham Act, alleging that Plastipure falsely advertised that Eastman’s resin contained a dangerous and unhealthy additive. Eastman Chemical Co. v. Plastipure, Inc., No. 13-51087 (Dec. 22, 2014). Relying on ONY, Inc. v. Cornerstone Therapeutics, Inc., 720 F.3d 490 (2d Cir. 2013), Plastipure argued that “commercial statements relating to live scientific controversies should be treated as opinions for Lanham Act purposes.” The Fifth Circuit disagreed, noting that Plastipure made these statements in commercial ads rather than scientific literature, and observing: “Otherwise, the Lanham Act would hardly ever be enforceable — ‘many, if not most, products may be tied to public concerns with the environment, energy, economic policy, or individual health and safety.'” The Court also rejected challenges to the jury instructions and to the sufficiency of the evidence as to falsity.

Eastman Chemical, the manufacturer of a plastic resin used in water bottles and food containers, successfully sued Plastipure under the Lanham Act, alleging that Plastipure falsely advertised that Eastman’s resin contained a dangerous and unhealthy additive. Eastman Chemical Co. v. Plastipure, Inc., No. 13-51087 (Dec. 22, 2014). Relying on ONY, Inc. v. Cornerstone Therapeutics, Inc., 720 F.3d 490 (2d Cir. 2013), Plastipure argued that “commercial statements relating to live scientific controversies should be treated as opinions for Lanham Act purposes.” The Fifth Circuit disagreed, noting that Plastipure made these statements in commercial ads rather than scientific literature, and observing: “Otherwise, the Lanham Act would hardly ever be enforceable — ‘many, if not most, products may be tied to public concerns with the environment, energy, economic policy, or individual health and safety.'” The Court also rejected challenges to the jury instructions and to the sufficiency of the evidence as to falsity.

While affirming the dismissal of the borrowers’ other claims related to a foreclosure, the Fifth Circuit reversed as to a claim for wrongful foreclosure, reasoning: “Under Texas law, a claim for wrongful foreclosure generally requires: (1) ‘a defect in the foreclosure sale proceedings;’ (2) ‘a grossly inadequate selling price;’ and (3) ‘a causal connection between the defect and grossly inadequate selling price.’ In their Third Amended

Complaint, Plaintiffs allege that JPMC failed to comply with the notice procedures required for a foreclosure sale,and that, as a result, they lost the opportunity to obtain cash or to find a buyer for the Property before JPMC foreclosed. Plaintiffs also specifically allege that the Property sold for a grossly inadequate sales price.” Guajardo v. JP Morgan Chase Bank, N.A., No. 13-51025 (Jan. 12, 2015, unpublished) (citations omitted). Notably, while the pleading describes the type of notice required and avers that it did not occur, it does not provide detail about the sales price and why it was not adequate.

Two rulings for mortgage servicers offer points of general interest to start the New Year:

1. This allegation does not satisfy Twombly, with respect to the intent requirement of the Texas fraudulent lien statute: “the transactions by the Defendants jointly and severally were designed to defraud the Plaintiff out of her property.” The Fifth Circuit found that “this allegation is, at most, a legal conclusion that [Defendant Law Firm] acted with the requisite intent; it lacks any ‘factual content’ that would ‘allow[] the court to draw the reasonable inference that the intent element was met.” Trang v. Taylor Bean & Whitaker Mortgage Corp., No. 14-5028 (Jan. 7, 2015, unpublished).

2. Footnote 1 of the Trang opinion reviews the apparent split in authority on whether a lien assignment falls within the scope of that statute.

3. A borrower seeking refinancing of a mortgage loan is not a consumer under the Texas DTPA. “[T]he refinancing that Perkins sought from BOA is “directly analogous to the [auto] refinancing services sought by the claimant in Riverside [National Bank v. Lewis, 603 S.W.2d 169 (Tex. 1980)].” Perkins v. Bank of America, No. 14-20284 (revised March 4, 2015).

1. The Fifth Circuit heard oral arguments on Friday, January 9, in the gay marriage appeals from each of the three states in the Circuit. Here is a representative news article about the arguments, and the recording of the arguments is available here.

2. Also on January 9, the Court denied en banc review of a Clean Water Act case arising from the Deepwater Horizon disaster. The vote was 6 in favor of review, 7 opposed, with a short dissenting opinion. I have not followed this opinion previously, and the en banc split is not as telling about commercial cases as a a trio of other votes, but it is nevertheless an uncommon insight on the full Court’s view of an issue.

