A Louisiana statute requires that cancellation of an insurance policy be done in a certain way; the Fifth Circuit affirmed judgment for the insurer in Williams v. GoAuto Ins. Co.: “What is necessary prior to cancellation is that the insurer had “receipt” of notice of cancellation sent by the premium finance company. … This is a modern statute set in current times, and company computers do much that individuals once did. GoAuto’s method of receiving the notice and reacting to it satisfies the statute.” No. 24-30646 (Oct. 3, 2025).

Category Archives: Insurance

In the case of Wilson v. Kemper Corp. Servcs., the Fifth Circuit held that the district court erred in denying the plaintiff’s motion to remand, because the non-diverse defendant was properly joined.

The Court emphasized that under Mississippi law, the “duty to read” doctrine did not bar the plaintiff’s negligence claim against that defedndant. The Court further explained that the district court’s reliance on Maria Wilson’s affidavit, which admitted her illiteracy and inability to read the policy, was insufficient by itself to establish improper joinder, especially when the policy’s language was ambiguous and did not explicitly require the plainitff to reside in the house to be covered. No. 24-60090, Apr. 11, 2025.

In McDonnell Grouo, LLC v. Starr Surplus Lines Ins. Co., the Fifth Circuit addressed the perennial topic of contract ambiguity; in this case, in the context of a builder’s risk insurance policy. The court affirmed the district court ‘s conclusion that the flood deductible provision in the policy was ambiguous.

The ambiguity arose from the language: “5% of the total insured values at risk at the time and place of loss subject to a $500,000 minimum deduction as respects … FLOOD.” The plaintiffs and the insurers had reasonable interpretations of this provision, but extrinsic evidence, in the form of industry standards and expert testimony, resolved the ambiguity. That extrinsic evidence clarified the term “VARTOL” (value-at-risk-at-time-of-loss) to mean the total value of the project at the time of loss, favoring the insurers’ interpretation. No. 23-30824, Jan. 29, 2025.

In TIG Ins. Co. v. Woodsboro Farmers Coop., the Fifth Circuit identified fact issues that precluded summary judgment in an insurance-coverage case.

In TIG Ins. Co. v. Woodsboro Farmers Coop., the Fifth Circuit identified fact issues that precluded summary judgment in an insurance-coverage case.

A key is whether damage to certain grain silos was “property damage” under a CGL policy. The diistrict court concluded that damage was due to defective construction. The Fifth Circuit credited the insured’s evidence that wind and weather caused the silos’ metal parts to degrade, bend, and fatigue. This evidence, including testimony from an inspector who saw the damage, supported the insured’s argument that the damage was not merely cosmetic but a “harmful change in appearance, shape, composition, or some other physical dimension to the claimants’ property.”

The Court also noted a fact issue about whether the damage occurred during the policy period, emphasizing that under Texas law, “occurred means when damage occurred, not when discovery occurred,” making it irrelevant that the damage was first observed after the policy period expired. No. 23-40435, Sept. 20, 2024.

In Century Surety Co. v. Colgate Operating, LLC:

In Century Surety Co. v. Colgate Operating, LLC:

- The parties’ contract required Colgate (an oil well operator) and Triangle (a consultant) “to purchase indemnity insurance with limits the lesser of (1) ‘not less than $5 million’, or (2) ‘the maximum amount which may be required by law, if any, without rendering this mutual indemnification obligation void, unenforceable or otherwise inoperative.'”

- Clause 2 referred to a potential legislative restriction on indemnity agreement that didn’t come to pass.

- The district court say Clause 1 as setting a ceiling but not a floor on the indemnity obligation, but the Fifth Circuit saw the clause as setting both: “At heart, Century’s position assumes that Colgate set out a $76 million dollar indemnity obligation without clearly saying so in the contract by virtue of policies that Colgate acquired years after it had entered into the [contract].”

No. 23-50530 (Sept. 10, 2024).

SKAV, LLC, the operator of a Best Western hotel in Abbeville, Louisiana, sued a surplus-lines insurer about a hurricane-damage claim. The insurer sought to compel arbitration, based on a Louisiana statute that says:

SKAV, LLC, the operator of a Best Western hotel in Abbeville, Louisiana, sued a surplus-lines insurer about a hurricane-damage claim. The insurer sought to compel arbitration, based on a Louisiana statute that says:

A. No insurance contract delivered or issued for delivery in this state and covering subjects located, resident, or to be performed in this state, or any group health and accident policy insuring a resident of this state regardless of where made or delivered, shall contain any condition, stipulation, or agreement ..

(2) Depriving the courts of this state of the jurisdiction or venue of action against the insurer. …

D. The provisions of Subsection A of this Section shallnot prohibit a forum or venue selection clause in a policy form that is not subject to approval by the Department of Insurance.

Acknowledging differing approaches by district courts to examine this issue, the Fifth Circuit held in SKAV, LLC v. Indep. Specialty Ins. Co. that section (a)(2) of this statute applied to arbitration, and was not affected by section (D), which was fairly read as limited to forum and venue-selection clauses. No. 23-30293 (June 5, 2024).

In a dispute about insurance coverage for a freak accident at a drag-racing event, the Fifth Circuit rejected the argument that the policy was ambiguous, reasoning:

In a dispute about insurance coverage for a freak accident at a drag-racing event, the Fifth Circuit rejected the argument that the policy was ambiguous, reasoning:

“[W]e must construe every part of the CGL Policy—the CGL Declaration, the CGL Form, and the CGL Endorsements simultaneously. So construed, the CGL Policy is not ambiguous.

Begin by considering the relationship between the CGL Form and the CGL Endorsements. Generalia specialibus non derogant. Given that the CGL Form provides general statements regarding coverage, a CGL Endorsement’s more specific statement regarding the same will control where the two conflict. …

As the CDE Endorsement and MV Endorsement illustrate, the CGL Endorsements modify express subsets of provisions in the CGL Form. They do not, however, expressly purport to modify the CGL Declaration, other provisions in the CGL Form, or other CGL Endorsements. So, relative to the CGL Form, each of the CGL Endorsements addresses a narrower set of provisions in greater detail.

Kinsale Ins. Co. v. Flyin Diesel Performance & Offroad, LLC, No. 23-50336 (April 26, 2024).

After a massive computer failure, Southwest sued one of its cyber risk insures about five categories of damages (vouchers, frequent-flier miles, etc. used to mitigate the effects of the outage). The district court ruled against Southwest, describing the losses as arising from “purely discretionary” decisions.

After a massive computer failure, Southwest sued one of its cyber risk insures about five categories of damages (vouchers, frequent-flier miles, etc. used to mitigate the effects of the outage). The district court ruled against Southwest, describing the losses as arising from “purely discretionary” decisions.

The Fifth Circuit reversed. Acknowledging that the policy covered “all Loss … that in Insured incurs … solely as a result of a System Failure,” the Court reasoned:

Here, Liberty argues that the system failure cannot be the sole cause of Southwest’s claimed costs because the “independent” and “more direct” cause of those losses was Southwest’s decision to incur them. But those decisions can only be independent, sole causes of the costs if they were the precipitating causes of the costs. The decisions, like the infection in Wright or the medical complications in Wells, were not precipitating causes that competed with the system failure, but links in a causal chain that led back to the system failure.

Accordingly, the Court reversed and remanded. Southwest Airlines Co. v. Liberty Ins. Underwriters, Inc., No. 22-10942 (Jan. 16, 2024). The Court noted that “[t]he parties concede that there are no cases directly on point in the context of business interruption insurance.”

The concurrent causation doctrine precluded recovery under an insurance policy for alleged hurricane damage in Shree Rama, LLC v. Mt. Hawley Ins. Co.:

The concurrent causation doctrine precluded recovery under an insurance policy for alleged hurricane damage in Shree Rama, LLC v. Mt. Hawley Ins. Co.:

Shree Rama did not carry its burden under the concurrent causation doctrine. The policy issued by Mt. Hawley explicitly covers damage from wind and explicitly excludes damage from wear and tear. Viewing the facts in the light most favorable to Shree Rama, it is possible that some damage to the hotel roof came from Hurricane Hanna and some from wear and tear. But the concurrent causation doctrine requires Shree Rama to provide the jury with “a reasonable basis” for allocating the damage between wind and wear and tear. . Shree Rama provided no reasonable basis. To the contrary, Shree Rama admitted at the district court level that its causation expert “could not definitively attribute [specific damages to the roof] to Hurricane Hanna when deposed.” Without a basis for allocating damages between covered and non- covered causes, Mt. Hawley was entitled to summary judgment.

No. 23-40123 (Dec. 14, 2023) (citations omitted).

Princeton Excess & Surplus Lines Ins. Co. v. A.H.D. Houston, Inc. addresses – coverage – in strip clubs, holding that the clubs are – exposed.

