In Lewis Brisbois Bisgaard & Smith LLP v. Bitgood, the Fifth Circuit vacated statutory damages awarded under the Lanham Act, remanding because the district court did not explain the statutory basis for its award in light of a gap in registration for the primary mark at issue. The panel rejected the argument that a prior panel’s footnote foreclosed statutory damages, characterizing that statement as dicta.

Central to the ruling was the Court’s recognition that statutory damages under 15 U.S.C. § 1117(c) require infringement of a registered mark under § 1114(1)(a). Because the “Lewis Brisbois Bisgaard & Smith” registration had lapsed during the relevant period, the panel concluded it could not assess whether the award could be sustained by other, similar registered marks allegedly “identical with, or substantially indistinguishable from,” the misused name. The Fifth Circuit also directed the district court to address a Seventh Amendment issue on remand. No. 24-20458, Oct. 23, 2025

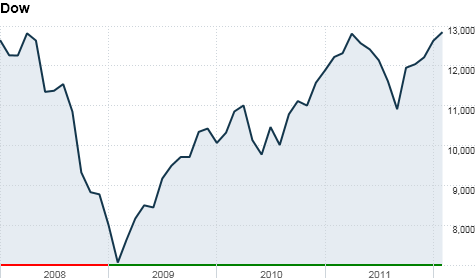

reaty Energy sued for its damages after an involuntary bankruptcy petition against it was dismissed. One of its claims sought damages for losses in connection with attempts to sell its restricted stock during that period. The Fifth Circuit affirmed summary judgment for the defendants, noting: (1) “Though the sales price of restricted shares did fluctuate, it averaged 0.5¢ immediately before, during, and after the pendency of the involuntary petition, and (2) the affiant about an alleged plan to sell restricted shares at a substantial discount lacked personal knowledge, claiming only that he “did assist in the process when requested, which included gathering information when given direct instructions by his superiors.”

reaty Energy sued for its damages after an involuntary bankruptcy petition against it was dismissed. One of its claims sought damages for losses in connection with attempts to sell its restricted stock during that period. The Fifth Circuit affirmed summary judgment for the defendants, noting: (1) “Though the sales price of restricted shares did fluctuate, it averaged 0.5¢ immediately before, during, and after the pendency of the involuntary petition, and (2) the affiant about an alleged plan to sell restricted shares at a substantial discount lacked personal knowledge, claiming only that he “did assist in the process when requested, which included gathering information when given direct instructions by his superiors.”