While the mortgage debtor was in default, a notice provision in the related deed of trust was an independent obligation, the breach of which could support a stand-alone action against the foreclosing party. “If performance of the terms of a deed of trust governing the parties’ rights and obligations in the event of default can always be excused by pointing to the debtor’s default under the terms off the note, the notice terms have no meaning.” That said, the Court noted that on remand, the claim would have to withstand attacks on thie measure of damage as well as causation. Williams v. Wells Fargo Bank, No. 16-20507 (Feb. 26, 2018).

While the mortgage debtor was in default, a notice provision in the related deed of trust was an independent obligation, the breach of which could support a stand-alone action against the foreclosing party. “If performance of the terms of a deed of trust governing the parties’ rights and obligations in the event of default can always be excused by pointing to the debtor’s default under the terms off the note, the notice terms have no meaning.” That said, the Court noted that on remand, the claim would have to withstand attacks on thie measure of damage as well as causation. Williams v. Wells Fargo Bank, No. 16-20507 (Feb. 26, 2018).

Monthly Archives: February 2018

Gotech, a Chinese company, “knowingly chose to ignore” a lawsuit filed against it by Nagravision in the Southern District of Texas, “and even the ensuing $100 million-plus default judgment” in favor of Nagravasion. After Nagravision began enforcement proceedings in Hong Kong, Gotech then sought relief from the judgment under Fed. R. Civ. P. 60(b)(4). The Fifth Circuit rejected challenges based on standing, federal question jurisdiction, and service of process, finding fundamental problems with each. As for personal jurisdiction based on Fed. R. Civ. P. 4(k)(2), which applies “where the defendant has contacts with the United States as a whole sufficient to satisfy due process concerns and the defendnat is not subject to jurisdiction in any particular state,” the Court acknowledged some disagreement about who has the burden of proof, especially in the Rule 60(b)(4) context, but found that Nagravision had met its initial burden and Gotech had not overcome it. Nagravision, S.A. v. GoTech bInt’l Tech. Ltd., No. 16-20817 (Feb. 7, 2018).

Gotech, a Chinese company, “knowingly chose to ignore” a lawsuit filed against it by Nagravision in the Southern District of Texas, “and even the ensuing $100 million-plus default judgment” in favor of Nagravasion. After Nagravision began enforcement proceedings in Hong Kong, Gotech then sought relief from the judgment under Fed. R. Civ. P. 60(b)(4). The Fifth Circuit rejected challenges based on standing, federal question jurisdiction, and service of process, finding fundamental problems with each. As for personal jurisdiction based on Fed. R. Civ. P. 4(k)(2), which applies “where the defendant has contacts with the United States as a whole sufficient to satisfy due process concerns and the defendnat is not subject to jurisdiction in any particular state,” the Court acknowledged some disagreement about who has the burden of proof, especially in the Rule 60(b)(4) context, but found that Nagravision had met its initial burden and Gotech had not overcome it. Nagravision, S.A. v. GoTech bInt’l Tech. Ltd., No. 16-20817 (Feb. 7, 2018).

“[Kansas City] Southern [Railway] was caught between hundreds of thousands of tons of rock and a hard place.” Problems with the construction of a new rail line in South Texas resulted in a dispute about payment for 74,260 tons of “rail ballast” – crushed stone that forms the base for the train tracks. The railway won the resulting litigation against its contractor, and the Fifth Circuit rejected several rocks thrown at the damages model, observing:

“[Kansas City] Southern [Railway] was caught between hundreds of thousands of tons of rock and a hard place.” Problems with the construction of a new rail line in South Texas resulted in a dispute about payment for 74,260 tons of “rail ballast” – crushed stone that forms the base for the train tracks. The railway won the resulting litigation against its contractor, and the Fifth Circuit rejected several rocks thrown at the damages model, observing:

- Acknowledging that the payments made had to be reasonable, the Court reminded that “magic words” are not needed, and found that on this record: “Reasonableness can thus be demonstrated by the general market prices Southern was paying for these expenses before it had any knowledge that some excess ballast costs would be passed on to Balfour via litigation.

- Evidence of post-breach costs was appropriate, as the substantive damage calculation looks at the difference between “what Southern expected” and “the cost Southern ultimately had to pay (value received)”;

- Southern acted appropriately, and the defenses of waiver and quasi-estoppel did not apply: “It could have refused to ship additional ballast at Balfour’s request, but that would have necessitated stopping the project, finding a new contractor, and

resuming later, all of which likely would have cost substantially more than the

damages awarded here. Southern had a duty to mitigate as much as possible.

