Judge James Ho’s dissent from the denial of en banc review in Gonzalez v. Trevino persuaded the ultimate audience yesterday, when the Supreme Court reversed the Fifth Circuit, and allowed the wrongful-arrest claim of Sylvia Gonzalez – an unfortunate victim of small-town politics – to proceed past the pleadings stage. No. 22-1025 (U.S. June 21, 2024). His opinion built on Judge Andrew Oldham’s dissent at the panel stage.

Judge James Ho’s dissent from the denial of en banc review in Gonzalez v. Trevino persuaded the ultimate audience yesterday, when the Supreme Court reversed the Fifth Circuit, and allowed the wrongful-arrest claim of Sylvia Gonzalez – an unfortunate victim of small-town politics – to proceed past the pleadings stage. No. 22-1025 (U.S. June 21, 2024). His opinion built on Judge Andrew Oldham’s dissent at the panel stage.

Category Archives: Pleadings – Twombly/Iqbal

In D&T Partners LLC v. Baymark Partners Mgmnt., LLC, “[a] group of individuals allegedly sought to steal the assets and trade secrets of an e-commerce company,” and “did so with shell entities, corrupt lending practices, and a fraudulent bankruptcy.” The plainitffs’ complaint did not state a RICO claim, however:

In D&T Partners LLC v. Baymark Partners Mgmnt., LLC, “[a] group of individuals allegedly sought to steal the assets and trade secrets of an e-commerce company,” and “did so with shell entities, corrupt lending practices, and a fraudulent bankruptcy.” The plainitffs’ complaint did not state a RICO claim, however:

“While the complaint alleges coordinated theft, the alleged victims are limited in number, and the scope and nature of the scheme was finite and focused on a singular objective. … [T]his does not constitute a “pattern” of racketeering conduct sufficient to state a RICO claim ….”

No. 22-11148 (Apr. 4, 2024).

The Fifth Circuit reversed the dismissal of a securities claim against Six Flags involving its public statements about an expansion effort in China, concluding that as to some of the challenged statements, the plaintiff had satisfied the PSLRA’s demanding requirements. Oklahoma Firefighters Pension & Retirement System v. Six Flags Entertainment Corp., No. 21-10865 (Jan. 18, 2022). The opinion provides detailed discussion of just is required to adequately plead falsity and scienter, especially in the context of forward-looking statements. It also provides what appears to be the first reference in the Federal Reporter to vexillology (the study of flags):

Stringer v. Remington Arms, No. 18-60590 (Nov, 7, 2022), presents an instructive analysis of failure-to-disclose allegations, in the context of alleged fraudulent nondisclosure of a design defect in a popular rifle design.

The panel majority found a failure to satisfy Rule 9(b):

“In [plaintiffs’] complaint, they explain that they have found public resources that contradict Remington’s public statements regarding the safety of the XMP trigger. They also allege that Remington had “actual and/or physical knowledge of manufacturing, and/or, design deficiencies in the XMP Fire Control years before the death of Justin Stringer” and that the company received customer complaints regarding trigger malfunctions as early as 2008. But Plaintiffs do not make the leap to fraudulent concealment. They say merely that Remington “ignored” notice of a safety related problem.“

(applying Tuchman v. DSC Commc’ns Corp., 14 F.3d 1061, 1068 (5th Cir. 1994) (“If the facts pleaded in a complaint are peculiarly within the opposing party’s knowledge, fraud pleadings may be based on information and belief. However, this luxury ‘must not be mistaken for license to base claims of fraud on speculation and conclusory allegations.'”).

The dissent would have found that rule satisfied, based in part of the detail provided about what Remington knew: “The complaint’s allegations indicate that Remington knew about problems with the X-Mark Pro trigger before the recall but did not disclose its knowledge of those problems during the limitations period. And, contrary to Defendants’ assertion that the complaint allegations relate only to the “Walker” trigger, the deposition testimony cited in the complaint expressly references the “XMP” trigger at issue here.”

The plaintiffs in Lee v. Andrew Lawrence Collection LLC sought to register the trademark “THEEILOVE” – a phrase associated with the alma mater of Jackson State University. Then they sued that university’s licensing agent and some licensees.

The defendants successfully moved to dismiss under the infrequently-used combination of Fed. R. Civ. P. 19 and 12(b)(7), based on the university’s interest in the subject matter, and the Fifth Circuit affirmed. It reasoned:

- Interest. The university had a non-frivolous interest in the ownership of the mark based on the university’s consistent usage of it, and that interest could be “practically impaired” by a decision on that topic in this case (as distinct from an analysis of whether a judgment would in fact be preclusive). Thus, the university was a required party under Rule 19(a)(1)(B)(i).

- Proceed or dismiss? As a state university, Jackson State had sovereign immunity from suit; that interest “is necessarily impaired when plaintiffs try to use the state’s sovereign immunity to lure it into a lawsuit against its will.” That issue alone favored dismissal. The Court noted that the other, practically focused factots in Rule 19(b) also favored dismissal.

No. 20-30796 (Aug. 24, 2022). (In honor of this fairly rare analysis of Rule 19, here is a link to Paul Hardcastle’s 1985 hit Nineteen.)

The Fifth Circuit found that Petrobras did not have sufficient knowledge of a potential claim to trigger limitations in Petrobras America, Inc. v. Samsung Heavy Indus. Co., holding:

- two officers “acted in their own interests by accepting $10 million in bribes . . . [t]hus, [they] are clearly adverse agents of Petrobras. Their knowledge cannot be imputed to Petrobras.”;

- “an ujnfavorable contract alone is not a legally cognizable injury”;

- statements in SEC filings about the general topic of bribery, when they involved “separate bribery schemes [that] involved separate parties, separate contracts, and separate ships,” “at best raise fact questions not suitable for disposition under Rule 12(b)(6).”

No. 20-20339 (Aug. 11, 2021).

The Fifth Circuit reversed the Rule 12 dismissal of a Lanham Act case in which “Plaintiffs allege that Defendants purchased trademark terms as keywords for search-engine advertising, then placed generic advertisements that confused customers as to whether the advertisements belonged to or were affiliated with the Plaintiffs.” Adler v. McNeil Consultants, No. 20-10936 (Aug. 10, 2021) (LPHS represented the appellee in this matter).

A recent antitrust case reminds of an important but infrequently-litigated point about the review of pleadings in the context of a motion to dismiss: “If an attached exhibit contradicts a factual allegation in the complaint, ‘then indeed the exhibit and not the allegation controls.'” Quadvest LP v. San Jacinto River Auth., No. 20-20447 (Aug. 3, 2021).

A recent antitrust case reminds of an important but infrequently-litigated point about the review of pleadings in the context of a motion to dismiss: “If an attached exhibit contradicts a factual allegation in the complaint, ‘then indeed the exhibit and not the allegation controls.'” Quadvest LP v. San Jacinto River Auth., No. 20-20447 (Aug. 3, 2021).

The plaintiffs in Quadvest LP v. San Jacinto River Auth. alleged that a state-created river authority violated Section 1 of the Sherman Act by unreasonably restraining the market for wholesale raw water in Montgomery County. Procedurally, the Fifth Circuit concluded that the denial of the authority’s motion to dismiss on immunity grounds was appealable under Circuit precedent (acknowledging that the Fifth Circuit is an outlier on this point). Substantively, the Court affirmed the denial of the authority’s motion “at this stage” of the case, concluding that “the Texas Legislature did not authorize [the authority’s] entry into and enforcement of the challenged [contract] provisions with the intent to displace competition in the market for wholesale raw water in Montgomery County.” No. 20-20447 (August 5, 2021).

The plaintiffs in Quadvest LP v. San Jacinto River Auth. alleged that a state-created river authority violated Section 1 of the Sherman Act by unreasonably restraining the market for wholesale raw water in Montgomery County. Procedurally, the Fifth Circuit concluded that the denial of the authority’s motion to dismiss on immunity grounds was appealable under Circuit precedent (acknowledging that the Fifth Circuit is an outlier on this point). Substantively, the Court affirmed the denial of the authority’s motion “at this stage” of the case, concluding that “the Texas Legislature did not authorize [the authority’s] entry into and enforcement of the challenged [contract] provisions with the intent to displace competition in the market for wholesale raw water in Montgomery County.” No. 20-20447 (August 5, 2021).

“While litigants should, when possible, identify specific contractual provisions alleged to have been breached, Rule 8 does not require that level of granularity. ‘So long as a pleading alleges facts upon which relief can be granted, it states a claim even if it “fails to categorize correctly the legal theory giving rise to the claim.”‘ ” (citations omitted).

