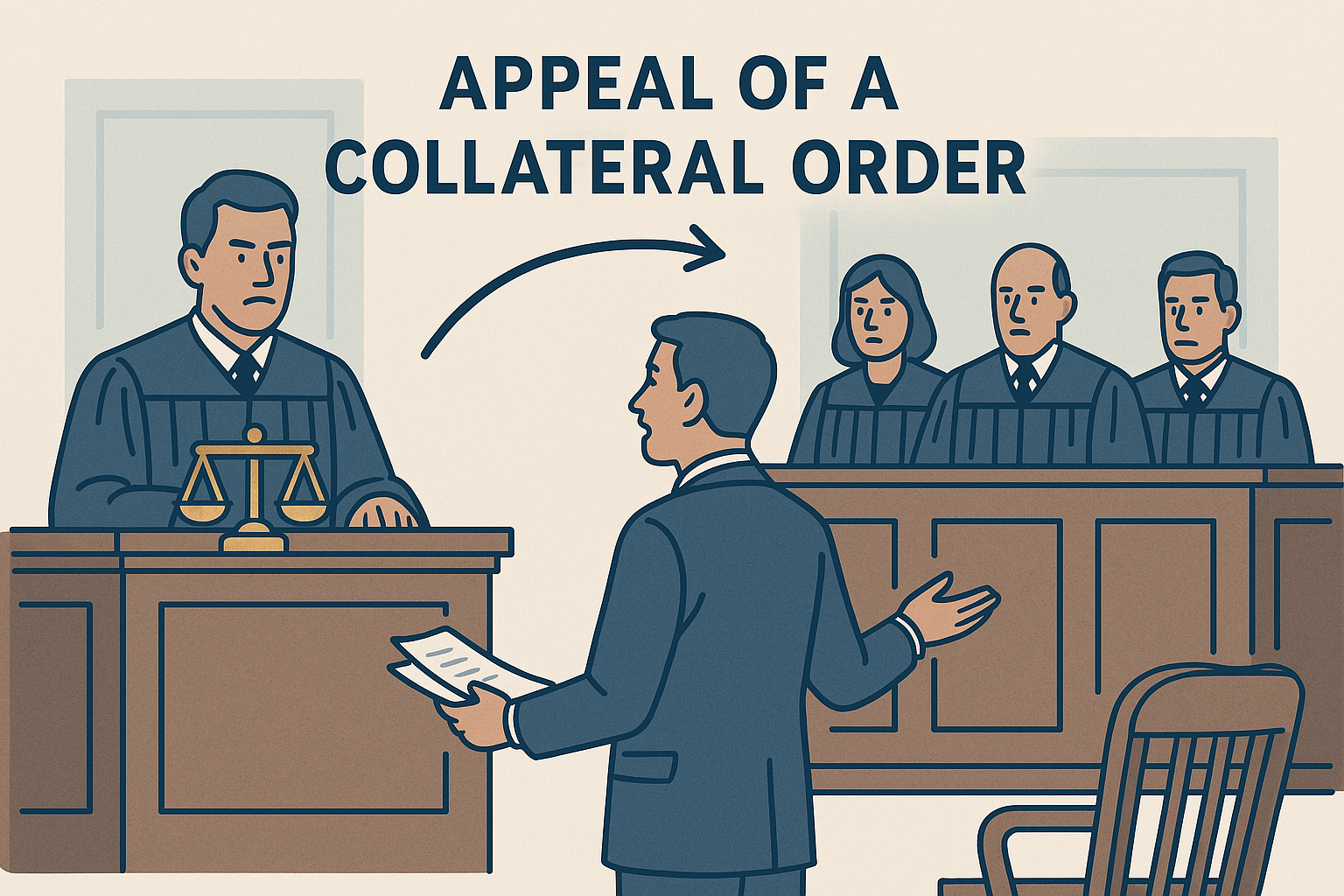

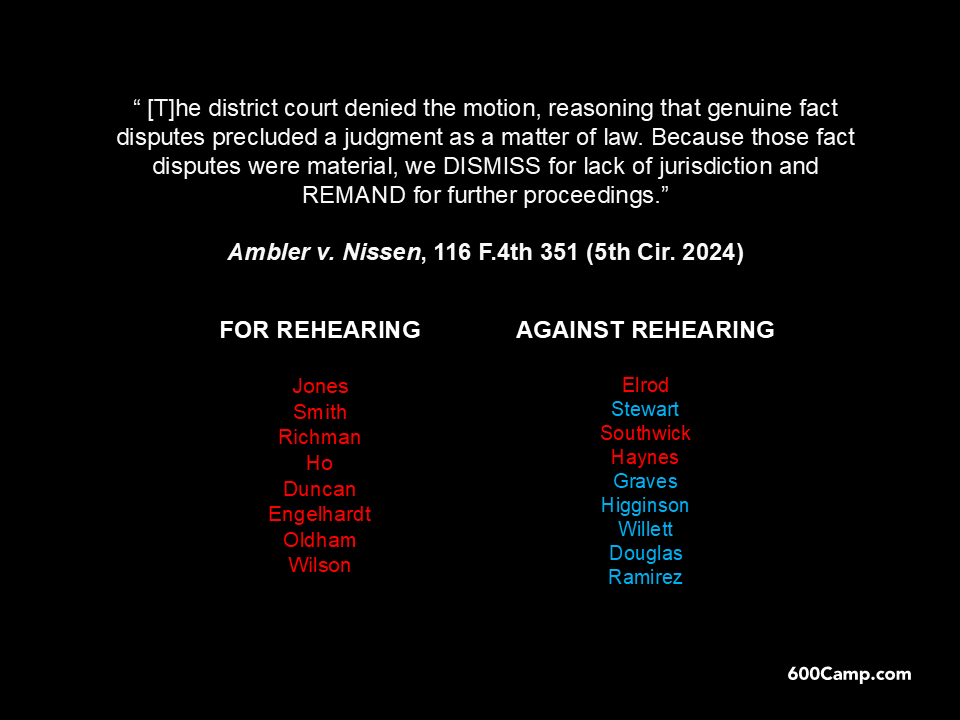

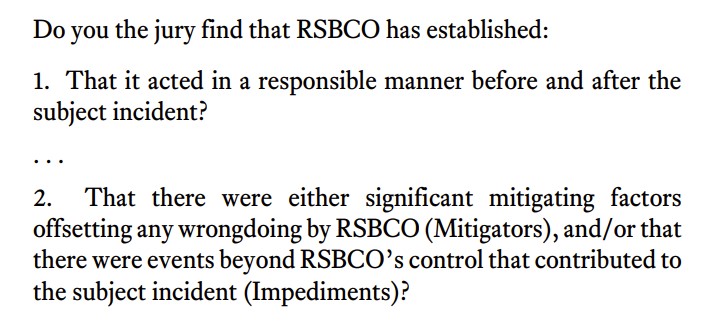

A breach-of-contract suit against a governmental entity led to these holdings about how the district court handled immunity defenses:

The district court thus made two errors. First, the district court held that Texas’s state-law immunity from suit deprived it of subject matter jurisdiction. But state-created immunities do not and cannot limit the jurisdiction of federal courts. If these state-law immunities apply at all in federal court under the Erie doctrine, they must be treated as non-jurisdictional, merits-based defenses.

The second error flows directly from the first. The district court dismissed for lack of jurisdiction—without addressing the two other bases for dismissal that really do implicate subject matter jurisdiction. State sovereign immunity and the absence of complete diversity—unlike state-law immunities—are jurisdictional defects. And either of the former two problems would require a without-prejudice jurisdictional dismissal. Such jurisdictional problems must be addressed first, before the district court considers any merits-based defenses.

Anthology, Inc. v. Tarrant County College Dist., No. 24-10630-CV (May 2, 2025).