Many personal injury claims are resolved by a “structured settlement,” in which the plaintiff receives a large sum in installments over his or her lifetime. Symetra is a company that contracts with tort defendants to fund those settlements. Rapid is a company that offers large lump sum payments to the beneficiaries of those settlements, seeking to profit by the time value of money. In many states, offers such as Rapid’s are regulated by Structured Settlement Payment Acts (“SSPAs”), and Rapid’s noncompliance with those laws gave rise to Symetra Life Ins. Co. v. Rapid Settlements, Ltd., No. 13-20412 (Dec. 23, 2014).

The trial court found that when Rapid had a dispute with an annuitant, it invoked an arbitration right that “w[as] a sham — designed to circumvent the SSPA’s exclusive method for transferring future payments.” The first issue on appeal related to the accompanying award of attorneys fees. The Fifth Circuit remanded for further consideration under Texas law, focusing on the distinction between claims involving present disputes with annuitants (fees allowed), and for future injuctive relief (not allowed). The Court also held that attorneys fees were recoverable as direct damages on Symetra’s claims for tortious interference, when it was “completely foreseeable” to Rapid that its arbitration practices would involve Symetra in state court litigation.

The fault, dear Brutus, is not in our proof, but in our pleadings, that they fail Twombly.

January 6, 2015The plaintiff in Wooten v. McDonald Transit Assocs. sued for age discrimination and the defendant defaulted. The trial court received damages evidence and entered judgment for the plaintiff. The defendant then appeared – unsuccessfully – but obtained reversal from the Fifth Circuit. No. 13-11035 (Jan 2, 2015).

“On appeal, the [defaulted] defendant, although he may not challenge the sufficiency of the evidence, is entitled to contest the sufficiency of the complaint and its allegations to support the judgment.” Here, the majority saw the pleading as a “threadbare recital of a cause of action,” especially weak as to causation. At the hearing, however, “[P]laintiff’s live testimony provides sufficient evidence of each of the elements of his ADEA cause of action to support the entry of default.”

After a careful review of the language of the rules, precedent, and policy, the majority emphasized the pleadings over the evidence: “As there can be no judgment absent competent pleadings, it strains the text of [Rule 55] to suppose that this investigatory power encompasses the adduction of facts necessary to render the pleadings competent in the first place.” The trial court should have either dismissed or, in one of various ways, ordered amendment of the pleadings and afforded the defendant the chance to answer them. A dissent found that “[t]his result is inordinately lopsided and, even worse, favors the wearer of the black hat over the wearer of the white hat.”

Judge Emilio Garza of San Antonio, who served ably on the Fifth Circuit over 20 years, has retired effective January 5, 2015.

Plaintiffs sued for securities fraud about their investments in a business that auctioned antiques. Heck v. Triche, No. 14-30146 (Dec. 23, 2014). They won on many claims at trial and the Fifth Circuit affirmed, largely on procedural grounds:

Plaintiffs sued for securities fraud about their investments in a business that auctioned antiques. Heck v. Triche, No. 14-30146 (Dec. 23, 2014). They won on many claims at trial and the Fifth Circuit affirmed, largely on procedural grounds:

1. Appeal Deadline Extended. As a threshold matter, the plaintiffs’ motion for attorneys fees tolled the deadline for the notice of appeal, because the district court entered an order under Fed. R. Civ. P. 83(e) that stayed the deadline until the disposition of the motion. The Court noted some tension between its analysis of this issue and that of the Second Circuit’s in Mendes Junior Int’l Co. v. Banco Do Brasil, S.A., 215 F.3d 306 (2000).

2. Invited Charge Error. The Court agreed that the district court’s verdict form erroneously conflated the elements of a federal 10b-5 claim with those of a Louisiana securities claim. It found, however, that the plaintiffs invited this error by advocating for this part of the charge (citing United States v. Gray, 626 F.2d 494, 501 n.2 (5th Cir. 1980) [“The invited error doctrine bars reversal even if the instruction constituted plain error.”])

3. Cross-Appeal Needed. The plaintiffs argued that the district court erred by imposing liability under state law, not 10b-5. The Court found this argument waived, because its acceptance would change the amount of the judgment as well as its basis, and the plaintiffs did not cross-appeal.

Several labor unions arbitrated disputes with American Airlines about pilot seniority. Mackenzie v. Air Lines Pilots Association, No. 11-11098 (Dec. 23, 2014, unpublished). Two pilots sought to bring a class action to challenge the arbitration award. The Fifth Circuit dismissed for lack of standing: “[W]hen a CBA formed pursuant to the RLA establishes a mandatory, binding grievance procedure and vests the union with the exclusive right to pursue claims on behalf of aggrieved employees, an aggrieved employee whose employment is governed by the CBA lacks standing to attack the results of the grievance process in court—the sole exception being the authorization of an aggrieved employee to bring an unfair representation claim.” (citing Mitchell v. Continental Airlines, 481 F.3d 225 (5th Cir. 2007)). The Court’s analysis of this issue resembles discussion about the broader topic of claim preclusion, arising from a privity relationship, based on another party’s litigation activity.

