The plaintiffs’ takings claim failed in Treme v. St. John the Baptist Parish Council, when the relevant mineral lease was “for a period of Three (3) years from the date Lessee procures approval to commence operations frm local, state and federal authorities, as needed ….” The requirement of government approvals created a “suspensive condition” to the lease’s effectiveness, and “[b]ecuase they have not been obtained, the district court was correct in determining that the lease had not yet become effective.” No. 23-30084 (Feb. 16, 2024).

The plaintiffs’ takings claim failed in Treme v. St. John the Baptist Parish Council, when the relevant mineral lease was “for a period of Three (3) years from the date Lessee procures approval to commence operations frm local, state and federal authorities, as needed ….” The requirement of government approvals created a “suspensive condition” to the lease’s effectiveness, and “[b]ecuase they have not been obtained, the district court was correct in determining that the lease had not yet become effective.” No. 23-30084 (Feb. 16, 2024).

Category Archives: Oil & Gas

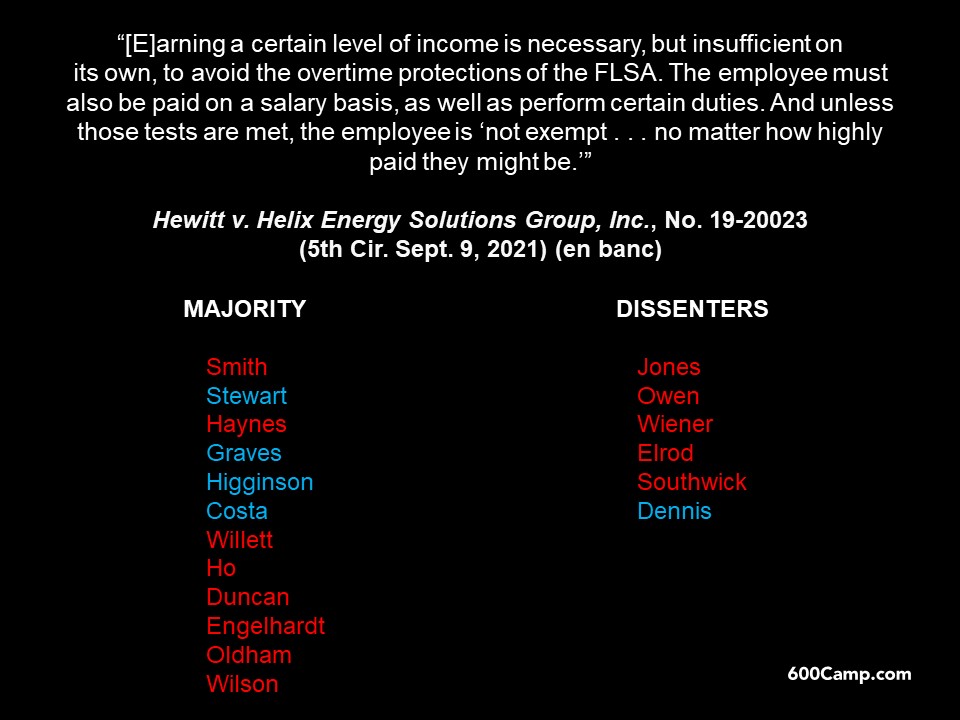

The en banc court divided along atypical lines in Hewitt v. Helix Energy, a dispute about overtime-pay obligations for highly compensated employees in the oil-and-gas industry. The Texas Lawbook and Houston Chronicle have covered the opinion thoroughly; below is a chart showing which judges joined the majority opinion and which judges dissented in some way. Note that Senior Judge Wiener participated in this en banc case because he was part of the original panel.

Longtime observers of the Court may see echoes of the divided en banc court in Mississippi Poultry Ass’n v. Madigan, 31 F.3d 293 (5th Cir. 1994) (en banc), a dispute about the import of the word “same” in the Poultry Products Inspection Act.

Several parties entered an “Area of Mutual Interest” (AMI) agreement, a common feature of oil-and-gas development projects. The AMI included various interests “which were or are acquired after” the agreement’s effective date, “by a Party” to the agreement. But it excluded “all interests, leases or agreements owned by a Party prior to the Effective Date.” Thus, when a party bought interests from another party after the effective date, that sale was not within the scope of the AMI. The Fifth Circuit observed: “If Appellees sought to prohibit the type of activity in which EnerQuest engaged, they could have easily done so through the contract.” Glassell Non-Operated Interests, Ltd. v. EnerQuest Oil & Gas, LLC, No. 18-20125 (June 12, 2019).

