The defendant in United States v. Meals sought to suppress evidence obtained when Facebook monitored his inappropriate online communication. His conviction was affirmed: “Under the private search doctrine, when a private actor finds evidence of criminal conduct after searching someone else’s person, house, papers, and effects without a warrant, the government can use the evidence, privacy expectations notwithstanding.” And while a federal statute “mandates reporting child exploitation on internet platforms to the [National Center for Missing and Exploited Children], … it neither compels nor coercively encourages internet companies to search actively for such evidence” and thus did not bring Facebook within a “government agent” exception to the private-search doctrine. No. 20-40752 (Dec. 30, 2021).

The defendant in United States v. Meals sought to suppress evidence obtained when Facebook monitored his inappropriate online communication. His conviction was affirmed: “Under the private search doctrine, when a private actor finds evidence of criminal conduct after searching someone else’s person, house, papers, and effects without a warrant, the government can use the evidence, privacy expectations notwithstanding.” And while a federal statute “mandates reporting child exploitation on internet platforms to the [National Center for Missing and Exploited Children], … it neither compels nor coercively encourages internet companies to search actively for such evidence” and thus did not bring Facebook within a “government agent” exception to the private-search doctrine. No. 20-40752 (Dec. 30, 2021).

Walmart sued the U.S. government, seeking declaratory judgments on several issues about the enforcement of laws related to opioids. In the meantime, the the US brought an enforcement action against Walmart in Delaware. The panel in Walmart, Inc. v. U.S. Dep’t of Justice concluded that the Delaware action made this declaratory-judgment case unnecessary; two judges also concluded that Wal-Mart had not identified a specific type of action or decision as to which the United States had waived sovereign immunity in the Administrative Procedure Act. No. 21-40157 (Dec. 22, 2021).

Walmart sued the U.S. government, seeking declaratory judgments on several issues about the enforcement of laws related to opioids. In the meantime, the the US brought an enforcement action against Walmart in Delaware. The panel in Walmart, Inc. v. U.S. Dep’t of Justice concluded that the Delaware action made this declaratory-judgment case unnecessary; two judges also concluded that Wal-Mart had not identified a specific type of action or decision as to which the United States had waived sovereign immunity in the Administrative Procedure Act. No. 21-40157 (Dec. 22, 2021).

In DeOtte v. State of Nevada, the district court’s injunction about the contraceptive mandate in the Affordable Care Act became moot after a 2020 Supreme Court opinion. The State of Nevada, a latecomer to the case, sought vacatur of the injunction.

The Fifth Circuit summarized the applicable principles. Its “authority to vacate comes from [28 U.S.C. § 2106] that provides that an appellate court ‘may affirm, modify, vacate, set aside or reverse any judgment, decree, or order of a court lawfully brought before it for review.'” (emphasis omitted). Under that statute:

“[V]acatur is not automatic; it is ‘equitable relief’ and must ‘take account of the public interest.’ Precedents ‘are not merely the property of private litigants and should stand unless a court concludes that the public interest would be served by a vacatur.’ A court must assess ‘the equities of the individual case’ to determine whether vacatur is proper. This consideration centers on (1) ‘whether the party seeking relief from the judgment below caused the mootness by voluntary action’; and (2) whether public interests support vacatur.”

(citations omitted). After a thorough review of Nevada’s unusual procedural position in the case, the Court found that Nevada had standing (in the language of the statute, had “lawfully brought” the appeal), and granted Nevada the requested relief of vacatur. No. 19-10754 (Dec. 17, 2021).

Reminder: “Standing to appeal a bankruptcy court order is, of necessity, quite limited. … [t]his test is an even more exacting standard than traditional constitutional standing.” Dean v. Seidel, No. 21-10468 (Dec. 7, 2021) (citations omitted).

Therefore: “Here, the order on appeal — approval of a litigation funding agreement — does not affect whether Dean’s debts will be discharged. Neither does it affect Reticulum’s related pending case in which it ‘objected to Dean’s bankruptcy discharge and to discharge of its claims against Dean.’ Dean thus does not have bankruptcy standing because he cannot show how the order approving the litigation funding agreement would directly, adversely, and financially impact him.”

Under Wyoming law, an indemnity agreement related to an oil-field injury could not be enforced; under Texas law, it could be. Applying the Restatement’s choice-of-law framework, the Fifth Circuit concluded:

More significant relationship. “The section 188 contacts rack up points for Wyoming. Cannon started negotiations by contacting KLX’s Wyoming office, and the parties executed the agreements in Wyoming and West Virginia. These place-of-negotiation-and-contracting contacts favor Wyoming and overwhelmingly disfavor Texas. … The only debatable section 188 contact is the principal place of business. Cannon leans on this contact, arguing that it favors Texas because the agreement was drafted by a Texas-based company. But although KLX’s principal place of business is in Texas, its Texas presence is negated by Cannon’s Wyoming domicile.”

More significant relationship. “The section 188 contacts rack up points for Wyoming. Cannon started negotiations by contacting KLX’s Wyoming office, and the parties executed the agreements in Wyoming and West Virginia. These place-of-negotiation-and-contracting contacts favor Wyoming and overwhelmingly disfavor Texas. … The only debatable section 188 contact is the principal place of business. Cannon leans on this contact, arguing that it favors Texas because the agreement was drafted by a Texas-based company. But although KLX’s principal place of business is in Texas, its Texas presence is negated by Cannon’s Wyoming domicile.”- Materially greater interest. “Wyoming’s interest in promoting worker safety in its oilfields is at its zenith on these facts. The underlying state court proceeding—in which a Wyoming resident was injured in Wyoming by the alleged negligence of a Wyoming oil company—implicates Wyoming’s policy with precision. Enforcing the indemnity provision would discourage what Wyoming hopes to encourage Cannon’s taking steps to avoid injuries in its oilfield operations. On the other side of the scale, Texas’s interest in this dispute is more attenuated. Its interest in enforcing the contract of one of its businesses is lessened when the contract was not negotiated, drafted, or performed within its borders.”

Fundamental policy. “Wyoming’s ban on oilfield indemnification is codified and voids any such agreement as being ‘against public policy.’ … Because Wyoming “has taken the unusual step of stating [the policy] explicitly” in a statute, and “will refuse to enforce an agreement” contrary to the policy even when other states connected to the agreement would enforce it, the anti-indemnity policy is a fundamental one.” (citations omitted).

Fundamental policy. “Wyoming’s ban on oilfield indemnification is codified and voids any such agreement as being ‘against public policy.’ … Because Wyoming “has taken the unusual step of stating [the policy] explicitly” in a statute, and “will refuse to enforce an agreement” contrary to the policy even when other states connected to the agreement would enforce it, the anti-indemnity policy is a fundamental one.” (citations omitted).

Cannon Oil & Gas Servcs., Inc. v. KLX Energy Services, L.L.C, No. 21-20115 (Dec. 10, 2021).

Yes, it’s kind of a pain, and yes, it comes around every year. But you have a voice in the oft-cited “Super Lawyers” awards, and you can make it heard on the Super Lawyers’ website: Nominations are due by December 16, 2021

The district court certified a class based on a Texas statute about late fees, which says: “A landlord may not charge a tenant a late fee for failing to pay rent unless … the fee is a reasonable estimate of uncertain damages to the landlord that are incapable of precise calculation and result from late payment of rent.”

The panel majority in Cleven v. Mid-Am. Apartments disagreed with the district court’s reading of the statute, and thus remanded: “[T]here is no requirement that a landlord engage in a process to arrive at its late fee so long as the fee is a reasonable estimate at the time of contracting of damages that are incapable of precise calculation. Therefore, the district court erred in interpreting section 92.019 and the case is remanded to the district court to determine if class certification is appropriate.”

A dissent saw matters differently: “That the plaintiffs all raised a common contention about how § 92.019 should be interpreted that is central to their claims for relief is sufficient reason for us to affirm class certification, and we do not have jurisdiction to review the district court’s partial summary judgment ruling on only the issue of liability at this stage in the litigation.” No. 18-50846 (Dec. 9, 2021).

Yes, it’s kind of a pain, and yes, it comes around every year. But you have a voice in the oft-cited “Super Lawyers” awards, and you can make it heard on the Super Lawyers’ website: Nominations are due by December 16, 2021.

The Fifth Circuit affirmed a default judgment against the Elephant Group when it “agree[d] with the district court that neither claimed defense suffices. The presentation of meritorious defenses requires ‘definite factual allegations, as opposed to mere legal conclusions.’ Legal conclusions were all that were presented.” Tango Marine v. Elephant Group, No. 21-10068 (Dec. 5, 2021) (citations omitted) (On rehearing in 2022, the Court withdrew this opinion.)

The Fifth Circuit affirmed a default judgment against the Elephant Group when it “agree[d] with the district court that neither claimed defense suffices. The presentation of meritorious defenses requires ‘definite factual allegations, as opposed to mere legal conclusions.’ Legal conclusions were all that were presented.” Tango Marine v. Elephant Group, No. 21-10068 (Dec. 5, 2021) (citations omitted) (On rehearing in 2022, the Court withdrew this opinion.)

“Most of the time, to be sure, Rule 60(b) orders denying relief are final and appealable because ‘Rule 60(b) motions ordinarily are made only after the district court has disposed completely of the subject litigation.’ But this is not so when unresolved matters remain pending in the district court. Where there is no ‘effective termination[] of district-court proceedings, a denial of a Rule 60(b) motion is not final for purposes of 28 U.S.C. § 1291.” Gross v. Keen Group, No. 20-20594 (Dec. 2, 2021) (citations omitted).

“Louisiana residents can access Eastrock’s website, no less than residents of other states. But as our cases suggest, and as we now expressly hold, a defendant does not have sufficient minimum contacts with a forum state just because its website is accessible there. The defendant must also target the forum state by purposefully availing itself of the opportunity to do business in that state. And here, there is no evidence that Eastrock targets Louisiana: Eastrock has not sold a single accused product to a Louisiana resident, and it solicits no business there through targeted advertising. That ends this case.” Admar Int’l Inc. v. Eastrock LLC, No. 21-30098-CV (Nov. 19, 2021). (For reference, I think this is the current version of the website in question; the litigation involved the defendant’s alleged misuse of product images.)

A Louisiana-based defendant removed a class action brought by an individual citizen of Louisiana, contending that a co-defendant’s “non-diverse Louisiana citizenship could be disregarded because the [statutory] claims against [the co-defendant] were ‘improperly and egregiously misjoined’ with the assignment-based bad faith claim against the removing defendant.”