It did so by allowing Balfour to finish the project and then determining the

extent of damages.”

Concluding that the record was rock-solid, the Court affirmed. Balfour Beatty Rail v. Kansas City Southern Railway, No. 16-11645 (Feb. 15, 2018, unpublished).

“Not all errors are correctable on mandamus. This one, however is.” In the case of In re: Itron, the Fifth Circuit granted mandamus relief as to a finding of an extensive waiver of attorney-client privilege, reasoning:

“Not all errors are correctable on mandamus. This one, however is.” In the case of In re: Itron, the Fifth Circuit granted mandamus relief as to a finding of an extensive waiver of attorney-client privilege, reasoning:

- Itron showed the “inadequacy of relief by other means” as to the erroneous disclosure of privileged documents, especially since it had “exhausted every other opportunity for interlocutory review of the magistrate judge”s order compellig production”;

- Itron established a clear abuse of discretion: “[T]he magistrate judge failed to apply Mississippi”s Jackson Medical test for waiver, and misapplied even the broad, erroneous waiver test Defendants urge instead. . . . [B]oth aspects of this error are obvious and purely legal in nature.”; and

- “[C]orrecting this error is a proper exercise of our discretion,” noting “the issue’s ‘importance beyond the immediate case'” in other disputes about privilege, as “more district courts could mistakenly find waiver whenever attorney-client communications would be relevant.”

A dissent said that a clear abuse of discretion had not been established. This opinion does not reflect any sea change in the Fifth Circuit’s willingness to grant mandamus relief, but it does show that even a court reluctant to grant such relief will do so in a compelling case (indeed, the panel majority opinion is written by Judge Higginson, who dissented from the panel opinion and subsequent denial of en banc review in In re: Radmax, 720 F.3d 285 (5th Cir. 2013).

Three tugboats towed a barge; one of the tugboats served as the “lead” while the other two assisted. One of the assisting tugboats had an accident and sank. The question for the Fifth Circuit in Continental Insurance v. L&L Marine Transportation was whether the sunken boat was a “tow” of the lead boat, and thus came within the coverage of the insurance policy for the lead. (As distinct from a TOW missile, right.) Reviewing dictionaries and court precedent, the Court concluded that “tow” describes a situation where “some ship or boat is being provided extra motive power from another ship or boat by being pushed or pulled,” which was not the case here. The Court rejected an argument based on the maritime “dominant mind” doctrine – a concept derived from the duty of a lead boat in a flotilla to navigate resonably – as bearing only on potential tort liability and not the issue of interpreting the terms of this insurance policy. No. 17-30424 (Feb. 15, 2018).

Three tugboats towed a barge; one of the tugboats served as the “lead” while the other two assisted. One of the assisting tugboats had an accident and sank. The question for the Fifth Circuit in Continental Insurance v. L&L Marine Transportation was whether the sunken boat was a “tow” of the lead boat, and thus came within the coverage of the insurance policy for the lead. (As distinct from a TOW missile, right.) Reviewing dictionaries and court precedent, the Court concluded that “tow” describes a situation where “some ship or boat is being provided extra motive power from another ship or boat by being pushed or pulled,” which was not the case here. The Court rejected an argument based on the maritime “dominant mind” doctrine – a concept derived from the duty of a lead boat in a flotilla to navigate resonably – as bearing only on potential tort liability and not the issue of interpreting the terms of this insurance policy. No. 17-30424 (Feb. 15, 2018).

O’Donnell v. Harris County substantially affirmed the district court’s handling of a major civil rights case about Harris County’s pretrial bail system. The key liability holding is of general interest as an important application of equal protection; the key remedy holding is of broader application to any equitable remedy involving a process rather than a substantive result.

O’Donnell v. Harris County substantially affirmed the district court’s handling of a major civil rights case about Harris County’s pretrial bail system. The key liability holding is of general interest as an important application of equal protection; the key remedy holding is of broader application to any equitable remedy involving a process rather than a substantive result.