“While litigants should, when possible, identify specific contractual provisions alleged to have been breached, Rule 8 does not require that level of granularity. ‘So long as a pleading alleges facts upon which relief can be granted, it states a claim even if it “fails to categorize correctly the legal theory giving rise to the claim.”‘ ” (citations omitted).- That said — “That the pleading was sufficient in this contract dispute, governed by an agreement neither exceedingly long nor rife with addenda, exhibits, and multiple parts, does not mean that Rule 8 would necessarily be satisfied by general allegations involving more complex contracts.”

Sanchez Oil & Gas Corp. v. Crescent Drilling & Prod., Inc., No. 20-20304 (July 30, 2021).

The plaintiff in Arruda v. Curves Int’l alleged that violations of the Franchise Rule were RICO predicate acts, but the Fifth Circuit disagreed: “Congress’s omission of a private right of action in the [Federal Trade Commission Act] controls. A violation of the Franchise Rule does not itself constitute a predicate act of mail or wire fraud to support a RICO claim.” The Court cited D.C. Circuit opinion about the Service Contract Act that asked the cogent question: “If there is no implied cause of action for damages, how much the less for treble damages?” No. 20-50734 (June 28, 2021) (unpublished).

A wrongful-foreclosure case reminds of a basic Twombly principle: “Green’s breach-of contract claim in her complaint alleged that Defendants violated conditions in the deed of trust, but she never explained which part of the deed was violated. It was only in response to Defendants’ summary judgment motion that Green identified the deed’s notice requirement as the specific violation. Her failure to specify her breach-of-contract claim in her complaint warrants dismissal of that claim.” Green v. Windsor Park Asset Holding Trust, No. 20-11226 (June 18, 2021, unpublished) (per curiam).

An error in pleading jurisdiction led to an inconclusive end in Accordant Communications v. Sayer Construction, No. 20-50169 (Dec. 4, 2020):

- Accordant won a $1.4 million arbitration award against Sayer.

- Accordant sued to confirm the award in federal court.

“As to the citizenship of the parties, Accordant alleged that it ‘is a limited liability company organized under the laws of Georgia with its principal place of business in Seminole County, Florida” and that Sayers ‘is a limited liability company organized under the laws of Texas with its principal place of business in Travis County, Texas.'”

“As to the citizenship of the parties, Accordant alleged that it ‘is a limited liability company organized under the laws of Georgia with its principal place of business in Seminole County, Florida” and that Sayers ‘is a limited liability company organized under the laws of Texas with its principal place of business in Travis County, Texas.'” - Sayer declined to answer postjudgment discovery, and on appeal argued that the district court lacked subject-matter jurisdiction (as the above allegations are based on the standards for a corporation rather than an LLC).

Despite this ‘clearly deficient’ and ‘basic’ pleading problem, the Fifth Circuit did not dismiss the case: “Considering the evidence in the record on appeal … we find that ‘jurisdiction is not clear from the record, but there is some reason to believe that jurisdiction exists.’ Therefore, we exercise our discretion under [28 USC] § 1653 and ‘remand the case to the district court for amendment of the allegations and for the record to be supplemented,’ if necessary.” (citation omitted).

Despite this ‘clearly deficient’ and ‘basic’ pleading problem, the Fifth Circuit did not dismiss the case: “Considering the evidence in the record on appeal … we find that ‘jurisdiction is not clear from the record, but there is some reason to believe that jurisdiction exists.’ Therefore, we exercise our discretion under [28 USC] § 1653 and ‘remand the case to the district court for amendment of the allegations and for the record to be supplemented,’ if necessary.” (citation omitted).

The dispute in Smith v. Toyota Motor Corp., No 19-60938 (Oct. 20, 2020), was whether there was diversity jurisdiction over two business entities with diverse business activities, one of which was named . . . Diversity Vuteq LLC. Despite the abundant diversity in the case, the Fifth Circuit reminded that there is not a diversity of opinion about how to properly plead citizenship:

The dispute in Smith v. Toyota Motor Corp., No 19-60938 (Oct. 20, 2020), was whether there was diversity jurisdiction over two business entities with diverse business activities, one of which was named . . . Diversity Vuteq LLC. Despite the abundant diversity in the case, the Fifth Circuit reminded that there is not a diversity of opinion about how to properly plead citizenship:

- “To adequately allege the citizenship of Toyota, a corporation, Smith needed to ‘set out the principal place of business of the corporation as well as the stat e of its incorporation.'” (citations omitted);

- “To adequately allege the citizenship of Diversity, a limited liability corporation, Smith needed to ‘specifically allege the citizenship of every member of every LLC or partnership involved in a litigation.'”

Basic Capital Management v. Dynex, No. 20-40643 (Sept. 30, 2020), reminds about the proper record for evaluating a Rule 12 dismissal mo tion:

tion:

- “[A]s the district court correctly observed, the Form 10-K and the state-court [case] record ‘are al publicly available governmental filings and the existence of the documents, and the contents therein, cannot reasonably be questioned.’ Therefore, the Form 10-K and the state-court record fall squarely within the ambit of [Fed. R. Evid.] 201(b).”

- “Rule 201(d) expressly provides that a court ‘may take judicial notice at any stage of the proceeding,’ and our precedents confirm judicially noticed facts may be considered in ruling on a 12(b)(6) motion. Therefore, in ruling on the 12(b)(6) motion, ‘the district court appropriately used judicial notice.'”

Following two recent opinions about Fed. R. Civ. P. 9(b), the Fifth Circuit again applied it in Waste Management v. AIG: “We need not resolve this dispute because, even assuming that an adjuster can be held liable under [the] Texas Insurance Code . . . Waste did not allege facts that, taken as true, demonstrate a violation of these provisions. The only relevant, AIG Claims-specific facts that Waste alleged in its

Following two recent opinions about Fed. R. Civ. P. 9(b), the Fifth Circuit again applied it in Waste Management v. AIG: “We need not resolve this dispute because, even assuming that an adjuster can be held liable under [the] Texas Insurance Code . . . Waste did not allege facts that, taken as true, demonstrate a violation of these provisions. The only relevant, AIG Claims-specific facts that Waste alleged in its

complaint are that (1) AIG Claims served as the adjuster for ASIC and (2) ‘On July 9, 2013, AIG Claims sent Waste Management a letter denying [certain] coverage . . . .’ These threadbare factual allegations, along with Waste’s conclusory recitation of the elements of a claim under the Texas Insurance Code, are insufficient to state a plausible claim for relief. Notably, Waste did not allege that AIG Claims failed to investigate, delayed any investigation, misevaluated, misprocessed, made any misrepresentation of the policy, or otherwise failed to ‘effectuate’ a fair settlement.” (citations omitted).

Applying Fed. R. Civ. P. 9(b), the Fifth Circuit found no fraud claims stated in:

Applying Fed. R. Civ. P. 9(b), the Fifth Circuit found no fraud claims stated in:

- Colonial Oaks Assisted Living v. Hannie Development, No. 19-30995 (Aug. 25, 2020): “The pleadings are devoid of allegations regarding what instructions the employees received, who gave the instructions, whether anyone followed the instructions, and whether Sellers were aware of the specific instructions given.

- Umbrella Investment Group v. Wolters Kluwer, No. 20-30078 (Aug. 25, 2020): “In this case, the only relevant fact that UIG has alleged beyond what little it alleges ‘on information and belief’ is that Wolters Kluwer provided ‘written certification that the property subject to the loan was not in a flood hazard area that required flood insurance under FEMA regulations pursuant to the Flood Disaster Protection Act of 1973.’ That fact alone can ground nothing more than speculation as to the cause of the error, and therefore, UIG has failed to state a claim for fraud.”

Rules of procedure require precision in pleading a cause of action. The eight-corners rule of insurance coverage, in contrast, often rewards imprecision. A powerful example appears in Allied World Specialty Ins. Co. v. McCathern, PLLC, a duty-to-defend claim arising from a legal malpractice claim, where the Fifth Circuit held: “The allegations that McCathern did not monitor the file, conduct legal research, or communicate with the client are factual assertions—as opposed to causes of action—even if they are vague. Allied World’s challenge to the factual allegations thus seems to be that they are not specific enough or may not prove true. But at the duty-to-defend stage it is not for us to say whether West Star will be able to prove that McCathern was negligent in failing to monitor the personal injury suit or in failing to research legal issues.” No. 17-10615 (Feb. 26, 2020, unpublished).

Rules of procedure require precision in pleading a cause of action. The eight-corners rule of insurance coverage, in contrast, often rewards imprecision. A powerful example appears in Allied World Specialty Ins. Co. v. McCathern, PLLC, a duty-to-defend claim arising from a legal malpractice claim, where the Fifth Circuit held: “The allegations that McCathern did not monitor the file, conduct legal research, or communicate with the client are factual assertions—as opposed to causes of action—even if they are vague. Allied World’s challenge to the factual allegations thus seems to be that they are not specific enough or may not prove true. But at the duty-to-defend stage it is not for us to say whether West Star will be able to prove that McCathern was negligent in failing to monitor the personal injury suit or in failing to research legal issues.” No. 17-10615 (Feb. 26, 2020, unpublished).