A Louisiana-based defendant removed a class action brought by an individual citizen of Louisiana, contending that a co-defendant’s “non-diverse Louisiana citizenship could be disregarded because the [statutory] claims against [the co-defendant] were ‘improperly and egregiously misjoined’ with the assignment-based bad faith claim against the removing defendant.”

This concept — called “fraudulent misjoinder” and reliant upon state-law procedural rules — is distinct from the traditional concept of “improper joinder” (a/k/a “fraudulent joinder”), which focuses on the viability of the claim against the nondiverse defendant.

The panel majority in Williams v. Homeland Ins. Co., written by Judge Haynes and joined by Judge Ho, soundly rejected removal based on fraudulent misjoinder, emphasizing the doctrine’s practical consequences: “Adopting the fraudulent misjoinder doctrine will dramatically expand federal jurisdiction, putting the federal district courts in this circuit in the position of resolving procedural matters that are more appropriately resolved in state court—all without a clear statutory hook.” No. 20-30196 (Nov. 30, 2021).

A concurrence by Judge Ho emphasized the importance of the statutory text in rejecting the doctrine; a dissent by Judge Jones focused on “the unusual circumstances here, which bespeak obvious joinder machinations undertaken to avoid federal court.” (both opinions are in the above link). The trio of opinions suggests that this case may receive serious consideration for en banc review.

In a coverage dispute between two excess carriers, the Fifth Circuit observed: “At bottom, the allocation issue depends upon the sufficiency of Great American’s summary judgment evidence. To support its allocation theory and establish that the covered claims were worth at least $7 million, Great American submitted the affidavits of (1) Brent Anderson, Liberty Tire’s attorney in the Underlying Litigation, and (2) Carol Euwema, Great American’s lead adjuster for the relevant claims.” Great Am. Ins. Co. v. Employers Mut. Cas. Co. The trial court found those affidavits conclusive, but the Fifth Circuit disagreed; they provide good references for summary-judgment practice generally. No. 20-11113 (Nov. 17, 2021).

In a coverage dispute between two excess carriers, the Fifth Circuit observed: “At bottom, the allocation issue depends upon the sufficiency of Great American’s summary judgment evidence. To support its allocation theory and establish that the covered claims were worth at least $7 million, Great American submitted the affidavits of (1) Brent Anderson, Liberty Tire’s attorney in the Underlying Litigation, and (2) Carol Euwema, Great American’s lead adjuster for the relevant claims.” Great Am. Ins. Co. v. Employers Mut. Cas. Co. The trial court found those affidavits conclusive, but the Fifth Circuit disagreed; they provide good references for summary-judgment practice generally. No. 20-11113 (Nov. 17, 2021).

The question whether an insurance statute violated the Texas Constitution’s prohibition on “retroactive laws” presented a textbook case for certification in Fire Protection Service, Inc. v. Survitec Survival Prods, Inc.: “Beyond the closeness of the question and the dearth of on-point precedent, considerations of comity counsel in favor of certification.” No. 21-20145 (Nov. 22, 2021).

The question whether an insurance statute violated the Texas Constitution’s prohibition on “retroactive laws” presented a textbook case for certification in Fire Protection Service, Inc. v. Survitec Survival Prods, Inc.: “Beyond the closeness of the question and the dearth of on-point precedent, considerations of comity counsel in favor of certification.” No. 21-20145 (Nov. 22, 2021).

If you think that the modern administrative state relies heavily upon acronyms, you are not alone, as the Fifth Circuit illustrated in Leigh Ann H v. Reisel ISD, No. 20-50003-CV (Nov. 22, 2021):

In Great Am. Ins. Co. v. Employers Mut. Cas. Co., both the Great American and Employers’ umbrella policies were “excess,” in that they both provided coverage for liability “in excess” of a “retained limit.” That said . . .

In Great Am. Ins. Co. v. Employers Mut. Cas. Co., both the Great American and Employers’ umbrella policies were “excess,” in that they both provided coverage for liability “in excess” of a “retained limit.” That said . . .

- the Employers’ policy defined “retained limit” as “the available limits of all ‘underlying insurance,'” a term that was, in turn, defined by two descriptions of primary coverage; while

- the Great American policy defined “retained limit” to include “the applicable limits of any other insurance providing coverage to the ‘Insured’ during the Policy Period.” (emphasis added).

Thus, “[b]ased on the plain terms of these policies, the Great American Umbrella Policy was the true excess policy after all other policies.” No. 20-11113 (Nov. 17, 2021).

In a rough stretch for the administrative state, after the Fifth Circuit’s recent skeptical rejection of an FDA regulation of e-cigarettes, another panel stayed OSHA’s vaccine-mandate regulation. It based its decision on several administrative-law principles and summarized:

In a rough stretch for the administrative state, after the Fifth Circuit’s recent skeptical rejection of an FDA regulation of e-cigarettes, another panel stayed OSHA’s vaccine-mandate regulation. It based its decision on several administrative-law principles and summarized:

“[T]he Mandate’s strained prescriptions combine to make it the rare government pronouncement that is both overinclusive (applying to employers and employees in virtually all industries and workplaces in America, with little attempt to account for the obvious differences between the risks facing, say, a security guard on a lonely night shift, and a meatpacker working shoulder to shoulder in a cramped warehouse) and underinclusive (purporting to save employees with 99 or more coworkers from a “grave danger” in the workplace, while making no attempt to shield employees with 98 or fewer coworkers from the very same threat). The Mandate’s stated impetus—a purported “emergency” that the entire globe has now endured for nearly two years, and which OSHA itself spent nearly two months responding to—is unavailing as well. And its promulgation grossly exceeds OSHA’s statutory authority.”

No. 21-60845 (Nov. 12, 2021) (footnotes omitted, emphasis in original).

The dispute in Guzman v. Allstate Assurance Co. was whether the insured was a smoker when he applied for insurance; the Fifth Circuit concluded that “self-serving” affidavits by family members were sufficient to raise a fact issue and avoid summary judgment. The details offer an excellent, general example about this sort of affidavit:

The dispute in Guzman v. Allstate Assurance Co. was whether the insured was a smoker when he applied for insurance; the Fifth Circuit concluded that “self-serving” affidavits by family members were sufficient to raise a fact issue and avoid summary judgment. The details offer an excellent, general example about this sort of affidavit:

“Mirna’s and Martha’s affidavits are competent summary judgment evidence. They are based on personal knowledge, set out facts that are admissible in evidence, are given by competent witnesses, and are particularized rather than vague or conclusory. Mirna and Martha testify about their personal experiences with Guzman. In her deposition and affidavit, Mirna claimed that Guzman was not a smoker; that she was often with Guzman and would know if he smoked; that she is “able to tell whether [people] use tobacco because they have a peculiar and specific smoke smell”; and that neither Guzman nor his belongings, including his clothes and truck, ever smelled like smoke. Martha made substantially similar claims in her own affidavit. Though self-serving, this testimony is sufficient to—and does— create a genuine dispute of material fact.”

No. 21-10023 (Nov. 10, 2021).

“Federal courts can enforce an arbitration agreement only if they could hear the underlying ‘controversy between the parties.’ 9 U.S.C. § 4. In Vaden v. Discover Bank, 556 U.S. 49 (2009), the court told us to define that ‘controversy’ by looking to the whole dispute, including any state-court pleadings.” ADT, LLC v. Richmond, No. 21-10023 (Nov. 10, 2021).

ADT presented the question whether that technique for definition also applies to the parties in the case–a material issue in that case, because federal diversity jurisdiction over the arbitration suit depended on how the court treated nondiverse parties in the underlying state-court lawsuit.

The Fifth Circuit concluded that Vaden did not apply,, based on the plain language of section 4: “Having agreed to arbitrate its claims against a diverse defendant, a plaintiff may not escape our power by joining to its state-court suit nondiverse persons whom it could not hale into arbitration. ‘Parties,’ in § 4, means the parties to the § 4 suit–not everyone against whom one party claims relief.” (emphasis added).

In Wages & White Lions Investments LLC v. FDA, the Fifth Circuit found many problems with the FDA’s denial of a company’s application to market flavored e-cigarettes. Among them, the Court identified two issues with the FDA’s review of the company’s marketing plan to avoid improper product use by young people; the Court’s reasoning is of broad general interest for Daubert practice as well as administrative law:

In Wages & White Lions Investments LLC v. FDA, the Fifth Circuit found many problems with the FDA’s denial of a company’s application to market flavored e-cigarettes. Among them, the Court identified two issues with the FDA’s review of the company’s marketing plan to avoid improper product use by young people; the Court’s reasoning is of broad general interest for Daubert practice as well as administrative law:

- The FDA’s contention “that no marketing plan would be sufficient, so it stopped working”: “That’s like an Article III judge saying that she stopped reading briefs because she previously found them unhelpful.”

- Reliance on expertise and experience. “An agency’s ‘experience and expertise’ presumably enable the agency to provide the required explanation, but they do not substitute for the explanation, any more than an expert witness’s credentials substitute for the substantive requirements applicable to the expert’s testimony under [Rule] 702.”

No. 21-60766 (Oct. 26, 2021).

In Gezu v. Charter Communications, “the record show[ed] a valid modification to [plaintiff’s] employment contract–i.e., notice and acceptance,” when:

- Notice. “On October 6, 2017, Charter sent an email notice to Gezu of its new Program aimed at ‘efficiently resolv[ing] covered employment-related legal disputes through binding arbitration.’ … The email stated that by participating, the recipient and Charter ‘both waive[d] the right to initiate or participate in court litigation … involving a covered claim’ and that recipients ‘would be automatically enrolled in the Program unless they chose to ‘opt out of participating … within … 30 days.’ This language, along with the referenced links to additional information about the Program provided in the email, was sufficient to notify Gezu unequivocally of the arbitration agreement.” (emphasis added); and

- Acceptance. “The October 6, 2017 email ‘conspicuously warned that employees were deemed to accept’ the Program unless they opted out within 30 days. In re Dillard Dep’t Stores, Inc., 198 S.W.3d 778, 780 (Tex. 2006). The email also provided recipients with directions on how to opt out. Nonetheless, Gezu did not opt out of the Program and continued working for Charter for over a year until he was terminated in May 2019.”

No. 21-10198 (Nov. 2, 2021).

A key issue facing OSHA’s new COVID regulation is whether a “grave danger” justified the agency acting so rapidly. In an unusual flash of appellate-court wit, the Fifth Circuit temporarily stayed the regulation, observing:

(Regrettably, Judge Graves was not on the panel.)