A helicopter crashed in the Gulf of Mexico. Its owner sued three defendants — Rolls-Royce, who built the engine bearing in question; the designer of the “pontoon flotation” system that deployed after the crash; and a repair company that worked on that system. Rolls-Royce sought severance and transfer to Indiana, based on a forum selection clause in its warranty, and relying on the recent case of Atlantic Marine Construction v. Western District of Texas, 134 S. Ct. 568 (2013). The district court denied its motions; in a 2-1 decision, the Fifth Circuit reversed. In re: Rolls Royce Corp., 775 F.3d 671 (5th Cir. 2014).

A helicopter crashed in the Gulf of Mexico. Its owner sued three defendants — Rolls-Royce, who built the engine bearing in question; the designer of the “pontoon flotation” system that deployed after the crash; and a repair company that worked on that system. Rolls-Royce sought severance and transfer to Indiana, based on a forum selection clause in its warranty, and relying on the recent case of Atlantic Marine Construction v. Western District of Texas, 134 S. Ct. 568 (2013). The district court denied its motions; in a 2-1 decision, the Fifth Circuit reversed. In re: Rolls Royce Corp., 775 F.3d 671 (5th Cir. 2014).

After confirming that mandamus relief was available, despite the novel procedural context of a combined transfer and venue motion, the majority reviewed the applicability of Atlantic Marine. “For cases where all parties signed a forum selection contract, the analysis is easy: except in a truly exceptional case, the contract controls.” For a situation such as this one, however, the analysis is more subtle: “While Atlantic Marine noted that public factors, standing alone, were unlikely to defeat a transfer motion, the Supreme Court has also noted that section 1404 was designed to minimize the waste of judicial resources of parallel litigation of a dispute. The tension between these centrifugal considerations suggests that the need — rooted in the valued public interest in judicial economy — to pursue the same claims in a single action in a single court can trump a forum-selection clause.”

The dissent “believe[s] the majority have erroneously and confusingly diminished the scope of Atlantic Marine,” concluding: “Simple two-party disputes are near a vanishing breed of litigation. It seems highly unlikely that the Supreme Court granted certiorari and awarded the extraordinary relief of mandamus simply to proclaim that a forum selection clause must prevail only when one party sues one other party. The Court is not naive about the nature of litigation today.”

The United States sued Bollinger Shipyards, alleging that it submitted false claims in connection with upgrades on the Coast Guard’s 110-foot patrol ships (right). The gist of the complaint was that “Bollinger eventually submitted the highest of three [strength] calculations (5,232) to the Coast Guard, while employing in its internal documents the middle calculation (3,037).” As to these strength measurements and their review by an independent agency, an internal email said, “adverse results could cause the entire conversion to be an uneconomical solution” and expressed concern that “we BLOW the program.” United States v. Bollinger Shipyards, Inc., No. 13-31301 (Dec. 23, 2014).

The United States sued Bollinger Shipyards, alleging that it submitted false claims in connection with upgrades on the Coast Guard’s 110-foot patrol ships (right). The gist of the complaint was that “Bollinger eventually submitted the highest of three [strength] calculations (5,232) to the Coast Guard, while employing in its internal documents the middle calculation (3,037).” As to these strength measurements and their review by an independent agency, an internal email said, “adverse results could cause the entire conversion to be an uneconomical solution” and expressed concern that “we BLOW the program.” United States v. Bollinger Shipyards, Inc., No. 13-31301 (Dec. 23, 2014).

While the parties disputed the proper interpretation of this evidence, and the district court agreed with the defendants, the Fifth Circuit reversed: “Rule 12(b)(6) does not require the United States to present its best case or even a particularly good case, only to state a plausible case” that Bollinger acted “in reckless disregard of the truthy or falsity” of the measurements. The Court also held: “The government knowledge defense is not appropriate at the motion to dismiss stage, which requires us to draw all inferences in favor of the United States. It is more proper at the summary judgment or trial stage as ‘a means by which the defendant can rebut the government’s assertion of the “knowing” presentation of a false claim.'”

Mingo sold her partnership interest in PWC to IBM; part of its value included $126,240 of unrealized receivables. She sought to report them for tax purposes using the installment method of accounting. The IRS disagreed and the Tax Court and Fifth Circuit accepted its position. Mingo v. Commissioner of Internal Revenue, No. 13-60801 (Dec. 9, 2014). The underlying statute, section 741 of the Internal Revenue Code, provides that sale of a partnership interest is ordinarily considered the sale of a capital asset, except for gain from unrealized receivables; the purpose “is to prohibit ordinary income from being transformed into capital gains (which is taxed more favorably) simply by being passed through a partnership and sold.”