A substantial body of law, focused on the requirements of the Federal Rules of Civil Procedure, defines the appropriate level of specificity for a plaintiff’s complaint. Pleading specificity can interact with other bodies of law as well, such as insurance coverage, where additional detail can affect an “eight-corners” analysis of whether the allegations fall within coverage. Another illustrative, if infrequent, situation appeared in the FCA case of United States ex rel. Hendrickson v. Bank of America, N.A., where a plaintiff’s lack of detail fed into the defendants’ defense of public disclosure: “Not disputing that the six documents constituted public disclosures, Hendrickson claims they do not disclose substantially the same allegations as his complaint because they do not reference DNEs or name specific banks. The banks respond that the documents’ disclosures are as specific as the complaint, which fails to allege particular instances of their receiving DNEs or differentiate allegations made against each defendant.” No. 18-11472 (Oct. 7, 2019).

A substantial body of law, focused on the requirements of the Federal Rules of Civil Procedure, defines the appropriate level of specificity for a plaintiff’s complaint. Pleading specificity can interact with other bodies of law as well, such as insurance coverage, where additional detail can affect an “eight-corners” analysis of whether the allegations fall within coverage. Another illustrative, if infrequent, situation appeared in the FCA case of United States ex rel. Hendrickson v. Bank of America, N.A., where a plaintiff’s lack of detail fed into the defendants’ defense of public disclosure: “Not disputing that the six documents constituted public disclosures, Hendrickson claims they do not disclose substantially the same allegations as his complaint because they do not reference DNEs or name specific banks. The banks respond that the documents’ disclosures are as specific as the complaint, which fails to allege particular instances of their receiving DNEs or differentiate allegations made against each defendant.” No. 18-11472 (Oct. 7, 2019).

“Respect for the state system and the strictly circumscribed nature of federal jurisdiction requires our unflagging attention to these limits. We expect the same unflagging attention from litigants who invoke our jurisdiction.” Accordingly, the Fifth Circuit remanded the case of Midcap Media Finance LLC v. Pathway Data, Inc. for further review of diversity jurisdiction. “The parties in this case failed to properly allege diversity of ciizenship. First, the alleged only that Coulter was a California resident, not that he was a California citizen. Second, because MidCap is an LLC, the pleadings needed to identify MidCap’s members and allege their citizenship.” No. 18-50650 (July 9, 2019) (citations omitted).

“Respect for the state system and the strictly circumscribed nature of federal jurisdiction requires our unflagging attention to these limits. We expect the same unflagging attention from litigants who invoke our jurisdiction.” Accordingly, the Fifth Circuit remanded the case of Midcap Media Finance LLC v. Pathway Data, Inc. for further review of diversity jurisdiction. “The parties in this case failed to properly allege diversity of ciizenship. First, the alleged only that Coulter was a California resident, not that he was a California citizen. Second, because MidCap is an LLC, the pleadings needed to identify MidCap’s members and allege their citizenship.” No. 18-50650 (July 9, 2019) (citations omitted).

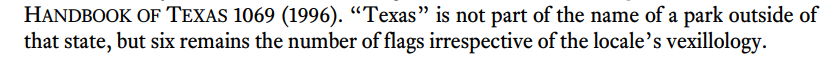

Life Partners’ Creditors’ Trust v. Cowley, No. 17-11477 (May 31, 2019), reviewed the dismissal of several highly-technical claims brought by a bankruptcy trustee about the sale of “viaticals” (investments in life insurance policies sold to third parties by the insureds). For each claim, the Fifth Circuit reviewed whether FRCP 9(b) or 8(a) applied, and then assessed the pleaded allegations, reaching these conclusions:

“In their Fourth Amended Complaint, the Bowmans make claims under the [Texas Debt Collection Act] without citing the appropriate sections of the statute for each claim. CitiMortgage raised this issue, and the Bowmans responded that they provided enough information for CitiMortgage to figure out which provisions it violated. As the district court reasoned, this is insufficient to provide fair notice to the defendant under Federal Rule of Civil Procedure 8(a).” Bowman v. CitiMortgage, No. 18-10867 (April 12, 2019) (unpublished).

“In their Fourth Amended Complaint, the Bowmans make claims under the [Texas Debt Collection Act] without citing the appropriate sections of the statute for each claim. CitiMortgage raised this issue, and the Bowmans responded that they provided enough information for CitiMortgage to figure out which provisions it violated. As the district court reasoned, this is insufficient to provide fair notice to the defendant under Federal Rule of Civil Procedure 8(a).” Bowman v. CitiMortgage, No. 18-10867 (April 12, 2019) (unpublished).

Fed. R. Civ. P. 8(c) requires parties to “affirmatively state any avoidance or affirmative defense.” Germain v. U.S. Bank applied that rule in a mortgage-servicing case, reasoning: “Germain alleged that the Defendants did not comply with § 1024.41. The Defendants denied this allegation, insisting that they had complied with that section. That is a denial or direct contradiction of Germain’s claim, not an affirmative defense. The Defendants did not expressly rely on § 1024.41(i) in their answer, but the use of § 1024.41(i) in their motion for summary judgment is merely an expansion of the denial in their answer.” No. 18-10508 (April 3, 2019). (“8c” also refers to an Alfa Romeo model, pictured above for general reference.)

Fed. R. Civ. P. 8(c) requires parties to “affirmatively state any avoidance or affirmative defense.” Germain v. U.S. Bank applied that rule in a mortgage-servicing case, reasoning: “Germain alleged that the Defendants did not comply with § 1024.41. The Defendants denied this allegation, insisting that they had complied with that section. That is a denial or direct contradiction of Germain’s claim, not an affirmative defense. The Defendants did not expressly rely on § 1024.41(i) in their answer, but the use of § 1024.41(i) in their motion for summary judgment is merely an expansion of the denial in their answer.” No. 18-10508 (April 3, 2019). (“8c” also refers to an Alfa Romeo model, pictured above for general reference.)

A colorful, and deft, summary of Iqbal’s pleading requirements in a § 1983 case appeared in Shaw v. Villanueva: “Shaw[] . . . has pleaded no specific facts showing that Villanueva and Ebrom misdirected Sotelo into issuing the arrest warrant. And so he has not established the exception to the independent-intermediary doctrine. In other words, his allegations are all broth and no beans.” No. 17-50937 (March 11, 2019). (A classic Texas Monthly article offers similar sayings, such as: “He thinks the sun comes up just to hear him crow,” etc.)

A colorful, and deft, summary of Iqbal’s pleading requirements in a § 1983 case appeared in Shaw v. Villanueva: “Shaw[] . . . has pleaded no specific facts showing that Villanueva and Ebrom misdirected Sotelo into issuing the arrest warrant. And so he has not established the exception to the independent-intermediary doctrine. In other words, his allegations are all broth and no beans.” No. 17-50937 (March 11, 2019). (A classic Texas Monthly article offers similar sayings, such as: “He thinks the sun comes up just to hear him crow,” etc.)

The plaintiffs in Alaska Elec. Pension Fund v. Asar alleged securities fraud about the affairs of Hanger, Inc., the nation’s largest provider of orthotic and prosthetic patient care. The Fifth Circuit largely affirmed dismissal, but as to one defendant found adequate allegations of scienter based primarily on statements in an audit committee report, which “support the inference that McHenry shared the objectives of improperly enhancing Hanger’s financial results, or that he at least knew that others were doing so. A dissent would have also dismissed as to him, noting that “the complaint makes no effort to demonstrate which portions of the Report show that McHenry, or any other defendant, had the requisite scienter.” No. 17-50162 (Aug. 6, 2018).

The plaintiffs in Alaska Elec. Pension Fund v. Asar alleged securities fraud about the affairs of Hanger, Inc., the nation’s largest provider of orthotic and prosthetic patient care. The Fifth Circuit largely affirmed dismissal, but as to one defendant found adequate allegations of scienter based primarily on statements in an audit committee report, which “support the inference that McHenry shared the objectives of improperly enhancing Hanger’s financial results, or that he at least knew that others were doing so. A dissent would have also dismissed as to him, noting that “the complaint makes no effort to demonstrate which portions of the Report show that McHenry, or any other defendant, had the requisite scienter.” No. 17-50162 (Aug. 6, 2018).