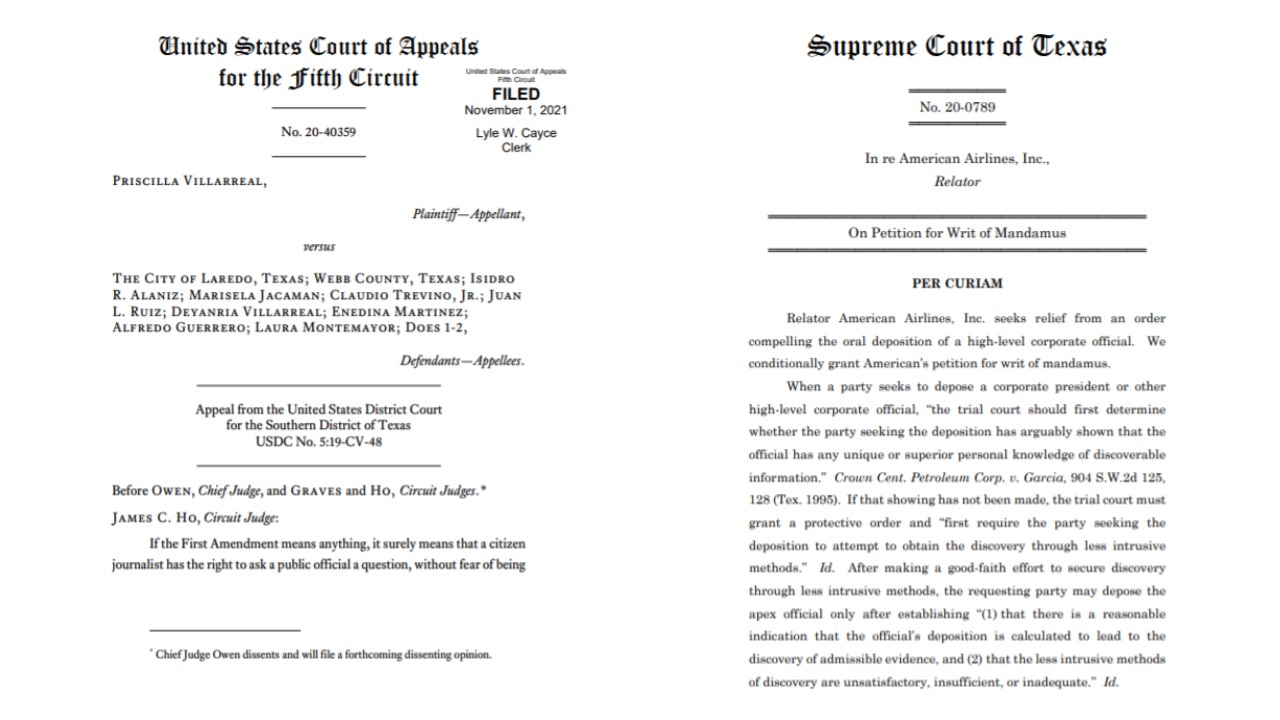

“It should be obvious to any reasonable police officer that locking up a journalist for asking a question violates the First Amendment. Indeed, even Captain Lorenzo, the stubborn police chief in Die Hard 2, acknowledged: ‘Now personally, I’d like to lock every [expletive] reporter out of the airport. But then they’d just pull that “freedom of speech” [expletive] on us and the ACLU would be all over us.” Die Hard 2 (1990). Captain Lorenzo understood this. The officers in Laredo should have, too. Cf. Dickerson v. United States, 530 U.S. 428, 443 (2000) (‘Miranda has become embedded in routine police practice to the point where the warnings have become part of our national culture.’). The complaint here alleges an obvious violation of the First Amendment. The district court erred in holding otherwise.”

Villarreal v. City of Laredo, No. 20-40359 (Nov. 1, 2021).

In the course of resolving a long-running dispute about arbitration, the Fifth Circuit highlighted an important but infrequently litigated collateral-estoppel issue:

In the course of resolving a long-running dispute about arbitration, the Fifth Circuit highlighted an important but infrequently litigated collateral-estoppel issue:

… an unappealable ruling like a remand order is not entitled to preclusive effect. Beiser v. Weyler, 284 F.3d 665, 673 (5th Cir. 2002) (explaining that when “a litigant, as a matter of law, has no right to appellate review, then he has not had a full and fair opportunity to litigate and the issue is not precluded”); see Winters v. Diamond Shamrock Chem. Co., 149 F.3d 387, 395 (5th Cir. 1998) (suggesting that “collateral estoppel may not be applied offensively to a jurisdictional decision—such as one granting a motion to remand—that is not capable of being subjected to appellate review”) … The unappealability of remand orders is why, after a remand, a state court may revisit the federal court’s jurisdictional reasoning. … We recognized this principle in dismissing the appeal of the 2002 remand: “[T]he district court determined that the arbitration clause was invalid in the process of ascertaining whether it had subject matter jurisdiction,” which meant the ruling “has no preclusive effect in state court.” Dahiya, 371 F.3d at 211. The state court could freely reexamine the issue and “reach a different conclusion about [the] dispute’s arbitrability.” Beiser, 284 F.3d at 674.

Neptune Shipmanagement Services v. Dahiya, No. 20-30776 (Oct. 1, 2021) (emphasis added).

I recently wrote an article, “Federalism and Appellate Procedure: Five Texas-Federal Differences to Know,” in the Appellate Advocate, the quarterly publication by the Appellate Section of the State Bar of Texas. I hope you find it interesting and useful.

A frequent international traveler alleged that he had been placed on a TSA list that required additional, invasive searches of him when he flew. The Fifth Circuit affirmed the dismissal of the several Constitutional claims that he raised in a lawsuit against the leaders of the relevant federal agencies:

A frequent international traveler alleged that he had been placed on a TSA list that required additional, invasive searches of him when he flew. The Fifth Circuit affirmed the dismissal of the several Constitutional claims that he raised in a lawsuit against the leaders of the relevant federal agencies:

“In short, Ghedi has no right to hassle-free travel. In the Supreme Court’s view, international travel is a ‘freedom’ subject to ‘reasonable governmental regulation.’ And when it comes to reasonable governmental regulation, our sister circuits have held that Government-caused inconveniences during international travel do not deprive a traveler’s right to travel. In the Sixth Circuit’s view, ‘incidental or negligible’ delays of ‘ten minutes’ to ‘an entire day’ do not ‘implicate the right to travel.’ The Second and Tenth Circuits have held the same. Ghedi has therefore failed to plausibly allege that he has been deprived of his right to travel internationally by the extra security measures he has experienced.”

Ghedi v. Mayorkas, No. 20-10995 (Oct. 25, 2021) (footnotes omitted).

A New Orleans bar was sued after two patrons were stabbed by another, underaged patron who had been drinking at the bar. The insurance company denied coverage under a “weapons” exclusion (reaching “instruments of an offensive or defensive nature and include but are not limited to batons, bow or crossbow [?!], arrows, knives, mace, stun guns, tasers, or swords.” The Fifth Circuit affirmed judgment for the insurer:

“The district court described the claims of negligence in state court as Funky 544’s failure to require patron identifications and, more generally, its failure to prevent underage drinking. Even so, an element of each of [the plaintiffs’] claims is that Funky 544’s negligence caused them to be injured by a knife. … The term in this exclusion of ‘arising out of’ the use of weapons unambiguously provides that for coverage, an injury must be entirely separate from those relating to the use of weapons.”

Funky 544, LLC v. Houston Specialty Ins. Co., No. 21-30310 (Oct. 22, 2021) (unpublished).

While specifically addressing a novel Hague Convention child-custody issue, Harm v. Lake-Harm provides a useful general illustration of clear-error review: “There is evidence that SLH might have established a habitual residence in Ireland. As noted above, the family discussed and took steps toward setting up a ‘home base’ in Ireland to provide more opportunities to SLH. … It is equally plausible, however, as the trial court concluded, that SLH’s presence in Ireland was transitory. Ms. Lake-Harm’s career as a

professional musician sent mother and daughter on a dogged schedule of

travel outside Ireland. … We hold that the district court’s determinations are plausible in light of the record as a whole.” No. 20-30488 (Oct. 21, 2021).

In a challenge to the constitutionality of the “eviction moratorium,” the federal government argued that the case had become moot because the specific order at issue had expired. The Fifth Circuit expressed skepticism:

“Appellees respond that the appeal is not moot because the parties still dispute whether the government has constitutional power under the Commerce Clause to invade individual property rights by limiting landlords’ use of state court eviction remedies. The government maintains it has such authority. And in the government’s view, espoused at oral argument, that constitutional power is in no way limited to combatting the ongoing pandemic; the government asserts it can wield that staggering constitutional authority for any reason. Appellees further contend the proposed dismissal is a pretext to avoid appellate review of the constitutional question.”

(emphasis added). The court concluded, however, that it did not need to address mootness because it was granting the government’s motion to dismiss “on terms . . . fixed by the court” under FRAP 42. Those terms included the “express condition” that ‘”our dismissal does not abrogate the district court’s judgment or opinion, both of which remain in full force according to the express concession of the government during oral argument and in briefing.” Terkel v. Centers for Disease Control, No. 21-40137 (Oct. 19, 2021) (One panelist joined the result only.)

The complexity of the route map for the Erie Railway is well-illustrated by Butler v. Denka Performance Elastomer, LLC, No. 20-30365 (Oct. 15, 2021), in which one judge dissented from the panel’s decision to apply Louisiana tort law without certifying the issue to the Louisiana Supreme Court, and another dissented about the panel’s decision, based on Louisiana law, about whether prescription (limitations) had been established. No. 20-30365 (Oct. 15, 2021).

The complexity of the route map for the Erie Railway is well-illustrated by Butler v. Denka Performance Elastomer, LLC, No. 20-30365 (Oct. 15, 2021), in which one judge dissented from the panel’s decision to apply Louisiana tort law without certifying the issue to the Louisiana Supreme Court, and another dissented about the panel’s decision, based on Louisiana law, about whether prescription (limitations) had been established. No. 20-30365 (Oct. 15, 2021).

