After trial of a Lanham Act claim involving the right to use the term “Cowboy” in advertising bourbon, the jury found abandonment of the plaintiff’s alleged mark, and the Fifth Circuit affirmed. “As the district court observed, the jury fairly rejected the testimony of Allied’s founder, Marci Palatella, and Allied’s price lists as evidence of intent to resume use. . . . Garrison Brothers presented evidence undermining Palatella’s contention that Allied specializes in old, rare, and expensive whiskeys; disputing Palatella’s reliance on a bourbon shortage as a reason for Allied’s failure to sell ‘COWBOY LITTLE BARREL’ bourbon after 2009; and highlighting Palatella’s inconsistent testimony concerning Allied’s price lists.” Allied Lomar, Inc. v. Lone Star Distillery LLC, No. 17-50148 (July 17, 2018, unpublished).

After trial of a Lanham Act claim involving the right to use the term “Cowboy” in advertising bourbon, the jury found abandonment of the plaintiff’s alleged mark, and the Fifth Circuit affirmed. “As the district court observed, the jury fairly rejected the testimony of Allied’s founder, Marci Palatella, and Allied’s price lists as evidence of intent to resume use. . . . Garrison Brothers presented evidence undermining Palatella’s contention that Allied specializes in old, rare, and expensive whiskeys; disputing Palatella’s reliance on a bourbon shortage as a reason for Allied’s failure to sell ‘COWBOY LITTLE BARREL’ bourbon after 2009; and highlighting Palatella’s inconsistent testimony concerning Allied’s price lists.” Allied Lomar, Inc. v. Lone Star Distillery LLC, No. 17-50148 (July 17, 2018, unpublished).

Monthly Archives: July 2018

In addition to inspiring 600Camp’s most painful pun of 2018, Ditech Financial LLC v. Naumann provides a thorough summary of the requirement – unique to default judgments, among all judgments available under the Federal Rules – that the relief awarded “must not differ in kind from, or exceed in amount, what is demanded in the pleadings.” As applied here, “Ditech’s demand for judicial foreclosure gave meaningful notice that, in the event of default, a writ of possession would issue in favor of the foreclosure-sale purchaser. Texas’s process of enforcing a judicial foreclosure—and specifically its mechanism for enforcing the foreclosure sale— entails issuance of the writ. Accordingly, in this case the judgment’s provision for future issuance of the writ did not expand or alter the kind or amount of relief prayed for by Ditech.” No. 17-50616 (July 19, 2018, unpublished).

In addition to inspiring 600Camp’s most painful pun of 2018, Ditech Financial LLC v. Naumann provides a thorough summary of the requirement – unique to default judgments, among all judgments available under the Federal Rules – that the relief awarded “must not differ in kind from, or exceed in amount, what is demanded in the pleadings.” As applied here, “Ditech’s demand for judicial foreclosure gave meaningful notice that, in the event of default, a writ of possession would issue in favor of the foreclosure-sale purchaser. Texas’s process of enforcing a judicial foreclosure—and specifically its mechanism for enforcing the foreclosure sale— entails issuance of the writ. Accordingly, in this case the judgment’s provision for future issuance of the writ did not expand or alter the kind or amount of relief prayed for by Ditech.” No. 17-50616 (July 19, 2018, unpublished).

An element of judicial estoppel is that “a court accepted the prior position” that is inconsistent with a party’s position in the case at hand. In Fornesa v. Fifth Third Mortgage Co., a bankruptcy debtor’s failure to amend his financial schedules satisfied that requirement, as “the bankruptcy court . . . implicitly accepted the representation by operating as though [Debtor’s] financial status were unchanged. ‘Had the court been aware . . . it may well have altered the plan.'” No. 17-20324 (July 27, 2018).

An element of judicial estoppel is that “a court accepted the prior position” that is inconsistent with a party’s position in the case at hand. In Fornesa v. Fifth Third Mortgage Co., a bankruptcy debtor’s failure to amend his financial schedules satisfied that requirement, as “the bankruptcy court . . . implicitly accepted the representation by operating as though [Debtor’s] financial status were unchanged. ‘Had the court been aware . . . it may well have altered the plan.'” No. 17-20324 (July 27, 2018).

The issue in Kirchner v. Deutsche Bank was whether a spouse’s signature on a deed of trust – but not the loan instrument – satisfied the Texas Constitution’s requirements about home equity loans. The Fifth Circuit found the issue was squarely addressed by a prior unpublished opinion, which it called “persuasive,” and affirmed – this time, in a published opinion. The broader principle is that unpublished opinions can work their way into published “status” when the issues they address are recurring ones. No. 17-50736 (July 11, 2018).