IAS, an insurance claim-adjusting firm, acquired Buckley, another such firm. Litigation ensued after Buckley was unable to bring the business from a large client, QBE. The Fifth Circuit found that IAS stated a viable fraudulent-inducement claim under Fed. R. Civ. P. 9(b) as to “three alleged misrepresentations that it contends led it to enter into the asset purchase agreement: (1) Buckley’s statement that Buckley & Associates was QBE’s ‘number one’ vendor; (2) Buckley’s statement that Buckley & Associates’ revenue from QBE would continue to grow; and (3) the statement in § 2.3 of the purchase agreement that its execution would not ‘violate, conflict, [or] result in a breach of . . . any Contract . . . to which [Buckley & Associates] is a party.'” The Court’s analysis of the third factor is particularly informative, touching on recent Texas Supreme Court authority about waiver-of-reliance provisions (Italian Cowboy Partners v. Prudential Ins. Co., 341 S.W.3d 323 (Tex. 2011)) and “red flags” that can negate justifiable reliance. (JPMorgan Chase Bank v. Orca Assets GP, LLC, 546 S.W.3d 648 (Tex. 2018)). A dissent would not have found any of the representations fraudulent as pleaded. IAS Service Group v. Buckley & Assocs., No. 17-50105 (Aug. 17, 2018).

IAS, an insurance claim-adjusting firm, acquired Buckley, another such firm. Litigation ensued after Buckley was unable to bring the business from a large client, QBE. The Fifth Circuit found that IAS stated a viable fraudulent-inducement claim under Fed. R. Civ. P. 9(b) as to “three alleged misrepresentations that it contends led it to enter into the asset purchase agreement: (1) Buckley’s statement that Buckley & Associates was QBE’s ‘number one’ vendor; (2) Buckley’s statement that Buckley & Associates’ revenue from QBE would continue to grow; and (3) the statement in § 2.3 of the purchase agreement that its execution would not ‘violate, conflict, [or] result in a breach of . . . any Contract . . . to which [Buckley & Associates] is a party.'” The Court’s analysis of the third factor is particularly informative, touching on recent Texas Supreme Court authority about waiver-of-reliance provisions (Italian Cowboy Partners v. Prudential Ins. Co., 341 S.W.3d 323 (Tex. 2011)) and “red flags” that can negate justifiable reliance. (JPMorgan Chase Bank v. Orca Assets GP, LLC, 546 S.W.3d 648 (Tex. 2018)). A dissent would not have found any of the representations fraudulent as pleaded. IAS Service Group v. Buckley & Assocs., No. 17-50105 (Aug. 17, 2018).

In addition to inspiring 600Camp’s most painful pun of 2018, Ditech Financial LLC v. Naumann provides a thorough summary of the requirement – unique to default judgments, among all judgments available under the Federal Rules – that the relief awarded “must not differ in kind from, or exceed in amount, what is demanded in the pleadings.” As applied here, “Ditech’s demand for judicial foreclosure gave meaningful notice that, in the event of default, a writ of possession would issue in favor of the foreclosure-sale purchaser. Texas’s process of enforcing a judicial foreclosure—and specifically its mechanism for enforcing the foreclosure sale— entails issuance of the writ. Accordingly, in this case the judgment’s provision for future issuance of the writ did not expand or alter the kind or amount of relief prayed for by Ditech.” No. 17-50616 (July 19, 2018, unpublished).

In addition to inspiring 600Camp’s most painful pun of 2018, Ditech Financial LLC v. Naumann provides a thorough summary of the requirement – unique to default judgments, among all judgments available under the Federal Rules – that the relief awarded “must not differ in kind from, or exceed in amount, what is demanded in the pleadings.” As applied here, “Ditech’s demand for judicial foreclosure gave meaningful notice that, in the event of default, a writ of possession would issue in favor of the foreclosure-sale purchaser. Texas’s process of enforcing a judicial foreclosure—and specifically its mechanism for enforcing the foreclosure sale— entails issuance of the writ. Accordingly, in this case the judgment’s provision for future issuance of the writ did not expand or alter the kind or amount of relief prayed for by Ditech.” No. 17-50616 (July 19, 2018, unpublished).

Applying Singh v. RadioShack Corp., 882 F.3d 137 (5th Cir. 2018), which in turn relied upon Fifth Third Bancorp v. Dudenhoeffer, 134 S. Ct. 2459 (2014), the Fifth Circuit rejected a duty-of-prudence claim against an ERISA fiduciary based on the defendants allowing investments to continue a troubled company’s stock. Specifically, the plaintiffs alleged that the defendants “knew that it was inappropriate to rely on the market price of Idearc stock because their own fraudulent activities had caused the public markets to overvalue Idearc stock.” The Court did not agree: “[T]he alleged fraud is by definition not public information, and [Plaintiff] does not address how this information would affect the reliability of the market price ‘as an unbiased assessment of the security’s value in light of all public information.'” No. 16-11590 (June 27, 2018).

Applying Singh v. RadioShack Corp., 882 F.3d 137 (5th Cir. 2018), which in turn relied upon Fifth Third Bancorp v. Dudenhoeffer, 134 S. Ct. 2459 (2014), the Fifth Circuit rejected a duty-of-prudence claim against an ERISA fiduciary based on the defendants allowing investments to continue a troubled company’s stock. Specifically, the plaintiffs alleged that the defendants “knew that it was inappropriate to rely on the market price of Idearc stock because their own fraudulent activities had caused the public markets to overvalue Idearc stock.” The Court did not agree: “[T]he alleged fraud is by definition not public information, and [Plaintiff] does not address how this information would affect the reliability of the market price ‘as an unbiased assessment of the security’s value in light of all public information.'” No. 16-11590 (June 27, 2018).

Illustrating the sort of highly specific, but highly practical, issues that arise under Twombly, the Fifth Circuit held that “plaintiffs alleging claims under [ERISA] § 1132(a)(1)(B) for plan benefits need not necessarily identify the specific language of every plan provision at issue to survive a motion to dismiss under Rule 12(b)(6) (applying Electrostim Medical Services, Inc. v. Health Care Service Corp., 614 F. App’x 731 (5th Cir. 2015)). It was important to this holding that the plaintiff “was unable to obtain plan documents even after good-faith efforts to do so,” and the insurers “did not produce most of the relevant plan documents until the deadline to re-plead had passed . . . .” Innova Hospital v. Blue Cross, No. 14-11300 (June 12, 2018).

Illustrating the sort of highly specific, but highly practical, issues that arise under Twombly, the Fifth Circuit held that “plaintiffs alleging claims under [ERISA] § 1132(a)(1)(B) for plan benefits need not necessarily identify the specific language of every plan provision at issue to survive a motion to dismiss under Rule 12(b)(6) (applying Electrostim Medical Services, Inc. v. Health Care Service Corp., 614 F. App’x 731 (5th Cir. 2015)). It was important to this holding that the plaintiff “was unable to obtain plan documents even after good-faith efforts to do so,” and the insurers “did not produce most of the relevant plan documents until the deadline to re-plead had passed . . . .” Innova Hospital v. Blue Cross, No. 14-11300 (June 12, 2018).

Among other Twombly problems, the Fifth Circuit criticized a bankruptcy trustee’s claims about excessive bonuses, noting: “The Trustee does not explain how ATP’s compensation was excessive in comparison to other similarly sized public companies in the oil and gas industry at the time. Indeed,the Trustee offers no metric or explanation for finding the bonuses ‘exorbitant.'” And in this procedural setting, “these pleading deficiencies are ‘particularly striking’ because the Trustee has ample access to ATP’s books and records.” Tow v. Bulmahn, No. 17-30077 (Oct. 27, 2017, unpublished).

Among other Twombly problems, the Fifth Circuit criticized a bankruptcy trustee’s claims about excessive bonuses, noting: “The Trustee does not explain how ATP’s compensation was excessive in comparison to other similarly sized public companies in the oil and gas industry at the time. Indeed,the Trustee offers no metric or explanation for finding the bonuses ‘exorbitant.'” And in this procedural setting, “these pleading deficiencies are ‘particularly striking’ because the Trustee has ample access to ATP’s books and records.” Tow v. Bulmahn, No. 17-30077 (Oct. 27, 2017, unpublished).

Atlas Trading sued AT&T based on the “filed rate doctrine,” which prohibits a common carrier from charging rates other than those on file with the FCC. The Fifth Circuit affirmed the dismissal of that claim on the pleadings; after a thorough discussion of the requirements of Twombly and Iqbal, the Court observed:

Atlas Trading sued AT&T based on the “filed rate doctrine,” which prohibits a common carrier from charging rates other than those on file with the FCC. The Fifth Circuit affirmed the dismissal of that claim on the pleadings; after a thorough discussion of the requirements of Twombly and Iqbal, the Court observed:

Atlas has neither pled nor shown, though, how these charges are inconsistent with the tariffed rates. That the terms are not found in the tariffs is insufficient. For example, it could allege what it should have been charged under the tariffed rate or compared that to what it was actually charged. It simply asserts that charges such as the composite access-rate charge are not found in the tariffs and from that asks the court to let its claims go forward.