As to liability, the Court held: “[T]he essence of the district court’s equal protection analysis can be boiled down to the following: take two misdemeanor arrestees who are identical in every way—same charge, same criminal backgrounds, same circumstances, etc.—except that one is wealthy and one is indigent. Applying the County’s current custom and practice, with their lack of individualized assessment and mechanical application of the secured bail schedule, both arrestees would almost certainly receive identical secured bail amounts. One arrestee is able to post bond, and the other is not. As a result, the wealthy arrestee is less likely to plead guilty, more likely to receive a shorter sentence or be acquitted, and less likely to bear the social costs of incarceration. The poor arrestee, by contrast, must bear the brunt of all of these, simply because he has less money than his wealthy counterpart. The district court held that this state of affairs violates the equal protection clause, and we agree.”

And as to remedy: “There is a significant mismatch between the district court’s procedure-focused legal analysis and the sweeping injunction it implemented. The fundamental source of constitutional deficiency in the due process and equal protection analyses is the same: the County’s mechanical application of the secured bail schedule without regard for the individual arrestee’s personal circumstances. Thus,  the equitable remedy necessary to cure the constitutional infirmities arising under both clauses is the same: the County must implement the constitutionally-necessary procedures to engage in a caseby-case evaluation of a given arrestee’s circumstances, taking into account the various factors required by Texas state law (only one of which is ability to pay). These procedures are: notice, an opportunity to be heard and submit evidence within 48 hours of arrest, and a reasoned decision by an impartial decisionmaker. That is not what the preliminary injunction does, however. Rather, it amounts to the outright elimination of secured bail for indigent misdemeanor arrestees.”

the equitable remedy necessary to cure the constitutional infirmities arising under both clauses is the same: the County must implement the constitutionally-necessary procedures to engage in a caseby-case evaluation of a given arrestee’s circumstances, taking into account the various factors required by Texas state law (only one of which is ability to pay). These procedures are: notice, an opportunity to be heard and submit evidence within 48 hours of arrest, and a reasoned decision by an impartial decisionmaker. That is not what the preliminary injunction does, however. Rather, it amounts to the outright elimination of secured bail for indigent misdemeanor arrestees.”

No. 17-2033 (Feb. 14, 2018).

The issue in Fort Worth 4th Street Partners LP v. Chesapeake Energy Corp. was whether a payment provision in a “Surface Use Agreement,” signed at the same time as a mineral lease, created an obligation that ran with the land. On the element of whether the covenant “touched and concerned” the property, the Fifth Circuit observed that the benefit of the provision “is not merely the right to receive payment but also how the method of calculating this payment preserves the land’s value to its owner. By basing the payment due on the square footage occupied by the lessee, the terms of the provision operate to incentivize the lessee to use, and consequently, damage, as little of the surface land as possible. Critically, structuring the payment in this way does not merely compensate FWP for any such damage; it impacts how the lessee will

The issue in Fort Worth 4th Street Partners LP v. Chesapeake Energy Corp. was whether a payment provision in a “Surface Use Agreement,” signed at the same time as a mineral lease, created an obligation that ran with the land. On the element of whether the covenant “touched and concerned” the property, the Fifth Circuit observed that the benefit of the provision “is not merely the right to receive payment but also how the method of calculating this payment preserves the land’s value to its owner. By basing the payment due on the square footage occupied by the lessee, the terms of the provision operate to incentivize the lessee to use, and consequently, damage, as little of the surface land as possible. Critically, structuring the payment in this way does not merely compensate FWP for any such damage; it impacts how the lessee will

use the land, thereby preserving its value to its owner.” No. 17-10040 (Feb. 15, 2018).

Celebrate with a true New Orleans muffuletta.

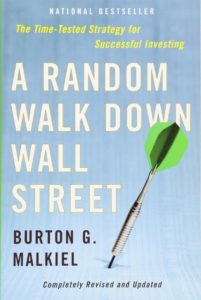

Plaintiffs sued under ERISA about the handling of company stock in RadioShack employees’ 401K plans. The Fifth Circuit affirmed dismissal. As to the claims based on ERISA’s duty of prudence, the Court reminded: “Dudenoeffer establishes that for publicly-traded stocks, ‘allegations that a fiduciary should have recognized from publicly available information alone that the market was over- or undervaluing the stock are implausible as a general rule, at least in the absence of special circumstances.'” Here: “Plaintiffs argue

