No credit? NoLa.

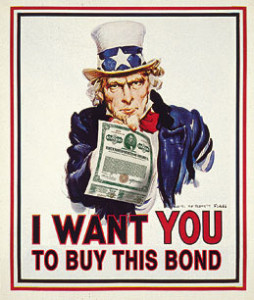

March 7, 2016 The financially unfortunate City of New Orleans, saddled with a “just above junk” credit status, hired Ambac to provide insurance for its municipal bonds. Ambac’s AAA rating slipped after the 2008 financial crisis, causing New Orleans to incur tens of millions of dollars in additional debt service and refinancing costs. The City sued Ambac on several legal theories for not maintaining a high credit rating. The Fifth Circuit affirmed their dismissal: “[T]he resolutions that the City so heavily relies upon show only that the City purchased a bond insurance policy from a highly rated insurer, which, at the time of issuance, lessened the perceived credit risk of the City’s bonds. Any alleged representation by Ambac to provide a larger credit enhancement is foreclosed by the clear language of the Policy.” New Orleans City v. Ambac Assurance Corp., No. 15-30532 (March 2, 2016).

The financially unfortunate City of New Orleans, saddled with a “just above junk” credit status, hired Ambac to provide insurance for its municipal bonds. Ambac’s AAA rating slipped after the 2008 financial crisis, causing New Orleans to incur tens of millions of dollars in additional debt service and refinancing costs. The City sued Ambac on several legal theories for not maintaining a high credit rating. The Fifth Circuit affirmed their dismissal: “[T]he resolutions that the City so heavily relies upon show only that the City purchased a bond insurance policy from a highly rated insurer, which, at the time of issuance, lessened the perceived credit risk of the City’s bonds. Any alleged representation by Ambac to provide a larger credit enhancement is foreclosed by the clear language of the Policy.” New Orleans City v. Ambac Assurance Corp., No. 15-30532 (March 2, 2016).