The trustee of a litigation trust formed from the bankruptcy of Idearc, Inc. sued its former parent, Verizon, alleging billions of dollars in damages in connection with its spinoff. After a bench trial and several other orders, the district court ruled in favor of defendants, and the Fifth Circuit affirmed in U.S. Bank, N.A. v. Verizon Communications, No. 13-10752 (revised Sept. 2, 2014).

The opinion, while lengthy, still only hints at the complexity of the case, and much of its analysis is fact-specific. Some of the issues addressed include:

1. A bankruptcy litigation trust does not have a right to jury trial on a fraudulent transfer claim, when the defendant creditor has filed a proof of claim in the bankruptcy, and the bankruptcy court must resolve whether a fraudulent transfer occurred to rule on that claim (analyzing and applying Langemkamp v. Culp, 498 U.S. 42 (1990), in light of Stern v. Marshall, 131 S. Ct. 2594 (2011)).

2. In the context of determining whether the district court reviewed an earlier ruling correctly, on pages 26-27, the Court provided crisp definitions of the basic concepts of dictum and holding.

3. In the course of rejecting an argument about the refusal to admit several pieces of evidence, the Court noted that the trustee “does not discuss how each specific piece of evidence was likely to affect the outcome of the trial, in light of all the evidence presented.”

4. A defense expert, without experience in the particular industry, was still qualified to speak to valuation methodology in the bench trial, and “we cannot reverse the district court for adopting one permissible view over the other.”

5. The Court thoroughly reviewed the fiduciary duties owed from a parent to a subsidiary under Delaware law, while affirming the district court’s conclusions about causation associated with their alleged breach.

A civilian treatement of contract formation appears in

A civilian treatement of contract formation appears in

In

In

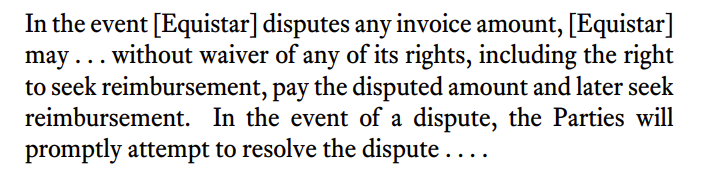

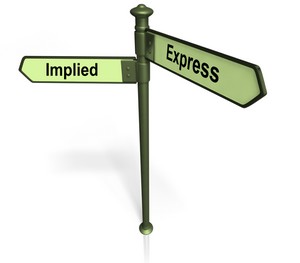

pects of a deed of trust. With respect to when a servicer could pay the borrower’s property taxes by the servicer, the key provision used the fact-specific phrase “reasonable or appropriate”; other provisions both suggested that the power was limited to back taxes, but also that it could be made “at any time.” Accordingly, “Wease was entitled to proceed to trial on his claim that Ocwen breached the contract by paying his 2010 taxes before the tax lien attached and before they became delinquent.” This analysis led to finding a triable fact issue as to whether Ocwen provided adequate notice of its actions.

pects of a deed of trust. With respect to when a servicer could pay the borrower’s property taxes by the servicer, the key provision used the fact-specific phrase “reasonable or appropriate”; other provisions both suggested that the power was limited to back taxes, but also that it could be made “at any time.” Accordingly, “Wease was entitled to proceed to trial on his claim that Ocwen breached the contract by paying his 2010 taxes before the tax lien attached and before they became delinquent.” This analysis led to finding a triable fact issue as to whether Ocwen provided adequate notice of its actions.

bout Transocean’s ability to recover “maintenance and cure” payments to Boudreaux, a seaman, the parties reached a “high-low” settlement agreement. The Fifth Circuit then held — in an outcome not clearly anticipated by the parties’ deal — that Transocean had no affirmative right of recovery as against Boudreaux,but did have a right to make offsets against future payments.

bout Transocean’s ability to recover “maintenance and cure” payments to Boudreaux, a seaman, the parties reached a “high-low” settlement agreement. The Fifth Circuit then held — in an outcome not clearly anticipated by the parties’ deal — that Transocean had no affirmative right of recovery as against Boudreaux,but did have a right to make offsets against future payments.