The issue in Kirchner v. Deutsche Bank was whether a spouse’s signature on a deed of trust – but not the loan instrument – satisfied the Texas Constitution’s requirements about home equity loans. The Fifth Circuit found the issue was squarely addressed by a prior unpublished opinion, which it called “persuasive,” and affirmed – this time, in a published opinion. The broader principle is that unpublished opinions can work their way into published “status” when the issues they address are recurring ones. No. 17-50736 (July 11, 2018).

A practical tidbit about whether a notice of appeal is “jurisdictional” appeared during the last SCOTUS term in Hamer v. Neighborhood Housing Services: “Several Courts of Appeals, including the Court of Appeals in Hamer’s case, have tripped over our statement in Bowles [v. Russell, 551 U. S. 205, 210–213 (2007)], that “the taking of an appeal within the prescribed time is ‘mandatory and jurisdictional.’ The ‘mandatory and jurisdictional’ formulation is a characterization left over from days when we were ‘less than meticulous’ in our use of the term ‘jurisdictional.’ The statement was correct as applied in Bowles because, as the Court there explained, the time prescription at issue in Bowles was imposed by Congress. But ‘mandatory and jurisdictional’ is erroneous and confounding terminology where, as here, the relevant time prescription is absent from the U.S. Code. Because Rule 4(a)(5)(C), not § 2107, limits the length of the extension granted here, the time prescription is not jurisdictional.” No. 16-658 (Nov. 18, 2017) (citations and footnote omitted).

A practical tidbit about whether a notice of appeal is “jurisdictional” appeared during the last SCOTUS term in Hamer v. Neighborhood Housing Services: “Several Courts of Appeals, including the Court of Appeals in Hamer’s case, have tripped over our statement in Bowles [v. Russell, 551 U. S. 205, 210–213 (2007)], that “the taking of an appeal within the prescribed time is ‘mandatory and jurisdictional.’ The ‘mandatory and jurisdictional’ formulation is a characterization left over from days when we were ‘less than meticulous’ in our use of the term ‘jurisdictional.’ The statement was correct as applied in Bowles because, as the Court there explained, the time prescription at issue in Bowles was imposed by Congress. But ‘mandatory and jurisdictional’ is erroneous and confounding terminology where, as here, the relevant time prescription is absent from the U.S. Code. Because Rule 4(a)(5)(C), not § 2107, limits the length of the extension granted here, the time prescription is not jurisdictional.” No. 16-658 (Nov. 18, 2017) (citations and footnote omitted).

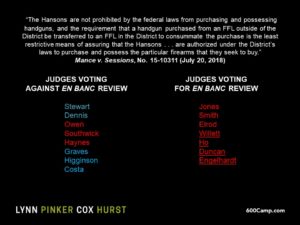

Rehearing motions led to a revised panel opinion and an en banc vote in Mance v. Sessions, a Constitutional challenge to restrictions on handgun sales by an authorized federally-licensed firearm dealer, to a purchaser who lives in a different state from the dealer. The revised opinion affirming the restrictions stood, with the Court voting 9-7 against rehearing en banc. Two of the three dissents from the vote were written by recent nominees of President Trump, with all of his nominees joining the vote in favor of review. Notably, this vote reflects two vacancies at the time it was conducted (one of which has since been filled with the confirmation of Judge Oldham, and other to be filled when a nomination is made to replace Judge Jolly of Mississippi). Assuming the two nominees would join the other new judges in their view of this case, their addition would be outcome-determinative as to its en banc review.

Rehearing motions led to a revised panel opinion and an en banc vote in Mance v. Sessions, a Constitutional challenge to restrictions on handgun sales by an authorized federally-licensed firearm dealer, to a purchaser who lives in a different state from the dealer. The revised opinion affirming the restrictions stood, with the Court voting 9-7 against rehearing en banc. Two of the three dissents from the vote were written by recent nominees of President Trump, with all of his nominees joining the vote in favor of review. Notably, this vote reflects two vacancies at the time it was conducted (one of which has since been filled with the confirmation of Judge Oldham, and other to be filled when a nomination is made to replace Judge Jolly of Mississippi). Assuming the two nominees would join the other new judges in their view of this case, their addition would be outcome-determinative as to its en banc review.

The Senate has now confirmed Andrew Oldham of Texas as the newest judge on the Fifth Circuit. Congratulations and every best wish to Judge Oldham.

The Senate has now confirmed Andrew Oldham of Texas as the newest judge on the Fifth Circuit. Congratulations and every best wish to Judge Oldham.