Defendants removed, averring: “The real property at issue has a current fair market value of $87,500.” The district court denied remand. Plaintiffs appealed, and the Fifth Circuit entertained her argument because it went to the existence of subject matter jurisdiction. Taking judicial notice of county appraisal records that valued the property at $62,392, the Court remanded for the gathering of more evidence about the amount in controversy. Statin v. Deutsche Bank, No. 14-20200 (Dec. 19, 2014, unpublished). The Court noted the recent Supreme Court case of Dart Cherokee Basin Operating Co. v. Williams, No. 13-719 (U.S. Dec. 15, 2014), which confirmed that while “defendants to not need to attach evidence supporting the alleged amount in controversy to the notice of removal,” “once the notice of removal’s asserted amount is ‘challenged,’ the parties ‘must submit proof and the court decides, by a preponderance of the evidence, whether the amount-in-controversy requirement has been satisfied.'”

The same week as  the en banc vote in the whooping crane litigation, the Fifth Circuit analyzed “Whoomp! (There It Is).” The unfortunate song has been mired in copyright infringement litigation for a decade; the district court entered judgment for the plaintiff for over $2 million, and it was affirmed in Isbell v. DM Records, Inc., Nos. 13-40787 and 14-40545 (Dec. 18, 2014). [The opinion notes: “The word “‘Whoomp!’ appears to be a neologism, perhaps a variant of ‘Whoop!,’ as in a cry of excitement.”]

the en banc vote in the whooping crane litigation, the Fifth Circuit analyzed “Whoomp! (There It Is).” The unfortunate song has been mired in copyright infringement litigation for a decade; the district court entered judgment for the plaintiff for over $2 million, and it was affirmed in Isbell v. DM Records, Inc., Nos. 13-40787 and 14-40545 (Dec. 18, 2014). [The opinion notes: “The word “‘Whoomp!’ appears to be a neologism, perhaps a variant of ‘Whoop!,’ as in a cry of excitement.”]

The main appellate issue was a variant of a frequently-litigated topic — the role of extrinsic evidence in contract interpretation. The assignment in question was governed by California law, which the Court found to “employ[] a liberal parol evidence rule” with respect to consideration of extrinsic evidence. The appellant argued that the district  court erred “in interpreting the Recording Agreement without asking the jury to make any findings on the extrinsic evidence.” The Court disagreed, finding that the record did not present “a question of the credibility of conflicting extrinsic evidence” (emphasis in original): “The only dispute is over the meaning of the Recording Agreement and the inferences that should be drawn from the numerous undisputed pieces of extrinsic evidence. This is a question of law for the court, not for a jury.”

court erred “in interpreting the Recording Agreement without asking the jury to make any findings on the extrinsic evidence.” The Court disagreed, finding that the record did not present “a question of the credibility of conflicting extrinsic evidence” (emphasis in original): “The only dispute is over the meaning of the Recording Agreement and the inferences that should be drawn from the numerous undisputed pieces of extrinsic evidence. This is a question of law for the court, not for a jury.”

The Fifth Circuit revised its earlier opinion in Aransas Project v. Shaw, No. 13-40317 (Dec. 15, 2014) and also denied en banc review over a dissent joined by three judges (with a fourth also voting for review). The Court continues to hold that the plaintiff failed to establish proximate cause in an environmental case about the environment for whooping cranes. The points of division are whether the panel “independently weighs facts to render judgment in violation of fundamental principles of federal law,” or simply finds that “the record permits only one resolution of the factual issue after the correct law is applied”; a related issue is whether rendition or remand is the appropriate appellate remedy for fact findings premised on an error of law.

The Fifth Circuit revised its earlier opinion in Aransas Project v. Shaw, No. 13-40317 (Dec. 15, 2014) and also denied en banc review over a dissent joined by three judges (with a fourth also voting for review). The Court continues to hold that the plaintiff failed to establish proximate cause in an environmental case about the environment for whooping cranes. The points of division are whether the panel “independently weighs facts to render judgment in violation of fundamental principles of federal law,” or simply finds that “the record permits only one resolution of the factual issue after the correct law is applied”; a related issue is whether rendition or remand is the appropriate appellate remedy for fact findings premised on an error of law.

Here’s a holiday gift from 600Camp — a short article called “How (not) to Draft Arbitration Clauses.” It reviews five cases to offer practical, specific tips for drafting arbitration clauses; specifically, in business settings involving more than one contract signed at different times. Enjoy!