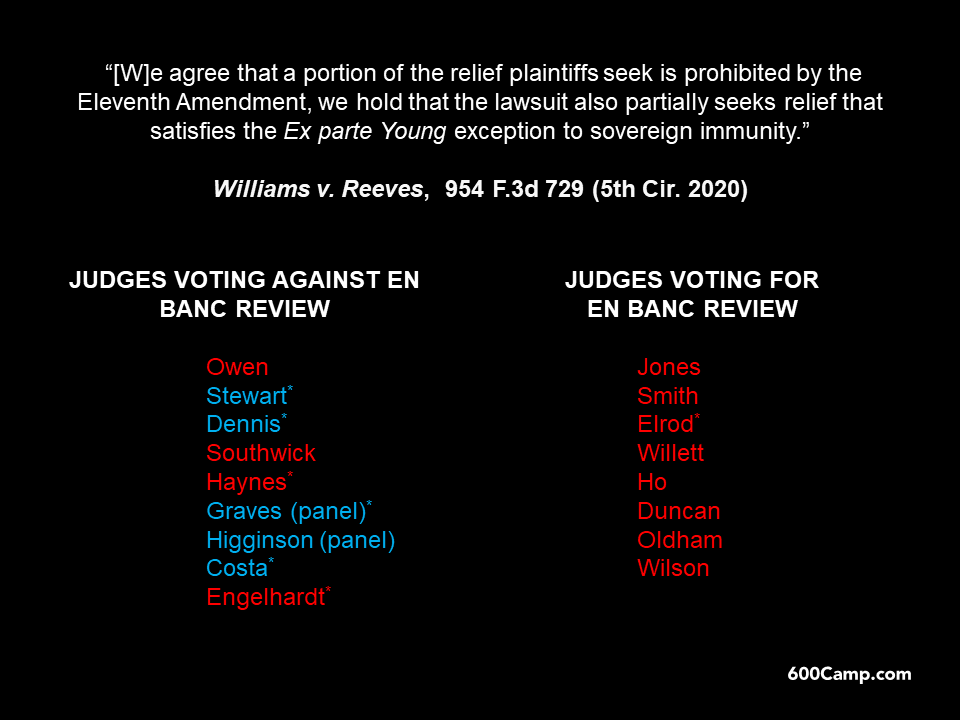

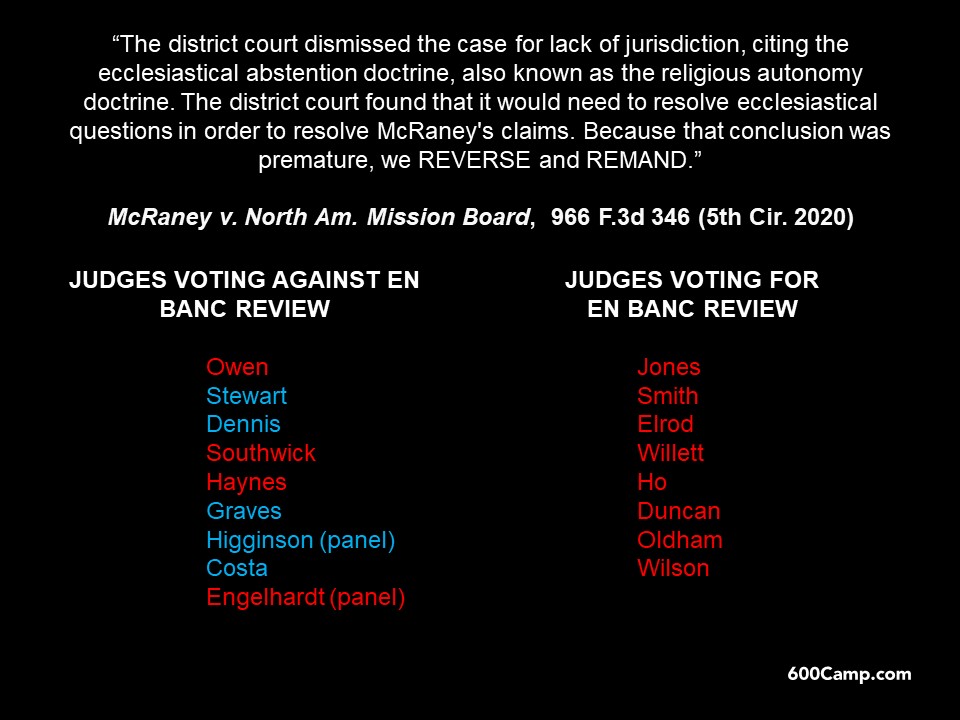

The Fifth Circuit denied the stay application in the appeal of the DOJ’s lawsuit against SB8, stating: While the referenced Fifth Circuit opinion primarily focused on Ex Parte Young (not relevant in a suit by the US, see West Virginia v. United States, 479 U.S. 305 (1987)), it made other observations about justiciability that this order suggests will now be central in the resolution of the merits. Professor Steve Vladeck further analyzes the relationship of the two cases in a recent Twitter thread.

While the referenced Fifth Circuit opinion primarily focused on Ex Parte Young (not relevant in a suit by the US, see West Virginia v. United States, 479 U.S. 305 (1987)), it made other observations about justiciability that this order suggests will now be central in the resolution of the merits. Professor Steve Vladeck further analyzes the relationship of the two cases in a recent Twitter thread.

The annual Appellate Judges Education Institute, hosted by the Appellate Judges Conference, an arm of the American Bar Association’s Judicial Division, will be held November 11-14, 2021, at the Hyatt Regency in Austin, Texas. This Appellate Summit offers four days of advanced-level appellate educational programming and is the largest nationwide gathering of appellate jurists and advocates. The most recent Summit sold out and the ABA had to cut off registrations early. Early-bird registration for the 2021 Summit is now open through October 15, 2021. Over 100 judges from throughout the country have already signed up for the Summit.

The annual Appellate Judges Education Institute, hosted by the Appellate Judges Conference, an arm of the American Bar Association’s Judicial Division, will be held November 11-14, 2021, at the Hyatt Regency in Austin, Texas. This Appellate Summit offers four days of advanced-level appellate educational programming and is the largest nationwide gathering of appellate jurists and advocates. The most recent Summit sold out and the ABA had to cut off registrations early. Early-bird registration for the 2021 Summit is now open through October 15, 2021. Over 100 judges from throughout the country have already signed up for the Summit.

This year’s summit features speakers on the following topics, among others:

- How Judges Read in an E-filing Era

- Top-Notch Oral Argument Answers

- Managing Stress and Strengthening Resiliency: Practical Strategies for Judges and Lawyers

- Building and Growing an Appellate Practice

- Supreme Court Preview

- Writing from the Reader’s Perspective: How the English Language Really Works

- United States Supreme Court Civil Update

- Storytelling for Advocates and Judges: How and Why We Should Incorporate Storytelling Techniques and Themes into our Work

Panelists include:

Erwin Chemerinsky, Dean of the University of California, Berkeley, School of Law

Hon. Nathan Hecht, Chief Justice, Texas Supreme Court

Hon. Bridget Mary McCormack, Chief Justice, Michigan Supreme Court

Hon. Albert Diaz, United States Court of Appeals for the Fourth Circuit

Hon. James Earl Graves Jr., United States Court of Appeals for the Fifth Circuit

Hon. Consuelo Callahan, United States Court of Appeals for the Ninth Circuit

Hon. Steven H. David, Indiana Supreme Court

Hon. Marsha Ternus, former Chief Justice, Iowa Supreme Court

Hon. Samuel A. Thumma, Arizona Court of Appeals

Hon. Martha Warner, Fourth District Court of Appeal, Florida

Hon. David W. Ellis, Illinois Court of Appeals and best-selling author

Kannon K. Shanmugam, Partner, Paul, Weiss, Rifkind, Wharton & Garrison LLP

George Gopen, Ph.D., Professor Emeritus of the Practice of Rhetoric, Duke University & Consultant on Writing the English Language

The summit will be taking place in a hotel that will easily accommodate social distancing for attendees and presenter. The ballroom boasts over 14,000 square feet and a ceiling height of 22 feet. It is rated to hold more than 1,000 attendees during normal times, but will be capped at 400 attendees. Round tables will be set with no more than 4-5 seats instead of the usual 7 to 8. The opening reception at the Bullock Museum will be held in the museum’s Grand Lobby, which has a capacity of 600. Additionally, a color coding system, to reflect your social distancing preference, will be offered at registration. Meals also will have enhanced safety measures.

For further details on speakers, programs, and registration, go to: https://lnkd.in/exxjtGjA.

In the movie “Girls! Girls! Girls!” Elvis  Presley enthusiastically sang “Return to Sender.” In that general spirit, the Fifth Circuit affirmed a disgorgement award in SEC v. Blackburn when “[f]irst, the disgorgement amounts are the profits defendants received from their securities fraud,” and “[s]econd, the district court concluded that the SEC has identified the victims and created a process for the return of disgorged funds” to the victims. (emphasis added). In so doing, the SEC avoided the “the issue [Liu v. SEC, 140 S. Ct. 1936 (2020)] left open: whether

Presley enthusiastically sang “Return to Sender.” In that general spirit, the Fifth Circuit affirmed a disgorgement award in SEC v. Blackburn when “[f]irst, the disgorgement amounts are the profits defendants received from their securities fraud,” and “[s]econd, the district court concluded that the SEC has identified the victims and created a process for the return of disgorged funds” to the victims. (emphasis added). In so doing, the SEC avoided the “the issue [Liu v. SEC, 140 S. Ct. 1936 (2020)] left open: whether

disgorgement is ‘awarded for victims’ when the money is put into a

Treasury fund that helps “pay whistleblowers reporting securities fraud and

to fund the activities of the Inspector General.” No. 20-30464 (Oct. 12, 2021).

The fantastically controversial Texas abortion statute returned to the Fifth Circuit, which granted an administrative stay on Friday, October 8, while it receives further briefing about a stay during the appeal of Judge Pittman’s preliminary-injunction order. Enthusiasts of court history will note that the motions panel —

bears substantial similarity to the original panel in what led to the 2021 Supreme Court opinion in Collins v. Yellen. The panel divided 2-1 (Judges Haynes and Stewart, joining) about the constitutional problem with Fannie Mae’s regulator, and then again divided 2-1 (Judges Haynes and Willett, joining) about the proper remedy:

bears substantial similarity to the original panel in what led to the 2021 Supreme Court opinion in Collins v. Yellen. The panel divided 2-1 (Judges Haynes and Stewart, joining) about the constitutional problem with Fannie Mae’s regulator, and then again divided 2-1 (Judges Haynes and Willett, joining) about the proper remedy:

Johnson alleged that BOKF’s collection of “extended overdraft charges” (fees charged to customers who overdraw on their checking accounts and fail to timely pay the bank for covering the overdraft) were “interest” within the meaning of the National Bank Act. The Fifth Circuit rejected her claim, giving Auer deference to an interpretive letter of the Office of the Comptroller of the Currency, and noting as to the relevant considerations:

Johnson alleged that BOKF’s collection of “extended overdraft charges” (fees charged to customers who overdraw on their checking accounts and fail to timely pay the bank for covering the overdraft) were “interest” within the meaning of the National Bank Act. The Fifth Circuit rejected her claim, giving Auer deference to an interpretive letter of the Office of the Comptroller of the Currency, and noting as to the relevant considerations:

- Authoritative. The letter was drafted by the OCC’s chief counsel, in response to a bank’s request for OCC guidance, and thus “bears the hallmarks of an official interpretation by OCC.”