Princeton Excess & Surplus Lines Ins. Co. v. A.H.D. Houston, Inc. addresses – coverage – in strip clubs, holding that the clubs are – exposed.

As with Jan Tiffany’s burlesque act of the 1950s (right), matters “largely turn[ed] on whether the … coverage should be viewed as one ‘umbrella’ of coverage or carved into subcategories … .”

The specific issue involved insurance coverage for damages arising from unauthorized use of models’ photos, and turned on construction of the policies’ exclusions to “advertising injury” coverage. A dissent would certify the issue to the Texas Supreme Court. No. 22-20473 (Aug. 25, 20230.

A boat sank during a hurricane, leading to an insurance-coverage dispute about whether the boat was in not located in the place warranted by the insured.

A boat sank during a hurricane, leading to an insurance-coverage dispute about whether the boat was in not located in the place warranted by the insured.

The insurance policy at issue had two “incorporation” clauses. “The first provides that ‘[t]his insuring agreement incorporates in full [Gray Group’s] application for insurance[.]’ The second states that ‘[t]his is a legally binding insurance document between [Gray Group] and [Great Lakes], incorporating in full the application form signed by [Gray Group].'”

The Fifth Circuit agreed with the district court that these clauses were ambiguous as to what specific documents were referenced. Unfortunately for the plaintiff, though, the extrinsic evidence showed that the parties intended “application for insurance” to include a document about the boat’s location–and thus, made a warranty that the boat would be in New Orleans during hurricane season. Great Lakes Ins. v. Gray Group Investments, LLC, No. 22-30041 (Aug. 1, 2023).

The question in Allstate Fire & Casualty Co. v. Love was whether “the amount of an insurancy policy or the underlying claim determines the amount in controversy to establish diversity jurisdiction ….” The Court addressed, and clarified, earlier Circuit precedent on that generaly topic, and went on to hold that in this case: “where the claim under the policy exceeds the value of the policy limit, courts … should ask whether there is a legal possibility that the insurer could be subject to liability in excess of the policy limit” (a Stowers claim having been made in this dispute). No. 22-20405 (June 22, 2023).

Central Crude, Inc. v. Liberty Mutual confirms that under Louisiana law, a pollution exclusion doesn’t require the insured to have the ultimate fault for the alleged pollution:

Central Crude, Inc. v. Liberty Mutual confirms that under Louisiana law, a pollution exclusion doesn’t require the insured to have the ultimate fault for the alleged pollution:

Neither the CGL policy nor [the Louisiana Supreme Court’s opinion in Doerr] requires identification of the party at fault for the oil spill in determining whether the total pollution exclusion applies here. The CGL policy’s total pollution exclusion broadly precludes coverage for bodily injury or property damage that “would not have occurred in whole or in part but for the actual, alleged or threatened discharge, dispersal, seepage, migration, release or escape of ‘pollutants’ at any time.” The provision requires a dispersal of pollutants but makes no requirement that the party responsible for the dispersal be determined.

No. 21-30707 (Oct. 26, 2022).

Among other issues from an insurance-coverage case arising from a building collapse, in Hudson Specialty Ins. Co. v. Talex Enterprises, LLC, the Fifth Circuit considered whether the expense of fire and police personnel was “maintenance” within the meaning of a policy exclusion. The Court found that term ambiguous as to those expenses, and thus construed it against the insurer:

The City paid for the around-the-clock presence of its fire and police personnel to protect the integrity of the site and keep people out.

On the one hand, it is reasonable to read this police and fire department presence as maintenance. By keeping watch over the site and keeping people out, these public safety officials were “upholding or keeping in being” the property in its current state. This aligns with one of the definitions of maintenance listed above.

On the other hand, the definitions of maintenance as “[t]he action of keeping something in working order” or “[t]he care and work put into property” both imply that actions are taken upon the property to keep it in working order. Keeping watch is an action, but it is not performed upon the property and does not involve putting work into the property. Thus, there are at least two reasonable meanings for the term maintenance—one where these expenses would fall under the exclusion and one where they would not.

No. 21-60794 (Oct. 28, 2022) (paragraph breaks added).

In a COVID-19 coverage case, the appellant in Coleman E. Adler & Sons v. Axis Surplus Ins. Co. tried to avoid earlier Fifth Circuit precedent by pointing to a recent opinion from an intermediate Louisiana appellate court. The Fifth Circuit did not accept the appellant’s argument, noting:

In a COVID-19 coverage case, the appellant in Coleman E. Adler & Sons v. Axis Surplus Ins. Co. tried to avoid earlier Fifth Circuit precedent by pointing to a recent opinion from an intermediate Louisiana appellate court. The Fifth Circuit did not accept the appellant’s argument, noting:

- Orderliness. “Our court’s rule of orderliness applies to Erie cases no less than cases interpreting federal law.”

- Erie. “[T]here has been ‘neither a clearly contrary subsequent holding of the highest court of [Louisiana] nor a subsequent statutory authority, squarely on point.’ Nor has there been contrary intervening precedent that ‘comprises unanimous or near-unanimous holdings from several—preferably a majority —of the intermediate appellate courts of [Louisiana].’ We have only one subsequent decision from an intermediate state court, and that cannot overcome our rule of orderliness.” (citations omitted).

No. 21-30478 (Sept. 20, 2022).

In Dune, Duke Leto Atreides cautions his son about the family’s move to Arrakis, telling him to watch for “a feint within a feint within a feint…seemingly without end.” In that spirit, Advanced Indicator & Mfg. v. Acadia Ins. Co. analyzed a complex removal issue, noting:

In Dune, Duke Leto Atreides cautions his son about the family’s move to Arrakis, telling him to watch for “a feint within a feint within a feint…seemingly without end.” In that spirit, Advanced Indicator & Mfg. v. Acadia Ins. Co. analyzed a complex removal issue, noting:

- “Ordinarily, diversity jurisdiction requires complete diversity—if any plaintiff is a citizen of the same State as any defendant, then diversity jurisdiction does not exist.”

- “‘However, if the plaintiff improperly joins a non-diverse defendant, then the court may disregard the citizenship of that defendant, dismiss the non-diverse defendant from the case, and exercise subject matter jurisdiction over the remaining diverse defendant.’ … A defendant may establish improper joinder in two ways: ‘(1) actual fraud in the pleading of jurisdictional facts, or (2) inability of the plaintiff to establish a cause of action against the non-diverse party in state court.’”

- But see: “[T]he voluntary-involuntary rule … dictates that ‘an action nonremovable when commenced may become removable thereafter only by the voluntary act of the plaintiff.’”

These principles applied to this situation: Advanced Indicator (a Texas business) sued Acadia Insurance (diverse) and its Texas-based insurance agent (not-diverse). But after suit was filed, Acadia invoked a Texas statute “which provides that should an insurer accept responsibility for its agent after suit is filed, ‘the court shall dismiss the action against the agent with prejudice.'”

The Fifth Circuit, noting different district-court opinions about this statute and carefully reviewing its own precedents, concluded that “because [the agent] was improperly joined at the time of removal, Acadia’s removal was proper.” No. 21-20092 (Oct. 3, 2022) (emphasis added, citations removed).

Overstreet v. Allstate, an insurance-coverage case about hail damage, presented an unsettled issue under Texas’ “concurrent causation” doctrine. Accordingly, the Fifth Circuit hailed the Texas Supreme Court for assistance, certifying the issue to it for review (a topic where the Fifth Circuit had previously certified the same topic, only for the parties to settle). No. 21-10462 (May 19, 2022). (As is customary for such requests, the Court disclaimed any intention to hale the Texas Supreme Court toward any particular result.)

Overstreet v. Allstate, an insurance-coverage case about hail damage, presented an unsettled issue under Texas’ “concurrent causation” doctrine. Accordingly, the Fifth Circuit hailed the Texas Supreme Court for assistance, certifying the issue to it for review (a topic where the Fifth Circuit had previously certified the same topic, only for the parties to settle). No. 21-10462 (May 19, 2022). (As is customary for such requests, the Court disclaimed any intention to hale the Texas Supreme Court toward any particular result.)

Making an Erie guess about Louisiana insurance law, the Fifth Circuit held: “Consistent with our decision in Terry Black’s, and the decisions of the unanimous circuit courts, we conclude, pursuant to Louisiana law, that losses caused by civil authority orders closing nonessential businesses in response to the COVID-19 pandemic do not fall within the meaning of ‘direct physical loss of or damage to property.'” Q Clothier v. Twin City Fire Ins., No. 21-30278 (March 22, 2022).

Making an Erie guess about Louisiana insurance law, the Fifth Circuit held: “Consistent with our decision in Terry Black’s, and the decisions of the unanimous circuit courts, we conclude, pursuant to Louisiana law, that losses caused by civil authority orders closing nonessential businesses in response to the COVID-19 pandemic do not fall within the meaning of ‘direct physical loss of or damage to property.'” Q Clothier v. Twin City Fire Ins., No. 21-30278 (March 22, 2022).