As chronicled in the sister blog 600Commerce (following business cases in the Dallas Court of Appeals), the issue of whether a guarantor can waive the “fair market value” offset right provided by the Texas Property Code — a problem that arises frequently after foreclosure sales — was hotly-litigated until the Texas Supreme Court settled the matter in Moyaedi v. Interstate 35/Chisam Road, L.P, 438 S.W.3d 1 (Tex. 2014), finding that the right was waivable.

The Fifth Circuit acknowledged and applied that holding in Hometown 2006-1 1925 Valley View, LLC v. Prime Income Asset Management LLC, finding that the waiver there was even clearer than in Moyaedi. In Moyaedi, the guarantor waived “every . . . defense”; here, the guarantor waived “any . . . offset, claim or defense,” and the guaranty also had a provision saying: “Guarantor WAIVES each and every right to which it may be entitled by virtue of any suretyship law, including any rights it may have pursuant to . . . Section

51.005 of the Texas Property Code.” No. 14-10182 (Dec. 11, 2014, unpublished).

Sundown Energy could access its oil and gas production facility via the Mississippi River, but had to cross Haller’s land to access it from the highway. They litigated about Sundown’s rights and reached a settlement, which their counsel read into the record on the day set for trial. The Fifth Circuit found that the parties had reached a settlement, which the district court had the authority to enforce pursuant to their agreement. The Court reversed, though, as to the district court’s resolution of several logistical issues: “Here, the district court erred by imposing several terms which either conflicted with or added to the agreement read into the record by the parties. Although the parties gave the district court the authority to enforce and interpret the settlement agreement, the district court did not have the power to change the terms of the settlement agreed to by the parties.” Sundown Energy L.P. v. Haller, No. 13-30294 et al. (Dec. 8, 2014).

Can a note be endorsed with a photocopied signature? Yes. Whittier v. Ocwen Loan Servicing, LLC, No. 13-20639 (Dec. 3, 2014, unpublished) (citing Tex. Bus. & Com. Code § 1.201(b)(37)) (“Signed” includes using any symbol executed or adopted with present intention to adopt or accept a writing.”)

Can a note be endorsed with a photocopied signature? Yes. Whittier v. Ocwen Loan Servicing, LLC, No. 13-20639 (Dec. 3, 2014, unpublished) (citing Tex. Bus. & Com. Code § 1.201(b)(37)) (“Signed” includes using any symbol executed or adopted with present intention to adopt or accept a writing.”)

Can a “deed of trust . . . upon a homestead exempted from execution,” which “shall not be valid or binding unless signed by the spouse of the owner,” be signed in separate but identical documents? Yes. Avakian v. Citibank, N.A., No. 14-60175 (Dec. 9, 2014) (citing Duncan v. Moore, 7 So. 221, 221-22 (Miss. 1890)) (“There is much force in the  argument of defendant’s counsel that the statute does not require a joint deed of husband and wife for the conveyance of the husband’s homestead . . . that the substantial thing is the written evidence of such consent; and that this may be as certainly shown by a separate instrument as by signing the deed of the husband.”)

argument of defendant’s counsel that the statute does not require a joint deed of husband and wife for the conveyance of the husband’s homestead . . . that the substantial thing is the written evidence of such consent; and that this may be as certainly shown by a separate instrument as by signing the deed of the husband.”)

The borrowers’ complaint in a wrongful foreclosure case sought: “‘an order canceling the Mortgage’ on property that is worth more than $200,000 while also stipulating that they will not recover more than $75,000.” Accordingly: “Given our established rule that the amount in controversy in cases like this is determined by the value of the property, it is irrelevant whether the stipulation is binding. A party cannot sue over a mountain but stipulate that it is a molehill.” Solis v. HSBC Bank USA, No. 14-40489 (Nov. 17, 2014, unpublished).

The borrowers’ complaint in a wrongful foreclosure case sought: “‘an order canceling the Mortgage’ on property that is worth more than $200,000 while also stipulating that they will not recover more than $75,000.” Accordingly: “Given our established rule that the amount in controversy in cases like this is determined by the value of the property, it is irrelevant whether the stipulation is binding. A party cannot sue over a mountain but stipulate that it is a molehill.” Solis v. HSBC Bank USA, No. 14-40489 (Nov. 17, 2014, unpublished).

Class action suits alleged that First Community Bank mismanaged its customers’ bank accounts. The bank’s insurer admitted that there would be coverage under the professional liability policy, but for the “fee dispute exclusion” [excluding claims “based upon, arising out of or attributable to any dispute involving fees or charges for an Insured’s services”]. While the collection of excessive overdraft fees was a major part of the pleadings, “at least some” of their allegations dealt with “First Community’s providing misleading information on its account practices and customers’ account balances . . . that do not have a causal connection to a disagreement that necessarily includes fees.” Accordingly, under Texas’s “eight corners” rule, the Fifth Circuit affirmed judgment for the insured as to the duty to defend. First Community Bancshares v. St. Paul Mercury Ins. Co., No. 13-50657 (Nov. 14, 2014, unpublished).