Even accepting as true Atlas’s allegation that the labels for the charges are not found in the tariffs, we cannot make a reasonable inference that the defendants have violated the filed-rate doctrine. At most, we can only infer that certain labels for charges are not found in the tariffs filed with the FCC. Such an inference is not the equivalent of a plausible allegation that the defendants have charged Atlas different rates from those on file with the FCC.

Atlas Trading v. AT&T, No. 16-11661 (Oct. 18, 2017) (emphasis added).

Body by Cook, Inc. v. State Farm gives a useful reminder about the basic rules for a federal pleading: “[A] complaint may simultaneously satisfy Rule 8’s technical requirements but fail to state a claim under Rule 12(b)(6). Mere compliance with Rule 8 does not itself immunize the complaint against a motion to dismiss. Rule 8(a)(2) specifies the conditions of the formal adequacy of a pleading,” but “it does not specify the conditions of its substantive adequacy, that is, its legal merit.” No. 16-31034-CV (Aug. 24, 2017) (citations omitted).

Body by Cook, Inc. v. State Farm gives a useful reminder about the basic rules for a federal pleading: “[A] complaint may simultaneously satisfy Rule 8’s technical requirements but fail to state a claim under Rule 12(b)(6). Mere compliance with Rule 8 does not itself immunize the complaint against a motion to dismiss. Rule 8(a)(2) specifies the conditions of the formal adequacy of a pleading,” but “it does not specify the conditions of its substantive adequacy, that is, its legal merit.” No. 16-31034-CV (Aug. 24, 2017) (citations omitted).

Plaintiffs alleged that a terrible crime would have been averted with a faster response to a 9-1-1 call. The Fifth Circuit, applying City of Dallas v. Sanchez, 494 S.W.3d 722 (Tex. 2016), found a lack of proximate cause (and thus, immunity applied) because “plaintiffs have not plausibly alleged that any of the intervening parties would have acted differently,” including the call center operator and emergency personnel on the scene. The allegations on the general subject of response time were too speculative to satisfy Twombly (footnote 4). And “‘even if the brief delay in relaying Cook’s location ‘contributed to circumstances that delayed potentially life-saving assistance, the [delay] was too attenuated from the cause of [Cook’s] death . . . to be a proximate cause.” Cook v. City of Dallas, No. 16-10105 (March 29, 2017).

Recipients of Section 8 housing assistance sued mortgage originators, complaining that the originators either denied or discouraged the recipients’ credit applications by not considering their Section 8 income, in violation of the Equal Credit Opportunity Act. The Fifth Circuit affirmed the dismissal of claims by recipients who had only inquired about, rather than actually starting, the application process, as well as claims based on Wells Fargo’s policies about the purchase of mortgages in the secondary market. It reversed as to one group of applicants, however, finding under Iqbal and the substantive law that they “plausibly alleged that AmeriPro refused to consider their Section 8 income in assessing their creditworthiness as mortgage applicants, and that they received mortgages on less favorable terms and in lesser amounts than they would have had their Section 8 income been considered.” Alexander v. AmeriPro, No. 15-20710 (Feb. 16, 2017).

Recipients of Section 8 housing assistance sued mortgage originators, complaining that the originators either denied or discouraged the recipients’ credit applications by not considering their Section 8 income, in violation of the Equal Credit Opportunity Act. The Fifth Circuit affirmed the dismissal of claims by recipients who had only inquired about, rather than actually starting, the application process, as well as claims based on Wells Fargo’s policies about the purchase of mortgages in the secondary market. It reversed as to one group of applicants, however, finding under Iqbal and the substantive law that they “plausibly alleged that AmeriPro refused to consider their Section 8 income in assessing their creditworthiness as mortgage applicants, and that they received mortgages on less favorable terms and in lesser amounts than they would have had their Section 8 income been considered.” Alexander v. AmeriPro, No. 15-20710 (Feb. 16, 2017).

Hoffman v. L&M Arts arose from the sale of a 1961 Rothko painting (right) by Sotheby’s in 2010; a previous owner alleged that this sale revealed facts about her own sale, in violation of a confidentiality provision in the sales contract that said: “All parties agree to make maximum efforts to keep all aspects of this transaction confidential indefinitely.” The Fifth Circuit ruled for the defense in all respects, concluding that:

Hoffman v. L&M Arts arose from the sale of a 1961 Rothko painting (right) by Sotheby’s in 2010; a previous owner alleged that this sale revealed facts about her own sale, in violation of a confidentiality provision in the sales contract that said: “All parties agree to make maximum efforts to keep all aspects of this transaction confidential indefinitely.” The Fifth Circuit ruled for the defense in all respects, concluding that:

- The original owner did not state a fraud claim against the relevant gallery, based on its alleged misrepresentation of its authority to act on behalf of an unnamed buyer, or its alleged misrepresentation about representing an entity or individual. (Notably, the owner did not argue in the district court that equitable relief could still be appropriate without proof of damage), or its claim that the piece would “disappear” into its client’s private collection.

- The contract did not require secrecy about the fact of the sale, based on the plain meaning of the term “aspect,” other provisions in the agreement, and the Texas policy against restraints on alienability.

- The questions about damages associated with the alleged breach either reflected speculative bargains, incorrect damages measures, or a disgorgement theory that is not well-supported as a Texas contract remedy.

No. 15-10046 (Sept. 28, 2016).

ERISA litigation about investment management presents a tension between the administrators’ fiduciary obligations, on the one hand, and discouraging needless litigation, on the other. After the Supreme Court’s most recent guidance about an ERISA fiduciary’s “duty of prudence” in Amgen Inc. v. Harris, 136 S. Ct. 758 (2016), the Fifth Circuit found that the plaintiffs in Whitley v. BP. PLC failed to meet their pleading burden: “The amended complaint states that BP’s stock was overvalued prior to the Deepwater Horizon explosion due to “numerous undisclosed safety breaches” known only to insiders. In other words, the stockholders theorize that BP stock was overpriced because BP had a greater risk exposure to potential accidents than was known to the market. Based on this fact alone, it does not seem reasonable to say that a prudent fiduciary at that time could not have concluded that (1) disclosure of such information to the public or (2) freezing trades of BP stock—both of which would likely lower the stock price—would do more harm than good. In fact, it seems that a prudent fiduciary could very easily conclude that such actions would do more harm than good.” No. 15-20282 (Sept. 26, 2016).

ERISA litigation about investment management presents a tension between the administrators’ fiduciary obligations, on the one hand, and discouraging needless litigation, on the other. After the Supreme Court’s most recent guidance about an ERISA fiduciary’s “duty of prudence” in Amgen Inc. v. Harris, 136 S. Ct. 758 (2016), the Fifth Circuit found that the plaintiffs in Whitley v. BP. PLC failed to meet their pleading burden: “The amended complaint states that BP’s stock was overvalued prior to the Deepwater Horizon explosion due to “numerous undisclosed safety breaches” known only to insiders. In other words, the stockholders theorize that BP stock was overpriced because BP had a greater risk exposure to potential accidents than was known to the market. Based on this fact alone, it does not seem reasonable to say that a prudent fiduciary at that time could not have concluded that (1) disclosure of such information to the public or (2) freezing trades of BP stock—both of which would likely lower the stock price—would do more harm than good. In fact, it seems that a prudent fiduciary could very easily conclude that such actions would do more harm than good.” No. 15-20282 (Sept. 26, 2016).

Insurance coverage litigation provided another example of the tension between the “Scylla” of pleading — the “plead more detail” command from Twombly and Iqbal — and its “Charybids” — the principle of insurance law that “[a]ll doubts regarding the duty to defend are resolved in favor of the insured.” Fed Ins. Co. v. Northfield Ins. Co., No. 14-20633 (Sept. 16, 2016). Here, ltigation about pollution liability led to a dispute about whether a “pollution exclusion” eliminated the duty to defend. The Fifth Circuit reversed a summary judgment in favor of the insurer, noting: “ExxonMobil’s petition does not attach any of the petitions in the Louisiana Litigation. ExxonMobil’s petition provides very little information about the nature of the claims made in the Louisiana Litigation, for which ExxonMobil seeks indemnity and defense costs from [the insured].” As a result, “because of the breadth and generality of the allegations in ExxonMobil’s state court petition, we cannot say that all of the claims fall clearly within the exclusion.”