Hurricane Harvey insurance litigation continues. The dispute in Landmark Am. Ins. Co. v. SCD Mem. Place II, LLC involved a “named perils” policy, one of which was “Windstorm or Hail associated with a Named Storm.” While the unfortunate insured experienced significant damage when Buffalo Bayou overflowed its banks and flooded the insured’s property, it did not experience any wind or hail damage. The Fifth Circuit sided with the insured, holding that “[t]his framing sets up ‘Windstorm’ and ‘Hail’ as specific perils that may be associated with a number of weather events rather than as weather events that may encompass any number of perils.” No. 20-20389 (Feb. 3, 2022)

Hurricane Harvey insurance litigation continues. The dispute in Landmark Am. Ins. Co. v. SCD Mem. Place II, LLC involved a “named perils” policy, one of which was “Windstorm or Hail associated with a Named Storm.” While the unfortunate insured experienced significant damage when Buffalo Bayou overflowed its banks and flooded the insured’s property, it did not experience any wind or hail damage. The Fifth Circuit sided with the insured, holding that “[t]his framing sets up ‘Windstorm’ and ‘Hail’ as specific perils that may be associated with a number of weather events rather than as weather events that may encompass any number of perils.” No. 20-20389 (Feb. 3, 2022)

A high-profile case about a child’s gruesome accident produced considerable media coverage, but the insurer’s awareness of that coverage did not satisfy the insurance policy’s “claim” requirement: “The fact that [the insured] became aware of media reports about Braylon’s injuries and sent those reports to Evanston, which in turn opened an internal ‘Claim/Occurrence’ file and monitored further developments, does not substitute for the Jordans actually making a timely claim against M&O. Their failure to do so is fatal to their assertion of coverage.” Jordan v. Evanston Ins. Co., No. 20-60716 (Jan. 17, 2022).

Terry Black’s Barbecue provides outstanding Texas barbecue from its location in Dallas’s Deep Ellum neighborhood; it also experienced business interruptions from complying with various stay-at-home orders issued during the COVID-19 pandemic in 2020. The Fifth Circuit affirmed the district court’s conclusion that Terry Black’s did not have business-interruption coverage because it did not suffer a direct physical loss of property at its restaurants. The Court reasoned:

Terry Black’s Barbecue provides outstanding Texas barbecue from its location in Dallas’s Deep Ellum neighborhood; it also experienced business interruptions from complying with various stay-at-home orders issued during the COVID-19 pandemic in 2020. The Fifth Circuit affirmed the district court’s conclusion that Terry Black’s did not have business-interruption coverage because it did not suffer a direct physical loss of property at its restaurants. The Court reasoned:

… A “physical loss of property” cannot mean something as broad as the “loss of use of property for its intended purpose.” None of those words fall within the plain meaning of physical, loss, or property. And that phrase has an entirely different meaning from the language in the BI/EE provision. “Physical loss of property” is not synonymous with “loss of use of property for its intended purpose.”

We conclude the Texas Supreme Court would interpret a direct physical loss of property to require a tangible alteration or deprivation of property. Because the civil authority orders prohibiting dine-in services at restaurants did not tangibly alter TBB’s restaurants, and TBB having failed to allege any other tangible alteration or deprivation of its property, the policy does not provide coverage for TBB’s claimed losses.

Terry Black’s Barbecue BBQ, LLC v. State Automobile Mut. Ins. Co., No. 21-50078 (Jan. 5, 2022).

In Great Am. Ins. Co. v. Employers Mut. Cas. Co., both the Great American and Employers’ umbrella policies were “excess,” in that they both provided coverage for liability “in excess” of a “retained limit.” That said . . .

In Great Am. Ins. Co. v. Employers Mut. Cas. Co., both the Great American and Employers’ umbrella policies were “excess,” in that they both provided coverage for liability “in excess” of a “retained limit.” That said . . .

- the Employers’ policy defined “retained limit” as “the available limits of all ‘underlying insurance,'” a term that was, in turn, defined by two descriptions of primary coverage; while

- the Great American policy defined “retained limit” to include “the applicable limits of any other insurance providing coverage to the ‘Insured’ during the Policy Period.” (emphasis added).

Thus, “[b]ased on the plain terms of these policies, the Great American Umbrella Policy was the true excess policy after all other policies.” No. 20-11113 (Nov. 17, 2021).

A New Orleans bar was sued after two patrons were stabbed by another, underaged patron who had been drinking at the bar. The insurance company denied coverage under a “weapons” exclusion (reaching “instruments of an offensive or defensive nature and include but are not limited to batons, bow or crossbow [?!], arrows, knives, mace, stun guns, tasers, or swords.” The Fifth Circuit affirmed judgment for the insurer:

“The district court described the claims of negligence in state court as Funky 544’s failure to require patron identifications and, more generally, its failure to prevent underage drinking. Even so, an element of each of [the plaintiffs’] claims is that Funky 544’s negligence caused them to be injured by a knife. … The term in this exclusion of ‘arising out of’ the use of weapons unambiguously provides that for coverage, an injury must be entirely separate from those relating to the use of weapons.”

Funky 544, LLC v. Houston Specialty Ins. Co., No. 21-30310 (Oct. 22, 2021) (unpublished).

Zurich won an insurance coverage dispute with Maxim Crane. On appeal, in addition to defending the merits, Zurich argued that the matter should be dismissed entirely because Maxim lacked standing. This argument led to the question whether a cross-appeal was needed to make that point, and the Fifth Circuit concluded:

… although our judgment would be different if we credited Zurich’s standing argument, that does not mean that Zurich needed to file a cross-appeal to present that argument. To be sure, as a matter of standard appellate practice, “[m]any cases state the general rule that a cross-appeal is required to support modification of the judgment,” whereas “arguments that support the judgment as entered can be made without a cross-appeal.” (quoting [Wright & Miller]). But this case falls within an exception to that general rule. A cross-appeal “is not necessary to challenge the subject-matter jurisdiction of the district court, under the well-established rule that both district court and appellate courts are obliged to raise such questions on their own initiative.” Id.

Maxim Crane Works LP v. Zurich Am. Ins. Co., No. 19-20489 (Aug. 20, 2021) (ultimately, certifying the underlying coverage issue to the Texas Supreme Court).

The plaintiffs in Turner v. Cincinnati Ins. Co. obtained a “non-adversarial” default judgment against a defunct vocational school. The Fifth Circuit found that Texas’s “no-direct action” rule did not bar their claim against the school’s insurer: “[T]he Plaintiffs’ default judgment against ATI is an adjudication that satisfies the no-action clause. Accordingly, although the non-adversarial default judgment does not bind Cincinnati to its terms, the no-direct-action rule is not a bar to this coverage suit.” (citation omitted). (Unfortunately for the plaintiffs, the Court then affirmed the dismissal of their claim on timeliness grounds.) No. 20-50548 (Aug. 13, 2021).

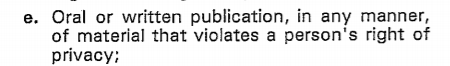

The relevant policy language in a data-breach coverage dispute provided insurance for:

In Landry’s, Inc. v. Ins. Co. of the State of Penn., the Fifth Circuit found that this language created coverage, observing, inter alia:

In Landry’s, Inc. v. Ins. Co. of the State of Penn., the Fifth Circuit found that this language created coverage, observing, inter alia:

- “Publication”: “[C]overage is triggered by a ‘publication, in any manner.’ It follows that the Policy intended to use every definition of the word ‘publication’—even the very broadest ones. And some of the dictionary definitions of ‘publication’ are quite broad.”

- Scope: “[T]he Policy does not simply extend to violations of privacy rights; the Policy instead extends to all injuries that arise out of such violations. … [I]t’s undisputed that a person has a ‘right of privacy’ in his or her credit-card data.” (emphasis in original).

- Injury: “[E]veryone agrees that the facts alleged in the Paymentech complaint constitute an injury arising from the violation of customers’ privacy rights, as those terms are commonly understood. It does not matter that Paymentech’s legal theories sound in contract rather than tort. Nor does it matter that Paymentech (rather than individual customers) sued Landry’s. Paymentech’s alleged injuries arise from the violations of customers’ rights to keep their credit-card data private.”

The Fifth Circuit harmonized two insurance-policy provisions in Miller v. Reliance Std. Ins. Co.:

The Fifth Circuit harmonized two insurance-policy provisions in Miller v. Reliance Std. Ins. Co.:

“[T]he phrase ‘active, full-time’ employees must be construed in the insured’s favor to include those who, on the relevant date, are current employees even if not actually working. We also agree that the term ‘regular work week’ must be construed to refer to an employee’s job description, or to his typical workload when on duty.