A difficult question of administrative law produced a divided panel in Collins v. Mnuchin. The panel majority concluded that the Federal Housing Finance Agency (a regulator for Fannie Mae and Freddie Mac created by Congress in the wake of the 2008 financial crisis) was unconstitutionally structured. After careful review of the Supreme Court’s precedents in the area, the panel excised a “for cause” limitation on the removal of FHFA’s director from the relevant statute, finding that with this revision “the FHFA survives as a properly supervised executive agency.” One dissent took issue with that holding; another dissent criticized the majority’s conclusion that the specific FHFA action at issue – a “net worth sweep” requiring payment of substantial quarterly dividends to the Treasury by Fannie and Freddie – was within the scope of FHFA’s statutory authority and thus insulated from judicial review. No. 17-20364 (July 16, 2018).

A difficult question of administrative law produced a divided panel in Collins v. Mnuchin. The panel majority concluded that the Federal Housing Finance Agency (a regulator for Fannie Mae and Freddie Mac created by Congress in the wake of the 2008 financial crisis) was unconstitutionally structured. After careful review of the Supreme Court’s precedents in the area, the panel excised a “for cause” limitation on the removal of FHFA’s director from the relevant statute, finding that with this revision “the FHFA survives as a properly supervised executive agency.” One dissent took issue with that holding; another dissent criticized the majority’s conclusion that the specific FHFA action at issue – a “net worth sweep” requiring payment of substantial quarterly dividends to the Treasury by Fannie and Freddie – was within the scope of FHFA’s statutory authority and thus insulated from judicial review. No. 17-20364 (July 16, 2018).

A succinct case study in bankruptcy standing appears in Furlough v. Cage: “Furlough’s primary contention is that, but for NOV’s proof of claim, Technicool’s assets would exceed its debt, and he would be entitled to any estate surplus. Because SBPC represents both NOV and the Trustee, Furlough argues, it might fail to disclose any problems with NOV’s claim, robbing him of the possibility of recovering a surplus. This speculative prospect of harm is far from a direct, adverse, pecuniary hit. Furlough must clear a higher standing hurdle: The order must burden his pocket before he burdens a docket.” No. 17-20603 (July 16, 2018) (emphasis added).

A succinct case study in bankruptcy standing appears in Furlough v. Cage: “Furlough’s primary contention is that, but for NOV’s proof of claim, Technicool’s assets would exceed its debt, and he would be entitled to any estate surplus. Because SBPC represents both NOV and the Trustee, Furlough argues, it might fail to disclose any problems with NOV’s claim, robbing him of the possibility of recovering a surplus. This speculative prospect of harm is far from a direct, adverse, pecuniary hit. Furlough must clear a higher standing hurdle: The order must burden his pocket before he burdens a docket.” No. 17-20603 (July 16, 2018) (emphasis added).

An emotionally-charged lawsuit about the disposal of embryonic and fetal tissue led to an unfortunately-timed subpoena (during Holy Week) to the Texas Conference of Catholic Bishops, which in turn led to emergency appellate proceedings. The Fifth Circuit’s panel majority found the order was appealable as an interlocutory order notwithstanding Mohawk Indus. v. Carpenter, 558 U.S. 100 (2009), noting the importance of the First Amendment issues involved and that “Mohawk does not speak to the predicament of third parties, whose claims to reasonable protection from the courts have often been met with respect.” A dissenting opinion would not have accepted the interlocutory appeal, noting that mandamus was also available (although requiring a “clear and indisputable” right rather than simply a substantial question), and observing that the movants’ “failure to object to the in camera inspection [at issue] certainly forfeits an appellate challenge to it, and the affirmative act of producing the documents likely amounts to full-scale waiver.” Whole Woman’s Health v. Smith, No. 18-50484 (revised July 17, 2018).

An emotionally-charged lawsuit about the disposal of embryonic and fetal tissue led to an unfortunately-timed subpoena (during Holy Week) to the Texas Conference of Catholic Bishops, which in turn led to emergency appellate proceedings. The Fifth Circuit’s panel majority found the order was appealable as an interlocutory order notwithstanding Mohawk Indus. v. Carpenter, 558 U.S. 100 (2009), noting the importance of the First Amendment issues involved and that “Mohawk does not speak to the predicament of third parties, whose claims to reasonable protection from the courts have often been met with respect.” A dissenting opinion would not have accepted the interlocutory appeal, noting that mandamus was also available (although requiring a “clear and indisputable” right rather than simply a substantial question), and observing that the movants’ “failure to object to the in camera inspection [at issue] certainly forfeits an appellate challenge to it, and the affirmative act of producing the documents likely amounts to full-scale waiver.” Whole Woman’s Health v. Smith, No. 18-50484 (revised July 17, 2018).