- Within the agency’s substantive expertise. OCC administers the National Bank Act, the letter “appears aimed at providing assurance to regulated parties,” and did not appear to merely take a “convenient litigating position.”

- Fair and considered judgment. The letter “is neither plainly erroneous nor inconsistent with the regulations it interprets.”

No. 18-11375 (Sept. 29, 2021).

“[T]he district court erred by failing to give notice to the parties. We ask, then, whether that error was harmless. Lexon argues that, had it received notice, it would have submitted different evidence of the value of its ‘lost collateral’—less than the full amount of the letters of credit. Lexon argues that the lost collateral, while perhaps not being worth the full value of the letters of credit, ‘had at least some economic value.’ However, Lexon never pleaded nor argued in the district court that its damages could be anything less than the full value of the letters of credit—$9,985,500. If the district court did not have an opportunity to rule on an argument, we will not address it on appeal.” Lexon Ins. Co. v. FDIC, No. 20-30173 (Aug. 2, 2021) (footnote and citation omitted) (emphasis added).

In Jungian psychology, the “Trickster” archetype (right) has been called “the embodiment of ambiguity.” In McDonnel Group, LLC v. Jung, LLC, the Fifth Circuit found an embodiment of ambiguity in an insurance policy provision that defined the flood-damage deductible as:

In Jungian psychology, the “Trickster” archetype (right) has been called “the embodiment of ambiguity.” In McDonnel Group, LLC v. Jung, LLC, the Fifth Circuit found an embodiment of ambiguity in an insurance policy provision that defined the flood-damage deductible as:

“5% of the total insured values at risk at the time and place of loss subject to a $500,000 minimum deduction as respects … FLOOD.”

The Court observed that “the plaintiffs read the deductible as saying ‘5% of the total insured values at risk … as respects FLOOD,'” and that “the insurers read the provision as ‘5% of the total insured values at risk at the time and place of loss, subject to a $500,000 minimum deduction … as respects FLOOD.” In other words: “[U]nder the plaintiffs’ theory, ‘as respects FLOOD’ modifies ‘total insured values at risk,'” while “[u]nder the insurer’s theory, ‘as respects FLOOD’ pertains only to the ‘$500,000 minimum deduction.'” The Court concluded that “[b]oth parties’ interpretations are reasonable, so the policy is ambiguous.” No. 20-30140 (Sept. 24, 2021).

The United States successfully seized the M/Y Galactic Star, a valuable yacht, in connection with a massive bribery scheme involving Nigerian government officials. The Fifth Circuit agreed with the district court that the majority shareholder of the yacht’s corporate owner lacked standing to complain: “LightRay chose to maintain Earnshaw as a separate corporate entity, thereby securing all the attendant advantages of doing so, including an attempt by its principals to support the argument that LightRay is an innocent owner. We agree with the Eighth Circuit that ‘[a] court of equity will not disregard a corporation’s exclusive ownership of assets and claims ‘where those in control have deliberately adopted the corporate form in order to secure its advantages.’'” United States v. The M/Y Galactic Star, No. 20-20471 (Sept. 13, 2021) (citations omitted).

The United States successfully seized the M/Y Galactic Star, a valuable yacht, in connection with a massive bribery scheme involving Nigerian government officials. The Fifth Circuit agreed with the district court that the majority shareholder of the yacht’s corporate owner lacked standing to complain: “LightRay chose to maintain Earnshaw as a separate corporate entity, thereby securing all the attendant advantages of doing so, including an attempt by its principals to support the argument that LightRay is an innocent owner. We agree with the Eighth Circuit that ‘[a] court of equity will not disregard a corporation’s exclusive ownership of assets and claims ‘where those in control have deliberately adopted the corporate form in order to secure its advantages.’'” United States v. The M/Y Galactic Star, No. 20-20471 (Sept. 13, 2021) (citations omitted).

Forby v. One Technologies presented the unusual situation of an arbitration waiver by the defendant, followed by an arbitration waiver the plaintiff as to a newly asserted claim: “We again address a class action claiming that One Technologies, L.P. (“One Tech”), duped consumers into signing up for ‘free’ credit reports that were not really free. The last time around, we ruled One Tech waived its right to arbitrate the plaintiffs’ state-law claims. Forby v. One Technologies., 909 F.3d 780 (5th Cir. 2018) [hereinafter Forby I]. Now, we consider whether One Tech also waived its right to arbitrate federal claims added after remand. Adhering to our precedent that waivers of arbitral rights are evaluated on a claim-by-claim basis, see Subway Equip. Leasing Corp. v. Forte, 169 F.3d 324, 328 (5th Cir. 1999), we hold that One Tech did not waive its right to arbitrate the new federal claims.” No. 20-10088 (Sept. 14, 2021) (citing, inter alia, Collado v. J&G Transp., Inc., 820 F.3d 1256 (11th Cir. 2016)).

Forby v. One Technologies presented the unusual situation of an arbitration waiver by the defendant, followed by an arbitration waiver the plaintiff as to a newly asserted claim: “We again address a class action claiming that One Technologies, L.P. (“One Tech”), duped consumers into signing up for ‘free’ credit reports that were not really free. The last time around, we ruled One Tech waived its right to arbitrate the plaintiffs’ state-law claims. Forby v. One Technologies., 909 F.3d 780 (5th Cir. 2018) [hereinafter Forby I]. Now, we consider whether One Tech also waived its right to arbitrate federal claims added after remand. Adhering to our precedent that waivers of arbitral rights are evaluated on a claim-by-claim basis, see Subway Equip. Leasing Corp. v. Forte, 169 F.3d 324, 328 (5th Cir. 1999), we hold that One Tech did not waive its right to arbitrate the new federal claims.” No. 20-10088 (Sept. 14, 2021) (citing, inter alia, Collado v. J&G Transp., Inc., 820 F.3d 1256 (11th Cir. 2016)).

Despite the defeat of the Moorish armies in 732 by Charles Martel at the Battle of Tours (right), the appellants in Luminant Mining Co. v. PakeyBey asserted rights as cotenants to certain real property in East Texas as “’Moorish Americans’ who are ‘sovereign freemen under the Republic . . . .'” The Fifth Circuit affirmed judgment for the appellees, concluding: “[T]the PakeyBey parties contend that Luminant failed to demonstrate hostile possession vis-à-vis its cotenants. They assert that the record is devoid of evidence of actual notice of repudiation of the common title. They further contend that Luminant cannot show constructive notice of repudiation, arguing that constructive notice and ouster require more than Luminant’s demonstrated possession of the land and the absence of a claim against the land by Walling’s heirs. Their argument rests on a correct reading of the law, up to a point. (citation omitted) But Luminant’s possession and Luminant’s recorded deeds are sufficient to give constructive notice of hostility to cotenants and to effect an ouster.” No. 20-40803 (Sept. 17, 2021).

Despite the defeat of the Moorish armies in 732 by Charles Martel at the Battle of Tours (right), the appellants in Luminant Mining Co. v. PakeyBey asserted rights as cotenants to certain real property in East Texas as “’Moorish Americans’ who are ‘sovereign freemen under the Republic . . . .'” The Fifth Circuit affirmed judgment for the appellees, concluding: “[T]the PakeyBey parties contend that Luminant failed to demonstrate hostile possession vis-à-vis its cotenants. They assert that the record is devoid of evidence of actual notice of repudiation of the common title. They further contend that Luminant cannot show constructive notice of repudiation, arguing that constructive notice and ouster require more than Luminant’s demonstrated possession of the land and the absence of a claim against the land by Walling’s heirs. Their argument rests on a correct reading of the law, up to a point. (citation omitted) But Luminant’s possession and Luminant’s recorded deeds are sufficient to give constructive notice of hostility to cotenants and to effect an ouster.” No. 20-40803 (Sept. 17, 2021).

Ten years ago, I posted a short note about a CAFA case (right); today, I make the 1,957th post on this blog. Tomorrow, I’ll make the 1,958th — blogging is a road traveled one case at a time. Publishing this blog has been a fantastic journey and I appreciate everyone who has shared the ride so far.

Ten years ago, I posted a short note about a CAFA case (right); today, I make the 1,957th post on this blog. Tomorrow, I’ll make the 1,958th — blogging is a road traveled one case at a time. Publishing this blog has been a fantastic journey and I appreciate everyone who has shared the ride so far.

To celebrate this anniversary properly, I observe three 600Camp traditions:

- Valuable 600Camp Merchandise. Anyone who catches an error in a post goes on the list to receive valuable 600Camp merchandise. Unfortunately I do not yet have any merchandise, but I assure you that all such commitments will be duly honored at the earliest possible time.

Update on the M/V OCEAN SHANGHAI. The 2013 case of Farenco Shipping Co. v. Farenco Shipping PTE, Ltd. produced the best mootness argument of all time — a case about the seizure of a marine vessel became moot once the ship had sailed. The M/V OCEAN SHANGHAI, recently renamed as SFERA, has avoided the Fifth Circuit’s waters ever since; as of September 18, 2021, it was transiting the Laccadive Sea south of Sri Lanka (right).

Update on the M/V OCEAN SHANGHAI. The 2013 case of Farenco Shipping Co. v. Farenco Shipping PTE, Ltd. produced the best mootness argument of all time — a case about the seizure of a marine vessel became moot once the ship had sailed. The M/V OCEAN SHANGHAI, recently renamed as SFERA, has avoided the Fifth Circuit’s waters ever since; as of September 18, 2021, it was transiting the Laccadive Sea south of Sri Lanka (right).- Creole Recipe. The Fifth Circuit is blessed to be headquartered in the culturally rich city of New Orleans; to celebrate 600Camp’s birthday properly, I recommend the Artisanal Eggs Benedict at Brennan’s.