Insurance coverage litigation provided another example of the tension between the “Scylla” of pleading — the “plead more detail” command from Twombly and Iqbal — and its “Charybids” — the principle of insurance law that “[a]ll doubts regarding the duty to defend are resolved in favor of the insured.” Fed Ins. Co. v. Northfield Ins. Co., No. 14-20633 (Sept. 16, 2016). Here, ltigation about pollution liability led to a dispute about whether a “pollution exclusion” eliminated the duty to defend. The Fifth Circuit reversed a summary judgment in favor of the insurer, noting: “ExxonMobil’s petition does not attach any of the petitions in the Louisiana Litigation. ExxonMobil’s petition provides very little information about the nature of the claims made in the Louisiana Litigation, for which ExxonMobil seeks indemnity and defense costs from [the insured].” As a result, “because of the breadth and generality of the allegations in ExxonMobil’s state court petition, we cannot say that all of the claims fall clearly within the exclusion.”

Whitlock, a truck driver, sued his employer for racial discrimination, alleging that the stated reason for discharge (running a red light at a loading dock) was pretextual. As to discriminatory discharge, “[t]he complaint fails to specify the [comparable] white employees’ work violations” and “fails to allege the white employees’ jobs” with the employer. As to hostile work environment, the complaint alleged that the workplace “was difficult [to] endure,” “caused stress related problems,” and that “[a] white employee was allowed to ride around in a pickup ruck without doing his job but given credit for the work done by African-American employees. The Fifth Circuit affirmed dismissal on the pleadings; this case illustrates a straightforward application of Rule 12 where the substantive law clearly dictates a certain level of detail about the claim. Whitlock v. Lazer Spot, Inc., No. 16-30139 (Aug. 15, 2016, unpublished).

Whitlock, a truck driver, sued his employer for racial discrimination, alleging that the stated reason for discharge (running a red light at a loading dock) was pretextual. As to discriminatory discharge, “[t]he complaint fails to specify the [comparable] white employees’ work violations” and “fails to allege the white employees’ jobs” with the employer. As to hostile work environment, the complaint alleged that the workplace “was difficult [to] endure,” “caused stress related problems,” and that “[a] white employee was allowed to ride around in a pickup ruck without doing his job but given credit for the work done by African-American employees. The Fifth Circuit affirmed dismissal on the pleadings; this case illustrates a straightforward application of Rule 12 where the substantive law clearly dictates a certain level of detail about the claim. Whitlock v. Lazer Spot, Inc., No. 16-30139 (Aug. 15, 2016, unpublished).

Thomas v. Chevron USA involved a suit for damages after a pirate attack off the shore of Nigeria. The Fifth Circuit reversed the districr court’s denial of leave to amend; on the key issue of duty, the Court observed: “Thomas alleged that Chevron knew about of the real risk of piracy in the region and of the specific threats received by the [ship]. He alleged that despite its knowledge, Chevron requested that the [ship] take an unaccompanied support trip that would pass by the source of the recent threats. Finally, he alleged that Chevron broadcast his route information and locations over easily-accessible VHF radios, through which they could be heard by pirates known to be in the area. These allegations are sufficient to suggest that the harm suffered by Thomas was reasonably foreseeable to Chevron and that Chevron consequently owed him a duty not to subject him to the conditions he encountered . . . .” No. 15-20490 (Aug. 11, 2016).

Thomas v. Chevron USA involved a suit for damages after a pirate attack off the shore of Nigeria. The Fifth Circuit reversed the districr court’s denial of leave to amend; on the key issue of duty, the Court observed: “Thomas alleged that Chevron knew about of the real risk of piracy in the region and of the specific threats received by the [ship]. He alleged that despite its knowledge, Chevron requested that the [ship] take an unaccompanied support trip that would pass by the source of the recent threats. Finally, he alleged that Chevron broadcast his route information and locations over easily-accessible VHF radios, through which they could be heard by pirates known to be in the area. These allegations are sufficient to suggest that the harm suffered by Thomas was reasonably foreseeable to Chevron and that Chevron consequently owed him a duty not to subject him to the conditions he encountered . . . .” No. 15-20490 (Aug. 11, 2016).

In a fraudulent joinder analysis, the Fifth Circuit observed: “The Mastronardis’ claims against Estrada and Marin are insufficiently pled under either the federal standard or the revised Texas standard, which now tracks the federal standard.” Mastronardi v. Wells Fargo Bank, N.A., No. 15-11028 (June 29, 2016) (citing, inter alia, Tex. R. Civ. P. 91a.1). See also Int’l Energy Ventures v. United Energy Group, No. 14-20552 (March 31, 2016).

I recently published an article, titled “Convergence of Federal Rules 8(A) and 9(B) – The Fifth Circuit’s Application of Twombly and Iqbal” in the Southern University Law Review.

Building on Wooten v. McDonald Transit Associates, Inc., 788 F.3d 490 (5th Cir. 2015), the Fifth Circuit found that a pro se plaintiff had adequately pleaded an ADEA claim in Haskett v. T.S. Dudley Land Co., No. 14-41459 (May 20, 2016, unpublished). Haskett attached his employer’s response to his EEOC charge as an exhibit to his complaint, and the employer argued that the statements in that response negated Haskett’s claim. The Court disagreed: “Haskett clearly did not adopt [his employer’s] allegations to the EEOC as his own for purposes of his complaint. They are therefore still ‘unilateral’ and to the extent they are in tension with the complaint itself, they cannot control.” (citing Bosarge v. Mississippi Bureau of Narcotics, 796 F.3d 435, 440 (5th Cir. 2015)).

Building on Wooten v. McDonald Transit Associates, Inc., 788 F.3d 490 (5th Cir. 2015), the Fifth Circuit found that a pro se plaintiff had adequately pleaded an ADEA claim in Haskett v. T.S. Dudley Land Co., No. 14-41459 (May 20, 2016, unpublished). Haskett attached his employer’s response to his EEOC charge as an exhibit to his complaint, and the employer argued that the statements in that response negated Haskett’s claim. The Court disagreed: “Haskett clearly did not adopt [his employer’s] allegations to the EEOC as his own for purposes of his complaint. They are therefore still ‘unilateral’ and to the extent they are in tension with the complaint itself, they cannot control.” (citing Bosarge v. Mississippi Bureau of Narcotics, 796 F.3d 435, 440 (5th Cir. 2015)).

In a significant contribution to the Fifth Circuit’s case law applying Twombly and Iqbal, the Court reversed the Rule 12 dismissal of a products liability case in Flagg v. Stryker Corp., recognizing that “in products liability lawsuits, almost all of the evidence is in the possession of the defendant.” The defendants, manufacturers of toe implants, contended that Flagg’s allegations “lack . . .details about how the implants may have deviated from specifications and performance standards” and did not “sufficiently allege an existing and non-burdensome alternative design.” The Court found sufficient detail, for the pleading stage, in Flagg’s allegations that “the shape and sizing of the implants led to the implants’ fracturing and caused them to be difficult to remove once broken,” as well as his allegation that a different alloy would have performed better. It concluded: “Perhaps after discovery Flagg will not prevail, but at a pre-discovery stage of this case, in an area of law where defendants are likely to exclusively possess the information relevant to making more detailed factual allegations, we cannot say that he is merely on a fishing expedition.” No. 14-31169 (April 26, 2016, unpublished).

In a significant contribution to the Fifth Circuit’s case law applying Twombly and Iqbal, the Court reversed the Rule 12 dismissal of a products liability case in Flagg v. Stryker Corp., recognizing that “in products liability lawsuits, almost all of the evidence is in the possession of the defendant.” The defendants, manufacturers of toe implants, contended that Flagg’s allegations “lack . . .details about how the implants may have deviated from specifications and performance standards” and did not “sufficiently allege an existing and non-burdensome alternative design.” The Court found sufficient detail, for the pleading stage, in Flagg’s allegations that “the shape and sizing of the implants led to the implants’ fracturing and caused them to be difficult to remove once broken,” as well as his allegation that a different alloy would have performed better. It concluded: “Perhaps after discovery Flagg will not prevail, but at a pre-discovery stage of this case, in an area of law where defendants are likely to exclusively possess the information relevant to making more detailed factual allegations, we cannot say that he is merely on a fishing expedition.” No. 14-31169 (April 26, 2016, unpublished).

The financially unfortunate City of New Orleans, saddled with a “just above junk” credit status, hired Ambac to provide insurance for its municipal bonds. Ambac’s AAA rating slipped after the 2008 financial crisis, causing New Orleans to incur tens of millions of dollars in additional debt service and refinancing costs. The City sued Ambac on several legal theories for not maintaining a high credit rating. The Fifth Circuit affirmed their dismissal: “[T]he resolutions that the City so heavily relies upon show only that the City purchased a bond insurance policy from a highly rated insurer, which, at the time of issuance, lessened the perceived credit risk of the City’s bonds. Any alleged representation by Ambac to provide a larger credit enhancement is foreclosed by the clear language of the Policy.” New Orleans City v. Ambac Assurance Corp., No. 15-30532 (March 2, 2016).