To hold otherwise, as Reliance urges, would render the second paragraph of the Transfer Provision virtually redundant with the first. On Reliance’s reading, the paragraph would cover employees who actually maintain a full-time work schedule at the time of transfer. But this is barely different, if at all, from the previous paragraph’s provision for employees who at the time are ‘Actively at Work,’ defined to mean ‘actually performing on a Full-time basis the material duties pertaining to his/her job'[.]

Effectively, Reliance’s reading is that the second paragraph covers employees who are not “actually performing” work duties but are ‘otherwise’ actually working. We reject this convoluted construction as the unambiguous meaning of the provision.”

No. 20-30240 (June 2, 2021) (emphasis in original, breaks added).

During Hurricane Harvey, “to prevent the Lake Conroe Dam from overflowing and failing, the San Jacinto River Authority released from the dam 79,141 cubic feet of water per second—nearly the flow rate of Niagara Falls.” The resulting surge of water destroyed 22 boat slips owned by a condo association, which sought to recover from its insurer. The Fifth Circuit affirmed judgment for the condo association, noting:

During Hurricane Harvey, “to prevent the Lake Conroe Dam from overflowing and failing, the San Jacinto River Authority released from the dam 79,141 cubic feet of water per second—nearly the flow rate of Niagara Falls.” The resulting surge of water destroyed 22 boat slips owned by a condo association, which sought to recover from its insurer. The Fifth Circuit affirmed judgment for the condo association, noting:

- legally, while the policy’s Flood Endorsement says: “We will not pay for loss or damage caused by ‘flood’, arising from . . . [a h]urricane or tropical storm,” it defined a “flood” as “a general and temporary condition of partial or

complete inundation of 2 or more acres of normally dry land areas or of 2 or

more distinct parcels of land (at least one of which is your property) with

water”–and thus does not reach the boat slips, which were on water; - factually, the association offered evidence that the water release “created a suction effect, like a sink drain that is unplugged, but on a much greater scale. Because of the rate at which water was being released, the water on the north side of [the] lake (where the Boat Slips are located) was below normal levels afterwards, despite the rainfall brought by Harvey.”

Playa Vista Conroe v. Ins. Co. of the West, No. 20-20307 (March 5, 2021).

A class of plaintiffs settled with several insurance companies, resolving various disputes about a large sinkhole caused by years of salt mining by Texas Brine Co. Texas Brine objected to the settlement and the Fifth Circuit found that it lacked standing to do so. While “[n]on-settling

A class of plaintiffs settled with several insurance companies, resolving various disputes about a large sinkhole caused by years of salt mining by Texas Brine Co. Texas Brine objected to the settlement and the Fifth Circuit found that it lacked standing to do so. While “[n]on-settling  parties generally lack standing to object to a settlement agreement,” “[a] potential exception exists ‘if the settlement agreement purports tot strip non-settling defendants of rights to contribution or indemnity.” Here, Texas Brine did not not have any right to indemnification or contribution from these insurers for the remaining claims, so it lacked standing to object to the settlement. LeBlanc v. Texas Brine Co., LLC, No. 20-30208 (March 1, 2021).

parties generally lack standing to object to a settlement agreement,” “[a] potential exception exists ‘if the settlement agreement purports tot strip non-settling defendants of rights to contribution or indemnity.” Here, Texas Brine did not not have any right to indemnification or contribution from these insurers for the remaining claims, so it lacked standing to object to the settlement. LeBlanc v. Texas Brine Co., LLC, No. 20-30208 (March 1, 2021).

Mississippi Silicon (“MSH”), a manufacturer, was tricked into paying approximately $1 million to a cybercriminal, believing that it was in fact paying one of its regular vendors. MSH sought reimbursement under the “Computer Transfer Fraud” provision of an insurance policy, and the Fifth Circuit affirmed the district court’s conclusion that there was no coverage.

Mississippi Silicon (“MSH”), a manufacturer, was tricked into paying approximately $1 million to a cybercriminal, believing that it was in fact paying one of its regular vendors. MSH sought reimbursement under the “Computer Transfer Fraud” provision of an insurance policy, and the Fifth Circuit affirmed the district court’s conclusion that there was no coverage.

The provision said: “The insurer will pay for loss of . . . Covered Property resulting directly from Computer Transfer Fraud that causes the transfer, payment, or delivery of Covered Property from the Premises or Transfer Account to a person, place, or account beyond the Insured Entity’s control, without the Insured Entity’s knowledge or consent.”

But here: “Coverage under the Computer Transfer Fraud provision is available only when a computer-based fraud scheme causes a transfer of funds without the Insured’s knowledge or consent. Here, three MSH employees affirmatively authorized the transfer; it therefore cannot be said that the fraud caused a transfer without the

company’s knowledge. … [T]he agreement plainly limits coverage to instances in which the transfer is made without knowledge or consent.”

Mississippi Silicon Holdings v. Axis Ins. Co., No. 20-60215 (Feb. 4, 2021) (all emphasis in original).

At issue in Big Binder Express LLC v. Liberty Mutual Ins. Co. was the meaning of the term “you.” The Fifth Circuit concluded that the term “you” in the key endorsement about a large deductible, when given its “ordinary and generally accepted meaning,” referred only the named insured and not additional insureds. The Court also rejected the insured’s argument that “damages” meant only a court award of damages. No. 20-60188 (Jan. 27, 2021).

At issue in Big Binder Express LLC v. Liberty Mutual Ins. Co. was the meaning of the term “you.” The Fifth Circuit concluded that the term “you” in the key endorsement about a large deductible, when given its “ordinary and generally accepted meaning,” referred only the named insured and not additional insureds. The Court also rejected the insured’s argument that “damages” meant only a court award of damages. No. 20-60188 (Jan. 27, 2021).

Following two recent opinions about Fed. R. Civ. P. 9(b), the Fifth Circuit again applied it in Waste Management v. AIG: “We need not resolve this dispute because, even assuming that an adjuster can be held liable under [the] Texas Insurance Code . . . Waste did not allege facts that, taken as true, demonstrate a violation of these provisions. The only relevant, AIG Claims-specific facts that Waste alleged in its

Following two recent opinions about Fed. R. Civ. P. 9(b), the Fifth Circuit again applied it in Waste Management v. AIG: “We need not resolve this dispute because, even assuming that an adjuster can be held liable under [the] Texas Insurance Code . . . Waste did not allege facts that, taken as true, demonstrate a violation of these provisions. The only relevant, AIG Claims-specific facts that Waste alleged in its

complaint are that (1) AIG Claims served as the adjuster for ASIC and (2) ‘On July 9, 2013, AIG Claims sent Waste Management a letter denying [certain] coverage . . . .’ These threadbare factual allegations, along with Waste’s conclusory recitation of the elements of a claim under the Texas Insurance Code, are insufficient to state a plausible claim for relief. Notably, Waste did not allege that AIG Claims failed to investigate, delayed any investigation, misevaluated, misprocessed, made any misrepresentation of the policy, or otherwise failed to ‘effectuate’ a fair settlement.” (citations omitted).

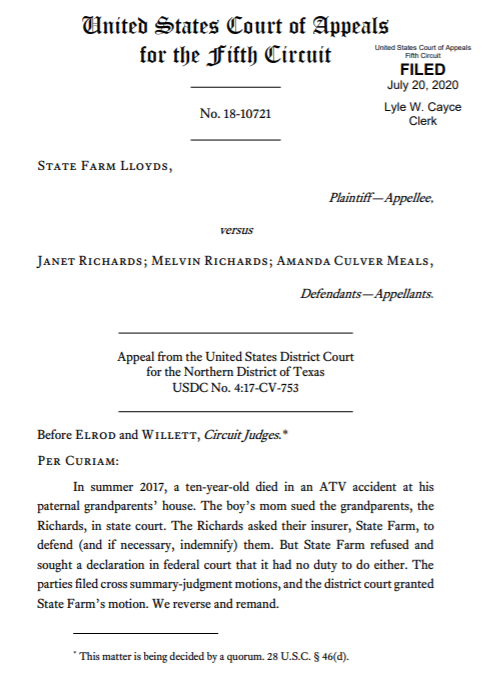

For insurance-coverage lawyers, State Farm Lloyds v. Richards represents another case in which the Fifth Circuit concludes that “the eight-corners rule applies here; the ‘very narrow exception’ does not,” and then finds that the relevant pleading “contains

For insurance-coverage lawyers, State Farm Lloyds v. Richards represents another case in which the Fifth Circuit concludes that “the eight-corners rule applies here; the ‘very narrow exception’ does not,” and then finds that the relevant pleading “contains

allegations within its four corners that potentially constitute a claim within the four corners of the policy.” No. 18-10721 (July 19, 2020).

For fans of legal typography, State Farm Lloyds represents a daring new look – stylish, yet readable!