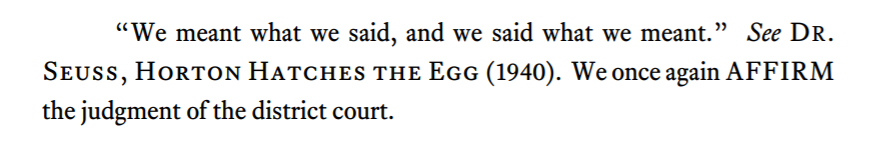

In light of the recent, intense debate about principles of “textualism” in Hewitt v. Helix Energy, it seemed a good time to revisit this classic meme:

The Fifth Circuit recently released its opinion on the emergency-stay motions of early September in the high-profile challenge to Texas’s “heartbeat law,” Whole Womens Health v. Jackson, No. 21-50792 (Sept. 10, 2021). In addition to identifying problems with the application of Ex parte Young, the Court observed: “We do not even take into account the many other justiciability defenses Defendants have raised beyond Young. Defendants have argued powerfully that, not only do they enjoy Eleventh Amendment immunity, but federal jurisdiction is also lacking under Article III. Related doctrines of standing, ripeness, and justiciability are also likely to prevail because these Plaintiffs have no present or imminent injury from the enactment of S.B 8.”

In reviewing a claim of improper joinder, a court may “conduct a Rule 12(b)(6)-type analysis” to determine if the claim against the in-state defendant “is plausible on its face.”

In reviewing a claim of improper joinder, a court may “conduct a Rule 12(b)(6)-type analysis” to determine if the claim against the in-state defendant “is plausible on its face.”- Alternatively, if “discrete and undisputed facts . . . would preclude plaintiff’s recovery against the in-state defendant,” then “the district court may, in its discretion, pierce the pleadings and conduct a summary inquiry.”

- But, “unlike summary judgment, which can be granted when there is ‘lack of substantive evidence’ to support a plaintiff’s claim, improper joinder requires the defendant to ‘put forward evidence that would negate a possibility of liability on the part of ‘ the in-state defendant.

Accordingly, the Fifth Circuit reversed a finding of improper joinder in Hicks v. Martinrea Automotive Structures (USA), Inc., No. 20-60926 (Sept. 7, 2021), noting that the defendant’s argument about the tortious-interference element of malice “rel[ies] on evidence developed during merits discovery, which is far afield from Rule 12(b)(6) [and] the evidence they cite relates to the crucial question of Clark’s motive in terminating Hicks.” No. 20-60926 (Sept. 7, 2021).

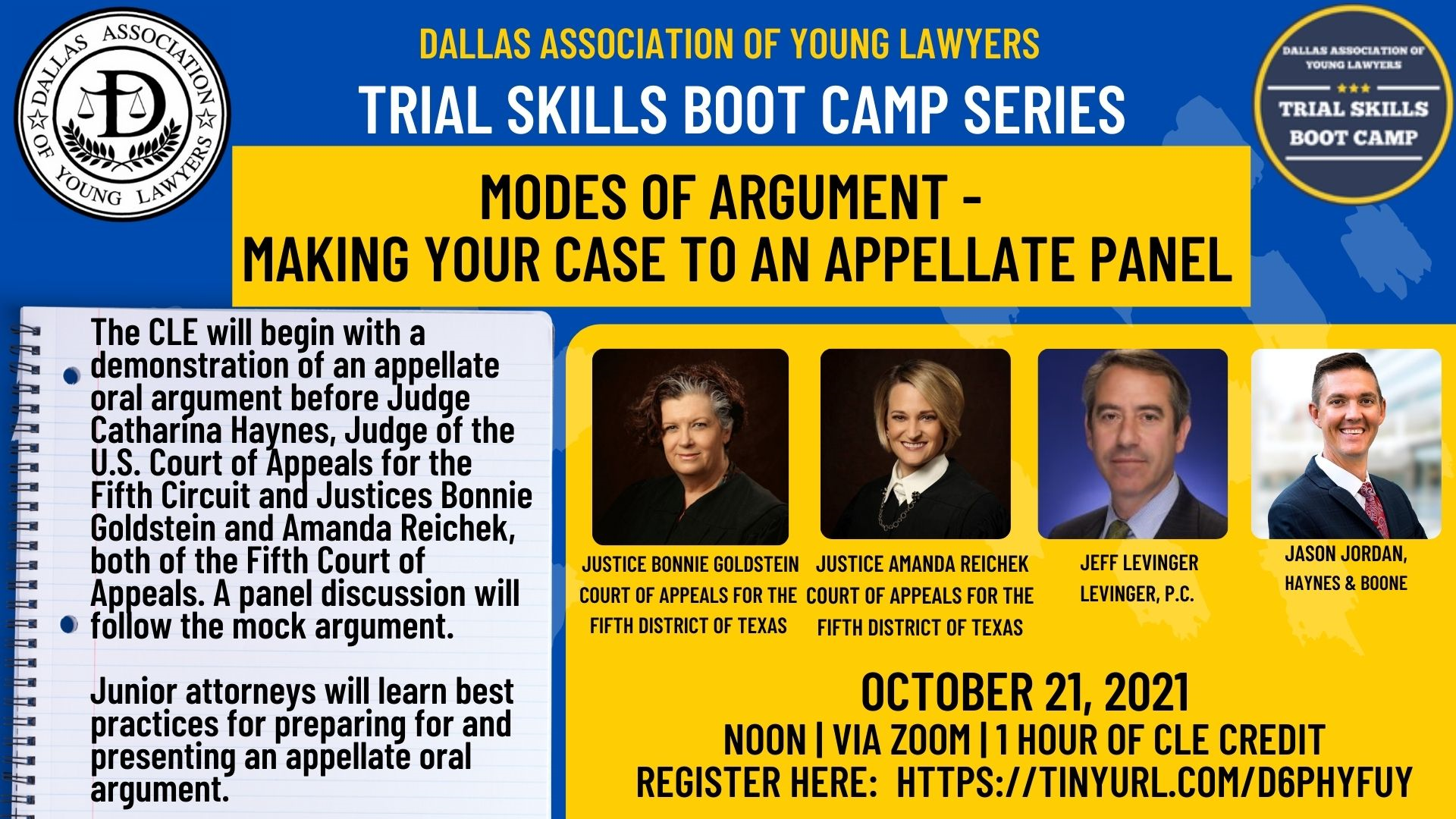

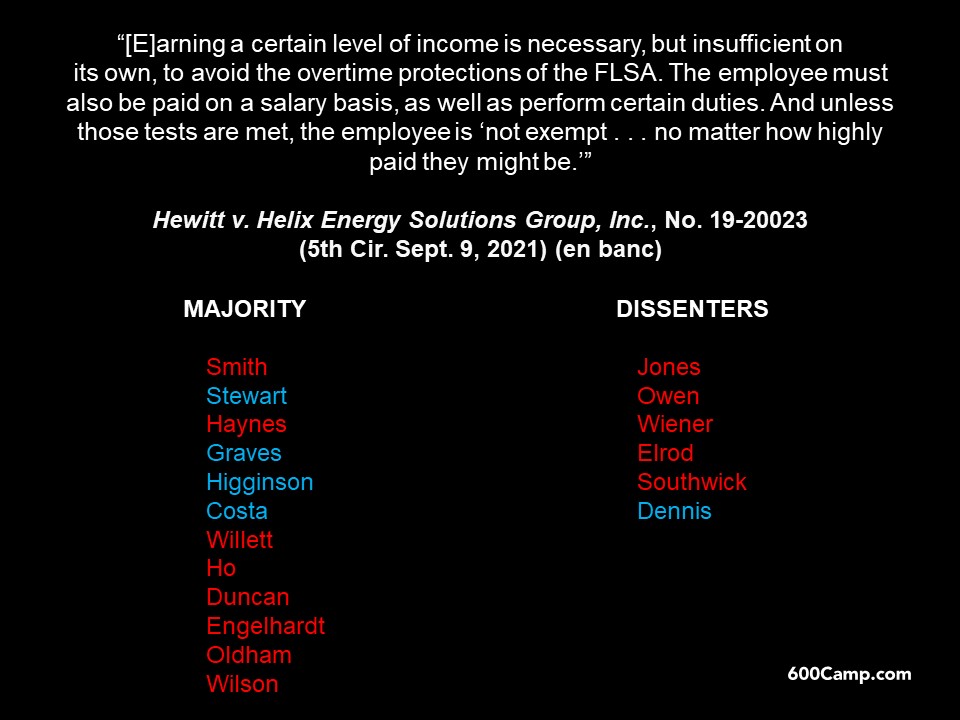

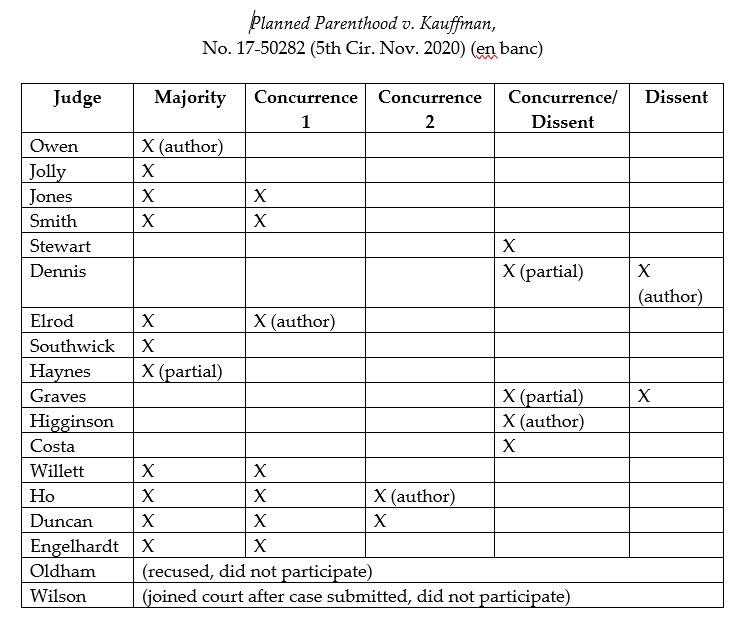

The en banc court divided along atypical lines in Hewitt v. Helix Energy, a dispute about overtime-pay obligations for highly compensated employees in the oil-and-gas industry. The Texas Lawbook and Houston Chronicle have covered the opinion thoroughly; below is a chart showing which judges joined the majority opinion and which judges dissented in some way. Note that Senior Judge Wiener participated in this en banc case because he was part of the original panel.

Longtime observers of the Court may see echoes of the divided en banc court in Mississippi Poultry Ass’n v. Madigan, 31 F.3d 293 (5th Cir. 1994) (en banc), a dispute about the import of the word “same” in the Poultry Products Inspection Act.

A chapter of the United Daughters of the Confederacy complained about the recent removal of a statue of a Confederate soldier from a San Antonio park. The Fifth Circuit affirmed the dismissal of its claim, observing (1) an 1899 document relating to the construction of the statue did not create a conveyance or use privilege for the relevant land; and (2) if it had done so, any such conveyance expired when an earlier chapter that actually received the document ceased operations in 1972, without conveying any such interest to its successor. Albert Sidney Johnston Chapter, Chapter No. 2060, UDC v. City of San Antonio, No. 20-50155 (Aug. 25, 2021).