The financially unfortunate City of New Orleans, saddled with a “just above junk” credit status, hired Ambac to provide insurance for its municipal bonds. Ambac’s AAA rating slipped after the 2008 financial crisis, causing New Orleans to incur tens of millions of dollars in additional debt service and refinancing costs. The City sued Ambac on several legal theories for not maintaining a high credit rating. The Fifth Circuit affirmed their dismissal: “[T]he resolutions that the City so heavily relies upon show only that the City purchased a bond insurance policy from a highly rated insurer, which, at the time of issuance, lessened the perceived credit risk of the City’s bonds. Any alleged representation by Ambac to provide a larger credit enhancement is foreclosed by the clear language of the Policy.” New Orleans City v. Ambac Assurance Corp., No. 15-30532 (March 2, 2016).

In Local 731 Pension Trust Fund v. Diodes, Inc., the Fifth Circuit affirmed the dismissal of securities claims related to the alleged nondisclosure of labor problems at a Shanghai manufacturing plant, finding a failure to adequately allege scienter. Most basically, the Court observed — “It is important to note the curious nature of the Fund’s claims. To recap the relevant facts: during the class period, Diodes repeatedly warned investors of a labor shortage that would affect its output in the first two quarters of 2011; Diodes accurately warned the precise impact this labor shortage would have on its financial results, not once, but twice. Yet the Fund contends that more disclosure was required.” The Court went on to reject arguments about the unique knowledge of the relevant executives, the company’s decision to make an early product shipment (noting this would have made the labor problem worse and more apparent), and circumstances of an insider’s stock sales. No. 14-41141 (Jan. 13, 2016).

In Local 731 Pension Trust Fund v. Diodes, Inc., the Fifth Circuit affirmed the dismissal of securities claims related to the alleged nondisclosure of labor problems at a Shanghai manufacturing plant, finding a failure to adequately allege scienter. Most basically, the Court observed — “It is important to note the curious nature of the Fund’s claims. To recap the relevant facts: during the class period, Diodes repeatedly warned investors of a labor shortage that would affect its output in the first two quarters of 2011; Diodes accurately warned the precise impact this labor shortage would have on its financial results, not once, but twice. Yet the Fund contends that more disclosure was required.” The Court went on to reject arguments about the unique knowledge of the relevant executives, the company’s decision to make an early product shipment (noting this would have made the labor problem worse and more apparent), and circumstances of an insider’s stock sales. No. 14-41141 (Jan. 13, 2016).

In Century Surety Co. v. Blevins, the district court dismissed two causes of action related to handling of insurance claims, and then sua sponte dismissed three other related causes of action — breach of contract, estoppel, and vicarious liability. The Fifth Circuit reversed, reminding: “While the district court has great discretion in how it manages its cases, in the Fifth Circuit litigants must — with certain exceptions – be given notice and an opportunity to respond before a district court dismisses claims sua sponte.” No. 14-31131 (Aug. 18, 2015).

In Century Surety Co. v. Blevins, the district court dismissed two causes of action related to handling of insurance claims, and then sua sponte dismissed three other related causes of action — breach of contract, estoppel, and vicarious liability. The Fifth Circuit reversed, reminding: “While the district court has great discretion in how it manages its cases, in the Fifth Circuit litigants must — with certain exceptions – be given notice and an opportunity to respond before a district court dismisses claims sua sponte.” No. 14-31131 (Aug. 18, 2015).

Wallace sued Tesoro Corporation for retaliation, alleging he was fired for activity protected by the Sarbanes-Oxley Act. he district court dismissed. The Fifth Circuit affirmed in part, finding that Wallace had not exhausted his administrative remedies as to his claims about Tesoro that he did not present to OSHA. Wallace v. Tesoro Corp., No. 13-51010 (July 31, 2015). The Court reversed as to other claims dismissed on the pleadings, holding:

Wallace sued Tesoro Corporation for retaliation, alleging he was fired for activity protected by the Sarbanes-Oxley Act. he district court dismissed. The Fifth Circuit affirmed in part, finding that Wallace had not exhausted his administrative remedies as to his claims about Tesoro that he did not present to OSHA. Wallace v. Tesoro Corp., No. 13-51010 (July 31, 2015). The Court reversed as to other claims dismissed on the pleadings, holding:

- As to the objective reasonableness of Wallace’s belief about an accounting practice — “The basis for that belief in this case, including the level and role of Wallace’s accounting expertise and how that should weigh against him, are grounded in factual disputes that cannot be resolved at this stage of the case.”

- As for Wallace’s reasonable belief that a fraud was occurring, Rule 9(b) is not implicated because “an employee who is providing information about potential fraud or assisting in a nascent fraud investigation might not know who is making the false representations or what that person is obtaining by the fraud; indeed, that may be the point of the investigation.”

- Wallace adequate pleaded the basis for his reasonable belief that Tesoro was not making proper SEC disclosures, and that Tesoro acted with the requisite mental state (primarily by detailing the steps he took to inform Tesoro management). The opinion provides more detail about the specific allegations made by Wallace.

Plaintiff’s FCA claims about billing for aircraft parts were dismissed for failure to comply with the heightened pleading requirements of Fed. R. Civ. P. 9(b), in that:

Plaintiff’s FCA claims about billing for aircraft parts were dismissed for failure to comply with the heightened pleading requirements of Fed. R. Civ. P. 9(b), in that:

- it is not sufficient to argue that certain federal regulations must have been contained in the relevant contract, because by their terms, they do not automatically apply;

- neither nondisclosure of a part’s history, nor the subsequent failure of a plane containing that part, establishes that a false claim was made about it; and

- speculation about a company’s billing practices does not adequately establish when the company actually submitted the allegedly false claims.

United States ex rel Gage v. Davis S.R. Aviation, LLC, No. 14-50704 (July 14, 2015).

The plaintiffs/relators in United States ex rel Rigsby v. State Farm contended that, in the wake of Hurricane Katrina, State Farm improperly skewed its claims handling process in favor of finding flood damage, as “wind policy claims were paid out of the company’s own pocket while flood policy claims were paid with government funds.” They won at trial and the Fifth Circuit affirmed, finding that – notwithstanding earlier investigations – they were “paradigmatic . . . whistleblowing insiders” as to this specific claim who qualified as “original sources.” The Court went on to find sufficient evidence of falsity and scienter, and reversed a discovery ruling that would not have allowed the plaintiffs to investigate the facts of other potentially false claims. ” 794 F.3d 457 (5th Cir. 2015). The Supreme Court granted review and affirmed on an issue about violation of the FCA’s sealing requirement.

The plaintiffs/relators in United States ex rel Rigsby v. State Farm contended that, in the wake of Hurricane Katrina, State Farm improperly skewed its claims handling process in favor of finding flood damage, as “wind policy claims were paid out of the company’s own pocket while flood policy claims were paid with government funds.” They won at trial and the Fifth Circuit affirmed, finding that – notwithstanding earlier investigations – they were “paradigmatic . . . whistleblowing insiders” as to this specific claim who qualified as “original sources.” The Court went on to find sufficient evidence of falsity and scienter, and reversed a discovery ruling that would not have allowed the plaintiffs to investigate the facts of other potentially false claims. ” 794 F.3d 457 (5th Cir. 2015). The Supreme Court granted review and affirmed on an issue about violation of the FCA’s sealing requirement.

Moving to dismiss? Drafting a complaint? Educating a colleague? Check out the newly-revised Twombly/Iqbal page on 600Camp, which includes the recent insights from Wooten v. McDonald Transit Associates, No. 13-11035 (June 7, 2015) (statutory employment claim), Owens v. Jastrow, No. 13-10928 (June 12, 2015) (scienter), and mortgage servicing cases.

On rehearing, the Fifth Circuit vacated its earlier panel opinion in Wooten v. McDonald Transit Associates, 775 F.3d 689 (5th Cir. 2015), which reversed a default judgment because of inadequate underlying pleadings, and replaced it with an opinion affirming the default judgment. The new opinion holds that “[a]lthough Wooten’s complaint contained very few factual allegations, we conclude that it met the low threshold of content demanded by Federal Rule of Civil Procedure 8 because it provided McDonald Transit with fair notice of Wooten’s claims.” No. 13-11035 (June 10, 2015). The Court thus continues to reserve the question left open in Nishimatsu Construction Co. v. Houston Nat’l Bank, 515 F.2d 1200 (5th Cir. 1975): “We do not consider here the possibility that otherwise fatal defects in the pleadings might be corrected by proof taken by the court at a hearing.”