The Supreme Court has granted review of the Fifth Circuit’s opinion in Texas Division, Sons of Confederate Veterans v. Vandegriff, a First Amendment case about Texas’s denial of a request for a specialty license plate featuring the Confederate battle flag.

The Supreme Court has denied review of BP’s challenges to the Deepwater Horizon settlement, resolved by the Fifth Circuit earlier this year in a complicated series of panel opinions and denials of rehearing.

Plaintiffs, alleging that the defendant wrongfully printed the expiration dates of credit cards on its store receipts, sought to certify a class of “[a]ll persons who made in-store purchases from the Defendant using a debit or credit card, in a transaction occurring from May 8, 2010, through May 10, 2012, at one of the [specified] stores . . . .” Ticknor v. Rouse’s Enterprises, LLC, No. _____. Noting a split in authority about similar class actions, and applying Mims v. Stewart Title, 590 F.3d 298 (5th Cir. 2009), the Fifth Circuit found no abuse of discretion in denying certification: “The district court determined that the plaintiffs needed to prove that they: (1) were not using someone else’s card to make their purchases, (2) were consumers rather than business purchasers, and (3) took their receipts. Rouse’s argued that these factors differed among the putative class members. First, it noted one instance in which an individual had used his mother’s credit card to make a purchase, suggesting there would be many similar situations. Second, Rouse’s observed that it markets to professional chefs and other business customers who shop at its stores. These customers are not “consumers” protected under [the federal statute]. Finally, Rouse’s showed that numerous customers leave its stores without their receipts.”

The issue in Omega Hospital LLC v. Louisiana Health Service & Indemnity was whether the defendant (also known as Blue Cross Blue Shield of Louisiana), had an objectively reasonable basis for removal. No. 13-31085 (Nov. 18, 2014, unpublished). Some of the Blue Cross insureds at issue were federal employees covered by a plan overseen by the U.S. Office of Personnel Management. The Fifth Circuit reversed an award of attorneys fees against Blue Cross, noting “case law arguably supporting Blue Cross, and the absence of a ruling from this court,” and thus concluding: “We cannot say that Blue Cross lacked a reasonable belief in the propriety of removal” under the “federal officer” statute, 28 U.S.C. § 1442(a)(1).

In Southwestern Elec. Power Co. v. Certain Underwriters at Lloyds, No. 13-31130 (Nov. 24, 2014), the trial court entered this order on September 25, 2013:

“IT IS ORDERED that the Motion to Compel Arbitration and Stay Proceedings (Doc. 16) is granted and the parties are ordered to resolve the claim presented in an arbitration conducted in accordance with the terms of their insurance policy. IT IS FURTHER ORDERED that this civil action is stayed, and the Clerk of Court is directed to close the case for administrative purposes given the unlikelihood that further proceedings in this action will be necessary.”

Several months later, the trial court further ordered:

“This court finds that pursuant to Freudensprung and American Heritage Ins. Co. v. Orr, 294 F.3d 702 (5th Cir. 2002), the September 25, 2013 order compelling arbitration and staying the underlying proceeding operates as a final, appealable decision within the statutory framework of the Federal Arbitration Act, 9 U.S.C. § 1-16.”

The Fifth Circuit gave little weight to that further order:

”In a later ruling on SWEPCO’s Rule 58(d) motion for a separate judgment, the district court carefully construed its earlier ruling. Notably, the district court considered case law to construe the prior order ‘as a final, appealable decision within the statutory framework of the [FAA].’ It did not issue a clarification that its prior order was intended to be final and appealable, did not purport to grant SWEPCO’s motion, and did not issue a new order with the necessary trappings of finality.”

Accordingly, because the previous order only stayed and administratively closed the matter — as opposed to dismissing it — the order was interlocutory and the Court lacked appellate jurisdiction.

In tour de force reviews of Louisiana’s Civil Code and civilian legal tradition, a plurality and dissent — both written by Louisiana-based judges — reviewed whether a 1923 deed created a “predial servitude” with respect to a right of access. The deed at issue said: “It is understood and agreed that the said Texas & Pacific Railway Company shall fence said strip of ground and shall maintain said fence at its own expense and shall provide three crossings across said strip at the points indicated on said Blue Print hereto attached and made part hereof, and the said Texas and Pacific Railway hereby binds itself, its successors and assigns, to furnish proper drainage out-lets across the land hereinabove conveyed.”