Plaintiffs sued under ERISA about the handling of company stock in RadioShack employees’ 401K plans. The Fifth Circuit affirmed dismissal. As to the claims based on ERISA’s duty of prudence, the Court reminded: “Dudenoeffer establishes that for publicly-traded stocks, ‘allegations that a fiduciary should have recognized from publicly available information alone that the market was over- or undervaluing the stock are implausible as a general rule, at least in the absence of special circumstances.'” Here: “Plaintiffs argue  that Dudenhoeffer addressses only allegations that public information showed that a stock was overvalued, not claims that the stock was excessively risky. This distinction between claims that stock is overvalued and claims that stock is excessively risky is ‘illusory.’ In an efficient market, market price accounts for risk. Plan fiduciaries cannot be expected to outperform the market or predict future stock performance using publicly available information.” Singh v. RadioShack Corp., 882 F.3d 137 (5th Cir. 2018) (applying Fifth Third Bancorp v. Dudenhoeffer, 134 S. Ct. 2459 (2014)).

that Dudenhoeffer addressses only allegations that public information showed that a stock was overvalued, not claims that the stock was excessively risky. This distinction between claims that stock is overvalued and claims that stock is excessively risky is ‘illusory.’ In an efficient market, market price accounts for risk. Plan fiduciaries cannot be expected to outperform the market or predict future stock performance using publicly available information.” Singh v. RadioShack Corp., 882 F.3d 137 (5th Cir. 2018) (applying Fifth Third Bancorp v. Dudenhoeffer, 134 S. Ct. 2459 (2014)).

Sangha, the “master in command” of a merchant vessel, sued Navi8 Shipmanagement, his former employer, in Texas. To support personal jurisdiction, he cited a number of communications with him in Texas. Citing Walden v. Fiore, 134 S. Ct. 1115 (2014), the Fifth Circuit found those contacts inadequate: “Even though Navig8’s email communications happened to affect Cpt. Sangha while he was at the Port of Houston, this single effect is not enough to confer specific jurisdiction over Navig8.” And the Court found that “Cpt. Sangha’s reliance on the ‘effects’ test of Calder v. Jones, 465 U.S. 783 (1984), is unavailing” — “The proper question is not whether Cpt. Sangha experienced an innjury of effect in a particular location, but whether Navig8’s conduct connects it to the forum in a meaningful way.” Sangha v. Navig8 Shipmanagement, No. 17-20093 (Feb. 5, 2018).

Sangha, the “master in command” of a merchant vessel, sued Navi8 Shipmanagement, his former employer, in Texas. To support personal jurisdiction, he cited a number of communications with him in Texas. Citing Walden v. Fiore, 134 S. Ct. 1115 (2014), the Fifth Circuit found those contacts inadequate: “Even though Navig8’s email communications happened to affect Cpt. Sangha while he was at the Port of Houston, this single effect is not enough to confer specific jurisdiction over Navig8.” And the Court found that “Cpt. Sangha’s reliance on the ‘effects’ test of Calder v. Jones, 465 U.S. 783 (1984), is unavailing” — “The proper question is not whether Cpt. Sangha experienced an innjury of effect in a particular location, but whether Navig8’s conduct connects it to the forum in a meaningful way.” Sangha v. Navig8 Shipmanagement, No. 17-20093 (Feb. 5, 2018).

Trois owned a gun collection and contracted with Apple Tree, an auction center based in Ohio. The auction did not go as well as Trois hoped, and he sued in Texas for breach of contract and fraudulent inducement. The Fifth Circuit found no personal jurisdiction over the contract claim: “The only alleged Texas contacts related to contract formation or breach are Schnaidt [Apple Tree’s principal]’s . . . conference calls negotiating the agreement while Trois was in Texas.” But as to fraud: “Although Schnaidt did not initiate the conference call to Trois in Texas, Schnaidt was not a passive participant on the call. Instead, he was the key negotiating party who made representations regarding his business in a call to Texas.” Trois v. Apple Tree Auction Center, Inc., No. 16-51414 (Feb. 5, 2018). The Court went on to find venue was also proper in Texas over the tort claim.

Trois owned a gun collection and contracted with Apple Tree, an auction center based in Ohio. The auction did not go as well as Trois hoped, and he sued in Texas for breach of contract and fraudulent inducement. The Fifth Circuit found no personal jurisdiction over the contract claim: “The only alleged Texas contacts related to contract formation or breach are Schnaidt [Apple Tree’s principal]’s . . . conference calls negotiating the agreement while Trois was in Texas.” But as to fraud: “Although Schnaidt did not initiate the conference call to Trois in Texas, Schnaidt was not a passive participant on the call. Instead, he was the key negotiating party who made representations regarding his business in a call to Texas.” Trois v. Apple Tree Auction Center, Inc., No. 16-51414 (Feb. 5, 2018). The Court went on to find venue was also proper in Texas over the tort claim.