Several parties entered an “Area of Mutual Interest” (AMI) agreement, a common feature of oil-and-gas development projects. The AMI included various interests “which were or are acquired after” the agreement’s effective date, “by a Party” to the agreement. But it excluded “all interests, leases or agreements owned by a Party prior to the Effective Date.” Thus, when a party bought interests from another party after the effective date, that sale was not within the scope of the AMI. The Fifth Circuit observed: “If Appellees sought to prohibit the type of activity in which EnerQuest engaged, they could have easily done so through the contract.” Glassell Non-Operated Interests, Ltd. v. EnerQuest Oil & Gas, LLC, No. 18-20125 (June 12, 2019).

A standard form of an oil-and-gas project’s Joint Operating Agreement contains an attorneys’ fee provision that says: “In the event any party is required to bring legal proceedings to enforce any financial obligation of a party hereunder, the prevailing party in such action shall be entitled to recover . . . a reasonable attorney’s fee.” In Seismic Wells LLC v. Sinclair Oil & Gas Co., the Fifth Circuit found that this provision did not allow fee recovery as to a successful claim about a well damaged by a water leak. “Turning over operatorship rights and running the well on Seismic’s preferred erms are not financial obligations. Sinclair did not refuse to make some payment specified in the agreement.” (emphasis in original). No. 17-10500 (Sept. 13, 2018, unpublished).

A standard form of an oil-and-gas project’s Joint Operating Agreement contains an attorneys’ fee provision that says: “In the event any party is required to bring legal proceedings to enforce any financial obligation of a party hereunder, the prevailing party in such action shall be entitled to recover . . . a reasonable attorney’s fee.” In Seismic Wells LLC v. Sinclair Oil & Gas Co., the Fifth Circuit found that this provision did not allow fee recovery as to a successful claim about a well damaged by a water leak. “Turning over operatorship rights and running the well on Seismic’s preferred erms are not financial obligations. Sinclair did not refuse to make some payment specified in the agreement.” (emphasis in original). No. 17-10500 (Sept. 13, 2018, unpublished).

Under Louisiana law, while “fugitive minerals” cannot be conveyed, “this principle by no means forbids a landowner or lessee from conveying pre-extraction mineral interests”;

Under Louisiana law, while “fugitive minerals” cannot be conveyed, “this principle by no means forbids a landowner or lessee from conveying pre-extraction mineral interests”;- An “overriding royalty interest” is a property interest, not “a mere interest in proceeds” from production; and

- The “safe harbor” provision in the Louisiana Oil Well Lien Act protected a party’s liens on a debtor’s overriding royalty interests – while that statute “may not be a model of clarity,” its reference to “hydrocarbons” includes such interests, when viewed in the complete context of the Louisiana property statutes.

OHA Investment Corp. v. Schlumberger Tech. Corp., No. 17-20224 (April 17, 2018).

The issue in Fort Worth 4th Street Partners LP v. Chesapeake Energy Corp. was whether a payment provision in a “Surface Use Agreement,” signed at the same time as a mineral lease, created an obligation that ran with the land. On the element of whether the covenant “touched and concerned” the property, the Fifth Circuit observed that the benefit of the provision “is not merely the right to receive payment but also how the method of calculating this payment preserves the land’s value to its owner. By basing the payment due on the square footage occupied by the lessee, the terms of the provision operate to incentivize the lessee to use, and consequently, damage, as little of the surface land as possible. Critically, structuring the payment in this way does not merely compensate FWP for any such damage; it impacts how the lessee will

The issue in Fort Worth 4th Street Partners LP v. Chesapeake Energy Corp. was whether a payment provision in a “Surface Use Agreement,” signed at the same time as a mineral lease, created an obligation that ran with the land. On the element of whether the covenant “touched and concerned” the property, the Fifth Circuit observed that the benefit of the provision “is not merely the right to receive payment but also how the method of calculating this payment preserves the land’s value to its owner. By basing the payment due on the square footage occupied by the lessee, the terms of the provision operate to incentivize the lessee to use, and consequently, damage, as little of the surface land as possible. Critically, structuring the payment in this way does not merely compensate FWP for any such damage; it impacts how the lessee will

use the land, thereby preserving its value to its owner.” No. 17-10040 (Feb. 15, 2018).