In tour de force reviews of Louisiana’s Civil Code and civilian legal tradition, a plurality and dissent — both written by Louisiana-based judges — reviewed whether a 1923 deed created a “predial servitude” with respect to a right of access. The deed at issue said: “It is understood and agreed that the said Texas & Pacific Railway Company shall fence said strip of ground and shall maintain said fence at its own expense and shall provide three crossings across said strip at the points indicated on said Blue Print hereto attached and made part hereof, and the said Texas and Pacific Railway hereby binds itself, its successors and assigns, to furnish proper drainage out-lets across the land hereinabove conveyed.”

The analysis involved citation to the Revised Civil Code of Louisiana of 1870 (the Code in effect at the time of conveyance), the 1899 treatise Traité de Droit Civil-Des Biens, and the 1893 work, Commentaire théorique & pratique du code civil. Despite the arcane overlay, the opinions turn on practical observations. The plurality notes that the deed uses “successors and assigns” language only with respect to drainage — not access — while the dissent observes that a “personal” access right, limited only to the parties to the conveyance and that does not run with the land, is impractical. Franks Investment Co. v. Union Pacific R.R. Co., No. 13-30990 (Dec. 2, 2014).

After receiving responses from the plaintiff and the District Court, the Fifth Circuit denied the mandamus petition in In re: Trinity Industries, Inc., this time with a simple one-line order — as compared to its previous ruling. No. 14-41297 (Dec. 2, 2014).

- This contract language binds the parties to an agreed-upon postjudgment interest rate: “All past due interest and/or principal shall bear interest from maturity until paid, both before and after judgment, at the rate of 9% per annum.” The language “clearly, unambiguously, and unequivocally” refers to postjudgment interest.

- This language does not: “Invoices not paid within the stated terms will be charged 1.5% per month. . . . All freight, demurrage and other charges shall be subject to an interest charge of 1-1/2% per month beginning on the first day after the due date of invoice.”

Celtic Marine Corp. v. James C. Justice Co., No. 13-31306 (Nov. 20, 2014, unpublished) (quoting Hymel v. UNC, Inc., 994 F.2d 260 (5th Cir. 1993) (emphasis added)).

The Fifth Circuit withdrew its original opinion in Scarlott v. Nissan North America to issue a revised opinion on rehearing. No. 13-20528 (Nov.10, 2014). The Court did not materially change its earlier holding that the amount-in-controversy requirement for diversity jurisdiction was not satisfied, or its disposition by a remand to the district court for purposes of remand to state court. The Court added discussion — and a dissent — about how the district court should handle a sanctions award on remand. The plurality simply said: “In light of our holding that the district court did not have jurisdiction over this case, the district court should reconsider whether to award attorneys’ fees and costs to the defendants; and if the court decides that attorneys’ fees and costs are still appropriate, the court should reconsider the amount of the award.” The dissent would vacate the award; among other points, it made this basic one: “By its very nature, section 1927 involves assessing the merits of the claim, which establishes the inappropriateness of the district court’s order in light of the lack of jurisdiction.”

The parties to a contract about the construction of a barge disputed whether an amendment required price adjustments based on the price of steel. Blessey Marine Services, Inc. v. Jeffboat, LLC, No. 13-30731 (Nov. 10, 2014, unpublished). In a pretrial summary judgment ruling, the district court rejected the plaintiff’s argument that the contract was unambiguous, and held a jury trial to hear extrinsic evidence and resolve the ambiguity. On appeal, the Fifth Circuit held:

1. Because the plaintiff did not renew the ambiguity argument in a Rule 50 motion (although it did raise the point in a motion in limine and in opposition to the other side’s motion), the Court could not consider it on appeal; and

2. “By adducing some of the same extrinsic evidence at trial that it had sought to exclude in its motion in limine, [Plaintiff] waived its right to challenge the district court’s admission of that evidence.” (citing Fed. R. Evid. 103(b) and Ohler v. United States, 529 U.S. 753, 755 (2000) [“[A] party introducing evidence cannot complain on appeal that the evidence was erroneously admitted.”])

The forum selection clause in Waste Management of Louisiana LLC v. Jefferson Parish was permissive, not mandatory:

“Jurisdiction: This Agreement and the performance thereof shall be governed, interpreted, construed and regulated by the laws of the State of Louisiana and the parties hereto submit to the jurisdiction of the 24th Judicial District Court for the Parish of Jefferson, State of Louisiana. The parties hereby waiving [sic] any and all plea[s] of lack of jurisdiction or improper venue.”