Deutsch, who relies upon a wheelchair for mobility, contended that the parking lot of a local business did not comply with the ADA, and sought injunctive relief against the business. The trial court dismissed for lack of Article III standing and the Fifth Circuit affirmed. “Deutsch hoas not provided a description of any concrete plans to return to Travis County Shoe, and he also has not shown how the alleged ADA violations negatively affect his day-to-day life. Deutsch . . . had not been to Travis County Shoe before the day he alleges he encountered the ADA violations . . . [and] that he had not returned to the business since that day.” Deutsch v. Travis County Shoe Hospital, No. 16-51431 (Feb. 2, 2018, unpublished).

Deutsch, who relies upon a wheelchair for mobility, contended that the parking lot of a local business did not comply with the ADA, and sought injunctive relief against the business. The trial court dismissed for lack of Article III standing and the Fifth Circuit affirmed. “Deutsch hoas not provided a description of any concrete plans to return to Travis County Shoe, and he also has not shown how the alleged ADA violations negatively affect his day-to-day life. Deutsch . . . had not been to Travis County Shoe before the day he alleges he encountered the ADA violations . . . [and] that he had not returned to the business since that day.” Deutsch v. Travis County Shoe Hospital, No. 16-51431 (Feb. 2, 2018, unpublished).

The uncommon animal of an “absurd result” was not only sighted, but used as the basis for reversing summary judgment, in Star Financial Services v. Cardtronics USA, a dispute about the obligation to update account information associated with an ATM network. The Court reasoned: “R]eading the Contract to not impose an obligation upon Cardtronics to use correct account information after receiving updated Terminal Set-Up Forms leads to the absurd consequence that Star Financial can never make effective changes to a Terminal Set-Up Form despite an explicit provision to the contrary. Cardtronic’s obligation to deploy account information in an updated Terminal Set-Up Form is implicit in the contractual process for updating a Terminal Set-Up Form.” No. 17-30258 (Feb. 2, 2018).

The uncommon animal of an “absurd result” was not only sighted, but used as the basis for reversing summary judgment, in Star Financial Services v. Cardtronics USA, a dispute about the obligation to update account information associated with an ATM network. The Court reasoned: “R]eading the Contract to not impose an obligation upon Cardtronics to use correct account information after receiving updated Terminal Set-Up Forms leads to the absurd consequence that Star Financial can never make effective changes to a Terminal Set-Up Form despite an explicit provision to the contrary. Cardtronic’s obligation to deploy account information in an updated Terminal Set-Up Form is implicit in the contractual process for updating a Terminal Set-Up Form.” No. 17-30258 (Feb. 2, 2018).

In United States v. Ganji, the Fifth Circuit reversed criminal convictions for conspiracy to commit health care fraud, noting (among other problems) these weaknesses in the government’s proof – weaknesses that could also appear in suits alleging civil conspiracies:

In United States v. Ganji, the Fifth Circuit reversed criminal convictions for conspiracy to commit health care fraud, noting (among other problems) these weaknesses in the government’s proof – weaknesses that could also appear in suits alleging civil conspiracies:

- Witness perspective. “The Government’s dependence on these witnesses is almost as peculiar as the scheme’s discovery. Notably, these individuals worked in the Hammond area, while Dr. Ganji and Davis worked sixty miles away in the New Orleans area. . . . Unlike other salient cases involving conspiracy to commit health care fraud, here the Government presented eighteen witnesses, none of whom could provide direct evidence of their alleged co-conspirator’s actions because the witnesses never acted with the defendants to commit the specific charged conduct.”

- Inference from job responsibilities. “The Government’s attempt to ascribe Davis with knowledge and agreement because of her position in the company falls far short of the necessary requirement for guilt beyond a reasonable doubt. One cannot negligently enter into a conspiracy.”

- Plausible alternative explanations. “Finally, the Government points to the nefarious Ponchatoula meeting. It argues that Davis would not have otherwise asked Dr. Murray to meet her to sign documents that included certification forms had she not agreed to participate in a conspiracy to defraud Medicare. Again, here the direct evidence is not on the Government’s side. . . . [T]he record illustrates a different, reasonable explanation for the meeting.”

No. 16-31119-CR (Jan. 30, 2018).