For fans of legal typography, State Farm Lloyds represents a daring new look – stylish, yet readable!

Soren Kierkegaard wondered, “What is the Absurd?” Contemporary artist Michael Cheval creates thought-provoking works of absurdist art (to the right, “Echo of Misconception” (2015)). And the Fifth Circuit plumbed the meaning of the absurd in Geovera Specialty Ins. Co. v. Joachin, No. 19-30604 (July 6, 2020), in a coverage dispute about a homeowners’ insurance policy, bserving: “Absurdity requires a result ‘that no reasonable person could approve.’ An insurance policy is thus absurd if it ‘exclude[s] all coverage’ from the outset. So is one that broadly excludes coverage without reasonable limitations. But the GeoVera policy is not absurd on its face. The policy makes perfect sense for a homeowner who purchases it while already living in the home.” No. 19-30605 (July 6, 2020) (citations omitted).

Soren Kierkegaard wondered, “What is the Absurd?” Contemporary artist Michael Cheval creates thought-provoking works of absurdist art (to the right, “Echo of Misconception” (2015)). And the Fifth Circuit plumbed the meaning of the absurd in Geovera Specialty Ins. Co. v. Joachin, No. 19-30604 (July 6, 2020), in a coverage dispute about a homeowners’ insurance policy, bserving: “Absurdity requires a result ‘that no reasonable person could approve.’ An insurance policy is thus absurd if it ‘exclude[s] all coverage’ from the outset. So is one that broadly excludes coverage without reasonable limitations. But the GeoVera policy is not absurd on its face. The policy makes perfect sense for a homeowner who purchases it while already living in the home.” No. 19-30605 (July 6, 2020) (citations omitted).

Rules of procedure require precision in pleading a cause of action. The eight-corners rule of insurance coverage, in contrast, often rewards imprecision. A powerful example appears in Allied World Specialty Ins. Co. v. McCathern, PLLC, a duty-to-defend claim arising from a legal malpractice claim, where the Fifth Circuit held: “The allegations that McCathern did not monitor the file, conduct legal research, or communicate with the client are factual assertions—as opposed to causes of action—even if they are vague. Allied World’s challenge to the factual allegations thus seems to be that they are not specific enough or may not prove true. But at the duty-to-defend stage it is not for us to say whether West Star will be able to prove that McCathern was negligent in failing to monitor the personal injury suit or in failing to research legal issues.” No. 17-10615 (Feb. 26, 2020, unpublished).

Rules of procedure require precision in pleading a cause of action. The eight-corners rule of insurance coverage, in contrast, often rewards imprecision. A powerful example appears in Allied World Specialty Ins. Co. v. McCathern, PLLC, a duty-to-defend claim arising from a legal malpractice claim, where the Fifth Circuit held: “The allegations that McCathern did not monitor the file, conduct legal research, or communicate with the client are factual assertions—as opposed to causes of action—even if they are vague. Allied World’s challenge to the factual allegations thus seems to be that they are not specific enough or may not prove true. But at the duty-to-defend stage it is not for us to say whether West Star will be able to prove that McCathern was negligent in failing to monitor the personal injury suit or in failing to research legal issues.” No. 17-10615 (Feb. 26, 2020, unpublished).

An insurance company drew the Fifth Circuit’s ire (“Only an insurance company could come up with the policy interpretation advanced here”) in a dispute about coverage for a collision caused by drunk driving. The insurer argued “that drunk driving collisions are not ‘accidents,’ because the decision to drink (and then later drive) was intentional—even though there was admittedly no intent to collide with another vehicle. As Cincinnati points out, a jury found that Sanchez intentionally decided to drive while intoxicated, with ‘actual, subjective awareness’ of the ‘extreme degree of risk, considering the probability and magnitude of the potential harm to others.'” The Court found this argument inconsistent with the common meaning of the term “accident,” and further noted that under this reading of the policy: “[A] collision caused by texting while driving would also not be an accident. A collision caused by eating while driving would not be an accident. And a collision caused by doing makeup while driving would not be an accident.” Frederking v. Cincinnati Ins. Co., No. 18-50536 (July 2, 2019).

An insurance company drew the Fifth Circuit’s ire (“Only an insurance company could come up with the policy interpretation advanced here”) in a dispute about coverage for a collision caused by drunk driving. The insurer argued “that drunk driving collisions are not ‘accidents,’ because the decision to drink (and then later drive) was intentional—even though there was admittedly no intent to collide with another vehicle. As Cincinnati points out, a jury found that Sanchez intentionally decided to drive while intoxicated, with ‘actual, subjective awareness’ of the ‘extreme degree of risk, considering the probability and magnitude of the potential harm to others.'” The Court found this argument inconsistent with the common meaning of the term “accident,” and further noted that under this reading of the policy: “[A] collision caused by texting while driving would also not be an accident. A collision caused by eating while driving would not be an accident. And a collision caused by doing makeup while driving would not be an accident.” Frederking v. Cincinnati Ins. Co., No. 18-50536 (July 2, 2019).

In SEC v. Stanford Int’l Bank, Ltd., the Fifth Circuit reviewed an intricate, court-supervised settlement between the receiver for Stanford International Bank and several D&O carriers, and “conclude[d] the district court lacked authority to approve the Receiver’s settlement to the extent it (a) nullified the coinsureds’ claims to the policy proceeds without an alternative compensation scheme; (b) released claims the Estate did not possess; and (c) barred suits that could not result in judgments against proceeds of the Underwriters’ policies or other receivership assets.”

In SEC v. Stanford Int’l Bank, Ltd., the Fifth Circuit reviewed an intricate, court-supervised settlement between the receiver for Stanford International Bank and several D&O carriers, and “conclude[d] the district court lacked authority to approve the Receiver’s settlement to the extent it (a) nullified the coinsureds’ claims to the policy proceeds without an alternative compensation scheme; (b) released claims the Estate did not possess; and (c) barred suits that could not result in judgments against proceeds of the Underwriters’ policies or other receivership assets.”

The Court observed: “By ignoring the distinction between Appellants’ contractual and extracontractual claims against Underwriters, the district court erred legally and abused its discretion in approving the bar orders. These claims . . . lie directly against the Underwriters and do not involve proceeds from the insurance policies or other receivership assets. . . . [R]eceivership courts have no authority to dismiss claims that are unrelated to the receivership estate. That the district court was ‘looking only to the fairness of the settlement as between the debtor and the settling claimant [and ignoring third-party rights] contravenes a basic notion of fairness.'” No. 17-10663 (June 17, 2019).

Ekhlassi sued National Lloyds in Texas state court for a flood-insurance claim, arising out of a “Write Your Own” insurance policy issued in the carrier’s name but underwritten by the federal government. His filing may have satisfied the one-year statute of limitations for such a claim – the

Ekhlassi sued National Lloyds in Texas state court for a flood-insurance claim, arising out of a “Write Your Own” insurance policy issued in the carrier’s name but underwritten by the federal government. His filing may have satisfied the one-year statute of limitations for such a claim – the  parties disputed the trigger event – but his choice of a state forum proved fatal. The panel majority, applying Circuit precedent and authority from other Circuits, found that the grant of “original exclusive jurisdiction” in federal court by 28 U.S.C. § 4072 applied to his suit. A dissent argued that this statute, by its terms, applied only to a suit against FEMA’s Administrator and not a “WYO” carrier. Ekhlassi v. National Lloyds Ins. Co., No. 18-20228 (June 4, 2019).

parties disputed the trigger event – but his choice of a state forum proved fatal. The panel majority, applying Circuit precedent and authority from other Circuits, found that the grant of “original exclusive jurisdiction” in federal court by 28 U.S.C. § 4072 applied to his suit. A dissent argued that this statute, by its terms, applied only to a suit against FEMA’s Administrator and not a “WYO” carrier. Ekhlassi v. National Lloyds Ins. Co., No. 18-20228 (June 4, 2019).

Sometimes, simply stating the issue gives a strong indication as to the answer. Such was the case in McGlothlin v. State Farm, which examined whether two Mississippi statutes were “repugnant” to one another (synonyms for “repugnant,” according to one online reference, include “abhorrent, revolting, repulsive, repellent, disgusting, offensive, objectionable, vile, foul, nasty, [and] loathsome . . . .” Specifically, Mississippi’s uninsured-motorist statute (1) required State Farm to pay the damages that an insured is “legally entitled to recover” from an uninsured driver, and (2) treats a fireman driving a fire truck as “uninsured,” as a result of the statute’s governmental-immunity statute. A driver who was rear-ended by a fire truck argued that these two statutes were “repugnant” and had to be read in favor of coverage; the Fifth Circuit disagreed: “The two sections’ being ‘confusing’ does not equate to repugnancy.” No. 18-60338 (May 31, 2019).

Sometimes, simply stating the issue gives a strong indication as to the answer. Such was the case in McGlothlin v. State Farm, which examined whether two Mississippi statutes were “repugnant” to one another (synonyms for “repugnant,” according to one online reference, include “abhorrent, revolting, repulsive, repellent, disgusting, offensive, objectionable, vile, foul, nasty, [and] loathsome . . . .” Specifically, Mississippi’s uninsured-motorist statute (1) required State Farm to pay the damages that an insured is “legally entitled to recover” from an uninsured driver, and (2) treats a fireman driving a fire truck as “uninsured,” as a result of the statute’s governmental-immunity statute. A driver who was rear-ended by a fire truck argued that these two statutes were “repugnant” and had to be read in favor of coverage; the Fifth Circuit disagreed: “The two sections’ being ‘confusing’ does not equate to repugnancy.” No. 18-60338 (May 31, 2019).

![]() Cohen argued, inter alia, that a letter from Allstate “merely denied ‘coverage for various items'” and thus lacked adequate specificity to effectively deny his flood-insurance claim (and thus start a 1-year federal statute of limitations). The Fifth Circuit disagreed, observing that “not even the temptations of a hard case will provide a basis for ordering recovery contrary to the terms of [a] regulation, for to do so would disregard the duty of all courts to observe the conditions defined by Congress for charging the public treasury.” Cohen v. Allstate Ins. Co., No. 18-20330 (May 17, 2019) (citation omitted).

Cohen argued, inter alia, that a letter from Allstate “merely denied ‘coverage for various items'” and thus lacked adequate specificity to effectively deny his flood-insurance claim (and thus start a 1-year federal statute of limitations). The Fifth Circuit disagreed, observing that “not even the temptations of a hard case will provide a basis for ordering recovery contrary to the terms of [a] regulation, for to do so would disregard the duty of all courts to observe the conditions defined by Congress for charging the public treasury.” Cohen v. Allstate Ins. Co., No. 18-20330 (May 17, 2019) (citation omitted).

An insurer argued that its insured breached the policy’s cooperation clause by not dismissing a counterclaim against a third party. The Fifth Circuit disagreed: “Mid-Continent offers no law to support its novel and dubious concept that the Cooperation Clause applies to an insured’s affirmative claims against a third party, and the direction of the law in this area is against such a conclusion.” Mid-Continent Casualty Co. v. Petroleum Solutions, Inc., No. 17-20652 (Feb. 26, 2019).

An insurer argued that its insured breached the policy’s cooperation clause by not dismissing a counterclaim against a third party. The Fifth Circuit disagreed: “Mid-Continent offers no law to support its novel and dubious concept that the Cooperation Clause applies to an insured’s affirmative claims against a third party, and the direction of the law in this area is against such a conclusion.” Mid-Continent Casualty Co. v. Petroleum Solutions, Inc., No. 17-20652 (Feb. 26, 2019).

A gruesome series of automobile accidents led to a fundamental question about causation and insurance coverage in Evanston Ins. Co. v. Mid-Continent Casualty Co.: “Over a ten-minute period on November 15, 2013, the insured’s Mack truck struck (1) a Dodge Ram, (2) a Ford F150, (3) a Honda Accord, (4) a toll plaza, and (5) a Dodge Charger. . . . [T]he Mack truck’s primary insurer refused to contribute more than $1 million toward the settlements of the final three collisions, claiming that they were part of a single ‘accident’ under its policy.” Examining the reference points about this question under Texas law, the Fifth Circuit noted that:

A gruesome series of automobile accidents led to a fundamental question about causation and insurance coverage in Evanston Ins. Co. v. Mid-Continent Casualty Co.: “Over a ten-minute period on November 15, 2013, the insured’s Mack truck struck (1) a Dodge Ram, (2) a Ford F150, (3) a Honda Accord, (4) a toll plaza, and (5) a Dodge Charger. . . . [T]he Mack truck’s primary insurer refused to contribute more than $1 million toward the settlements of the final three collisions, claiming that they were part of a single ‘accident’ under its policy.” Examining the reference points about this question under Texas law, the Fifth Circuit noted that:

- Eight specific sales from one shipment of contaminated bird seed created eight separate occurrences;

- Two fires, set by the same arsonist “several blocks and at least two hours apart,” created two separate occurrences; and

- “[A]n HEB employee’s sexual abuse of two different children, a week apart, at an HEB store” created separate occurrences; however,

- A flawed three-hour crop dusting that damaged the land of several neighbors created one occurrence, even though “the plane had landed several times to refuel . . . [and] the temperature, wind, and altitude varied during the several passes over different sections of thee property”; and

- Two separate storms that damaged the same drilling rig created two separate occurrences.

Under the principles behind these cases, the Court found that the harm caused by the Mack truck’s driver created a single occurrence: “Absent any indication that the driver regained control of the truck or that his negligence was otherwise interrupted between collisions . . . all of the collisions resulted from the same continuous condition – the unbroken negligence of the Mack truck driver.” No. 17-20812 (Nov. 19, 2018).

Dubrow sued 2200 West Alabama Inc., alleging that Dubrow was the “rightful tenant” of space leased by 2200 West. Western World declined to defend the action, noting that its coverage only extended to claims about “[t]he wrongful eviction from, wrongful entry into, or invasion of the right of private occupancy of a . . . premises that a person occupies.” (emphasis added). While the meaning of “occupies” could be debated in the abstract, the term has a clear and unambiguous meaning under Texas case law, that “requires physical presence or possession.” Because Dubow never became a tenant, he never “occupied” the premises and coverage did not arise. 2200 West Alabama v. Western World Ins. Co., No. 17-20640 (Oct. 22, 2018).

Dubrow sued 2200 West Alabama Inc., alleging that Dubrow was the “rightful tenant” of space leased by 2200 West. Western World declined to defend the action, noting that its coverage only extended to claims about “[t]he wrongful eviction from, wrongful entry into, or invasion of the right of private occupancy of a . . . premises that a person occupies.” (emphasis added). While the meaning of “occupies” could be debated in the abstract, the term has a clear and unambiguous meaning under Texas case law, that “requires physical presence or possession.” Because Dubow never became a tenant, he never “occupied” the premises and coverage did not arise. 2200 West Alabama v. Western World Ins. Co., No. 17-20640 (Oct. 22, 2018).

The issue in SCF Waxler Marine LLC v. Aris T MV was whether the excess insurers for a multi-vessel accident could enforce a “Crown Zellerbach clause,” and thus limit their liability to the value of the insured vessel. (The vessel at issue, the Aris T (right) is presently in the Atlantic en route to Rotterdam from Mobile.) The Fifth Circuit found that it lacked appellate jurisdiction over the district court’s ruling that the excess insurers could enforce such a clause: “The fundamentals of Bucher-Guyer bear a striking resemblance to this case. There, the district court determined the boundaries of a party’s liability— $500—based on the applicability of statutory language. Nevertheless, whether the opposing party was entitled to anything and, if so, how much was still to be determined. In this case, the court decided the boundaries of a party’s liability through determination of whether a contractual provision permitted them to do so. Whether Valero, Shell, and Motiva are legally permitted to recover anything from the Excess Insurers and, if so, how much remains to be determined.” No. 17-30805 (Oct. 30, 2018).

The issue in SCF Waxler Marine LLC v. Aris T MV was whether the excess insurers for a multi-vessel accident could enforce a “Crown Zellerbach clause,” and thus limit their liability to the value of the insured vessel. (The vessel at issue, the Aris T (right) is presently in the Atlantic en route to Rotterdam from Mobile.) The Fifth Circuit found that it lacked appellate jurisdiction over the district court’s ruling that the excess insurers could enforce such a clause: “The fundamentals of Bucher-Guyer bear a striking resemblance to this case. There, the district court determined the boundaries of a party’s liability— $500—based on the applicability of statutory language. Nevertheless, whether the opposing party was entitled to anything and, if so, how much was still to be determined. In this case, the court decided the boundaries of a party’s liability through determination of whether a contractual provision permitted them to do so. Whether Valero, Shell, and Motiva are legally permitted to recover anything from the Excess Insurers and, if so, how much remains to be determined.” No. 17-30805 (Oct. 30, 2018).

OGA Charters entered bankruptcy after a tragic accident involving one of its buses. Applying Louisiana World Exposition Inc. v. Fed. Ins. Co., 832 F.2d 1391 (5th Cir. 1987), and Houston v. Edgeworth, 993 F.2d 51 (5th Cir. 1993), the Fifth Circuit held: “We now make official what our cases have long contemplated: In the ‘limited circumstances,’ as here, where a siege of tort claimants threaten the debtor’s estate over and above the policy limits, we classify the proceeds as property of the estate. Here, over $400 million in related claims threaten the debtor’s estate over and above the $5 million policy limit, giving rise to an equitable interest of the debtor in having the proceeds applied to satisfy as much of those claims as possible.” Martinez v. OGA Charters LLC, No. 17-40920 (Aug. 24, 2018).

Problems in the construction of the Zapata County courthouse (right) led to litigation between S&P (the general contractor), and its subcontractors, as well as between S&P and its insurer. The insurer and S&P disputed S&P’s allocation of the proceeds from settlements with the subcontractors, and the Fifth Circuit affirmed judgment for the insurer: “S&P bears the burden to show that the subcontractor settlement proceeds were properly allocated to either covered or noncovered damages. If S&P cannot meet that burden, under the [two controlling cases], then we must assume that all of the settlement proceeds went first to satisfy the covered damages under U.S. Fire’s policy.” Satterfield & Pontikes Constr. v. U.S. Fire Ins. Co., No. 17-20513 (Aug. 2, 2018).

Problems in the construction of the Zapata County courthouse (right) led to litigation between S&P (the general contractor), and its subcontractors, as well as between S&P and its insurer. The insurer and S&P disputed S&P’s allocation of the proceeds from settlements with the subcontractors, and the Fifth Circuit affirmed judgment for the insurer: “S&P bears the burden to show that the subcontractor settlement proceeds were properly allocated to either covered or noncovered damages. If S&P cannot meet that burden, under the [two controlling cases], then we must assume that all of the settlement proceeds went first to satisfy the covered damages under U.S. Fire’s policy.” Satterfield & Pontikes Constr. v. U.S. Fire Ins. Co., No. 17-20513 (Aug. 2, 2018).

The judgment creditor in Century Surety Co. v. Seidel, a case involving sexual assault on an underage restaurant employee, tried valiantly to collect from the restaurant’s insurance carrier. The Fifth Circuit found that the policy’s “criminal acts” exclusion  precluded coverage, despite the plaintiff not specifically pleading that the underlying acts were criminal: “Appellants have cited no case law stating that, to trigger a criminal act exclusion, the plaintiff in the underlying suit must, in addition to describing actions that necessarily imply a crime, also specifically label those actions as criminal. Such a rule is incongruous with the plain language of the Policy and would create an artifice in criminal-act exclusions.” No. 17-10026 (June 25, 2018).

precluded coverage, despite the plaintiff not specifically pleading that the underlying acts were criminal: “Appellants have cited no case law stating that, to trigger a criminal act exclusion, the plaintiff in the underlying suit must, in addition to describing actions that necessarily imply a crime, also specifically label those actions as criminal. Such a rule is incongruous with the plain language of the Policy and would create an artifice in criminal-act exclusions.” No. 17-10026 (June 25, 2018).

The Fifth Circuit issued a rare reversal in favor of an ERISA beneficiary in White v. Life Ins. Co. of N. Am. The issue was whether an “intoxication” exclusion applied; a doctor consulted by the plan administrator in its decision about benefits opined: “Since the only blood test done was an alcohol [test] that was negative and no blood tested for the presence of drugs, an estimation of Mr. White’s level of impairment cannot be done. The drugs present in his urine only show that he had prior exposure and cannot be used to estimate a level of impairment. Further, the drug screen that was done on Mr. White’s urine specimen only provided qualitative positive results.” The Court concluded that even though the insurer’s denial of benefits was supported by substantial evidence, its failure to expressly consider this report in its analysis (or to produce the report to the beneficiary’s estate until litigation) showed that its inherent conflict of interest had predominated and invalidated its denial. No. 17-30367 (revised June 14, 2018).

The Fifth Circuit issued a rare reversal in favor of an ERISA beneficiary in White v. Life Ins. Co. of N. Am. The issue was whether an “intoxication” exclusion applied; a doctor consulted by the plan administrator in its decision about benefits opined: “Since the only blood test done was an alcohol [test] that was negative and no blood tested for the presence of drugs, an estimation of Mr. White’s level of impairment cannot be done. The drugs present in his urine only show that he had prior exposure and cannot be used to estimate a level of impairment. Further, the drug screen that was done on Mr. White’s urine specimen only provided qualitative positive results.” The Court concluded that even though the insurer’s denial of benefits was supported by substantial evidence, its failure to expressly consider this report in its analysis (or to produce the report to the beneficiary’s estate until litigation) showed that its inherent conflict of interest had predominated and invalidated its denial. No. 17-30367 (revised June 14, 2018).

The insured’s commercial property insurance policy provided coverage from June 2, 2012 to June 2, 2013. “The summary judgment evidence reveals that several hail storms struck the vicinity of the hotel in the several years preceding [the insured’s] claim. Only one of these storms fell within the coverage period.” The Fifth Circuit found that the insured failed to establish coverage, even with an expert’s opinion that said a date within the period was “most likely,” when that opinion was later disclaimed and “conflicts with the data it purports to rely on.” Certain Underwriters v. Lowen Valley View LLC, No. 17-10914 (June 6, 2018).

The insured’s commercial property insurance policy provided coverage from June 2, 2012 to June 2, 2013. “The summary judgment evidence reveals that several hail storms struck the vicinity of the hotel in the several years preceding [the insured’s] claim. Only one of these storms fell within the coverage period.” The Fifth Circuit found that the insured failed to establish coverage, even with an expert’s opinion that said a date within the period was “most likely,” when that opinion was later disclaimed and “conflicts with the data it purports to rely on.” Certain Underwriters v. Lowen Valley View LLC, No. 17-10914 (June 6, 2018).

A useful reminder about contract litigation appears in a recent insurance coverage dispute: “Neither party argues that the Hartford policy is ambiguous. Rather, the parties dispute whether the policy unambiguously provides coverage—Axis’s contention—or unambiguously excludes coverage—Hartford’s contention.” Bennett v. Hartford Ins. Co., No. 17-30311 (May 18, 2018) (emphasis in original).

A useful reminder about contract litigation appears in a recent insurance coverage dispute: “Neither party argues that the Hartford policy is ambiguous. Rather, the parties dispute whether the policy unambiguously provides coverage—Axis’s contention—or unambiguously excludes coverage—Hartford’s contention.” Bennett v. Hartford Ins. Co., No. 17-30311 (May 18, 2018) (emphasis in original).

Erie Railroad Co. v. Tompkins was decided in 1938. Sierra Equipment v. Lexington Ins. Co., an Erie case from the Fifth Circuit this week, turned on Texas authority that pre-dated Erie – specifically, a court of appeals opinion approved by the 1920s-era Texas Commission on Appeals (a representative picture of which is to the right). The specific question was whether the “equitable lien” doctrine allowed a lessee to sue on a lessor’s insurance policy absent a “loss payable” clause in the policy; consistent with the ruling of the Commission and most other cases on the point, the Court concluded that the lessee could not bring that suit. No. 17-10076 (May 15, 2018).

Erie Railroad Co. v. Tompkins was decided in 1938. Sierra Equipment v. Lexington Ins. Co., an Erie case from the Fifth Circuit this week, turned on Texas authority that pre-dated Erie – specifically, a court of appeals opinion approved by the 1920s-era Texas Commission on Appeals (a representative picture of which is to the right). The specific question was whether the “equitable lien” doctrine allowed a lessee to sue on a lessor’s insurance policy absent a “loss payable” clause in the policy; consistent with the ruling of the Commission and most other cases on the point, the Court concluded that the lessee could not bring that suit. No. 17-10076 (May 15, 2018).

The triangular relationship between (1) an insurer, (2) an insured, and (3) the counsel chosen by the insurer to defend the insured in litigation can become an uneasy one. Grain Dealers Mut. Ins. Co. v. Cooley illustrates when it can become unstable. The insurer (Grain Dealers) provided the insureds (the Cooleys) a defense, “yet simultaneously disclaimed coverage if the Cooleys were ordered to clean the spill. In doing so, Grain Dealers failed to inform the Cooleys of their right to hire independent counsel. When the [relevant administrative agency] ultimately found the Cooleys liable for the spill, Grain Dealers then refused to defend or indemnify the Cooleys against a resulting claim.” That failure created the prejudice needed to estop Grain Dealers from denying coverage for liability: ” [T]he Cooleys presented evidence that Grain Dealers’ attorney never informed them of their right to challenge the [agency] decision. That right has since lapsed. The loss of the right to challenge the underlying administrative order with the benefit of non-conflicted counsel is clearly prejudicial.” No. 17-60307 (May 14, 2017, unpublished).

The triangular relationship between (1) an insurer, (2) an insured, and (3) the counsel chosen by the insurer to defend the insured in litigation can become an uneasy one. Grain Dealers Mut. Ins. Co. v. Cooley illustrates when it can become unstable. The insurer (Grain Dealers) provided the insureds (the Cooleys) a defense, “yet simultaneously disclaimed coverage if the Cooleys were ordered to clean the spill. In doing so, Grain Dealers failed to inform the Cooleys of their right to hire independent counsel. When the [relevant administrative agency] ultimately found the Cooleys liable for the spill, Grain Dealers then refused to defend or indemnify the Cooleys against a resulting claim.” That failure created the prejudice needed to estop Grain Dealers from denying coverage for liability: ” [T]he Cooleys presented evidence that Grain Dealers’ attorney never informed them of their right to challenge the [agency] decision. That right has since lapsed. The loss of the right to challenge the underlying administrative order with the benefit of non-conflicted counsel is clearly prejudicial.” No. 17-60307 (May 14, 2017, unpublished).

An unusual but intriguing coverage dispute arose after the insured’s death as a result of a bite from a mosquito infected with the dangerous West Nile virus. The Fifth Circuit reversed summary judgment for the carrier, observing in its analysis of the policy’s coverage for “accidental injury” –

An unusual but intriguing coverage dispute arose after the insured’s death as a result of a bite from a mosquito infected with the dangerous West Nile virus. The Fifth Circuit reversed summary judgment for the carrier, observing in its analysis of the policy’s coverage for “accidental injury” –

- The importance of defining the specific injury – “Instead of focusing on Melton’s bite from a WNV-infected Culex mosquito, Minnesota Life argues that a mosquito bite generally is not unexpected and unforeseen in Texas. But a bite by a generic mosquito is not the accidental injury Gloria pleaded in her complaint; instead, she says it is the bite by a WNV-infected Culex mosquito that triggers coverage. Without guidance from the policy as to how broadly or narrowly an ;’accidental bodily injury’ is to be defined, we take the facts of the alleged accidental injury as

Gloria contends.” - And as to whether an injury as “accidental” – the Court quoted then-Judge Cardozo’s analysis from a 1925 opinion about inhalation of an airborne pathogen: “Germs may indeed be inhaled through the nose or mouth, or absorbed into the system through normal channels of entry. In such cases their inroads will seldom, if ever, be assignable to a determinate or single act, identified in space or time. For this as well as for the reason that the absorption is incidental to a bodily process both natural and normal, their action presents itself to the mind as a disease and not an accident.”

- But the Court distinguished the situation addressed by Judge Cardozo: “Here, however, there was a determinate, single act—the bite—that is not incidental to a bodily process. The mosquito, an external “physical” force, affirmatively acted to cause Melton harm and produce an unforeseen result. We find that inhaling a community-spread pathogen and being bitten by a mosquito can be thinly sliced so as to be distinguishable.”

Wells v. Minnesota Life, No. 16-20831 (March 22, 2018).

The plaintiff in Al Copeland Investments LLC v. First Specialty Ins. Corp. sued on an insurance policy about a claim for property damage to its business. It argued that this forum selection clause in the policy:

The plaintiff in Al Copeland Investments LLC v. First Specialty Ins. Corp. sued on an insurance policy about a claim for property damage to its business. It argued that this forum selection clause in the policy:

“The parties irrevocably submit to the exclusive jurisdiction of the Courts of the State of New York and to the extent permitted by law the parties expressly waive all rights to challenge or otherwise limit such jurisdiction.”

was trumped by this Louisiana statute:

“No insurance contract delivered or issued . . . in [Louisiana] . . . shall contain any condition, stipulation, or agreement . . . [d]epriving the courts of [Louisiana] of the jurisdiction of action against the insurer.”

The Fifth Circuit disagreed and affirmed dismissal based on forum non conveniens: “[The statute] prohibits provisions in an insurance contract that would deprive Louisiana courts of jurisdiction. ‘A forum-selection clause is a provision . . . that mandates a particular state, county, parish, or court as the proper venue in which the parties to an action must litigate . . . .’ As the district court recognized, venue and jurisdiction are ‘separate and distinct.'” No. 17-30557 (March 9, 2018) (emphasis in original).

Three tugboats towed a barge; one of the tugboats served as the “lead” while the other two assisted. One of the assisting tugboats had an accident and sank. The question for the Fifth Circuit in Continental Insurance v. L&L Marine Transportation was whether the sunken boat was a “tow” of the lead boat, and thus came within the coverage of the insurance policy for the lead. (As distinct from a TOW missile, right.) Reviewing dictionaries and court precedent, the Court concluded that “tow” describes a situation where “some ship or boat is being provided extra motive power from another ship or boat by being pushed or pulled,” which was not the case here. The Court rejected an argument based on the maritime “dominant mind” doctrine – a concept derived from the duty of a lead boat in a flotilla to navigate resonably – as bearing only on potential tort liability and not the issue of interpreting the terms of this insurance policy. No. 17-30424 (Feb. 15, 2018).

Three tugboats towed a barge; one of the tugboats served as the “lead” while the other two assisted. One of the assisting tugboats had an accident and sank. The question for the Fifth Circuit in Continental Insurance v. L&L Marine Transportation was whether the sunken boat was a “tow” of the lead boat, and thus came within the coverage of the insurance policy for the lead. (As distinct from a TOW missile, right.) Reviewing dictionaries and court precedent, the Court concluded that “tow” describes a situation where “some ship or boat is being provided extra motive power from another ship or boat by being pushed or pulled,” which was not the case here. The Court rejected an argument based on the maritime “dominant mind” doctrine – a concept derived from the duty of a lead boat in a flotilla to navigate resonably – as bearing only on potential tort liability and not the issue of interpreting the terms of this insurance policy. No. 17-30424 (Feb. 15, 2018).

The question of timely notice to a carrier can give rise to close questions about insurance coverage. Nautilus Ins. Co. v. Miranda-Mondragon, however, presented a straightforward issue: “The first notice Nautilus received of the lawsuit came from Miranda-Mondragon’s counsel 41 days after the state court entered default judgment . . . . The delayed notice prejudiced Nautilus as a matter of law and relieved Nautilus of liability under the policy.” No. 17-20261 (Oct. 20, 2017, unpublished).

The question of timely notice to a carrier can give rise to close questions about insurance coverage. Nautilus Ins. Co. v. Miranda-Mondragon, however, presented a straightforward issue: “The first notice Nautilus received of the lawsuit came from Miranda-Mondragon’s counsel 41 days after the state court entered default judgment . . . . The delayed notice prejudiced Nautilus as a matter of law and relieved Nautilus of liability under the policy.” No. 17-20261 (Oct. 20, 2017, unpublished).

Ramirez, on work trips to West Texas, contracted a fungal infection that led to the loss of an eye. His employee insurance plan would pay benefits “if an employee is injured as a result of an Accident, and that Injury is independent of Sickness and all other causes.” Based on the definitions of “Accident and “Sickness” in the policy, the Fifth Circuit affirmed summary judgment for the insurer. Ramirez tried to come within a “carve-back” provision at the end of the “Accident” definition, which extended coverage to “bacterial infection that is the natural and foreseeable result of an accidental external bodily Injury or accidental food poisoning, but the Court concluded that “neither the policy’s language nor its structure indicates that this provision applies beyond those two specific occurrences.” Ramirez v. United of Omaha Life Ins. Co., No. 16-11660 (Oct. 6, 2017).

Ramirez, on work trips to West Texas, contracted a fungal infection that led to the loss of an eye. His employee insurance plan would pay benefits “if an employee is injured as a result of an Accident, and that Injury is independent of Sickness and all other causes.” Based on the definitions of “Accident and “Sickness” in the policy, the Fifth Circuit affirmed summary judgment for the insurer. Ramirez tried to come within a “carve-back” provision at the end of the “Accident” definition, which extended coverage to “bacterial infection that is the natural and foreseeable result of an accidental external bodily Injury or accidental food poisoning, but the Court concluded that “neither the policy’s language nor its structure indicates that this provision applies beyond those two specific occurrences.” Ramirez v. United of Omaha Life Ins. Co., No. 16-11660 (Oct. 6, 2017).

In Mainali v. Covington Specialty Ins. Co., the Fifth Circuit addressed “whether a payment made to comply with an appraisal award, which in most if not all cases is going to be paid after the 60-day window [set by the Texas Prompt Payment statute], is subject to [a statutory] penalty.” In an Erie analysis, the Court followed intermediate Texas authority that held such a payment was not subject to those statutory penalties, observing: “Covington was not trying to avoid payment of the claim; it was invoking a contractually agreed to mechanism for assessing the amount it owed.” No. 17-10350 (revised Sept. 27, 2017).

In Mainali v. Covington Specialty Ins. Co., the Fifth Circuit addressed “whether a payment made to comply with an appraisal award, which in most if not all cases is going to be paid after the 60-day window [set by the Texas Prompt Payment statute], is subject to [a statutory] penalty.” In an Erie analysis, the Court followed intermediate Texas authority that held such a payment was not subject to those statutory penalties, observing: “Covington was not trying to avoid payment of the claim; it was invoking a contractually agreed to mechanism for assessing the amount it owed.” No. 17-10350 (revised Sept. 27, 2017).