U .S. Energy Devel. Corp. v. CL III Funding Holding Co. applied the attorneys’ fees provision of the form Joint Operating Agreement in Texas, which says: “Costs and Attorneys’ Fees: In the event any party is required to bring legal proceedings to enforce any financial obligation of a party hereunder, the prevailing party in such action shall be entitled to recover all court costs, costs of collection, and a reasonable attorney’s fee, which the lien provided for herein shall also secure.” The Fifth Circuit concluded that none of the four legal actions involved in the fee request involved a “financial obligation” within the meaning of the provision. No. 17-50217 (Jan. 10, 2018, unpublished).

.S. Energy Devel. Corp. v. CL III Funding Holding Co. applied the attorneys’ fees provision of the form Joint Operating Agreement in Texas, which says: “Costs and Attorneys’ Fees: In the event any party is required to bring legal proceedings to enforce any financial obligation of a party hereunder, the prevailing party in such action shall be entitled to recover all court costs, costs of collection, and a reasonable attorney’s fee, which the lien provided for herein shall also secure.” The Fifth Circuit concluded that none of the four legal actions involved in the fee request involved a “financial obligation” within the meaning of the provision. No. 17-50217 (Jan. 10, 2018, unpublished).

TDX Energy v. Chesapeake Operating begins with an entertaining – and accurate – summary of the challenge presented by oil and gas overproduction. Brought forward into today’s market and the parties’ dispute, at issue was a Louisiana statute, under which an operator can forfeit the right to deduct drilling costs on an “unleased oil and gas interest” – defined as one “upon which the operator or producer has no valid oil, gas, or mineral lease. (Here, the relevant interests were leased to TDX but not the operator, Chesapeake.) The Fifth Circuit elected to follow a Lousiana intermediate court opinion that it found to be consistent with the applicable canons of interpretation, and concluded that “The most natural reading of [the two relevant sections together] is that operators forfeit their right to contribution when they fail to send timely reports to lessees with oil and gas interests in lands upon which the operator has no lease . . . .” 857 F.3d 253 (5th Cir. 2017).

TDX Energy v. Chesapeake Operating begins with an entertaining – and accurate – summary of the challenge presented by oil and gas overproduction. Brought forward into today’s market and the parties’ dispute, at issue was a Louisiana statute, under which an operator can forfeit the right to deduct drilling costs on an “unleased oil and gas interest” – defined as one “upon which the operator or producer has no valid oil, gas, or mineral lease. (Here, the relevant interests were leased to TDX but not the operator, Chesapeake.) The Fifth Circuit elected to follow a Lousiana intermediate court opinion that it found to be consistent with the applicable canons of interpretation, and concluded that “The most natural reading of [the two relevant sections together] is that operators forfeit their right to contribution when they fail to send timely reports to lessees with oil and gas interests in lands upon which the operator has no lease . . . .” 857 F.3d 253 (5th Cir. 2017).

Guilbeau bought real property and sued Hess Corporation for alleged contamination resulting from oil and gas drilling done several years before. Acknowledging that the Louisiana Supreme Court had not ruled on the precise issue presented – whether the “subsequent purchaser” rule applied to mineral interests – the Fifth Circuit concluded that Louisiana law would bar Guilbeau’s claim. A consensus of Louisiana intermediate courts, applying the most analogous authority from that state’s Supreme Court, reasoned “that while mineral rights in the lessee are real rights, a lessor’s rights, including the right to sue for damages, are personal and do not automatically transfer with the property” absent an assignment. Guilbeau v. Hess Corp., No. 16-30971 (April 18, 2017).