A chapter of the United Daughters of the Confederacy complained about the recent removal of a statue of a Confederate soldier from a San Antonio park. The Fifth Circuit affirmed the dismissal of its claim, observing (1) an 1899 document relating to the construction of the statue did not create a conveyance or use privilege for the relevant land; and (2) if it had done so, any such conveyance expired when an earlier chapter that actually received the document ceased operations in 1972, without conveying any such interest to its successor. Albert Sidney Johnston Chapter, Chapter No. 2060, UDC v. City of San Antonio, No. 20-50155 (Aug. 25, 2021).

There’s always “that” customer, who brings rude remarks and behavior along with repeat business. In Sansone v. Jazz Casino Co., No. 20-30640 (Sept. 1, 2021), “that” customer led to a prima facie case about a hostile work environment: “The unidentified Harrah’s customer frequently asked Sansone about her sex life and expressed his desire to sleep with her. He commented on her breasts and physical appearance and directed sexual gestures towards her. His comments were made in the presence of others and occurred at least two times a week for a significant period of time. This contrasts with instances where we have held a smaller stint within a lengthy period of employment was not sufficiently pervasive to support a hostile work environment claim.” (citations omitted, applying Farpella-Crosby v. Horizon Health Care, 97 F.3d 803, 806 (5th Cir. 1996)).

There’s always “that” customer, who brings rude remarks and behavior along with repeat business. In Sansone v. Jazz Casino Co., No. 20-30640 (Sept. 1, 2021), “that” customer led to a prima facie case about a hostile work environment: “The unidentified Harrah’s customer frequently asked Sansone about her sex life and expressed his desire to sleep with her. He commented on her breasts and physical appearance and directed sexual gestures towards her. His comments were made in the presence of others and occurred at least two times a week for a significant period of time. This contrasts with instances where we have held a smaller stint within a lengthy period of employment was not sufficiently pervasive to support a hostile work environment claim.” (citations omitted, applying Farpella-Crosby v. Horizon Health Care, 97 F.3d 803, 806 (5th Cir. 1996)).

“When reviewing for abuse of discretion, we will reverse a district court’s refusal to give a requested jury instruction ‘only if the instruction (1) was a substantially correct statement of law, (2) was not substantially covered in the charge as a whole, and (3) concerned an important point in the trial such that the failure to instruct the jury on the issue seriously impaired the [party’s] ability to present a given [claim].'” (citations omitted). In HTC Corp. v. Telefonaktiebolaget LM Ericsson, while the panel divided 2-1 about whether a requested instruction was accurate, all three judges agreed that the appellant was not “seriously impaired” at trial by its absence. No. 19-40566 (Aug. 31, 2021).

CAFA creates an exception to federal class-action jurisdiction if, among other requirements, “the primary defendants[] are citizens of the State in which the action was originally filed.” Recognizing a lack of clear authority about the meaning of “primary defendant,” the Fifth Circuit reasoned that “there is much to commend the [Third Circuit’s] emphasis on the ‘real target’ of the litigation and [this Court’s] description of the controversy’s ‘primary thrust.'” Madison v. ADT, LLC, No. 21-90028 (Aug. 24, 2021).

CAFA creates an exception to federal class-action jurisdiction if, among other requirements, “the primary defendants[] are citizens of the State in which the action was originally filed.” Recognizing a lack of clear authority about the meaning of “primary defendant,” the Fifth Circuit reasoned that “there is much to commend the [Third Circuit’s] emphasis on the ‘real target’ of the litigation and [this Court’s] description of the controversy’s ‘primary thrust.'” Madison v. ADT, LLC, No. 21-90028 (Aug. 24, 2021).

“We are … persuaded that, under Texas law, undercapitalization alone would not be sufficient to pierce the corporate veil.” Ledford v. Keen, No. 20-50650 (applying, inter alia, Ramirez v. Hariri, 165 S.W.3d 912, 916 (Tex. App.–Dallas 2005, no pet.)).

Zurich won an insurance coverage dispute with Maxim Crane. On appeal, in addition to defending the merits, Zurich argued that the matter should be dismissed entirely because Maxim lacked standing. This argument led to the question whether a cross-appeal was needed to make that point, and the Fifth Circuit concluded:

… although our judgment would be different if we credited Zurich’s standing argument, that does not mean that Zurich needed to file a cross-appeal to present that argument. To be sure, as a matter of standard appellate practice, “[m]any cases state the general rule that a cross-appeal is required to support modification of the judgment,” whereas “arguments that support the judgment as entered can be made without a cross-appeal.” (quoting [Wright & Miller]). But this case falls within an exception to that general rule. A cross-appeal “is not necessary to challenge the subject-matter jurisdiction of the district court, under the well-established rule that both district court and appellate courts are obliged to raise such questions on their own initiative.” Id.

Maxim Crane Works LP v. Zurich Am. Ins. Co., No. 19-20489 (Aug. 20, 2021) (ultimately, certifying the underlying coverage issue to the Texas Supreme Court).

The practical problems cause by conversion of a Rule 12 motion to one for summary judgment were examined in Lexon Ins. Co. v. FDIC, where the nonmovant argued that “had it received [proper] notice, it would have submitted different evidence of the value of its ‘lost collateral,'” but the Fifth Circuit rejected that argument because the nonmovant “never pleaded nor argued in the district court that its damages could be anything less than the full value of the letters of credit ….” No. 20-30173 (Aug. 2, 2021).

The Texas Supreme Court’s longtime staff attorney for public information, Osler McCarthy, retires on August 31 after many years of dedicated service. I wanted to salute his hard work and share a well-written tribute to him recently prepared by former Chief Justice Wallace Jefferson.

The Texas Supreme Court’s longtime staff attorney for public information, Osler McCarthy, retires on August 31 after many years of dedicated service. I wanted to salute his hard work and share a well-written tribute to him recently prepared by former Chief Justice Wallace Jefferson.

The Fifth Circuit found that Petrobras did not have sufficient knowledge of a potential claim to trigger limitations in Petrobras America, Inc. v. Samsung Heavy Indus. Co., holding:

- two officers “acted in their own interests by accepting $10 million in bribes . . . [t]hus, [they] are clearly adverse agents of Petrobras. Their knowledge cannot be imputed to Petrobras.”;

- “an ujnfavorable contract alone is not a legally cognizable injury”;

- statements in SEC filings about the general topic of bribery, when they involved “separate bribery schemes [that] involved separate parties, separate contracts, and separate ships,” “at best raise fact questions not suitable for disposition under Rule 12(b)(6).”

No. 20-20339 (Aug. 11, 2021).

The Fifth Circuit reversed the Rule 12 dismissal of a Lanham Act case in which “Plaintiffs allege that Defendants purchased trademark terms as keywords for search-engine advertising, then placed generic advertisements that confused customers as to whether the advertisements belonged to or were affiliated with the Plaintiffs.” Adler v. McNeil Consultants, No. 20-10936 (Aug. 10, 2021) (LPHS represented the appellee in this matter).

Season Two of the “Coale Mind” podcast begins by returning to an earlier episode about the Supreme Court’s review of high-profile Fifth Circuit cases — “Is the Fifth Circuit More Conservative than the Roberts Court: Revisited.” I hope you have a chance to listen!

Season Two of the “Coale Mind” podcast begins by returning to an earlier episode about the Supreme Court’s review of high-profile Fifth Circuit cases — “Is the Fifth Circuit More Conservative than the Roberts Court: Revisited.” I hope you have a chance to listen!

A triable fact issue on the issue of pretext arose in Lindsey v. Bio-Medical Applications: “As anyone who has ever worked in an office environment can attest, there are real deadlines and hortatory ones—and everyone understands the difference between the two. Missing real deadlines results in actual adverse consequences for employer and employee alike—while failing to meet hortatory deadlines does not. BMA does not point to any adverse impact that Lindsey’s tardy reports had on the company. And in any event, there is no evidence BMA ever warned Lindsey that failure to submit the reports on time could jeopardize her job. So there is a genuine issue of material fact as to whether BMA’s assertion that it fired Lindsey for this reason is ‘unworthy of credence.'” No. 20-30289 (Aug. 16, 2021).

A triable fact issue on the issue of pretext arose in Lindsey v. Bio-Medical Applications: “As anyone who has ever worked in an office environment can attest, there are real deadlines and hortatory ones—and everyone understands the difference between the two. Missing real deadlines results in actual adverse consequences for employer and employee alike—while failing to meet hortatory deadlines does not. BMA does not point to any adverse impact that Lindsey’s tardy reports had on the company. And in any event, there is no evidence BMA ever warned Lindsey that failure to submit the reports on time could jeopardize her job. So there is a genuine issue of material fact as to whether BMA’s assertion that it fired Lindsey for this reason is ‘unworthy of credence.'” No. 20-30289 (Aug. 16, 2021).

The provocatively named book “Hooker to Looker: a makeup guide for the not so easily offended” (video summary available here) gave rise to a dispute about the preemptive force of the Copyright Act, which the Fifth Circuit resolved in favor of preemption by looking to:

- Factual allegations. “Although Di Angelo muddles its complaint with contract allegations aplenty, it also alleges that it ‘acquired copyrights in the [B]ook’ by ‘writing, editing, planning and taking all photographs and making all illustrations, and planning, designing, and arranging the layout of the [B]ook.’ … Although the complaint uses neither the term joint work” nor “co-author,” it is nigh impossible to read Di Angelo’s allegations … without concluding that Di Angelo is alleging, at minimum, co-authorship of the Book.”

- The parties’ contract. “The Contract does not define author, and the word’s common meaning can apply to multiple parties who collaboratively engage in producing one creative work, a possibility expressly contemplated by copyright law. And contrary to Kelley’s suggestion, the terms of the Contract lend some support to the notion that the Book would be produced collaboratively.” (footnote omitted).

- Requested relief. “[A] declaration of Di Angelo’s copyright in the updated work could permit it to exercise rights with respect to that work that it would not enjoy under the Contract. For instance, a declaration could allow Di Angelo to profit from the Book’s update, which according to its state court complaint, Kelley currently

prevents it from doing.”

Di Angelo Publications, Inc., No. 20-20523 (Aug. 12, 2021).