When Waste Management sued in Louisiana federal court, the defendant’s forum non conveniens motion was denied and the Fifth Circuit declined to review that denial by interlocutory appeal. No. 14-90040 (Nov. 28, 2014, unpublished). The Court noted: “Unlike their mandatory counterparts, permissive forum selection clauses allow but do not require litigation in a designated forum. As such, we have never required district courts to transfer or dismiss cases involving clauses that are permissive.” It held that Atlantic Marine Construction v. District Court, 134 S. Ct. 568 (2013), did not change that rule, as that case involved a mandatory clause, and “[t]he vast majority of district courts deciding this issue have rejected Atlantic Marine’s application to permissive forum selection clauses.”

Leftover turkey? Have no fear — continue the celebration New Orleans style with Emeril Lagasse’s recipe for Turkey Bone Gumbo. Happy Thanksgiving from 600Camp!

The parties in Morton v. Yonkers disputed whether a gas royalty interest was void under the laws of the Navajo Nation. No. 13-10926 (Nov. 19, 2014). One party submitted a letter from an attorney for the Navajo Nation Department of Justice, opining that the “purported overriding royalty interest is invalid under the applicable provisions of the Navajo Nation Code and is completely void.” The Fifth Circuit affirmed the lower courts’ conclusion that this letter was inadmissible hearsay, and did not qualify for an exemption under Fed. R. Evid. 803(8) or (15) [public records and statements about property interests]; or the general exception in Rule 807 [the former 803(24) and 804(b)(5), combined in 2011]: “Trustworthiness is the linchpin of these hearsay exceptions. We are persuaded by the district court’s thorough explanation that the letter is untrustworthy, in large part because it was drafted by Morton’s counsel and was prepared after Morton’s counsel provided the Navajo Nation official with only one side of the story.”

The parties in Morton v. Yonkers disputed whether a gas royalty interest was void under the laws of the Navajo Nation. No. 13-10926 (Nov. 19, 2014). One party submitted a letter from an attorney for the Navajo Nation Department of Justice, opining that the “purported overriding royalty interest is invalid under the applicable provisions of the Navajo Nation Code and is completely void.” The Fifth Circuit affirmed the lower courts’ conclusion that this letter was inadmissible hearsay, and did not qualify for an exemption under Fed. R. Evid. 803(8) or (15) [public records and statements about property interests]; or the general exception in Rule 807 [the former 803(24) and 804(b)(5), combined in 2011]: “Trustworthiness is the linchpin of these hearsay exceptions. We are persuaded by the district court’s thorough explanation that the letter is untrustworthy, in large part because it was drafted by Morton’s counsel and was prepared after Morton’s counsel provided the Navajo Nation official with only one side of the story.”

In Matassarin v. Grosvenor, the Fifth Circuit reversed a dismissal on personal jurisdiction grounds, reminding: “For an intentional tort claim, purposeful availment can be established through ‘a single phone call and the mailing of allegedly fraudulent information’ to the forum state if ‘the actual content of communications with a forum gives rise to’ the claim, as when the communications’ content was allegedly fraudulent.” (quoting Lewis v. Fresne, 252 F.3d 352, 355-56 (5th Cir. 2001)). Here, the plaintiff described communications, received in Texas by email and fax, that he alleged to contain misrepresentations about several features of a condominium unit.

After an unusual pretrial mandamus ruling by the Fifth Circuit in a high-profile False Claims Act case, and after the jury returned a plaintiff’s verdict for $175 million — which could be trebled upon final judgment — the defendants returned to the Fifth Circuit last week. They filed a renewed mandamus petition — drawing on the Court’s statements in the prior ruling — supported by amici filings from Texas A&M and another company. In re: Trinity Industries, Inc., No. 14-41297. The Court has requested a response, presently due on December 1. Further briefing, and the ultimate disposition of this mandamus petition, will be of interest both procedurally and substantively. (Disclaimer: I am not counsel of record in this proceeding, but do represent Trinity.)

In an intellectual property dispute with several pending motions, the district court held a telephone conference and said the following about the pending application for preliminary injunction:

“I can see that there at least would be a fact issue as to whether or not the contract’s violated, but that’s a different proposition from concluding that a preliminary injunction should be granted. There are a lot of factors to take into account to decide whether or not, ultimately there would — a breach of contract would be found to exist, such as, whether or not there’s a possibility for some relief besides injunctive relief, such as the recovery of damages. I haven’t found anything in the papers to indicate to me that the defendant couldn’t respond to a judgment in damages, if required to do so. I don’t — I don’t think a preliminary injunction is necessary or appropriate in this case, so I’m going to deny that request.”

Observing that the district court’s statmeent in damages “seems to relate to [Defendant’s] ability to respond to a judgment in damages, which does not relate to whether damages would be an adequate remedy,” the Fifth Circuit vacated and remanded for a lack of findings of fact and conclusions of law under Fed. R. Civ. P. 52(a). Software Development Technologies v. Trizetto Corp., No. 13-10829 (Nov. 5, 2014, unpublished).