Fisk Electric, a subcontractor, sued the general contractor and its surety under the Miller Act, a “federal statute that requires general contractors to secure payment to subcontractors on most federal construction projects.” Fisk claimed it was The dispute involved the inducement into of a settlement agreement; the specific issue on appeal was “whether the party alleging fraud must engage in active investigation to satisfy the standard of justifiable reliance.” In something of a counterpoint to recent Texas cases such as JP Morgan Chase v. Orca Assets, No. 15-0712 (Tex. March 23, 2018), the Court concluded that it was not, and Fisk was entitled to rely on the general contractor’s representations in these particular negotiations. Fisk Elec. Co. v. DQSI LLC, No. 17-30091 (June 29, 2018).

In-N-Out attempted to keep its employees from wearing buttons in support of the”Fight for $15″ minimum wage campaign (right, approximately actual size). The NLRB found this was an unfair labor practice and the Fifth Circuit affirmed. Presumptively unreasonable under federal labor law, In-N-Out argued that the ban fell within a “special circumstances” exception for reasons of the company’s public image and food safety. Both arguments failed, in large part because the company required the wearing of significantly larger buttons during the Christmas season and a charitable fund drive each April. In-N-Out-Burger v. NLRB, No. 17-60241 (July 6, 2018).

In-N-Out attempted to keep its employees from wearing buttons in support of the”Fight for $15″ minimum wage campaign (right, approximately actual size). The NLRB found this was an unfair labor practice and the Fifth Circuit affirmed. Presumptively unreasonable under federal labor law, In-N-Out argued that the ban fell within a “special circumstances” exception for reasons of the company’s public image and food safety. Both arguments failed, in large part because the company required the wearing of significantly larger buttons during the Christmas season and a charitable fund drive each April. In-N-Out-Burger v. NLRB, No. 17-60241 (July 6, 2018).

The plaintiffs in Firefighters’ Retirement System v. Grant Thornton LLP alleged that Grant Thornton waived its right to insist on presuit review of the claims by a review panel, as ordinarily required by Louisiana law. The Fifth Circuit rejected this argument, finding:

The plaintiffs in Firefighters’ Retirement System v. Grant Thornton LLP alleged that Grant Thornton waived its right to insist on presuit review of the claims by a review panel, as ordinarily required by Louisiana law. The Fifth Circuit rejected this argument, finding:

- Judicial estoppel did not apply to an allegedly inconsistent litigation position by Grant Thornton when the district court did not accept it (notably, stating the elements of the doctrine in a way that does not require the statement to have been made in a different proceeding), and

- Grant Thornton did not waive this requirement, distinguishing (and criticizing) a Louisiana appellate opinion on the issue, and noting that the litigation had been stayed for a lengthy period such that GT had not yet even filed an answer.

Accordingly, the court affirmed the dismissal of plaintiffs’ claims because of preemption. No. 17-30274 (July 3, 2018).

Applying Singh v. RadioShack Corp., 882 F.3d 137 (5th Cir. 2018), which in turn relied upon Fifth Third Bancorp v. Dudenhoeffer, 134 S. Ct. 2459 (2014), the Fifth Circuit rejected a duty-of-prudence claim against an ERISA fiduciary based on the defendants allowing investments to continue a troubled company’s stock. Specifically, the plaintiffs alleged that the defendants “knew that it was inappropriate to rely on the market price of Idearc stock because their own fraudulent activities had caused the public markets to overvalue Idearc stock.” The Court did not agree: “[T]he alleged fraud is by definition not public information, and [Plaintiff] does not address how this information would affect the reliability of the market price ‘as an unbiased assessment of the security’s value in light of all public information.'” No. 16-11590 (June 27, 2018).

Applying Singh v. RadioShack Corp., 882 F.3d 137 (5th Cir. 2018), which in turn relied upon Fifth Third Bancorp v. Dudenhoeffer, 134 S. Ct. 2459 (2014), the Fifth Circuit rejected a duty-of-prudence claim against an ERISA fiduciary based on the defendants allowing investments to continue a troubled company’s stock. Specifically, the plaintiffs alleged that the defendants “knew that it was inappropriate to rely on the market price of Idearc stock because their own fraudulent activities had caused the public markets to overvalue Idearc stock.” The Court did not agree: “[T]he alleged fraud is by definition not public information, and [Plaintiff] does not address how this information would affect the reliability of the market price ‘as an unbiased assessment of the security’s value in light of all public information.'” No. 16-11590 (June 27, 2018).

Courtesy of the Huffington Post, here are seven good trivia questions about the Declaration of Independence to enjoy on your July 4 holiday.

Courtesy of the Huffington Post, here are seven good trivia questions about the Declaration of Independence to enjoy on your July 4 holiday.