Under Texas insurance law: “Payment and acceptance of an appraisal award means there is nothing left for a breach of contract claim seeking those same damages. But a plaintiff may still have a claim under the prompt payment law after it accepts an appraisal award. The Supreme Court of Texas recently held that even a preappraisal payment that seemed reasonable at the time does not bar a prompt-payment claim if it does not ‘roughly correspond’ to the amount ultimately owed.” Randel v. Travelers Lloyds, No. 20-20567 (Aug. 12, 2021).

Under Texas insurance law: “Payment and acceptance of an appraisal award means there is nothing left for a breach of contract claim seeking those same damages. But a plaintiff may still have a claim under the prompt payment law after it accepts an appraisal award. The Supreme Court of Texas recently held that even a preappraisal payment that seemed reasonable at the time does not bar a prompt-payment claim if it does not ‘roughly correspond’ to the amount ultimately owed.” Randel v. Travelers Lloyds, No. 20-20567 (Aug. 12, 2021).

The plaintiffs in Turner v. Cincinnati Ins. Co. obtained a “non-adversarial” default judgment against a defunct vocational school. The Fifth Circuit found that Texas’s “no-direct action” rule did not bar their claim against the school’s insurer: “[T]he Plaintiffs’ default judgment against ATI is an adjudication that satisfies the no-action clause. Accordingly, although the non-adversarial default judgment does not bind Cincinnati to its terms, the no-direct-action rule is not a bar to this coverage suit.” (citation omitted). (Unfortunately for the plaintiffs, the Court then affirmed the dismissal of their claim on timeliness grounds.) No. 20-50548 (Aug. 13, 2021).

The Fifth Circuit affirmed a jurisdiction-based collateral attack on a judgment in Bessie Jeanne Worthy Revocable Trust, reasoning that in the prior litigation, “the Estate’s Texas citizenship defeated diversity among the parties,” creating a “‘total want of jurisdiction’ to enter judgment[.]” No. 20-10492 (Aug. 10, 2021). In so doing, the Court distinguished Picco v. Global Marine Drilling Co., 900 F.2d 846 (5th Cir. 1990), as turning on a distinct question about the effect of the automatic bankruptcy stay. The able Rory Ryan from Baylor’s law school cautions against an overly broad reading of this new opinion.

To illustrate a point about the risks of unbounded judicial discretion, the Fifth Circuit quoted a well-known gorilla joke in Rollins v. Home Depot USA, No. 20-50736 (Aug. 9, 2021):

To illustrate a point about the risks of unbounded judicial discretion, the Fifth Circuit quoted a well-known gorilla joke in Rollins v. Home Depot USA, No. 20-50736 (Aug. 9, 2021):

Counsel failed to file a summary-judgment response because his notification of filing went to his email “spam” folder. The Fifth Circuit affirmed the denial of relief under Fed. R. Civ. P. 59(e):

Counsel failed to file a summary-judgment response because his notification of filing went to his email “spam” folder. The Fifth Circuit affirmed the denial of relief under Fed. R. Civ. P. 59(e):

“It is not ‘manifest error to deny relief when failure to file was within [Rollins’s] counsel’s ‘reasonable control.’ Notice of Home Depot’s motion for summary judgment was sent to the email address that Rollins’s counsel provided. Rule 5(b)(2)(E) provides for service ‘by filing [the pleading] with the court’s electronic-filing system’ and explains that ‘service is complete upon filing or sending.’ That rule was satisfied here. Rollins’s counsel was plainly in the best position to ensure that his own email was working properly—certainly more so than either the district court or Home Depot. Moreover, Rollins’s counsel could have checked the docket after the agreed deadline for dispositive motions had already passed.”

Rollins v. Home Depot USA, No. 20-50736 (Aug. 9, 2021).

“‘Lost debt’ cases present a unique type of claim. They allege ‘a RICO violation whose central purpose [i]s to prevent the collection of a claim or judgment.’ The substantive RICO violation is the act of preventing collection. And the plaintiff’s injury is the inability to collect the lawful debt. So, when the plaintiff successfully recovers that debt, it is no longer lost. And because that unrecovered debt is the only source of the plaintiff’s injury, there is no RICO claim in its absence. As a result, a plaintiff cannot rely on its lost debt to animate a RICO suit after it has recovered that debt. The ‘debt is “lost” and thereby

“‘Lost debt’ cases present a unique type of claim. They allege ‘a RICO violation whose central purpose [i]s to prevent the collection of a claim or judgment.’ The substantive RICO violation is the act of preventing collection. And the plaintiff’s injury is the inability to collect the lawful debt. So, when the plaintiff successfully recovers that debt, it is no longer lost. And because that unrecovered debt is the only source of the plaintiff’s injury, there is no RICO claim in its absence. As a result, a plaintiff cannot rely on its lost debt to animate a RICO suit after it has recovered that debt. The ‘debt is “lost” and thereby

becomes a basis for RICO trebling only if the debt (1) cannot be collected (2)

“by reason of” a RICO violation.’ ‘In other words, to the extent of a successful collection, the RICO claim is abated pro tanto, prior to any application of trebling.'” HCB Fin. Corp. v. McPherson, No. 20-50718 (Aug. 4, 2021) (citations omitted). Put another way: “There must be independent damages to treble; the possibility of treble damages alone cannot confer statutory RICO standing.”

A recent antitrust case reminds of an important but infrequently-litigated point about the review of pleadings in the context of a motion to dismiss: “If an attached exhibit contradicts a factual allegation in the complaint, ‘then indeed the exhibit and not the allegation controls.'” Quadvest LP v. San Jacinto River Auth., No. 20-20447 (Aug. 3, 2021).

A recent antitrust case reminds of an important but infrequently-litigated point about the review of pleadings in the context of a motion to dismiss: “If an attached exhibit contradicts a factual allegation in the complaint, ‘then indeed the exhibit and not the allegation controls.'” Quadvest LP v. San Jacinto River Auth., No. 20-20447 (Aug. 3, 2021).

The plaintiffs in Quadvest LP v. San Jacinto River Auth. alleged that a state-created river authority violated Section 1 of the Sherman Act by unreasonably restraining the market for wholesale raw water in Montgomery County. Procedurally, the Fifth Circuit concluded that the denial of the authority’s motion to dismiss on immunity grounds was appealable under Circuit precedent (acknowledging that the Fifth Circuit is an outlier on this point). Substantively, the Court affirmed the denial of the authority’s motion “at this stage” of the case, concluding that “the Texas Legislature did not authorize [the authority’s] entry into and enforcement of the challenged [contract] provisions with the intent to displace competition in the market for wholesale raw water in Montgomery County.” No. 20-20447 (August 5, 2021).

The plaintiffs in Quadvest LP v. San Jacinto River Auth. alleged that a state-created river authority violated Section 1 of the Sherman Act by unreasonably restraining the market for wholesale raw water in Montgomery County. Procedurally, the Fifth Circuit concluded that the denial of the authority’s motion to dismiss on immunity grounds was appealable under Circuit precedent (acknowledging that the Fifth Circuit is an outlier on this point). Substantively, the Court affirmed the denial of the authority’s motion “at this stage” of the case, concluding that “the Texas Legislature did not authorize [the authority’s] entry into and enforcement of the challenged [contract] provisions with the intent to displace competition in the market for wholesale raw water in Montgomery County.” No. 20-20447 (August 5, 2021).

Two rulings about the crime-fraud exception to the attorney-client privilege were recently reversed, by both the Fifth Circuit and Dallas’s Fifth District, in response to mandamus petitions. (This is a cross-post with 600commerce.com.)

- In the Fifth Circuit: “[A]s Boeing argues, the district court clearly erred in finding that Plaintiffs established a prima facie case that the contested documents were subject to the crime-fraud exception. The district court concluded that the contested documents were reasonably connected to the fraud based on one finding only—that the documents sought ‘f[e]ll within the period Boeing admit to hav[ing] knowingly and intentionally committed “fraud” in the DPA. However, a temporal nexus between the contested documents and the fraudulent activity alone is insufficient to satisfy the second element for a prima facie showing that the crime-fraud exception applies.” In re The Boeing Co., No. 21-40190 (July 29, 2021, unpublished).

- In the Fifth District, the Court noted: “[A] determination at the TCPA stage as to a prima facie showing does not automatically translate to a prima facie showing for purposes of application of the crime–fraud exception to the attorney–client privilege. The exception UDF attempts to invoke is for crime–fraud, not crime–tort.” From there, it declined to follow a broad view of the exception defined by another Texas intermediate court, “and note that, notwithstanding certain language in the [relevant] opinion, the El Paso court continues to apply the elements of common-law fraud when determining the applicability of the crime fraud exception, rather than requiring proof of a false statement only.” In re Bass, No. 05-21-00102-CV (July 30, 2021) (mem. op.).

A long-running discovery dispute in Texas state court led to a contempt order, which in turn led to a federal-court habeas action. The Fifth Circuit noted that habeas relief was potentially available under the Antiterrorism and Effective Death Penalty Act of 1996, as codified in 28 U.S.C. § 2254, under which:

… if an adequate state ‘corrective process’ for raising a claim exists that the petitioner could avail him or herself of, a federal court may only consider the claim if the petitioner has exhausted available state remedies. And when the petitioner has done so and the state court has rejected the claim on the merits, federal courts may provide relief only when the state court adjudication was either ‘contrary to, or involved an unreasonable application of, clearly established Federal law, as determined by the Supreme Court of the United States,’ or ‘based on an unreasonable determination of the facts in light of the evidence presented in the State court proceeding.’

(citations omitted). Among other observations, the Court held: “A rule that due process does not permit the use of civil contempt to compel the production of documents that are in the hands of third parties would also overturn longstanding precedents and would likely be unworkable in practice.” Topletz v. Skinner, No. 20-40136 (July 30, 2021).

“While litigants should, when possible, identify specific contractual provisions alleged to have been breached, Rule 8 does not require that level of granularity. ‘So long as a pleading alleges facts upon which relief can be granted, it states a claim even if it “fails to categorize correctly the legal theory giving rise to the claim.”‘ ” (citations omitted).

“While litigants should, when possible, identify specific contractual provisions alleged to have been breached, Rule 8 does not require that level of granularity. ‘So long as a pleading alleges facts upon which relief can be granted, it states a claim even if it “fails to categorize correctly the legal theory giving rise to the claim.”‘ ” (citations omitted).- That said — “That the pleading was sufficient in this contract dispute, governed by an agreement neither exceedingly long nor rife with addenda, exhibits, and multiple parts, does not mean that Rule 8 would necessarily be satisfied by general allegations involving more complex contracts.”

Sanchez Oil & Gas Corp. v. Crescent Drilling & Prod., Inc., No. 20-20304 (July 30, 2021).