Guilbeau bought real property and sued Hess Corporation for alleged contamination resulting from oil and gas drilling done several years before. Acknowledging that the Louisiana Supreme Court had not ruled on the precise issue presented – whether the “subsequent purchaser” rule applied to mineral interests – the Fifth Circuit concluded that Louisiana law would bar Guilbeau’s claim. A consensus of Louisiana intermediate courts, applying the most analogous authority from that state’s Supreme Court, reasoned “that while mineral rights in the lessee are real rights, a lessor’s rights, including the right to sue for damages, are personal and do not automatically transfer with the property” absent an assignment. Guilbeau v. Hess Corp., No. 16-30971 (April 18, 2017).

The L/B Nicole Eymard (right) became stuck while servicing a well in the Gulf of Mexico. The owner of the boat sued the contractor that hired the boat, in addition to the well owner, and both were found liable for charter fees while the vessel was unable to move. The well owner obtained indemnity from the contractor because the contractor had agreed to indemnify it for

The L/B Nicole Eymard (right) became stuck while servicing a well in the Gulf of Mexico. The owner of the boat sued the contractor that hired the boat, in addition to the well owner, and both were found liable for charter fees while the vessel was unable to move. The well owner obtained indemnity from the contractor because the contractor had agreed to indemnify it for  claims “based upon personal injury or death or property damage or loss.” Unpaid charter fees are a “loss” within the meaning of that language, even without proof of damage to property. Offshore Marine Contractors, LLC v. Palm Energy Offshore, LLC, No. 14-30059 (March 2, 2015).

claims “based upon personal injury or death or property damage or loss.” Unpaid charter fees are a “loss” within the meaning of that language, even without proof of damage to property. Offshore Marine Contractors, LLC v. Palm Energy Offshore, LLC, No. 14-30059 (March 2, 2015).

Pioneer suffered an oil well blowout and paid millions to restore order. It sued for reimbursement under its umbrella policy and the Fifth Circuit affirmed judgment for the insurer, based largely on the broad language of the relevant exclusions. Pioneer Exploration LLC v. Steadfast Ins. Co., No. 13-30802 (Sept. 22, 2014). Pioneer argued that the “owned, rented or occupied” exclusion did not apply to a mineral lease. The Court disagreed, noting that the mineral lease gave Pioneer some control over surface land, and that the broad language of the exclusion reached activity associated with oil production (citing Aspen Ins. UK, Ltd. v. Dune Energy, Inc., No. 10-30335 (5th Cir. Nov. 8, 2010, unpublished)). Further, noting that Louisiana law allowed debate as to whether an “owned property” exclusion reached remediation costs incurred to minimize liability to third parties, the Court found that this exclusion “specifically excludes containment costs” (reviewing Norfolk Southern Corp. v. California Union Ins., 859 So. 2d 167 (La. App. 2003)).” Finally, as to another exclusion, the Court found that the insured could not meaningfully allocate expense “between controlling costs and plugging costs.”

Drillers asserted a subcontractors’ lien on Debtors’ oil well. Endeavor Energy Resources, L.P. v. Heritage Consolidated, L.L.C., No. 13-10969 (reviised Sept. 16, 2014). Debtors argued that when the general contractor acquired a 1% ownership interest in the lease, that interest related back to the time before Drillers began work, and voided any lien because a party cannot be both a contractor and an owner.

The Fifth Circuit rejected that argument and reversed the lower courts, finding that the Texas Supreme Court intended the relation-back doctrine in this context to expand the interest to which a valid lien can attach (applying Diversified Mortgage Investors v. Lloyd D. Blaylock General Contractor, Inc., 578 S.W.2d 794 (Tex. 1978)). Noting that this interest was not acquired until after the Drillers had done their work, the Court observed that even an earlier acquisition would reach the same result: “If [GC] gained a 1% ownership interest in the lease at the time that Drillers performed their work, then Drillers may have gained an additional claim for contractors’ liens against [GC]. It would not, however, prevent Drillers from asserting separate subcontractors’ liens against [Debtors].”

Plaintiffs own and operate a mineral lease in the Gulf of Mexico; they allege that their neighbors drilled so as to deplete the value of their lease. Specifically, they pleaded claims for “waste” and “unlawful drainage and trespass” under Louisiana law, as adopted by the Outer Continental Shelf Lands Act. Breton Energy LLC v. Mariner Energy Resources Inc., No. 13-20307 (Aug. 12, 2014). As to the waste claims, after a detailed review of the specific allegations and precedent, the Fifth Circuit found a cognizable waste claim pleaded against the defendant alleged to have perforated the relevant oil sands. The Court affirmed, however, the dismissal of claims against the non-perforating defendants, finding “equivocat[ion]” in a key allegation that those defendants could have caused the Minerals Management Service to “take[] other steps to protect the correlative rights of adjacent lessees.” The Court also rejected claims for drainage losses and trespass, describing the interplay of those claims with a waste claim under Louisiana law.

After recently reviewing the phrase “computed at the mouth of the well,” the Fifth Circuit returned to oil royalties in Potts v. Chesapeake Exploration LLC, No. 13-10601 (July 29, 2014). The lease fixed the royalty as a percentage of “the market value at the point of sale,” and would be “free and clear of all costs and expenses related to the exploration, production and marketing of oil and gas production . . . ” Since Chesapeake’s sales of gas occured at the wellhead, this language allowed it to deduct a reasonable post-production cost for delivering the gas from the wellhead under Heritage Resources, Inc. v. NationsBank, 939 S.W.2d 118 (Tex. 1996). The Court said that its conclusion was not affected, under the terms of this lease, by the fact that Chesapeake sold to an affiliate. The Court also rejected a procedural argument about whether Heritage was binding precedent after the Texas Supreme Court’s 4-4 vote on rehearing.

The defendants in Rainbow Gun Club, Inc. v. Denbury Onshore, LLC removed to federal court under CAFA, arguing that the 167 plaintiffs’ claims based on mineral leases were a “mass action.” No. 14-30514 (July 23, 2014). The dispute centered on whether those claims, which alleged negligent operation of the relevant well, arose from “an event or occurrence in the State” within the meaning of that statute. The Fifth Circuit concluded that the ordinary meaning of those terms, CAFA’s legislative history, and case law from other circuits supported the plaintiffs’ position that “the exclusion applies to a single event or occurrence, but the event or occurrence need not be constrained to a discrete moment in time.” Drawing an analogy to the Deepwater Horizon accident, the Court also rejected an argument based on allegations of multiple acts of negligence, as such an incident “was the event that resulted from a number of individual negligent acts related to each other . . . .” Accordingly, the Court affirmed the remand of the case to Louisiana state court.

Chesapeake’s lease obliged it to pay the Warrens a royalty based on “the amount realized by Lessee, computed at the mouth of the well.” A lease addendum said the royalty “shall be free of all costs and expenses related to the exploration, production, and marketing . . . including, but not limited to, costs of compression, dehydration, treatment and transportation.” Warren v. Chesapeake Exploration LLC, No. 13-10619 (July 16, 2014).

The addendum went on to say that “Lessor will, however, bear a proportionate part of all those expenses imposed upon Lessee by its gas sales contract to the extent incurred subsequent to those that are obligations of Lessee.” The Warrens contended that this sentence defined certain shared expenses which should not have been deducted from the royalty. The Fifth Circuit disagreed and affirmed the Rule 12 dismissal of their complaint, finding that the sentence only referred to “the cost of delivering marketable gas to a sales point other than the mouth of the well.” (distinguishing Heritage Resources, Inc. v. NationsBank, 939 S.W.2d 118 (Tex. 1996)).

The Court reversed, however, as to another pair of plaintiffs with a different lease addendum. Noting simply that it was different, the Court found that their claim should not have been dismissed, as “[i]t is not apparent from the face of the complaint or its attachments that they could not conceivably state a cause of action.”

The lower courts agreed that the sale of a pipeline system from a bankruptcy estate was free and clear of an obligation to pay certain fees to “Newco.” Newco Energy v. Energytec, Inc., No. 12-41162 (Dec. 31, 2013). The Fifth Circuit reversed, finding that the obligations arose from a covenant that ran with the land. First, the Court found that the lower courts’ reservation of the “free and clear” issue was sufficient to avoid section 363 of the Bankruptcy Code, which would otherwise moot the appeal for failure to get a stay. On the merits, the Court focused on “horizontal privity” between the parties at the time the covenant was created, expressing doubt that Texas in fact imposed such a requirement, but finding it satisfied in the conveyances here. (discussing Wayne Harwell Props. v. Pan Am. Logistics Center, Inc., 945 S.W.2d 216, 218 (Tex. App.–San Antonio 1997, writ denied)). The Court also concluded that the payment obligation ran with the land, as it related to transportation from the land and was secured by a lien on the entire pipeline. (distinguishing El Paso Refinery, LP v. TRMI Holdings, Inc., 302 F.3d 343 (5th Cir. 2002)).

A Louisiana mineral lease provided that the lessee would pay the lessor “one-eighth (1/8) of the market value at the mouth of the well of the gas so sold . . . .” Cimarex Energy v. Chastant, No. 13-30049 (Aug. 2, 2013, unpublished). The lessor claimed that the payment obligations extended to the benefits of a hedging program operated by the lessee/producer. The Fifth Circuit agreed with the district court that it did not: “[T]he mineral lease between Cimarex and Chastant does not require Cimarex to pay royalties on amounts generated through its separate financial activities. The Court distinguished a case about royalties on take-or-pay payments, noting: “Take-or-pay is, for these purposes, an alternative to actual production, or effectively a minimum production for purposes of rights under the lease. Hedging transactions do not serve that purpose. They are supplements to production, not substitutes.”

The parties arbitrated whether certain offshore oil dealings violated RICO. Grynberg v. BP, PLC, No. 12-20291 (June 7, 2013, unpublished). The arbitrator found that the claimant did not establish damage and dismissed that claim, noting that he lacked authority to determine whether any criminal violation of RICO occurred. The Fifth Circuit affirmed the dismissal of a subsequent RICO lawsuit on the grounds of res judicata, finding that the arbitrator’s ruling was on the merits and not jurisdictional.

An assignment of royalty interests for a continental shelf project had this “calculate or pay” clause: “The overriding royalty interest assigned herein shall be calculated and paid in the same manner and subject to the same terms and conditions as the landowner’s royalty under the Lease.” The parties disputed whether the clause simply required calculation of royalties in the same way as the government’s royalty, or allowed suspension of the assigned payments during a period when the government’s royalty right was suspended. Total E&P USA, Inc. v. Kerr-McGee Oil & Gas, No. 11-30038 (revised June 20, 2013). Applying Louisiana law, the majority found the clause ambiguous on that issue, and further reasoned that at the time of contracting, legal principles that eventually became settled and could resolve the ambiguity were not yet settled. Noting that no cross-appeal was taken, the Court reversed a summary judgment and remanded for consideration of extrinsic evidence. A succinct concurrence noted an additional reason for finding ambiguity based on the grammar of the clause. A dissent took issue with the majority’s analysis of other contract provisions and applicable law, and would have affirmed summary judgment about interpretation but reversed as to reformation for mutual mistake. Both the majority and dissent endorsed consideration of extrinsic evidence, for different reasons and purposes — a general topic which recurs with some regularity in the Court’s contract opinions.

A Louisiana statute requires a well operator to provide landowners “a sworn, detailed, [and] itemized statement” about drilling costs. Brannon Properties v. Chesapeake Operating, No. 12-30306 (Feb. 21, 2013, unpublished). The Fifth Circuit reversed a summary judgment for the operator, finding that the district court correctly concluded that its report lacked enough detail under the unambiguous language of the statute, and that the analysis should have ended there. Id. at 5 (“The statute clearly connects the costs reported to the benefits received in exchange. . . . [I]t must tell the unleased mineral owner what it is getting for its money.”). The Court faulted the district court for proceeding to analysis of the statute’s purpose after reaching a conclusion that its terms were unambiguous, and also for finding an incorrect purpose inconsistent with those terms. Id. at 6-7.

In Ergon-West Virginia, Inc. v. Dynegy Marketing & Trade, the Fifth Circuit found that Dynegy had no duty under two natural gas supply contracts to attempt to get replacement gas after a declaration of force majeure in response to hurricane damage, affirming the district court as to one contract and reversing as to the other. No. 11-60492 (Jan. 22, 2013). The first contract’s force majeure clause required Dynegy to “remed[y] with all reasonable dispatch” the event. The Court found that “reasonable” was not ambiguous but that extrinsic evidence of industry standards (favorable to Dynegy) was properly admitted to give it full meaning (contrasting its approach with the district court’s, which found the term ambiguous and admitted the testimony to resolve the ambiguity). The second contract’s provision had language about “due diligence” by Dynegy. The Court found the term ambiguous as both parties’ readings of it were reasonable, and then held that the district court should have credited the same evidence here as it did for the first contract.

The plaintiff in Coe v. Chesapeake Exploration won a $20 million judgment for breach of a contract to buy rights in the Haynesville Shale formation, against the background of a a “plummet[]” in the price of natural gas. No. 11-41003 (Sept. 12, 2012). The Fifth Circuit affirmed. After review of other analogous energy cases, the Court found that the parties’ writing had a sufficient “nucleus of description” of the property to satisfy the Statute of Frauds, even though some review of public records was required to fully identify the property from that “nucleus.” Id. at 11-12. The Court also found that the parties had reached an enforceable agreement and that Plaintiff had tendered performance, finding an “adjustment clause” specifying a per-acre price particularly relevant on the tender issue. Id. at 16, 17-18.

“What follows is the tale of competing mineral leases on the Louisiana property of Lee and Patsy Stockman during the Haynesville Shale leasing frenzy.” Petrohawk Properties v. Chesapeake Louisiana at 1, No. 11-30576 (as rev’d Aug. 2012). The Fifth Circuit affirmed a finding that one of the dueling leases was procured by fraudulent misrepresentations as to the legal effect of a lease extension, rejecting several challenges to whether such a representation was actionable under Louisiana law, as well as an argument that the fraud had been “confirmed [ratified].” The Court also rejected a counterclaim for tortious interference with contract, noting that Louisiana has a limited view of that tort and requires a “narrow, individualized duty” between plaintiff and tortfeasor. Id. at 20-24 (citing 9 to 5 Fashions v. Spurney, 538 So.2d 228 (1989)).

In Greenwood 950 LLC v. Chesapeake Louisiana LP, the Court found an ambiguity in a Louisiana mineral lease, seeing two reasonable ways to harmonize clauses about obligations to “repair all surface damages” and “pay . . . all damages.” No. 11-30436 (June 12, 2012) at 5-7 (emphasis added). On the threshold Erie issue, the Court reminded: “[W]e look first and foremost ‘to the final decisions of Louisiana’s highest court’ rather than this Court’s prior applications of Louisiana law.” Op. at 4 n.11 (quoting Holt v. State Farm, 627 F.3d 188, 191 (5th Cir. 2010)).

The parties in Ballard v. Devon Energy disputed when a provision in an oil field joint operating agreement, about the effect of “surrendering” certain leases, would apply. No. 10-20497 (April 19, 2012) The Court affirmed the denial of leave to amend the plaintiff’s contract claims to add a fiduciary duty count, based on a lengthy delay in raising the issue. Op. at 6. The Court then, applying Montana law, concluded that while the parties had both advanced “facially plausible” readings of the provision in isolation, the defendant’s reading was more persuasive in the overall context of the entire development project. Id. at 12-15. The Court affirmed summary judgment for the defendant, although it criticized the trial court for considering “extrinsic evidence” before attempting to construe the document on its face. Id. at 9-10.

The dispute in Preston Exploration v. GSF, LLC was whether a contract to sell certain oil and gas leases satisfied the Texas Statute of Frauds (“SOF”). (No. 10-20599, Feb. 1, 2012) Acknowledging that the parties’ documents envisioned future title work, the Court reversed the district court’s conclusion that this remaining work barred the contracts’ enforcement under the SOF, stating: “Such analysis reflects the conflating of two distinct principles — whether parties come to a meeting of the minds as to the subject matter of a contract with whether a writing’s legal description is sufficient to meet the statute of frauds.” Op. at 7.

The case of Texas Pipeline v. FERC involved a challenge to natural gas regulations as beyond FERC’s statutory authority. The Court found that the regulations were beyond that authority, and accordingly, did not reach any issues where agency deference under Chevron could be appropriate. See Op. at 5 (“[A]gencies cannot manufacture statutory ambiguity with semantics to enlarge their congressionally mandated border.”) The Fifth Circuit has taken a conservative view of agency opinions about statutory authority in other thoughtful opinions, see, e.g., Mississippi Poultry v. Madigan, 31 F.3d 293 (5th Cir. 1994) (en banc) (construing the term “same” in statute governing regulation of poultry processing).