The plaintiffs in Owens v. Jastrow sued officers of Guaranty Bank for securities fraud, alleging that their SEC filings and public comments misstated the vulnerability of the bank’s mortgage-related holdings. No. 13-10928 (June 12, 2015). The Fifth Circuit affirmed dismissal in a detailed opinion, holding, procedurally, that:

The plaintiffs in Owens v. Jastrow sued officers of Guaranty Bank for securities fraud, alleging that their SEC filings and public comments misstated the vulnerability of the bank’s mortgage-related holdings. No. 13-10928 (June 12, 2015). The Fifth Circuit affirmed dismissal in a detailed opinion, holding, procedurally, that:

- “A district court may best make sense of scienter allegations by first looking to the contribution of each individual allegation to a strong inference of scienter, especially in a complicated case such as this one. Of course, the court must follow this initial step with a holistic look at all the scienter allegations”; and

- “Group pleaded” allegations were properly disregarded, although the Court declined to adopt “a strict rule requiring outright dismissal for any group or puzzle pleading[.]”

And on the merits:

- Knowledge of undercapitalization showed motive and opportunity, but does not by itself establish scienter;

- “Defendants’ disclosure of the ‘red flags’ [cited by Plainitiffs] and candidness about the uncertainly underlying its models neutralize any scienter inference from ‘red flags'”; and

- “An inference of severe recklessness is more likely when a statement violates an objective rule than when GAAP permits a range of acceptable outcomes.”

Therefore: “Considered holistically, plaintiffs’ allegations of knowledge of Guaranty’s undercapitalization, a large misstatement, red flags, and ignorance of internal warnings, do not raise a strong inference of severe recklessness that is equally as likely as the competing inference that [Defendants] negligently relief on the AAA ratings and believed that Guaranty’s internal models were accurate.”

Estes sued JP Morgan Chase, alleging violations of the Texas Constitution with respect to a home equity loan. The Fifth Circuit affirmed dismissal on a basic ground: “Estes’s complaint fails to allege any connection between himself and JPMC except that Estes ‘notified [JPMC] that the original promissory note had not been returned,’ and that ‘[m]ore than 60 days have passed since plaintiff notified [JMPC] of its failure to cancel and return the promissory note.’ Considering the allegations in Estes’s complaint, and taking those allegations as true, Estes has not alleged that JPMC possessed the Note at the relevant time. He also has not alleged that he made payments to JPMC, nor has he alleged any other facts from which the Court could reasonably infer that the Note was made payable to “bearer” or to JPMC, as the definition of “holder” set forth in Tex. Bus. & Com. Code § 1.201 requires.” Estes v. JP Morgan Chase Bank, N.A., No. 14-51103 (May 20, 2015, unpublished).

After initially holding that the borrowers’ complaint survived a Twombly challenge as to whether the “grossly inadequate sales price” element of a wrongful foreclosure claim had been properly pleaded, the Fifth Circuit reversed field and issued a revised opinion that affirms dismissal: “We agree with the district court that Plaintiffs’ wrongful foreclosure claim should be dismissed, but for a different reason—Plaintiff’s abandoned the claim on appeal. In challenging the district court’s dismissal, Plaintiffs did not argue that their wrongful foreclosure claim should survive because they adequately pleaded a grossly inadequate sales price. They only argued that the claim should survive because they need not plead that element at all. However, our precedent requires this element in all but a specific category of cases that does not include the instant case.” Guajardo v. JP Morgan Chase, No. 13-51025 (March 10, 2015).

Richardson alleged that he was terminated, in violation of Louisiana’s whistleblower statute, for revealing fraudulent time records and overbilling. The district court granted summary judgment and the Fifth Circuit reversed. Richardson v. Axion Logistics, No. 14-30306 (revised March 23, 2015). Applying the Twombly “plausibility” standard, the Court found adequate pleading about his employer’s knowledge of the alleged misconduct, as well as the timeline of events leading up to his termination. The pleading itself is available for review here; the specific paragraphs identified by the Court as to the employer’s knowledge are highlighted in yellow, and those identified about his termination in orange.

Felder’s Collision Parts sells aftermarket parts for GM cars; it sued GM and several dealers in original equipment manufactured parts made by GM, alleging that they ran a pricing and rebate program (with the unfortunate name of “Bump the Competition”) that amounted to predatory pricing. The district court dismissed and the Fifth Circuit affirmed in Felder’s Collision Parts, Inc. v. All Star Advertising Agency, No. 14-30410 (Jan. 27, 2015).

Felder’s Collision Parts sells aftermarket parts for GM cars; it sued GM and several dealers in original equipment manufactured parts made by GM, alleging that they ran a pricing and rebate program (with the unfortunate name of “Bump the Competition”) that amounted to predatory pricing. The district court dismissed and the Fifth Circuit affirmed in Felder’s Collision Parts, Inc. v. All Star Advertising Agency, No. 14-30410 (Jan. 27, 2015).

Under the program, a dealer would offer a price significantly lower than the ordinary aftermarket part price. Felder’s argued the dealer was pricing beneath average variable cost — and thus engaging in predatory pricing — and offered an example of a dealer selling a part for $119 that it bought from GM for $135. The defendants pointed out that a key part of the program was a rebate to the dealer from GM based on sales, and including that rebate in the “cost” calculation turned the seeming $15 loss in this example into a 14% profit.

The Fifth Circuit agreed: “The price versus cost comparison focuses on whether the money flowing in for a particular transaction exceeds the money flowing out. The rebate undoubtedly affects that bottom line for All Star by guaranteeing that it makes a profit on any Bump the Competition sale. That undisputed fact resolves the case, as a ‘firm that is selling at a shortrun profit maximizing (or loss-minimizing) price is clearly not a predator.'” The Court acknowledged: “Felder’s no doubt is having a tougher time selling aftermarket equivalent parts for GM vehicles . . . But antitrust law welcomes those lower prices for consumers of collision parts so long as neither GM nor its dealers is selling parts at below-cost levels.” (Or, “parts is parts . . . “)

The district court dismissed a borrower’s breach of contract claim against a mortgage servicer because the borrower was in substantial arrears, and “as a general principle . . . an individual in breach cannot bring a cause of action for breach against another contracting party.” The Fifth Circuit reversed, finding that the borrower had alleged plausible claims that the servicer breached first; specially, that “the misapplication of [the borrrower’s] payments to an escrow account, resulting in default . . . constituted a material breach,” and that “Chase’s rejection of her mortgage payments, even if not a material breach, rendered performance impossible and that, as a result, any subsequent breach does not bar her claim.” Peters v. JP Morgan Chase, No. 13-50157 (Jan. 23, 2015, unpublished).

The district court dismissed a borrower’s breach of contract claim against a mortgage servicer because the borrower was in substantial arrears, and “as a general principle . . . an individual in breach cannot bring a cause of action for breach against another contracting party.” The Fifth Circuit reversed, finding that the borrower had alleged plausible claims that the servicer breached first; specially, that “the misapplication of [the borrrower’s] payments to an escrow account, resulting in default . . . constituted a material breach,” and that “Chase’s rejection of her mortgage payments, even if not a material breach, rendered performance impossible and that, as a result, any subsequent breach does not bar her claim.” Peters v. JP Morgan Chase, No. 13-50157 (Jan. 23, 2015, unpublished).

The actual pleading is available here, the key averment appears in paragaph 8: “According to the information received from the bank, Defendant believes Plaintiff is over $50,000 in arrears. According to the accounting done by Plaintiff, Plaintiff only owes $31, 437.30. Only $15,000 of this amount is on past due payments. Plaintiff believes that the disparity between the two figures is due to the fact that Chase has misapplied her payments under the mortgage to escrow fund, thereby causing her to be in default under the mortgage.”

While affirming the dismissal of the borrowers’ other claims related to a foreclosure, the Fifth Circuit reversed as to a claim for wrongful foreclosure, reasoning: “Under Texas law, a claim for wrongful foreclosure generally requires: (1) ‘a defect in the foreclosure sale proceedings;’ (2) ‘a grossly inadequate selling price;’ and (3) ‘a causal connection between the defect and grossly inadequate selling price.’ In their Third Amended

Complaint, Plaintiffs allege that JPMC failed to comply with the notice procedures required for a foreclosure sale,and that, as a result, they lost the opportunity to obtain cash or to find a buyer for the Property before JPMC foreclosed. Plaintiffs also specifically allege that the Property sold for a grossly inadequate sales price.” Guajardo v. JP Morgan Chase Bank, N.A., No. 13-51025 (Jan. 12, 2015, unpublished) (citations omitted). Notably, while the pleading describes the type of notice required and avers that it did not occur, it does not provide detail about the sales price and why it was not adequate.

Two rulings for mortgage servicers offer points of general interest to start the New Year: