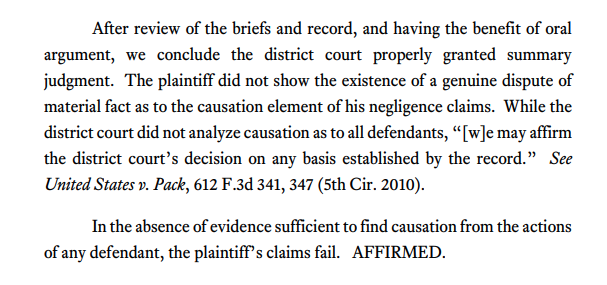

Central Crude, Inc. v. Liberty Mutual confirms that under Louisiana law, a pollution exclusion doesn’t require the insured to have the ultimate fault for the alleged pollution:

Central Crude, Inc. v. Liberty Mutual confirms that under Louisiana law, a pollution exclusion doesn’t require the insured to have the ultimate fault for the alleged pollution:

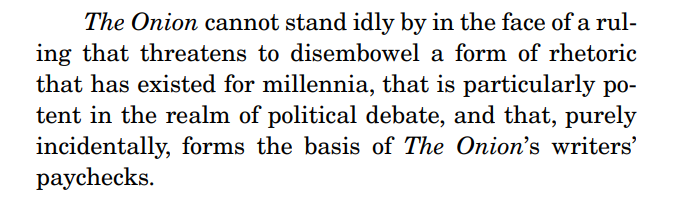

Neither the CGL policy nor [the Louisiana Supreme Court’s opinion in Doerr] requires identification of the party at fault for the oil spill in determining whether the total pollution exclusion applies here. The CGL policy’s total pollution exclusion broadly precludes coverage for bodily injury or property damage that “would not have occurred in whole or in part but for the actual, alleged or threatened discharge, dispersal, seepage, migration, release or escape of ‘pollutants’ at any time.” The provision requires a dispersal of pollutants but makes no requirement that the party responsible for the dispersal be determined.

No. 21-30707 (Oct. 26, 2022).